Key Insights

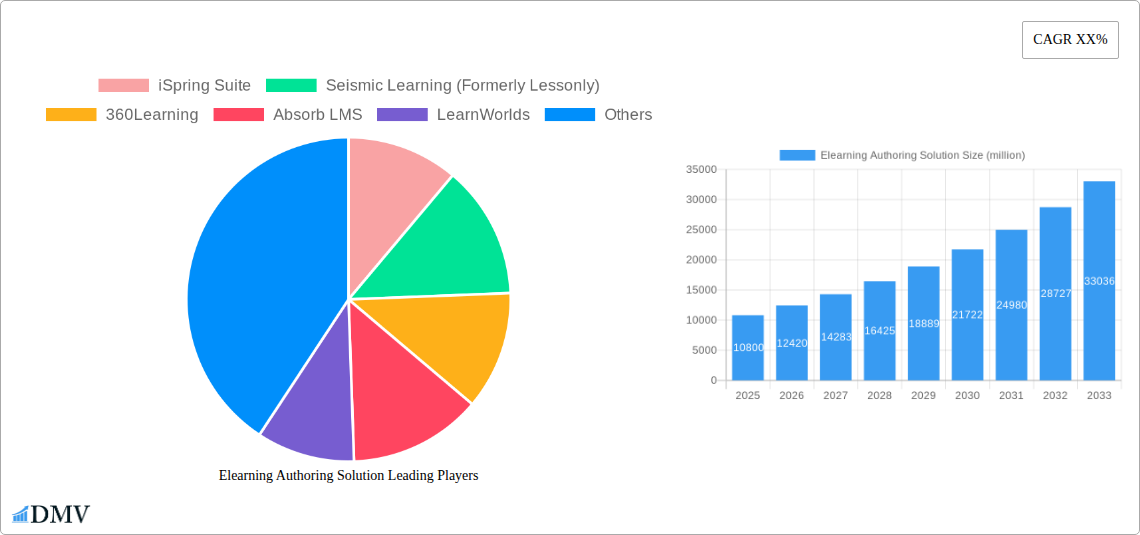

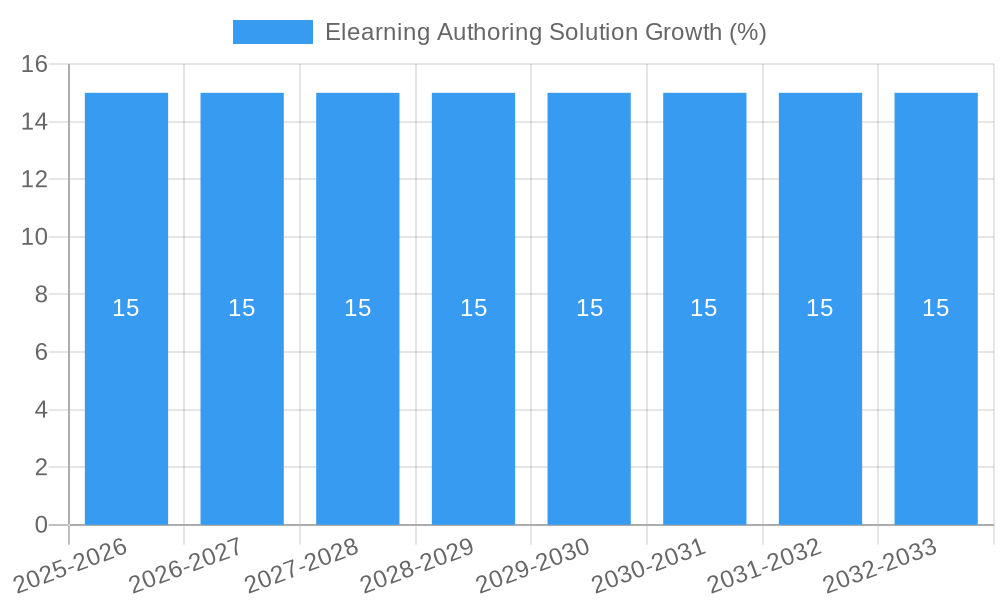

The eLearning Authoring Solution market is poised for significant expansion, estimated at approximately \$10,800 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust growth is fueled by the accelerating digital transformation across industries and the increasing demand for scalable, engaging, and accessible learning experiences. Enterprises of all sizes, from large corporations to small and medium-sized businesses (SMEs), are recognizing the strategic imperative of investing in sophisticated eLearning authoring tools to streamline employee training, enhance skill development, and foster a culture of continuous learning. The flexibility and cost-effectiveness offered by cloud-based solutions are driving their widespread adoption, allowing organizations to deploy and manage training content efficiently without substantial upfront infrastructure investment. Conversely, on-premises solutions continue to cater to organizations with stringent data security and compliance requirements. Key market drivers include the burgeoning need for remote and hybrid workforces, the continuous evolution of instructional design methodologies, and the integration of AI and gamification features to boost learner engagement and knowledge retention.

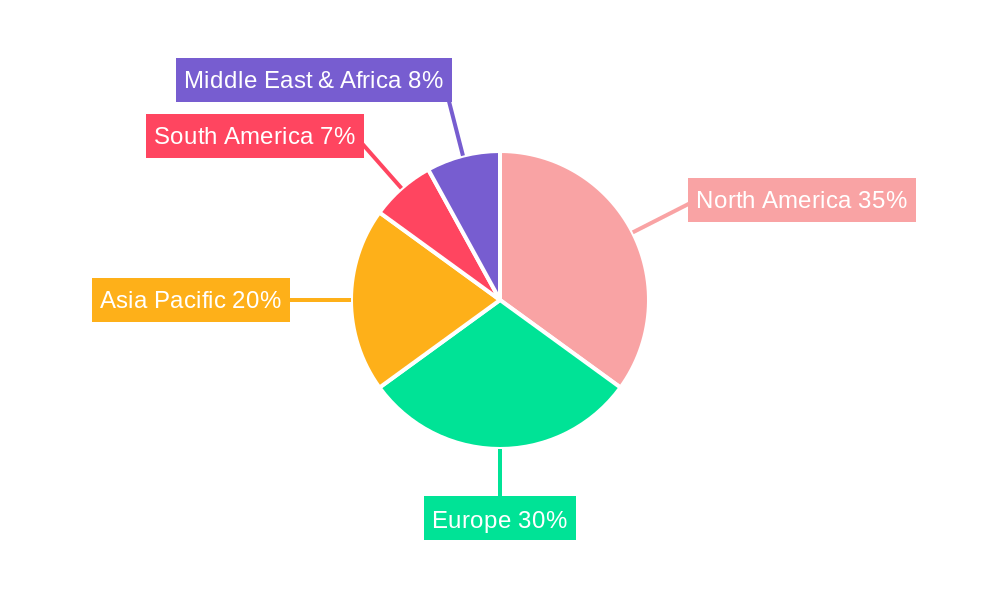

The eLearning Authoring Solution landscape is characterized by a dynamic competitive environment with a diverse range of players, from established giants like Adobe Captivate and Articulate 360 to innovative platforms such as 360Learning and LearnWorlds, alongside specialized microlearning providers like 7taps Microlearning. This competition fosters continuous innovation, pushing vendors to offer advanced features like interactive content creation, multimedia integration, learning analytics, and personalized learning paths. Emerging trends such as the demand for mobile-first learning experiences and the incorporation of immersive technologies like VR/AR are further shaping the market's trajectory. However, certain restraints, including the initial cost of advanced authoring tools, the need for specialized skills to leverage their full potential, and potential resistance to adopting new learning technologies within some organizations, may temper the pace of growth in specific segments. Geographically, North America and Europe are anticipated to lead the market due to their early adoption of digital learning technologies and strong corporate training initiatives, while the Asia Pacific region is expected to witness the fastest growth driven by its rapidly expanding economies and increasing focus on upskilling the workforce.

Unlocking the Future of Learning: Comprehensive Elearning Authoring Solution Market Report

This in-depth report delivers a strategic analysis of the Elearning Authoring Solution market, providing critical insights for stakeholders, from L&D professionals to C-suite executives. Covering a dynamic landscape from 2019 to 2033, with a base and estimated year of 2025 and a robust forecast period of 2025–2033, this report is your definitive guide to understanding market composition, industry evolution, regional dominance, product innovations, growth drivers, and future opportunities. Gain a competitive edge with data-backed strategies and actionable intelligence on this cloud-based and on-premises solution market, crucial for Large Enterprises and SMEs alike.

Elearning Authoring Solution Market Composition & Trends

The global Elearning Authoring Solution market exhibits a moderately concentrated composition, with key players driving significant innovation. Market share distribution is influenced by robust technological advancements and a growing demand for engaging and accessible learning experiences. Innovation catalysts include AI-powered content creation, personalized learning pathways, and immersive technologies like VR/AR integration. The regulatory landscape, while evolving, is largely supportive of digital learning initiatives aimed at upskilling workforces. Substitute products, such as traditional classroom training and ad-hoc content creation tools, are increasingly being outpaced by the specialized functionalities of dedicated authoring solutions. End-user profiles span diverse industries, with a strong emphasis on corporate training, higher education, and professional development. Mergers and Acquisitions (M&A) activities, with estimated deal values in the hundreds of millions, are actively consolidating the market and expanding service offerings.

- Market Concentration: Dominated by a blend of established giants and agile innovators.

- Innovation Catalysts: AI, personalization, gamification, microlearning, and mobile accessibility.

- Regulatory Landscape: Favorable policies supporting digital skills and lifelong learning initiatives.

- Substitute Products: Traditional training, basic document editors.

- End-User Profiles: Corporate L&D, HR, Sales Enablement, Higher Education, Government.

- M&A Deal Values: Expected to reach several hundred million in strategic acquisitions.

Elearning Authoring Solution Industry Evolution

The Elearning Authoring Solution industry has witnessed a transformative evolution, characterized by exponential growth trajectories and a paradigm shift in learning delivery. From 2019 to 2024, the historical period showcased a steady upward trend, fueled by increasing digital literacy and the initial adoption of remote work models. The base year of 2025 marks a pivotal point, with further acceleration anticipated as organizations fully embrace digital learning strategies. Technological advancements have been at the forefront of this evolution. The integration of Artificial Intelligence (AI) for automated content generation, intelligent feedback mechanisms, and personalized learning path recommendations has revolutionized content creation. Natural Language Processing (NLP) is enabling more intuitive authoring experiences, while SCORM and xAPI compliance ensures interoperability and robust data analytics.

Shifting consumer demands have also played a crucial role. Learners increasingly expect engaging, interactive, and self-paced learning experiences that can be accessed anytime, anywhere, on any device. This has driven the demand for authoring solutions that support multimedia integration, gamification, microlearning modules, and social learning features. The rise of the gig economy and the continuous need for upskilling and reskilling have further amplified the importance of flexible and scalable elearning solutions.

The forecast period of 2025–2033 is projected to see continued robust growth, with an estimated Compound Annual Growth Rate (CAGR) of over 15%. This growth will be propelled by the increasing adoption of blended learning models, the demand for compliance training, and the strategic use of elearning for employee onboarding and development. Adoption metrics indicate a significant increase in the percentage of organizational training budgets allocated to elearning solutions, expected to surpass 60% by 2028. The market is also seeing a surge in demand for solutions that offer robust analytics and reporting capabilities, enabling organizations to measure the effectiveness of their elearning initiatives and demonstrate ROI. Furthermore, the growing emphasis on corporate social responsibility and employee well-being is driving the development of elearning modules focused on soft skills, leadership development, and mental health awareness. The industry is poised for further innovation with the exploration of extended reality (XR) technologies and the metaverse for immersive learning experiences.

Leading Regions, Countries, or Segments in Elearning Authoring Solution

The Elearning Authoring Solution market’s dominance is clearly established in North America, driven by a confluence of factors including a strong technological infrastructure, a culture of continuous learning, and significant corporate investment in employee development. The United States, in particular, stands out as a key country due to its large enterprise sector, proactive adoption of new technologies, and a well-established ecosystem of elearning providers and content creators. The dominance is further amplified by substantial government support for digital education and workforce development initiatives.

In terms of application segments, Large Enterprises represent the most dominant segment. These organizations possess the financial resources, the complex training needs, and the strategic foresight to invest in comprehensive elearning authoring solutions. Their requirements often involve the creation of extensive training libraries, compliance modules, onboarding programs, and sales enablement content, necessitating robust, scalable, and feature-rich platforms.

The Cloud-Based type segment also exhibits unparalleled dominance. The scalability, accessibility, and cost-effectiveness of cloud-based solutions are highly attractive to businesses of all sizes, eliminating the need for significant on-premises infrastructure and IT support. This model facilitates seamless updates, global accessibility, and faster deployment, aligning perfectly with the agile demands of modern businesses.

- Dominant Region: North America, with the United States leading due to strong technological adoption and investment in L&D.

- Dominant Application Segment: Large Enterprises, requiring sophisticated, scalable, and feature-rich solutions for diverse training needs.

- Dominant Type: Cloud-Based Solutions, offering flexibility, scalability, and reduced IT overhead.

- Key Drivers of Dominance (North America & Large Enterprises):

- High R&D investment in elearning technologies.

- Proactive government policies supporting digital skills.

- Prevalence of multinational corporations with global training needs.

- Strong demand for data analytics and ROI measurement in training.

- Rapid adoption of AI and emerging technologies in learning design.

Elearning Authoring Solution Product Innovations

Product innovation in the Elearning Authoring Solution market is rapidly advancing, focusing on enhancing user experience and content effectiveness. Cutting-edge solutions are now integrating AI-powered content generation tools, enabling faster creation of interactive modules and personalized learning paths. Advanced analytics dashboards provide deeper insights into learner engagement and course completion rates, allowing for continuous improvement. The incorporation of gamification elements, immersive AR/VR capabilities, and microlearning formats are transforming how knowledge is imparted and retained, offering unique selling propositions that drive adoption and learner satisfaction. Performance metrics are consistently improving, with faster rendering times, broader device compatibility, and seamless integration with existing HR and LMS platforms.

Propelling Factors for Elearning Authoring Solution Growth

Several key growth drivers are propelling the Elearning Authoring Solution market forward. Technological advancements, particularly in AI and machine learning, are enabling more intuitive and efficient content creation. The increasing global adoption of remote and hybrid work models necessitates robust digital learning solutions for employee onboarding, upskilling, and reskilling. Economic factors, such as the need for cost-effective training alternatives and a focus on improving workforce productivity, also contribute significantly. Regulatory influences, such as mandates for compliance training in various industries, further boost demand.

- Technological Advancements: AI-driven content creation, VR/AR integration, advanced analytics.

- Remote Work Adoption: Essential for distributed workforces needing consistent training.

- Cost-Effectiveness: Elearning offers a more scalable and budget-friendly alternative to traditional training.

- Productivity Enhancement: Focus on upskilling and reskilling to meet evolving industry demands.

- Regulatory Compliance: Increasing demand for mandated training in sectors like healthcare and finance.

Obstacles in the Elearning Authoring Solution Market

Despite strong growth, the Elearning Authoring Solution market faces several obstacles. Initial implementation costs and the need for specialized technical expertise can be a barrier, particularly for SMEs. Resistance to change within organizations and the challenge of creating truly engaging and interactive content that combats learner fatigue are ongoing concerns. Supply chain disruptions, while less direct for software, can impact the availability of specialized hardware for immersive learning experiences. Stringent data privacy regulations and cybersecurity concerns require robust solutions to ensure learner data protection.

- High Initial Investment: Can deter smaller organizations.

- Learner Engagement Challenges: Designing content that truly captivates.

- Technical Expertise Requirements: Need for skilled instructional designers.

- Cybersecurity & Data Privacy: Ensuring compliance with evolving regulations.

- Integration Complexities: Seamlessly connecting with existing enterprise systems.

Future Opportunities in Elearning Authoring Solution

The Elearning Authoring Solution market is ripe with future opportunities. The burgeoning demand for personalized and adaptive learning experiences, powered by AI, presents a significant avenue for growth. Expansion into emerging markets, particularly in developing economies with a growing need for digital skills, offers vast potential. The integration of gamification and immersive technologies like VR/AR for experiential learning will continue to innovate the market. Furthermore, the increasing focus on soft skills development and leadership training through elearning platforms will open new segments. The rise of the creator economy within elearning also presents opportunities for specialized tools catering to individual educators and small content creation teams.

- AI-Powered Personalization: Adaptive learning paths and intelligent content recommendations.

- Emerging Market Expansion: Tapping into regions with increasing digital adoption.

- Immersive Learning Technologies: VR/AR for hands-on simulations and experiences.

- Soft Skills & Leadership Development: Expanding content beyond technical skills.

- Microlearning & Bite-Sized Content: Catering to shorter attention spans and mobile learning.

Major Players in the Elearning Authoring Solution Ecosystem

- iSpring Suite

- Seismic Learning (Formerly Lessonly)

- 360Learning

- Absorb LMS

- LearnWorlds

- Articulate 360

- Udemy Business

- Zenler

- Adobe Captivate

- Articulate Storyline

- EdApp

- LearnUpon

- Litmos

- Easygenerator

- Tovuti

- Visme

- 7taps Microlearning

- Elucidat

- Brainshark

- Kaltura

- Inkling

- SkyPrep

Key Developments in Elearning Authoring Solution Industry

- 2023: Launch of AI-powered content generation features by several leading providers, significantly reducing authoring time.

- 2023: Increased integration of xAPI for advanced learning analytics and personalized learning paths.

- 2024: Major mergers and acquisitions aimed at consolidating market share and expanding platform capabilities in the hundreds of millions of dollars.

- 2024: Enhanced support for augmented reality (AR) and virtual reality (VR) content creation, offering immersive learning experiences.

- 2025 (Projected): Widespread adoption of adaptive learning technologies, personalizing content delivery based on individual learner progress.

- 2025 (Projected): Focus on sustainability in elearning development and delivery, with energy-efficient platforms.

- 2026 (Projected): Increased emphasis on social learning features and collaborative content creation within authoring tools.

Strategic Elearning Authoring Solution Market Forecast

The strategic forecast for the Elearning Authoring Solution market indicates continued robust growth, driven by the relentless pursuit of agile and effective learning strategies by organizations worldwide. The market is poised to benefit from ongoing technological innovation, particularly in AI-driven personalization and immersive learning experiences. The increasing demand for upskilling and reskilling in response to rapid technological shifts and evolving job markets will remain a significant catalyst. Opportunities in emerging economies and the expanding scope of elearning for soft skills development further underscore the market's expansive potential. Organizations investing in user-friendly, data-rich, and adaptable elearning authoring solutions will be best positioned to capitalize on these trends and achieve their learning objectives.

Elearning Authoring Solution Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. Cloud Based

- 2.2. On-premises

Elearning Authoring Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Elearning Authoring Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Elearning Authoring Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 iSpring Suite

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seismic Learning (Formerly Lessonly)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 360Learning

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Absorb LMS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LearnWorlds

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Articulate 360

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Udemy Business

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zenler

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adobe Captivate

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Articulate Storyline

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EdApp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LearnUpon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Litmos

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Easygenerator

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tovuti

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Visme

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 7taps Microlearning

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Elucidat

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Brainshark

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Kaltura

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Inkling

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 SkyPrep

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 iSpring Suite

List of Figures

- Figure 1: Global Elearning Authoring Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Elearning Authoring Solution Revenue (million), by Application 2024 & 2032

- Figure 3: North America Elearning Authoring Solution Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Elearning Authoring Solution Revenue (million), by Types 2024 & 2032

- Figure 5: North America Elearning Authoring Solution Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Elearning Authoring Solution Revenue (million), by Country 2024 & 2032

- Figure 7: North America Elearning Authoring Solution Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Elearning Authoring Solution Revenue (million), by Application 2024 & 2032

- Figure 9: South America Elearning Authoring Solution Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Elearning Authoring Solution Revenue (million), by Types 2024 & 2032

- Figure 11: South America Elearning Authoring Solution Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Elearning Authoring Solution Revenue (million), by Country 2024 & 2032

- Figure 13: South America Elearning Authoring Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Elearning Authoring Solution Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Elearning Authoring Solution Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Elearning Authoring Solution Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Elearning Authoring Solution Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Elearning Authoring Solution Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Elearning Authoring Solution Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Elearning Authoring Solution Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Elearning Authoring Solution Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Elearning Authoring Solution Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Elearning Authoring Solution Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Elearning Authoring Solution Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Elearning Authoring Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Elearning Authoring Solution Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Elearning Authoring Solution Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Elearning Authoring Solution Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Elearning Authoring Solution Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Elearning Authoring Solution Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Elearning Authoring Solution Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Elearning Authoring Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Elearning Authoring Solution Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Elearning Authoring Solution Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Elearning Authoring Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Elearning Authoring Solution Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Elearning Authoring Solution Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Elearning Authoring Solution Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Elearning Authoring Solution Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Elearning Authoring Solution Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Elearning Authoring Solution Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Elearning Authoring Solution?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Elearning Authoring Solution?

Key companies in the market include iSpring Suite, Seismic Learning (Formerly Lessonly), 360Learning, Absorb LMS, LearnWorlds, Articulate 360, Udemy Business, Zenler, Adobe Captivate, Articulate Storyline, EdApp, LearnUpon, Litmos, Easygenerator, Tovuti, Visme, 7taps Microlearning, Elucidat, Brainshark, Kaltura, Inkling, SkyPrep.

3. What are the main segments of the Elearning Authoring Solution?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Elearning Authoring Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Elearning Authoring Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Elearning Authoring Solution?

To stay informed about further developments, trends, and reports in the Elearning Authoring Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence