Key Insights

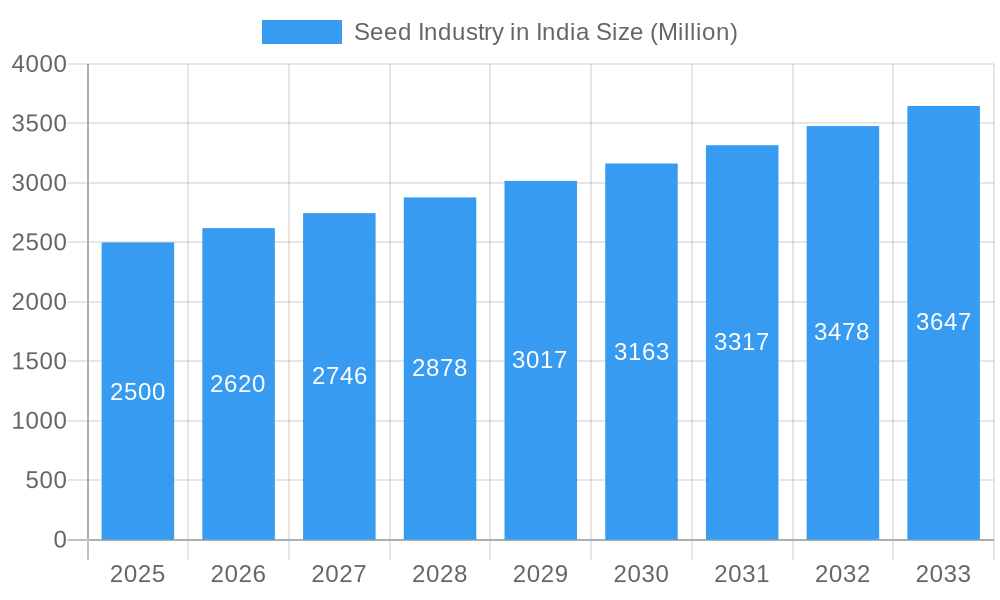

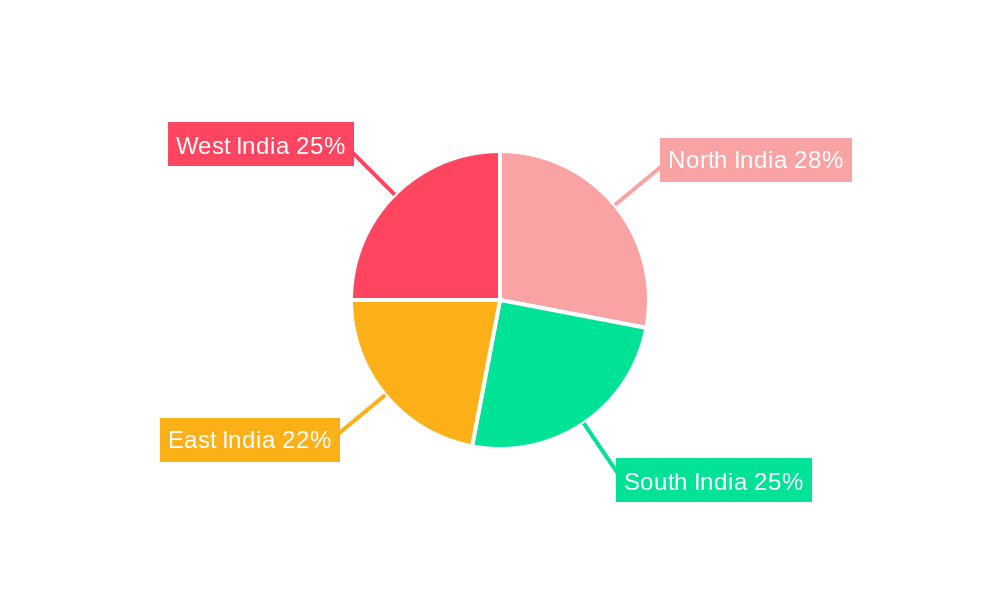

The Indian seed industry, valued at approximately ₹X million (estimated based on provided CAGR and market size data for a comparable period), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is driven by several factors, including increasing demand for high-yielding crop varieties, growing adoption of advanced agricultural technologies like hybrid seeds and protected cultivation, and government initiatives promoting agricultural modernization. The market is segmented by pulse types (vegetables), states (with key players in Bihar, Gujarat, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Telangana, Uttar Pradesh, and West Bengal), cultivation mechanisms (open field and protected cultivation), breeding technologies (hybrids), and crop types (row crops). Major players like Rijk Zwaan, Bayer, BASF, Kaveri Seeds, Limagrain, East-West Seed, Advanta Seeds, Syngenta, Corteva, and Nuziveedu Seeds are actively shaping market dynamics through innovation and distribution strategies. Regional variations exist, with North, South, East, and West India exhibiting unique growth trajectories based on specific climatic conditions and agricultural practices.

Seed Industry in India Market Size (In Billion)

The projected growth is expected to be influenced by factors such as climate change, increasing farmer awareness, and the evolving needs of a growing population. Government policies focused on promoting sustainable agriculture and improving seed quality are also key factors. However, challenges remain, including inconsistent rainfall patterns, limited access to technology in certain regions, and the need for further investment in research and development to enhance seed varieties suitable for diverse agro-climatic conditions. Addressing these restraints will be crucial for realizing the full potential of the Indian seed industry. Further analysis focusing on specific segments within the market—such as the growth of hybrid seeds or the regional performance of specific companies—could provide more granular insights into this dynamic sector.

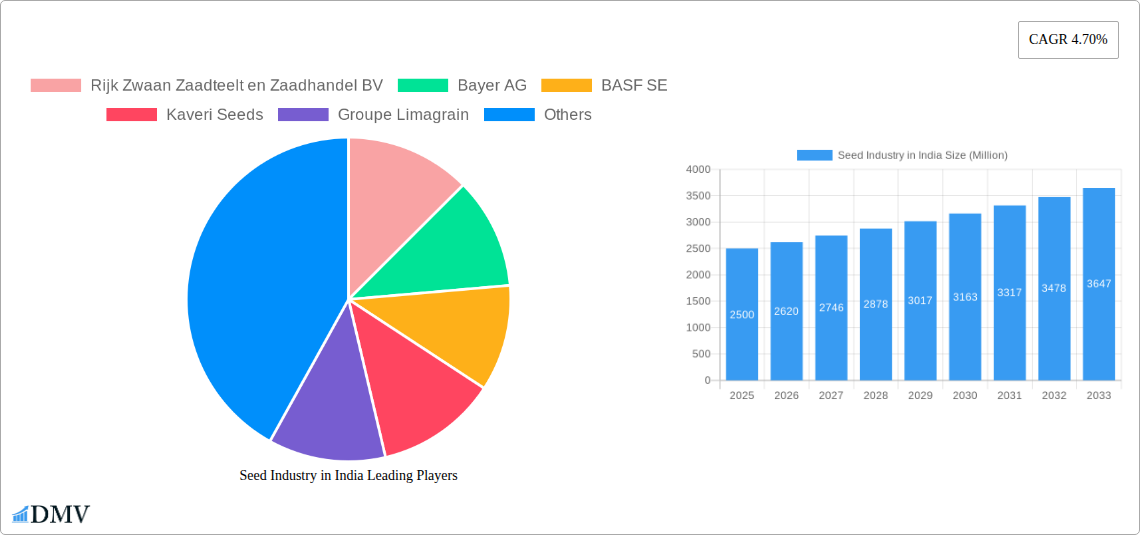

Seed Industry in India Company Market Share

Seed Industry in India: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Indian seed industry, encompassing market size, trends, leading players, and future prospects. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is crucial for stakeholders including investors, industry professionals, and policymakers seeking a comprehensive understanding of this dynamic sector. The Indian seed market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting robust growth driven by technological advancements and increasing demand for high-yielding crop varieties.

Seed Industry in India Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory framework, and market dynamics of the Indian seed industry. The market is characterized by a mix of multinational corporations and domestic players, with varying market share distributions. Key players like Rijk Zwaan, Bayer AG, BASF SE, and Syngenta Group hold significant market shares, alongside prominent Indian companies such as Kaveri Seeds and Nuziveedu Seeds Ltd. However, the sector also witnesses substantial competition from smaller, regionally focused seed companies.

- Market Concentration: The market exhibits moderate concentration with a few dominant players alongside numerous smaller regional players. The top 5 players collectively hold an estimated xx% market share in 2025.

- Innovation Catalysts: Significant investments in R&D, particularly in hybrid seed technology and genetically modified (GM) crops, are driving innovation. Furthermore, collaborations between public and private sector entities accelerate technological advancement.

- Regulatory Landscape: Government policies and regulations concerning seed certification, intellectual property rights, and the approval of GM crops significantly shape market dynamics. Recent regulatory changes have focused on enhancing seed quality and ensuring farmer access.

- Substitute Products: Traditional seed saving practices present a degree of competition, but the growing preference for high-yielding, disease-resistant varieties is driving adoption of commercially produced seeds.

- End-User Profiles: The primary end-users are farmers across diverse segments – from smallholder farmers to large-scale commercial agricultural operations.

- M&A Activities: The Indian seed industry has witnessed several mergers and acquisitions in recent years, primarily involving consolidation amongst smaller players or strategic partnerships between domestic and international companies. The total value of M&A deals in the last five years is estimated at xx Million.

Seed Industry in India Industry Evolution

The Indian seed industry has undergone a significant transformation over the past decade, driven by technological advancements, evolving consumer preferences, and government policies. The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) of xx%, primarily fueled by rising demand for high-yielding varieties, particularly in key crops like pulses and vegetables. Technological advancements, particularly in hybrid seed technology, precision breeding, and marker-assisted selection, have enhanced crop productivity and disease resistance. This trend is projected to continue during the forecast period (2025-2033), with an anticipated CAGR of xx%. The increasing adoption of protected cultivation practices in high-value vegetable crops further boosts market growth. Shifting consumer preferences towards healthier, higher-quality food products are driving demand for seeds that produce premium crops. The government's focus on improving agricultural productivity and enhancing farmer incomes through various initiatives also contributes positively to industry growth. The increased availability of credit and government subsidies, along with improved agricultural infrastructure, facilitated industry expansion in the historical period. However, challenges like climate change, variability in monsoon patterns and the need for resilient crop varieties pose some ongoing risks.

Leading Regions, Countries, or Segments in Seed Industry in India

Several regions and segments dominate the Indian seed market. The states of Uttar Pradesh, Maharashtra, and Madhya Pradesh consistently lead in terms of seed consumption, driven by their significant agricultural acreage and diverse cropping patterns. Within crop types, vegetables and pulses command a substantial market share due to high demand and profitability. The growth of the protected cultivation segment (greenhouses and polyhouses) also boosts the seed market, especially for high-value vegetables.

- Key Drivers:

- High agricultural productivity in leading states: Large cultivation areas and favorable climatic conditions in Uttar Pradesh, Maharashtra, and Madhya Pradesh contribute significantly to higher seed consumption.

- Government support for high-value crops: Government initiatives promoting the cultivation of high-value vegetables and pulses stimulate demand for improved seed varieties.

- Investment in irrigation infrastructure: Improved irrigation facilities in several regions enhance crop yields and, consequently, seed demand.

- Technological advancements: The adoption of hybrid seed technologies, precision breeding, and improved seed treatment methods increases yields and profitability, driving market expansion in certain states.

- Dominance Factors: The dominance of specific regions and segments stems from a confluence of factors including favorable climatic conditions, suitable soil types, high agricultural output, access to irrigation, government support, and favorable infrastructure. The higher profitability of certain crops, coupled with consumer preferences, also contributes to their significant market shares. Furthermore, the availability of well-established seed supply chains in key regions ensures efficient distribution.

Seed Industry in India Product Innovations

Recent innovations focus on developing hybrid varieties with enhanced yield, disease resistance, and stress tolerance. The use of marker-assisted selection (MAS) and other advanced breeding technologies accelerates the development of superior seeds. Unique selling propositions include improved nutritional content in certain varieties, reduced reliance on chemical inputs, and greater adaptability to changing climatic conditions. Examples include BASF's Xitavo soybean seeds featuring Enlist E3 technology for weed control, and Advanta Seeds' collaboration with Embrapa to develop nematode-resistant hybrid canola seeds. These innovations aim to address challenges such as pest and disease management, climate change impacts, and the demand for sustainable agricultural practices.

Propelling Factors for Seed Industry in India Growth

Several factors fuel the growth of the Indian seed industry:

- Technological advancements: Improved breeding techniques, like hybrid seed technology and marker-assisted selection, result in higher yields and disease resistance.

- Government support: Policies promoting agricultural modernization and increasing farmer income stimulate investment and adoption of improved seeds.

- Rising disposable incomes: Increasing purchasing power among farmers allows for greater investment in quality seeds.

- Growing demand for high-quality produce: Consumer preference for nutritious and safe food drives the demand for superior seed varieties.

- Climate change adaptation: Developing climate-resilient seed varieties becomes increasingly crucial, driving innovation and market growth.

Obstacles in the Seed Industry in India Market

Despite its growth potential, the Indian seed industry faces challenges:

- Regulatory hurdles: Complex seed certification procedures and approval processes can delay product launches.

- Supply chain inefficiencies: Fragmented supply chains can hinder timely seed distribution, particularly in remote areas.

- Counterfeit seeds: The presence of counterfeit seeds undermines market integrity and erodes farmer trust.

- Competition from traditional seed saving practices: In some regions, the practice of saving seeds from previous harvests limits the adoption of commercially produced seeds.

- Climate change impacts: Unpredictable weather patterns and extreme events negatively impact crop yields and seed production.

Future Opportunities in Seed Industry in India

The Indian seed industry presents significant future opportunities:

- Expansion into new markets: Untapped potential exists in less developed regions and for under-served crops.

- Biotechnology advancements: Developing genetically modified (GM) crops tailored to Indian conditions.

- Precision agriculture technologies: Integrating seed selection with precision farming techniques to enhance efficiency and yields.

- Organic and sustainable seeds: Growing demand for organically produced food drives demand for organic seeds.

- Focus on climate-resilient varieties: Addressing the impact of climate change through resilient seeds is crucial.

Major Players in the Seed Industry in India Ecosystem

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- Bayer AG

- BASF SE

- Kaveri Seeds

- Groupe Limagrain

- East-West Seed

- Advanta Seeds - UPL

- Syngenta Group

- Corteva Agriscience

- Nuziveedu Seeds Ltd

Key Developments in Seed Industry in India Industry

- July 2023: BASF expanded its Xitavo soybean seed portfolio with 11 new high-yielding varieties featuring Enlist E3 technology. This strengthens their position in the soybean seed market and addresses weed management challenges.

- June 2023: The launch of the WISH initiative by BASF, Syngenta, and Arisa highlights a commitment to ethical labor practices and improved working conditions in the seed sector. This initiative positively impacts the industry's social responsibility and could influence future labor practices and regulations.

- May 2023: Advanta Seeds' agreement with Embrapa to develop nematode-resistant hybrid canola seeds showcases innovation in addressing pest management challenges and expanding into new crop segments. This partnership promises to enhance the resilience of canola production in India.

Strategic Seed Industry in India Market Forecast

The Indian seed industry is poised for continued growth, driven by technological advancements, government support, and increasing demand for high-yielding, climate-resilient seeds. The market's expansion will be propelled by the rising adoption of hybrid seeds, particularly in high-value crops like vegetables and pulses. Furthermore, investments in precision agriculture and biotechnology are expected to further enhance productivity and efficiency. The focus on sustainable and organic seed production also presents significant opportunities for future growth. The overall outlook for the Indian seed industry remains positive, with strong potential for continued expansion and innovation in the coming years.

Seed Industry in India Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Insect Resistant Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Cultivation Mechanism

- 2.1. Open Field

- 2.2. Protected Cultivation

-

3. Crop Type

-

3.1. Row Crops

-

3.1.1. Fiber Crops

- 3.1.1.1. Cotton

- 3.1.1.2. Other Fiber Crops

-

3.1.2. Forage Crops

- 3.1.2.1. Alfalfa

- 3.1.2.2. Forage Corn

- 3.1.2.3. Forage Sorghum

- 3.1.2.4. Other Forage Crops

-

3.1.3. Grains & Cereals

- 3.1.3.1. Rice

- 3.1.3.2. Wheat

- 3.1.3.3. Other Grains & Cereals

-

3.1.4. Oilseeds

- 3.1.4.1. Canola, Rapeseed & Mustard

- 3.1.4.2. Soybean

- 3.1.4.3. Sunflower

- 3.1.4.4. Other Oilseeds

- 3.1.5. Pulses

-

3.1.1. Fiber Crops

-

3.2. Vegetables

-

3.2.1. Brassicas

- 3.2.1.1. Cabbage

- 3.2.1.2. Carrot

- 3.2.1.3. Cauliflower & Broccoli

- 3.2.1.4. Other Brassicas

-

3.2.2. Cucurbits

- 3.2.2.1. Cucumber & Gherkin

- 3.2.2.2. Pumpkin & Squash

- 3.2.2.3. Other Cucurbits

-

3.2.3. Roots & Bulbs

- 3.2.3.1. Garlic

- 3.2.3.2. Onion

- 3.2.3.3. Potato

- 3.2.3.4. Other Roots & Bulbs

-

3.2.4. Solanaceae

- 3.2.4.1. Chilli

- 3.2.4.2. Eggplant

- 3.2.4.3. Tomato

- 3.2.4.4. Other Solanaceae

-

3.2.5. Unclassified Vegetables

- 3.2.5.1. Asparagus

- 3.2.5.2. Lettuce

- 3.2.5.3. Okra

- 3.2.5.4. Peas

- 3.2.5.5. Spinach

- 3.2.5.6. Other Unclassified Vegetables

-

3.2.1. Brassicas

-

3.1. Row Crops

-

4. State

- 4.1. Bihar

- 4.2. Gujarat

- 4.3. Haryana

- 4.4. Karnataka

- 4.5. Madhya Pradesh

- 4.6. Maharashtra

- 4.7. Rajasthan

- 4.8. Telangana

- 4.9. Uttar Pradesh

- 4.10. West Bengal

- 4.11. Other States

-

5. Breeding Technology

-

5.1. Hybrids

- 5.1.1. Non-Transgenic Hybrids

- 5.1.2. Insect Resistant Hybrids

- 5.2. Open Pollinated Varieties & Hybrid Derivatives

-

5.1. Hybrids

-

6. Cultivation Mechanism

- 6.1. Open Field

- 6.2. Protected Cultivation

-

7. Crop Type

-

7.1. Row Crops

-

7.1.1. Fiber Crops

- 7.1.1.1. Cotton

- 7.1.1.2. Other Fiber Crops

-

7.1.2. Forage Crops

- 7.1.2.1. Alfalfa

- 7.1.2.2. Forage Corn

- 7.1.2.3. Forage Sorghum

- 7.1.2.4. Other Forage Crops

-

7.1.3. Grains & Cereals

- 7.1.3.1. Rice

- 7.1.3.2. Wheat

- 7.1.3.3. Other Grains & Cereals

-

7.1.4. Oilseeds

- 7.1.4.1. Canola, Rapeseed & Mustard

- 7.1.4.2. Soybean

- 7.1.4.3. Sunflower

- 7.1.4.4. Other Oilseeds

- 7.1.5. Pulses

-

7.1.1. Fiber Crops

-

7.2. Vegetables

-

7.2.1. Brassicas

- 7.2.1.1. Cabbage

- 7.2.1.2. Carrot

- 7.2.1.3. Cauliflower & Broccoli

- 7.2.1.4. Other Brassicas

-

7.2.2. Cucurbits

- 7.2.2.1. Cucumber & Gherkin

- 7.2.2.2. Pumpkin & Squash

- 7.2.2.3. Other Cucurbits

-

7.2.3. Roots & Bulbs

- 7.2.3.1. Garlic

- 7.2.3.2. Onion

- 7.2.3.3. Potato

- 7.2.3.4. Other Roots & Bulbs

-

7.2.4. Solanaceae

- 7.2.4.1. Chilli

- 7.2.4.2. Eggplant

- 7.2.4.3. Tomato

- 7.2.4.4. Other Solanaceae

-

7.2.5. Unclassified Vegetables

- 7.2.5.1. Asparagus

- 7.2.5.2. Lettuce

- 7.2.5.3. Okra

- 7.2.5.4. Peas

- 7.2.5.5. Spinach

- 7.2.5.6. Other Unclassified Vegetables

-

7.2.1. Brassicas

-

7.1. Row Crops

-

8. State

- 8.1. Bihar

- 8.2. Gujarat

- 8.3. Haryana

- 8.4. Karnataka

- 8.5. Madhya Pradesh

- 8.6. Maharashtra

- 8.7. Rajasthan

- 8.8. Telangana

- 8.9. Uttar Pradesh

- 8.10. West Bengal

- 8.11. Other States

Seed Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Seed Industry in India Regional Market Share

Geographic Coverage of Seed Industry in India

Seed Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Insect Resistant Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.2.1. Open Field

- 5.2.2. Protected Cultivation

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Row Crops

- 5.3.1.1. Fiber Crops

- 5.3.1.1.1. Cotton

- 5.3.1.1.2. Other Fiber Crops

- 5.3.1.2. Forage Crops

- 5.3.1.2.1. Alfalfa

- 5.3.1.2.2. Forage Corn

- 5.3.1.2.3. Forage Sorghum

- 5.3.1.2.4. Other Forage Crops

- 5.3.1.3. Grains & Cereals

- 5.3.1.3.1. Rice

- 5.3.1.3.2. Wheat

- 5.3.1.3.3. Other Grains & Cereals

- 5.3.1.4. Oilseeds

- 5.3.1.4.1. Canola, Rapeseed & Mustard

- 5.3.1.4.2. Soybean

- 5.3.1.4.3. Sunflower

- 5.3.1.4.4. Other Oilseeds

- 5.3.1.5. Pulses

- 5.3.1.1. Fiber Crops

- 5.3.2. Vegetables

- 5.3.2.1. Brassicas

- 5.3.2.1.1. Cabbage

- 5.3.2.1.2. Carrot

- 5.3.2.1.3. Cauliflower & Broccoli

- 5.3.2.1.4. Other Brassicas

- 5.3.2.2. Cucurbits

- 5.3.2.2.1. Cucumber & Gherkin

- 5.3.2.2.2. Pumpkin & Squash

- 5.3.2.2.3. Other Cucurbits

- 5.3.2.3. Roots & Bulbs

- 5.3.2.3.1. Garlic

- 5.3.2.3.2. Onion

- 5.3.2.3.3. Potato

- 5.3.2.3.4. Other Roots & Bulbs

- 5.3.2.4. Solanaceae

- 5.3.2.4.1. Chilli

- 5.3.2.4.2. Eggplant

- 5.3.2.4.3. Tomato

- 5.3.2.4.4. Other Solanaceae

- 5.3.2.5. Unclassified Vegetables

- 5.3.2.5.1. Asparagus

- 5.3.2.5.2. Lettuce

- 5.3.2.5.3. Okra

- 5.3.2.5.4. Peas

- 5.3.2.5.5. Spinach

- 5.3.2.5.6. Other Unclassified Vegetables

- 5.3.2.1. Brassicas

- 5.3.1. Row Crops

- 5.4. Market Analysis, Insights and Forecast - by State

- 5.4.1. Bihar

- 5.4.2. Gujarat

- 5.4.3. Haryana

- 5.4.4. Karnataka

- 5.4.5. Madhya Pradesh

- 5.4.6. Maharashtra

- 5.4.7. Rajasthan

- 5.4.8. Telangana

- 5.4.9. Uttar Pradesh

- 5.4.10. West Bengal

- 5.4.11. Other States

- 5.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.5.1. Hybrids

- 5.5.1.1. Non-Transgenic Hybrids

- 5.5.1.2. Insect Resistant Hybrids

- 5.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.5.1. Hybrids

- 5.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.6.1. Open Field

- 5.6.2. Protected Cultivation

- 5.7. Market Analysis, Insights and Forecast - by Crop Type

- 5.7.1. Row Crops

- 5.7.1.1. Fiber Crops

- 5.7.1.1.1. Cotton

- 5.7.1.1.2. Other Fiber Crops

- 5.7.1.2. Forage Crops

- 5.7.1.2.1. Alfalfa

- 5.7.1.2.2. Forage Corn

- 5.7.1.2.3. Forage Sorghum

- 5.7.1.2.4. Other Forage Crops

- 5.7.1.3. Grains & Cereals

- 5.7.1.3.1. Rice

- 5.7.1.3.2. Wheat

- 5.7.1.3.3. Other Grains & Cereals

- 5.7.1.4. Oilseeds

- 5.7.1.4.1. Canola, Rapeseed & Mustard

- 5.7.1.4.2. Soybean

- 5.7.1.4.3. Sunflower

- 5.7.1.4.4. Other Oilseeds

- 5.7.1.5. Pulses

- 5.7.1.1. Fiber Crops

- 5.7.2. Vegetables

- 5.7.2.1. Brassicas

- 5.7.2.1.1. Cabbage

- 5.7.2.1.2. Carrot

- 5.7.2.1.3. Cauliflower & Broccoli

- 5.7.2.1.4. Other Brassicas

- 5.7.2.2. Cucurbits

- 5.7.2.2.1. Cucumber & Gherkin

- 5.7.2.2.2. Pumpkin & Squash

- 5.7.2.2.3. Other Cucurbits

- 5.7.2.3. Roots & Bulbs

- 5.7.2.3.1. Garlic

- 5.7.2.3.2. Onion

- 5.7.2.3.3. Potato

- 5.7.2.3.4. Other Roots & Bulbs

- 5.7.2.4. Solanaceae

- 5.7.2.4.1. Chilli

- 5.7.2.4.2. Eggplant

- 5.7.2.4.3. Tomato

- 5.7.2.4.4. Other Solanaceae

- 5.7.2.5. Unclassified Vegetables

- 5.7.2.5.1. Asparagus

- 5.7.2.5.2. Lettuce

- 5.7.2.5.3. Okra

- 5.7.2.5.4. Peas

- 5.7.2.5.5. Spinach

- 5.7.2.5.6. Other Unclassified Vegetables

- 5.7.2.1. Brassicas

- 5.7.1. Row Crops

- 5.8. Market Analysis, Insights and Forecast - by State

- 5.8.1. Bihar

- 5.8.2. Gujarat

- 5.8.3. Haryana

- 5.8.4. Karnataka

- 5.8.5. Madhya Pradesh

- 5.8.6. Maharashtra

- 5.8.7. Rajasthan

- 5.8.8. Telangana

- 5.8.9. Uttar Pradesh

- 5.8.10. West Bengal

- 5.8.11. Other States

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. North America

- 5.9.2. South America

- 5.9.3. Europe

- 5.9.4. Middle East & Africa

- 5.9.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. North America Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6.1.1. Hybrids

- 6.1.1.1. Non-Transgenic Hybrids

- 6.1.1.2. Insect Resistant Hybrids

- 6.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 6.1.1. Hybrids

- 6.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 6.2.1. Open Field

- 6.2.2. Protected Cultivation

- 6.3. Market Analysis, Insights and Forecast - by Crop Type

- 6.3.1. Row Crops

- 6.3.1.1. Fiber Crops

- 6.3.1.1.1. Cotton

- 6.3.1.1.2. Other Fiber Crops

- 6.3.1.2. Forage Crops

- 6.3.1.2.1. Alfalfa

- 6.3.1.2.2. Forage Corn

- 6.3.1.2.3. Forage Sorghum

- 6.3.1.2.4. Other Forage Crops

- 6.3.1.3. Grains & Cereals

- 6.3.1.3.1. Rice

- 6.3.1.3.2. Wheat

- 6.3.1.3.3. Other Grains & Cereals

- 6.3.1.4. Oilseeds

- 6.3.1.4.1. Canola, Rapeseed & Mustard

- 6.3.1.4.2. Soybean

- 6.3.1.4.3. Sunflower

- 6.3.1.4.4. Other Oilseeds

- 6.3.1.5. Pulses

- 6.3.1.1. Fiber Crops

- 6.3.2. Vegetables

- 6.3.2.1. Brassicas

- 6.3.2.1.1. Cabbage

- 6.3.2.1.2. Carrot

- 6.3.2.1.3. Cauliflower & Broccoli

- 6.3.2.1.4. Other Brassicas

- 6.3.2.2. Cucurbits

- 6.3.2.2.1. Cucumber & Gherkin

- 6.3.2.2.2. Pumpkin & Squash

- 6.3.2.2.3. Other Cucurbits

- 6.3.2.3. Roots & Bulbs

- 6.3.2.3.1. Garlic

- 6.3.2.3.2. Onion

- 6.3.2.3.3. Potato

- 6.3.2.3.4. Other Roots & Bulbs

- 6.3.2.4. Solanaceae

- 6.3.2.4.1. Chilli

- 6.3.2.4.2. Eggplant

- 6.3.2.4.3. Tomato

- 6.3.2.4.4. Other Solanaceae

- 6.3.2.5. Unclassified Vegetables

- 6.3.2.5.1. Asparagus

- 6.3.2.5.2. Lettuce

- 6.3.2.5.3. Okra

- 6.3.2.5.4. Peas

- 6.3.2.5.5. Spinach

- 6.3.2.5.6. Other Unclassified Vegetables

- 6.3.2.1. Brassicas

- 6.3.1. Row Crops

- 6.4. Market Analysis, Insights and Forecast - by State

- 6.4.1. Bihar

- 6.4.2. Gujarat

- 6.4.3. Haryana

- 6.4.4. Karnataka

- 6.4.5. Madhya Pradesh

- 6.4.6. Maharashtra

- 6.4.7. Rajasthan

- 6.4.8. Telangana

- 6.4.9. Uttar Pradesh

- 6.4.10. West Bengal

- 6.4.11. Other States

- 6.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 6.5.1. Hybrids

- 6.5.1.1. Non-Transgenic Hybrids

- 6.5.1.2. Insect Resistant Hybrids

- 6.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 6.5.1. Hybrids

- 6.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 6.6.1. Open Field

- 6.6.2. Protected Cultivation

- 6.7. Market Analysis, Insights and Forecast - by Crop Type

- 6.7.1. Row Crops

- 6.7.1.1. Fiber Crops

- 6.7.1.1.1. Cotton

- 6.7.1.1.2. Other Fiber Crops

- 6.7.1.2. Forage Crops

- 6.7.1.2.1. Alfalfa

- 6.7.1.2.2. Forage Corn

- 6.7.1.2.3. Forage Sorghum

- 6.7.1.2.4. Other Forage Crops

- 6.7.1.3. Grains & Cereals

- 6.7.1.3.1. Rice

- 6.7.1.3.2. Wheat

- 6.7.1.3.3. Other Grains & Cereals

- 6.7.1.4. Oilseeds

- 6.7.1.4.1. Canola, Rapeseed & Mustard

- 6.7.1.4.2. Soybean

- 6.7.1.4.3. Sunflower

- 6.7.1.4.4. Other Oilseeds

- 6.7.1.5. Pulses

- 6.7.1.1. Fiber Crops

- 6.7.2. Vegetables

- 6.7.2.1. Brassicas

- 6.7.2.1.1. Cabbage

- 6.7.2.1.2. Carrot

- 6.7.2.1.3. Cauliflower & Broccoli

- 6.7.2.1.4. Other Brassicas

- 6.7.2.2. Cucurbits

- 6.7.2.2.1. Cucumber & Gherkin

- 6.7.2.2.2. Pumpkin & Squash

- 6.7.2.2.3. Other Cucurbits

- 6.7.2.3. Roots & Bulbs

- 6.7.2.3.1. Garlic

- 6.7.2.3.2. Onion

- 6.7.2.3.3. Potato

- 6.7.2.3.4. Other Roots & Bulbs

- 6.7.2.4. Solanaceae

- 6.7.2.4.1. Chilli

- 6.7.2.4.2. Eggplant

- 6.7.2.4.3. Tomato

- 6.7.2.4.4. Other Solanaceae

- 6.7.2.5. Unclassified Vegetables

- 6.7.2.5.1. Asparagus

- 6.7.2.5.2. Lettuce

- 6.7.2.5.3. Okra

- 6.7.2.5.4. Peas

- 6.7.2.5.5. Spinach

- 6.7.2.5.6. Other Unclassified Vegetables

- 6.7.2.1. Brassicas

- 6.7.1. Row Crops

- 6.8. Market Analysis, Insights and Forecast - by State

- 6.8.1. Bihar

- 6.8.2. Gujarat

- 6.8.3. Haryana

- 6.8.4. Karnataka

- 6.8.5. Madhya Pradesh

- 6.8.6. Maharashtra

- 6.8.7. Rajasthan

- 6.8.8. Telangana

- 6.8.9. Uttar Pradesh

- 6.8.10. West Bengal

- 6.8.11. Other States

- 6.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 7. South America Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 7.1.1. Hybrids

- 7.1.1.1. Non-Transgenic Hybrids

- 7.1.1.2. Insect Resistant Hybrids

- 7.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 7.1.1. Hybrids

- 7.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 7.2.1. Open Field

- 7.2.2. Protected Cultivation

- 7.3. Market Analysis, Insights and Forecast - by Crop Type

- 7.3.1. Row Crops

- 7.3.1.1. Fiber Crops

- 7.3.1.1.1. Cotton

- 7.3.1.1.2. Other Fiber Crops

- 7.3.1.2. Forage Crops

- 7.3.1.2.1. Alfalfa

- 7.3.1.2.2. Forage Corn

- 7.3.1.2.3. Forage Sorghum

- 7.3.1.2.4. Other Forage Crops

- 7.3.1.3. Grains & Cereals

- 7.3.1.3.1. Rice

- 7.3.1.3.2. Wheat

- 7.3.1.3.3. Other Grains & Cereals

- 7.3.1.4. Oilseeds

- 7.3.1.4.1. Canola, Rapeseed & Mustard

- 7.3.1.4.2. Soybean

- 7.3.1.4.3. Sunflower

- 7.3.1.4.4. Other Oilseeds

- 7.3.1.5. Pulses

- 7.3.1.1. Fiber Crops

- 7.3.2. Vegetables

- 7.3.2.1. Brassicas

- 7.3.2.1.1. Cabbage

- 7.3.2.1.2. Carrot

- 7.3.2.1.3. Cauliflower & Broccoli

- 7.3.2.1.4. Other Brassicas

- 7.3.2.2. Cucurbits

- 7.3.2.2.1. Cucumber & Gherkin

- 7.3.2.2.2. Pumpkin & Squash

- 7.3.2.2.3. Other Cucurbits

- 7.3.2.3. Roots & Bulbs

- 7.3.2.3.1. Garlic

- 7.3.2.3.2. Onion

- 7.3.2.3.3. Potato

- 7.3.2.3.4. Other Roots & Bulbs

- 7.3.2.4. Solanaceae

- 7.3.2.4.1. Chilli

- 7.3.2.4.2. Eggplant

- 7.3.2.4.3. Tomato

- 7.3.2.4.4. Other Solanaceae

- 7.3.2.5. Unclassified Vegetables

- 7.3.2.5.1. Asparagus

- 7.3.2.5.2. Lettuce

- 7.3.2.5.3. Okra

- 7.3.2.5.4. Peas

- 7.3.2.5.5. Spinach

- 7.3.2.5.6. Other Unclassified Vegetables

- 7.3.2.1. Brassicas

- 7.3.1. Row Crops

- 7.4. Market Analysis, Insights and Forecast - by State

- 7.4.1. Bihar

- 7.4.2. Gujarat

- 7.4.3. Haryana

- 7.4.4. Karnataka

- 7.4.5. Madhya Pradesh

- 7.4.6. Maharashtra

- 7.4.7. Rajasthan

- 7.4.8. Telangana

- 7.4.9. Uttar Pradesh

- 7.4.10. West Bengal

- 7.4.11. Other States

- 7.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 7.5.1. Hybrids

- 7.5.1.1. Non-Transgenic Hybrids

- 7.5.1.2. Insect Resistant Hybrids

- 7.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 7.5.1. Hybrids

- 7.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 7.6.1. Open Field

- 7.6.2. Protected Cultivation

- 7.7. Market Analysis, Insights and Forecast - by Crop Type

- 7.7.1. Row Crops

- 7.7.1.1. Fiber Crops

- 7.7.1.1.1. Cotton

- 7.7.1.1.2. Other Fiber Crops

- 7.7.1.2. Forage Crops

- 7.7.1.2.1. Alfalfa

- 7.7.1.2.2. Forage Corn

- 7.7.1.2.3. Forage Sorghum

- 7.7.1.2.4. Other Forage Crops

- 7.7.1.3. Grains & Cereals

- 7.7.1.3.1. Rice

- 7.7.1.3.2. Wheat

- 7.7.1.3.3. Other Grains & Cereals

- 7.7.1.4. Oilseeds

- 7.7.1.4.1. Canola, Rapeseed & Mustard

- 7.7.1.4.2. Soybean

- 7.7.1.4.3. Sunflower

- 7.7.1.4.4. Other Oilseeds

- 7.7.1.5. Pulses

- 7.7.1.1. Fiber Crops

- 7.7.2. Vegetables

- 7.7.2.1. Brassicas

- 7.7.2.1.1. Cabbage

- 7.7.2.1.2. Carrot

- 7.7.2.1.3. Cauliflower & Broccoli

- 7.7.2.1.4. Other Brassicas

- 7.7.2.2. Cucurbits

- 7.7.2.2.1. Cucumber & Gherkin

- 7.7.2.2.2. Pumpkin & Squash

- 7.7.2.2.3. Other Cucurbits

- 7.7.2.3. Roots & Bulbs

- 7.7.2.3.1. Garlic

- 7.7.2.3.2. Onion

- 7.7.2.3.3. Potato

- 7.7.2.3.4. Other Roots & Bulbs

- 7.7.2.4. Solanaceae

- 7.7.2.4.1. Chilli

- 7.7.2.4.2. Eggplant

- 7.7.2.4.3. Tomato

- 7.7.2.4.4. Other Solanaceae

- 7.7.2.5. Unclassified Vegetables

- 7.7.2.5.1. Asparagus

- 7.7.2.5.2. Lettuce

- 7.7.2.5.3. Okra

- 7.7.2.5.4. Peas

- 7.7.2.5.5. Spinach

- 7.7.2.5.6. Other Unclassified Vegetables

- 7.7.2.1. Brassicas

- 7.7.1. Row Crops

- 7.8. Market Analysis, Insights and Forecast - by State

- 7.8.1. Bihar

- 7.8.2. Gujarat

- 7.8.3. Haryana

- 7.8.4. Karnataka

- 7.8.5. Madhya Pradesh

- 7.8.6. Maharashtra

- 7.8.7. Rajasthan

- 7.8.8. Telangana

- 7.8.9. Uttar Pradesh

- 7.8.10. West Bengal

- 7.8.11. Other States

- 7.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 8. Europe Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 8.1.1. Hybrids

- 8.1.1.1. Non-Transgenic Hybrids

- 8.1.1.2. Insect Resistant Hybrids

- 8.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 8.1.1. Hybrids

- 8.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 8.2.1. Open Field

- 8.2.2. Protected Cultivation

- 8.3. Market Analysis, Insights and Forecast - by Crop Type

- 8.3.1. Row Crops

- 8.3.1.1. Fiber Crops

- 8.3.1.1.1. Cotton

- 8.3.1.1.2. Other Fiber Crops

- 8.3.1.2. Forage Crops

- 8.3.1.2.1. Alfalfa

- 8.3.1.2.2. Forage Corn

- 8.3.1.2.3. Forage Sorghum

- 8.3.1.2.4. Other Forage Crops

- 8.3.1.3. Grains & Cereals

- 8.3.1.3.1. Rice

- 8.3.1.3.2. Wheat

- 8.3.1.3.3. Other Grains & Cereals

- 8.3.1.4. Oilseeds

- 8.3.1.4.1. Canola, Rapeseed & Mustard

- 8.3.1.4.2. Soybean

- 8.3.1.4.3. Sunflower

- 8.3.1.4.4. Other Oilseeds

- 8.3.1.5. Pulses

- 8.3.1.1. Fiber Crops

- 8.3.2. Vegetables

- 8.3.2.1. Brassicas

- 8.3.2.1.1. Cabbage

- 8.3.2.1.2. Carrot

- 8.3.2.1.3. Cauliflower & Broccoli

- 8.3.2.1.4. Other Brassicas

- 8.3.2.2. Cucurbits

- 8.3.2.2.1. Cucumber & Gherkin

- 8.3.2.2.2. Pumpkin & Squash

- 8.3.2.2.3. Other Cucurbits

- 8.3.2.3. Roots & Bulbs

- 8.3.2.3.1. Garlic

- 8.3.2.3.2. Onion

- 8.3.2.3.3. Potato

- 8.3.2.3.4. Other Roots & Bulbs

- 8.3.2.4. Solanaceae

- 8.3.2.4.1. Chilli

- 8.3.2.4.2. Eggplant

- 8.3.2.4.3. Tomato

- 8.3.2.4.4. Other Solanaceae

- 8.3.2.5. Unclassified Vegetables

- 8.3.2.5.1. Asparagus

- 8.3.2.5.2. Lettuce

- 8.3.2.5.3. Okra

- 8.3.2.5.4. Peas

- 8.3.2.5.5. Spinach

- 8.3.2.5.6. Other Unclassified Vegetables

- 8.3.2.1. Brassicas

- 8.3.1. Row Crops

- 8.4. Market Analysis, Insights and Forecast - by State

- 8.4.1. Bihar

- 8.4.2. Gujarat

- 8.4.3. Haryana

- 8.4.4. Karnataka

- 8.4.5. Madhya Pradesh

- 8.4.6. Maharashtra

- 8.4.7. Rajasthan

- 8.4.8. Telangana

- 8.4.9. Uttar Pradesh

- 8.4.10. West Bengal

- 8.4.11. Other States

- 8.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 8.5.1. Hybrids

- 8.5.1.1. Non-Transgenic Hybrids

- 8.5.1.2. Insect Resistant Hybrids

- 8.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 8.5.1. Hybrids

- 8.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 8.6.1. Open Field

- 8.6.2. Protected Cultivation

- 8.7. Market Analysis, Insights and Forecast - by Crop Type

- 8.7.1. Row Crops

- 8.7.1.1. Fiber Crops

- 8.7.1.1.1. Cotton

- 8.7.1.1.2. Other Fiber Crops

- 8.7.1.2. Forage Crops

- 8.7.1.2.1. Alfalfa

- 8.7.1.2.2. Forage Corn

- 8.7.1.2.3. Forage Sorghum

- 8.7.1.2.4. Other Forage Crops

- 8.7.1.3. Grains & Cereals

- 8.7.1.3.1. Rice

- 8.7.1.3.2. Wheat

- 8.7.1.3.3. Other Grains & Cereals

- 8.7.1.4. Oilseeds

- 8.7.1.4.1. Canola, Rapeseed & Mustard

- 8.7.1.4.2. Soybean

- 8.7.1.4.3. Sunflower

- 8.7.1.4.4. Other Oilseeds

- 8.7.1.5. Pulses

- 8.7.1.1. Fiber Crops

- 8.7.2. Vegetables

- 8.7.2.1. Brassicas

- 8.7.2.1.1. Cabbage

- 8.7.2.1.2. Carrot

- 8.7.2.1.3. Cauliflower & Broccoli

- 8.7.2.1.4. Other Brassicas

- 8.7.2.2. Cucurbits

- 8.7.2.2.1. Cucumber & Gherkin

- 8.7.2.2.2. Pumpkin & Squash

- 8.7.2.2.3. Other Cucurbits

- 8.7.2.3. Roots & Bulbs

- 8.7.2.3.1. Garlic

- 8.7.2.3.2. Onion

- 8.7.2.3.3. Potato

- 8.7.2.3.4. Other Roots & Bulbs

- 8.7.2.4. Solanaceae

- 8.7.2.4.1. Chilli

- 8.7.2.4.2. Eggplant

- 8.7.2.4.3. Tomato

- 8.7.2.4.4. Other Solanaceae

- 8.7.2.5. Unclassified Vegetables

- 8.7.2.5.1. Asparagus

- 8.7.2.5.2. Lettuce

- 8.7.2.5.3. Okra

- 8.7.2.5.4. Peas

- 8.7.2.5.5. Spinach

- 8.7.2.5.6. Other Unclassified Vegetables

- 8.7.2.1. Brassicas

- 8.7.1. Row Crops

- 8.8. Market Analysis, Insights and Forecast - by State

- 8.8.1. Bihar

- 8.8.2. Gujarat

- 8.8.3. Haryana

- 8.8.4. Karnataka

- 8.8.5. Madhya Pradesh

- 8.8.6. Maharashtra

- 8.8.7. Rajasthan

- 8.8.8. Telangana

- 8.8.9. Uttar Pradesh

- 8.8.10. West Bengal

- 8.8.11. Other States

- 8.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 9. Middle East & Africa Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 9.1.1. Hybrids

- 9.1.1.1. Non-Transgenic Hybrids

- 9.1.1.2. Insect Resistant Hybrids

- 9.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 9.1.1. Hybrids

- 9.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 9.2.1. Open Field

- 9.2.2. Protected Cultivation

- 9.3. Market Analysis, Insights and Forecast - by Crop Type

- 9.3.1. Row Crops

- 9.3.1.1. Fiber Crops

- 9.3.1.1.1. Cotton

- 9.3.1.1.2. Other Fiber Crops

- 9.3.1.2. Forage Crops

- 9.3.1.2.1. Alfalfa

- 9.3.1.2.2. Forage Corn

- 9.3.1.2.3. Forage Sorghum

- 9.3.1.2.4. Other Forage Crops

- 9.3.1.3. Grains & Cereals

- 9.3.1.3.1. Rice

- 9.3.1.3.2. Wheat

- 9.3.1.3.3. Other Grains & Cereals

- 9.3.1.4. Oilseeds

- 9.3.1.4.1. Canola, Rapeseed & Mustard

- 9.3.1.4.2. Soybean

- 9.3.1.4.3. Sunflower

- 9.3.1.4.4. Other Oilseeds

- 9.3.1.5. Pulses

- 9.3.1.1. Fiber Crops

- 9.3.2. Vegetables

- 9.3.2.1. Brassicas

- 9.3.2.1.1. Cabbage

- 9.3.2.1.2. Carrot

- 9.3.2.1.3. Cauliflower & Broccoli

- 9.3.2.1.4. Other Brassicas

- 9.3.2.2. Cucurbits

- 9.3.2.2.1. Cucumber & Gherkin

- 9.3.2.2.2. Pumpkin & Squash

- 9.3.2.2.3. Other Cucurbits

- 9.3.2.3. Roots & Bulbs

- 9.3.2.3.1. Garlic

- 9.3.2.3.2. Onion

- 9.3.2.3.3. Potato

- 9.3.2.3.4. Other Roots & Bulbs

- 9.3.2.4. Solanaceae

- 9.3.2.4.1. Chilli

- 9.3.2.4.2. Eggplant

- 9.3.2.4.3. Tomato

- 9.3.2.4.4. Other Solanaceae

- 9.3.2.5. Unclassified Vegetables

- 9.3.2.5.1. Asparagus

- 9.3.2.5.2. Lettuce

- 9.3.2.5.3. Okra

- 9.3.2.5.4. Peas

- 9.3.2.5.5. Spinach

- 9.3.2.5.6. Other Unclassified Vegetables

- 9.3.2.1. Brassicas

- 9.3.1. Row Crops

- 9.4. Market Analysis, Insights and Forecast - by State

- 9.4.1. Bihar

- 9.4.2. Gujarat

- 9.4.3. Haryana

- 9.4.4. Karnataka

- 9.4.5. Madhya Pradesh

- 9.4.6. Maharashtra

- 9.4.7. Rajasthan

- 9.4.8. Telangana

- 9.4.9. Uttar Pradesh

- 9.4.10. West Bengal

- 9.4.11. Other States

- 9.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 9.5.1. Hybrids

- 9.5.1.1. Non-Transgenic Hybrids

- 9.5.1.2. Insect Resistant Hybrids

- 9.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 9.5.1. Hybrids

- 9.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 9.6.1. Open Field

- 9.6.2. Protected Cultivation

- 9.7. Market Analysis, Insights and Forecast - by Crop Type

- 9.7.1. Row Crops

- 9.7.1.1. Fiber Crops

- 9.7.1.1.1. Cotton

- 9.7.1.1.2. Other Fiber Crops

- 9.7.1.2. Forage Crops

- 9.7.1.2.1. Alfalfa

- 9.7.1.2.2. Forage Corn

- 9.7.1.2.3. Forage Sorghum

- 9.7.1.2.4. Other Forage Crops

- 9.7.1.3. Grains & Cereals

- 9.7.1.3.1. Rice

- 9.7.1.3.2. Wheat

- 9.7.1.3.3. Other Grains & Cereals

- 9.7.1.4. Oilseeds

- 9.7.1.4.1. Canola, Rapeseed & Mustard

- 9.7.1.4.2. Soybean

- 9.7.1.4.3. Sunflower

- 9.7.1.4.4. Other Oilseeds

- 9.7.1.5. Pulses

- 9.7.1.1. Fiber Crops

- 9.7.2. Vegetables

- 9.7.2.1. Brassicas

- 9.7.2.1.1. Cabbage

- 9.7.2.1.2. Carrot

- 9.7.2.1.3. Cauliflower & Broccoli

- 9.7.2.1.4. Other Brassicas

- 9.7.2.2. Cucurbits

- 9.7.2.2.1. Cucumber & Gherkin

- 9.7.2.2.2. Pumpkin & Squash

- 9.7.2.2.3. Other Cucurbits

- 9.7.2.3. Roots & Bulbs

- 9.7.2.3.1. Garlic

- 9.7.2.3.2. Onion

- 9.7.2.3.3. Potato

- 9.7.2.3.4. Other Roots & Bulbs

- 9.7.2.4. Solanaceae

- 9.7.2.4.1. Chilli

- 9.7.2.4.2. Eggplant

- 9.7.2.4.3. Tomato

- 9.7.2.4.4. Other Solanaceae

- 9.7.2.5. Unclassified Vegetables

- 9.7.2.5.1. Asparagus

- 9.7.2.5.2. Lettuce

- 9.7.2.5.3. Okra

- 9.7.2.5.4. Peas

- 9.7.2.5.5. Spinach

- 9.7.2.5.6. Other Unclassified Vegetables

- 9.7.2.1. Brassicas

- 9.7.1. Row Crops

- 9.8. Market Analysis, Insights and Forecast - by State

- 9.8.1. Bihar

- 9.8.2. Gujarat

- 9.8.3. Haryana

- 9.8.4. Karnataka

- 9.8.5. Madhya Pradesh

- 9.8.6. Maharashtra

- 9.8.7. Rajasthan

- 9.8.8. Telangana

- 9.8.9. Uttar Pradesh

- 9.8.10. West Bengal

- 9.8.11. Other States

- 9.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 10. Asia Pacific Seed Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 10.1.1. Hybrids

- 10.1.1.1. Non-Transgenic Hybrids

- 10.1.1.2. Insect Resistant Hybrids

- 10.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 10.1.1. Hybrids

- 10.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 10.2.1. Open Field

- 10.2.2. Protected Cultivation

- 10.3. Market Analysis, Insights and Forecast - by Crop Type

- 10.3.1. Row Crops

- 10.3.1.1. Fiber Crops

- 10.3.1.1.1. Cotton

- 10.3.1.1.2. Other Fiber Crops

- 10.3.1.2. Forage Crops

- 10.3.1.2.1. Alfalfa

- 10.3.1.2.2. Forage Corn

- 10.3.1.2.3. Forage Sorghum

- 10.3.1.2.4. Other Forage Crops

- 10.3.1.3. Grains & Cereals

- 10.3.1.3.1. Rice

- 10.3.1.3.2. Wheat

- 10.3.1.3.3. Other Grains & Cereals

- 10.3.1.4. Oilseeds

- 10.3.1.4.1. Canola, Rapeseed & Mustard

- 10.3.1.4.2. Soybean

- 10.3.1.4.3. Sunflower

- 10.3.1.4.4. Other Oilseeds

- 10.3.1.5. Pulses

- 10.3.1.1. Fiber Crops

- 10.3.2. Vegetables

- 10.3.2.1. Brassicas

- 10.3.2.1.1. Cabbage

- 10.3.2.1.2. Carrot

- 10.3.2.1.3. Cauliflower & Broccoli

- 10.3.2.1.4. Other Brassicas

- 10.3.2.2. Cucurbits

- 10.3.2.2.1. Cucumber & Gherkin

- 10.3.2.2.2. Pumpkin & Squash

- 10.3.2.2.3. Other Cucurbits

- 10.3.2.3. Roots & Bulbs

- 10.3.2.3.1. Garlic

- 10.3.2.3.2. Onion

- 10.3.2.3.3. Potato

- 10.3.2.3.4. Other Roots & Bulbs

- 10.3.2.4. Solanaceae

- 10.3.2.4.1. Chilli

- 10.3.2.4.2. Eggplant

- 10.3.2.4.3. Tomato

- 10.3.2.4.4. Other Solanaceae

- 10.3.2.5. Unclassified Vegetables

- 10.3.2.5.1. Asparagus

- 10.3.2.5.2. Lettuce

- 10.3.2.5.3. Okra

- 10.3.2.5.4. Peas

- 10.3.2.5.5. Spinach

- 10.3.2.5.6. Other Unclassified Vegetables

- 10.3.2.1. Brassicas

- 10.3.1. Row Crops

- 10.4. Market Analysis, Insights and Forecast - by State

- 10.4.1. Bihar

- 10.4.2. Gujarat

- 10.4.3. Haryana

- 10.4.4. Karnataka

- 10.4.5. Madhya Pradesh

- 10.4.6. Maharashtra

- 10.4.7. Rajasthan

- 10.4.8. Telangana

- 10.4.9. Uttar Pradesh

- 10.4.10. West Bengal

- 10.4.11. Other States

- 10.5. Market Analysis, Insights and Forecast - by Breeding Technology

- 10.5.1. Hybrids

- 10.5.1.1. Non-Transgenic Hybrids

- 10.5.1.2. Insect Resistant Hybrids

- 10.5.2. Open Pollinated Varieties & Hybrid Derivatives

- 10.5.1. Hybrids

- 10.6. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 10.6.1. Open Field

- 10.6.2. Protected Cultivation

- 10.7. Market Analysis, Insights and Forecast - by Crop Type

- 10.7.1. Row Crops

- 10.7.1.1. Fiber Crops

- 10.7.1.1.1. Cotton

- 10.7.1.1.2. Other Fiber Crops

- 10.7.1.2. Forage Crops

- 10.7.1.2.1. Alfalfa

- 10.7.1.2.2. Forage Corn

- 10.7.1.2.3. Forage Sorghum

- 10.7.1.2.4. Other Forage Crops

- 10.7.1.3. Grains & Cereals

- 10.7.1.3.1. Rice

- 10.7.1.3.2. Wheat

- 10.7.1.3.3. Other Grains & Cereals

- 10.7.1.4. Oilseeds

- 10.7.1.4.1. Canola, Rapeseed & Mustard

- 10.7.1.4.2. Soybean

- 10.7.1.4.3. Sunflower

- 10.7.1.4.4. Other Oilseeds

- 10.7.1.5. Pulses

- 10.7.1.1. Fiber Crops

- 10.7.2. Vegetables

- 10.7.2.1. Brassicas

- 10.7.2.1.1. Cabbage

- 10.7.2.1.2. Carrot

- 10.7.2.1.3. Cauliflower & Broccoli

- 10.7.2.1.4. Other Brassicas

- 10.7.2.2. Cucurbits

- 10.7.2.2.1. Cucumber & Gherkin

- 10.7.2.2.2. Pumpkin & Squash

- 10.7.2.2.3. Other Cucurbits

- 10.7.2.3. Roots & Bulbs

- 10.7.2.3.1. Garlic

- 10.7.2.3.2. Onion

- 10.7.2.3.3. Potato

- 10.7.2.3.4. Other Roots & Bulbs

- 10.7.2.4. Solanaceae

- 10.7.2.4.1. Chilli

- 10.7.2.4.2. Eggplant

- 10.7.2.4.3. Tomato

- 10.7.2.4.4. Other Solanaceae

- 10.7.2.5. Unclassified Vegetables

- 10.7.2.5.1. Asparagus

- 10.7.2.5.2. Lettuce

- 10.7.2.5.3. Okra

- 10.7.2.5.4. Peas

- 10.7.2.5.5. Spinach

- 10.7.2.5.6. Other Unclassified Vegetables

- 10.7.2.1. Brassicas

- 10.7.1. Row Crops

- 10.8. Market Analysis, Insights and Forecast - by State

- 10.8.1. Bihar

- 10.8.2. Gujarat

- 10.8.3. Haryana

- 10.8.4. Karnataka

- 10.8.5. Madhya Pradesh

- 10.8.6. Maharashtra

- 10.8.7. Rajasthan

- 10.8.8. Telangana

- 10.8.9. Uttar Pradesh

- 10.8.10. West Bengal

- 10.8.11. Other States

- 10.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kaveri Seeds

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Groupe Limagrain

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 East-West Seed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Advanta Seeds - UPL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Syngenta Grou

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Corteva Agriscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nuziveedu Seeds Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rijk Zwaan Zaadteelt en Zaadhandel BV

List of Figures

- Figure 1: Global Seed Industry in India Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Seed Industry in India Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: North America Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 4: North America Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 5: North America Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 6: North America Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 7: North America Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 8: North America Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 9: North America Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 10: North America Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 11: North America Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 12: North America Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 13: North America Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 14: North America Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 15: North America Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 16: North America Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 17: North America Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 18: North America Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 19: North America Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 20: North America Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 21: North America Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 22: North America Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 23: North America Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 24: North America Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 25: North America Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 26: North America Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 27: North America Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 28: North America Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 29: North America Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 30: North America Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 31: North America Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 32: North America Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 33: North America Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 34: North America Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 35: North America Seed Industry in India Revenue (undefined), by Country 2025 & 2033

- Figure 36: North America Seed Industry in India Volume (Kiloton), by Country 2025 & 2033

- Figure 37: North America Seed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: North America Seed Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 40: South America Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 41: South America Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 42: South America Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 43: South America Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 44: South America Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 45: South America Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 46: South America Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 47: South America Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 48: South America Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 49: South America Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 50: South America Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 51: South America Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 52: South America Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 53: South America Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 54: South America Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 55: South America Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 56: South America Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 57: South America Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 58: South America Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 59: South America Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 60: South America Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 61: South America Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 62: South America Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 63: South America Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 64: South America Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 65: South America Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 66: South America Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 67: South America Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 68: South America Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 69: South America Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 70: South America Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 71: South America Seed Industry in India Revenue (undefined), by Country 2025 & 2033

- Figure 72: South America Seed Industry in India Volume (Kiloton), by Country 2025 & 2033

- Figure 73: South America Seed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 74: South America Seed Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 75: Europe Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 76: Europe Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 77: Europe Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 78: Europe Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 79: Europe Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 80: Europe Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 81: Europe Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 82: Europe Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 83: Europe Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 84: Europe Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 85: Europe Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 86: Europe Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 87: Europe Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 88: Europe Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 89: Europe Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 90: Europe Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 91: Europe Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 92: Europe Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 93: Europe Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 94: Europe Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 95: Europe Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 96: Europe Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 97: Europe Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 98: Europe Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 99: Europe Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 100: Europe Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 101: Europe Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 102: Europe Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 103: Europe Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 104: Europe Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 105: Europe Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 106: Europe Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 107: Europe Seed Industry in India Revenue (undefined), by Country 2025 & 2033

- Figure 108: Europe Seed Industry in India Volume (Kiloton), by Country 2025 & 2033

- Figure 109: Europe Seed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 110: Europe Seed Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 111: Middle East & Africa Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 112: Middle East & Africa Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 113: Middle East & Africa Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 114: Middle East & Africa Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 115: Middle East & Africa Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 116: Middle East & Africa Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 117: Middle East & Africa Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 118: Middle East & Africa Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 119: Middle East & Africa Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 120: Middle East & Africa Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 121: Middle East & Africa Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 122: Middle East & Africa Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 123: Middle East & Africa Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 124: Middle East & Africa Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 125: Middle East & Africa Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 126: Middle East & Africa Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 127: Middle East & Africa Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 128: Middle East & Africa Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 129: Middle East & Africa Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 130: Middle East & Africa Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 131: Middle East & Africa Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 132: Middle East & Africa Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 133: Middle East & Africa Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 134: Middle East & Africa Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 135: Middle East & Africa Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 136: Middle East & Africa Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 137: Middle East & Africa Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 138: Middle East & Africa Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 139: Middle East & Africa Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 140: Middle East & Africa Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 141: Middle East & Africa Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 142: Middle East & Africa Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 143: Middle East & Africa Seed Industry in India Revenue (undefined), by Country 2025 & 2033

- Figure 144: Middle East & Africa Seed Industry in India Volume (Kiloton), by Country 2025 & 2033

- Figure 145: Middle East & Africa Seed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 146: Middle East & Africa Seed Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 147: Asia Pacific Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 148: Asia Pacific Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 149: Asia Pacific Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 150: Asia Pacific Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 151: Asia Pacific Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 152: Asia Pacific Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 153: Asia Pacific Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 154: Asia Pacific Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 155: Asia Pacific Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 156: Asia Pacific Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 157: Asia Pacific Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 158: Asia Pacific Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 159: Asia Pacific Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 160: Asia Pacific Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 161: Asia Pacific Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 162: Asia Pacific Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 163: Asia Pacific Seed Industry in India Revenue (undefined), by Breeding Technology 2025 & 2033

- Figure 164: Asia Pacific Seed Industry in India Volume (Kiloton), by Breeding Technology 2025 & 2033

- Figure 165: Asia Pacific Seed Industry in India Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 166: Asia Pacific Seed Industry in India Volume Share (%), by Breeding Technology 2025 & 2033

- Figure 167: Asia Pacific Seed Industry in India Revenue (undefined), by Cultivation Mechanism 2025 & 2033

- Figure 168: Asia Pacific Seed Industry in India Volume (Kiloton), by Cultivation Mechanism 2025 & 2033

- Figure 169: Asia Pacific Seed Industry in India Revenue Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 170: Asia Pacific Seed Industry in India Volume Share (%), by Cultivation Mechanism 2025 & 2033

- Figure 171: Asia Pacific Seed Industry in India Revenue (undefined), by Crop Type 2025 & 2033

- Figure 172: Asia Pacific Seed Industry in India Volume (Kiloton), by Crop Type 2025 & 2033

- Figure 173: Asia Pacific Seed Industry in India Revenue Share (%), by Crop Type 2025 & 2033

- Figure 174: Asia Pacific Seed Industry in India Volume Share (%), by Crop Type 2025 & 2033

- Figure 175: Asia Pacific Seed Industry in India Revenue (undefined), by State 2025 & 2033

- Figure 176: Asia Pacific Seed Industry in India Volume (Kiloton), by State 2025 & 2033

- Figure 177: Asia Pacific Seed Industry in India Revenue Share (%), by State 2025 & 2033

- Figure 178: Asia Pacific Seed Industry in India Volume Share (%), by State 2025 & 2033

- Figure 179: Asia Pacific Seed Industry in India Revenue (undefined), by Country 2025 & 2033

- Figure 180: Asia Pacific Seed Industry in India Volume (Kiloton), by Country 2025 & 2033

- Figure 181: Asia Pacific Seed Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 182: Asia Pacific Seed Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 2: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 3: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 4: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 5: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 6: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 7: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 8: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 9: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 10: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 11: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 12: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 13: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 14: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 15: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 16: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 17: Global Seed Industry in India Revenue undefined Forecast, by Region 2020 & 2033

- Table 18: Global Seed Industry in India Volume Kiloton Forecast, by Region 2020 & 2033

- Table 19: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 20: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 21: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 22: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 23: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 24: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 25: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 26: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 27: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 28: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 29: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 30: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 31: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 32: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 33: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 34: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 35: Global Seed Industry in India Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Seed Industry in India Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: United States Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United States Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Canada Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Canada Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Mexico Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Mexico Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 44: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 45: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 46: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 47: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 48: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 49: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 50: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 51: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 52: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 53: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 54: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 55: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 56: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 57: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 58: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 59: Global Seed Industry in India Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Seed Industry in India Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: Brazil Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Brazil Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 63: Argentina Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Argentina Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 67: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 68: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 69: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 70: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 71: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 72: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 73: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 74: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 75: Global Seed Industry in India Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 76: Global Seed Industry in India Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 77: Global Seed Industry in India Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 78: Global Seed Industry in India Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 79: Global Seed Industry in India Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 80: Global Seed Industry in India Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 81: Global Seed Industry in India Revenue undefined Forecast, by State 2020 & 2033

- Table 82: Global Seed Industry in India Volume Kiloton Forecast, by State 2020 & 2033

- Table 83: Global Seed Industry in India Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Global Seed Industry in India Volume Kiloton Forecast, by Country 2020 & 2033

- Table 85: United Kingdom Seed Industry in India Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: United Kingdom Seed Industry in India Volume (Kiloton) Forecast, by Application 2020 & 2033