Key Insights

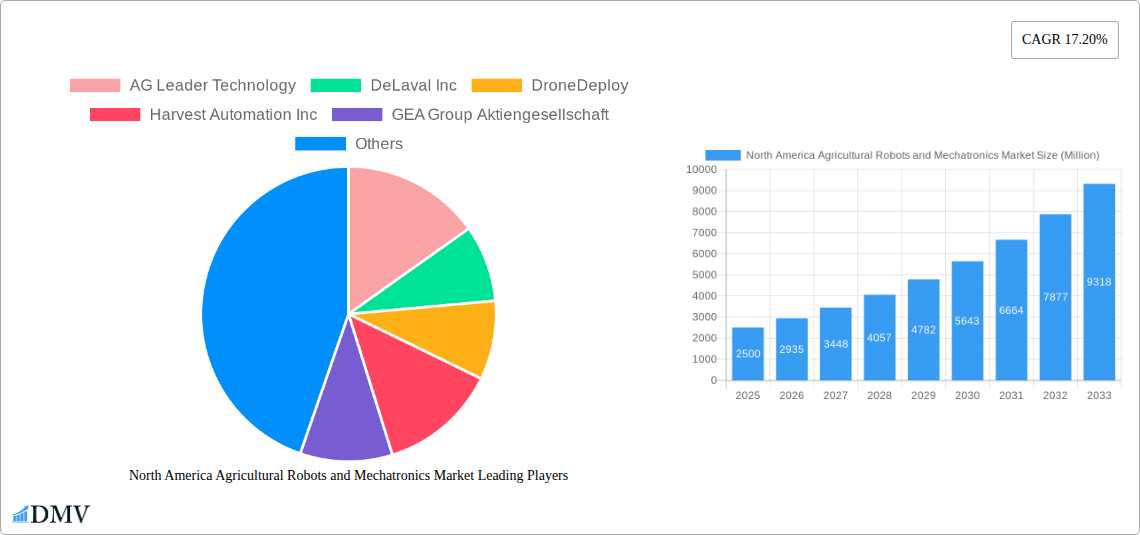

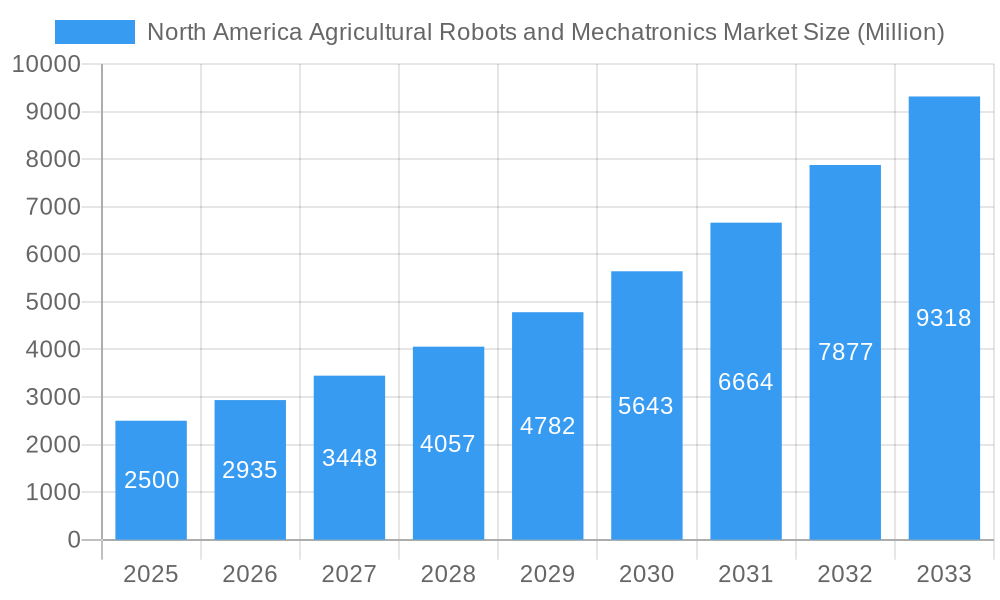

The North American agricultural robots and mechatronics market is experiencing robust growth, driven by the increasing demand for automation in farming to address labor shortages, improve efficiency, and enhance crop yields. The market, currently valued at approximately $X billion in 2025 (assuming a logical extrapolation based on the provided CAGR of 17.20% and a reasonable starting market size), is projected to reach $Y billion by 2033. This expansion is fueled by several key factors. Technological advancements in robotics, artificial intelligence, and precision agriculture are leading to the development of sophisticated agricultural robots capable of performing complex tasks autonomously, such as planting, harvesting, and spraying pesticides. Furthermore, the rising adoption of precision farming techniques, coupled with the increasing need for sustainable agriculture practices, is further propelling market growth. The market is segmented by type (autonomous tractors, UAVs, milking robots, and others) and application (crop production, animal husbandry, forest control, and others). Autonomous tractors and UAVs currently hold significant market share, but the adoption of other robotic systems is rapidly increasing. North America, particularly the United States, constitutes a significant portion of this market, owing to its extensive agricultural land and robust technological infrastructure. However, high initial investment costs and technological complexities associated with implementing these robots remain significant challenges.

North America Agricultural Robots and Mechatronics Market Market Size (In Billion)

Despite these challenges, several factors support continued market expansion. Government initiatives promoting agricultural technology adoption, coupled with the growing awareness of the benefits of automation among farmers, are fostering market growth. The emergence of innovative business models, such as robot-as-a-service, is making advanced agricultural technologies more accessible to smaller farms. While the market is presently dominated by established players like AG Leader Technology, DeLaval Inc., and others, several startups and emerging companies are contributing to innovation and competition. The continued development of more affordable, user-friendly, and versatile agricultural robots will further drive market expansion throughout the forecast period (2025-2033), making precision agriculture accessible to a wider range of farmers and contributing to improved agricultural productivity and sustainability across North America. The market is expected to maintain a high CAGR throughout the forecast period, driven by factors such as increasing demand for improved efficiency, technological advancements, and government support for the adoption of advanced agricultural technologies.

North America Agricultural Robots and Mechatronics Market Company Market Share

North America Agricultural Robots and Mechatronics Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America Agricultural Robots and Mechatronics market, offering a detailed understanding of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to navigate this rapidly evolving landscape. The market is segmented by type (Autonomous Tractors, Unmanned Aerial Vehicles (UAVs), Milking Robots, Other Types), application (Crop Production, Animal Husbandry, Forest Control, Other Applications), and geography (United States, Canada, Mexico, Rest of North America). Key players analyzed include AG Leader Technology, DeLaval Inc, DroneDeploy, Harvest Automation Inc, GEA Group Aktiengesellschaft, Blue River Technology, EcoRobotix Ltd, Agrobotix LLC, Lely Industries NV, Autonomous Solutions (ASI), and Autonomous Tractor Corporation. The report projects a market value of xx Million by 2033.

North America Agricultural Robots and Mechatronics Market Market Composition & Trends

This section delves into the competitive dynamics of the North American agricultural robots and mechatronics market. We analyze market concentration, identifying the leading players and their respective market shares. Innovation catalysts, such as advancements in AI and sensor technologies, are examined, alongside the impact of regulatory landscapes and the presence of substitute products on market growth. Furthermore, the report profiles end-users across various agricultural segments and analyzes recent mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation.

- Market Share Distribution: A detailed breakdown of market share held by key players (e.g., AG Leader Technology holding x%, DeLaval Inc. holding y%, etc.) will be provided.

- M&A Activity: The report will analyze significant M&A deals within the period, specifying deal values (e.g., Company X acquired Company Y for xx Million in 2023).

- Innovation Catalysts: The report will explore the impact of AI, robotics, and precision agriculture technologies on market growth.

- Regulatory Landscape: An examination of relevant regulations and their impact on market expansion.

- Substitute Products: Analysis of alternative technologies or methods and their competitive influence.

North America Agricultural Robots and Mechatronics Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the North American agricultural robots and mechatronics market. Technological advancements, such as the integration of GPS, AI, and machine learning, are explored in detail, along with their impact on market adoption rates and growth. The changing demands of consumers (farmers) for increased efficiency, precision, and sustainability are also examined, alongside specific data points such as compound annual growth rates (CAGR) and market penetration rates for specific technologies. The analysis will consider the impact of factors such as labor shortages and increasing demand for food production on market expansion.

Leading Regions, Countries, or Segments in North America Agricultural Robots and Mechatronics Market

This section identifies the dominant regions, countries, and segments within the North American agricultural robots and mechatronics market. A detailed analysis pinpoints the factors driving their dominance, supported by key performance indicators. The analysis will consider the influence of government policies, investment trends, and technological infrastructure.

- United States:

- High adoption rates due to technological advancements and favorable government policies.

- Strong investment in agricultural technology.

- Canada:

- Growing adoption driven by increasing automation needs in the agricultural sector.

- Government initiatives promoting sustainable agriculture practices.

- Mexico:

- Emerging market with increasing demand for efficient agricultural practices.

- Opportunities for market expansion driven by labor shortages and the rising demand for food.

- Dominant Segments: The report will identify the leading segments by type (e.g., Autonomous Tractors exhibiting highest growth) and application (e.g., Crop Production segment dominating due to high demand for precision farming solutions).

North America Agricultural Robots and Mechatronics Market Product Innovations

This section showcases recent product innovations in agricultural robotics and mechatronics, highlighting their unique selling propositions (USPs) and technological advancements. The analysis focuses on improved performance metrics (e.g., increased efficiency, higher accuracy, enhanced sustainability) achieved through these innovations and their impact on market competitiveness. Specific examples of innovative features and their functionalities will be provided.

Propelling Factors for North America Agricultural Robots and Mechatronics Market Growth

The growth of the North American agricultural robots and mechatronics market is driven by several key factors. These include technological advancements leading to increased efficiency and precision, the need to address labor shortages and rising labor costs in the agricultural sector, and governmental initiatives supporting the adoption of sustainable agricultural practices. The increasing demand for higher crop yields and the need for reduced environmental impact further propel market expansion.

Obstacles in the North America Agricultural Robots and Mechatronics Market Market

Despite significant growth potential, challenges exist within the North American agricultural robots and mechatronics market. High initial investment costs, complexities in technology integration, and potential supply chain disruptions can hamper widespread adoption. Furthermore, regulatory hurdles and intense competition among established players and new entrants present ongoing obstacles. The report will quantify the impact of these factors on market growth.

Future Opportunities in North America Agricultural Robots and Mechatronics Market

Future opportunities in the North American agricultural robots and mechatronics market are substantial. Expanding into new geographic markets with high agricultural potential, development of more affordable and user-friendly technologies, and integrating advanced technologies like AI and IoT present significant growth prospects. Further opportunities lie in catering to specific crop types and addressing the unique requirements of different agricultural regions.

Major Players in the North America Agricultural Robots and Mechatronics Market Ecosystem

- AG Leader Technology

- DeLaval Inc

- DroneDeploy

- Harvest Automation Inc

- GEA Group Aktiengesellschaft

- Blue River Technology

- EcoRobotix Ltd

- Agrobotix LLC

- Lely Industries NV

- Autonomous Solutions (ASI)

- Autonomous Tractor Corporation

Key Developments in North America Agricultural Robots and Mechatronics Market Industry

- January 2023: Company X launched a new autonomous tractor model with enhanced GPS capabilities.

- March 2024: Company Y and Company Z announced a merger to expand their product portfolio in precision farming.

- June 2024: Government Z introduces new subsidy program to encourage adoption of agricultural robotics.

- (Add further developments with year/month and impact)

Strategic North America Agricultural Robots and Mechatronics Market Market Forecast

The North American agricultural robots and mechatronics market is poised for significant growth over the forecast period (2025-2033). Continued technological advancements, increasing demand for efficient and sustainable agricultural practices, and supportive government policies will drive market expansion. Emerging opportunities in areas such as AI-powered crop monitoring and automated harvesting systems promise further growth and market diversification. The market is expected to reach xx Million by 2033, presenting substantial investment potential.

North America Agricultural Robots and Mechatronics Market Segmentation

-

1. Type

- 1.1. Autonomous Tractors

- 1.2. Unmanned Aerial Vehicles (UAVs)

- 1.3. Milking Robots

- 1.4. Other Types

-

2. Application

- 2.1. Crop Production

- 2.2. Animal Husbandry

- 2.3. Forest Control

- 2.4. Other Applications

-

3. North America

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest Of North America

-

4. Type

- 4.1. Autonomous Tractors

- 4.2. Unmanned Aerial Vehicles (UAVs)

- 4.3. Milking Robots

- 4.4. Other Types

-

5. Application

- 5.1. Crop Production

- 5.2. Animal Husbandry

- 5.3. Forest Control

- 5.4. Other Applications

-

6. North America

- 6.1. United States

- 6.2. Canada

- 6.3. Mexico

- 6.4. Rest Of North America

North America Agricultural Robots and Mechatronics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Robots and Mechatronics Market Regional Market Share

Geographic Coverage of North America Agricultural Robots and Mechatronics Market

North America Agricultural Robots and Mechatronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Growing Practice of Precision Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Autonomous Tractors

- 5.1.2. Unmanned Aerial Vehicles (UAVs)

- 5.1.3. Milking Robots

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Crop Production

- 5.2.2. Animal Husbandry

- 5.2.3. Forest Control

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by North America

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest Of North America

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Autonomous Tractors

- 5.4.2. Unmanned Aerial Vehicles (UAVs)

- 5.4.3. Milking Robots

- 5.4.4. Other Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Crop Production

- 5.5.2. Animal Husbandry

- 5.5.3. Forest Control

- 5.5.4. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by North America

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.6.4. Rest Of North America

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AG Leader Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DeLaval Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DroneDeploy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harvest Automation Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEA Group Aktiengesellschaft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blue River Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EcoRobotix Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agrobotix LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lely Industries NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autonomous Solutions (ASI)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Autonomous Tractor Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 AG Leader Technology

List of Figures

- Figure 1: North America Agricultural Robots and Mechatronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Robots and Mechatronics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by North America 2020 & 2033

- Table 4: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by North America 2020 & 2033

- Table 7: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by North America 2020 & 2033

- Table 11: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by North America 2020 & 2033

- Table 14: North America Agricultural Robots and Mechatronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States North America Agricultural Robots and Mechatronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Agricultural Robots and Mechatronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Agricultural Robots and Mechatronics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Robots and Mechatronics Market?

The projected CAGR is approximately 17.20%.

2. Which companies are prominent players in the North America Agricultural Robots and Mechatronics Market?

Key companies in the market include AG Leader Technology, DeLaval Inc, DroneDeploy, Harvest Automation Inc, GEA Group Aktiengesellschaft, Blue River Technology, EcoRobotix Ltd, Agrobotix LLC, Lely Industries NV, Autonomous Solutions (ASI), Autonomous Tractor Corporatio.

3. What are the main segments of the North America Agricultural Robots and Mechatronics Market?

The market segments include Type, Application, North America, Type, Application, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Growing Practice of Precision Farming.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Robots and Mechatronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Robots and Mechatronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Robots and Mechatronics Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Robots and Mechatronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence