Key Insights

The Indian maize seed market is poised for significant expansion, projected to reach 359.48 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.74% from 2025 to 2033. This growth is underpinned by escalating demand for maize in food and animal feed, bolstered by increasing disposable incomes and a growing population. Innovations in breeding technologies, especially the widespread adoption of high-yield hybrid maize seeds, are key drivers. Government support for agricultural modernization further fuels this upward trajectory. However, market growth may be tempered by unpredictable weather, volatile input costs, and uneven access to advanced agricultural technologies. The market is segmented by geography and breeding technology (hybrids vs. open-pollinated varieties). Major players include Bayer AG and Syngenta, actively contributing to innovation and market competition. Future success relies on agricultural reforms, climate-resilient seed development, and robust distribution networks.

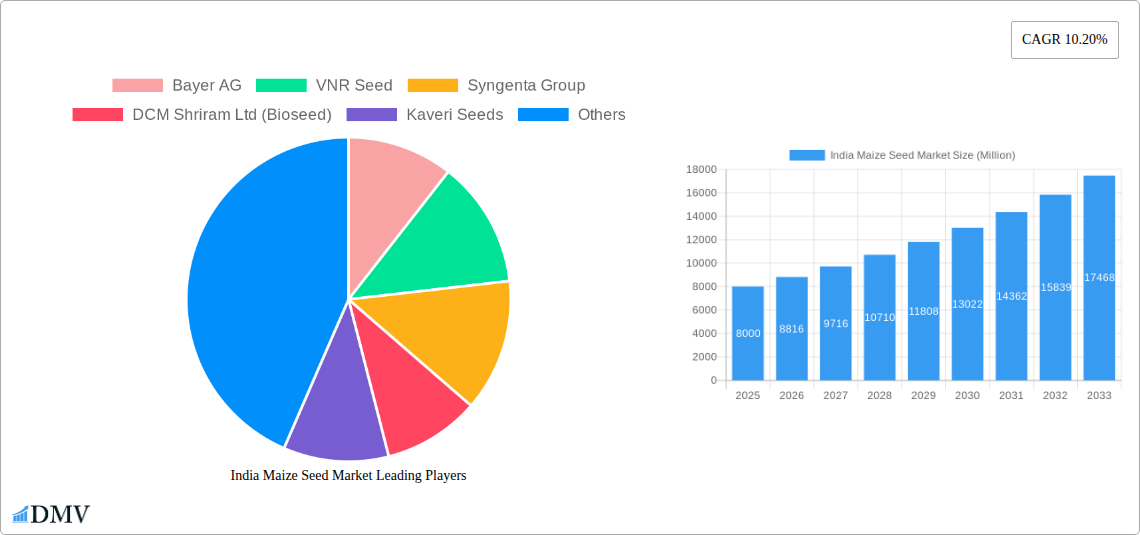

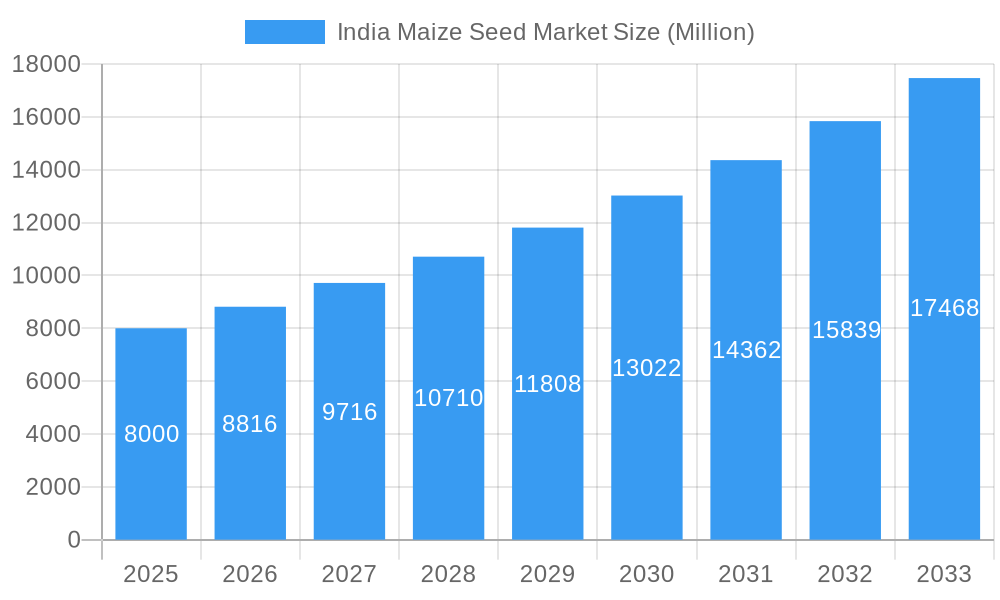

India Maize Seed Market Market Size (In Million)

The forecast period (2025-2033) indicates sustained growth, with a CAGR of 10.20%. Key regions like Maharashtra, Andhra Pradesh, and Karnataka are expected to lead market share due to favorable conditions and infrastructure. The increasing preference for hybrid varieties will benefit companies focused on advanced breeding. Sustainable growth necessitates addressing climate change impacts and ensuring equitable access to improved seed technologies, particularly in less developed states. Strategic collaborations among seed companies, government bodies, and farmer cooperatives are vital for realizing the market's full potential and ensuring food security.

India Maize Seed Market Company Market Share

India Maize Seed Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India maize seed market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market size in 2025 is estimated at xx Million.

India Maize Seed Market Market Composition & Trends

The Indian maize seed market exhibits a moderately concentrated landscape, with key players like Bayer AG, Syngenta Group, and Corteva Agriscience holding significant market share. However, regional players like VNR Seed, DCM Shriram Ltd (Bioseed), and Kaveri Seeds also contribute substantially, creating a competitive environment. Innovation in breeding technologies, particularly hybrids and non-transgenic hybrids, drives market growth. The regulatory landscape, while supportive of technological advancements, presents certain challenges related to approvals and biosafety regulations. Substitute products, such as sorghum and millet, pose limited competition due to maize's versatility and demand. The end-user profile consists primarily of smallholder farmers and large-scale agricultural businesses. M&A activity has been moderate, with deal values typically ranging from xx Million to xx Million, primarily focusing on enhancing breeding capabilities and expanding geographical reach.

- Market Share Distribution (2025): Bayer AG (xx%), Syngenta Group (xx%), Corteva Agriscience (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals with a total value of approximately xx Million.

India Maize Seed Market Industry Evolution

The Indian maize seed market has witnessed consistent growth over the historical period (2019-2024), driven by increasing maize consumption, rising disposable incomes, and government initiatives promoting agricultural modernization. The adoption of hybrid seeds has significantly contributed to yield enhancement, while the demand for non-transgenic hybrids and open-pollinated varieties continues to grow. Technological advancements in breeding techniques, seed treatment technologies, and precision agriculture have further propelled market expansion. Shifting consumer demands towards higher-yielding, disease-resistant, and climate-resilient varieties are shaping product development strategies. The market is projected to maintain a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033.

- Growth Rate (2019-2024): xx% CAGR

- Hybrid Seed Adoption Rate (2025): xx%

- Projected Market Size (2033): xx Million

Leading Regions, Countries, or Segments in India Maize Seed Market

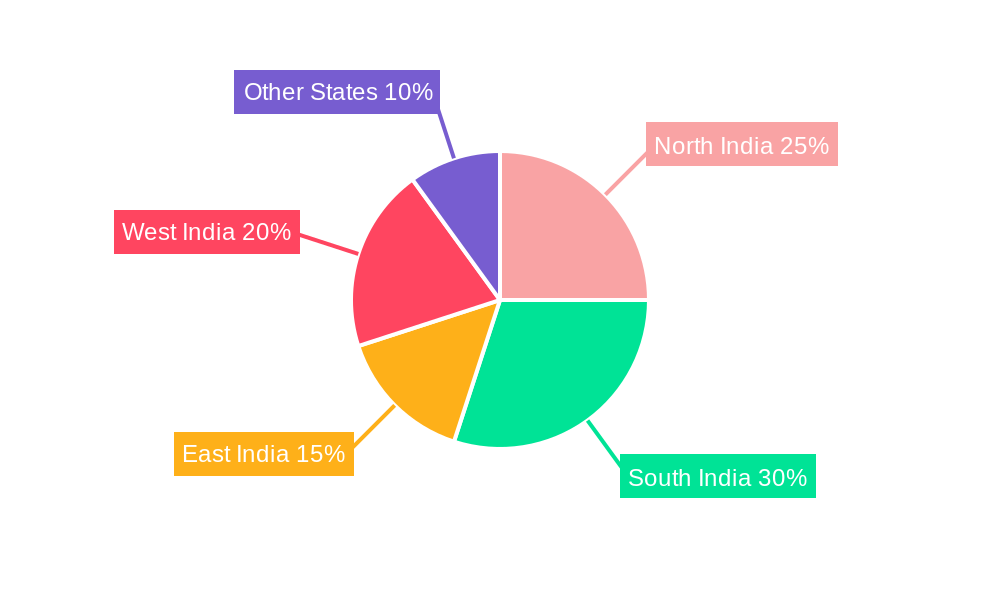

The Indian maize seed market is geographically diverse, with key states such as Madhya Pradesh, Maharashtra, Karnataka, Andhra Pradesh, and Uttar Pradesh leading in terms of production and consumption. These states benefit from favorable climatic conditions, well-developed agricultural infrastructure, and supportive government policies. Hybrid seeds dominate the breeding technology segment, accounting for a major share of the market due to their higher yield potential. However, the demand for non-transgenic hybrids and open-pollinated varieties remains significant, especially among smallholder farmers who prioritize affordability and adaptability.

- Key Drivers for Dominant Regions:

- Favorable climatic conditions.

- Existing agricultural infrastructure.

- Government support programs (e.g., subsidies, credit facilities).

- High maize productivity potential.

- Key Drivers for Hybrid Seed Dominance:

- Superior yield potential compared to traditional varieties.

- Improved disease and pest resistance.

- Enhanced adaptability to various environmental conditions.

India Maize Seed Market Product Innovations

Recent innovations focus on developing disease-resistant, high-yielding, and climate-resilient maize hybrids. Companies are leveraging advancements in biotechnology and gene-editing technologies to enhance seed quality and performance. Unique selling propositions (USPs) include improved drought tolerance, enhanced pest and disease resistance, and superior nutrient utilization efficiency. The introduction of new hybrid varieties with improved traits, such as herbicide tolerance and insect resistance, has significantly impacted market competitiveness.

Propelling Factors for India Maize Seed Market Growth

The Indian maize seed market is propelled by several factors, including rising domestic consumption, government initiatives promoting agricultural productivity, increasing adoption of hybrid seeds, and favorable government policies promoting technological advancements in agriculture. The expanding food processing industry and increasing demand for biofuels are also driving market growth. Investment in agricultural research and development is enhancing breeding technologies and seed quality.

Obstacles in the India Maize Seed Market Market

Challenges include supply chain disruptions, particularly during monsoon seasons, and stringent regulatory hurdles for new product approvals. Competition from established players and the need for continuous product innovation to meet evolving farmer demands also pose significant challenges. The impact of climate change, including erratic rainfall and extreme temperatures, poses a significant risk to maize production and seed quality.

Future Opportunities in India Maize Seed Market

Future opportunities lie in developing climate-smart maize hybrids, expanding market penetration in under-served regions, and tapping into the growing demand for organic and biofortified maize varieties. Investing in precision agriculture technologies and strengthening farmer outreach programs can unlock further market growth potential. The burgeoning biofuel industry presents a lucrative opportunity for maize seed producers.

Major Players in the India Maize Market Ecosystem

- Bayer AG

- VNR Seed

- Syngenta Group

- DCM Shriram Ltd (Bioseed)

- Kaveri Seeds

- Groupe Limagrain

- Rasi Seeds Private Limited

- Advanta Seeds - UPL

- Corteva Agriscience

- Nuziveedu Seeds Ltd

Key Developments in India Maize Seed Market Industry

- March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, enhancing disease resistance.

- March 2023: Pioneer Seeds (Corteva Agriscience) launched 44 new corn seed hybrid varieties with Vorceed Enlist technology for corn rootworm management.

- October 2022: Bayer AG launched the "DKC80-23 Mzati the Pillar" corn seed variety in Malawi, highlighting its commitment to global market expansion.

Strategic India Maize Seed Market Market Forecast

The Indian maize seed market is poised for significant growth, driven by favorable government policies, technological advancements, and rising domestic demand. The focus on developing climate-resilient and high-yielding varieties, coupled with improved seed distribution networks, will be key to unlocking future market potential. The market's growth trajectory will be influenced by factors such as government support, technological innovations, and climatic conditions. Continued investment in research and development is crucial for sustaining market growth and competitiveness.

India Maize Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. State

- 2.1. Andhra Pradesh

- 2.2. Bihar

- 2.3. Karnataka

- 2.4. Madhya Pradesh

- 2.5. Maharashtra

- 2.6. Rajasthan

- 2.7. Tamil Nadu

- 2.8. Telangana

- 2.9. Uttar Pradesh

- 2.10. West Bengal

- 2.11. Other States

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. State

- 4.1. Andhra Pradesh

- 4.2. Bihar

- 4.3. Karnataka

- 4.4. Madhya Pradesh

- 4.5. Maharashtra

- 4.6. Rajasthan

- 4.7. Tamil Nadu

- 4.8. Telangana

- 4.9. Uttar Pradesh

- 4.10. West Bengal

- 4.11. Other States

India Maize Seed Market Segmentation By Geography

- 1. India

India Maize Seed Market Regional Market Share

Geographic Coverage of India Maize Seed Market

India Maize Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Maize Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by State

- 5.2.1. Andhra Pradesh

- 5.2.2. Bihar

- 5.2.3. Karnataka

- 5.2.4. Madhya Pradesh

- 5.2.5. Maharashtra

- 5.2.6. Rajasthan

- 5.2.7. Tamil Nadu

- 5.2.8. Telangana

- 5.2.9. Uttar Pradesh

- 5.2.10. West Bengal

- 5.2.11. Other States

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by State

- 5.4.1. Andhra Pradesh

- 5.4.2. Bihar

- 5.4.3. Karnataka

- 5.4.4. Madhya Pradesh

- 5.4.5. Maharashtra

- 5.4.6. Rajasthan

- 5.4.7. Tamil Nadu

- 5.4.8. Telangana

- 5.4.9. Uttar Pradesh

- 5.4.10. West Bengal

- 5.4.11. Other States

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VNR Seed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DCM Shriram Ltd (Bioseed)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kaveri Seeds

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Limagrain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rasi Seeds Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advanta Seeds - UPL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuziveedu Seeds Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: India Maize Seed Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Maize Seed Market Share (%) by Company 2025

List of Tables

- Table 1: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 2: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 3: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 4: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 5: India Maize Seed Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 7: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 8: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 9: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 10: India Maize Seed Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Maize Seed Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the India Maize Seed Market?

Key companies in the market include Bayer AG, VNR Seed, Syngenta Group, DCM Shriram Ltd (Bioseed), Kaveri Seeds, Groupe Limagrain, Rasi Seeds Private Limited, Advanta Seeds - UPL, Corteva Agriscience, Nuziveedu Seeds Ltd.

3. What are the main segments of the India Maize Seed Market?

The market segments include Breeding Technology, State, Breeding Technology, State.

4. Can you provide details about the market size?

The market size is estimated to be USD 359.48 million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, which helps in providing resistance to multiple diseases.March 2023: Pioneer Seeds, a subsidiary of Corteva Agriscience, launched 44 new corn seed hybrid varieties with new Vorceed Enlist corn technology to help manage corn rootworms.October 2022: Bayer AG launched an early maturity and high-performance corn seed variety, "DKC80-23 Mzati the Pillar," in the Malawi region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Maize Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Maize Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Maize Seed Market?

To stay informed about further developments, trends, and reports in the India Maize Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence