Key Insights

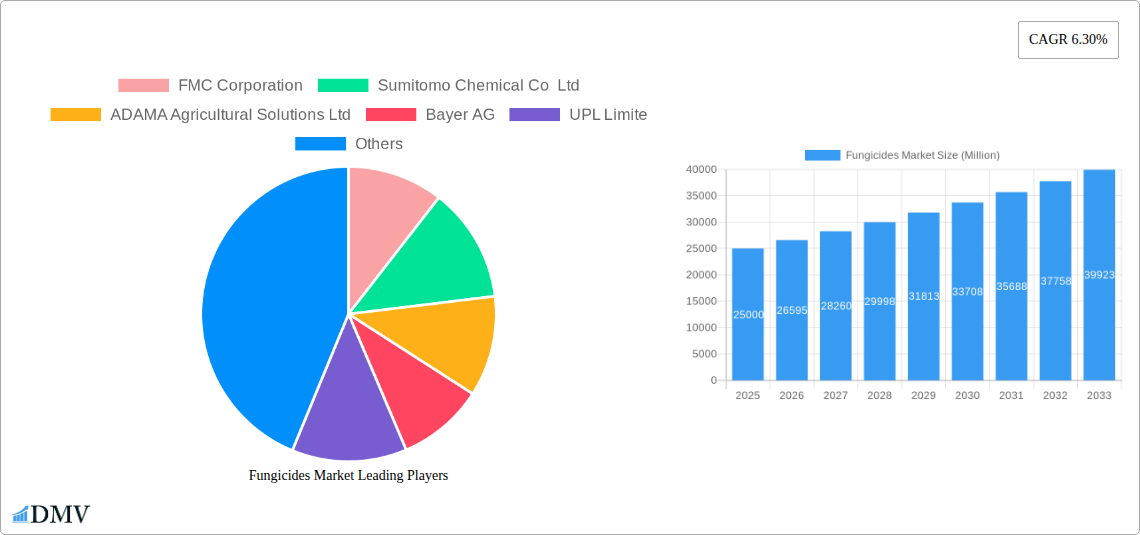

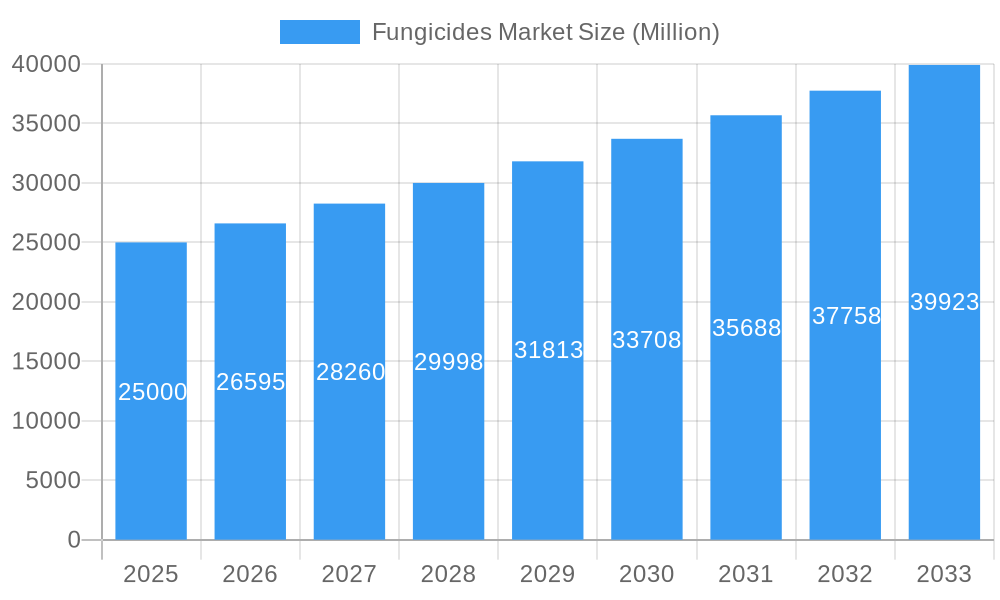

The global fungicides market, valued at approximately $25 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of fungal diseases in crops, exacerbated by climate change and intensive agricultural practices, necessitates higher fungicide usage to protect yields and ensure food security. Secondly, the growing global population necessitates increased food production, leading to higher demand for effective crop protection solutions. Furthermore, advancements in fungicide technology, including the development of more targeted and environmentally friendly formulations, are driving market growth. The market is segmented by application mode (chemigation, foliar, fumigation, seed treatment, soil treatment) and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), offering diverse opportunities for market players. Major players like FMC Corporation, Sumitomo Chemical, Adama, Bayer, UPL, Syngenta, and BASF are actively involved in research and development, expanding their product portfolios, and strategically focusing on emerging markets to capitalize on this growth.

Fungicides Market Market Size (In Billion)

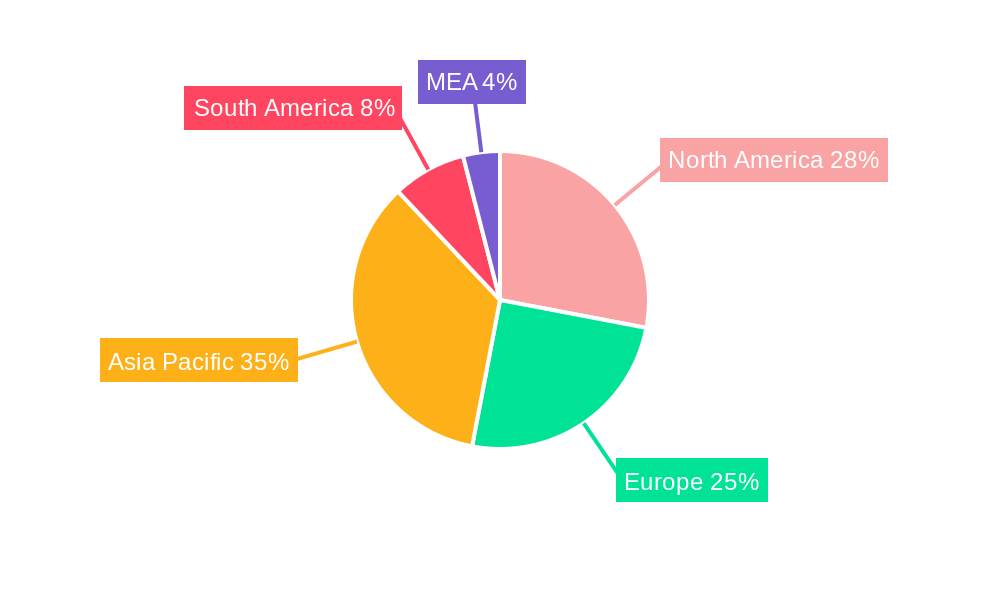

Regional variations in market growth are anticipated, with regions like Asia-Pacific, driven by expanding agricultural lands and increasing food demands in countries like India and China, expected to show significant growth. North America and Europe will maintain substantial market shares due to established agricultural practices and the presence of key industry players. However, stringent environmental regulations in some regions, coupled with the rising awareness of potential health and environmental impacts associated with certain fungicides, pose a challenge to market growth. The industry is adapting to these challenges through the development of biofungicides and sustainable agricultural practices, creating a shift towards environmentally conscious solutions within the fungicides market. The forecast period of 2025-2033 holds substantial potential for growth, with continuous innovation and adaptation being crucial for success in this dynamic market.

Fungicides Market Company Market Share

Fungicides Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Fungicides Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, demonstrating substantial growth potential.

Fungicides Market Market Composition & Trends

This section delves into the intricate composition of the fungicides market, examining key aspects influencing its evolution. We analyze market concentration, revealing the market share distribution among leading players like FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limited, Syngenta Group, Jiangsu Yangnong Chemical Co Ltd, Corteva Agriscience, Nufarm Ltd, and BASF SE. The report also quantifies the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their influence on market consolidation. Innovation catalysts, such as advancements in formulation technologies and the development of novel active ingredients, are also explored. Furthermore, we analyze the regulatory landscape, encompassing evolving environmental regulations and their implications for market players. The report includes a detailed profile of end-users, encompassing farmers, agricultural businesses, and landscaping companies, and assesses the influence of substitute products and their potential impact on market share.

- Market Concentration: The market is characterized by a [High/Medium/Low] level of concentration, with the top 5 players holding approximately xx% of the market share in 2024.

- M&A Activity: The total value of M&A deals in the fungicides market between 2019 and 2024 is estimated at xx Million.

- Innovation Catalysts: Focus on biological fungicides, and development of resistance management strategies drive innovation.

- Regulatory Landscape: Stringent regulations regarding pesticide residues and environmental impact shape market dynamics.

Fungicides Market Industry Evolution

This section provides a comprehensive analysis of the fungicides market's evolution from 2019 to 2024 and projects its trajectory through 2033. We examine market growth trajectories, highlighting the factors influencing expansion or contraction. Technological advancements, including the development of novel formulations and application methods, are scrutinized for their impact on market trends. Shifting consumer demands, influenced by factors such as increasing awareness of sustainable agriculture and growing concerns about food safety, are also assessed. Specific data points, including historical and projected compound annual growth rates (CAGR) and adoption rates for new technologies, are presented. We investigate the rise of biofungicides and their competitive landscape within the broader chemical fungicide market. The influence of climate change on disease prevalence and the resulting demand for fungicides is also explored. Furthermore, we analyze the evolution of application methods and their impact on market segmentation.

Leading Regions, Countries, or Segments in Fungicides Market

This section identifies and analyzes the leading regions, countries, and segments within the fungicides market. We determine the dominant application mode (Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment) and crop type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental). The analysis includes an examination of key drivers (investment trends, regulatory support, etc.) through bullet points and in-depth explanations of the factors contributing to segment dominance in paragraph form.

- Dominant Application Mode: Foliar application is currently the leading segment, driven by its ease of use and widespread adoption.

- Dominant Crop Type: Fruits & Vegetables segment shows strong growth owing to high disease pressure and value of the crop.

- Key Drivers:

- Increasing Disease Prevalence: Climate change and changing agricultural practices are contributing to increased disease incidence in various crops.

- Government Support: Government initiatives promoting agricultural productivity and food security are bolstering fungicide usage.

- Technological Advancements: Development of novel formulations and application techniques enhances efficacy and reduces environmental impact.

Fungicides Market Product Innovations

Recent years have witnessed significant innovation in fungicide technology. Companies are focusing on developing products with improved efficacy, broader spectrum activity, and reduced environmental impact. The introduction of new active ingredients with novel modes of action is a key trend. For example, the launch of Corteva Agriscience's Univoq demonstrates a focus on targeted solutions for specific crops, like grains, addressing significant disease pressures and improving yield. Similarly, Syngenta's Orondis Ultra highlights advancements in disease prevention for high-value crops like tomatoes. These innovations are driven by the need for more sustainable and effective crop protection solutions.

Propelling Factors for Fungicides Market Growth

The growth of the fungicides market is propelled by several key factors. The increasing prevalence of crop diseases due to climate change and the intensification of agriculture is a major driver. Higher agricultural yields and increased food demand worldwide contribute to this growth. Furthermore, technological advancements leading to more effective and environmentally friendly fungicides are also significantly influencing market expansion. Government regulations mandating crop protection and encouraging sustainable agricultural practices further contribute to market growth.

Obstacles in the Fungicides Market Market

Despite the positive growth outlook, the fungicide market faces several challenges. Stringent regulatory approvals and increasing environmental concerns pose significant hurdles for new product launches. Supply chain disruptions can impact the availability and cost of raw materials and finished products. Intense competition among major players puts downward pressure on prices and profit margins. The development of resistance to existing fungicides is another major concern.

Future Opportunities in Fungicides Market

Several promising opportunities exist within the fungicides market. The increasing demand for sustainable and biological fungicides presents a significant growth avenue. The development of integrated pest management (IPM) strategies offers opportunities for the adoption of innovative solutions. Expansion into emerging markets, particularly in developing countries, represents untapped potential. Furthermore, the development of fungicides with improved efficacy against emerging diseases promises significant returns.

Major Players in the Fungicides Market Ecosystem

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Jiangsu Yangnong Chemical Co Ltd

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Developments in Fungicides Market Industry

- February 2023: Corteva Agriscience launched Univoq, a new fungicide for grains offering preventative, curative, and long-lasting efficacy. This signifies a strategic move towards targeted solutions for specific crops.

- February 2023: ADAMA opened a new multi-purpose facility in Brazil, expanding its production capacity and market reach for Prothioconazole-based products. This enhances the company's global supply chain and market competitiveness.

- February 2023: Syngenta introduced Orondis Ultra, a new fungicide for tomatoes, reinforcing its leadership in the tomato market and showcasing innovation in mildew avoidance.

Strategic Fungicides Market Market Forecast

The fungicides market is poised for continued growth, driven by several factors. Technological advancements, increasing disease prevalence, and growing demand for food security will continue to fuel market expansion. The development of sustainable and targeted solutions will be crucial for future growth. The market will continue to consolidate, with mergers and acquisitions reshaping the competitive landscape. Opportunities in emerging markets and the adoption of integrated pest management strategies will offer significant potential for market players.

Fungicides Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Fungicides Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fungicides Market Regional Market Share

Geographic Coverage of Fungicides Market

Fungicides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Growth in the crop infestations by the fungal pathogens raise the fungicides adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. North America Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Mode

- 6.1.1. Chemigation

- 6.1.2. Foliar

- 6.1.3. Fumigation

- 6.1.4. Seed Treatment

- 6.1.5. Soil Treatment

- 6.2. Market Analysis, Insights and Forecast - by Crop Type

- 6.2.1. Commercial Crops

- 6.2.2. Fruits & Vegetables

- 6.2.3. Grains & Cereals

- 6.2.4. Pulses & Oilseeds

- 6.2.5. Turf & Ornamental

- 6.3. Market Analysis, Insights and Forecast - by Application Mode

- 6.3.1. Chemigation

- 6.3.2. Foliar

- 6.3.3. Fumigation

- 6.3.4. Seed Treatment

- 6.3.5. Soil Treatment

- 6.4. Market Analysis, Insights and Forecast - by Crop Type

- 6.4.1. Commercial Crops

- 6.4.2. Fruits & Vegetables

- 6.4.3. Grains & Cereals

- 6.4.4. Pulses & Oilseeds

- 6.4.5. Turf & Ornamental

- 6.1. Market Analysis, Insights and Forecast - by Application Mode

- 7. South America Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Mode

- 7.1.1. Chemigation

- 7.1.2. Foliar

- 7.1.3. Fumigation

- 7.1.4. Seed Treatment

- 7.1.5. Soil Treatment

- 7.2. Market Analysis, Insights and Forecast - by Crop Type

- 7.2.1. Commercial Crops

- 7.2.2. Fruits & Vegetables

- 7.2.3. Grains & Cereals

- 7.2.4. Pulses & Oilseeds

- 7.2.5. Turf & Ornamental

- 7.3. Market Analysis, Insights and Forecast - by Application Mode

- 7.3.1. Chemigation

- 7.3.2. Foliar

- 7.3.3. Fumigation

- 7.3.4. Seed Treatment

- 7.3.5. Soil Treatment

- 7.4. Market Analysis, Insights and Forecast - by Crop Type

- 7.4.1. Commercial Crops

- 7.4.2. Fruits & Vegetables

- 7.4.3. Grains & Cereals

- 7.4.4. Pulses & Oilseeds

- 7.4.5. Turf & Ornamental

- 7.1. Market Analysis, Insights and Forecast - by Application Mode

- 8. Europe Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Mode

- 8.1.1. Chemigation

- 8.1.2. Foliar

- 8.1.3. Fumigation

- 8.1.4. Seed Treatment

- 8.1.5. Soil Treatment

- 8.2. Market Analysis, Insights and Forecast - by Crop Type

- 8.2.1. Commercial Crops

- 8.2.2. Fruits & Vegetables

- 8.2.3. Grains & Cereals

- 8.2.4. Pulses & Oilseeds

- 8.2.5. Turf & Ornamental

- 8.3. Market Analysis, Insights and Forecast - by Application Mode

- 8.3.1. Chemigation

- 8.3.2. Foliar

- 8.3.3. Fumigation

- 8.3.4. Seed Treatment

- 8.3.5. Soil Treatment

- 8.4. Market Analysis, Insights and Forecast - by Crop Type

- 8.4.1. Commercial Crops

- 8.4.2. Fruits & Vegetables

- 8.4.3. Grains & Cereals

- 8.4.4. Pulses & Oilseeds

- 8.4.5. Turf & Ornamental

- 8.1. Market Analysis, Insights and Forecast - by Application Mode

- 9. Middle East & Africa Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Mode

- 9.1.1. Chemigation

- 9.1.2. Foliar

- 9.1.3. Fumigation

- 9.1.4. Seed Treatment

- 9.1.5. Soil Treatment

- 9.2. Market Analysis, Insights and Forecast - by Crop Type

- 9.2.1. Commercial Crops

- 9.2.2. Fruits & Vegetables

- 9.2.3. Grains & Cereals

- 9.2.4. Pulses & Oilseeds

- 9.2.5. Turf & Ornamental

- 9.3. Market Analysis, Insights and Forecast - by Application Mode

- 9.3.1. Chemigation

- 9.3.2. Foliar

- 9.3.3. Fumigation

- 9.3.4. Seed Treatment

- 9.3.5. Soil Treatment

- 9.4. Market Analysis, Insights and Forecast - by Crop Type

- 9.4.1. Commercial Crops

- 9.4.2. Fruits & Vegetables

- 9.4.3. Grains & Cereals

- 9.4.4. Pulses & Oilseeds

- 9.4.5. Turf & Ornamental

- 9.1. Market Analysis, Insights and Forecast - by Application Mode

- 10. Asia Pacific Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Mode

- 10.1.1. Chemigation

- 10.1.2. Foliar

- 10.1.3. Fumigation

- 10.1.4. Seed Treatment

- 10.1.5. Soil Treatment

- 10.2. Market Analysis, Insights and Forecast - by Crop Type

- 10.2.1. Commercial Crops

- 10.2.2. Fruits & Vegetables

- 10.2.3. Grains & Cereals

- 10.2.4. Pulses & Oilseeds

- 10.2.5. Turf & Ornamental

- 10.3. Market Analysis, Insights and Forecast - by Application Mode

- 10.3.1. Chemigation

- 10.3.2. Foliar

- 10.3.3. Fumigation

- 10.3.4. Seed Treatment

- 10.3.5. Soil Treatment

- 10.4. Market Analysis, Insights and Forecast - by Crop Type

- 10.4.1. Commercial Crops

- 10.4.2. Fruits & Vegetables

- 10.4.3. Grains & Cereals

- 10.4.4. Pulses & Oilseeds

- 10.4.5. Turf & Ornamental

- 10.1. Market Analysis, Insights and Forecast - by Application Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FMC Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Chemical Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ADAMA Agricultural Solutions Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UPL Limite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Syngenta Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiangsu Yangnong Chemical Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corteva Agriscience

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nufarm Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 FMC Corporation

List of Figures

- Figure 1: Global Fungicides Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 3: North America Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 4: North America Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 5: North America Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 6: North America Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 7: North America Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 8: North America Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 9: North America Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 10: North America Fungicides Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 13: South America Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 14: South America Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 15: South America Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 16: South America Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 17: South America Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 18: South America Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 19: South America Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 20: South America Fungicides Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 23: Europe Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 24: Europe Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 25: Europe Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 26: Europe Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 27: Europe Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 28: Europe Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 29: Europe Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 30: Europe Fungicides Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 33: Middle East & Africa Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 34: Middle East & Africa Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 35: Middle East & Africa Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 36: Middle East & Africa Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 37: Middle East & Africa Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 38: Middle East & Africa Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 39: Middle East & Africa Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 40: Middle East & Africa Fungicides Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 43: Asia Pacific Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 44: Asia Pacific Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 45: Asia Pacific Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 46: Asia Pacific Fungicides Market Revenue (Million), by Application Mode 2025 & 2033

- Figure 47: Asia Pacific Fungicides Market Revenue Share (%), by Application Mode 2025 & 2033

- Figure 48: Asia Pacific Fungicides Market Revenue (Million), by Crop Type 2025 & 2033

- Figure 49: Asia Pacific Fungicides Market Revenue Share (%), by Crop Type 2025 & 2033

- Figure 50: Asia Pacific Fungicides Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Fungicides Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 2: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 3: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 4: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 5: Global Fungicides Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 7: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 8: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 9: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 10: Global Fungicides Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 15: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 16: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 17: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 18: Global Fungicides Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 23: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 24: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 25: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 26: Global Fungicides Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 37: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 38: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 39: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 40: Global Fungicides Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 48: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 49: Global Fungicides Market Revenue Million Forecast, by Application Mode 2020 & 2033

- Table 50: Global Fungicides Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 51: Global Fungicides Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Fungicides Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fungicides Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Fungicides Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Jiangsu Yangnong Chemical Co Ltd, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Fungicides Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Growth in the crop infestations by the fungal pathogens raise the fungicides adoption.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

February 2023: Corteva Agriscience launched Univoq, the company's first fungicide product designed specifically for grains. With Inatreq's distinctive mode of action, Univoq delivers preventative, curative, and long-lasting efficacy on the main diseases that endanger cereals as compared to the already available tools.February 2023: ADAMA opened a new multi-purpose facility in Brazil. With this factory, the company will be able to deliver all the Prothioconazole-based products in its pipeline to the global market and achieve its objective of introducing a number of innovative items to the Brazilian market in the upcoming years.February 2023: Syngenta affirmed its intent to maintain its position as the industry standard in the tomato market by introducing Orondis Ultra, a significant advancement in mildew avoidance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fungicides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fungicides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fungicides Market?

To stay informed about further developments, trends, and reports in the Fungicides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence