Key Insights

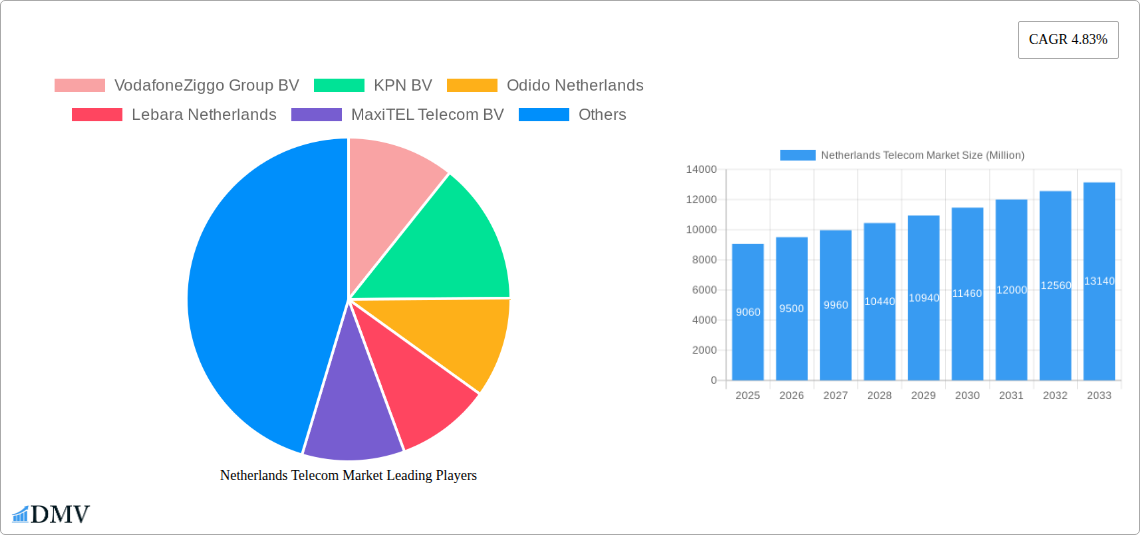

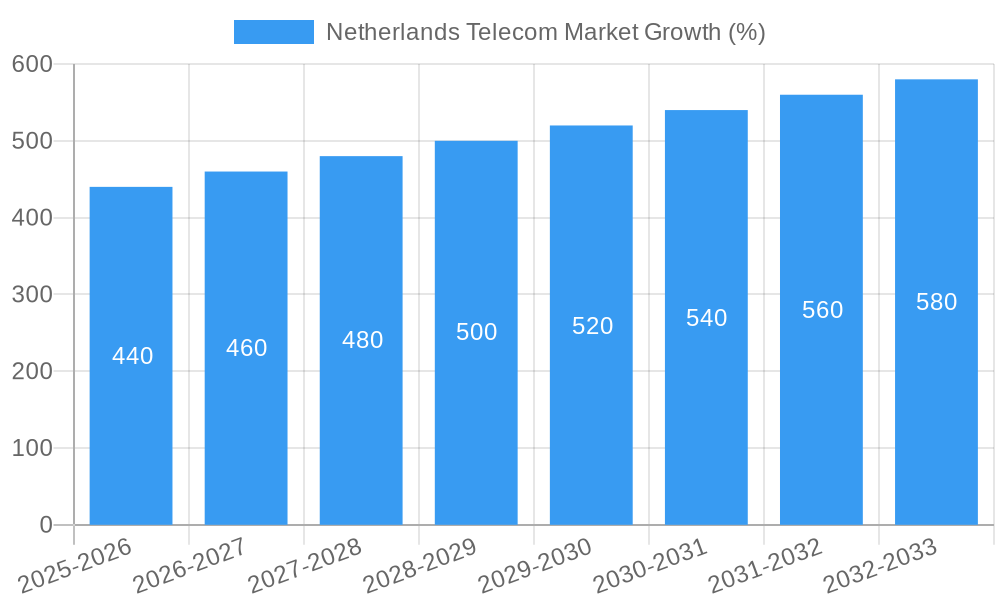

The Netherlands telecom market, valued at €9.06 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising data consumption fueled by streaming services and remote work, and the ongoing expansion of 5G networks. Key players like VodafoneZiggo, KPN, and others are investing heavily in infrastructure upgrades and innovative service offerings to cater to this growing demand. The market's Compound Annual Growth Rate (CAGR) of 4.83% from 2019-2033 signifies a consistent upward trajectory. Growth is further supported by government initiatives promoting digitalization and broadband access across the country. However, market saturation in certain segments, intense competition among established players and new entrants, and potential regulatory hurdles could present challenges to sustained growth. The market is segmented by service type (mobile, fixed-line, broadband, etc.) and technology (4G, 5G, fiber optics), with mobile services likely representing the largest segment given the high mobile phone penetration rates. Future growth will likely be influenced by the successful rollout of 5G, the increasing adoption of bundled services, and the emergence of new technologies like IoT and edge computing. Competitive pricing strategies and customer acquisition costs remain significant factors influencing profitability.

The forecast period (2025-2033) anticipates continued expansion, albeit at a pace potentially moderated by economic factors and market maturity. The competitive landscape is dynamic, with mergers, acquisitions, and strategic partnerships influencing market share. The emphasis on customer experience, personalized service offerings, and value-added services will be crucial for sustained success. Innovation in areas such as network security, cloud services, and AI-powered solutions will also play a significant role in shaping the future of the Netherlands telecom market. Maintaining a competitive edge requires continuous investment in infrastructure, technological advancements, and customer relationship management.

Netherlands Telecom Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Netherlands telecom market, encompassing market size, key players, technological advancements, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This report is invaluable for stakeholders seeking to understand the dynamic landscape of the Dutch telecom sector and make informed strategic decisions. The market is expected to reach xx Million by 2033.

Netherlands Telecom Market Composition & Trends

The Netherlands telecom market exhibits a moderate level of concentration, with KPN BV and VodafoneZiggo Group BV holding significant market share. Innovation is driven by the increasing adoption of 5G technology, the expansion of fiber optic networks, and the growth of the IoT (Internet of Things) sector. The regulatory landscape, overseen by the Dutch Authority for Consumers and Markets (ACM), plays a crucial role in shaping market competition and infrastructure development. Substitute products, such as VoIP services and satellite communication, pose a moderate threat. The end-user profile is diverse, encompassing residential, enterprise, and government segments. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million.

- Market Share Distribution (2024): KPN BV (xx%), VodafoneZiggo Group BV (xx%), Others (xx%).

- Recent M&A Activity: The June 2024 formation of TowerCo, a joint venture between ABP and KPN, valued at an estimated xx Million, highlights the ongoing consolidation within the infrastructure segment.

- Innovation Catalysts: 5G deployment, fiber optic expansion, IoT growth.

- Regulatory Landscape: ACM's influence on market competition and infrastructure.

Netherlands Telecom Market Industry Evolution

The Netherlands telecom market has experienced steady growth over the past five years, fueled by increasing broadband penetration, rising smartphone adoption, and the demand for higher bandwidth services. Technological advancements, such as 5G and fiber optic deployments, are transforming the industry, enabling faster speeds, higher capacity, and improved network reliability. Consumer demands are shifting towards more data-intensive services, including streaming video, online gaming, and cloud computing. The market is projected to maintain a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033).

- Growth Trajectories: CAGR of xx% (2025-2033).

- Technological Advancements: 5G rollout, fiber optic network expansion.

- Shifting Consumer Demands: Increased demand for higher bandwidth services and data-intensive applications.

Leading Regions, Countries, or Segments in Netherlands Telecom Market

The Netherlands telecom market is relatively homogenous, with no single region dominating. However, urban areas typically exhibit higher broadband penetration and 5G adoption rates than rural regions. The enterprise segment is a key growth driver, fueled by the increasing adoption of private 5G networks and cloud-based solutions.

- Key Drivers:

- Investment Trends: Significant investments in 5G infrastructure and fiber optic networks.

- Regulatory Support: Favorable regulatory environment promoting competition and investment.

- Dominance Factors:

- High Broadband Penetration: Consistent high broadband penetration across the country.

- Strong Enterprise Demand: Significant demand for advanced telecommunications services in the business sector.

Netherlands Telecom Market Product Innovations

Recent innovations in the Netherlands telecom market include the launch of advanced 5G services, enhanced fiber optic networks offering gigabit speeds, and the introduction of innovative IoT solutions. These advancements provide businesses and consumers with faster speeds, greater reliability, and increased capacity. Key selling propositions center on speed, reliability, and seamless connectivity.

Propelling Factors for Netherlands Telecom Market Growth

The Netherlands telecom market's growth is driven by several factors. The ongoing deployment of 5G infrastructure is expanding network capacity and improving connectivity, driving adoption of data-intensive services. Government initiatives aimed at promoting digitalization, increasing broadband penetration, and supporting 5G development also contribute significantly. Finally, rising disposable incomes and the increasing demand for high-speed internet access fuel continued growth.

Obstacles in the Netherlands Telecom Market Market

The Netherlands telecom market faces challenges, including the high cost of infrastructure deployment, particularly in rural areas. Competition among established players can lead to price wars, impacting profitability. Supply chain disruptions, particularly regarding semiconductor chips, also represent a significant obstacle. The impact of these factors on market growth is estimated at approximately xx Million annually.

Future Opportunities in Netherlands Telecom Market

Future opportunities lie in the expansion of 5G networks, the growth of the IoT sector, and the increasing demand for cloud-based services. The development of innovative solutions for smart cities and the increasing adoption of private 5G networks by businesses present further growth potential. The development of sustainable infrastructure is also expected to contribute significantly.

Major Players in the Netherlands Telecom Market Ecosystem

- VodafoneZiggo Group BV

- KPN BV

- Odido Netherlands

- Lebara Netherlands

- MaxiTEL Telecom BV

- Youfone

- Telefonaktiebolaget LM Ericsson

- Nokia Solutions and Networks BV

- Liberty Global PLC

- Ziggo B

Key Developments in Netherlands Telecom Market Industry

- June 2024: Formation of TowerCo, a joint venture between ABP and KPN, combining 3,800 telecom tower sites. This significantly impacts the telecom infrastructure landscape.

- May 2024: KPN launched KPN Campus, a private 5G network targeting large Dutch enterprises. This strengthens KPN's position in the enterprise market and drives 5G adoption.

Strategic Netherlands Telecom Market Market Forecast

The Netherlands telecom market is poised for continued growth, driven by ongoing 5G deployment, increasing demand for high-bandwidth services, and the growth of the IoT sector. Opportunities exist in expanding fiber optic networks, developing innovative 5G applications, and catering to the growing needs of businesses. The market's strong fundamentals and continued investment in infrastructure suggest substantial growth potential in the coming years.

Netherlands Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Netherlands Telecom Market Segmentation By Geography

- 1. Netherlands

Netherlands Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT usage in Telecom

- 3.4. Market Trends

- 3.4.1. Voice Services Accounts for Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 VodafoneZiggo Group BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KPN BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Odido Netherlands

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lebara Netherlands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MaxiTEL Telecom BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Youfone

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telefonaktiebolaget LM Ericsson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nokia Solutions and Networks BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Liberty Global PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ziggo B

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 VodafoneZiggo Group BV

List of Figures

- Figure 1: Netherlands Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Netherlands Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Netherlands Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 5: Netherlands Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Netherlands Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Netherlands Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 9: Netherlands Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Netherlands Telecom Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Telecom Market?

The projected CAGR is approximately 4.83%.

2. Which companies are prominent players in the Netherlands Telecom Market?

Key companies in the market include VodafoneZiggo Group BV, KPN BV, Odido Netherlands, Lebara Netherlands, MaxiTEL Telecom BV, Youfone, Telefonaktiebolaget LM Ericsson, Nokia Solutions and Networks BV, Liberty Global PLC, Ziggo B.

3. What are the main segments of the Netherlands Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Voice Services Accounts for Major Share.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT usage in Telecom.

8. Can you provide examples of recent developments in the market?

June 2024: Dutch pension fund ABP signed an agreement with mobile network operator KPN to create a new tower company named TowerCo. The 3,800-site business will combine passive telecom infrastructure assets owned by KPN with the tower and rooftop assets of Open Tower Company (OTC), which was majority-owned by ABP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Telecom Market?

To stay informed about further developments, trends, and reports in the Netherlands Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence