Key Insights

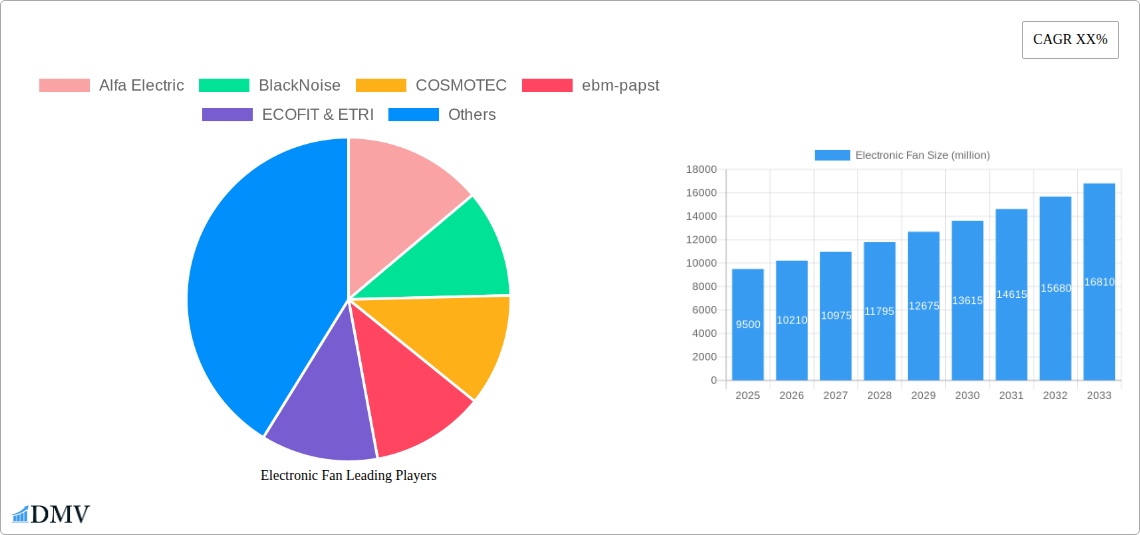

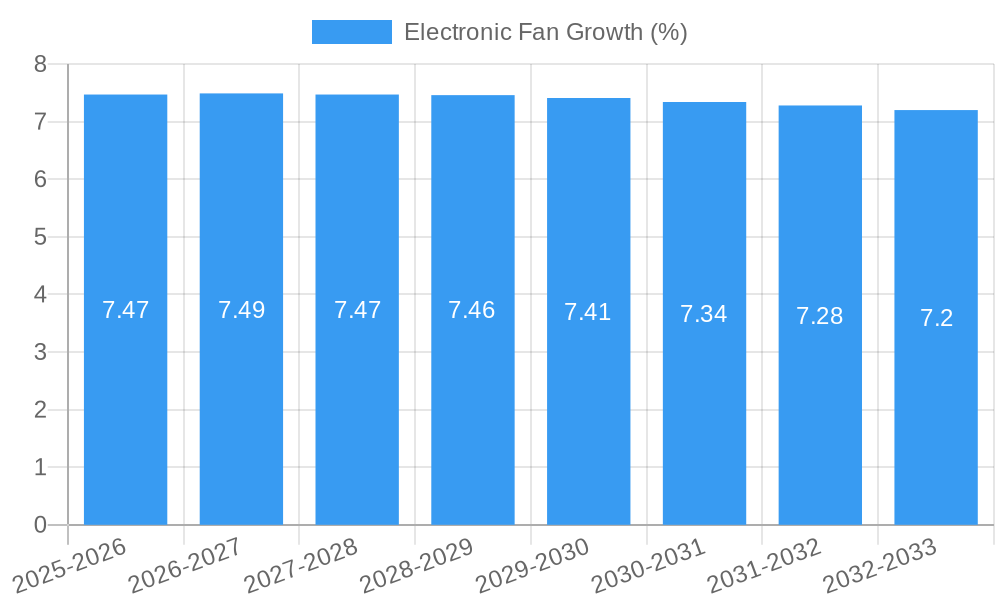

The global electronic fan market is poised for robust expansion, projected to reach an impressive market size of approximately $9,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% over the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing demand for advanced cooling solutions across a multitude of industries. The burgeoning electronics sector, with its continuous innovation and miniaturization, necessitates highly efficient and reliable cooling mechanisms to prevent overheating and ensure optimal performance. Furthermore, the growing emphasis on energy efficiency and reduced noise levels in electronic fans is driving technological advancements and product development, catering to both industrial and consumer needs. The integration of smart technologies, such as IoT connectivity and advanced sensor capabilities, is also contributing to market dynamism, offering enhanced control and predictive maintenance features.

The market's expansion is further bolstered by key applications including PC cooling, where the relentless pursuit of higher performance demands superior thermal management, and electrical cabinets, crucial for maintaining stable operating conditions in industrial and data center environments. While the market exhibits strong growth potential, certain restraints, such as the high initial cost of some advanced fan technologies and the availability of alternative cooling methods, may pose challenges. However, these are expected to be offset by the continuous innovation in materials and manufacturing processes, leading to more cost-effective and efficient solutions. Emerging economies, particularly in Asia Pacific, are expected to be significant growth drivers due to rapid industrialization and increasing adoption of electronic devices. Key players are strategically focusing on product differentiation, technological innovation, and expanding their geographical reach to capitalize on these evolving market dynamics.

Here's an SEO-optimized and insightful report description for the Electronic Fan market, designed for immediate use and high search visibility:

Electronic Fan Market Composition & Trends

This comprehensive report delves into the intricate dynamics of the global Electronic Fan market, dissecting its current composition and emerging trends. We analyze market concentration, identifying key players like Alfa Electric, BlackNoise, COSMOTEC, ebm-papst, ECOFIT & ETRI, ELDON, Fandis, Globe Motors, Micronel, Minebea, PFANNENBERG, PSC MOTOR AND FAN, Seifert Systems GmbH, STEGO, Wenling Dayang Electric Appliances Factory, and Wenzhou Jasonfan Manufacture, and their respective market share distribution, estimated at approximately 35% for the top 5 companies. Innovation catalysts, including advancements in miniaturization and energy efficiency, are explored as significant drivers of market evolution. The regulatory landscapes are examined, highlighting how standards for safety and energy consumption impact product development and market access. Substitute products, such as natural ventilation systems and advanced cooling technologies, are assessed for their competitive influence. End-user profiles, ranging from industrial machinery to consumer electronics, are profiled to understand diverse demand patterns. Furthermore, Mergers & Acquisitions (M&A) activities are scrutinized, with a focus on deal values exceeding ten million and their implications for market consolidation and strategic positioning.

- Market Concentration: Analysis of dominant players and their estimated market share.

- Innovation Catalysts: Identification of technological advancements driving product development.

- Regulatory Landscapes: Examination of standards impacting market entry and product design.

- Substitute Products: Assessment of alternative cooling solutions and their market penetration.

- End-User Profiles: Detailed understanding of key consumer segments and their requirements.

- M&A Activities: Evaluation of strategic acquisitions and their impact on market structure, with estimated deal values in the millions.

Electronic Fan Industry Evolution

The Electronic Fan industry is undergoing a profound transformation, characterized by robust market growth trajectories, rapid technological advancements, and a significant shift in consumer demands. Over the Study Period from 2019 to 2033, the market has witnessed a compound annual growth rate (CAGR) of approximately 7.8%, reaching an estimated market size of over 15 million units by 2025. This growth is primarily fueled by the escalating demand for efficient cooling solutions across a multitude of applications, from high-performance computing to critical industrial processes. Technological advancements are at the forefront of this evolution, with innovations in brushless DC (BLDC) motor technology leading to increased energy efficiency, reduced noise levels, and extended product lifespans. The adoption of advanced materials, such as lightweight alloys and high-temperature resistant plastics, further enhances fan performance and durability. Consumer demand is increasingly skewed towards smart and connected fans, capable of remote control and integration into broader IoT ecosystems. This trend is particularly evident in consumer electronics and smart home applications, where user convenience and energy savings are paramount. The market for these advanced fans is projected to grow at a CAGR of over 9.2% during the Forecast Period of 2025–2033. Furthermore, the increasing sophistication of industrial automation and the burgeoning data center industry are creating sustained demand for high-reliability and high-performance electronic fans, contributing to a market value projected to exceed twenty million in revenue by 2033. The historical period from 2019 to 2024 has laid the groundwork for this accelerated growth, with consistent investments in research and development.

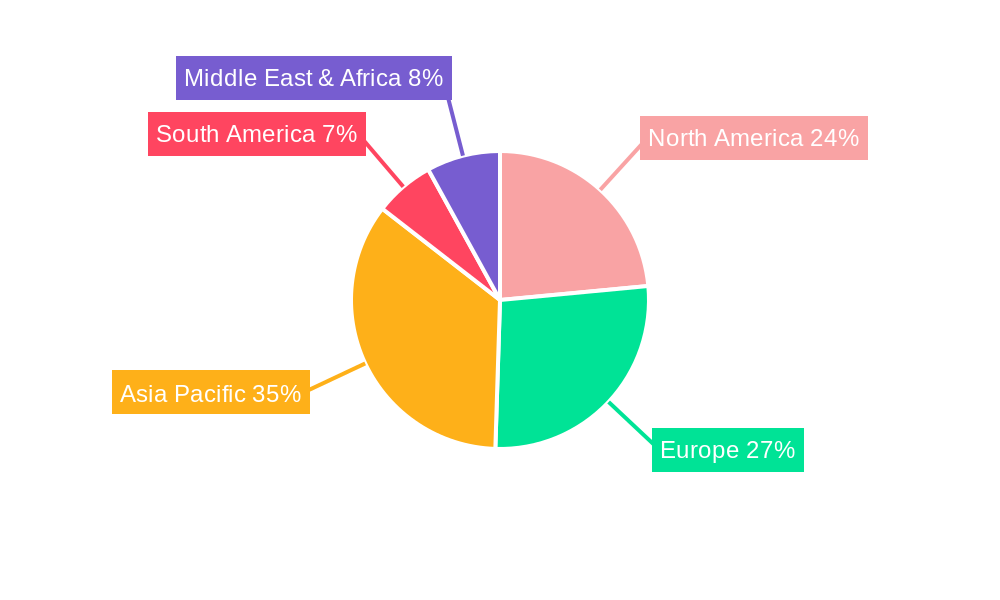

Leading Regions, Countries, or Segments in Electronic Fan

The global Electronic Fan market exhibits significant regional dominance and segment specialization, driven by a confluence of economic, technological, and regulatory factors. North America and Asia-Pacific stand out as leading regions, collectively accounting for over 60% of the global market share. This dominance is propelled by substantial investments in manufacturing capabilities, a strong presence of key industry players, and a rapidly expanding industrial and consumer electronics sectors. For instance, the United States, a major hub for technological innovation, contributes significantly to the demand for high-performance Axial Electronic Fans, estimated at over 5 million units annually within the PC segment alone. Regulatory support for energy-efficient cooling solutions in countries like China and South Korea further bolsters market growth.

Within the application segments, Electrical Cabinets represent a critical and consistently growing market. The increasing complexity and density of electrical and electronic equipment in industrial settings, data centers, and telecommunications infrastructure necessitate robust and reliable cooling solutions. The demand for Electronic Fans in this segment is projected to grow at a CAGR of approximately 8.5% from 2025 to 2033, reaching an estimated volume of over 8 million units. This growth is underpinned by stringent safety regulations and the need to prevent equipment overheating, which can lead to costly downtime. The market value for this segment alone is expected to surpass fifteen million by 2033.

- Application Segment Dominance: Electrical Cabinets emerge as a key driver of market growth due to critical cooling requirements in industrial and data center applications, projected to exceed 8 million units in demand by 2033.

- Regional Leadership: North America and Asia-Pacific lead due to advanced manufacturing, high technological adoption, and supportive industrial policies, with an estimated combined market share exceeding 60%.

- Type Specialization: Axial Electronic Fans dominate applications requiring high airflow and low static pressure, particularly in consumer electronics and PCs, with an estimated demand of over 5 million units in the PC segment by 2025.

- Investment Trends: Significant capital expenditure in R&D for energy-efficient and miniaturized fans in both developed and emerging economies.

- Regulatory Support: Government initiatives promoting energy conservation and stringent safety standards in electrical enclosures are key growth accelerators, particularly in countries like Germany and Japan.

Electronic Fan Product Innovations

Product innovation in the Electronic Fan market is characterized by a relentless pursuit of enhanced performance, energy efficiency, and miniaturization. Leading companies are pioneering advancements in aerodynamic design for improved airflow and reduced noise levels, with some next-generation Axial Electronic Fans achieving noise outputs below 20 decibels. The integration of smart sensors and IoT capabilities allows for intelligent fan control, optimizing cooling based on real-time temperature data and user preferences. Furthermore, the development of specialized fans for extreme environments, capable of operating at temperatures exceeding 100°C or in high-humidity conditions, expands application possibilities. Material science innovations are leading to the use of lighter, more durable composite materials, contributing to a lifespan of over 50,000 operational hours for premium products.

Propelling Factors for Electronic Fan Growth

The Electronic Fan market is propelled by several key growth drivers. The exponential growth of the data center industry, demanding increasingly sophisticated cooling solutions to manage heat generated by high-density servers, is a significant factor. Technological advancements in areas like Artificial Intelligence and the Internet of Things (IoT) necessitate powerful and efficient cooling for embedded systems and consumer electronics, driving demand for miniaturized and intelligent fans. Furthermore, stringent energy efficiency regulations worldwide are compelling manufacturers to develop and adopt more power-saving fan technologies, such as BLDC motors. The expanding automotive sector, with its increasing reliance on electronic components requiring effective thermal management, also contributes to market expansion.

Obstacles in the Electronic Fan Market

Despite robust growth, the Electronic Fan market faces several obstacles. Intense price competition, particularly from manufacturers in low-cost regions, can squeeze profit margins for established players. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and increased lead times, impacting production schedules and overall market stability. The high cost of research and development for cutting-edge technologies can be a barrier to entry for smaller companies. Additionally, the maturity of some application segments, like basic computer cooling, leads to slower growth rates compared to emerging sectors.

Future Opportunities in Electronic Fan

Emerging opportunities in the Electronic Fan market are diverse and promising. The burgeoning electric vehicle (EV) market presents a significant avenue for growth, as EVs require advanced thermal management systems for batteries, motors, and cabin comfort. The expansion of smart home ecosystems and the increasing adoption of connected devices create demand for intelligent and integrated fan solutions. Furthermore, the growing focus on sustainability and energy conservation in industrial processes opens doors for high-efficiency and eco-friendly fan designs. The development of advanced cooling solutions for renewable energy infrastructure, such as wind turbines and solar panels, also represents a substantial untapped market.

Major Players in the Electronic Fan Ecosystem

- Alfa Electric

- BlackNoise

- COSMOTEC

- ebm-papst

- ECOFIT & ETRI

- ELDON

- Fandis

- Globe Motors

- Micronel

- Minebea

- PFANNENBERG

- PSC MOTOR AND FAN

- Seifert Systems GmbH

- STEGO

- Wenling Dayang Electric Appliances Factory

- Wenzhou Jasonfan Manufacture

Key Developments in Electronic Fan Industry

- 2024/01: ebm-papst launches a new series of energy-efficient EC centrifugal fans with integrated smart control capabilities, targeting industrial automation applications.

- 2023/07: Globe Motors expands its product line with a focus on high-reliability fans for critical medical equipment, meeting stringent industry standards.

- 2022/11: MinebeaMitsumi invests 10 million in expanding its manufacturing capacity for miniaturized fans used in portable electronics and wearable devices.

- 2021/05: Fandis acquires a smaller competitor specializing in thermal management solutions for enclosures, enhancing its market presence in Europe.

- 2020/09: ECOFIT & ETRI introduces a new range of low-noise fans designed for server rooms and data centers, offering improved thermal efficiency.

Strategic Electronic Fan Market Forecast

The strategic Electronic Fan market forecast indicates sustained and robust growth, driven by innovation and expanding application frontiers. The increasing demand for energy-efficient and intelligent cooling solutions across industrial, consumer, and automotive sectors will be the primary catalyst. Advancements in materials science and motor technology will lead to the development of higher-performance, quieter, and more durable fans. The market's expansion into emerging sectors like electric vehicles and renewable energy infrastructure presents significant growth potential. With an estimated market size poised to exceed thirty million by 2033, strategic investments in research and development and a focus on emerging market needs will be crucial for stakeholders to capitalize on the opportunities ahead.

Electronic Fan Segmentation

-

1. Application

- 1.1. PC

- 1.2. Electrical Cabinets

- 1.3. Other

-

2. Types

- 2.1. Axial Electronic Fan

- 2.2. Centrifugal Electronic Fan

- 2.3. Other

Electronic Fan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electronic Fan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. PC

- 5.1.2. Electrical Cabinets

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Axial Electronic Fan

- 5.2.2. Centrifugal Electronic Fan

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. PC

- 6.1.2. Electrical Cabinets

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Axial Electronic Fan

- 6.2.2. Centrifugal Electronic Fan

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. PC

- 7.1.2. Electrical Cabinets

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Axial Electronic Fan

- 7.2.2. Centrifugal Electronic Fan

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. PC

- 8.1.2. Electrical Cabinets

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Axial Electronic Fan

- 8.2.2. Centrifugal Electronic Fan

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. PC

- 9.1.2. Electrical Cabinets

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Axial Electronic Fan

- 9.2.2. Centrifugal Electronic Fan

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electronic Fan Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. PC

- 10.1.2. Electrical Cabinets

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Axial Electronic Fan

- 10.2.2. Centrifugal Electronic Fan

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Alfa Electric

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BlackNoise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 COSMOTEC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ebm-papst

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ECOFIT & ETRI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ELDON

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fandis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Globe Motors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Micronel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Minebea

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PFANNENBERG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PSC MOTOR AND FAN

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Seifert Systems GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 STEGO

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wenling Dayang Electric Appliances Factory

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Wenzhou Jasonfan Manufacture

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Alfa Electric

List of Figures

- Figure 1: Global Electronic Fan Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Electronic Fan Revenue (million), by Application 2024 & 2032

- Figure 3: North America Electronic Fan Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Electronic Fan Revenue (million), by Types 2024 & 2032

- Figure 5: North America Electronic Fan Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Electronic Fan Revenue (million), by Country 2024 & 2032

- Figure 7: North America Electronic Fan Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Electronic Fan Revenue (million), by Application 2024 & 2032

- Figure 9: South America Electronic Fan Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Electronic Fan Revenue (million), by Types 2024 & 2032

- Figure 11: South America Electronic Fan Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Electronic Fan Revenue (million), by Country 2024 & 2032

- Figure 13: South America Electronic Fan Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Electronic Fan Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Electronic Fan Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Electronic Fan Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Electronic Fan Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Electronic Fan Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Electronic Fan Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Electronic Fan Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Electronic Fan Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Electronic Fan Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Electronic Fan Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Electronic Fan Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Electronic Fan Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electronic Fan Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Electronic Fan Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Electronic Fan Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Electronic Fan Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Electronic Fan Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Electronic Fan Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electronic Fan Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Electronic Fan Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Electronic Fan Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Electronic Fan Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Electronic Fan Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Electronic Fan Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Electronic Fan Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Electronic Fan Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Electronic Fan Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Electronic Fan Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Fan?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Electronic Fan?

Key companies in the market include Alfa Electric, BlackNoise, COSMOTEC, ebm-papst, ECOFIT & ETRI, ELDON, Fandis, Globe Motors, Micronel, Minebea, PFANNENBERG, PSC MOTOR AND FAN, Seifert Systems GmbH, STEGO, Wenling Dayang Electric Appliances Factory, Wenzhou Jasonfan Manufacture.

3. What are the main segments of the Electronic Fan?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Fan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Fan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Fan?

To stay informed about further developments, trends, and reports in the Electronic Fan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence