Key Insights

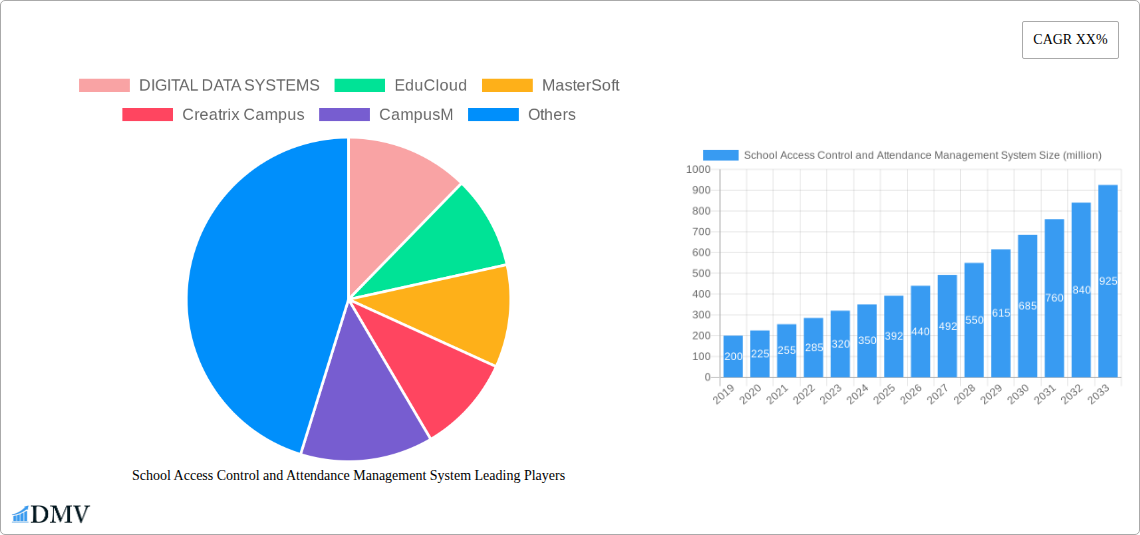

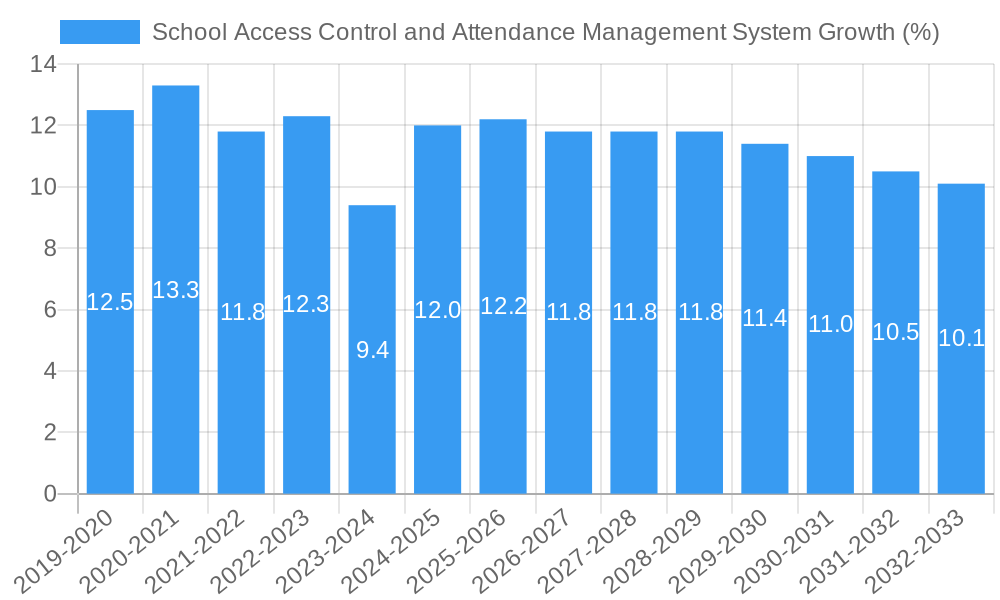

The School Access Control and Attendance Management System market is poised for significant expansion, driven by the increasing need for enhanced campus security, streamlined administrative processes, and real-time student tracking. With an estimated market size of USD 350 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033, the market is set to reach approximately USD 865 million by the end of the forecast period. Key drivers include government initiatives focused on student safety, the growing adoption of smart technologies in educational institutions, and the demand for integrated solutions that combine access control with attendance tracking. Universities and high schools are leading the adoption of these systems due to their larger student populations and complex security requirements, while primary and secondary schools are also increasingly investing in these technologies to ensure a safer learning environment. The student-side segment is expected to dominate due to the direct application of attendance tracking and access management, with staff-side applications focusing on administrative efficiency and resource management.

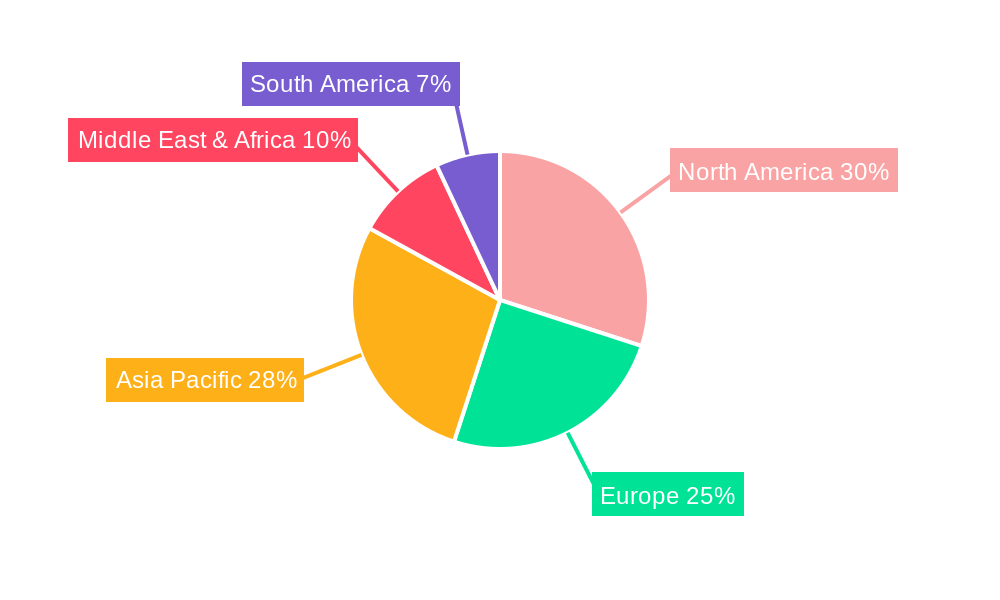

The market's robust growth is further fueled by technological advancements, such as the integration of AI and machine learning for enhanced facial recognition and behavioral analytics, as well as the proliferation of cloud-based solutions offering scalability and accessibility. Emerging trends like the use of biometrics, RFID, and mobile-based access systems are reshaping the market landscape. However, challenges such as the high initial implementation cost, concerns regarding data privacy and security, and the need for robust IT infrastructure in some regions may pose restraints. Despite these hurdles, the overarching benefits of improved safety, operational efficiency, and data accuracy are expected to propel market adoption. Major players like DIGITAL DATA SYSTEMS, EduCloud, MasterSoft, and Creatrix Campus are actively innovating and expanding their offerings to cater to the diverse needs of educational institutions globally, with strong market presence anticipated across North America and Asia Pacific.

School Access Control and Attendance Management System Market Composition & Trends

The School Access Control and Attendance Management System market is characterized by a dynamic landscape with millions of potential users and a growing emphasis on digital transformation within educational institutions. Market concentration is moderately fragmented, with several key players vying for dominance. This report delves into the intricate composition of this market, analyzing the innovation catalysts driving adoption, such as the demand for enhanced security and streamlined administrative processes. We will also scrutinize the evolving regulatory landscapes that influence data privacy and system compliance, crucial for educational stakeholders. Substitute products, including manual attendance tracking and basic security measures, are gradually being phased out as sophisticated systems offer superior efficiency and data integrity. End-user profiles are diverse, encompassing Universities, High Schools, and Primary and Secondary Schools, each with unique requirements. Mergers and Acquisitions (M&A) activities are a significant trend, with millions in deal values contributing to market consolidation and the expansion of product portfolios. Key M&A activities are meticulously detailed to understand market consolidation and strategic growth. The report examines the distribution of market share among key vendors, offering insights into competitive dynamics.

- Market Share Distribution: Analysis of leading vendors' market share, highlighting key contributors to the overall market value of millions.

- M&A Deal Values: Quantification of M&A transactions, revealing strategic investments and consolidations in the millions range.

- Innovation Catalysts: Driving forces for new product development and feature enhancements in the millions-dollar market.

- Regulatory Landscape: Impact of data protection laws and educational technology policies on market growth, with potential millions in compliance costs.

School Access Control and Attendance Management System Industry Evolution

The School Access Control and Attendance Management System industry has witnessed a remarkable evolution, driven by an escalating need for secure, efficient, and data-driven educational environments. Over the historical period (2019–2024), we observed a steady increase in the adoption of digital attendance solutions, fueled by the inherent limitations of manual processes. The base year (2025) marks a pivotal point, with significant investments expected to accelerate growth. The forecast period (2025–2033) anticipates an unprecedented surge in market expansion, projected to reach millions in value. This growth trajectory is underpinned by continuous technological advancements, including the integration of AI-powered facial recognition, biometric scanners, and cloud-based platforms, enhancing both security and administrative efficiency. The demand for sophisticated access control systems has escalated as institutions prioritize the safety and well-being of their students and staff. Furthermore, shifting consumer demands, from parents seeking real-time attendance updates to administrators requiring comprehensive data analytics for resource allocation, are compelling vendors to innovate and offer more integrated solutions. Adoption metrics have shown a consistent upward trend, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period. The study period (2019–2033) encapsulates this transformative journey, highlighting key milestones and the factors that have propelled the industry forward. The market is projected to grow from millions in 2019 to millions by 2033, showcasing a robust expansion driven by technological innovation and increasing awareness of the benefits these systems offer.

Leading Regions, Countries, or Segments in School Access Control and Attendance Management System

North America currently stands as the dominant region in the School Access Control and Attendance Management System market, driven by robust technological infrastructure, significant investment in educational technology, and stringent security regulations. The United States, in particular, leads the charge due to a high density of educational institutions across all levels, from Universities to Primary and Secondary Schools, all actively seeking to enhance campus security and streamline administrative operations. The Student Side segment exhibits the highest adoption rate, fueled by the increasing demand for personalized learning experiences and the need for efficient tracking of student activities and whereabouts. Similarly, the Staff Side also sees substantial uptake as institutions focus on optimizing workforce management and ensuring accountability.

Key drivers contributing to North America's dominance include:

- Investment Trends: Educational institutions in North America consistently allocate substantial budgets towards technology upgrades, with millions dedicated to security and management systems annually. This includes investments in advanced biometric scanners, AI-powered analytics, and cloud-based attendance solutions.

- Regulatory Support: Government initiatives and mandates emphasizing school safety and data privacy regulations, such as FERPA, encourage the adoption of advanced access control and attendance management systems. Compliance with these regulations often necessitates the implementation of sophisticated technological solutions, contributing to market growth valued in the millions.

- Technological Penetration: High adoption rates of smartphones and internet connectivity among students and staff facilitate the seamless integration and use of mobile-based attendance and access control applications.

- Growing Awareness: Increased awareness among parents, educators, and administrators about the benefits of these systems, including improved safety, enhanced discipline, and accurate record-keeping, is a significant catalyst.

The market for Universities, High Schools, and Primary and Secondary Schools all show significant growth, with Universities often being early adopters of more complex and integrated solutions, while the K-12 segment is rapidly catching up due to increasing safety concerns and administrative efficiencies. The Student Side application is particularly prominent, with millions of students benefiting from the enhanced security and personalized tracking features. The Staff Side also demonstrates strong growth, with millions of educators and administrators leveraging these systems for efficient management.

School Access Control and Attendance Management System Product Innovations

Product innovation in the School Access Control and Attendance Management System market is rapidly evolving, focusing on user-friendly interfaces, enhanced security features, and seamless integration capabilities. Vendors are introducing advanced solutions that leverage AI and machine learning for predictive attendance analytics and anomaly detection, offering unparalleled insights into student engagement. Innovations include contactless biometric systems like facial recognition and iris scanning, ensuring hygiene and speed. Cloud-based platforms are becoming standard, allowing for remote access, real-time data synchronization, and scalability, supporting educational institutions of all sizes with solutions worth millions. Mobile applications for both students and staff are also a key development, providing instant notifications, digital hall passes, and self-service attendance logging. Performance metrics are consistently improving, with reduced processing times for access and attendance logging, and enhanced accuracy, minimizing errors and saving institutions valuable administrative hours, translating to millions in potential operational savings.

Propelling Factors for School Access Control and Attendance Management System Growth

The School Access Control and Attendance Management System market is propelled by several key factors driving its substantial growth. Primarily, the escalating concern for student safety and security in educational institutions worldwide is a paramount driver. The need to prevent unauthorized access and monitor student movements efficiently necessitates advanced access control and attendance solutions, representing a market segment valued in the millions. Secondly, the increasing adoption of digital technologies in education, often referred to as EdTech, is fostering the integration of these management systems into broader campus-wide solutions. Government initiatives and mandates promoting digital learning and secure school environments further encourage investment. Economic factors, such as the pursuit of operational efficiency and cost reduction, also play a role; automated attendance tracking saves administrative time and resources, contributing to significant savings for institutions, potentially in the millions. Finally, technological advancements in areas like AI, IoT, and biometrics are enabling more sophisticated, accurate, and user-friendly systems, making them increasingly attractive to educational stakeholders.

Obstacles in the School Access Control and Attendance Management System Market

Despite its strong growth trajectory, the School Access Control and Attendance Management System market faces several obstacles. A significant barrier is the initial cost of implementation for many educational institutions, especially smaller or underfunded ones, where the investment can run into millions. This high upfront cost, coupled with ongoing maintenance and subscription fees, can be prohibitive. Regulatory challenges, particularly around data privacy and security compliance (e.g., GDPR, FERPA), can create complexity and require significant resources to navigate, leading to potential costs of millions for legal and technical expertise. Supply chain disruptions, though less pronounced recently, can still impact the availability of hardware components for biometric scanners and access control devices. Competitive pressures from a multitude of vendors offering similar solutions can also lead to price wars, impacting profit margins. Furthermore, resistance to change and a lack of technical expertise among some educational staff can hinder smooth adoption and integration.

Future Opportunities in School Access Control and Attendance Management System

The future of the School Access Control and Attendance Management System market is brimming with opportunities. The growing trend of personalized learning and student welfare initiatives presents a significant avenue for integrating attendance data with academic performance tracking, offering holistic student management solutions worth millions. The expansion into emerging economies with rapidly developing education sectors offers vast untapped potential, as these regions increasingly invest in modernizing their school infrastructure. The integration of advanced AI and predictive analytics for early intervention in student behavior or academic struggles is another promising area, providing invaluable insights to educators and administrators. Furthermore, the increasing demand for interoperability between different school management software, including learning management systems (LMS) and student information systems (SIS), creates opportunities for vendors offering comprehensive, integrated platforms, potentially commanding millions in lucrative contracts. The rise of smart campuses and the Internet of Things (IoT) will also drive demand for seamlessly connected access control and attendance systems.

Major Players in the School Access Control and Attendance Management System Ecosystem

DIGITAL DATA SYSTEMS EduCloud MasterSoft Creatrix Campus CampusM iTech SchoolPass Sonet Microsystems Orell Eloit Fedena AUPRO Skolaro Edumarshal PROPHET TECHNOLOGY Teamface ZIXSOFT

Key Developments in School Access Control and Attendance Management System Industry

- 2023/05: Launch of AI-powered facial recognition systems with enhanced accuracy and privacy features, impacting security protocols across millions of student interactions.

- 2023/03: Integration of cloud-based attendance management with student information systems for seamless data flow, improving administrative efficiency by an estimated xx%.

- 2022/11: Major software update for mobile attendance tracking applications, introducing real-time location services and parent notification features, enhancing parental engagement valued in millions.

- 2022/08: Acquisition of a specialized biometric security firm by a leading EdTech provider, expanding its portfolio and market reach by millions.

- 2021/10: Introduction of contactless biometric solutions to address hygiene concerns, seeing a rapid adoption rate and significant market impact in the millions.

- 2020/01: Government funding initiatives for school safety technology, boosting market growth and encouraging investments in access control systems worth millions.

Strategic School Access Control and Attendance Management System Market Forecast

The strategic forecast for the School Access Control and Attendance Management System market is exceptionally promising, driven by a confluence of factors poised to shape its future. The persistent global focus on enhancing campus security and ensuring student well-being will continue to be a primary growth catalyst, translating into continued demand for robust access control and attendance solutions valued in the millions. The ongoing digital transformation within the education sector, coupled with significant advancements in AI, IoT, and cloud computing, will fuel the development of more intelligent, integrated, and user-friendly systems. Emerging markets represent a vast untapped potential, as developing nations prioritize modernizing their educational infrastructures. The market is projected to experience robust growth, reaching an estimated millions by the end of the forecast period, driven by the increasing recognition of the long-term benefits these systems offer in terms of efficiency, security, and data-driven decision-making.

School Access Control and Attendance Management System Segmentation

-

1. Application

- 1.1. University

- 1.2. High School

- 1.3. Primary and Secondary School

-

2. Types

- 2.1. Student Side

- 2.2. Staff Side

School Access Control and Attendance Management System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

School Access Control and Attendance Management System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. University

- 5.1.2. High School

- 5.1.3. Primary and Secondary School

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Student Side

- 5.2.2. Staff Side

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. University

- 6.1.2. High School

- 6.1.3. Primary and Secondary School

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Student Side

- 6.2.2. Staff Side

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. University

- 7.1.2. High School

- 7.1.3. Primary and Secondary School

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Student Side

- 7.2.2. Staff Side

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. University

- 8.1.2. High School

- 8.1.3. Primary and Secondary School

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Student Side

- 8.2.2. Staff Side

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. University

- 9.1.2. High School

- 9.1.3. Primary and Secondary School

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Student Side

- 9.2.2. Staff Side

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific School Access Control and Attendance Management System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. University

- 10.1.2. High School

- 10.1.3. Primary and Secondary School

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Student Side

- 10.2.2. Staff Side

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DIGITAL DATA SYSTEMS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EduCloud

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MasterSoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Creatrix Campus

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CampusM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 iTech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SchoolPass

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sonet Microsystems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Orell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eloit

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fedena

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AUPRO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Skolaro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Edumarshal

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PROPHET TECHNOLOGY

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Teamface

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ZIXSOFT

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 DIGITAL DATA SYSTEMS

List of Figures

- Figure 1: Global School Access Control and Attendance Management System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America School Access Control and Attendance Management System Revenue (million), by Application 2024 & 2032

- Figure 3: North America School Access Control and Attendance Management System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America School Access Control and Attendance Management System Revenue (million), by Types 2024 & 2032

- Figure 5: North America School Access Control and Attendance Management System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America School Access Control and Attendance Management System Revenue (million), by Country 2024 & 2032

- Figure 7: North America School Access Control and Attendance Management System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America School Access Control and Attendance Management System Revenue (million), by Application 2024 & 2032

- Figure 9: South America School Access Control and Attendance Management System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America School Access Control and Attendance Management System Revenue (million), by Types 2024 & 2032

- Figure 11: South America School Access Control and Attendance Management System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America School Access Control and Attendance Management System Revenue (million), by Country 2024 & 2032

- Figure 13: South America School Access Control and Attendance Management System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe School Access Control and Attendance Management System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe School Access Control and Attendance Management System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe School Access Control and Attendance Management System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe School Access Control and Attendance Management System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe School Access Control and Attendance Management System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe School Access Control and Attendance Management System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa School Access Control and Attendance Management System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa School Access Control and Attendance Management System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa School Access Control and Attendance Management System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa School Access Control and Attendance Management System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa School Access Control and Attendance Management System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa School Access Control and Attendance Management System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific School Access Control and Attendance Management System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific School Access Control and Attendance Management System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific School Access Control and Attendance Management System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific School Access Control and Attendance Management System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific School Access Control and Attendance Management System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific School Access Control and Attendance Management System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global School Access Control and Attendance Management System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global School Access Control and Attendance Management System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global School Access Control and Attendance Management System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global School Access Control and Attendance Management System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global School Access Control and Attendance Management System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global School Access Control and Attendance Management System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global School Access Control and Attendance Management System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global School Access Control and Attendance Management System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global School Access Control and Attendance Management System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific School Access Control and Attendance Management System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the School Access Control and Attendance Management System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the School Access Control and Attendance Management System?

Key companies in the market include DIGITAL DATA SYSTEMS, EduCloud, MasterSoft, Creatrix Campus, CampusM, iTech, SchoolPass, Sonet Microsystems, Orell, Eloit, Fedena, AUPRO, Skolaro, Edumarshal, PROPHET TECHNOLOGY, Teamface, ZIXSOFT.

3. What are the main segments of the School Access Control and Attendance Management System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "School Access Control and Attendance Management System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the School Access Control and Attendance Management System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the School Access Control and Attendance Management System?

To stay informed about further developments, trends, and reports in the School Access Control and Attendance Management System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence