Key Insights

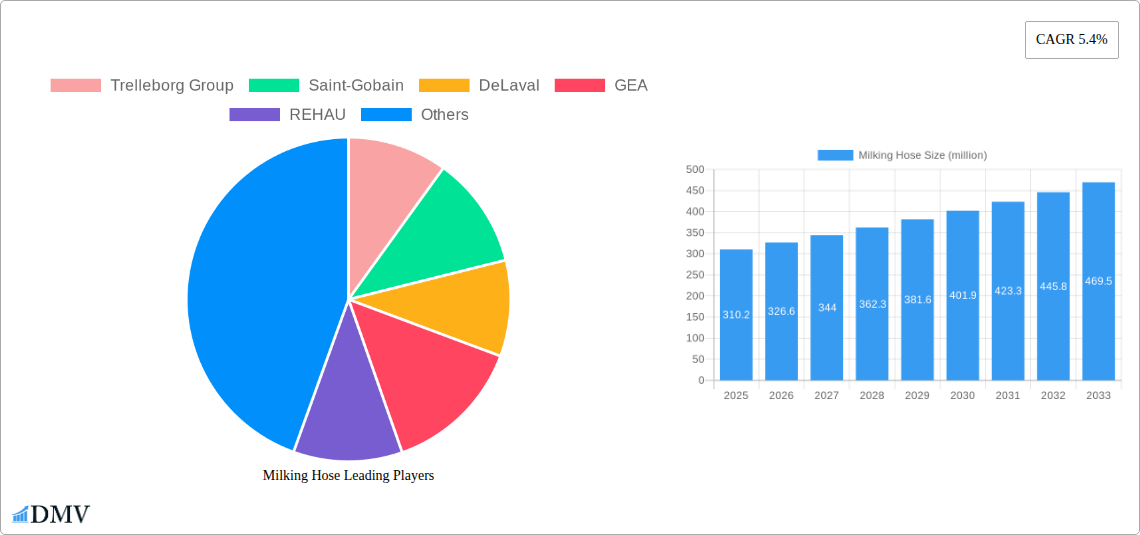

The global Milking Hose market is poised for substantial growth, with a current market size of USD 310.2 million and a projected Compound Annual Growth Rate (CAGR) of 5.4% over the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing demand for automated milking systems and the continuous adoption of advanced dairy farming technologies worldwide. As dairy producers prioritize efficiency, hygiene, and animal welfare, the need for reliable and high-performing milking hoses becomes paramount. The market is witnessing a strong inclination towards silicone and high-quality rubber hoses due to their superior durability, flexibility, and resistance to milk components, which minimize contamination risks and ensure longevity. Furthermore, government initiatives promoting modern agricultural practices and subsidies for dairy farm upgrades are significantly bolstering market penetration. The growing global population also fuels the demand for milk and dairy products, indirectly stimulating the market for milking hose manufacturers who are investing in product innovation to meet evolving industry standards and farmer requirements for sterile and efficient milk transfer.

Milking Hose Market Size (In Million)

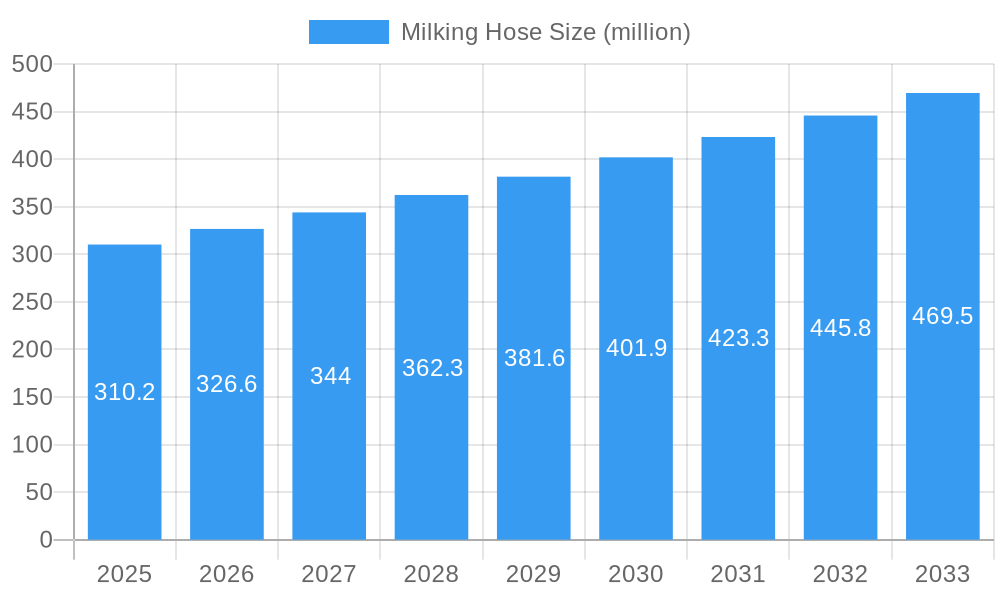

The market is segmented by application into Milk Tubes and Air Tubes, with Milk Tubes representing a larger share due to their direct involvement in milk collection. In terms of material type, Rubber and Silicone hoses are the dominant segments, favored for their performance characteristics in demanding dairy environments. Emerging trends include the development of antimicrobial hoses and smart hoses with integrated sensors for real-time monitoring of milk flow and quality. However, the market also faces certain restraints, such as fluctuating raw material prices and the initial investment cost associated with upgrading to advanced milking systems, which can be a barrier for small-scale dairy farmers. Despite these challenges, the strategic importance of efficient and hygienic milking processes, coupled with ongoing technological advancements, ensures a dynamic and promising future for the Milking Hose market. Leading players like Trelleborg Group, Saint-Gobain, and GEA are actively engaged in research and development to offer cutting-edge solutions, further driving innovation and market expansion across key regions like North America, Europe, and Asia Pacific.

Milking Hose Company Market Share

Milking Hose Market Composition & Trends

The global milking hose market, valued at approximately $XXX million in 2025, exhibits a moderately concentrated landscape with a few dominant players and a significant number of regional and specialized manufacturers. Innovation remains a key catalyst, driven by the pursuit of enhanced animal welfare, increased milking efficiency, and improved hygiene standards. Regulatory frameworks, primarily focused on food safety and animal health, play a crucial role in shaping product development and market entry, ensuring compliance with stringent industry standards. The threat of substitute products, such as automated milking systems with integrated tubing, is present but currently limited by cost and accessibility for many dairy operations. End-user profiles range from large-scale commercial dairies to smaller family farms, each with distinct purchasing criteria influenced by herd size, automation levels, and budget constraints. Mergers and acquisitions (M&A) activity, with reported deal values in the range of $XX million to $XXX million, continues to consolidate market share and expand technological capabilities.

- Market Share Distribution: Leading companies like Trelleborg Group, Saint-Gobain, DeLaval, and GEA collectively hold an estimated XX% market share.

- Innovation Focus Areas: Enhanced material durability, antimicrobial properties, and improved flexibility are key innovation drivers.

- M&A Activity: Strategic acquisitions aim to bolster product portfolios and expand geographical reach, with recent deals totaling approximately $XXX million.

- Regulatory Impact: Food contact material certifications and animal health directives significantly influence product design and material selection.

Milking Hose Industry Evolution

The milking hose industry has undergone a significant evolution throughout the historical period of 2019–2024 and is poised for substantial growth during the forecast period of 2025–2033. The market experienced a compound annual growth rate (CAGR) of approximately X.XX% during the historical period, driven by increasing global demand for dairy products and the continuous need for efficient and hygienic milking solutions. Technological advancements have been instrumental in this evolution. Innovations in material science have led to the development of more durable, flexible, and antimicrobial milking hoses, enhancing their lifespan and reducing the risk of contamination. For instance, the adoption of advanced silicone and specialized rubber compounds has significantly improved performance characteristics such as resistance to wear, temperature fluctuations, and milk fat. Consumer demand is shifting towards solutions that prioritize animal comfort and ease of use for farm operators. This has spurred the development of lighter, more ergonomic milking hose designs that minimize stress on cows and improve milking speed. The base year of 2025 is expected to see a market valuation of $XXX million, with the estimated year of 2025 reflecting this baseline. The forecast period anticipates a sustained CAGR of Y.YY% from 2025 to 2033, driven by factors such as the growing global dairy herd, increasing adoption of advanced milking technologies, and a greater emphasis on sustainable and efficient farming practices. The increasing mechanization of dairy farms, particularly in emerging economies, is a key driver of this growth. Furthermore, the development of specialized hoses for specific applications, such as vacuum lines and milk transfer, has further diversified the market and catered to niche demands. The continuous improvement in manufacturing processes also contributes to cost-effectiveness and increased accessibility of milking hose solutions.

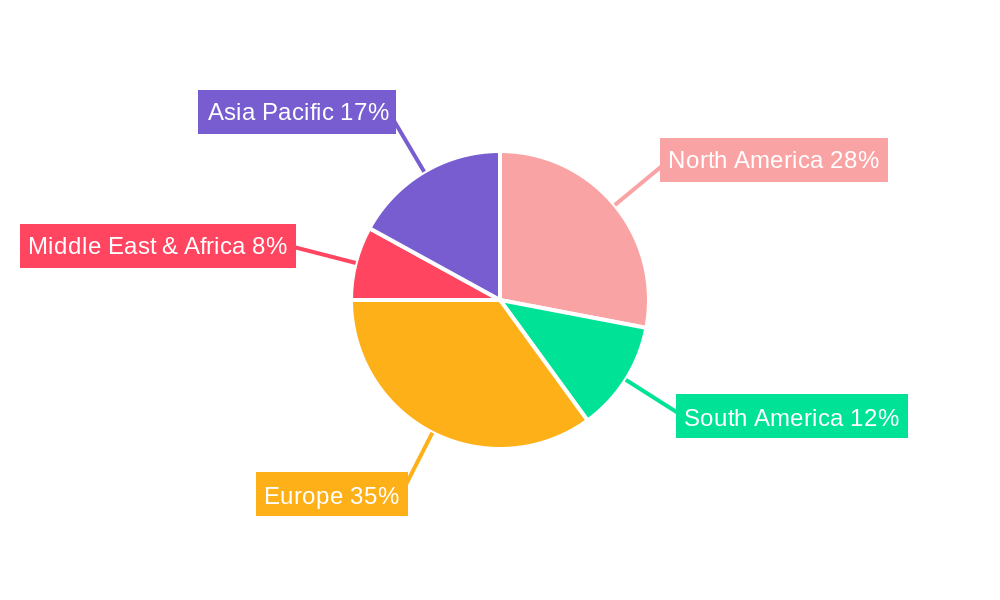

Leading Regions, Countries, or Segments in Milking Hose

The global milking hose market is characterized by a dynamic interplay of regional strengths and segment dominance, with a clear lead established by the Milk Tube application segment, particularly within the Rubber type category. North America and Europe currently represent the most significant geographical markets, driven by well-established dairy industries, high levels of technological adoption, and stringent regulatory environments that necessitate high-quality milking equipment. The United States, in particular, stands out as a leading country, boasting a substantial dairy herd and significant investment in advanced dairy farming infrastructure. The dominance of the Milk Tube segment is directly linked to its critical role in the direct transfer of milk from the animal to the collection system. The inherent properties of rubber, including its durability, flexibility, and resistance to the corrosive effects of milk and cleaning agents, make it the preferred material for this application.

- Application Dominance (Milk Tube): The Milk Tube segment accounts for an estimated XX% of the total market revenue. Its direct contact with milk necessitates high standards of hygiene, durability, and flexibility, which are optimally met by specialized milking hoses.

- Type Dominance (Rubber): Rubber milking hoses are the preferred choice for milk transfer due to their excellent elasticity, abrasion resistance, and ability to maintain flexibility across a wide range of temperatures encountered in dairy operations. They represent approximately YY% of the total milking hose market by volume.

- Regional Leadership (North America & Europe): These regions exhibit strong demand due to mature dairy industries, advanced farming practices, and favorable economic conditions that support investment in high-quality milking equipment.

- Key Drivers in Leading Segments:

- Technological Advancement: Innovations in rubber formulations and manufacturing techniques are continually enhancing the performance and lifespan of milk tubes.

- Regulatory Compliance: Strict food safety and animal health regulations in leading regions mandate the use of certified, high-quality milking hoses, boosting demand for premium rubber products.

- Investment Trends: Government support for agricultural modernization and private sector investment in dairy farm upgrades are significant growth catalysts.

- End-User Adoption: The increasing adoption of automated and semi-automated milking systems further fuels the demand for specialized and reliable milking hose solutions.

Milking Hose Product Innovations

Recent product innovations in the milking hose market are centered on enhancing animal welfare, improving operational efficiency, and extending product lifespan. Manufacturers are increasingly focusing on developing hoses with superior antimicrobial properties, reducing the risk of bacterial contamination and mastitis in dairy cows. Advanced material science has led to the creation of ultra-flexible, kink-resistant hoses that minimize stress on both the animals and farm personnel. Performance metrics are being optimized for increased durability and resistance to harsh cleaning chemicals, leading to a longer service life and reduced replacement costs. Unique selling propositions often revolve around specialized compounds that offer superior grip, improved vacuum stability, and reduced milk flow turbulence. Technological advancements include the integration of sensors for real-time monitoring of milking parameters and the development of lightweight, ergonomic designs for easier handling.

Propelling Factors for Milking Hose Growth

The milking hose market is propelled by a confluence of technological advancements, favorable economic conditions, and supportive regulatory environments. Increasing global demand for dairy products, driven by population growth and rising disposable incomes, directly translates into a larger dairy herd and, consequently, a higher demand for milking equipment, including hoses. Technological innovations in material science are leading to the development of more durable, hygienic, and efficient milking hoses, enhancing their appeal to dairy farmers. Furthermore, a growing emphasis on animal welfare and sustainable farming practices encourages the adoption of advanced milking solutions that minimize stress on livestock. Government initiatives and subsidies aimed at modernizing dairy farming infrastructure also contribute significantly to market expansion.

Obstacles in the Milking Hose Market

Despite robust growth prospects, the milking hose market faces several obstacles. Stringent regulatory requirements for food contact materials and animal health can increase product development costs and time-to-market, acting as a barrier for smaller manufacturers. Supply chain disruptions, particularly in the sourcing of raw materials like natural and synthetic rubber, can lead to price volatility and availability issues. Intense competition among numerous global and regional players exerts downward pressure on profit margins. Additionally, the initial investment cost for high-quality milking hoses can be a deterrent for smaller dairy farms with limited capital.

Future Opportunities in Milking Hose

Emerging opportunities in the milking hose market are diverse and promising. The increasing adoption of automated and robotic milking systems presents a significant avenue for growth, requiring specialized and highly reliable hose solutions. Expansion into developing economies with growing dairy sectors offers untapped market potential. Innovations in smart milking technologies, such as hoses with integrated sensors for real-time data collection, represent a frontier for value-added products. Furthermore, the development of biodegradable or recyclable milking hose materials aligns with the growing consumer and industry demand for sustainable solutions.

Major Players in the Milking Hose Ecosystem

- Trelleborg Group

- Saint-Gobain

- DeLaval

- GEA

- REHAU

- BouMatic

- MILKRITE

- Skellerup

- Terraflex

- Finger-Lakes Extrusion

- Lauren Agrisystems

- Kuriyama

- TBL Performance Plastics

Key Developments in Milking Hose Industry

- 2024/Q1: DeLaval launches a new range of antimicrobial milking liners designed to reduce somatic cell counts and improve udder health.

- 2023/Q4: Trelleborg Group announces a strategic partnership with an agricultural technology firm to integrate advanced sensor capabilities into their milking hose offerings.

- 2023/Q3: GEA expands its milking equipment portfolio with the acquisition of a specialized milking hose manufacturer, strengthening its market presence.

- 2023/Q2: Saint-Gobain introduces a new, highly durable silicone milking hose with enhanced resistance to harsh cleaning chemicals, extending its lifespan by an estimated XX%.

- 2023/Q1: REHAU invests in advanced extrusion technology to improve the precision and consistency of its milking tube production.

- 2022/Q4: BouMatic unveils a lightweight, ergonomic milking hose designed to reduce operator fatigue and improve handling efficiency.

Strategic Milking Hose Market Forecast

The strategic milking hose market forecast indicates sustained robust growth driven by the persistent global demand for dairy products and the ongoing need for efficient, hygienic, and animal-friendly milking solutions. Key growth catalysts include the increasing adoption of advanced technologies like robotic milking systems, which necessitate specialized and high-performance hoses. Emerging economies with developing dairy sectors represent significant untapped markets. Innovations in smart milking technologies, offering real-time data and enhanced monitoring, are expected to create new avenues for value-added products. Furthermore, the industry's growing commitment to sustainability will drive the development and adoption of eco-friendly milking hose materials, aligning with evolving consumer and regulatory preferences. The market's potential is further bolstered by continuous research and development in material science, promising enhanced durability, antimicrobial properties, and overall performance.

Milking Hose Segmentation

-

1. Application

- 1.1. Milk Tube

- 1.2. Air Tube

-

2. Types

- 2.1. Rubber

- 2.2. Silicone and PVC

Milking Hose Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Milking Hose Regional Market Share

Geographic Coverage of Milking Hose

Milking Hose REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Milking Hose Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Milk Tube

- 5.1.2. Air Tube

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rubber

- 5.2.2. Silicone and PVC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Milking Hose Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Milk Tube

- 6.1.2. Air Tube

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Rubber

- 6.2.2. Silicone and PVC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Milking Hose Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Milk Tube

- 7.1.2. Air Tube

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Rubber

- 7.2.2. Silicone and PVC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Milking Hose Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Milk Tube

- 8.1.2. Air Tube

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Rubber

- 8.2.2. Silicone and PVC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Milking Hose Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Milk Tube

- 9.1.2. Air Tube

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Rubber

- 9.2.2. Silicone and PVC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Milking Hose Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Milk Tube

- 10.1.2. Air Tube

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Rubber

- 10.2.2. Silicone and PVC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trelleborg Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DeLaval

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 REHAU

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BouMatic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MILKRITE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Skellerup

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terraflex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Finger-Lakes Extrusion

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lauren Agrisystems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kuriyama

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TBL Performance Plastics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Trelleborg Group

List of Figures

- Figure 1: Global Milking Hose Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Milking Hose Revenue (million), by Application 2025 & 2033

- Figure 3: North America Milking Hose Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Milking Hose Revenue (million), by Types 2025 & 2033

- Figure 5: North America Milking Hose Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Milking Hose Revenue (million), by Country 2025 & 2033

- Figure 7: North America Milking Hose Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Milking Hose Revenue (million), by Application 2025 & 2033

- Figure 9: South America Milking Hose Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Milking Hose Revenue (million), by Types 2025 & 2033

- Figure 11: South America Milking Hose Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Milking Hose Revenue (million), by Country 2025 & 2033

- Figure 13: South America Milking Hose Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Milking Hose Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Milking Hose Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Milking Hose Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Milking Hose Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Milking Hose Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Milking Hose Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Milking Hose Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Milking Hose Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Milking Hose Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Milking Hose Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Milking Hose Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Milking Hose Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Milking Hose Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Milking Hose Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Milking Hose Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Milking Hose Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Milking Hose Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Milking Hose Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Milking Hose Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Milking Hose Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Milking Hose Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Milking Hose Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Milking Hose Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Milking Hose Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Milking Hose Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Milking Hose Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Milking Hose Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Milking Hose?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Milking Hose?

Key companies in the market include Trelleborg Group, Saint-Gobain, DeLaval, GEA, REHAU, BouMatic, MILKRITE, Skellerup, Terraflex, Finger-Lakes Extrusion, Lauren Agrisystems, Kuriyama, TBL Performance Plastics.

3. What are the main segments of the Milking Hose?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 310.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Milking Hose," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Milking Hose report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Milking Hose?

To stay informed about further developments, trends, and reports in the Milking Hose, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence