Key Insights

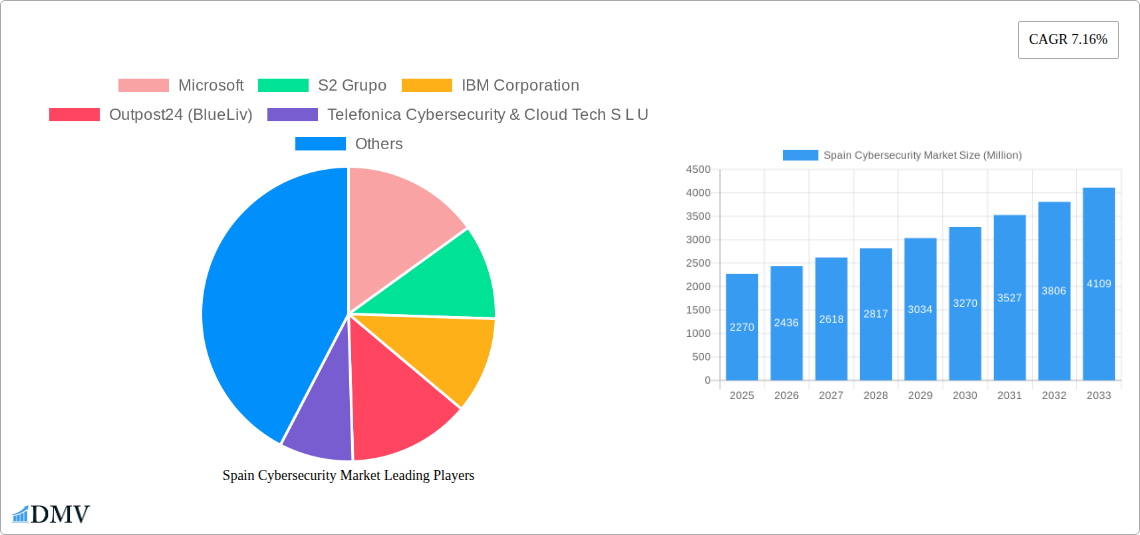

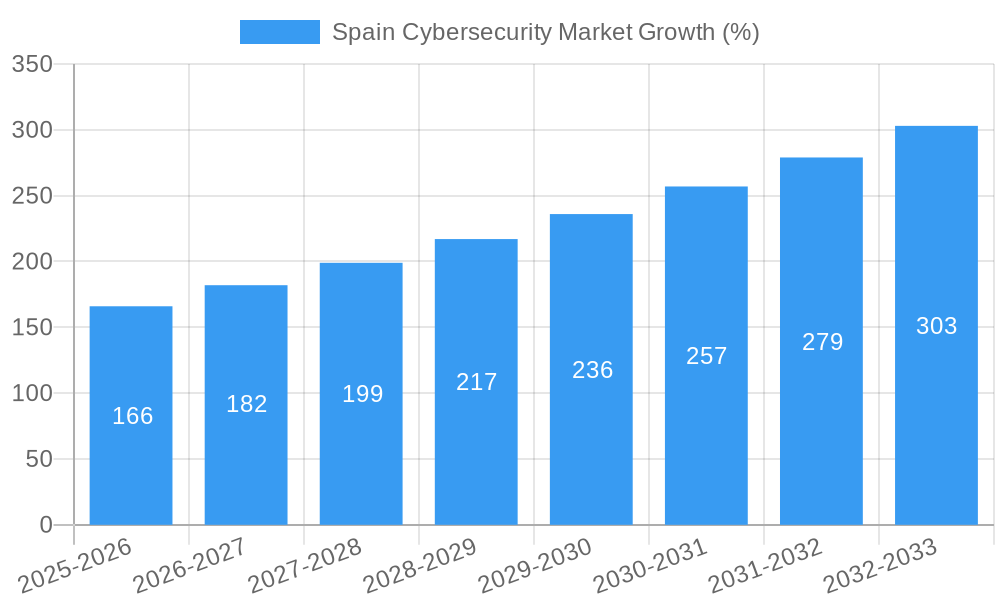

The Spain cybersecurity market, valued at €2.27 billion in 2025, is projected to experience robust growth, driven by increasing digitalization across sectors like BFSI, healthcare, and manufacturing. A compound annual growth rate (CAGR) of 7.16% from 2025 to 2033 indicates a significant expansion of the market. This growth is fueled by rising cyber threats, stringent data privacy regulations like GDPR, and the increasing adoption of cloud-based services. The market is segmented by end-user, offering type (security solutions and services), and deployment (cloud and on-premise). The demand for comprehensive cybersecurity solutions, including advanced threat protection, vulnerability management, and incident response services, is driving significant investments. Key players like Microsoft, IBM, and specialized Spanish firms such as S2 Grupo and Indra Sistemas are actively competing within this expanding market. The increasing sophistication of cyberattacks and the growing reliance on interconnected systems are key factors underpinning the market's growth trajectory. The on-premise segment is expected to witness a gradual decline, while the cloud segment will dominate market share due to its scalability and cost-effectiveness. Government initiatives promoting cybersecurity awareness and infrastructure development are further supporting the market's expansion.

The competitive landscape is characterized by a mix of multinational corporations and specialized Spanish cybersecurity companies. While established players leverage their global reach and established portfolios, local firms offer specialized expertise tailored to the Spanish market. The market is expected to witness strategic partnerships and mergers and acquisitions, as companies strive to expand their product offerings and market share. Furthermore, a growing emphasis on proactive security measures, such as threat intelligence and security awareness training, will contribute to market expansion. The ongoing evolution of cyber threats necessitates continuous innovation in security technologies, driving further growth in the coming years. This dynamic market presents lucrative opportunities for both established players and emerging companies specializing in niche security solutions.

Spain Cybersecurity Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Spain Cybersecurity Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a focus on market size, growth drivers, challenges, and opportunities, this report is an essential resource for stakeholders seeking to understand and navigate this dynamic landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects market trends from 2025 to 2033, utilizing data from the historical period of 2019-2024. The market size is expected to reach xx Million by 2033.

Spain Cybersecurity Market Composition & Trends

The Spain Cybersecurity Market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, a considerable number of smaller, specialized firms also contribute to the market's dynamism. Innovation is driven by increasing cyber threats, stringent data privacy regulations (like GDPR), and the growing adoption of cloud computing and IoT technologies. The regulatory landscape is evolving, with ongoing efforts to strengthen cybersecurity frameworks and enhance data protection. Substitute products are limited, as robust cybersecurity solutions are crucial for businesses and government organizations. M&A activity is relatively high, with deals driven by the need for enhanced capabilities, geographical expansion, and technological advancements. Market share distribution is currently estimated as follows: Microsoft (xx%), IBM Corporation (xx%), S2 Grupo (xx%), and others (xx%). The total value of M&A deals in the last 5 years is estimated at xx Million.

- Market Concentration: Moderately concentrated

- Innovation Catalysts: Increasing cyber threats, data privacy regulations, cloud adoption, IoT growth.

- Regulatory Landscape: Evolving, focused on strengthening cybersecurity frameworks and data protection.

- Substitute Products: Limited

- End-User Profiles: Diverse, including BFSI, Healthcare, Manufacturing, Government & Defense, IT & Telecommunications, and others.

- M&A Activity: High, driven by capability enhancement, expansion, and technological advancements.

Spain Cybersecurity Market Industry Evolution

The Spain Cybersecurity Market has witnessed significant growth over the past few years, driven by factors such as the increasing digitization of businesses, growing reliance on cloud services, and a rise in sophisticated cyberattacks. The market's growth trajectory is expected to remain positive throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. Technological advancements, including AI-powered threat detection, blockchain-based security solutions, and advanced endpoint protection, are further fueling market expansion. Consumer demands are shifting towards more comprehensive and integrated security solutions that address evolving threat landscapes. The adoption rate of cloud-based security solutions is increasing rapidly, while the demand for managed security services is also rising steadily. The market experienced a xx% growth from 2020-2024. Increased government investment in cybersecurity infrastructure is also driving growth.

Leading Regions, Countries, or Segments in Spain Cybersecurity Market

The Spanish Cybersecurity Market is witnessing robust growth across multiple segments. The Government & Defense sector exhibits the highest growth rate, fuelled by substantial investments in cybersecurity infrastructure to counter evolving threats. The BFSI sector is another significant contributor, driven by stringent regulatory compliance requirements and the rising value of financial data. Cloud-based deployment models are rapidly gaining traction, favored for their scalability and cost-effectiveness. Within security types, endpoint security and network security solutions continue to dominate the market.

- Key Drivers (By End User):

- Government & Defense: High government spending on cybersecurity infrastructure.

- BFSI: Stringent regulatory compliance, high value of financial data.

- Healthcare: Increasing reliance on electronic health records and connected medical devices.

- Key Drivers (By Offering):

- Security Type: Growing demand for advanced threat detection & response capabilities.

- Services: Rising adoption of managed security services (MSS) and security consulting.

- Key Drivers (By Deployment):

- Cloud: Scalability, cost-effectiveness, and ease of management.

Spain Cybersecurity Market Product Innovations

Recent product innovations include AI-driven threat detection systems, cloud-based security platforms offering enhanced scalability and agility, and advanced endpoint protection solutions that leverage machine learning for improved threat identification. These innovations boast unique selling propositions like real-time threat detection, automated response mechanisms, and proactive threat mitigation capabilities. This technological advancement has significantly improved the overall effectiveness of cybersecurity measures in Spain.

Propelling Factors for Spain Cybersecurity Market Growth

The Spain Cybersecurity Market is propelled by several key factors. Technological advancements, such as AI and machine learning, are enhancing threat detection and response capabilities. The increasing adoption of cloud computing and IoT devices creates new security vulnerabilities, driving demand for protective measures. Stringent data privacy regulations like GDPR necessitate robust security solutions, while rising cyberattacks and the increasing sophistication of cybercrime further emphasize the need for enhanced cybersecurity.

Obstacles in the Spain Cybersecurity Market

The Spain Cybersecurity Market faces several challenges. The complexity of regulatory compliance can hinder market growth. Supply chain disruptions, especially in the manufacturing and procurement of hardware and software components, can impact availability and costs. Moreover, intense competition among vendors necessitates innovative strategies to maintain market share and competitiveness. These factors can significantly impact market growth.

Future Opportunities in Spain Cybersecurity Market

Future opportunities lie in the increasing adoption of cloud-based security solutions, the growing importance of IoT security, and the increasing demand for specialized cybersecurity services in sectors like healthcare and manufacturing. Emerging technologies such as blockchain and quantum computing present both opportunities and challenges.

Major Players in the Spain Cybersecurity Market Ecosystem

- Microsoft

- S2 Grupo

- IBM Corporation

- Outpost24 (BlueLiv)

- Telefonica Cybersecurity & Cloud Tech S L U

- Alias Robotics S L

- Evolium Technologies S L U (Redtrust)

- Acuntia S A U (Axians)

- Grupo S21Sec Gestion S A U

- Titanium Industrial Security S L

- Indra Sistemas S A

Key Developments in Spain Cybersecurity Market Industry

- June 2022: Telefónica Tech launched a security monitoring service for OT and IoT environments, leveraging Nozomi Networks technology and its global network of security operations centers. This signifies a significant move towards comprehensive IoT and OT security solutions.

- January 2022: Microsoft expanded its collaboration with Minsait (Indra company), offering hybrid cloud services and solutions, strengthening cloud security and data sovereignty for Spanish businesses and public administrations. This further emphasizes the growing trend of hybrid cloud adoption and highlights the importance of data sovereignty.

Strategic Spain Cybersecurity Market Forecast

The Spain Cybersecurity Market is poised for continued growth, driven by technological advancements, increasing cyber threats, and stringent regulatory requirements. The market's potential is substantial, with opportunities across various segments and technologies. Growth will be fueled by ongoing investments in cybersecurity infrastructure, increasing adoption of cloud-based security solutions, and the growing focus on data protection. The market is expected to show sustained growth in the coming years.

Spain Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government and Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Spain Cybersecurity Market Segmentation By Geography

- 1. Spain

Spain Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand from Digitalization

- 3.2.2 e-Commerce

- 3.2.3 and Scaling IT Infrastructure for Businesses; Economic Catch-Up Effect Supporting Digital Businesses and Cybersecurity; Large Spanish Defense and Security Firms Driving the Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Workforce

- 3.4. Market Trends

- 3.4.1. E-Commerce and Digitalization to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government and Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 S2 Grupo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Outpost24 (BlueLiv)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telefonica Cybersecurity & Cloud Tech S L U

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alias Robotics S L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evolium Technologies S L U (Redtrust)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acuntia S A U (Axians)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo S21Sec Gestion S A U

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Titanium Industrial Security S L

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indra Sistemas S A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Spain Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Spain Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Spain Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Spain Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Spain Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Spain Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 8: Spain Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Spain Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Spain Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Cybersecurity Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Spain Cybersecurity Market?

Key companies in the market include Microsoft, S2 Grupo, IBM Corporation, Outpost24 (BlueLiv), Telefonica Cybersecurity & Cloud Tech S L U, Alias Robotics S L, Evolium Technologies S L U (Redtrust)*List Not Exhaustive, Acuntia S A U (Axians), Grupo S21Sec Gestion S A U, Titanium Industrial Security S L, Indra Sistemas S A.

3. What are the main segments of the Spain Cybersecurity Market?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Digitalization. e-Commerce. and Scaling IT Infrastructure for Businesses; Economic Catch-Up Effect Supporting Digital Businesses and Cybersecurity; Large Spanish Defense and Security Firms Driving the Growth.

6. What are the notable trends driving market growth?

E-Commerce and Digitalization to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Workforce.

8. Can you provide examples of recent developments in the market?

June 2022 - Telefónica Tech announced the launch of a security monitoring service for operational technology (OT) and Internet of Things (IoT) environments. The service scans network traffic to envision the network's assets, analyzes and highlights susceptibilities, and detects potential threats in the environment. The company's new offerings leverage the capabilities of its global network of 11 security operations centers for developing a managed OT and IoT security service based on Nozomi Networks technology. It obtains certification in Nozomi Networks' MSSP Elite program to provide managed services for industrial and IoT operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Spain Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence