Key Insights

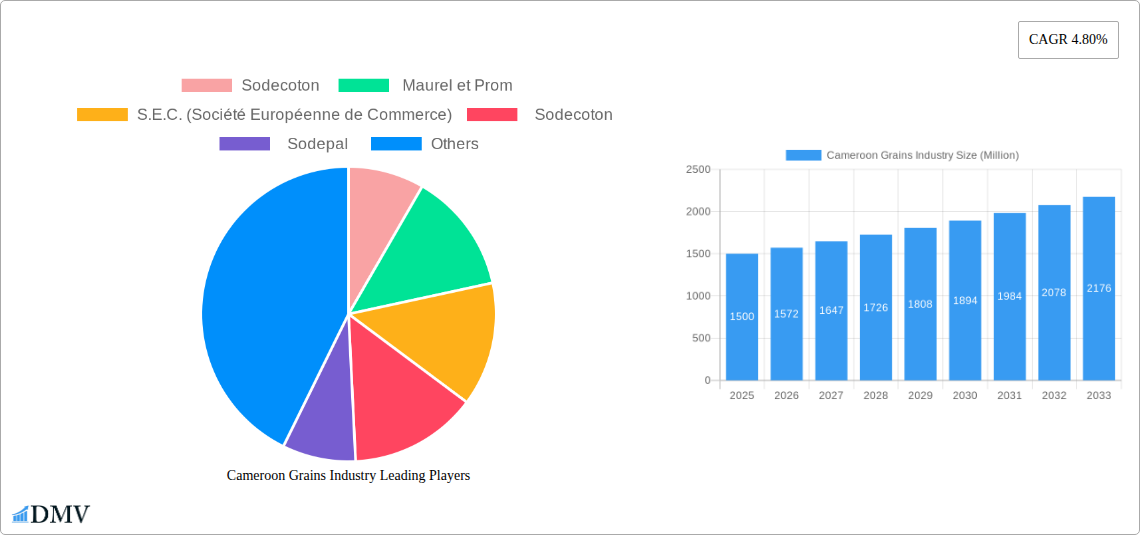

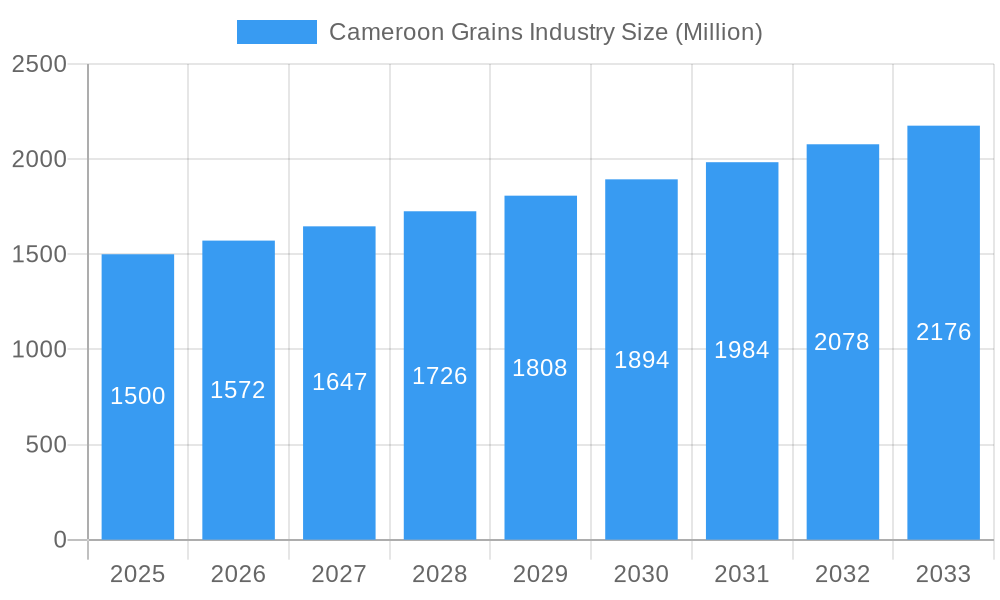

The Cameroon grains industry, encompassing cereals, pulses, and oilseeds, presents a significant market opportunity with a projected Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033. This growth is fueled by several key factors. Rising population and increasing urbanization drive demand for staple grains like maize, rice, and millet. Furthermore, a growing middle class with enhanced purchasing power contributes to increased consumption of processed grain products. Government initiatives promoting agricultural development and food security also play a crucial role in stimulating market expansion. However, challenges remain. Climate change poses a significant risk to crop yields, while infrastructural limitations hinder efficient transportation and distribution networks, impacting market access and price stability. Competition from imported grains also exerts pressure on local producers. The industry is segmented by grain type, with cereals holding the largest market share, followed by pulses and oilseeds. Major players such as Sodecoton, Maurel et Prom, and Cameroon Development Corporation (CDC) dominate the market, leveraging their established distribution networks and processing capabilities. The price trends in pulses and oilseeds are influenced by global market fluctuations and domestic supply dynamics. Opportunities for growth exist in improving agricultural practices, enhancing value-added processing, and developing sustainable supply chains. Strategic partnerships between private sector players and the government are essential for addressing the challenges and unlocking the full potential of the Cameroon grains industry.

Cameroon Grains Industry Market Size (In Billion)

The forecast period of 2025-2033 anticipates a steady expansion of the Cameroon grains market, driven by continued population growth and increasing demand for diverse grain-based products. The industry will benefit from investments in agricultural technology and infrastructure upgrades that enhance productivity and efficiency. The ongoing efforts to diversify agricultural production and improve food security will contribute significantly to market growth. While challenges related to climate change and market competition persist, the overall outlook remains positive. The industry’s dynamism is further underscored by the involvement of both large multinational corporations and smaller local producers, creating a competitive and evolving landscape. The focus on value addition and export opportunities promises to enhance profitability and contribute positively to the country's economy.

Cameroon Grains Industry Company Market Share

Cameroon Grains Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Cameroon grains industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market trends, competitive dynamics, and future growth prospects, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The analysis encompasses key segments like cereals, pulses, and oilseeds, revealing the intricate workings of this vital sector in Cameroon's economy. The report is replete with data points, providing a granular understanding of market size, growth rates, and future potential, all valued in Millions.

Cameroon Grains Industry Market Composition & Trends

The Cameroon grains industry is characterized by a moderately concentrated market, with several key players vying for market share. Sodecoton, Sodepal, and the Cameroon Development Corporation (CDC) hold significant positions, particularly within the cotton and oilseed sectors. However, the presence of smaller, regional players and the potential for further consolidation through mergers and acquisitions (M&A) suggests a dynamic landscape. Innovation is driven by the need for improved crop yields, enhanced processing technologies, and value-added product development. Regulatory changes, including import/export policies and agricultural subsidies, significantly influence market dynamics. Substitute products, like imported grains, exert competitive pressure, especially during periods of local supply shortages. End-users encompass food processors, livestock farmers, and consumers, with the food processing sector displaying significant growth.

- Market Share Distribution (2024 Estimate): Sodecoton (30%), CDC (20%), Sodepal (15%), Others (35%)

- M&A Activity (2019-2024): XX Million in deal value across approximately 5 transactions.

- Innovation Catalysts: Government support for research and development, technological advancements in seed varieties and farming techniques, and increasing consumer demand for value-added products.

- Regulatory Landscape: Subject to government policies on agricultural production, trade, and food safety. The impact of these policies on market access and pricing is notable.

Cameroon Grains Industry Industry Evolution

The Cameroon grains industry has exhibited fluctuating growth trajectories over the historical period (2019-2024), influenced by factors such as weather patterns, global commodity prices, and domestic policies. However, a positive growth trend is projected for the forecast period (2025-2033), driven by increasing population, rising incomes, and government initiatives to enhance agricultural productivity. Technological advancements, including the adoption of improved seeds, precision farming techniques, and mechanization, are key drivers of efficiency gains. Consumer demand is shifting towards processed and value-added grain products, creating opportunities for growth within these sectors. The industry is gradually moving towards more sustainable and climate-resilient practices in response to increasing environmental awareness. While the exact figures are still being calculated, estimates predict that the CAGR (Compound Annual Growth Rate) for the forecast period could be around xx%. The adoption of modern technologies in agriculture is anticipated to reach xx% by 2033.

Leading Regions, Countries, or Segments in Cameroon Grains Industry

The Northern and Adamawa regions of Cameroon are dominant in the production of cereals, pulses, and oilseeds, benefiting from favorable climatic conditions and suitable land for cultivation. The leading segments by type are as follows:

Cereals: Maize and rice dominate, driven by high demand and established cultivation practices. Investment in irrigation infrastructure and improved seed varieties is enhancing production. Government support and agricultural extension services are crucial factors that drive growth.

Pulses: Production is geographically diverse, but certain regions specialize in particular pulses, like cowpeas or beans. Growth is influenced by factors like fluctuating prices, consumer preferences, and competition from imported pulses.

Oilseeds: Cotton remains a significant contributor to the oilseed segment due to established export markets and government support. However, other oilseeds like soybeans and groundnuts have the potential for substantial growth. This potential hinges on investments in processing infrastructure and value-added product development.

Cameroon Grains Industry Product Innovations

Recent innovations include the introduction of improved high-yielding seed varieties resistant to pests and diseases, advancements in post-harvest handling and storage technologies, and the development of value-added grain products such as fortified flours, ready-to-eat meals, and animal feeds. These innovations enhance product quality, shelf-life, and market competitiveness. The adoption of improved seed varieties is enhancing yields and supporting sustainable intensification of agriculture.

Propelling Factors for Cameroon Grains Industry Growth

Several factors are propelling growth in the Cameroon grains industry: increased government investment in agricultural infrastructure and research, expanding domestic demand fueled by population growth and rising incomes, favorable climatic conditions in key production regions, and rising global demand for certain grains, particularly for export. These factors collectively support sustainable industry growth and development.

Obstacles in the Cameroon Grains Industry Market

The Cameroon grains industry faces challenges such as limited access to credit for smallholder farmers, inadequate infrastructure for storage and transportation, fluctuating global commodity prices, and periodic supply chain disruptions due to weather events or political instability. These limitations impact farmers’ ability to access markets and optimize operations. The impact of these factors can be seen in reduced yields and increased production costs.

Future Opportunities in Cameroon Grains Industry

Future opportunities exist in expanding value-added processing to cater to increasing demand for convenience foods, tapping into regional export markets for niche grain products, and adopting precision agriculture technologies to increase yield and efficiency. Investing in improved storage and transport infrastructure will also unlock significant growth potential. Moreover, exploring sustainable farming practices to address climate change concerns presents an important growth pathway.

Major Players in the Cameroon Grains Industry Ecosystem

- Sodecoton

- Maurel et Prom

- S.E.C. (Société Européenne de Commerce)

- Sodepal

- Cameroon Grains

- Intercontinental Grain

- Cameroon Development Corporation (CDC)

- Herakles Farms

- CotonChad

Key Developments in Cameroon Grains Industry Industry

- September 2022: The Ministry of Agriculture and Rural Development and the FAO signed a project to implement the Hand in Hand Initiative, fostering multi-stakeholder partnerships for improved agricultural development. This initiative aims to enhance efficiency and sustainability within the sector.

- May 2022: The World Bank launched a project to combat the food crisis and strengthen food security in Cameroon until 2025, allocating funding to the agriculture sector. This emergency measure supports national food security and resilience efforts.

Strategic Cameroon Grains Industry Market Forecast

The Cameroon grains industry is poised for significant growth over the forecast period (2025-2033), driven by favorable demographic trends, supportive government policies, and technological advancements. Focus on value-added processing, sustainable agriculture practices, and efficient supply chain management will further unlock substantial market potential and ensure long-term growth for this critical sector within Cameroon's economy.

Cameroon Grains Industry Segmentation

-

1. Type

-

1.1. Cereals

- 1.1.1. Production Analysis

- 1.1.2. Consumption Analysis and Market Value

- 1.1.3. Import Market Analysis (Volume and Value)

- 1.1.4. Export Market Analysis (Volume and Value)

- 1.1.5. Price Trend Analysis

- 1.2. Pulses

- 1.3. Oilseeds

-

1.1. Cereals

-

2. Type

-

2.1. Cereals

- 2.1.1. Production Analysis

- 2.1.2. Consumption Analysis and Market Value

- 2.1.3. Import Market Analysis (Volume and Value)

- 2.1.4. Export Market Analysis (Volume and Value)

- 2.1.5. Price Trend Analysis

- 2.2. Pulses

- 2.3. Oilseeds

-

2.1. Cereals

Cameroon Grains Industry Segmentation By Geography

- 1. Cameroon

Cameroon Grains Industry Regional Market Share

Geographic Coverage of Cameroon Grains Industry

Cameroon Grains Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Animal Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cameroon Grains Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cereals

- 5.1.1.1. Production Analysis

- 5.1.1.2. Consumption Analysis and Market Value

- 5.1.1.3. Import Market Analysis (Volume and Value)

- 5.1.1.4. Export Market Analysis (Volume and Value)

- 5.1.1.5. Price Trend Analysis

- 5.1.2. Pulses

- 5.1.3. Oilseeds

- 5.1.1. Cereals

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cereals

- 5.2.1.1. Production Analysis

- 5.2.1.2. Consumption Analysis and Market Value

- 5.2.1.3. Import Market Analysis (Volume and Value)

- 5.2.1.4. Export Market Analysis (Volume and Value)

- 5.2.1.5. Price Trend Analysis

- 5.2.2. Pulses

- 5.2.3. Oilseeds

- 5.2.1. Cereals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cameroon

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sodecoton

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maurel et Prom

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 S.E.C. (Société Européenne de Commerce)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sodecoton

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sodepal

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cameroon Grains

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Intercontinental Grain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cameroon Development Corporation (CDC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Herakles Farms

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CotonChad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sodecoton

List of Figures

- Figure 1: Cameroon Grains Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cameroon Grains Industry Share (%) by Company 2025

List of Tables

- Table 1: Cameroon Grains Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Cameroon Grains Industry Volume Metric Tons Forecast, by Type 2020 & 2033

- Table 3: Cameroon Grains Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Cameroon Grains Industry Volume Metric Tons Forecast, by Type 2020 & 2033

- Table 5: Cameroon Grains Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Cameroon Grains Industry Volume Metric Tons Forecast, by Region 2020 & 2033

- Table 7: Cameroon Grains Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Cameroon Grains Industry Volume Metric Tons Forecast, by Type 2020 & 2033

- Table 9: Cameroon Grains Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Cameroon Grains Industry Volume Metric Tons Forecast, by Type 2020 & 2033

- Table 11: Cameroon Grains Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Cameroon Grains Industry Volume Metric Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cameroon Grains Industry?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Cameroon Grains Industry?

Key companies in the market include Sodecoton , Maurel et Prom , S.E.C. (Société Européenne de Commerce), Sodecoton , Sodepal , Cameroon Grains , Intercontinental Grain, Cameroon Development Corporation (CDC), Herakles Farms, CotonChad .

3. What are the main segments of the Cameroon Grains Industry?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Increasing Demand for Animal Feed.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

September 2022: The Ministery of Agriculture and Rural Development and the Food and Agriculture Organization (FAO) representative in Cameroon, Dr. Athman Mravili, jointly signed a support project for implementing the Hand in Hand Initiative in Cameroon. With this initiative, the organization will help the country establish multi-stakeholder and cross-sectoral partnerships to ensure the country's strong commitment to donors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cameroon Grains Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cameroon Grains Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cameroon Grains Industry?

To stay informed about further developments, trends, and reports in the Cameroon Grains Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence