Key Insights

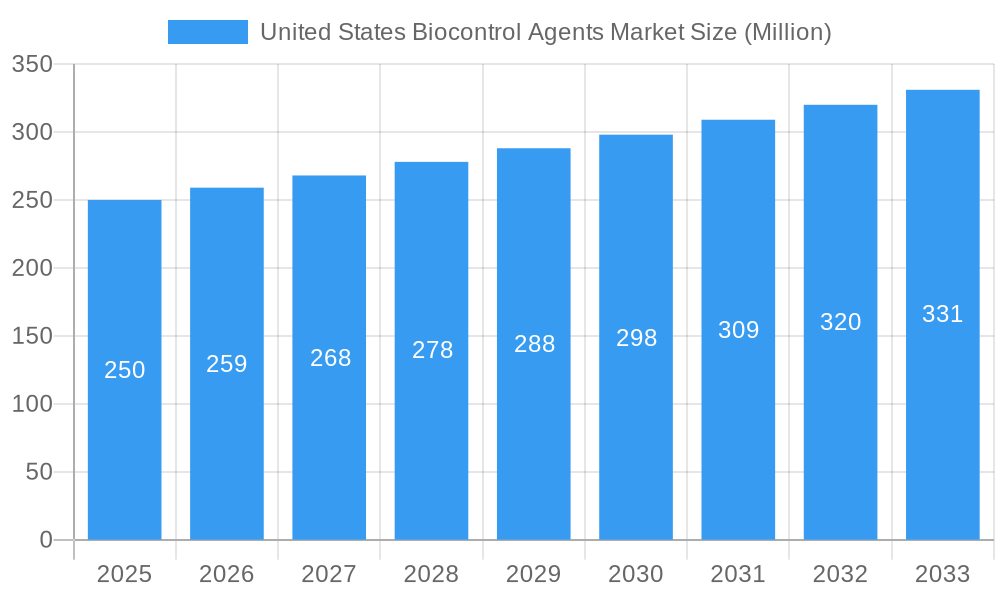

The United States biocontrol agents market is poised for significant expansion, driven by a heightened demand for sustainable pest management and stricter regulations on synthetic pesticides. The market, valued at approximately $7 billion in 2025, is projected to achieve a robust compound annual growth rate (CAGR) of 15.9% between 2025 and 2033. This upward trajectory is propelled by the increasing adoption of organic and sustainably produced crops, as farmers seek safer, eco-friendly alternatives to conventional chemical pesticides. Escalating pest resistance to traditional pesticides further accelerates the shift towards biocontrol solutions. Key segments, including microbial biocontrol agents for cash and horticultural crops, exhibit even stronger growth potential due to their superior efficacy and broad applicability.

United States Biocontrol Agents Market Market Size (In Billion)

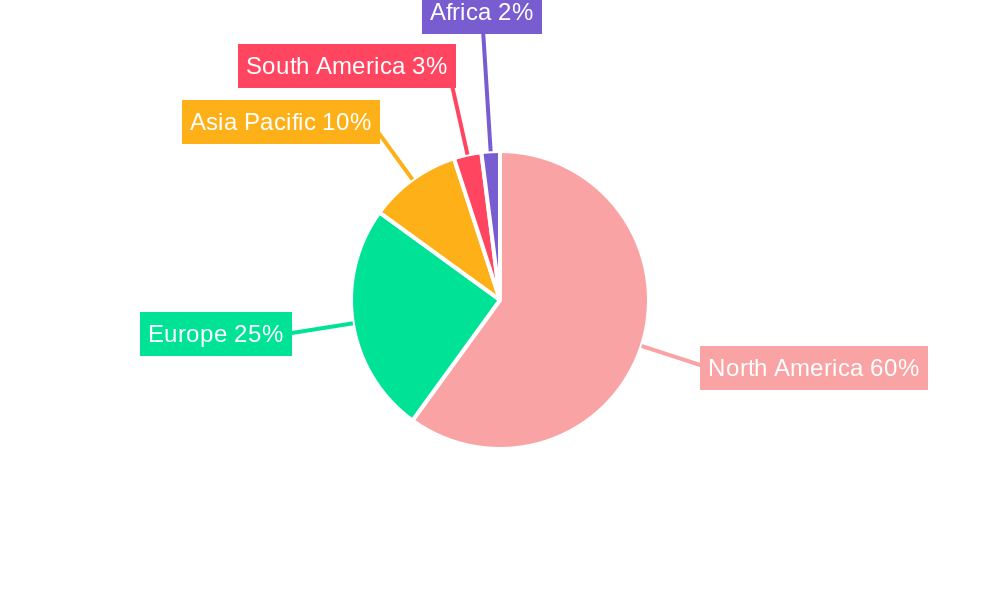

Despite this positive outlook, the market encounters certain hurdles. Substantial initial investment costs for implementing biocontrol strategies can present a challenge for smaller agricultural operations. Additionally, the performance of biocontrol agents can be influenced by environmental variables, necessitating precise application methods that may lead to inconsistent outcomes. Nevertheless, the future of the US biocontrol agents market remains exceptionally bright, supported by ongoing innovation in agent development, supportive government initiatives for sustainable agriculture, and a growing consumer preference for pesticide-free produce. Leading companies like Koppert Biological Systems Inc. and Bioline AgroSciences Ltd. are instrumental in this growth through research, product diversification, and strategic collaborations. The North American region, with the US at its forefront, commands a dominant share of the global biocontrol agents market, owing to its vast agricultural sector and supportive regulatory framework for eco-friendly farming practices.

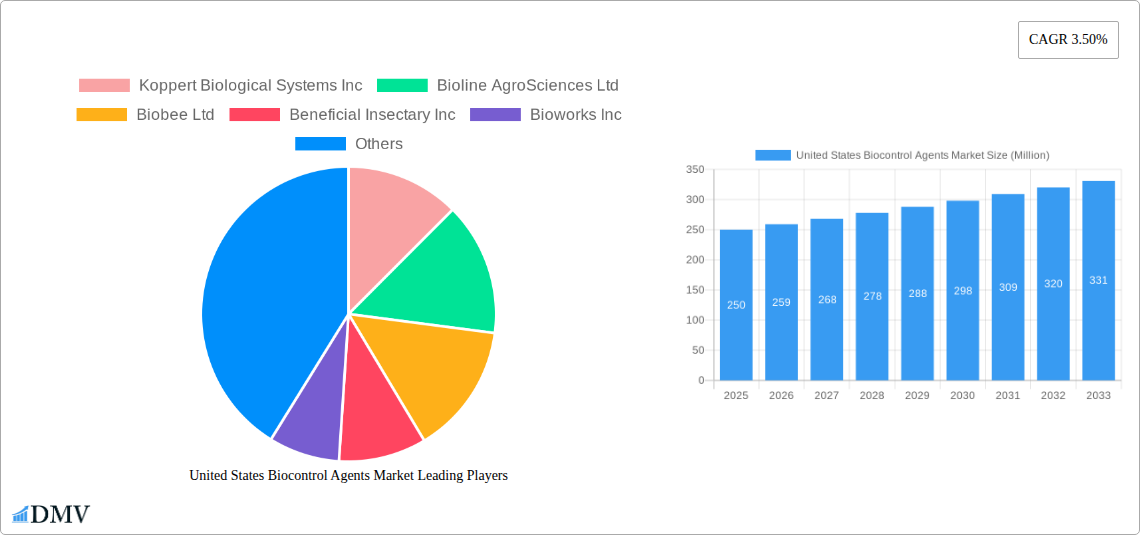

United States Biocontrol Agents Market Company Market Share

United States Biocontrol Agents Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States biocontrol agents market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market size, segmentation, growth drivers, challenges, and opportunities, providing valuable intelligence for stakeholders seeking to navigate this dynamic market. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

United States Biocontrol Agents Market Market Composition & Trends

This section delves into the intricate structure of the U.S. biocontrol agents market, analyzing its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape with several key players commanding significant market share. Koppert Biological Systems Inc. holds an estimated xx% market share, followed by Bioline AgroSciences Ltd. with xx%, and Biobee Ltd. with xx%. However, a considerable portion of the market is also occupied by smaller, specialized companies, reflecting the diverse nature of biocontrol agent applications.

Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be xx, indicating a moderately concentrated market.

Innovation Catalysts: Growing consumer demand for sustainable and eco-friendly agricultural practices is a major driver of innovation, leading to the development of novel biocontrol agents with enhanced efficacy and application methods.

Regulatory Landscape: The Environmental Protection Agency (EPA) plays a crucial role in regulating the registration and use of biocontrol agents, influencing market growth and innovation. Stringent regulations ensure the safety and efficacy of these products.

Substitute Products: Chemical pesticides still represent a significant substitute, though their use is declining due to increasing awareness of their environmental impact and the emergence of more effective biocontrol alternatives.

End-User Profiles: The market comprises diverse end-users including large-scale commercial farms, small-scale farmers, horticultural businesses, and government agencies.

M&A Activities: Recent years have witnessed significant M&A activity, with notable examples including the acquisition of Beneficial Insectary Inc. by Biobest Group NV in 2020. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

United States Biocontrol Agents Market Industry Evolution

The U.S. biocontrol agents market has experienced substantial growth over the past few years, fueled by increasing consumer demand for organic produce, stringent regulations on chemical pesticides, and technological advancements. Market growth is closely tied to the adoption of sustainable agricultural practices and heightened environmental consciousness. The market has shown consistent growth, with a CAGR of xx% during the historical period (2019-2024), and is projected to maintain a strong growth trajectory in the coming years. Technological advancements, such as improved formulation techniques and the development of targeted biocontrol agents, have enhanced the efficacy and user-friendliness of these products, further stimulating market expansion. The shift towards sustainable agriculture is a major driver, with growing consumer preference for organic and pesticide-free produce creating significant demand for biocontrol agents.

Leading Regions, Countries, or Segments in United States Biocontrol Agents Market

The U.S. biocontrol agents market exhibits regional variations in growth and adoption. While data on specific regional dominance is limited, analysis suggests that the cash crop segment currently represents the largest market share, driven by high economic value and large-scale farming practices. The macrobial form of biocontrol agents dominates the market by application due to its widespread use in various crops.

Key Drivers for Cash Crops Segment Dominance:

- High economic value of cash crops incentivizes investment in advanced pest management solutions.

- Extensive use of biocontrol agents in high-value crops such as fruits, vegetables, and cotton.

- Technological advancements specifically targeting cash crop pests.

Key Drivers for Microbials Form Dominance:

- Cost-effectiveness compared to other biocontrol forms.

- Ease of application and compatibility with integrated pest management strategies.

- Widespread adoption across diverse crops and applications.

Detailed regional and segmental breakdowns with precise market share data will be included in the full report.

United States Biocontrol Agents Market Product Innovations

Recent years have witnessed significant product innovations in the U.S. biocontrol agents market. Companies are focusing on developing more targeted and effective biocontrol agents, enhancing their efficacy, and improving formulation for better application methods. Innovations include novel strains of beneficial microorganisms, improved delivery systems, and integrated pest management solutions incorporating biocontrol agents with other sustainable practices. These advancements result in improved pest control, reduced environmental impact, and increased crop yields. Specific details on novel formulations, applications, and performance metrics will be detailed in the full report.

Propelling Factors for United States Biocontrol Agents Market Growth

Several factors are driving the growth of the U.S. biocontrol agents market. The rising awareness of the environmental consequences of chemical pesticides is a primary driver. Governments are increasingly promoting sustainable agriculture, creating a favorable regulatory environment for biocontrol agents. The growing demand for organic and pesticide-free food products further boosts market growth, aligning with consumer preferences. Technological advancements enhancing the efficacy and usability of biocontrol agents also contribute significantly.

Obstacles in the United States Biocontrol Agents Market Market

Despite significant growth potential, the U.S. biocontrol agents market faces challenges. The high cost of research and development, coupled with regulatory hurdles for product registration, can hinder market expansion. The efficacy of biocontrol agents can vary depending on environmental conditions and pest pressures, impacting their adoption. Supply chain disruptions, particularly concerning the production and distribution of specialized biocontrol agents, can also create challenges.

Future Opportunities in United States Biocontrol Agents Market

The U.S. biocontrol agents market presents several opportunities for growth. The expansion of organic agriculture, increasing consumer preference for natural products, and government support for sustainable farming are key factors. Advancements in biotechnology and genetic engineering hold the potential to create more effective and targeted biocontrol agents. Exploring new applications in various sectors, including horticulture, forestry, and stored product protection, offer promising avenues for future growth.

Major Players in the United States Biocontrol Agents Market Ecosystem

- Koppert Biological Systems Inc

- Bioline AgroSciences Ltd

- Biobee Ltd

- Beneficial Insectary Inc

- Bioworks Inc

- Andermatt Group AG

- Arizona Biological Control Inc

Key Developments in United States Biocontrol Agents Market Industry

- January 2022: Beneficial Insectary and The Association for Counseling, Education & Support launched Shasta Force Farm, promoting chemical-free farming and education. This initiative enhances consumer awareness and market acceptance of biocontrol agents.

- January 2022: The merger of Andermatt Biocontrol AG with Andermatt Group AG streamlined operations and increased management effectiveness, potentially leading to improved market competitiveness and product development.

- November 2020: The acquisition of Beneficial Insectary Inc. by Biobest Group NV strengthened the latter’s market presence and distribution network, enhancing its reach and market share.

Strategic United States Biocontrol Agents Market Market Forecast

The U.S. biocontrol agents market is poised for significant growth in the coming years, driven by a confluence of factors including increasing consumer demand for sustainable agricultural practices, supportive government policies, and ongoing technological advancements. The market’s expansion will be fueled by the continued development of novel, more effective biocontrol agents, catering to the evolving needs of diverse agricultural sectors. This presents lucrative opportunities for market players to capitalize on the expanding demand for environmentally friendly pest management solutions. Specific quantitative forecasts for various segments and regions will be detailed in the full report.

United States Biocontrol Agents Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Biocontrol Agents Market Segmentation By Geography

- 1. United States

United States Biocontrol Agents Market Regional Market Share

Geographic Coverage of United States Biocontrol Agents Market

United States Biocontrol Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Hybrid Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Biocontrol Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bioline AgroSciences Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biobee Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beneficial Insectary Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bioworks Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andermatt Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arizona Biological Control Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: United States Biocontrol Agents Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Biocontrol Agents Market Share (%) by Company 2025

List of Tables

- Table 1: United States Biocontrol Agents Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Biocontrol Agents Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Biocontrol Agents Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Biocontrol Agents Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Biocontrol Agents Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Biocontrol Agents Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: United States Biocontrol Agents Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Biocontrol Agents Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Biocontrol Agents Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Biocontrol Agents Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Biocontrol Agents Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Biocontrol Agents Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Biocontrol Agents Market?

The projected CAGR is approximately 15.9%.

2. Which companies are prominent players in the United States Biocontrol Agents Market?

Key companies in the market include Koppert Biological Systems Inc, Bioline AgroSciences Ltd, Biobee Ltd, Beneficial Insectary Inc, Bioworks Inc, Andermatt Group AG, Arizona Biological Control Inc.

3. What are the main segments of the United States Biocontrol Agents Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increase in Adoption of Hybrid Seeds.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

January 2022: Beneficial Insectary and The Association for Counseling, Education & Support started Shasta Force Farm with an aim to educate the farming community on the importance of chemical-free farming, providing fresh produce and garden healing therapy.January 2022: The company announced the merger of Andermatt Biocontrol AG with Andermatt Group AG, with all companies reporting directly to Andermatt Group AG. The merger increased the effectiveness of the management and simplified the company's structure.November 2020: Beneficial Insectary Inc. was acquired by Biobest Group NV in 2020 and became a part of the multinational organization. The acquisition strengthened its presence and distribution network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Biocontrol Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Biocontrol Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Biocontrol Agents Market?

To stay informed about further developments, trends, and reports in the United States Biocontrol Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence