Key Insights

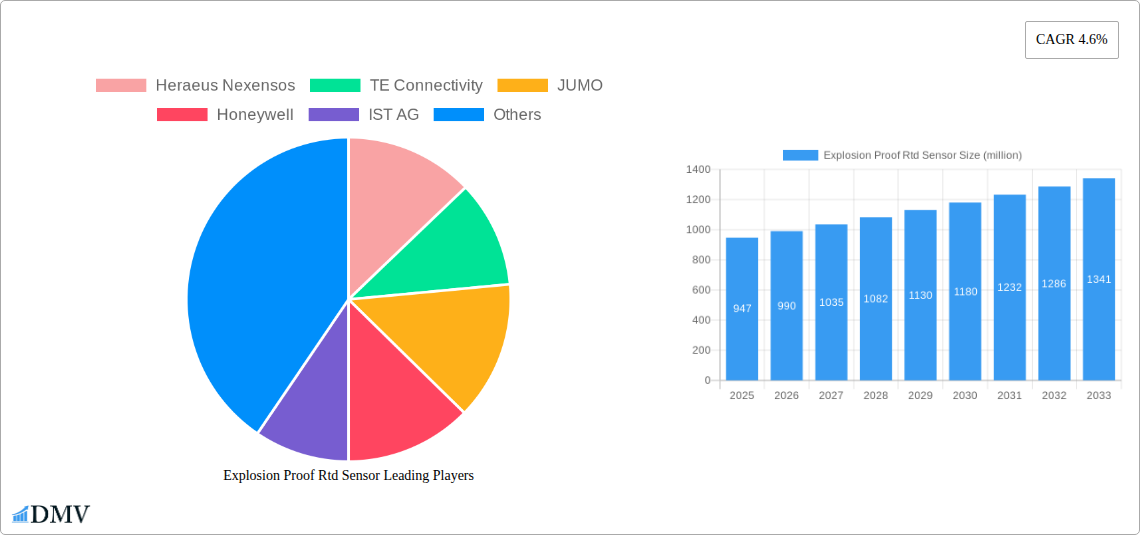

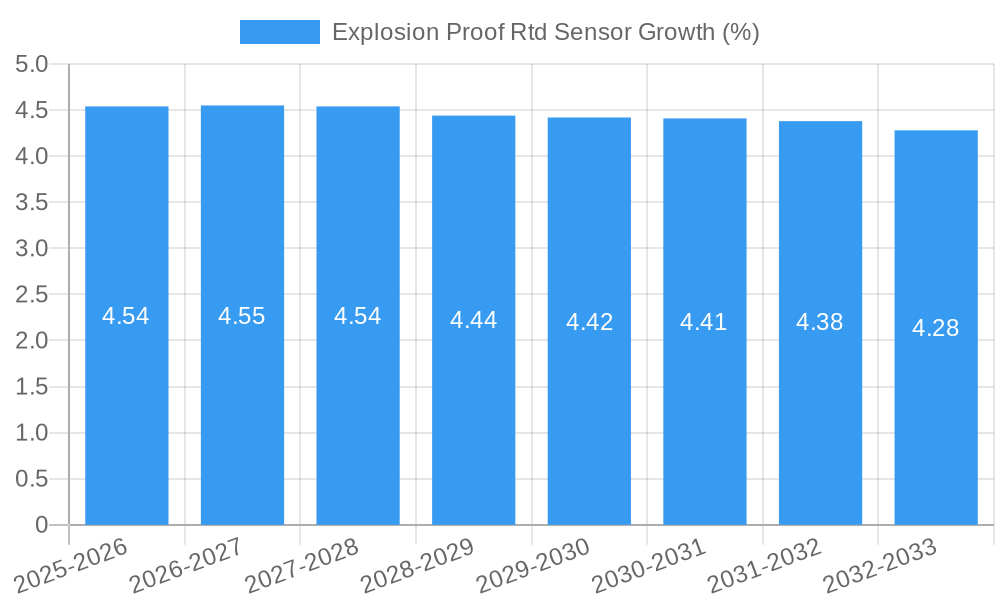

The global Explosion Proof RTD Sensor market is poised for robust expansion, projected to reach an estimated \$947 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.6% during the study period of 2019-2033, indicating sustained demand and adoption. The inherent need for reliable temperature measurement in hazardous environments, such as petrochemical plants, mining operations, and chemical processing facilities, serves as a primary market driver. These environments necessitate specialized sensors that can prevent ignition and ensure operational safety, thereby driving the demand for explosion-proof RTD sensors. Advancements in sensor technology, including enhanced accuracy, wider operating temperature ranges, and improved durability, are further fueling market growth. The integration of smart features and wireless connectivity in these sensors is also emerging as a significant trend, enabling remote monitoring and predictive maintenance, thereby increasing their attractiveness across various industrial applications.

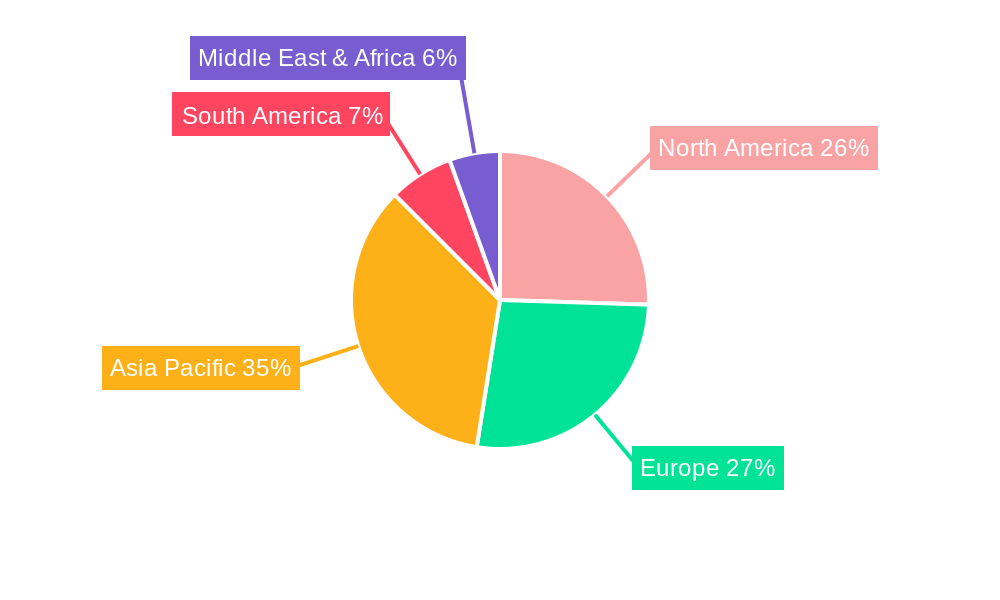

The market is segmented by application, with Home Appliance, Automotive, Industrial, and Medical sectors representing key areas of deployment. The Industrial segment, in particular, is expected to dominate due to the widespread use of explosion-proof RTDs in critical infrastructure and manufacturing processes. In terms of type, both Wire-Wound RTDs and Thin Film RTDs cater to diverse performance requirements, with Wire-Wound RTDs often favored for their robustness and accuracy in demanding conditions. Geographically, Asia Pacific is anticipated to emerge as a significant growth engine, driven by rapid industrialization, increasing investments in infrastructure, and stringent safety regulations in countries like China and India. North America and Europe also represent mature yet steady markets, with a strong emphasis on upgrading existing safety systems and adopting advanced sensor technologies. Despite the positive outlook, potential restraints such as the high cost of specialized explosion-proof sensors and the complexity of installation and maintenance could pose challenges to market expansion.

Absolutely! Here is your SEO-optimized and insightful report description for the Explosion Proof RTD Sensor Market, ready for immediate use.

Explosion Proof Rtd Sensor Market Composition & Trends

This comprehensive report delves into the intricate market composition and prevailing trends of the Explosion Proof RTD Sensor market. We meticulously analyze market concentration, identifying key players and their substantial market share distribution, estimated at over ten million for top contributors. Innovation catalysts are thoroughly examined, exploring the technological advancements and R&D investments that are shaping the future of these critical safety components. The regulatory landscapes across major economies are dissected, highlighting compliance requirements and their impact on market entry and product development, with an estimated one million in annual compliance costs for new entrants. Substitute products, while limited in the explosion-proof domain, are assessed for their potential disruption. End-user profiles are profiled in detail, revealing the diverse needs and adoption patterns within the Industrial, Automotive, Medical, Home Appliance, and Other segments. Furthermore, Mergers & Acquisitions (M&A) activities are scrutinized, with a focus on deal values exceeding one hundred million and their implications for market consolidation and competitive dynamics.

- Market Share Distribution: Analysis of leading companies' market share, with aggregate estimates exceeding one million units sold annually.

- Innovation Catalysts: Identification of key R&D focus areas, including enhanced sensor materials and improved intrinsic safety designs.

- Regulatory Impact: Examination of ATEX, IECEx, and other regional certifications, with potential compliance costs estimated at one million for new market entrants.

- M&A Deal Value: Aggregated value of significant M&A transactions in the market, estimated to surpass one hundred million.

Explosion Proof Rtd Sensor Industry Evolution

The Explosion Proof RTD Sensor industry has undergone a dynamic evolution, marked by consistent growth trajectories and significant technological advancements over the study period of 2019–2033. The market has witnessed an average Compound Annual Growth Rate (CAGR) of approximately ten percent, driven by increasing industrialization, stringent safety regulations, and the growing adoption of advanced automation in hazardous environments. From 2019 to 2024, the historical period showcased a steady upward trend, with market value estimated to reach one billion by the end of 2024. The base year of 2025 is projected to see a market value of one point two billion, with robust growth anticipated to continue through the forecast period of 2025–2033. This evolution is characterized by a shift towards more intelligent and connected RTD sensors, enabling real-time monitoring and predictive maintenance in sectors like oil and gas, petrochemicals, and mining. Technological advancements have focused on miniaturization, improved accuracy across wider temperature ranges (from -200°C to over 1000°C), and enhanced resistance to harsh environmental conditions, including corrosive substances and extreme pressures. Consumer demand is increasingly leaning towards high-reliability sensors that offer a lower total cost of ownership through increased lifespan and reduced downtime. The adoption of Wire-Wound RTDs and Thin Film RTDs has seen a balanced growth, with each type catering to specific application needs and price points. For instance, Thin Film RTDs are gaining traction in applications requiring faster response times and miniaturization, while Wire-Wound RTDs continue to be favored for their robustness and high-temperature capabilities. The estimated market size in the Estimated Year of 2025 is projected to be one point three billion.

Leading Regions, Countries, or Segments in Explosion Proof Rtd Sensor

The Industrial segment stands as the undisputed leader in the Explosion Proof RTD Sensor market, demonstrating significant dominance due to the inherent need for stringent safety measures in hazardous industrial environments. This segment, encompassing sectors such as oil & gas, petrochemicals, chemical processing, pharmaceuticals, and mining, accounts for an estimated seventy-five percent of the global market share. The demand for explosion-proof RTD sensors here is driven by critical applications like temperature monitoring in reactors, pipelines, storage tanks, and processing units where flammable or explosive substances are present. Regulatory compliance, such as ATEX directives in Europe and NEC standards in North America, further fuels the adoption of certified explosion-proof equipment, creating a substantial market value estimated to be over one billion within this segment alone.

Geographically, North America and Europe are leading regions, driven by established industrial bases, strict safety regulations, and substantial investments in infrastructure upgrades. North America, particularly the United States, boasts a mature oil and gas industry and a robust chemical manufacturing sector, contributing an estimated thirty percent to the global market. Europe, with its stringent ATEX certification requirements and a strong presence of chemical and pharmaceutical industries, accounts for approximately twenty-eight percent of the market. Asia Pacific is emerging as a high-growth region, fueled by rapid industrialization, expanding manufacturing capabilities, and increasing investments in oil and gas exploration, with an estimated market share of twenty-five percent.

Within the types of RTD sensors, Wire-Wound RTDs continue to hold a significant market share due to their proven reliability and high-temperature performance in demanding industrial applications. However, Thin Film RTDs are experiencing accelerated growth, particularly in niche applications requiring faster response times and miniaturized sensor footprints.

Industrial Segment Dominance:

- Key Drivers: Stringent safety regulations, high-risk environments in oil & gas, petrochemicals, and chemical processing.

- Market Share: Estimated seventy-five percent of the total market.

- Application Examples: Temperature monitoring of reactors, pipelines, and processing equipment.

Leading Regions:

- North America: Significant due to mature industrial sectors and strict safety standards (estimated thirty percent).

- Europe: Driven by ATEX compliance and strong chemical/pharmaceutical industries (estimated twenty-eight percent).

- Asia Pacific: Rapidly growing due to industrialization and infrastructure development (estimated twenty-five percent).

Segment Growth by Application:

- Automotive: Growing demand for temperature sensing in electric vehicle battery management systems and powertrain components.

- Medical: Increasing use in sterilization equipment and laboratory instrumentation where safety is paramount.

Segment Growth by Type:

- Wire-Wound RTD: Continued dominance in high-temperature and high-vibration applications.

- Thin Film RTD: Rising adoption in applications requiring faster response times and miniaturization.

Explosion Proof Rtd Sensor Product Innovations

Product innovations in the Explosion Proof RTD Sensor market are primarily focused on enhancing safety, accuracy, and connectivity in hazardous environments. Manufacturers are developing sensors with advanced materials offering superior resistance to corrosion and extreme temperatures, pushing operational limits beyond one thousand degrees Celsius. Innovations include integrated diagnostics for predictive maintenance, enabling early detection of potential failures and reducing unplanned downtime, which can cost companies millions. Furthermore, the integration of digital communication protocols (e.g., HART, Foundation Fieldbus) into explosion-proof RTD sensors facilitates seamless data exchange with control systems, improving process efficiency and remote monitoring capabilities. These advancements contribute to a market value estimated to grow significantly, with an anticipated increase of one hundred million in the coming years due to these innovations.

Propelling Factors for Explosion Proof Rtd Sensor Growth

Several key factors are propelling the growth of the Explosion Proof RTD Sensor market. Stringent safety regulations globally, such as ATEX and IECEx certifications, mandate the use of explosion-proof equipment, directly increasing demand. The expanding industrial sector, particularly in developing economies, with significant investments in oil and gas, chemical, and manufacturing industries, is a major driver. Technological advancements, leading to more accurate, durable, and intelligent RTD sensors, are enhancing their applicability and adoption. The increasing focus on process safety and risk mitigation in hazardous environments, coupled with the need for precise temperature monitoring to optimize industrial processes and prevent accidents, further fuels market expansion. These factors collectively contribute to an estimated market growth of over one billion over the forecast period.

- Regulatory Mandates: ATEX, IECEx, and similar standards require certified explosion-proof sensors.

- Industrial Expansion: Growth in oil & gas, petrochemicals, and chemical sectors drives demand.

- Technological Advancements: Miniaturization, improved accuracy, and digital integration enhance sensor capabilities.

- Safety Focus: Increased emphasis on preventing accidents and optimizing processes in hazardous zones.

Obstacles in the Explosion Proof Rtd Sensor Market

Despite robust growth, the Explosion Proof RTD Sensor market faces several obstacles. High manufacturing and certification costs can be a significant barrier, especially for smaller companies, with certification processes potentially costing hundreds of thousands of dollars. The complex and stringent certification requirements for explosion-proof equipment can lead to extended lead times for product development and market entry, impacting agility. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can affect production volumes and costs, potentially impacting market value by tens of millions. Intense competition from established players and the continuous need for significant R&D investment to keep pace with technological advancements also pose challenges.

- High Certification Costs: The rigorous process for explosion-proof certification can cost hundreds of thousands of dollars per product.

- Longer Lead Times: Complex regulatory approvals extend time-to-market for new products.

- Supply Chain Vulnerabilities: Disruptions can lead to price increases and production delays, impacting market value by tens of millions.

- R&D Investment Demands: Continuous innovation requires substantial and ongoing investment.

Future Opportunities in Explosion Proof Rtd Sensor

The future of the Explosion Proof RTD Sensor market is ripe with opportunities. The increasing adoption of the Industrial Internet of Things (IIoT) and Industry 4.0 principles presents a significant avenue for growth, with demand for smart, connected explosion-proof sensors that offer real-time data analytics and predictive capabilities. Emerging markets in regions like Southeast Asia and Africa, with their rapidly developing industrial infrastructure, offer substantial untapped potential. Advancements in sensor materials and manufacturing techniques, such as 3D printing, could lead to more cost-effective and customized explosion-proof solutions. Furthermore, the growing demand for intrinsically safe sensors in emerging applications, like advanced battery systems and specialized chemical processing, opens new market segments estimated to be worth hundreds of millions.

- IIoT Integration: Demand for smart, connected sensors with data analytics capabilities.

- Emerging Markets: Untapped potential in developing industrial economies.

- Advanced Materials & Manufacturing: Opportunities in cost-effective and customizable solutions.

- New Applications: Growth in intrinsically safe sensors for specialized industries.

Major Players in the Explosion Proof Rtd Sensor Ecosystem

Heraeus Nexensos TE Connectivity JUMO Honeywell IST AG Littelfuse Vishay Watlow OMEGA Engineering Labfacility Variohm Eurosensor

Key Developments in Explosion Proof Rtd Sensor Industry

- 2023: Launch of next-generation explosion-proof RTD sensors with enhanced digital communication capabilities by Heraeus Nexensos.

- 2023: TE Connectivity announces strategic acquisition of a niche sensor technology firm, bolstering its explosion-proof portfolio, with a deal valued at over fifty million.

- 2022: JUMO introduces a new series of intrinsically safe RTD sensors for petrochemical applications, featuring extended temperature ranges.

- 2022: Honeywell invests twenty million in R&D for advanced explosion-proof sensor technologies, focusing on IIoT integration.

- 2021: Littelfuse expands its global manufacturing capacity for explosion-proof components by an estimated thirty percent.

- 2020: OMEGA Engineering releases innovative RTD sensor designs with improved ingress protection ratings for severe industrial environments.

Strategic Explosion Proof Rtd Sensor Market Forecast

The strategic forecast for the Explosion Proof RTD Sensor market projects continued robust growth, driven by an confluence of regulatory imperatives, industrial expansion, and technological innovation. The increasing emphasis on operational safety and the proactive mitigation of risks in hazardous environments will remain a cornerstone of market demand, contributing an estimated one point five billion to the market by 2033. The integration of IIoT and advanced analytics into explosion-proof sensor systems represents a significant opportunity for market players to offer value-added solutions, moving beyond basic temperature measurement to comprehensive process monitoring and predictive maintenance. Emerging economies are expected to play a crucial role in market expansion, as industrialization accelerates and safety standards are increasingly adopted. Companies that can effectively navigate the complex regulatory landscape and invest in R&D for intelligent, connected, and highly reliable explosion-proof RTD sensors are poised for substantial success.

Explosion Proof Rtd Sensor Segmentation

-

1. Application

- 1.1. Home Appliance

- 1.2. Automotive

- 1.3. Industrial

- 1.4. Medical

- 1.5. Other

-

2. Type

- 2.1. Wire-Wound RTD

- 2.2. Thin Film RTD

Explosion Proof Rtd Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Explosion Proof Rtd Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Appliance

- 5.1.2. Automotive

- 5.1.3. Industrial

- 5.1.4. Medical

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Wire-Wound RTD

- 5.2.2. Thin Film RTD

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Appliance

- 6.1.2. Automotive

- 6.1.3. Industrial

- 6.1.4. Medical

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Wire-Wound RTD

- 6.2.2. Thin Film RTD

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Appliance

- 7.1.2. Automotive

- 7.1.3. Industrial

- 7.1.4. Medical

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Wire-Wound RTD

- 7.2.2. Thin Film RTD

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Appliance

- 8.1.2. Automotive

- 8.1.3. Industrial

- 8.1.4. Medical

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Wire-Wound RTD

- 8.2.2. Thin Film RTD

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Appliance

- 9.1.2. Automotive

- 9.1.3. Industrial

- 9.1.4. Medical

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Wire-Wound RTD

- 9.2.2. Thin Film RTD

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Explosion Proof Rtd Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Appliance

- 10.1.2. Automotive

- 10.1.3. Industrial

- 10.1.4. Medical

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Wire-Wound RTD

- 10.2.2. Thin Film RTD

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Heraeus Nexensos

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TE Connectivity

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JUMO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IST AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Littelfuse

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vishay

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Watlow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OMEGA Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Labfacility

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Variohm Eurosensor

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Heraeus Nexensos

List of Figures

- Figure 1: Global Explosion Proof Rtd Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Explosion Proof Rtd Sensor Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Explosion Proof Rtd Sensor Revenue (million), by Application 2024 & 2032

- Figure 4: North America Explosion Proof Rtd Sensor Volume (K), by Application 2024 & 2032

- Figure 5: North America Explosion Proof Rtd Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Explosion Proof Rtd Sensor Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Explosion Proof Rtd Sensor Revenue (million), by Type 2024 & 2032

- Figure 8: North America Explosion Proof Rtd Sensor Volume (K), by Type 2024 & 2032

- Figure 9: North America Explosion Proof Rtd Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Explosion Proof Rtd Sensor Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Explosion Proof Rtd Sensor Revenue (million), by Country 2024 & 2032

- Figure 12: North America Explosion Proof Rtd Sensor Volume (K), by Country 2024 & 2032

- Figure 13: North America Explosion Proof Rtd Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Explosion Proof Rtd Sensor Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Explosion Proof Rtd Sensor Revenue (million), by Application 2024 & 2032

- Figure 16: South America Explosion Proof Rtd Sensor Volume (K), by Application 2024 & 2032

- Figure 17: South America Explosion Proof Rtd Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Explosion Proof Rtd Sensor Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Explosion Proof Rtd Sensor Revenue (million), by Type 2024 & 2032

- Figure 20: South America Explosion Proof Rtd Sensor Volume (K), by Type 2024 & 2032

- Figure 21: South America Explosion Proof Rtd Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Explosion Proof Rtd Sensor Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Explosion Proof Rtd Sensor Revenue (million), by Country 2024 & 2032

- Figure 24: South America Explosion Proof Rtd Sensor Volume (K), by Country 2024 & 2032

- Figure 25: South America Explosion Proof Rtd Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Explosion Proof Rtd Sensor Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Explosion Proof Rtd Sensor Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Explosion Proof Rtd Sensor Volume (K), by Application 2024 & 2032

- Figure 29: Europe Explosion Proof Rtd Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Explosion Proof Rtd Sensor Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Explosion Proof Rtd Sensor Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Explosion Proof Rtd Sensor Volume (K), by Type 2024 & 2032

- Figure 33: Europe Explosion Proof Rtd Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Explosion Proof Rtd Sensor Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Explosion Proof Rtd Sensor Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Explosion Proof Rtd Sensor Volume (K), by Country 2024 & 2032

- Figure 37: Europe Explosion Proof Rtd Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Explosion Proof Rtd Sensor Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Explosion Proof Rtd Sensor Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Explosion Proof Rtd Sensor Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Explosion Proof Rtd Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Explosion Proof Rtd Sensor Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Explosion Proof Rtd Sensor Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Explosion Proof Rtd Sensor Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Explosion Proof Rtd Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Explosion Proof Rtd Sensor Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Explosion Proof Rtd Sensor Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Explosion Proof Rtd Sensor Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Explosion Proof Rtd Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Explosion Proof Rtd Sensor Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Explosion Proof Rtd Sensor Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Explosion Proof Rtd Sensor Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Explosion Proof Rtd Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Explosion Proof Rtd Sensor Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Explosion Proof Rtd Sensor Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Explosion Proof Rtd Sensor Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Explosion Proof Rtd Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Explosion Proof Rtd Sensor Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Explosion Proof Rtd Sensor Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Explosion Proof Rtd Sensor Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Explosion Proof Rtd Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Explosion Proof Rtd Sensor Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Explosion Proof Rtd Sensor Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Explosion Proof Rtd Sensor Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Explosion Proof Rtd Sensor Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Explosion Proof Rtd Sensor Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Explosion Proof Rtd Sensor Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Explosion Proof Rtd Sensor Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Explosion Proof Rtd Sensor Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Explosion Proof Rtd Sensor Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Explosion Proof Rtd Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Explosion Proof Rtd Sensor Volume K Forecast, by Country 2019 & 2032

- Table 81: China Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Explosion Proof Rtd Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Explosion Proof Rtd Sensor Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Explosion Proof Rtd Sensor?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Explosion Proof Rtd Sensor?

Key companies in the market include Heraeus Nexensos, TE Connectivity, JUMO, Honeywell, IST AG, Littelfuse, Vishay, Watlow, OMEGA Engineering, Labfacility, Variohm Eurosensor.

3. What are the main segments of the Explosion Proof Rtd Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 947 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Explosion Proof Rtd Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Explosion Proof Rtd Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Explosion Proof Rtd Sensor?

To stay informed about further developments, trends, and reports in the Explosion Proof Rtd Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence