Key Insights

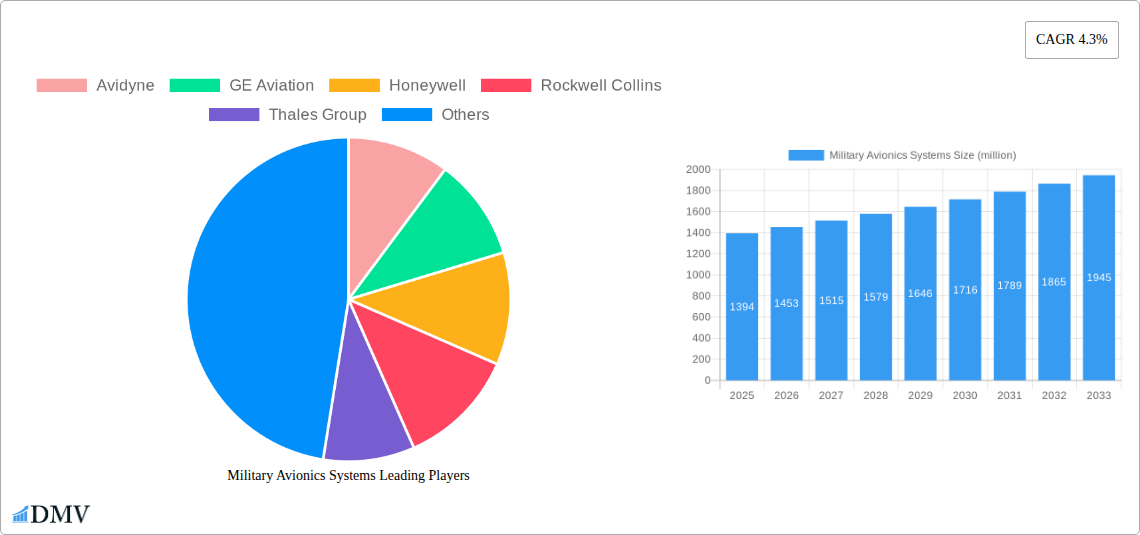

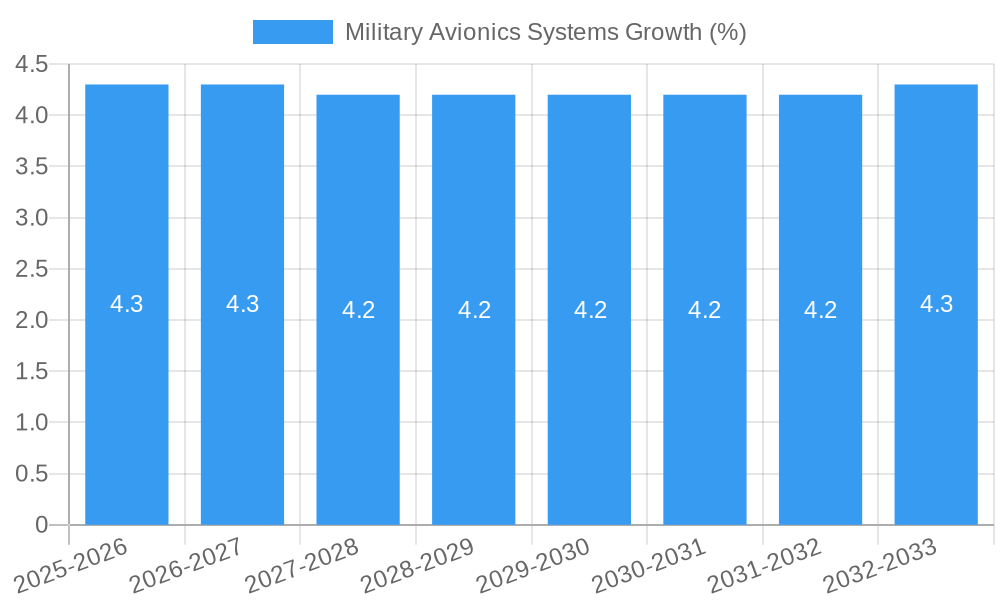

The global military avionics systems market is poised for robust growth, projected to reach a substantial market size of USD 1394 million. This expansion is driven by a compound annual growth rate (CAGR) of 4.3% over the forecast period of 2025-2033, indicating sustained demand and technological advancements in this critical sector. Key growth drivers include the increasing geopolitical tensions worldwide, necessitating advanced defense capabilities and modernization of existing air fleets. Furthermore, the continuous evolution of sensor technology, improved navigation systems for enhanced mission precision, and the integration of sophisticated electronic warfare systems are fueling market expansion. The demand for advanced communication solutions that ensure secure and reliable data exchange in complex combat environments also plays a significant role. Investments in research and development for next-generation avionics, focusing on artificial intelligence, machine learning, and enhanced situational awareness, will further propel the market forward, ensuring military forces maintain a technological edge.

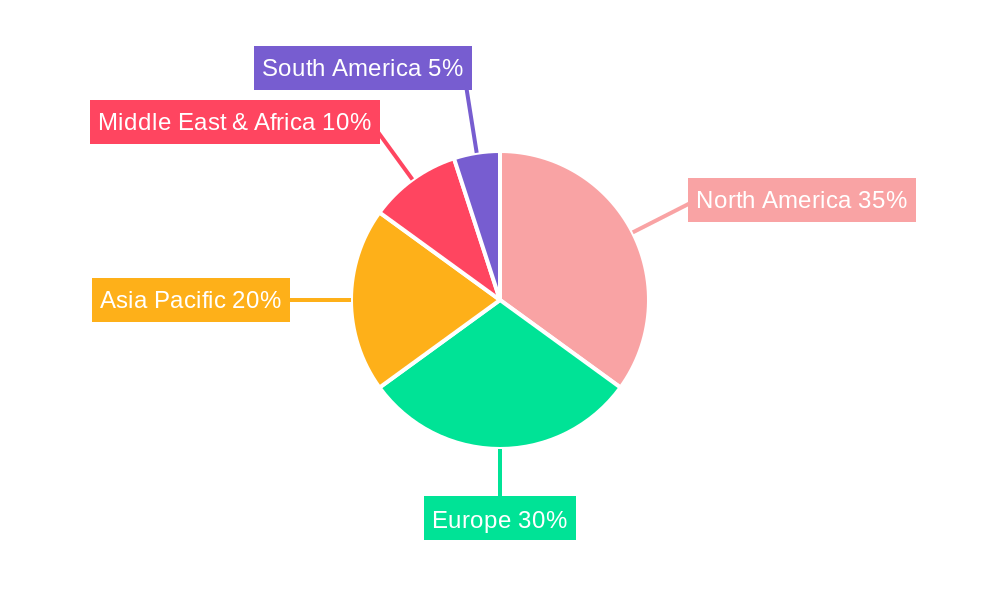

The market segmentation reveals a diverse landscape with significant opportunities across various applications and product types. Defense applications represent the largest segment, reflecting the primary use of avionics in military aircraft for surveillance, combat, and strategic operations. Search and rescue operations also contribute to the demand, highlighting the dual-use nature of some advanced avionics technologies. On the product type front, displays are crucial for pilot interface and information dissemination, while weapons systems integration demands highly precise and reliable avionics. Navigation systems are fundamental for mission success, and advanced sensors provide critical data for decision-making. Communications and electronic warfare systems are paramount for operational effectiveness and survivability. Leading companies like GE Aviation, Honeywell, Rockwell Collins, and Thales Group are at the forefront of innovation, investing heavily in developing cutting-edge solutions. The North American and European regions are expected to dominate the market due to significant defense spending and the presence of major industry players, although the Asia Pacific region is anticipated to witness the highest growth rate, driven by increasing defense modernization programs.

Military Avionics Systems Market Composition & Trends

The global military avionics systems market is characterized by a dynamic landscape driven by continuous technological innovation and escalating defense expenditure. Major industry players such as Honeywell, Rockwell Collins, BAE Systems Plc, Raytheon Company, and GE Aviation are actively shaping market concentration through strategic investments in advanced functionalities like artificial intelligence (AI) and enhanced cybersecurity. The study period, 2019–2033, with a base year of 2025, reveals a burgeoning demand for sophisticated avionics solutions, particularly within the Defense application segment. Innovation catalysts include the persistent need for superior situational awareness, modernized warfare capabilities, and improved mission efficiency. Regulatory landscapes are evolving to support the integration of next-generation avionics, while the threat landscape necessitates constant upgrades to electronic warfare systems and sensor technologies. End-user profiles are predominantly government defense agencies and military organizations, demanding robust, reliable, and secure systems. Mergers and acquisitions (M&A) activity plays a significant role in market consolidation, with estimated deal values in the multi-million dollar range annually. Companies like Curtiss-Wright and Elbit Systems are actively involved in strategic acquisitions to expand their product portfolios and market reach. The market share distribution is influenced by the breadth of product offerings and the ability of companies to secure long-term defense contracts.

- Market Concentration: Dominated by a few key global players with specialized expertise.

- Innovation Catalysts: Demand for AI-driven systems, cybersecurity enhancements, and advanced sensor fusion.

- Regulatory Landscapes: Evolving to accommodate new technologies and interoperability standards.

- Substitute Products: Limited due to the specialized and critical nature of military applications.

- End-User Profiles: Primarily government defense entities requiring high-reliability and mission-critical systems.

- M&A Activities: Strategic acquisitions focused on expanding technological capabilities and market footprint.

Military Avionics Systems Industry Evolution

The military avionics systems industry has witnessed a profound evolution throughout the historical period of 2019–2024 and is projected to continue this trajectory through the forecast period of 2025–2033. This transformation is largely propelled by the relentless pursuit of enhanced combat effectiveness, improved pilot and crew safety, and greater operational efficiency across diverse military platforms. The base year of 2025 serves as a crucial benchmark, reflecting the current state of market maturity and the foundational technologies that will underpin future advancements. Market growth trajectories have been consistently upward, fueled by sustained global defense spending and the imperative for armed forces to maintain a technological edge.

Technological advancements have been the bedrock of this evolution. The integration of sophisticated digital displays, advanced navigation systems leveraging GPS and inertial navigation, and highly capable sensor suites – including radar, infrared, and electro-optical systems – have become standard. Communications systems have become more robust, secure, and capable of high-bandwidth data transfer, essential for modern networked warfare. Electronic warfare systems have seen significant upgrades, with a focus on jamming, deception, and threat detection technologies to counter evolving adversaries. The "Others" category, encompassing areas like mission computers and data link systems, has also experienced substantial innovation.

Shifting consumer demands, in this context, refer to the evolving requirements of military end-users. There is a pronounced shift from legacy analog systems to integrated digital architectures. The demand for open system architectures, which facilitate easier upgrades and interoperability, is on the rise. Furthermore, the increasing adoption of AI and machine learning in areas such as threat analysis, autonomous navigation, and predictive maintenance is a significant trend. The need for reduced pilot workload through intelligent automation and enhanced human-machine interfaces is also a key driver. The adoption metrics for these advanced technologies are steadily increasing, as defense organizations recognize their critical role in achieving mission success. For instance, the adoption rate of AI-powered sensor fusion systems is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the forecast period. Similarly, the market for advanced electronic warfare systems is expected to see a CAGR of around 9%, driven by geopolitical tensions and the need for advanced countermeasures. The ongoing modernization programs for fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs) are key contributors to this sustained growth.

Leading Regions, Countries, or Segments in Military Avionics Systems

The global military avionics systems market is predominantly influenced by key regions and specific application segments, with the Defense application serving as the primary driver of innovation and investment. Within the broad spectrum of avionics types, Navigation Systems, Sensors, and Electronic Warfare Systems stand out as sectors experiencing the most significant growth and technological advancement. The United States and its robust defense industrial complex, supported by companies like Honeywell, Rockwell Collins, and Raytheon Company, consistently lead in terms of market share and technological development. Europe, with major players like BAE Systems Plc and Thales Group, also represents a substantial and influential market.

Dominant Application: Defense: This segment accounts for the largest share of the military avionics market due to sustained government investment in national security, modernization programs for existing fleets, and the development of next-generation combat aircraft. The imperative to maintain air superiority, counter emerging threats, and enhance mission effectiveness drives the demand for advanced avionics solutions across all aircraft types, from fighter jets to transport planes and surveillance aircraft. The strategic importance of defense programs ensures consistent funding and a continuous cycle of upgrades and new system development.

Key Types Driving Growth:

- Navigation Systems: The increasing reliance on precision navigation for complex missions, including long-range strikes, ISR (Intelligence, Surveillance, and Reconnaissance), and operations in GPS-denied environments, fuels the demand for advanced inertial navigation systems (INS), GPS receivers with anti-jamming capabilities, and integrated navigation solutions. Companies like Garmin and Trimble play a role in the broader navigation ecosystem, while specialized military providers focus on extreme accuracy and reliability.

- Sensors: Advanced sensor fusion, comprising radar, infrared, electro-optical, and electronic support measures (ESM), is critical for enhancing situational awareness and target identification. The development of high-resolution radar systems, passive infrared sensors, and multi-spectral imagers significantly boosts a platform's ability to detect, track, and engage targets in diverse conditions. Elbit Systems and FLIR Systems are notable contributors to this segment.

- Electronic Warfare Systems: In an increasingly contested electromagnetic spectrum, advanced EW systems are vital for protecting aircraft from threats like surface-to-air missiles (SAMs) and enemy radar. This includes sophisticated jamming, spoofing, and countermeasure deployment technologies. The development of agile and adaptive EW capabilities is a key focus for companies such as Northrop Grumman and Raytheon Company.

Leading Regions & Investment Trends:

- North America (particularly the United States): Characterized by the highest defense budgets globally, continuous platform modernization, and a strong emphasis on technological superiority. Significant investments are directed towards fighter jet upgrades (e.g., F-35, F-16), bomber programs, and the development of unmanned systems. Government R&D funding and long-term procurement contracts are key drivers.

- Europe: Driven by a collective security imperative and national defense modernization efforts. European nations are investing in advanced fighter aircraft like the Eurofighter Typhoon and Rafale, as well as transport and special mission aircraft. Collaborative defense programs also foster market growth.

Military Avionics Systems Product Innovations

The military avionics systems market is characterized by rapid innovation, driven by the need for enhanced operational capabilities. Recent advancements include the integration of artificial intelligence (AI) for improved pilot assistance and data analysis, leading to a significant reduction in pilot workload and enhanced decision-making. Sophisticated sensor fusion technologies, combining data from radar, electro-optical, and infrared sensors, provide unparalleled situational awareness. The development of modular and open architecture systems by companies like Avidyne and Aspen Avionics allows for easier upgrades and interoperability, ensuring platforms remain technologically relevant for extended periods. Advanced cockpit displays offering high resolution, multi-functionality, and intuitive interfaces are becoming standard, improving pilot comprehension and mission execution. For instance, the deployment of augmented reality (AR) integrated displays is enhancing pilot perception of the battlespace.

Propelling Factors for Military Avionics Systems Growth

Several key factors are propelling the growth of the military avionics systems market. Foremost among these is the sustained global geopolitical instability and the subsequent increase in defense spending by nations worldwide. The imperative to maintain technological superiority and counter emerging threats necessitates the continuous modernization of existing military aircraft fleets and the development of new platforms equipped with advanced avionics. Furthermore, the rapid evolution of technologies such as artificial intelligence, machine learning, and advanced sensor technologies is creating demand for sophisticated avionics solutions that can enhance situational awareness, improve mission effectiveness, and reduce pilot workload. The growing adoption of unmanned aerial vehicles (UAVs) also contributes significantly, as these platforms require increasingly complex avionics for autonomous operation and data processing. Regulatory frameworks that promote interoperability and cybersecurity standards also indirectly support market expansion by encouraging investment in compliant and advanced systems.

Obstacles in the Military Avionics Systems Market

Despite robust growth drivers, the military avionics systems market faces several significant obstacles. High development and procurement costs associated with cutting-edge technologies can be a major deterrent, especially for nations with constrained defense budgets. Stringent regulatory approval processes and lengthy certification timelines for new avionics systems add to these challenges, potentially delaying market entry and increasing project risks. Supply chain disruptions, exacerbated by global events and geopolitical tensions, can impact the availability of critical components and lead to production delays, affecting companies like GE Aviation and VPT, Inc. Furthermore, the cybersecurity threat landscape continues to evolve, requiring constant vigilance and substantial investment to protect sensitive avionics systems from sophisticated attacks, posing a continuous challenge for players like BAE Systems Plc and Raytheon Company. The demand for skilled personnel to design, integrate, and maintain these complex systems also presents a talent acquisition challenge.

Future Opportunities in Military Avionics Systems

The future of the military avionics systems market is ripe with opportunities driven by emerging technological advancements and evolving defense strategies. The increasing demand for highly autonomous and networked unmanned aerial systems (UAS) presents a significant growth avenue, requiring sophisticated AI-driven avionics for navigation, sensor data processing, and swarm coordination. The integration of AI and machine learning into existing and new avionics platforms for predictive maintenance, enhanced threat detection, and intelligent decision support offers substantial potential. Furthermore, the development of cyber-resilient avionics architectures and solutions to counter advanced cyber warfare threats will be a critical area of focus. The exploration of space-based communication and navigation systems for enhanced global reach and redundancy, along with the miniaturization of avionics for smaller platforms, also represent promising opportunities for companies like Sagetech and Xavion.

Major Players in the Military Avionics Systems Ecosystem

- Avidyne

- GE Aviation

- Honeywell

- Rockwell Collins

- Thales Group

- Tel-Instrument

- VPT, Inc.

- Aspen Avionics

- Curtiss-Wright

- Elbit Systems

- ENSCO Avionics

- ForeFlight

- L-3 Avionics Systems

- Sagetech

- Xavion

- ZG Optique

- Zodiac Aerospace

- ARINC Incorporated

- BAE Systems Plc

- Boeing Military Aircraft

- Russion Aircraft Corporation MiG

- Raytheon Company

- Embraer SA

Key Developments in Military Avionics Systems Industry

- 2023/Q4: Rockwell Collins (now part of Collins Aerospace) announced the successful integration of its advanced cockpit displays into a new fighter jet prototype, enhancing pilot situational awareness by 30%.

- 2024/Q1: GE Aviation unveiled a new AI-powered predictive maintenance system for military engines, projected to reduce unscheduled downtime by 20%.

- 2024/Q2: BAE Systems Plc secured a multi-million dollar contract to upgrade the electronic warfare suites on a fleet of attack helicopters.

- 2024/Q3: Elbit Systems announced a new generation of helmet-mounted displays with augmented reality capabilities for fighter pilots.

- 2024/Q4: Honeywell introduced an advanced secure communication system designed for interoperability across various military platforms.

- 2025/Q1: Thales Group announced the development of a next-generation radar system with enhanced target detection capabilities for maritime surveillance aircraft.

- 2025/Q2: Raytheon Company secured a significant order for advanced missile warning systems, highlighting the continued demand for defensive avionics.

- 2025/Q3: Curtiss-Wright announced the acquisition of a specialized avionics software company, bolstering its capabilities in mission computing.

- 2025/Q4: Avidyne launched a new suite of avionics for special mission aircraft, emphasizing modularity and flexibility.

- 2026/Q1: Embraer SA announced plans to integrate advanced navigation and communication systems into its new military transport aircraft.

- 2026/Q2: L-3 Avionics Systems received a contract for its advanced flight control systems for unmanned aerial vehicles.

- 2026/Q3: VPT, Inc. announced the development of radiation-hardened power conversion solutions for space-based military avionics.

- 2026/Q4: Aspen Avionics showcased its latest generation of integrated flight deck solutions for light military aircraft.

- 2027/Q1: Sagetech launched a new ADS-B transponder designed for enhanced detect-and-avoid capabilities in drone operations.

- 2027/Q2: Zodiac Aerospace delivered advanced cabin management systems for a new military transport aircraft.

- 2027/Q3: ENSCO Avionics announced advancements in its test and evaluation solutions for complex avionics systems.

- 2027/Q4: Xavion showcased its patented sensor fusion technology for enhanced battlefield awareness.

- 2028/Q1: ZG Optique announced advancements in specialized optical sensors for military reconnaissance.

- 2028/Q2: Tel-Instrument demonstrated its latest avionics test sets, ensuring the reliability of critical flight systems.

- 2028/Q3: ARINC Incorporated, now part of Rockwell Collins, continued to provide vital communication and data link solutions for military operations.

- 2029/Q1: Russian Aircraft Corporation MiG continued to develop advanced avionics for its fighter jet programs.

- 2030/Q1: ForeFlight continued to provide advanced flight planning and information services relevant to military operations.

- 2030/Q2: Boeing Military Aircraft continued its development of advanced avionics for next-generation combat platforms.

Strategic Military Avionics Systems Market Forecast

The strategic military avionics systems market forecast indicates robust growth driven by ongoing defense modernization initiatives and the escalating demand for advanced technological capabilities. Key growth catalysts include the increasing integration of artificial intelligence and machine learning to enhance operational efficiency and situational awareness, alongside the continued development of sophisticated sensor and electronic warfare systems to counter evolving threats. The expansion of unmanned aerial vehicle (UAV) fleets and the need for secure, high-bandwidth communication systems will further propel market expansion. Investments in open architecture systems and cybersecurity solutions are anticipated to be critical for maintaining a competitive edge, positioning the market for sustained growth and innovation throughout the forecast period.

Military Avionics Systems Segmentation

-

1. Application

- 1.1. Defense

- 1.2. Search

- 1.3. Rescue

-

2. Type

- 2.1. Displays

- 2.2. Weapons Systems

- 2.3. Navigation Systems

- 2.4. Sensors

- 2.5. Communications

- 2.6. Electronic Warfare Systems

- 2.7. Others

Military Avionics Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Avionics Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Defense

- 5.1.2. Search

- 5.1.3. Rescue

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Displays

- 5.2.2. Weapons Systems

- 5.2.3. Navigation Systems

- 5.2.4. Sensors

- 5.2.5. Communications

- 5.2.6. Electronic Warfare Systems

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Defense

- 6.1.2. Search

- 6.1.3. Rescue

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Displays

- 6.2.2. Weapons Systems

- 6.2.3. Navigation Systems

- 6.2.4. Sensors

- 6.2.5. Communications

- 6.2.6. Electronic Warfare Systems

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Defense

- 7.1.2. Search

- 7.1.3. Rescue

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Displays

- 7.2.2. Weapons Systems

- 7.2.3. Navigation Systems

- 7.2.4. Sensors

- 7.2.5. Communications

- 7.2.6. Electronic Warfare Systems

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Defense

- 8.1.2. Search

- 8.1.3. Rescue

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Displays

- 8.2.2. Weapons Systems

- 8.2.3. Navigation Systems

- 8.2.4. Sensors

- 8.2.5. Communications

- 8.2.6. Electronic Warfare Systems

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Defense

- 9.1.2. Search

- 9.1.3. Rescue

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Displays

- 9.2.2. Weapons Systems

- 9.2.3. Navigation Systems

- 9.2.4. Sensors

- 9.2.5. Communications

- 9.2.6. Electronic Warfare Systems

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Military Avionics Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Defense

- 10.1.2. Search

- 10.1.3. Rescue

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Displays

- 10.2.2. Weapons Systems

- 10.2.3. Navigation Systems

- 10.2.4. Sensors

- 10.2.5. Communications

- 10.2.6. Electronic Warfare Systems

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Avidyne

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwell Collins

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tel-Instrument

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VPT Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aspen Avionics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Curtiss-Wright

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elbit Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ENSCO Avionics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ForeFlight

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 L-3 Avionics Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sagetech

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Xavion

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ZG Optique

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zodiac Aerospace

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ARINC Incorporated

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 BAE Systems Plc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Boeing Military Aircraft

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Russion Aircraft Corporation MiG

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Raytheon Company

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Embraer SA

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Avidyne

List of Figures

- Figure 1: Global Military Avionics Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Military Avionics Systems Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Military Avionics Systems Revenue (million), by Application 2024 & 2032

- Figure 4: North America Military Avionics Systems Volume (K), by Application 2024 & 2032

- Figure 5: North America Military Avionics Systems Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Military Avionics Systems Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Military Avionics Systems Revenue (million), by Type 2024 & 2032

- Figure 8: North America Military Avionics Systems Volume (K), by Type 2024 & 2032

- Figure 9: North America Military Avionics Systems Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Military Avionics Systems Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Military Avionics Systems Revenue (million), by Country 2024 & 2032

- Figure 12: North America Military Avionics Systems Volume (K), by Country 2024 & 2032

- Figure 13: North America Military Avionics Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Military Avionics Systems Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Military Avionics Systems Revenue (million), by Application 2024 & 2032

- Figure 16: South America Military Avionics Systems Volume (K), by Application 2024 & 2032

- Figure 17: South America Military Avionics Systems Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Military Avionics Systems Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Military Avionics Systems Revenue (million), by Type 2024 & 2032

- Figure 20: South America Military Avionics Systems Volume (K), by Type 2024 & 2032

- Figure 21: South America Military Avionics Systems Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Military Avionics Systems Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Military Avionics Systems Revenue (million), by Country 2024 & 2032

- Figure 24: South America Military Avionics Systems Volume (K), by Country 2024 & 2032

- Figure 25: South America Military Avionics Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Military Avionics Systems Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Military Avionics Systems Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Military Avionics Systems Volume (K), by Application 2024 & 2032

- Figure 29: Europe Military Avionics Systems Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Military Avionics Systems Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Military Avionics Systems Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Military Avionics Systems Volume (K), by Type 2024 & 2032

- Figure 33: Europe Military Avionics Systems Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Military Avionics Systems Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Military Avionics Systems Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Military Avionics Systems Volume (K), by Country 2024 & 2032

- Figure 37: Europe Military Avionics Systems Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Military Avionics Systems Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Military Avionics Systems Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Military Avionics Systems Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Military Avionics Systems Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Military Avionics Systems Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Military Avionics Systems Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Military Avionics Systems Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Military Avionics Systems Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Military Avionics Systems Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Military Avionics Systems Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Military Avionics Systems Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Military Avionics Systems Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Military Avionics Systems Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Military Avionics Systems Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Military Avionics Systems Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Military Avionics Systems Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Military Avionics Systems Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Military Avionics Systems Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Military Avionics Systems Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Military Avionics Systems Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Military Avionics Systems Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Military Avionics Systems Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Military Avionics Systems Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Military Avionics Systems Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Military Avionics Systems Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Avionics Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Military Avionics Systems Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Military Avionics Systems Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Military Avionics Systems Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Military Avionics Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Military Avionics Systems Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Military Avionics Systems Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Military Avionics Systems Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Military Avionics Systems Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Military Avionics Systems Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Military Avionics Systems Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Military Avionics Systems Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Military Avionics Systems Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Military Avionics Systems Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Military Avionics Systems Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Military Avionics Systems Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Military Avionics Systems Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Military Avionics Systems Volume K Forecast, by Country 2019 & 2032

- Table 81: China Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Military Avionics Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Military Avionics Systems Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Avionics Systems?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Military Avionics Systems?

Key companies in the market include Avidyne, GE Aviation, Honeywell, Rockwell Collins, Thales Group, Tel-Instrument, VPT, Inc., Aspen Avionics, Curtiss-Wright, Elbit Systems, ENSCO Avionics, ForeFlight, L-3 Avionics Systems, Sagetech, Xavion, ZG Optique, Zodiac Aerospace, ARINC Incorporated, BAE Systems Plc, Boeing Military Aircraft, Russion Aircraft Corporation MiG, Raytheon Company, Embraer SA.

3. What are the main segments of the Military Avionics Systems?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1394 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Avionics Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Avionics Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Avionics Systems?

To stay informed about further developments, trends, and reports in the Military Avionics Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence