Key Insights

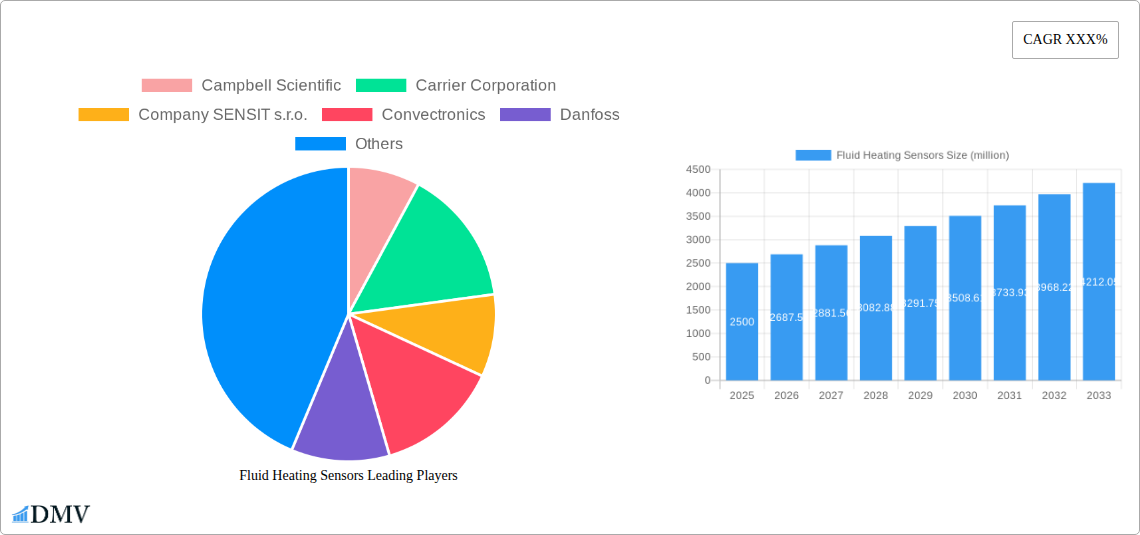

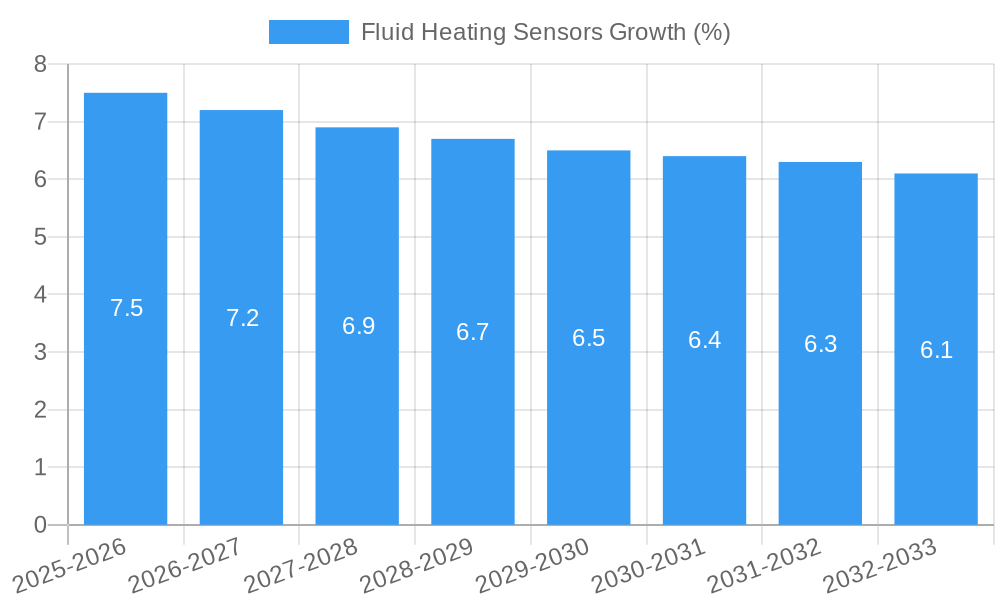

The global Fluid Heating Sensors market is poised for robust expansion, projected to reach an estimated market size of USD 2,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This significant growth is propelled by a confluence of factors, primarily the increasing demand for precise temperature control across a multitude of industrial applications. The expansion of manufacturing sectors such as Machinery and Plant Engineering, Marine and Shipbuilding, and Aerospace necessitates sophisticated fluid heating systems for optimal performance and safety. Furthermore, stringent regulatory requirements and the growing emphasis on energy efficiency in processes within the Food & Beverages and Chemical & Petrochemical industries are driving the adoption of advanced heating sensor technologies. The continuous innovation in sensor design, leading to improved accuracy, durability, and cost-effectiveness, further fuels market penetration. The integration of IoT and AI in industrial automation is also creating new avenues for smart fluid heating solutions, enhancing predictive maintenance and operational efficiency.

The market is segmented by application and type, with Machinery and Plant Engineering emerging as a dominant segment due to its widespread use of fluid heating systems in diverse manufacturing processes. Water Heating Sensors represent a significant and growing segment within the type classification, driven by applications ranging from industrial boilers to HVAC systems and water treatment plants. While the market benefits from strong growth drivers, certain restraints such as the high initial cost of advanced sensor systems in some niche applications and the availability of cheaper, less sophisticated alternatives in less demanding sectors may pose minor challenges. However, the long-term trend towards enhanced operational precision, energy conservation, and the development of more intelligent and interconnected industrial ecosystems strongly favors sustained market growth. Key players are focusing on product innovation, strategic partnerships, and geographical expansion to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

Fluid Heating Sensors Market Report: Driving Efficiency and Innovation Across Industries

This comprehensive market research report provides an in-depth analysis of the fluid heating sensors market, a critical component for maintaining optimal temperatures and ensuring operational efficiency across a multitude of industrial applications. Leveraging advanced temperature sensing technology, this report delves into the market's intricate dynamics, growth trajectories, and future outlook. With a study period spanning 2019–2033, a base year of 2025, and an extensive forecast period from 2025–2033, this analysis offers unparalleled insights for stakeholders seeking to capitalize on market opportunities and navigate potential challenges. This report focuses on high-ranking keywords such as fluid temperature sensors, industrial heating sensors, process temperature monitoring, accurate temperature measurement, and energy efficiency solutions.

Fluid Heating Sensors Market Composition & Trends

The fluid heating sensors market exhibits a moderately consolidated structure, characterized by a blend of established global players and specialized regional manufacturers. Innovation is a significant catalyst, driven by the increasing demand for enhanced accuracy, faster response times, and greater robustness in harsh industrial environments. Emerging trends include the integration of IoT capabilities for remote monitoring and predictive maintenance, alongside the development of sensors with improved material science for extended lifespan and chemical resistance. Regulatory landscapes, particularly those focused on industrial safety standards and energy conservation mandates, are influencing product development and adoption. Substitute products, such as basic thermostats, exist but often lack the precision and advanced functionalities offered by dedicated fluid heating sensors. End-user profiles span a broad spectrum, from large-scale machinery and plant engineering operations to specialized sectors like aerospace and food and beverages. Mergers and acquisitions (M&A) activities, while not consistently high, tend to be strategic, focusing on acquiring technological expertise or expanding market reach. For instance, hypothetical M&A deals in the past have seen values in the range of several hundred million dollars, indicating the strategic importance of acquiring niche sensor technologies or market share. The market share distribution is dynamic, with key players holding significant portions, but innovation from smaller entities continually reshapes competitive landscapes. The estimated market size is projected to reach over one million dollars by 2025.

Fluid Heating Sensors Industry Evolution

The fluid heating sensors industry has witnessed a remarkable evolution, marked by consistent market growth trajectories fueled by industrial expansion and the relentless pursuit of operational excellence. From 2019 to 2024, the historical period, the market saw steady adoption driven by the increasing need for precise temperature control in diverse industrial processes. The base year, 2025, represents a pivotal point, with the market poised for accelerated growth. Technological advancements have been a primary engine of this evolution. Initially, the industry relied on simpler thermistors and thermocouples. However, the advent of RTD (Resistance Temperature Detector) sensors, infrared sensors, and advanced digital temperature sensors has revolutionized capabilities. These advancements have enabled higher accuracy (often within fractions of a degree Celsius), faster response times (measured in milliseconds), and broader operating temperature ranges. Adoption metrics indicate a significant shift towards digital and smart sensors, with an estimated adoption rate of over seventy percent for these advanced types by 2025. Consumer demands have also played a crucial role, with industries increasingly seeking solutions that not only ensure precise temperature monitoring but also contribute to energy efficiency and reduced downtime. This has spurred the development of sensors with integrated diagnostics and communication protocols. The forecast period, 2025–2033, is expected to see continued innovation, with a focus on miniaturization, enhanced durability, and seamless integration into complex industrial control systems. The market is projected to experience a compound annual growth rate (CAGR) of approximately six percent during this forecast period, reaching several million dollars in value.

Leading Regions, Countries, or Segments in Fluid Heating Sensors

The Machinery and Plant Engineering segment stands out as a dominant force within the fluid heating sensors market. This is largely attributable to the pervasive need for precise temperature monitoring and control across a vast array of industrial machinery and plant operations. Investment trends in this segment are robust, driven by ongoing industrialization and upgrades to existing infrastructure worldwide. Regulatory support, particularly concerning workplace safety and operational efficiency standards, further propels the demand for reliable industrial heating sensors.

- Key Drivers in Machinery and Plant Engineering:

- High Volume Demand: Numerous machines and processes within plants require continuous temperature monitoring.

- Operational Efficiency Focus: Precise temperature control is crucial for optimizing energy consumption and product quality.

- Safety Regulations: Stringent safety standards necessitate reliable temperature monitoring to prevent overheating and potential hazards.

- Predictive Maintenance: Advanced sensors enable early detection of anomalies, reducing unplanned downtime.

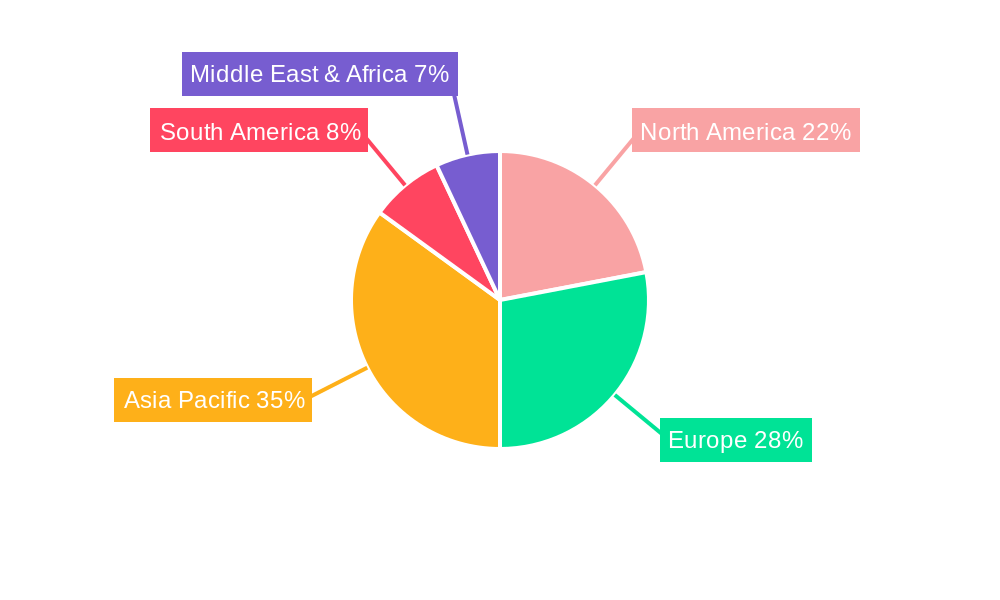

Geographically, North America and Europe have historically led the market, driven by their mature industrial bases and high adoption rates of advanced technologies. However, the Asia Pacific region is emerging as a significant growth powerhouse, fueled by rapid industrialization, substantial investments in manufacturing, and government initiatives promoting technological adoption.

Within the Type category, Water Heating Sensors are experiencing substantial demand due to their application in diverse sectors such as HVAC systems, industrial water treatment, and power generation. Air Heating Sensors, while also significant, cater to a more specific set of applications within industrial air handling units and climate control systems. The Chemical and Petrochemical segment, along with Food and Beverages, represent other key application areas where accurate fluid heating sensing is paramount for process integrity, product quality, and safety. The ability of these sensors to withstand corrosive environments and meet stringent hygiene standards is a critical factor in their adoption.

Fluid Heating Sensors Product Innovations

Product innovation in the fluid heating sensors market is characterized by advancements in accuracy, durability, and connectivity. Leading manufacturers are developing high-precision digital sensors with response times measured in milliseconds, enabling real-time process adjustments. Innovations include wireless fluid temperature sensors that reduce installation complexity and wiring costs, and self-diagnosing sensors that alert operators to potential issues before failure. The integration of advanced materials allows for enhanced resistance to extreme temperatures, corrosive fluids, and high pressures, expanding the application range into challenging environments such as the chemical and petrochemical industries. Furthermore, the incorporation of edge computing capabilities within sensors allows for preliminary data processing, reducing bandwidth requirements and enabling faster decision-making in critical applications like machinery and plant engineering.

Propelling Factors for Fluid Heating Sensors Growth

The growth of the fluid heating sensors market is significantly propelled by several key factors. The increasing global emphasis on energy efficiency and resource optimization is a primary driver, as accurate temperature control directly impacts energy consumption in industrial processes. Technological advancements, including the development of more sensitive, durable, and smart temperature sensors with IoT capabilities, are expanding their application scope. Furthermore, stringent industrial safety regulations across various sectors, such as food and beverages and chemical and petrochemical, mandate precise temperature monitoring to prevent accidents and ensure product integrity. The ongoing expansion of manufacturing industries worldwide, particularly in emerging economies, also fuels demand for reliable process temperature monitoring solutions.

Obstacles in the Fluid Heating Sensors Market

Despite robust growth, the fluid heating sensors market faces several obstacles. High initial investment costs for advanced sensor technologies can be a deterrent for smaller enterprises or those in price-sensitive industries. Supply chain disruptions, exacerbated by geopolitical events and material shortages, can impact the availability and cost of key components. Technical expertise requirements for installation, calibration, and maintenance of sophisticated sensors can also pose a barrier, especially in regions with a less developed skilled workforce. Moreover, the presence of legacy systems that are not easily compatible with newer sensor technologies can slow down market penetration. Competitive pressures from both established players and new entrants can also lead to price wars, impacting profit margins for manufacturers.

Future Opportunities in Fluid Heating Sensors

The future of the fluid heating sensors market is rich with opportunities. The burgeoning adoption of Industry 4.0 principles and the Industrial Internet of Things (IIoT) presents a significant avenue for growth, with demand for connected and data-driven temperature monitoring solutions on the rise. Emerging markets in sectors such as renewable energy (e.g., geothermal heating) and advanced manufacturing will create new application landscapes. The development of miniaturized and highly specialized sensors for niche applications in fields like aerospace and biotechnology offers further potential. Furthermore, advancements in AI and machine learning for predictive analytics based on sensor data will enhance the value proposition of fluid heating sensors, driving demand for their integration into more sophisticated control systems.

Major Players in the Fluid Heating Sensors Ecosystem

- Campbell Scientific

- Carrier Corporation

- Company SENSIT s.r.o.

- Convectronics

- Danfoss

- Heatcon Sensors

- Honeywell International

- KROHNE Messtechnik GmbH

- Siemens AG

- SIKA

Key Developments in Fluid Heating Sensors Industry

- 2023 October: Siemens AG launches a new series of high-accuracy industrial temperature sensors with enhanced wireless connectivity for remote monitoring in the chemical industry.

- 2024 January: Honeywell International announces a strategic partnership to integrate its advanced fluid heating sensors with IIoT platforms, enabling predictive maintenance for machinery and plant engineering.

- 2024 March: Danfoss introduces innovative water heating sensors designed for improved energy efficiency in HVAC systems, contributing to reduced carbon footprints.

- 2024 May: KROHNE Messtechnik GmbH expands its portfolio of fluid temperature sensors to cater to the stringent requirements of the marine and shipbuilding sector.

- 2024 July: Carrier Corporation showcases its latest advancements in air heating sensor technology for optimized climate control in commercial buildings.

Strategic Fluid Heating Sensors Market Forecast

The strategic forecast for the fluid heating sensors market remains exceptionally positive, driven by an ongoing surge in demand for enhanced industrial automation and efficiency. The integration of AI-powered analytics with advanced temperature sensing technology is set to unlock new levels of process optimization and predictive capabilities. Emerging applications in areas like advanced robotics and smart grids, alongside continuous innovation in material science for extreme environment resilience, will further fuel market expansion. Investments in R&D by leading companies will continue to drive the development of more accurate, compact, and cost-effective solutions, solidifying the indispensable role of fluid heating sensors across the global industrial landscape, projected to reach several million dollars in market value.

Fluid Heating Sensors Segmentation

-

1. Application

- 1.1. Machinery And Plant Engineering

- 1.2. Marine And Shipbuilding

- 1.3. Aerospace

- 1.4. Food And Beverages

- 1.5. Chemical And Petrochemical

- 1.6. Other

-

2. Type

- 2.1. Air Heating Sensors

- 2.2. Water Heating Sensors

Fluid Heating Sensors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fluid Heating Sensors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Machinery And Plant Engineering

- 5.1.2. Marine And Shipbuilding

- 5.1.3. Aerospace

- 5.1.4. Food And Beverages

- 5.1.5. Chemical And Petrochemical

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Air Heating Sensors

- 5.2.2. Water Heating Sensors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Machinery And Plant Engineering

- 6.1.2. Marine And Shipbuilding

- 6.1.3. Aerospace

- 6.1.4. Food And Beverages

- 6.1.5. Chemical And Petrochemical

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Air Heating Sensors

- 6.2.2. Water Heating Sensors

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Machinery And Plant Engineering

- 7.1.2. Marine And Shipbuilding

- 7.1.3. Aerospace

- 7.1.4. Food And Beverages

- 7.1.5. Chemical And Petrochemical

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Air Heating Sensors

- 7.2.2. Water Heating Sensors

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Machinery And Plant Engineering

- 8.1.2. Marine And Shipbuilding

- 8.1.3. Aerospace

- 8.1.4. Food And Beverages

- 8.1.5. Chemical And Petrochemical

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Air Heating Sensors

- 8.2.2. Water Heating Sensors

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Machinery And Plant Engineering

- 9.1.2. Marine And Shipbuilding

- 9.1.3. Aerospace

- 9.1.4. Food And Beverages

- 9.1.5. Chemical And Petrochemical

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Air Heating Sensors

- 9.2.2. Water Heating Sensors

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fluid Heating Sensors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Machinery And Plant Engineering

- 10.1.2. Marine And Shipbuilding

- 10.1.3. Aerospace

- 10.1.4. Food And Beverages

- 10.1.5. Chemical And Petrochemical

- 10.1.6. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Air Heating Sensors

- 10.2.2. Water Heating Sensors

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Campbell Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carrier Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Company SENSIT s.r.o.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Convectronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danfoss

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Heatcon Sensors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KROHNE Messtechnik GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SIKA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Campbell Scientific

List of Figures

- Figure 1: Global Fluid Heating Sensors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fluid Heating Sensors Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fluid Heating Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fluid Heating Sensors Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fluid Heating Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fluid Heating Sensors Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fluid Heating Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fluid Heating Sensors Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fluid Heating Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fluid Heating Sensors Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fluid Heating Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fluid Heating Sensors Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fluid Heating Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fluid Heating Sensors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fluid Heating Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fluid Heating Sensors Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fluid Heating Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fluid Heating Sensors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fluid Heating Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fluid Heating Sensors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fluid Heating Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fluid Heating Sensors Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fluid Heating Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fluid Heating Sensors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fluid Heating Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fluid Heating Sensors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fluid Heating Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fluid Heating Sensors Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fluid Heating Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fluid Heating Sensors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fluid Heating Sensors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fluid Heating Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fluid Heating Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fluid Heating Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fluid Heating Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fluid Heating Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fluid Heating Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fluid Heating Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fluid Heating Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fluid Heating Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fluid Heating Sensors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluid Heating Sensors?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Fluid Heating Sensors?

Key companies in the market include Campbell Scientific, Carrier Corporation, Company SENSIT s.r.o., Convectronics, Danfoss, Heatcon Sensors, Honeywell International, KROHNE Messtechnik GmbH, Siemens AG, SIKA.

3. What are the main segments of the Fluid Heating Sensors?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fluid Heating Sensors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fluid Heating Sensors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fluid Heating Sensors?

To stay informed about further developments, trends, and reports in the Fluid Heating Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence