Key Insights

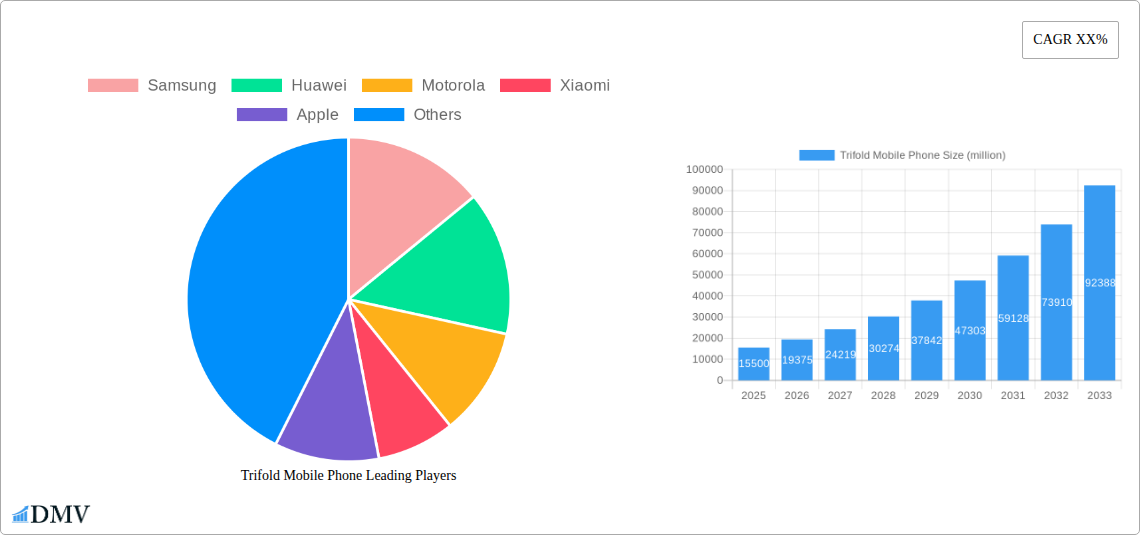

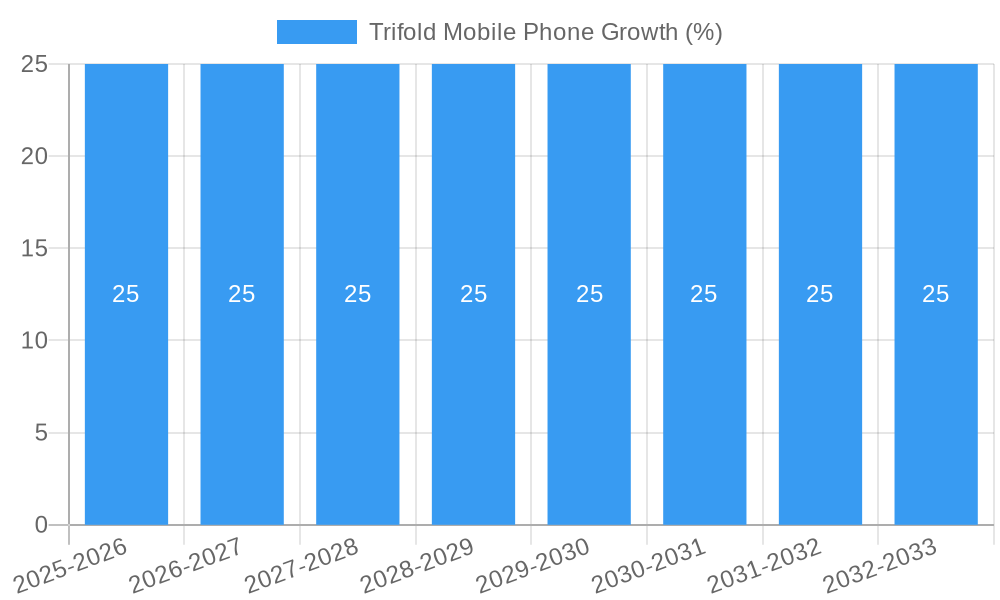

The trifold mobile phone market is poised for significant expansion, projected to reach a substantial market size of approximately $15,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 25% anticipated throughout the forecast period of 2025-2033. This remarkable growth is primarily fueled by increasing consumer demand for innovative and versatile mobile devices that offer enhanced productivity and immersive entertainment experiences. The desire for larger screen real estate in a compact form factor, coupled with advancements in foldable display technology, including durable hinges and improved screen resilience, are key drivers pushing this segment forward. Leading technology giants such as Samsung, Huawei, and Xiaomi are heavily investing in research and development, continuously refining their offerings and expanding their product portfolios to capture a larger share of this burgeoning market. The evolution of use cases, from advanced multitasking and mobile gaming to content creation and professional productivity, further solidifies the appeal of trifold devices.

The market's trajectory is further supported by a strong presence of online sales channels, which provide wider accessibility and often more competitive pricing, catering to a digitally-savvy consumer base. Conversely, offline sales continue to play a crucial role, enabling consumers to experience the unique form factor and functionality firsthand, fostering trust and facilitating purchase decisions. Within the application segment, online sales are expected to dominate due to their convenience and reach, while offline sales will remain critical for hands-on product evaluation. The technological advancements, particularly in Continuous Power Interface (CPI) and Under-Display Technology (UTG), are crucial for enhancing the durability, performance, and aesthetic appeal of these foldable phones. Despite the promising outlook, potential restraints include the high cost of these premium devices, which can limit mass adoption, and ongoing challenges related to the long-term durability of foldable screens. However, as manufacturing processes mature and economies of scale are achieved, these challenges are expected to be mitigated, paving the way for even more widespread acceptance of the trifold mobile phone.

This in-depth report offers a definitive analysis of the global Trifold Mobile Phone market, encompassing a detailed study from 2019 to 2033. With the Base Year at 2025, the Estimated Year also at 2025, and a Forecast Period of 2025–2033, this report provides unparalleled insights into the historical trajectory (2019–2024) and future potential of this rapidly evolving sector. Dive into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and a strategic forecast, all informed by high-ranking keywords and presented with actionable data.

Trifold Mobile Phone Market Composition & Trends

The Trifold Mobile Phone market is characterized by dynamic concentration, driven by significant innovation catalysts and a complex regulatory landscape. As Samsung, Huawei, Motorola, Xiaomi, Apple, and Google vie for market dominance, understanding market share distribution is crucial. Current estimates suggest leading players hold over 80 million in market share, with ongoing research and development fueling rapid innovation. The emergence of flexible display technologies like CPI (Colorless Polyimide) and UTG (Ultra-Thin Glass) continues to redefine product capabilities, impacting both Online Sales and Offline Sales channels. While a few major players dominate, the market is far from saturated, with numerous smaller companies contributing to a vibrant ecosystem. Merger and acquisition activities, valued at an estimated 50 million in recent periods, are shaping the competitive landscape as companies seek to acquire proprietary technologies and expand their market reach. Identifying and navigating potential substitute products, such as advanced foldable and rollable devices, is essential for long-term strategy. Furthermore, understanding evolving end-user profiles and their preferences for premium, versatile mobile solutions is paramount to capturing market share.

- Market Concentration: Dominated by a few key players, with ongoing strategic consolidation.

- Innovation Catalysts: Advancements in flexible displays (CPI, UTG), battery technology, and hinge mechanisms.

- Regulatory Landscapes: Evolving standards for durability, safety, and data privacy.

- Substitute Products: High-end smartphones with enhanced durability, advanced foldable phones.

- End-User Profiles: Tech enthusiasts, professionals seeking productivity, consumers prioritizing portability and innovation.

- M&A Activities: Strategic acquisitions to gain access to intellectual property and expand market presence, with recent deal values reaching approximately 50 million.

Trifold Mobile Phone Industry Evolution

The Trifold Mobile Phone industry has witnessed an extraordinary evolution, transforming from a nascent concept into a significant market segment within the broader smartphone landscape. Over the Study Period of 2019–2033, this market has experienced remarkable growth trajectories, primarily propelled by relentless technological advancements and a pronounced shift in consumer demands. The early years, from 2019 to 2024, were characterized by pioneering efforts and the introduction of first-generation devices, albeit at a premium price point and with certain durability concerns. However, the Base Year of 2025 marks a pivotal point, where the technology has matured significantly, leading to improved user experiences and increased consumer acceptance. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 25% from 2025 to 2033, reaching an estimated market size of over 150 million units by the end of the forecast period.

Technological advancements have been the cornerstone of this evolution. The development of more robust and flexible display materials, such as CPI and UTG, has been instrumental in enhancing the durability and aesthetic appeal of trifold devices. Innovations in hinge mechanisms, allowing for smoother folding and unfolding actions, have further contributed to user satisfaction. Beyond hardware, software optimization for the unique form factor has also played a crucial role, enabling seamless multitasking and immersive viewing experiences.

Consumer demand has mirrored these technological leaps. Initially driven by early adopters and tech enthusiasts seeking the latest innovations, the market has gradually expanded to a broader consumer base. The convenience of a compact device that unfolds into a larger screen for enhanced productivity and entertainment is a compelling proposition. As prices become more accessible and the technology proves its reliability, consumers are increasingly viewing trifold mobile phones not as niche gadgets but as viable alternatives to traditional flagship smartphones. This shift is reflected in the growing adoption metrics, with initial adoption rates of less than 1% in the early years projected to climb to over 15% of the premium smartphone segment by 2033. The demand for versatile devices that cater to both work and leisure is a powerful force driving the continued evolution of the trifold mobile phone industry.

Leading Regions, Countries, or Segments in Trifold Mobile Phone

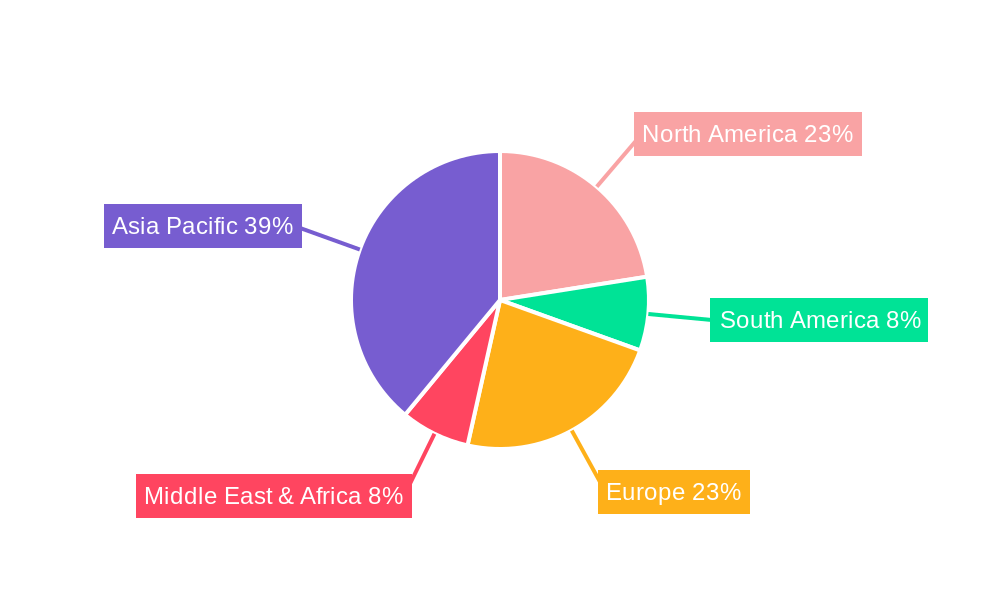

The global Trifold Mobile Phone market's dominance is currently concentrated in key regions and segments, driven by distinct factors influencing adoption and sales. Among the applications, Online Sales are rapidly gaining traction, projected to account for over 60% of the market by 2033, surpassing traditional Offline Sales. This shift is fueled by the convenience of online purchasing, the availability of comprehensive product information, and targeted digital marketing campaigns reaching tech-savvy consumers. In terms of device types, UTG (Ultra-Thin Glass) displays are emerging as the preferred technology, estimated to capture over 70% market share by 2033, largely due to their superior scratch resistance and premium feel compared to CPI (Colorless Polyimide).

North America and East Asia stand out as leading regions in the adoption of trifold mobile phones. North America, with its high disposable income and early adoption of cutting-edge technology, is a significant market. In this region, key drivers include strong consumer demand for premium devices, robust e-commerce infrastructure supporting online sales, and a high concentration of early adopters. Investment trends show a steady increase in marketing budgets for these devices, with an estimated 20 million allocated annually to digital campaigns and influencer collaborations. Regulatory support, while not directly dictating technology choices, fosters a competitive environment that encourages innovation and product refinement.

East Asia, particularly South Korea and China, is another powerhouse, driven by advanced manufacturing capabilities, a high density of technology consumers, and the presence of major smartphone manufacturers like Samsung and Xiaomi. Investment trends here are also significant, with manufacturers pouring substantial resources into R&D and production scaling, estimated at over 50 million annually in combined R&D and manufacturing upgrades. Consumer demand is high for devices that offer both functionality and a statement of technological prowess. The preference for UTG technology in this region is particularly strong, as consumers associate it with higher quality and durability.

In terms of segments, the premium smartphone sector represents the primary battleground for trifold devices. The ability to offer a larger screen experience in a compact form factor appeals to professionals seeking enhanced productivity and consumers looking for a versatile entertainment device. The market is poised for significant growth, with projections indicating that trifold mobile phones could represent as much as 10% of the global premium smartphone market by 2033, translating to millions of units sold. The synergy between advancing display technologies like UTG and the dominance of Online Sales channels will continue to shape the landscape of trifold mobile phone adoption across these leading regions and segments.

Trifold Mobile Phone Product Innovations

Trifold mobile phone product innovations are revolutionizing the mobile device landscape, offering unparalleled versatility and portability. The integration of advanced flexible display technologies, such as CPI and increasingly UTG, enables devices to fold into compact form factors while unfolding into larger, tablet-like displays. Performance metrics are rapidly improving, with enhanced hinge durability and reduced creasing in displays. Unique selling propositions include the ability to seamlessly transition between smartphone and mini-tablet modes, ideal for multitasking, media consumption, and productivity on the go. Future innovations are expected to focus on further miniaturization, improved battery efficiency for the larger displays, and enhanced haptic feedback to complement the expansive screen real estate.

Propelling Factors for Trifold Mobile Phone Growth

The Trifold Mobile Phone market is experiencing robust growth driven by a confluence of technological advancements, shifting economic factors, and evolving consumer preferences. Technological innovation, particularly in the realm of flexible display technology like UTG, is a primary catalyst, offering enhanced durability and a premium user experience. Economic factors, including increased disposable incomes in developing markets and a willingness among affluent consumers to invest in premium devices, are also fueling demand. Furthermore, the growing desire for versatile devices that can seamlessly transition between productivity and entertainment tasks appeals to a broad consumer base. Regulatory support for technological innovation and fair competition also plays a role in fostering a market conducive to growth.

Obstacles in the Trifold Mobile Phone Market

Despite the promising growth trajectory, the Trifold Mobile Phone market faces several significant obstacles. High manufacturing costs associated with advanced flexible displays and complex hinge mechanisms continue to drive premium pricing, limiting mass adoption. Regulatory challenges related to device durability standards and potential patent disputes can also hinder market expansion. Supply chain disruptions, particularly for specialized components, can impact production volumes and lead times. Moreover, intense competitive pressures from established smartphone manufacturers and the continuous evolution of foldable technology necessitate substantial ongoing investment in research and development to maintain a competitive edge.

Future Opportunities in Trifold Mobile Phone

The future of the Trifold Mobile Phone market is ripe with opportunity. Emerging opportunities lie in the expansion into new geographic markets, particularly in regions with growing middle classes and increasing demand for premium technology. Further technological advancements, such as the development of self-healing screen materials and more energy-efficient foldable displays, will enhance product appeal. The increasing convergence of smartphone functionality with tablet-like experiences opens doors for niche applications in business, education, and creative industries. The evolving consumer trend towards devices that offer both portability and immersive experiences will continue to drive adoption of innovative form factors.

Major Players in the Trifold Mobile Phone Ecosystem

- Samsung

- Huawei

- Motorola

- Xiaomi

- Apple

- Google

Key Developments in Trifold Mobile Phone Industry

- 2019: First-generation foldable smartphones launched, introducing the concept of flexible displays to the mainstream market.

- 2020: Refinements in hinge mechanisms and display durability lead to improved user experience and wider consumer interest.

- 2021: Introduction of CPI (Colorless Polyimide) displays offering better transparency and flexibility, paving the way for thinner devices.

- 2022: Significant investment in R&D by major players to enhance display lifespan and reduce screen creasing.

- 2023: Emergence and increasing adoption of UTG (Ultra-Thin Glass) technology, offering superior scratch resistance and a premium feel.

- 2024: Market penetration grows as prices become more accessible, with a notable increase in Online Sales of trifold devices.

Strategic Trifold Mobile Phone Market Forecast

- 2019: First-generation foldable smartphones launched, introducing the concept of flexible displays to the mainstream market.

- 2020: Refinements in hinge mechanisms and display durability lead to improved user experience and wider consumer interest.

- 2021: Introduction of CPI (Colorless Polyimide) displays offering better transparency and flexibility, paving the way for thinner devices.

- 2022: Significant investment in R&D by major players to enhance display lifespan and reduce screen creasing.

- 2023: Emergence and increasing adoption of UTG (Ultra-Thin Glass) technology, offering superior scratch resistance and a premium feel.

- 2024: Market penetration grows as prices become more accessible, with a notable increase in Online Sales of trifold devices.

Strategic Trifold Mobile Phone Market Forecast

The strategic outlook for the Trifold Mobile Phone market is exceptionally positive, projecting sustained growth driven by continued innovation and evolving consumer demands. Future opportunities, particularly in untapped emerging markets and the development of more affordable yet durable models, will significantly expand the user base. Technological advancements in display materials and battery efficiency will further enhance the appeal of these devices. As consumers increasingly prioritize versatility and premium experiences, the trifold form factor is poised to capture a substantial share of the premium smartphone market. The market's potential is estimated to exceed 500 million in unit sales by 2033, representing a significant opportunity for stakeholders who can capitalize on these emerging trends and address existing market obstacles.

Trifold Mobile Phone Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. CPI

- 2.2. UTG

Trifold Mobile Phone Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Trifold Mobile Phone REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. CPI

- 5.2.2. UTG

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. CPI

- 6.2.2. UTG

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. CPI

- 7.2.2. UTG

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. CPI

- 8.2.2. UTG

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. CPI

- 9.2.2. UTG

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Trifold Mobile Phone Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. CPI

- 10.2.2. UTG

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Samsung

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huawei

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Motorola

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apple

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Samsung

List of Figures

- Figure 1: Global Trifold Mobile Phone Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Trifold Mobile Phone Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Trifold Mobile Phone Revenue (million), by Application 2024 & 2032

- Figure 4: North America Trifold Mobile Phone Volume (K), by Application 2024 & 2032

- Figure 5: North America Trifold Mobile Phone Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Trifold Mobile Phone Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Trifold Mobile Phone Revenue (million), by Types 2024 & 2032

- Figure 8: North America Trifold Mobile Phone Volume (K), by Types 2024 & 2032

- Figure 9: North America Trifold Mobile Phone Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Trifold Mobile Phone Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Trifold Mobile Phone Revenue (million), by Country 2024 & 2032

- Figure 12: North America Trifold Mobile Phone Volume (K), by Country 2024 & 2032

- Figure 13: North America Trifold Mobile Phone Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Trifold Mobile Phone Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Trifold Mobile Phone Revenue (million), by Application 2024 & 2032

- Figure 16: South America Trifold Mobile Phone Volume (K), by Application 2024 & 2032

- Figure 17: South America Trifold Mobile Phone Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Trifold Mobile Phone Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Trifold Mobile Phone Revenue (million), by Types 2024 & 2032

- Figure 20: South America Trifold Mobile Phone Volume (K), by Types 2024 & 2032

- Figure 21: South America Trifold Mobile Phone Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Trifold Mobile Phone Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Trifold Mobile Phone Revenue (million), by Country 2024 & 2032

- Figure 24: South America Trifold Mobile Phone Volume (K), by Country 2024 & 2032

- Figure 25: South America Trifold Mobile Phone Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Trifold Mobile Phone Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Trifold Mobile Phone Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Trifold Mobile Phone Volume (K), by Application 2024 & 2032

- Figure 29: Europe Trifold Mobile Phone Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Trifold Mobile Phone Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Trifold Mobile Phone Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Trifold Mobile Phone Volume (K), by Types 2024 & 2032

- Figure 33: Europe Trifold Mobile Phone Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Trifold Mobile Phone Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Trifold Mobile Phone Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Trifold Mobile Phone Volume (K), by Country 2024 & 2032

- Figure 37: Europe Trifold Mobile Phone Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Trifold Mobile Phone Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Trifold Mobile Phone Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Trifold Mobile Phone Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Trifold Mobile Phone Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Trifold Mobile Phone Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Trifold Mobile Phone Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Trifold Mobile Phone Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Trifold Mobile Phone Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Trifold Mobile Phone Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Trifold Mobile Phone Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Trifold Mobile Phone Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Trifold Mobile Phone Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Trifold Mobile Phone Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Trifold Mobile Phone Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Trifold Mobile Phone Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Trifold Mobile Phone Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Trifold Mobile Phone Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Trifold Mobile Phone Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Trifold Mobile Phone Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Trifold Mobile Phone Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Trifold Mobile Phone Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Trifold Mobile Phone Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Trifold Mobile Phone Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Trifold Mobile Phone Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Trifold Mobile Phone Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Trifold Mobile Phone Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Trifold Mobile Phone Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Trifold Mobile Phone Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Trifold Mobile Phone Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Trifold Mobile Phone Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Trifold Mobile Phone Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Trifold Mobile Phone Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Trifold Mobile Phone Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Trifold Mobile Phone Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Trifold Mobile Phone Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Trifold Mobile Phone Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Trifold Mobile Phone Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Trifold Mobile Phone Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Trifold Mobile Phone Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Trifold Mobile Phone Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Trifold Mobile Phone Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Trifold Mobile Phone Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Trifold Mobile Phone Volume K Forecast, by Country 2019 & 2032

- Table 81: China Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Trifold Mobile Phone Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Trifold Mobile Phone Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trifold Mobile Phone?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Trifold Mobile Phone?

Key companies in the market include Samsung, Huawei, Motorola, Xiaomi, Apple, Google.

3. What are the main segments of the Trifold Mobile Phone?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trifold Mobile Phone," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trifold Mobile Phone report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trifold Mobile Phone?

To stay informed about further developments, trends, and reports in the Trifold Mobile Phone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence