Key Insights

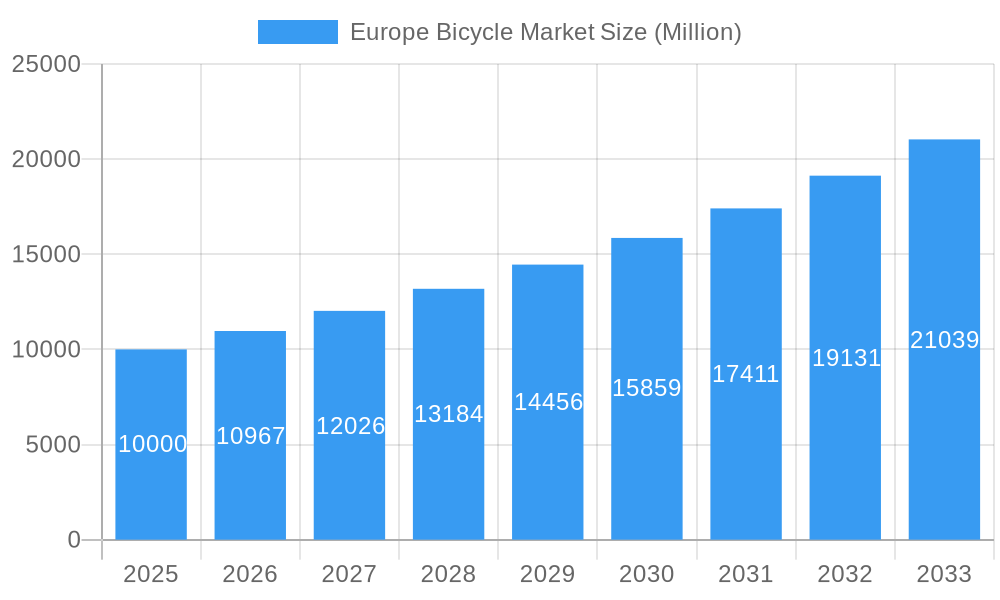

The European bicycle market, valued at €24,406 million in 2025, is projected for significant expansion. Anticipated to achieve a Compound Annual Growth Rate (CAGR) of 11.4% from 2025 to 2033, market growth is propelled by escalating environmental consciousness and a preference for sustainable urban mobility. Supportive government policies and infrastructure development further catalyze adoption. The burgeoning e-bike segment, driven by innovation in battery technology and design, represents a key growth area. The market is segmented by bicycle type (including road, hybrid, all-terrain, and e-bikes) and distribution channel, with online retail demonstrating increasing prominence due to enhanced consumer access and convenience.

Europe Bicycle Market Market Size (In Billion)

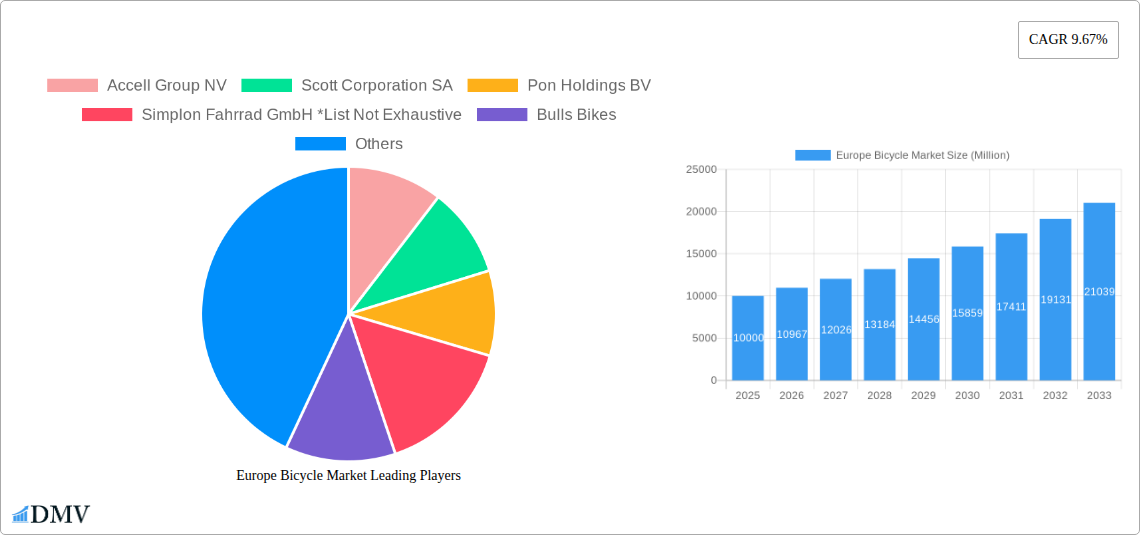

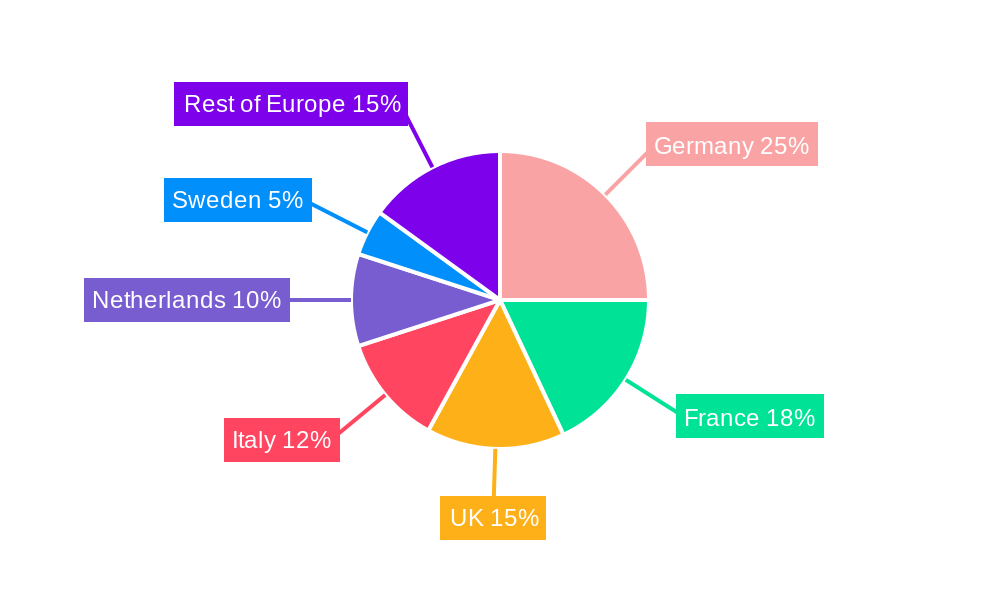

Leading market participants, such as Accell Group NV, Scott Corporation SA, Pon Holdings BV, and Giant Manufacturing Co Ltd, are prioritizing research and development to enhance product offerings and manufacturing efficiencies. Intense competition encourages innovation and value-driven pricing. Despite potential challenges like supply chain volatility and economic headwinds, the robust demand for e-bikes and the persistent focus on sustainability indicate a favorable market trajectory. Germany, France, Italy, and the UK are expected to continue as primary revenue generators, bolstered by established cycling cultures and proactive governmental support.

Europe Bicycle Market Company Market Share

Europe Bicycle Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe bicycle market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It offers a deep dive into market trends, competitive landscapes, and future growth potential, equipping stakeholders with actionable intelligence to navigate this dynamic sector. The market size in 2025 is estimated at xx Million, poised for significant growth in the coming years.

Europe Bicycle Market Composition & Trends

This section analyzes the competitive intensity of the European bicycle market, examining market share distribution among key players like Accell Group NV, Scott Corporation SA, Pon Holdings BV, and Giant Manufacturing Co Ltd. We delve into innovation drivers, regulatory changes impacting the industry, the role of substitute products (e.g., e-scooters), end-user preferences (commuters, recreational cyclists, etc.), and the impact of mergers and acquisitions (M&A). The report includes a quantitative assessment of M&A deal values over the study period, revealing significant shifts in market consolidation. For example, the xx Million acquisition of Veloretti by Pon Bike highlights the increasing importance of e-bike technology.

- Market Concentration: Analysis of market share held by top 5 players (xx%).

- Innovation Catalysts: Examination of R&D spending and the emergence of new technologies (e.g., e-bike advancements).

- Regulatory Landscape: Impact of EU regulations on bicycle safety and e-bike standards.

- Substitute Products: Analysis of competition from alternative transportation modes.

- End-User Profiles: Segmentation of the market based on demographics and cycling usage.

- M&A Activity: Review of key acquisitions and their impact on market dynamics, including deal values (e.g., Pon Bike’s acquisition of Veloretti for xx Million).

Europe Bicycle Market Industry Evolution

This section charts the evolution of the European bicycle market from 2019 to 2033, highlighting key growth trajectories, technological advancements, and evolving consumer preferences. The analysis covers the impact of factors such as increasing environmental awareness, government initiatives promoting cycling infrastructure, and the rising popularity of e-bikes. We will present data points such as compound annual growth rates (CAGR) for different bicycle types and adoption rates for innovative features. For instance, we explore the surge in e-bike sales and the influence of technological advancements in battery technology and motor performance. The shift towards lightweight materials and improved aerodynamic design in road bicycles will also be covered. Overall, the report paints a picture of an industry adapting to changing consumer demands and integrating technological innovation for a greener future.

Leading Regions, Countries, or Segments in Europe Bicycle Market

This section identifies the leading regions, countries, and bicycle types within the European market. Germany, France, and the Netherlands are expected to remain major markets due to well-established cycling cultures and supportive infrastructure. We examine the key drivers behind the dominance of specific segments, providing an in-depth analysis of each segment's performance.

Dominant Segments:

- By Type: E-bicycles are projected to demonstrate the highest growth rate, driven by government incentives and increasing consumer demand. Road bicycles and Hybrid bicycles also maintain considerable market share.

- By Distribution Channel: Offline retail stores are likely to retain a larger share, while online retail is anticipated to exhibit strong growth.

Key Drivers:

- Investment Trends: Government funding for cycling infrastructure and e-bike subsidies.

- Regulatory Support: Policies promoting cycling as a sustainable mode of transportation.

- Consumer Preferences: Shift towards eco-friendly transportation and fitness-oriented activities.

Europe Bicycle Market Product Innovations

Recent years have witnessed significant innovations in bicycle design and technology, including advancements in e-bike battery technology, lightweight materials, and integrated electronic systems. The introduction of new features like improved suspension systems, advanced gear shifting mechanisms, and enhanced safety features continues to drive market growth. These innovations cater to diverse consumer needs, from high-performance racing bikes to comfortable commuter bicycles. The focus on user experience and sustainability further propels the adoption of these innovative products.

Propelling Factors for Europe Bicycle Market Growth

The European bicycle market is driven by several key factors. The increasing awareness of environmental concerns and the need for sustainable transportation options fuel the demand for bicycles, particularly e-bikes. Furthermore, government initiatives promoting cycling infrastructure and offering financial incentives for e-bike purchases strongly contribute to market growth. Finally, advancements in bicycle technology and design create higher-performance and more comfortable riding experiences, attracting a wider range of consumers.

Obstacles in the Europe Bicycle Market

The growth of the European bicycle market faces several challenges. Supply chain disruptions, particularly in the sourcing of key components like batteries and electronic parts, have significantly impacted production and availability. Additionally, intense competition among established and emerging players creates price pressures and necessitates constant product innovation. Regulatory hurdles and variations in standards across different European countries also complicate market access and expansion. The overall impact of these obstacles is estimated to reduce market growth by approximately xx% in the forecast period.

Future Opportunities in Europe Bicycle Market

Future growth opportunities in the European bicycle market are abundant. The increasing integration of smart technology in bicycles, including GPS tracking, fitness monitoring, and connectivity features, opens new avenues for growth. The expansion of shared bicycle programs in urban areas provides convenient and cost-effective transportation solutions, further stimulating market demand. Finally, the development of innovative bicycle designs tailored to specific user needs (e.g., cargo bikes, folding bikes) will fuel market expansion.

Major Players in the Europe Bicycle Market Ecosystem

- Accell Group NV

- Scott Corporation SA

- Pon Holdings BV

- Simplon Fahrrad GmbH

- Bulls Bikes

- Merida Industry Co Ltd

- Giant Manufacturing Co Ltd

- Ribble Cycles

- Trek Bicycle Corporation

- Riese und Muller GmbH

Key Developments in Europe Bicycle Market Industry

- September 2022: Pon Bike acquired the Dutch e-bike brand Veloretti.

- September 2022: The Accell Group's Haibike brand launched the Lyke eMTB.

- October 2022: Pon Holdings' Cervélo launched the ZHT-5 cross-country mountain bike.

Strategic Europe Bicycle Market Forecast

The European bicycle market is poised for sustained growth, driven by a confluence of factors. The increasing popularity of e-bikes, coupled with supportive government policies and advancements in bicycle technology, will continue to fuel market expansion. The emergence of new market segments, such as cargo bikes and specialized e-bikes for specific activities, will create additional growth opportunities. The overall market is expected to reach xx Million by 2033, reflecting a strong trajectory of growth and innovation.

Europe Bicycle Market Segmentation

-

1. Type

- 1.1. Road Bicycles

- 1.2. Hybrid Bicycles

- 1.3. All Terrain Bicycles

- 1.4. E-bicycles

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Europe Bicycle Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Netherlands

- 7. Rest of Europe

Europe Bicycle Market Regional Market Share

Geographic Coverage of Europe Bicycle Market

Europe Bicycle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Transport Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Number of Cycling Events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Road Bicycles

- 5.1.2. Hybrid Bicycles

- 5.1.3. All Terrain Bicycles

- 5.1.4. E-bicycles

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Netherlands

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Spain Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Road Bicycles

- 6.1.2. Hybrid Bicycles

- 6.1.3. All Terrain Bicycles

- 6.1.4. E-bicycles

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Road Bicycles

- 7.1.2. Hybrid Bicycles

- 7.1.3. All Terrain Bicycles

- 7.1.4. E-bicycles

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Road Bicycles

- 8.1.2. Hybrid Bicycles

- 8.1.3. All Terrain Bicycles

- 8.1.4. E-bicycles

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Road Bicycles

- 9.1.2. Hybrid Bicycles

- 9.1.3. All Terrain Bicycles

- 9.1.4. E-bicycles

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Road Bicycles

- 10.1.2. Hybrid Bicycles

- 10.1.3. All Terrain Bicycles

- 10.1.4. E-bicycles

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Netherlands Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Road Bicycles

- 11.1.2. Hybrid Bicycles

- 11.1.3. All Terrain Bicycles

- 11.1.4. E-bicycles

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Offline Retail Stores

- 11.2.2. Online Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Road Bicycles

- 12.1.2. Hybrid Bicycles

- 12.1.3. All Terrain Bicycles

- 12.1.4. E-bicycles

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Offline Retail Stores

- 12.2.2. Online Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Accell Group NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Scott Corporation SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pon Holdings BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Simplon Fahrrad GmbH *List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bulls Bikes

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Merida Industry Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Giant Manufacturing Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ribble Cycles

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Trek Bicycle Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Riese und Muller GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Accell Group NV

List of Figures

- Figure 1: Europe Bicycle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Bicycle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Bicycle Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Bicycle Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 15: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 39: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bicycle Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Europe Bicycle Market?

Key companies in the market include Accell Group NV, Scott Corporation SA, Pon Holdings BV, Simplon Fahrrad GmbH *List Not Exhaustive, Bulls Bikes, Merida Industry Co Ltd, Giant Manufacturing Co Ltd, Ribble Cycles, Trek Bicycle Corporation, Riese und Muller GmbH.

3. What are the main segments of the Europe Bicycle Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 24406 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population.

6. What are the notable trends driving market growth?

Increasing Number of Cycling Events.

7. Are there any restraints impacting market growth?

Availability of Alternative Transport Solutions.

8. Can you provide examples of recent developments in the market?

October 2022: Pon Holdings' Cervélo launched ZHT-5, a cross-country mountain bike that prioritizes low weight and efficiency. Cervélo claimed that the ZHT-5 is 'purpose-built' for XC racing and will make its race debut at the first round of the XCO World Cups in Valkenburg, Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bicycle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bicycle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bicycle Market?

To stay informed about further developments, trends, and reports in the Europe Bicycle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence