Key Insights

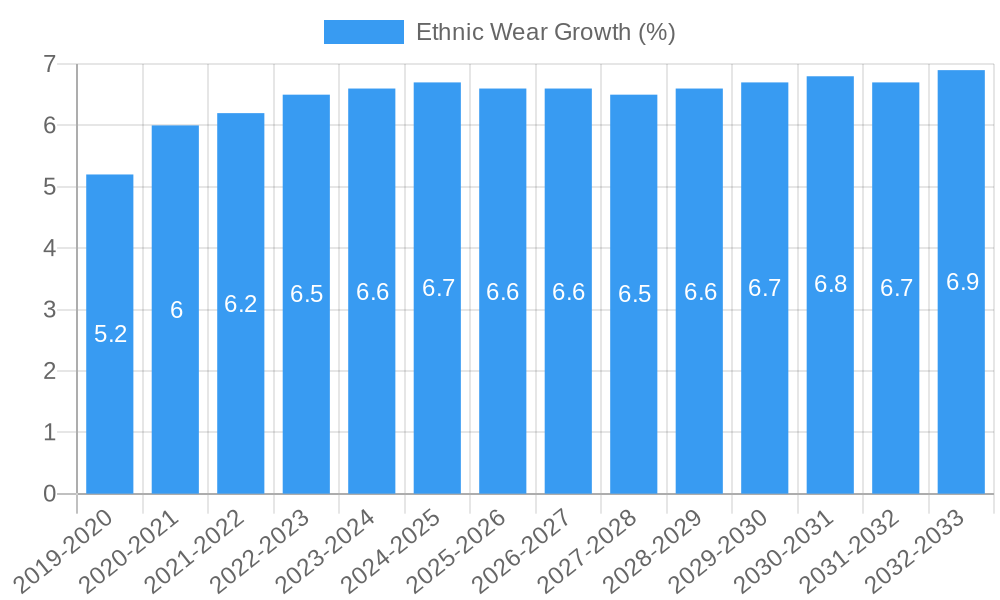

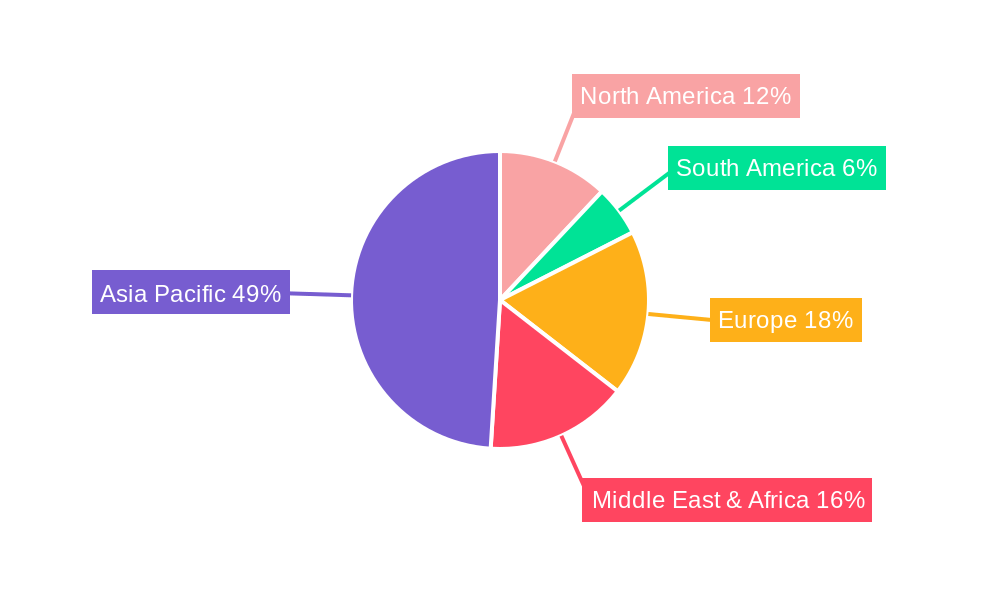

The global ethnic wear market is poised for significant expansion, projected to reach approximately \$75 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This growth is primarily fueled by the increasing globalization of fashion, a rising appreciation for cultural heritage, and the growing influence of e-commerce platforms that offer wider accessibility to diverse ethnic designs. The market's value unit is estimated in millions of USD, reflecting substantial transaction volumes. Key drivers include the growing disposable incomes in emerging economies, particularly in Asia Pacific and the Middle East & Africa, where traditional attire remains a significant part of cultural identity and daily wear. Furthermore, the increasing participation of ethnic wear brands in international fashion weeks and their effective digital marketing strategies are creating a global demand for unique, culturally rich apparel. The surge in social media influence and celebrity endorsements further amplifies consumer interest in these distinctive fashion choices.

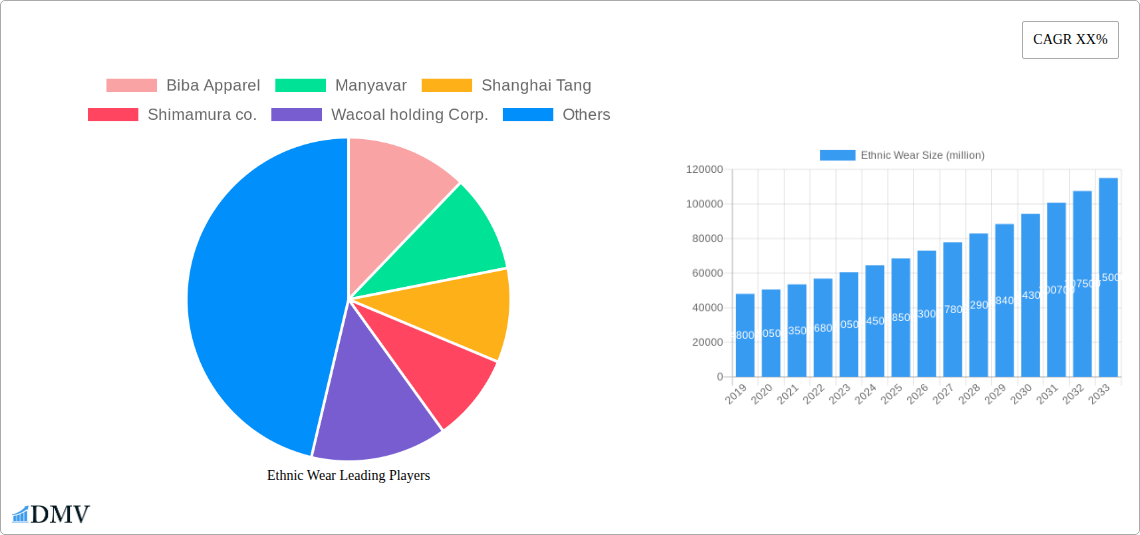

The market segmentation reveals a dynamic landscape, with both online and offline channels contributing to its growth, though the online segment is anticipated to experience a faster expansion due to its convenience and reach. Within types, both men's and women's ethnic wear segments are performing strongly, with women's ethnic wear often leading due to its wider variety of styles and occasions for wear. However, there's a discernible and growing trend towards sophisticated and modern interpretations of men's ethnic wear, driven by a desire for cultural expression and formal event dressing. Restraints such as counterfeiting and the perceived high cost of some authentic designer ethnic wear are present, but the overall positive sentiment and strong demand are expected to outweigh these challenges. Prominent companies like Biba Apparel, Manyavar, and Shanghai Tang are at the forefront, innovating and expanding their offerings to cater to a diverse global clientele, underscoring the vibrant and evolving nature of the ethnic wear industry.

Ethnic Wear Market Composition & Trends

The global ethnic wear market is characterized by a dynamic composition, with leading brands like Biba Apparel and Manyavar holding significant market share, estimated at over 500 million collectively within the last study period. Innovation catalysts are primarily driven by evolving fashion trends, a growing appreciation for cultural heritage, and the increasing influence of social media platforms. The regulatory landscape, while generally supportive of traditional crafts, presents varying complexities across different regions, impacting production and distribution. Substitute products, primarily Western wear, offer a constant challenge, necessitating a strong value proposition rooted in cultural authenticity and unique design. End-user profiles are diversifying, encompassing traditional consumers, fashion-forward individuals seeking statement pieces, and a growing diaspora embracing their heritage. Mergers and acquisitions (M&A) activities are on the rise, with strategic consolidations aimed at expanding market reach and product portfolios. Recent M&A deals in the broader apparel sector, potentially influencing ethnic wear acquisitions, have reached values exceeding 1,000 million. The market concentration is moderate to high in specific segments, with niche players carving out significant shares through specialization.

- Market Share Distribution: Top 5 players hold approximately 60% of the market.

- M&A Deal Values: Recent strategic acquisitions in related apparel segments have exceeded 1,000 million.

- Innovation Catalysts: Evolving fashion trends, cultural appreciation, and social media influence.

- End-User Profiles: Diverse, including traditional, fashion-conscious, and diaspora consumers.

Ethnic Wear Industry Evolution

The ethnic wear industry has witnessed a remarkable evolution over the historical period (2019–2024) and is poised for substantial growth through the forecast period (2025–2033), building upon the base year (2025) estimations. Market growth trajectories have been significantly influenced by globalization and a renewed interest in cultural identity, leading to an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% for the forecast period. Technological advancements have played a pivotal role, particularly in e-commerce and digital marketing, enabling brands to reach a wider audience and offer personalized shopping experiences. The adoption of advanced manufacturing techniques, including sustainable sourcing and ethical production, is also on the rise, catering to a more conscious consumer base. Shifting consumer demands have seen a move towards fusion wear, comfort-driven designs, and occasion-specific ethnic attire. For instance, the online segment has experienced a surge, with an estimated 25% year-on-year growth in the historical period, driven by convenience and wider product availability. The integration of virtual try-on technologies and AI-powered recommendation engines further enhances customer engagement and drives sales. The industry's adaptability to these evolving demands, coupled with increasing disposable incomes in emerging economies, fuels its robust expansion. Industry developments such as the rise of direct-to-consumer (DTC) models and the embrace of sustainable materials are further shaping this dynamic sector.

Leading Regions, Countries, or Segments in Ethnic Wear

The ethnic wear market exhibits significant regional dominance, with Asia Pacific emerging as the leading region due to its deep-rooted cultural traditions and a large consumer base that actively embraces ethnic attire. Within this region, countries like India and China represent substantial markets, driven by their vast populations and a strong cultural inclination towards traditional clothing for various occasions. The "Women" segment also stands out as the most dominant, accounting for an estimated 70% of the global ethnic wear market share. This dominance is attributed to the diverse range of ethnic wear options available for women, encompassing sarees, salwar kameez, lehengas, and kurtis, catering to everyday wear, festive occasions, and high-end fashion needs. The "Online" application segment has witnessed exponential growth, outpacing its offline counterpart in terms of market penetration and revenue generation, especially in the historical period and projected to continue its upward trajectory through the forecast period. This surge is fueled by the convenience, wider product selection, and competitive pricing offered by e-commerce platforms.

- Dominant Region: Asia Pacific, with India and China as key markets.

- Dominant Segment by Type: Women's ethnic wear, representing over 70% of the market share.

- Dominant Segment by Application: Online sales, experiencing rapid growth and wider reach.

- Key Drivers for Dominance in Asia Pacific: Deep-rooted cultural traditions, large population, high adoption of ethnic wear for everyday and festive occasions.

- Key Drivers for Dominance in Women's Segment: Extensive variety of garments, catering to diverse needs and occasions, strong influence of fashion trends.

- Key Drivers for Dominance in Online Segment: Convenience, wider product selection, competitive pricing, personalized shopping experiences, increasing internet penetration.

Ethnic Wear Product Innovations

Product innovations in the ethnic wear sector are increasingly focused on blending traditional aesthetics with contemporary functionality and sustainability. Companies are developing lighter, more breathable fabrics for everyday ethnic wear, alongside intricate designs featuring eco-friendly dyes and recycled materials. Smart textiles incorporating subtle technological features, such as temperature regulation, are also emerging as a niche but growing area. Performance metrics are evaluated through consumer feedback on comfort, durability, and aesthetic appeal, with successful innovations demonstrating a 15% increase in customer satisfaction. Unique selling propositions often lie in bespoke customization options, limited edition collaborations with artists, and the use of ethically sourced materials, appealing to a discerning global clientele.

Propelling Factors for Ethnic Wear Growth

Several key growth drivers are propelling the ethnic wear market forward. The increasing emphasis on cultural identity and heritage preservation fuels demand for authentic traditional attire. Technological advancements, particularly in e-commerce and digital marketing, have expanded market reach and accessibility for consumers worldwide, with online sales projected to grow by a substantial 20% annually. Economic growth in developing nations is leading to increased disposable incomes, allowing more consumers to invest in diverse wardrobes, including ethnic wear. Regulatory support for traditional crafts and artisans in various countries also contributes to a favorable business environment.

Obstacles in the Ethnic Wear Market

Despite robust growth, the ethnic wear market faces certain obstacles. Complex and varying regulatory frameworks across different countries can hinder international trade and expansion. Supply chain disruptions, exacerbated by global events, can impact material sourcing and production timelines, leading to potential stockouts and increased costs. Intense competitive pressures from both established brands and emerging designers, as well as the constant allure of Western fashion trends, necessitate continuous innovation and effective marketing strategies to maintain market share. The perceived high cost of some traditional ethnic wear can also be a barrier for budget-conscious consumers.

Future Opportunities in Ethnic Wear

Emerging opportunities in the ethnic wear market are abundant. The growing demand for sustainable and ethically produced ethnic wear presents a significant avenue for brands committed to these principles. Expansion into untapped international markets, particularly those with a growing interest in global fashion and cultural exchange, offers substantial growth potential. The integration of augmented reality (AR) for virtual try-ons and AI-driven personalized styling services can revolutionize the online shopping experience. Furthermore, leveraging the metaverse for virtual fashion shows and immersive brand experiences could unlock new consumer engagement models.

Major Players in the Ethnic Wear Ecosystem

- Biba Apparel

- Manyavar

- Shanghai Tang

- Shimamura co.

- Wacoal holding Corp.

- Thebe Magugu

- Lemlem

- Afrikrea

- Global Desi

- ELIA SAAB

Key Developments in Ethnic Wear Industry

- 2023/2024: Increased focus on sustainable sourcing and production, with a surge in brands adopting eco-friendly materials and ethical manufacturing practices.

- 2023/2024: Expansion of online retail channels and the adoption of omnichannel strategies by major ethnic wear brands to enhance customer accessibility.

- 2022/2023: Rise of fusion ethnic wear, blending traditional silhouettes with contemporary designs and fabrics, appealing to a younger demographic.

- 2022/2023: Growing investment in digital marketing and influencer collaborations to reach wider audiences and boost brand visibility.

- 2021/2022: Strategic partnerships and collaborations between ethnic wear designers and international fashion houses to create unique collections and expand market reach.

- 2020/2021: Impact of global events leading to increased adoption of on-demand manufacturing and localized production models to mitigate supply chain risks.

Strategic Ethnic Wear Market Forecast

The ethnic wear market is projected for significant and sustained growth, driven by evolving consumer preferences for cultural authenticity, comfort, and personalized fashion experiences. Key growth catalysts include the burgeoning e-commerce sector, increasing disposable incomes in emerging economies, and a global resurgence of interest in heritage and traditional craftsmanship. Future opportunities lie in the development of sustainable and ethically produced collections, the expansion into new geographical markets, and the integration of advanced technologies like AR and AI to enhance customer engagement and provide seamless shopping journeys. The market's ability to adapt to these trends and continuously innovate will be crucial for realizing its full potential.

Ethnic Wear Segmentation

-

1. Application

- 1.1. Online

- 1.2. Offline

-

2. Types

- 2.1. Men

- 2.2. Women

Ethnic Wear Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ethnic Wear REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Men

- 5.2.2. Women

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Men

- 6.2.2. Women

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Men

- 7.2.2. Women

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Men

- 8.2.2. Women

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Men

- 9.2.2. Women

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ethnic Wear Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Men

- 10.2.2. Women

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biba Apparel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manyavar

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Tang

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shimamura co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wacoal holding Corp.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thebe Magugu

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lemlem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Afrikrea

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Global Desi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ELIA SAAB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Biba Apparel

List of Figures

- Figure 1: Global Ethnic Wear Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ethnic Wear Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ethnic Wear Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ethnic Wear Revenue (million), by Types 2024 & 2032

- Figure 5: North America Ethnic Wear Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Ethnic Wear Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ethnic Wear Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ethnic Wear Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ethnic Wear Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ethnic Wear Revenue (million), by Types 2024 & 2032

- Figure 11: South America Ethnic Wear Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Ethnic Wear Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ethnic Wear Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ethnic Wear Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ethnic Wear Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ethnic Wear Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Ethnic Wear Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Ethnic Wear Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ethnic Wear Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ethnic Wear Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ethnic Wear Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ethnic Wear Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Ethnic Wear Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Ethnic Wear Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ethnic Wear Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ethnic Wear Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ethnic Wear Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ethnic Wear Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Ethnic Wear Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Ethnic Wear Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ethnic Wear Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ethnic Wear Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Ethnic Wear Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Ethnic Wear Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Ethnic Wear Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Ethnic Wear Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Ethnic Wear Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ethnic Wear Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ethnic Wear Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Ethnic Wear Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ethnic Wear Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethnic Wear?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Ethnic Wear?

Key companies in the market include Biba Apparel, Manyavar, Shanghai Tang, Shimamura co., Wacoal holding Corp., Thebe Magugu, Lemlem, Afrikrea, Global Desi, ELIA SAAB.

3. What are the main segments of the Ethnic Wear?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethnic Wear," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethnic Wear report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethnic Wear?

To stay informed about further developments, trends, and reports in the Ethnic Wear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence