Key Insights

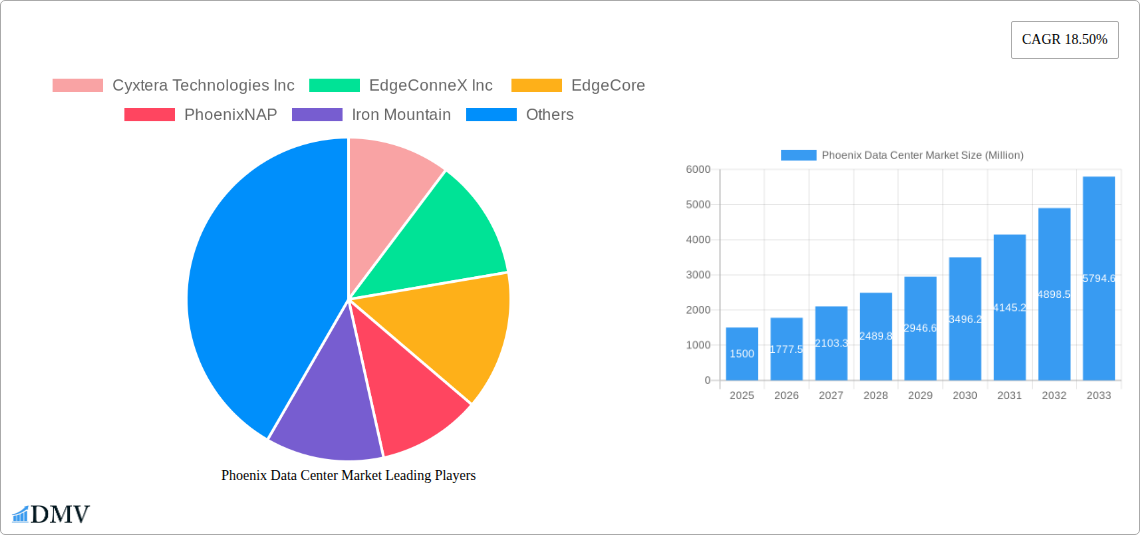

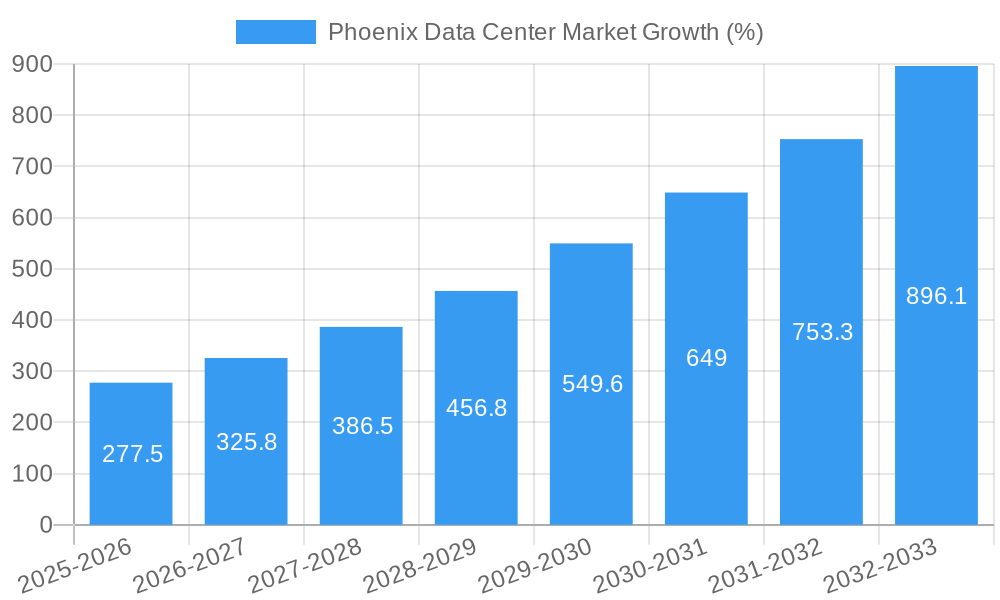

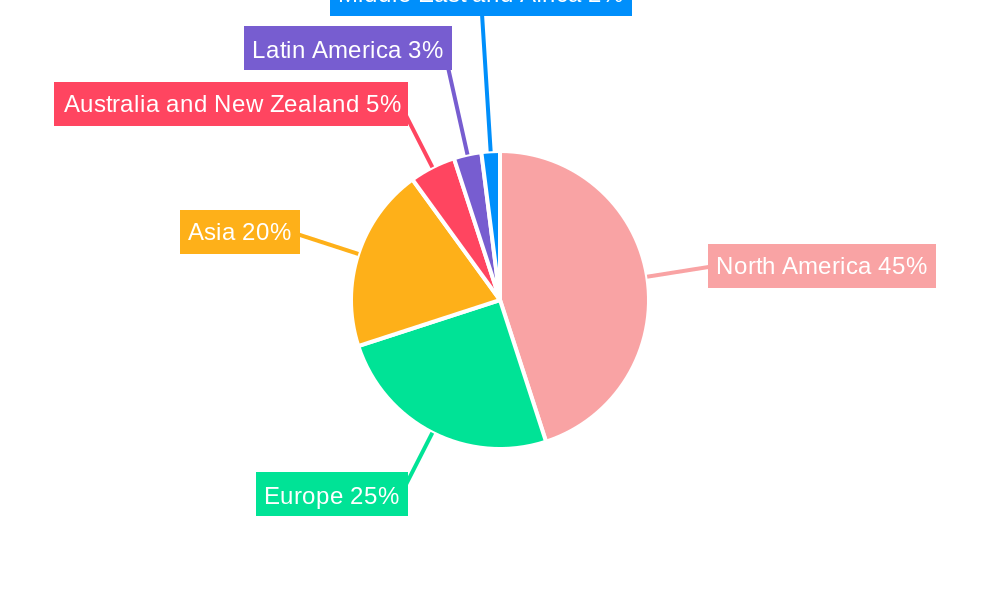

The Phoenix data center market is experiencing robust growth, driven by increasing cloud adoption, the rise of edge computing, and expanding digital infrastructure needs across various sectors. The market's Compound Annual Growth Rate (CAGR) of 18.50% from 2019-2033 indicates significant expansion potential. Key drivers include the burgeoning e-commerce sector demanding high bandwidth and low latency, the proliferation of data-intensive applications (like AI and IoT), and the growing need for businesses to ensure data security and disaster recovery. Several market segments are contributing to this growth: hyperscale colocation facilities are attracting large cloud providers, while retail colocation caters to smaller businesses. The demand for larger data center footprints (Mega and Massive) is also significantly propelling expansion. Growth is distributed across various end-users, including Cloud & IT, Telecom, Media & Entertainment, and BFSI, reflecting a broad-based digital transformation. While specific regional market shares are unavailable, it's reasonable to assume North America holds a dominant position initially, followed by Europe and Asia, with other regions showing increasing adoption. Growth may be slightly tempered by factors such as the high initial capital investment required for data center infrastructure development and potential fluctuations in energy costs. However, the long-term outlook remains positive, supported by continuing technological advancements and the ever-increasing demand for digital services.

Competitive intensity is high, with major players like Cyxtera Technologies, EdgeConneX, and Digital Realty Trust vying for market share. The success of these companies hinges on their ability to offer flexible solutions, scalable infrastructure, and strong operational capabilities that meet the diverse needs of their clients. Furthermore, the market is likely to see increased consolidation as larger players seek to expand their footprint and gain a competitive edge. The ongoing development of sustainable data center practices will become increasingly important, driving innovation in energy efficiency and environmental responsibility within the sector. The forecast period of 2025-2033 presents significant opportunities for existing and emerging players to capitalize on the growth trajectory of the Phoenix data center market.

Phoenix Data Center Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Phoenix data center market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic market. The report encompasses market sizing, segmentation, competitive landscape analysis, and future projections, empowering informed decision-making for investors, operators, and technology providers. The total market value is projected to reach xx Million by 2033.

Phoenix Data Center Market Composition & Trends

This section delves into the Phoenix data center market's competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user characteristics. We examine the impact of mergers and acquisitions (M&A) activity, providing insights into deal values and their influence on market share distribution. The analysis considers the interplay of factors shaping the market, including technological advancements, evolving consumer demands, and the regulatory environment. Key metrics such as market share distribution among leading players like Cyxtera Technologies Inc, Digital Realty Trust Inc, and others are presented. The report also explores the impact of substitute products and services on market dynamics. M&A activity analysis reveals xx Million in deal value for the period 2019-2024, with a predicted xx Million in deal value during the forecast period.

- Market Concentration: Analysis of market share held by top players, including Cyxtera Technologies Inc, EdgeConneX Inc, and Digital Realty Trust Inc.

- Innovation Catalysts: Examination of technological advancements driving market growth, such as AI and cloud computing.

- Regulatory Landscape: Assessment of relevant regulations impacting data center operations in Phoenix.

- Substitute Products: Evaluation of alternative solutions that might affect market demand.

- End-User Profiles: Characterization of key end-user segments (Cloud & IT, Telecom, etc.) and their consumption patterns.

- M&A Activities: Analysis of completed and potential mergers and acquisitions, including their impact on market consolidation.

Phoenix Data Center Market Industry Evolution

This section provides a detailed analysis of the Phoenix data center market's evolution, encompassing market growth trajectories, technological advancements, and changing consumer needs. The analysis utilizes historical data (2019-2024) and projects future trends (2025-2033), providing valuable insights into market dynamics. Growth rates for various segments (e.g., by colocation type, end-user) are presented, along with detailed information on technological advancements like the adoption of sustainable energy solutions and increased use of AI-powered management systems. The data reveals a Compound Annual Growth Rate (CAGR) of xx% for the period 2025-2033. Specific adoption metrics for various technologies within the data center sector are analyzed, highlighting the transition towards more efficient and sustainable practices. Market drivers influencing demand and supply are comprehensively explored.

Leading Regions, Countries, or Segments in Phoenix Data Center Market

This section identifies the dominant regions, countries, or segments within the Phoenix data center market, utilizing data across various categories:

- By DC Size: Small, Medium, Large, Massive, Mega – Analysis reveals the Large and Mega data center segments as the dominant players due to the increasing demand for large-scale cloud deployments. The key drivers include substantial capital investments in infrastructure development and the expansion of hyperscale operations.

- By Tier Type: Tier 1, Tier 2, Tier 3 – The dominance of Tier 3 facilities reflects the focus on high availability and redundancy.

- By Absorption: Utilized, Non-Utilized – Utilized capacity is the dominant segment, reflecting the significant demand.

- By Colocation Type: Retail, Wholesale, Hyperscale – The strong growth in the hyperscale colocation segment points to the increasing preference for large-scale deployments by major cloud providers.

- By End User: Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other End User – The Cloud & IT sector leads due to the rapid expansion of cloud services and the associated need for robust data center infrastructure.

Each segment's dominance is analyzed, exploring driving forces such as investment trends, regulatory support, and technological advancements.

Phoenix Data Center Market Product Innovations

The Phoenix data center market is witnessing continuous innovation in hardware and software solutions, enhancing efficiency, scalability, and security. These advancements include improved cooling technologies (e.g., liquid cooling), AI-powered management systems, and edge computing solutions. This results in enhanced performance metrics in terms of power usage effectiveness (PUE) and reduced operational costs. Companies are focusing on developing unique selling propositions (USPs) such as enhanced sustainability features and improved security protocols to gain a competitive edge.

Propelling Factors for Phoenix Data Center Market Growth

Several factors fuel the growth of the Phoenix data center market. Favorable government policies, such as tax incentives, promote investment in data center infrastructure. The increasing adoption of cloud computing and big data analytics drives demand for scalable and reliable data center facilities. Furthermore, the burgeoning technology sector and the favorable business environment in Phoenix attract significant investment, fueling market expansion. The region's access to renewable energy sources also supports the growth of sustainable data centers.

Obstacles in the Phoenix Data Center Market

Despite its growth potential, the Phoenix data center market faces challenges. Land scarcity and high construction costs can limit expansion. Competition among existing data center providers, along with potential supply chain disruptions, poses significant risks. Regulatory compliance and environmental concerns also impact the market, requiring operators to navigate complex regulations and implement sustainable practices.

Future Opportunities in Phoenix Data Center Market

The Phoenix data center market presents several opportunities. The increasing demand for edge computing, coupled with growing adoption of 5G technology, opens new avenues for data center providers. Expansion into adjacent markets and leveraging technological advancements, such as AI and machine learning for data center management, offer lucrative opportunities. Furthermore, focusing on sustainable and environmentally responsible data center solutions can attract environmentally conscious businesses.

Major Players in the Phoenix Data Center Market Ecosystem

- Cyxtera Technologies Inc

- EdgeConneX Inc

- EdgeCore

- PhoenixNAP

- Iron Mountain

- DataBank

- Evocative

- CyrusOne

- Expedient

- Flexential

- Cogent

- Evoque

- Vantage Data Center

- H5 Data centers

- Digital Realty Trust Inc

Key Developments in Phoenix Data Center Market Industry

- November 2022: STACK Infrastructure announces plans for a massive new data center campus in downtown Phoenix, a 230-megawatt campus with 1.78 million square feet of data centers, signaling significant investment and expansion in the market.

- October 2022: Aligned Data Centers expands its Arizona presence by acquiring two more plots of land in Phoenix, reinforcing commitment to sustainable data center development and capitalizing on Arizona's attractive business environment.

Strategic Phoenix Data Center Market Forecast

The Phoenix data center market is poised for continued growth, driven by strong demand for cloud services, technological advancements, and supportive government policies. The expansion of hyperscale facilities, coupled with increased adoption of edge computing, will significantly contribute to market expansion. The forecast period (2025-2033) anticipates a strong CAGR, indicating considerable potential for market players and investors. Continued focus on sustainability and innovation will be critical for success in this competitive landscape.

Phoenix Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Phoenix Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Phoenix Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Cloud computing is anticipated to hold a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. By Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. By End User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End User

- 6.3.1.1. By Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. By Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. By End User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End User

- 7.3.1.1. By Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. By Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. By End User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End User

- 8.3.1.1. By Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. By Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. By End User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End User

- 9.3.1.1. By Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. By Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. By End User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End User

- 10.3.1.1. By Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Phoenix Data Center Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Cyxtera Technologies Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 EdgeConneX Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 EdgeCore

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 PhoenixNAP

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Iron Mountain

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 DataBank

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Evocative

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 CyrusOne

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Expedient

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Flexential

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Cogent

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Evoque

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Vantage Data Center

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 H5 Data centers

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Digital Realty Trust Inc

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Global Phoenix Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Phoenix Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 15: North America Phoenix Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 16: North America Phoenix Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 17: North America Phoenix Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 18: North America Phoenix Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 19: North America Phoenix Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 20: North America Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Phoenix Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 23: South America Phoenix Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 24: South America Phoenix Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 25: South America Phoenix Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 26: South America Phoenix Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 27: South America Phoenix Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 28: South America Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 29: South America Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Europe Phoenix Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 31: Europe Phoenix Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 32: Europe Phoenix Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 33: Europe Phoenix Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 34: Europe Phoenix Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 35: Europe Phoenix Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 36: Europe Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East & Africa Phoenix Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 39: Middle East & Africa Phoenix Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 40: Middle East & Africa Phoenix Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 41: Middle East & Africa Phoenix Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 42: Middle East & Africa Phoenix Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 43: Middle East & Africa Phoenix Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 44: Middle East & Africa Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Middle East & Africa Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Asia Pacific Phoenix Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 47: Asia Pacific Phoenix Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 48: Asia Pacific Phoenix Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 49: Asia Pacific Phoenix Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 50: Asia Pacific Phoenix Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 51: Asia Pacific Phoenix Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 52: Asia Pacific Phoenix Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Phoenix Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phoenix Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Phoenix Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 26: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 27: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 28: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 33: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 34: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 35: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United Kingdom Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Italy Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Russia Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Benelux Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Nordics Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 46: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 47: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 48: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Turkey Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Israel Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: GCC Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: North Africa Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Africa Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Middle East & Africa Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Phoenix Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 56: Global Phoenix Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 57: Global Phoenix Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 58: Global Phoenix Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: China Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: India Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: ASEAN Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Oceania Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific Phoenix Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phoenix Data Center Market?

The projected CAGR is approximately 18.50%.

2. Which companies are prominent players in the Phoenix Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, EdgeConneX Inc , EdgeCore, PhoenixNAP, Iron Mountain, DataBank, Evocative, CyrusOne, Expedient, Flexential, Cogent, Evoque, Vantage Data Center, H5 Data centers, Digital Realty Trust Inc.

3. What are the main segments of the Phoenix Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Cloud computing is anticipated to hold a significant share.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

November 2022: STACK Infrastructure Plans Massive New Data Centre Campus in Downtown Phoenix. STACK Infrastructure will build a 230-megawatt campus with 1.78 million square feet of data centers, continuing the developer's global expansion. This 50-acre campus will help meet the demand for cloud capacity in the rapidly growing Phoenix market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phoenix Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phoenix Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phoenix Data Center Market?

To stay informed about further developments, trends, and reports in the Phoenix Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence