Key Insights

The European specialty fertilizer market is set for significant expansion, with an estimated market size of $7.25 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.9%. This growth is propelled by the increasing demand for higher crop yields, optimized nutrient utilization, and sustainable farming methods across Europe. Farmers are increasingly adopting advanced fertilizers, such as Controlled-Release Fertilizers (CRF) and Water-Soluble Fertilizers, for precise nutrient delivery, minimizing waste and environmental impact. Growing emphasis on soil health and the reduction of fertilizer runoff further accelerates the adoption of these solutions. Additionally, consumer demand for premium produce and adherence to environmental regulations are key drivers for the specialty fertilizer sector.

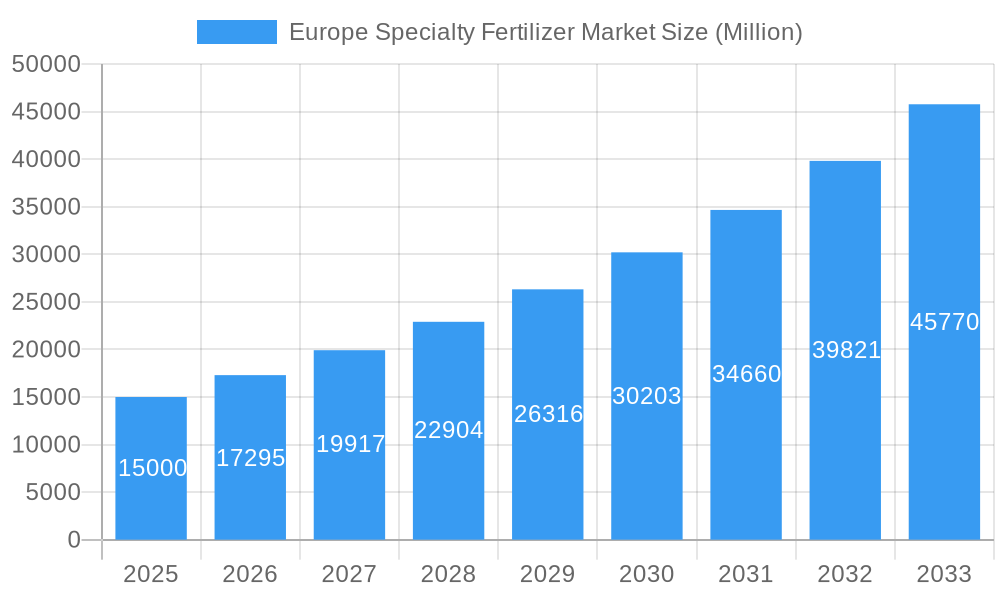

Europe Specialty Fertilizer Market Market Size (In Billion)

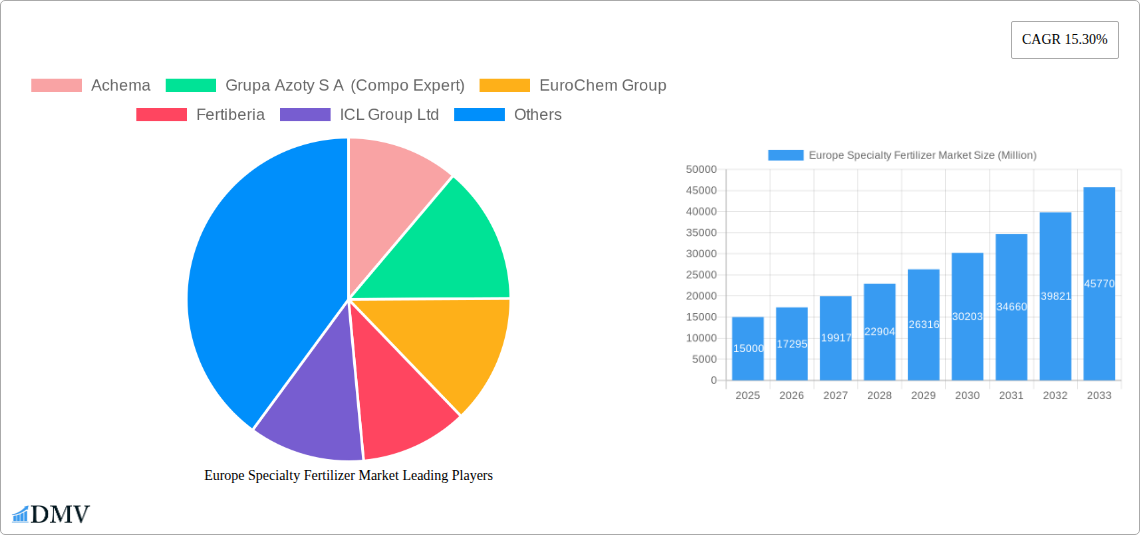

Key market segments include Polymer Coated and Polymer-Sulfur Coated CRF, offering extended nutrient release ideal for European crop cycles. Liquid fertilizers and Slow-Release Fertilizers (SRF) are also gaining prominence for their application flexibility and enhanced nutrient uptake. Fertigation and Foliar applications lead in application modes, indicating a shift towards efficient, targeted nutrient delivery. Field Crops and Horticultural Crops are the primary end-use sectors, with Turf & Ornamental also demonstrating consistent growth. Leading innovators like Yara International AS, EuroChem Group, and ICL Group Ltd are driving R&D to meet specific European agricultural needs. The region's advanced agricultural infrastructure and commitment to sustainability position it as a pivotal growth area for this market.

Europe Specialty Fertilizer Market Company Market Share

Europe Specialty Fertilizer Market: Growth Drivers, Innovations, and Forecast 2025-2033

This comprehensive report offers an in-depth analysis of the Europe Specialty Fertilizer Market, providing critical insights into its present state and future trajectory. Spanning the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033), this study delves into the market's composition, trends, industry evolution, leading regions, product innovations, growth drivers, obstacles, opportunities, and key players. Leveraging advanced analytical techniques and extensive market data, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning demand for high-efficiency specialty fertilizers in Europe. The market is segmented by Speciality Type including Controlled-Release Fertilizers (CRF) - Polymer Coated, Polymer-Sulfur Coated, Others - Liquid Fertilizers, Slow-Release Fertilizers (SRF), and Water Soluble Fertilizers. Application modes covered include Fertigation, Foliar, and Soil application, catering to Field Crops, Horticultural Crops, and Turf & Ornamental segments.

Europe Specialty Fertilizer Market Market Composition & Trends

The Europe Specialty Fertilizer Market exhibits a dynamic and evolving composition, driven by an increasing focus on sustainable agriculture and enhanced crop yields. Market concentration is moderate, with key players investing significantly in research and development (R&D) to introduce innovative specialty nutrient solutions. Innovation catalysts are primarily centered on developing environmentally friendly fertilizers, such as slow-release and controlled-release fertilizers (SRF and CRF), which minimize nutrient leaching and optimize absorption. The regulatory landscape in Europe, emphasizing eco-friendly farming practices and reduced chemical inputs, further propels the adoption of specialty fertilizers. Substitute products, while existing in the form of conventional fertilizers, are gradually being phased out in favor of more efficient and targeted specialty fertilizer applications. End-user profiles are increasingly sophisticated, with professional farmers, horticulturalists, and turf managers prioritizing precision agriculture and crop-specific nutrient management. Mergers and acquisitions (M&A) activities, with estimated deal values in the hundreds of millions of Euros, are evident as larger entities seek to expand their portfolios and market reach within this lucrative segment. The market share distribution is influenced by the penetration of advanced farming techniques and the presence of key global and regional manufacturers.

Europe Specialty Fertilizer Market Industry Evolution

The Europe Specialty Fertilizer Market has undergone a significant transformation driven by a confluence of factors including evolving agricultural practices, technological advancements, and increasing environmental consciousness. Over the Historical Period (2019-2024), the market witnessed a steady upward trajectory, propelled by a growing understanding of the benefits associated with specialty fertilizers. These benefits include improved nutrient use efficiency, reduced environmental impact, and enhanced crop quality and yield. Technological advancements have been a cornerstone of this evolution. The development and refinement of Controlled-Release Fertilizers (CRF), such as polymer-coated and polymer-sulfur coated variants, have revolutionized nutrient delivery, ensuring a gradual release of essential elements over time. Similarly, the increased sophistication of Liquid Fertilizers and Water-Soluble Fertilizers has facilitated precise application through fertigation and foliar spray systems, aligning with the principles of precision agriculture. Shifting consumer demands for sustainably produced food, free from excessive chemical residues, have also played a pivotal role. This has put pressure on the agricultural sector to adopt more efficient and eco-friendly nutrient management strategies. The market's growth rate has been robust, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5-7% in recent years. Adoption metrics for specialty fertilizers, particularly among large-scale commercial farms and in regions with intensive horticultural production, have shown a marked increase, indicating a strong market acceptance and a promising outlook for the Forecast Period (2025-2033). The focus is shifting from bulk commodity fertilizers to high-value, performance-driven specialty nutrient solutions.

Leading Regions, Countries, or Segments in Europe Specialty Fertilizer Market

The Europe Specialty Fertilizer Market is characterized by several dominant regions, countries, and segments, each contributing to its overall growth and dynamism. Among the Speciality Types, Controlled-Release Fertilizers (CRF), encompassing both polymer-coated and polymer-sulfur coated variants, have emerged as a significant segment due to their superior nutrient efficiency and environmental benefits. Liquid Fertilizers also hold substantial market share, driven by their ease of application and suitability for precision farming techniques.

In terms of Application Mode, Fertigation stands out as a primary driver, particularly in regions with water scarcity or intensive greenhouse cultivation. This method allows for the direct delivery of nutrients to the root zone, maximizing uptake and minimizing waste. Foliar application also plays a crucial role, offering rapid nutrient absorption for correcting deficiencies or boosting crop performance during critical growth stages.

By Crop Type, Horticultural Crops represent a leading segment. The high value of produce in this sector justifies the investment in premium specialty fertilizers that enhance quality, yield, and shelf-life. Field Crops, while traditionally relying on conventional fertilizers, are increasingly adopting specialty solutions for specific nutrient needs and to improve soil health. Turf & Ornamental applications also contribute to the market, with a growing demand for specialized fertilizers that promote dense, healthy, and aesthetically pleasing turf.

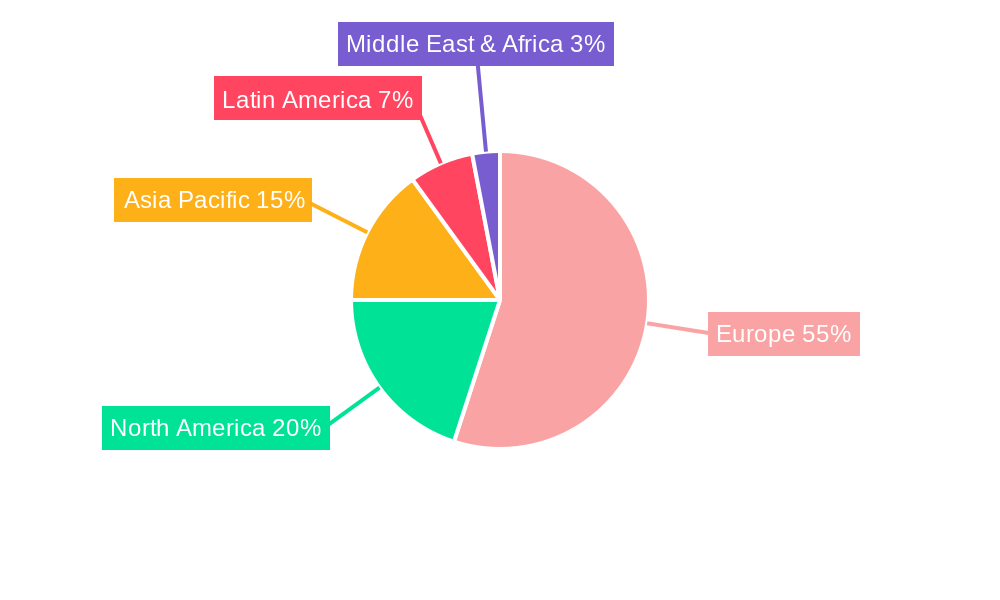

Leading Regions and Countries driving this market include Germany, France, the Netherlands, and the United Kingdom. These nations boast advanced agricultural infrastructure, high adoption rates of precision farming technologies, and strong regulatory frameworks supporting sustainable agriculture.

- Key Drivers for Dominance:

- Investment Trends: Significant R&D expenditure by leading fertilizer manufacturers in Europe on innovative formulations.

- Regulatory Support: Government initiatives promoting sustainable agriculture, reduced chemical usage, and precision farming techniques.

- Technological Adoption: High penetration of advanced irrigation systems (for fertigation) and smart farming technologies.

- Demand for High-Value Crops: Strong consumer and export demand for high-quality horticultural produce.

- Environmental Concerns: Increasing awareness and pressure to adopt eco-friendly agricultural practices to mitigate environmental pollution.

- Availability of Skilled Workforce: A well-educated agricultural workforce capable of implementing complex nutrient management strategies.

The dominance of these segments and regions underscores the shift towards a more sophisticated and sustainable approach to crop nutrition in the European agricultural landscape.

Europe Specialty Fertilizer Market Product Innovations

Recent product innovations in the Europe Specialty Fertilizer Market are centered on enhancing nutrient delivery, improving crop resilience, and minimizing environmental impact. Leading companies are introducing advanced Controlled-Release Fertilizers (CRF) with novel coating technologies, ensuring precise nutrient release profiles that match crop uptake patterns. Examples include polymer-sulfur coated fertilizers offering enhanced efficacy and reduced nutrient losses. Furthermore, the development of liquid fertilizers enriched with micronutrients and biostimulants is gaining traction, enabling rapid absorption and improved plant health. These innovations are characterized by unique selling propositions such as extended nutrient availability, reduced application frequency, and improved crop tolerance to environmental stresses. Performance metrics such as increased crop yields by up to 15-20%, improved nutrient use efficiency by 30-40%, and reduced greenhouse gas emissions by up to 25% are being reported for these advanced formulations.

Propelling Factors for Europe Specialty Fertilizer Market Growth

The Europe Specialty Fertilizer Market is experiencing robust growth propelled by several key factors. Technologically, the increasing adoption of precision agriculture and smart farming techniques drives demand for highly efficient specialty fertilizers that can be tailored to specific crop needs and soil conditions. Economically, rising awareness among farmers about the long-term benefits of specialty fertilizers, including improved crop yields and reduced waste, leads to greater investment. Regulatory influences, such as the European Union's Farm to Fork strategy, which promotes sustainable food systems and reduced fertilizer use, further encourage the adoption of slow-release and controlled-release fertilizers (SRF & CRF). The demand for higher quality produce and the growing trend of organic and sustainable farming practices are also significant catalysts.

Obstacles in the Europe Specialty Fertilizer Market Market

Despite its strong growth prospects, the Europe Specialty Fertilizer Market faces certain obstacles. High initial costs associated with premium specialty fertilizers can be a deterrent for some farmers, particularly smallholders. Limited awareness and understanding of the full benefits of certain advanced formulations can also hinder widespread adoption. Stringent regulatory requirements for product registration and environmental impact assessments can lead to longer development and market entry times. Supply chain disruptions, exacerbated by geopolitical events and global logistics challenges, can impact the availability and cost of raw materials and finished products. Furthermore, intense competition from established conventional fertilizer producers who are increasingly introducing their own specialty lines, and the potential for counterfeit products, pose significant challenges.

Future Opportunities in Europe Specialty Fertilizer Market

The Europe Specialty Fertilizer Market is poised for significant future opportunities. The ongoing push towards sustainable agriculture and circular economy principles will drive demand for bio-based and slow-release nutrient solutions. Emerging technologies like IoT-enabled precision farming tools will enable even more targeted application of specialty fertilizers, optimizing their use and maximizing returns for farmers. The growing consumer preference for healthier, sustainably produced food will continue to fuel the demand for high-quality specialty crops, necessitating advanced nutrient management. Furthermore, the exploration of new markets within Europe and the potential for developing specialty fertilizers for niche crops and urban farming applications present untapped potential. The development of fertilizers that also address soil health improvement and carbon sequestration will be a key growth area.

Major Players in the Europe Specialty Fertilizer Market Ecosystem

- Achema

- Grupa Azoty S A (Compo Expert)

- EuroChem Group

- Fertiberia

- ICL Group Ltd

- AGLUKON Spezialduenger GmbH & Co

- Sociedad Quimica y Minera de Chile SA

- Kingenta Ecological Engineering Group Co Ltd

- Petrokemija DD Fertilizer Factory

- Yara International AS

Key Developments in Europe Specialty Fertilizer Market Industry

- January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. This long-term agreement will also focus on international expansion, bolstering ICL's presence in the food ingredients sector and specialty nutrient markets.

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements. This launch signifies ICL's commitment to developing advanced, nutrient-rich fertilizer solutions aimed at optimizing crop yields and quality, catering to evolving agricultural needs.

- May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, in 2022 at 590 USD per ton. While focusing on potash, this development highlights ICL's significant role in the global nutrient supply chain and its ability to secure large-scale supply contracts, influencing broader fertilizer market dynamics.

Strategic Europe Specialty Fertilizer Market Market Forecast

The Europe Specialty Fertilizer Market is projected for continued strategic growth, driven by an intensifying focus on sustainable agriculture and advanced crop nutrition. The increasing adoption of precision farming technologies, coupled with regulatory support for environmentally friendly practices, will fuel demand for Controlled-Release Fertilizers (CRF) and Liquid Fertilizers. Innovations in nutrient efficiency and the development of bio-based alternatives are expected to further enhance market penetration. The forecast period anticipates a strong upward trend, as farmers increasingly recognize the economic and environmental advantages of investing in high-performance specialty nutrient solutions to meet the growing demand for high-quality, sustainably produced food across Europe.

Europe Specialty Fertilizer Market Segmentation

-

1. Speciality Type

-

1.1. CRF

- 1.1.1. Polymer Coated

- 1.1.2. Polymer-Sulfur Coated

- 1.1.3. Others

- 1.2. Liquid Fertilizer

- 1.3. SRF

- 1.4. Water Soluble

-

1.1. CRF

-

2. Application Mode

- 2.1. Fertigation

- 2.2. Foliar

- 2.3. Soil

-

3. Crop Type

- 3.1. Field Crops

- 3.2. Horticultural Crops

- 3.3. Turf & Ornamental

-

4. Speciality Type

-

4.1. CRF

- 4.1.1. Polymer Coated

- 4.1.2. Polymer-Sulfur Coated

- 4.1.3. Others

- 4.2. Liquid Fertilizer

- 4.3. SRF

- 4.4. Water Soluble

-

4.1. CRF

-

5. Application Mode

- 5.1. Fertigation

- 5.2. Foliar

- 5.3. Soil

-

6. Crop Type

- 6.1. Field Crops

- 6.2. Horticultural Crops

- 6.3. Turf & Ornamental

Europe Specialty Fertilizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Specialty Fertilizer Market Regional Market Share

Geographic Coverage of Europe Specialty Fertilizer Market

Europe Specialty Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Specialty Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Speciality Type

- 5.1.1. CRF

- 5.1.1.1. Polymer Coated

- 5.1.1.2. Polymer-Sulfur Coated

- 5.1.1.3. Others

- 5.1.2. Liquid Fertilizer

- 5.1.3. SRF

- 5.1.4. Water Soluble

- 5.1.1. CRF

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Fertigation

- 5.2.2. Foliar

- 5.2.3. Soil

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Field Crops

- 5.3.2. Horticultural Crops

- 5.3.3. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Speciality Type

- 5.4.1. CRF

- 5.4.1.1. Polymer Coated

- 5.4.1.2. Polymer-Sulfur Coated

- 5.4.1.3. Others

- 5.4.2. Liquid Fertilizer

- 5.4.3. SRF

- 5.4.4. Water Soluble

- 5.4.1. CRF

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Fertigation

- 5.5.2. Foliar

- 5.5.3. Soil

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Field Crops

- 5.6.2. Horticultural Crops

- 5.6.3. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Speciality Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Achema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupa Azoty S A (Compo Expert)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EuroChem Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fertiberia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICL Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGLUKON Spezialduenger GmbH & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sociedad Quimica y Minera de Chile SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kingenta Ecological Engineering Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petrokemija DD Fertilizer Factory

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yara International AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Achema

List of Figures

- Figure 1: Europe Specialty Fertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Specialty Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 2: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 3: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 5: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 6: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 7: Europe Specialty Fertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 9: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 10: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 11: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 12: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 13: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: Europe Specialty Fertilizer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Sweden Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Norway Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Poland Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Denmark Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Specialty Fertilizer Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Europe Specialty Fertilizer Market?

Key companies in the market include Achema, Grupa Azoty S A (Compo Expert), EuroChem Group, Fertiberia, ICL Group Ltd, AGLUKON Spezialduenger GmbH & Co, Sociedad Quimica y Minera de Chile SA, Kingenta Ecological Engineering Group Co Ltd, Petrokemija DD Fertilizer Factory, Yara International AS.

3. What are the main segments of the Europe Specialty Fertilizer Market?

The market segments include Speciality Type, Application Mode, Crop Type, Speciality Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Specialty Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Specialty Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Specialty Fertilizer Market?

To stay informed about further developments, trends, and reports in the Europe Specialty Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence