Key Insights

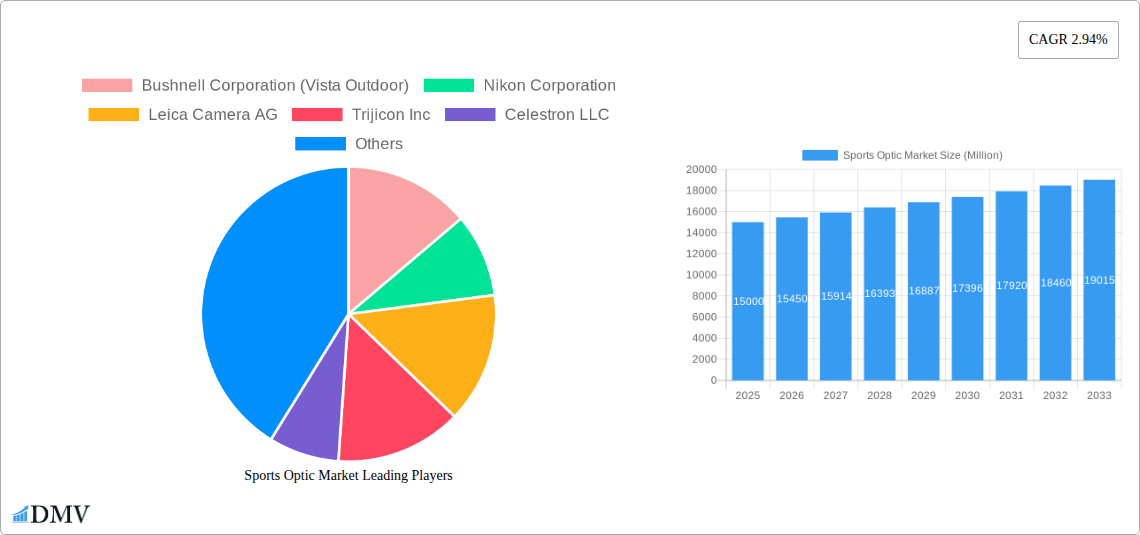

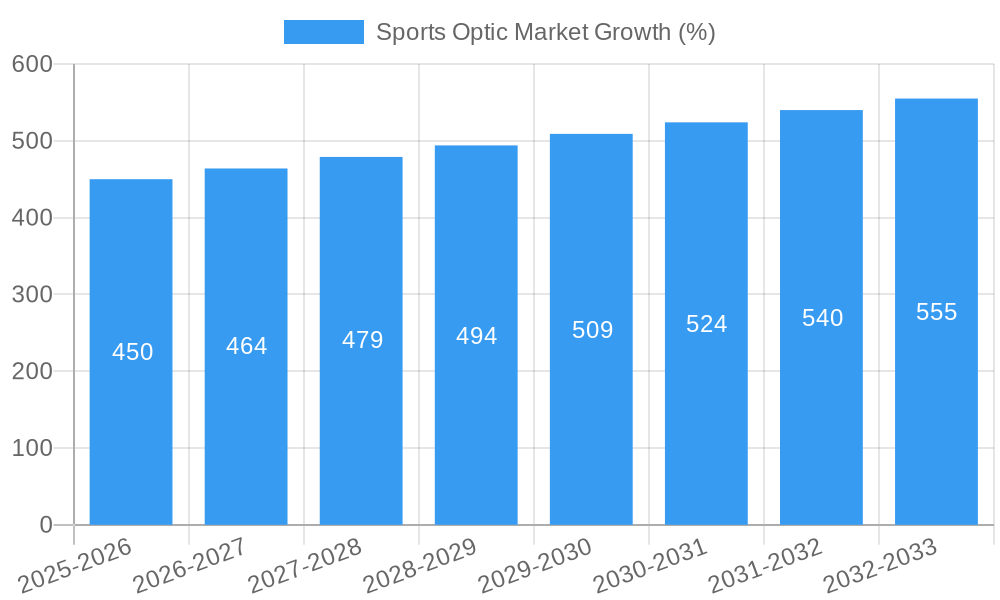

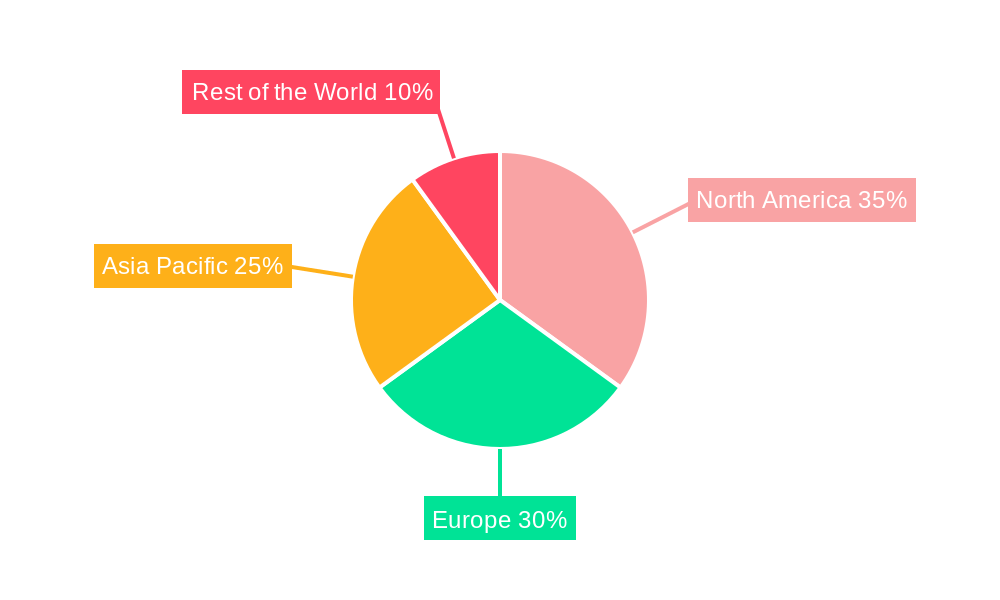

The global sports optics market, encompassing telescopes, binoculars, rifle scopes, rangefinders, and other specialized products, is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 2.94% from 2025 to 2033. This growth is fueled by several key drivers. The increasing popularity of outdoor recreational activities like hunting, birdwatching, and stargazing is significantly boosting demand. Technological advancements resulting in higher-quality optics with improved features such as enhanced magnification, clarity, and durability are also contributing to market expansion. Furthermore, the rising disposable incomes in developing economies are driving increased consumer spending on high-quality sporting goods, including specialized optics. While the market faces certain restraints, such as the high cost of premium products potentially limiting accessibility for some consumers, the overall positive trends suggest a continuously expanding market. The segmentation by product type reveals that rifle scopes and binoculars currently hold significant market shares, owing to their widespread use in hunting and recreational activities, respectively. However, the "other product types" segment, likely encompassing specialized equipment like spotting scopes and night vision devices, is poised for accelerated growth driven by niche applications and technological innovations. Leading players such as Bushnell, Nikon, and Leica continue to invest heavily in research and development, further propelling the overall market evolution. The geographic distribution of the market will likely continue to see robust growth in the Asia-Pacific region, driven by increasing participation in outdoor recreation and a rising middle class.

The competitive landscape is characterized by both established industry giants and innovative smaller players. Companies are focusing on strategic partnerships, product diversification, and marketing initiatives to capture larger market shares. The integration of advanced technologies, such as image stabilization and digital connectivity, is expected to become increasingly important in driving product differentiation and influencing consumer choices. The emphasis on environmentally friendly manufacturing processes and sustainable materials is also gaining traction, aligning with the growing consumer preference for ethical and responsible brands. Overall, the sports optics market presents a promising outlook for sustained expansion, driven by converging factors of increased participation in outdoor activities, technological innovation, and a growing global consumer base. The market is expected to reach a significant value by 2033, reflecting the continued success of leading players and the emergence of new competitors. We estimate the 2025 market size to be approximately $XX Billion (assuming a reasonable market value based on typical industry size for related markets and the provided CAGR), which will further increase in the coming years.

Sports Optic Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Sports Optic Market, covering the period 2019-2033, with a focus on market trends, leading players, and future growth opportunities. The study period encompasses historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. This comprehensive report is essential for stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed strategic decisions. The market size is projected to reach xx Million by 2033.

Sports Optic Market Market Composition & Trends

This section delves into the competitive landscape of the Sports Optic Market, analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure with key players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation.

Market Share Distribution (2024): Bushnell Corporation holds an estimated xx% market share, followed by Nikon Corporation at xx%, and Leica Camera AG at xx%. The remaining share is distributed among other players, including Trijicon Inc, Celestron LLC, Carl Zeiss AG, Burris Optics, Vortex Optics, Swarovski Optik, and Karl Kaps GmbH & Co KG. These figures are estimates and subject to minor variations due to data availability.

Innovation Catalysts: Continuous advancements in lens technology, including improved coatings and materials, are driving product innovation. The integration of digital features, such as rangefinding capabilities and image stabilization, is also fueling market growth.

Regulatory Landscape: Regulations concerning product safety and environmental impact vary across different regions, influencing market dynamics and player strategies. Compliance costs impact pricing and profitability.

Substitute Products: Alternatives like smartphone cameras with zoom capabilities pose a competitive challenge to some segments of the market, particularly in the entry-level range. However, the superior image quality and performance features of dedicated sports optics continue to sustain demand.

End-User Profiles: The market is primarily driven by sports enthusiasts, hunters, outdoor adventurers, and professionals in fields like wildlife observation and surveying.

M&A Activities: The Sports Optic Market has witnessed a moderate level of M&A activity in recent years, with deal values averaging xx Million per transaction. These activities primarily involve smaller companies being acquired by larger players to enhance their product portfolio or expand into new markets.

Sports Optic Market Industry Evolution

The Sports Optic Market has exhibited a steady growth trajectory over the past five years, fueled by increasing consumer disposable income and growing participation in outdoor activities. Technological advancements, particularly in lens technology and digital integration, have significantly enhanced the performance and user experience of sports optics. The market growth rate is estimated to have averaged xx% annually during the historical period (2019-2024) and is projected to continue growing at xx% CAGR during the forecast period (2025-2033).

This growth is being driven by several key factors, including the rising popularity of outdoor recreational activities, the increasing demand for high-quality images and videos in sports and recreational pursuits, and ongoing technological advancements which are constantly increasing performance and improving user experience.

Consumer demands are also shifting, with a growing preference for compact and lightweight devices, integrated digital features, and improved durability. This is prompting manufacturers to focus on developing innovative products which cater to this demand. Adoption of advanced features such as image stabilization and GPS integration is also rising amongst consumers. The increasing use of virtual reality and augmented reality technology is also expected to impact this market and drive further innovation and growth.

Leading Regions, Countries, or Segments in Sports Optic Market

The North American market currently dominates the global Sports Optic Market, driven primarily by strong consumer demand and high per capita spending on sporting goods and outdoor recreation.

- Key Drivers in North America:

- High levels of disposable income among consumers.

- Strong preference for high-quality sports optics.

- Well-established distribution networks.

- Growing popularity of hunting, wildlife viewing and other outdoor sports.

- Supportive regulatory environment encouraging outdoor recreational activities.

Europe holds the second largest market share, and although exhibiting strong growth, is less prominent in certain product types compared to North America. Asia-Pacific is experiencing rapid growth due to rising disposable incomes and increasing participation in outdoor activities. This rapid expansion is being especially noticeable within the binoculars and rifle scope segments.

- Dominance Factors: High consumer spending power, favorable regulatory environments, and strong distribution networks have contributed to the North American market's leading position. The region's robust sporting culture, with various hunting and outdoor activities, fuels high demand for advanced sports optics.

Sports Optic Market Product Innovations

Recent product innovations in the Sports Optic Market have focused on enhancing image quality, improving portability, and integrating advanced features. The introduction of lightweight materials and improved lens coatings has increased performance and reduced size and weight, improving the end-user experience. Smart features, such as rangefinders and Bluetooth connectivity, provide additional functionality. Companies are focusing on creating unique selling propositions through advanced lens technology and specialized coatings that enable enhanced performance in specific conditions, such as low-light environments.

Propelling Factors for Sports Optic Market Growth

Technological advancements in optics and electronics are crucial to the Sports Optic Market's growth. Improved lens coatings, lighter materials, and digital enhancements continuously enhance image clarity, durability, and user experience. Economic factors like rising disposable income and increased participation in outdoor recreation create growing demand. A supportive regulatory environment that encourages outdoor activities and hunting in certain regions also supports this growth.

Obstacles in the Sports Optic Market Market

Several factors hinder Sports Optic Market growth. Stricter environmental regulations in certain countries may limit the use of certain materials. Supply chain disruptions, particularly in component sourcing, can increase manufacturing costs and reduce product availability. Intense competition among numerous players, with a range of quality and pricing points, presents a further challenge.

Future Opportunities in Sports Optic Market

Emerging markets in Asia and Latin America present significant growth opportunities for Sports Optic manufacturers. The integration of augmented reality (AR) and virtual reality (VR) technologies holds potential for enhancing the user experience. Increasing consumer demand for more sustainable and eco-friendly products presents further opportunities.

Major Players in the Sports Optic Market Ecosystem

- Bushnell Corporation (Vista Outdoor)

- Nikon Corporation

- Leica Camera AG

- Trijicon Inc

- Celestron LLC

- Carl Zeiss AG

- Burris Optics

- Vortex Optics

- Swarovski Optik

- Karl Kaps GmbH & Co KG

Key Developments in Sports Optic Market Industry

- October 2022: The National Research Council of Canada (NRC) developed an experimental adaptive optics system for improved telescope image clarity.

- December 2022: Panda Optics (UK) introduced Snowsport visual solutions with advanced lens technology for improved goggle vision.

- January 2023: ZEISS launched Smart Focus Lightweight (SFL) binoculars, highlighting lightweight design and improved optics.

Strategic Sports Optic Market Market Forecast

The Sports Optic Market is poised for continued growth, driven by technological advancements, increasing consumer demand, and expanding market penetration in emerging economies. The focus on innovation, coupled with the rising popularity of outdoor activities, suggests significant market potential in the coming years. The market is expected to experience steady growth, with potential for accelerated expansion driven by emerging technologies and market segments.

Sports Optic Market Segmentation

-

1. Product Type

- 1.1. Telescopes

- 1.2. Binoculars

- 1.3. Rifle Scopes

- 1.4. Rangefinders

- 1.5. Other Product Types

Sports Optic Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Sports Optic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Performance Specifications such as Clarity

- 3.2.2 Sharpness

- 3.2.3 and Magnification; Enhanced Fan Experience

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Telescopes to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Telescopes

- 5.1.2. Binoculars

- 5.1.3. Rifle Scopes

- 5.1.4. Rangefinders

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Telescopes

- 6.1.2. Binoculars

- 6.1.3. Rifle Scopes

- 6.1.4. Rangefinders

- 6.1.5. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Telescopes

- 7.1.2. Binoculars

- 7.1.3. Rifle Scopes

- 7.1.4. Rangefinders

- 7.1.5. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Telescopes

- 8.1.2. Binoculars

- 8.1.3. Rifle Scopes

- 8.1.4. Rangefinders

- 8.1.5. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Telescopes

- 9.1.2. Binoculars

- 9.1.3. Rifle Scopes

- 9.1.4. Rangefinders

- 9.1.5. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. North America Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Sports Optic Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Bushnell Corporation (Vista Outdoor)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nikon Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Leica Camera AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Trijicon Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Celestron LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Carl Zeiss AG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Burris Optics

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Vortex Optics

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Swarovski Optik

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Karl Kaps GmbH & Co KG*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Bushnell Corporation (Vista Outdoor)

List of Figures

- Figure 1: Global Sports Optic Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Sports Optic Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: North America Sports Optic Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: North America Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sports Optic Market Revenue (Million), by Product Type 2024 & 2032

- Figure 15: Europe Sports Optic Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: Europe Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Sports Optic Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Asia Pacific Sports Optic Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Asia Pacific Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Sports Optic Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Sports Optic Market Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Rest of the World Sports Optic Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Rest of the World Sports Optic Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Sports Optic Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sports Optic Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sports Optic Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Sports Optic Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Sports Optic Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sports Optic Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Sports Optic Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Sports Optic Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Sports Optic Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Sports Optic Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Sports Optic Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Sports Optic Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Sports Optic Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Optic Market?

The projected CAGR is approximately 2.94%.

2. Which companies are prominent players in the Sports Optic Market?

Key companies in the market include Bushnell Corporation (Vista Outdoor), Nikon Corporation, Leica Camera AG, Trijicon Inc, Celestron LLC, Carl Zeiss AG, Burris Optics, Vortex Optics, Swarovski Optik, Karl Kaps GmbH & Co KG*List Not Exhaustive.

3. What are the main segments of the Sports Optic Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Performance Specifications such as Clarity. Sharpness. and Magnification; Enhanced Fan Experience.

6. What are the notable trends driving market growth?

Telescopes to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023 - ZEISS launched Smart Focus Lightweight (SFL) binoculars. These are specially designed for wildlife enthusiasts and travelers. The company claims this to be the lightest series of SFL. Improved optical design, high-quality glass, and special coating are some of the other vital features of the product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Optic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Optic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Optic Market?

To stay informed about further developments, trends, and reports in the Sports Optic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence