Key Insights

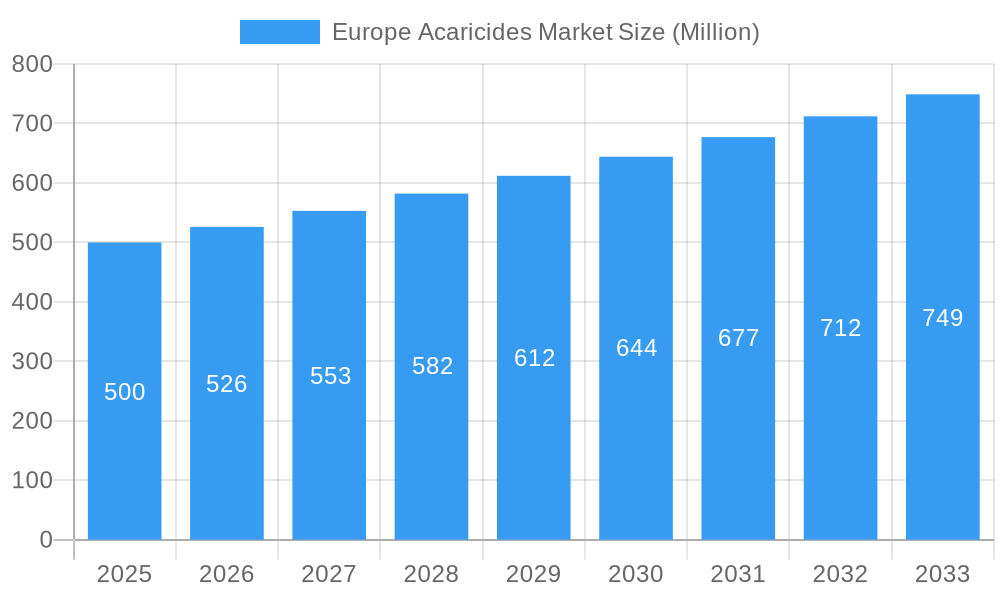

The European acaricide market, projected to reach $56.14 million by 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.1% between 2025 and 2033. Key drivers for this growth include escalating pest infestations in agricultural crops, particularly fruits and vegetables, necessitating robust acaricide application to safeguard yields and quality. The increasing integration of Integrated Pest Management (IPM) strategies, while emphasizing reduced chemical reliance, still requires potent acaricides for targeted mite control. Furthermore, innovations in acaricide formulations, focusing on environmentally conscious and specific products, are fueling market expansion. While spray application remains prevalent, growing demand for user-friendly methods is driving the adoption of dipping and hand dressing techniques.

Europe Acaricides Market Market Size (In Million)

Major market segments encompass organophosphates, carbamates, organochlorines, pyrethrins, pyrethroids, and other chemical classes. Although organophosphates and pyrethroids currently dominate due to their effectiveness, heightened regulatory oversight and environmental concerns are promoting the development and uptake of less toxic alternatives. Leading entities such as Nissan Chemical Industries Ltd, Syngenta International AG, BASF SE, FMC Corporation, UPL Limited, Bayer CropScience, and Corteva Agriscience are at the forefront of research and development, introducing novel acaricide solutions to meet evolving market needs. The robust agricultural sectors in Germany, France, Italy, and the United Kingdom, supported by favorable government crop protection policies, further bolster the European market. However, growing public awareness of potential environmental and health risks associated with acaricide use may pose a long-term challenge, underscoring the need for continued innovation in sustainable and eco-friendly acaricide solutions.

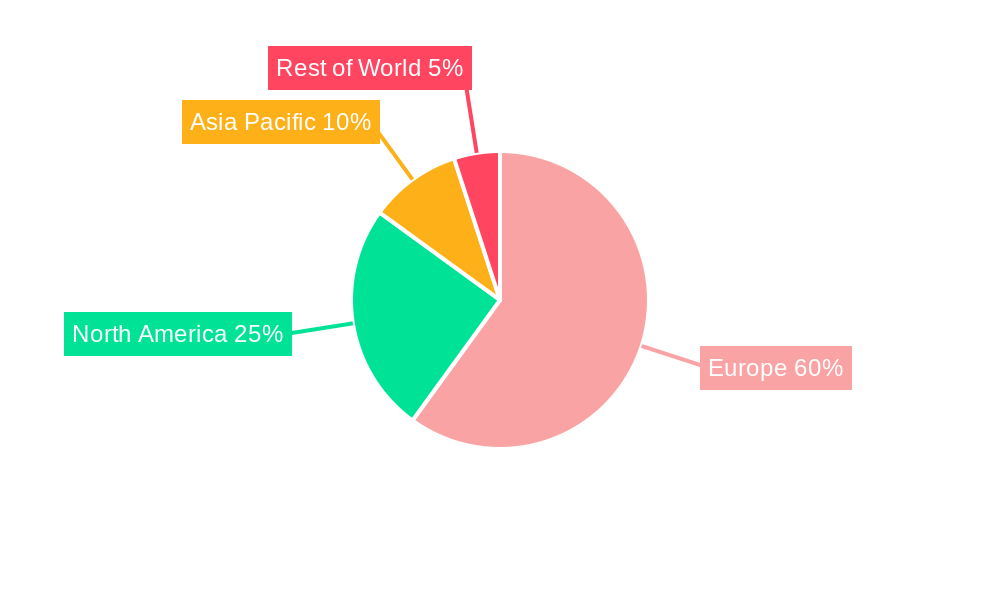

Europe Acaricides Market Company Market Share

Europe Acaricides Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Acaricides Market, offering a comprehensive overview of market dynamics, key players, and future growth projections. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is invaluable for stakeholders seeking to understand and capitalize on opportunities within this dynamic market segment. The total market value in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Europe Acaricides Market Market Composition & Trends

This section delves into the competitive landscape of the European acaricide market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute product penetration, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution among key players like Nissan Chemical Industries Ltd, Syngenta International AG, BASF SE, FMC Corporation, UPL Limited, Bayer CropScience, and Corteva Agriscience.

- Market Concentration: The market exhibits a [Describe market concentration – e.g., moderately concentrated] structure, with the top five players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Stringent regulations and growing resistance to existing acaricide formulations are driving innovation in the development of novel, environmentally friendly products.

- Regulatory Landscape: EU regulations concerning pesticide use significantly influence market growth and product development, necessitating compliance with stringent safety and environmental standards.

- Substitute Products: The availability of biological control methods and integrated pest management (IPM) strategies pose a competitive threat to synthetic acaricides.

- End-User Profiles: The primary end-users are agricultural producers (fruits, vegetables, vineyards, etc.), as well as landscape management companies and horticultural businesses.

- M&A Activities: The report analyzes recent M&A activities in the sector, including deal values and their impact on market consolidation. The total value of M&A deals in the last five years is estimated at xx Million.

Europe Acaricides Market Industry Evolution

This section provides a detailed analysis of the Europe Acaricides Market's historical performance (2019-2024), current status (2025), and future projections (2025-2033). We explore market growth trajectories, technological advancements (e.g., development of novel active ingredients, improved formulation technologies), and evolving consumer preferences towards environmentally sustainable solutions. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), primarily driven by [mention specific drivers, e.g., increased crop production, growing awareness of pest control]. Adoption of new technologies is projected to accelerate growth, with a CAGR of xx% expected during the forecast period (2025-2033). The shift towards sustainable agriculture practices is anticipated to further drive demand for eco-friendly acaricide solutions.

Leading Regions, Countries, or Segments in Europe Acaricides Market

This section identifies the dominant regions, countries, and market segments within Europe based on type (Spray, Dipping, Hand Dressing, Other Applications) and application (Organophosphates, Carbamates, Organochlorines, Pyrethrins, Pyrethroids, Other Chemical Types).

Dominant Segments:

- By Type: Spray applications currently dominate the market due to [Reasons, e.g., ease of use and wide applicability across various crops].

- By Application: Pyrethroids hold the largest market share due to [Reasons, e.g., their effectiveness against a broad range of mites and their relatively low toxicity].

Key Drivers of Dominance:

- Investment Trends: Significant investments in R&D for developing novel acaricides are driving market growth, particularly in regions with high agricultural output.

- Regulatory Support: Government initiatives promoting sustainable pest management strategies contribute to the adoption of specific acaricide types.

Europe Acaricides Market Product Innovations

Recent innovations in the acaricide market include the development of novel active ingredients with improved efficacy and reduced environmental impact. The introduction of formulations with enhanced delivery systems, such as microencapsulated products, has also enhanced the effectiveness and longevity of acaricidal treatments. Several companies are focusing on developing biological acaricides, based on naturally occurring substances, as a more environmentally friendly alternative. These innovative products often boast unique selling propositions such as reduced toxicity to beneficial insects, extended residual activity, and improved target specificity.

Propelling Factors for Europe Acaricides Market Growth

Several factors are driving the growth of the Europe Acaricides Market. The increasing prevalence of mite infestations in agricultural crops and horticultural settings is a major driver. Technological advancements in acaricide formulation and delivery systems also contribute. Furthermore, supportive government regulations and policies promoting sustainable pest management practices stimulate market growth.

Obstacles in the Europe Acaricides Market Market

The Europe Acaricides Market faces several challenges. Stringent regulatory approvals and environmental concerns surrounding pesticide use pose significant barriers to market entry and expansion. Furthermore, supply chain disruptions and fluctuations in raw material prices can impact profitability. Intense competition among established players also limits pricing power and market share growth. The growing adoption of integrated pest management (IPM) practices is likely to constrain the market growth for synthetic acaricides.

Future Opportunities in Europe Acaricides Market

Emerging opportunities lie in the development of biopesticides and other environmentally friendly acaricide solutions. The growing demand for organic and sustainably produced agricultural products creates a lucrative market segment for such products. Furthermore, the exploration of new active ingredients and innovative delivery systems presents significant potential for market expansion.

Major Players in the Europe Acaricides Market Ecosystem

- Nissan Chemical Industries Ltd

- Syngenta International AG

- BASF SE

- FMC Corporation

- UPL Limited

- Bayer CropScience

- Corteva Agriscience

Key Developments in Europe Acaricides Market Industry

- [Year/Month]: [Development - e.g., Launch of a new acaricide product by Company X.] This development [Impact - e.g., increased market competition and expanded product portfolio.]

- [Year/Month]: [Development] This development [Impact]

- [Year/Month]: [Development] This development [Impact] (Add more bullet points as needed)

Strategic Europe Acaricides Market Market Forecast

The Europe Acaricides Market is poised for robust growth in the coming years, driven by factors such as increasing pest infestations and the growing demand for high-quality agricultural products. The development of innovative and environmentally friendly acaricides will be crucial in shaping future market trends. The market's growth trajectory will be significantly influenced by regulatory changes and advancements in pest management technologies. The forecast indicates a promising future, particularly for sustainable and targeted acaricide solutions.

Europe Acaricides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Acaricides Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Acaricides Market Regional Market Share

Geographic Coverage of Europe Acaricides Market

Europe Acaricides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Need for Increasing Agricultural Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Acaricides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nissan Chemical Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngenta International AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FMC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer CropScience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Nissan Chemical Industries Ltd

List of Figures

- Figure 1: Europe Acaricides Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Acaricides Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Acaricides Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Acaricides Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Acaricides Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Acaricides Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Acaricides Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Acaricides Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Europe Acaricides Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Acaricides Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Acaricides Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Acaricides Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Acaricides Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Acaricides Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Acaricides Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Acaricides Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Europe Acaricides Market?

Key companies in the market include Nissan Chemical Industries Ltd, Syngenta International AG, BASF SE, FMC Corporation, UPL Limite, Bayer CropScience, Corteva Agriscience.

3. What are the main segments of the Europe Acaricides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.14 million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Need for Increasing Agricultural Productivity.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Acaricides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Acaricides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Acaricides Market?

To stay informed about further developments, trends, and reports in the Europe Acaricides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence