Key Insights

The Brazil organic fertilizer market, projected at $14.44 million in 2025, is poised for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 9.63% through 2033. This upward trajectory is propelled by heightened consumer consciousness regarding sustainable agriculture, escalating demand for organic produce, and robust government mandates advocating for eco-friendly farming methods nationwide. The widespread adoption of organic cultivation across diverse crop segments, including cash, horticultural, and row crops, is a primary growth driver. While manure and meal-based fertilizers currently lead due to cost efficiency and availability, a growing interest in specialized options like oilcakes and novel formulations signals market diversification. Leading entities such as Adubasul Fertilizantes, Coromandel International Ltd, Plantin, T Stanes and Company Limited, and Sigma AgriScience LLC are strategically enhancing their product offerings and distribution channels to meet burgeoning demand. Nevertheless, potential constraints include elevated production expenses relative to synthetic alternatives and variability in organic product quality.

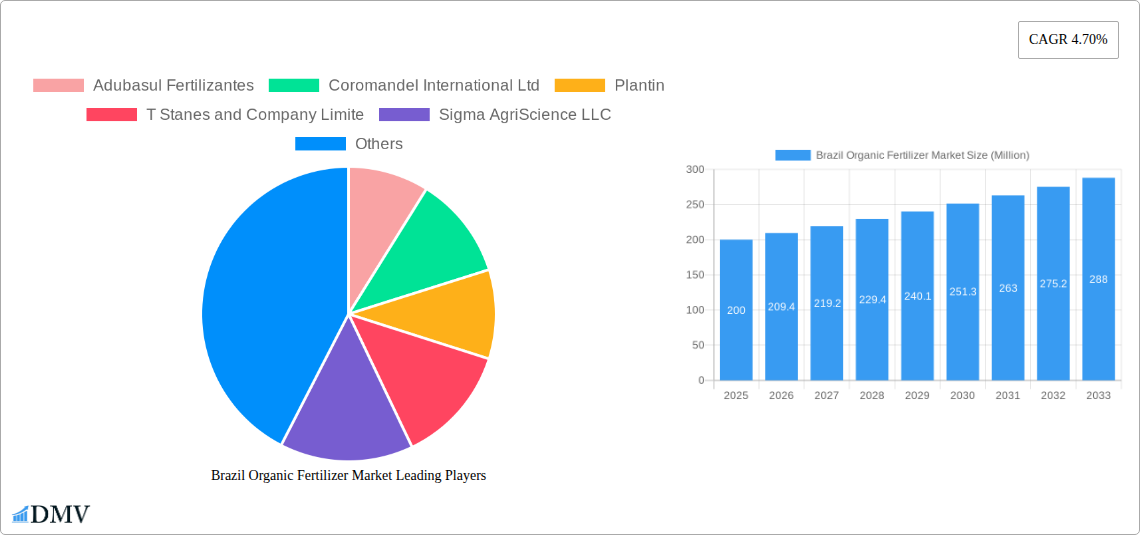

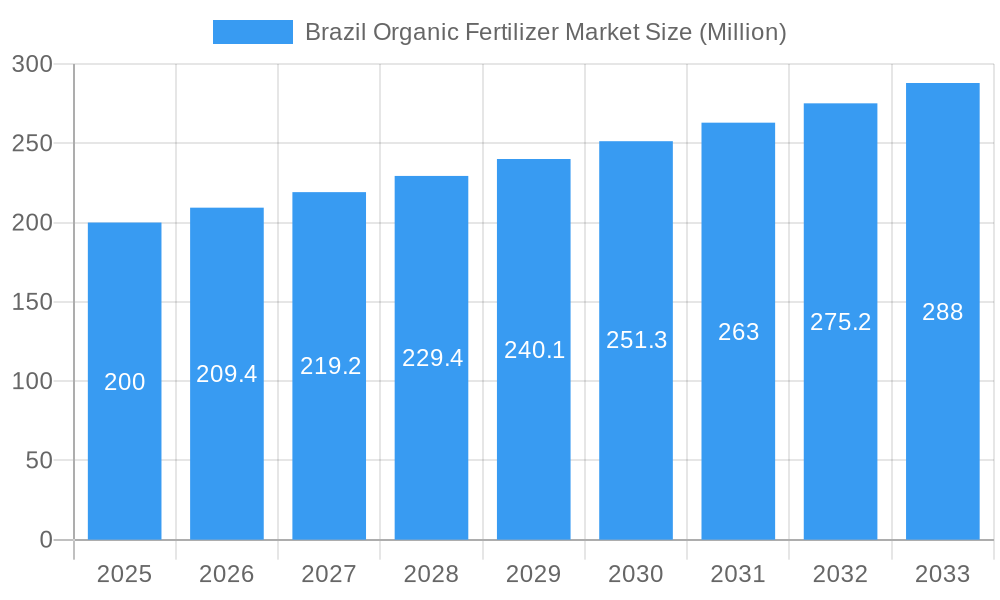

Brazil Organic Fertilizer Market Market Size (In Million)

Market segmentation by fertilizer type (manure, meal-based, oilcakes, others) and crop application (cash crops, horticultural crops, row crops) offers critical insights into market dynamics and consumer preferences. Further granular analysis of regional trends within Brazil will enhance market projections. Sustained growth will be contingent upon supportive governmental policies for organic farming, advancements in organic fertilizer technology, and the seamless integration of organic practices into large-scale agricultural enterprises. The forecast period presents a prime opportunity for innovation, supply chain optimization, and effective communication of organic fertilizer benefits to Brazilian farmers, ensuring continued market growth.

Brazil Organic Fertilizer Market Company Market Share

Brazil Organic Fertilizer Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Brazil organic fertilizer market, encompassing market size, segmentation, key players, growth drivers, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers valuable insights for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Brazil Organic Fertilizer Market Composition & Trends

This section delves into the intricate landscape of the Brazilian organic fertilizer market, examining its structure, influential trends, and regulatory dynamics. We analyze market concentration, revealing the share held by key players like Adubasul Fertilizantes, Coromandel International Ltd, Plantin, T Stanes and Company Limite, and Sigma AgriScience LLC. The report dissects innovation catalysts, highlighting the role of technological advancements in shaping product development and market expansion. Furthermore, we explore the regulatory environment, considering its impact on market access and product compliance. The analysis also includes an assessment of substitute products and their competitive influence, coupled with a detailed examination of end-user profiles across various agricultural sectors. Finally, we meticulously review mergers and acquisitions (M&A) activity, quantifying deal values and assessing their implications for market consolidation and future growth. Market share distribution amongst the top 5 players is estimated at xx% in 2025, with projected M&A deal values reaching xx Million by 2030.

- Market Concentration: Analysis of market share distribution among key players.

- Innovation Catalysts: Examination of technological advancements driving market growth.

- Regulatory Landscape: Assessment of regulations impacting market access and compliance.

- Substitute Products: Evaluation of alternative fertilization methods and their market impact.

- End-User Profiles: Detailed analysis of agricultural sectors utilizing organic fertilizers.

- M&A Activities: Review of mergers and acquisitions, including deal values and strategic implications.

Brazil Organic Fertilizer Market Industry Evolution

This section provides a detailed account of the evolutionary trajectory of the Brazil organic fertilizer market, incorporating quantitative and qualitative insights. We meticulously trace the market's growth trajectory from 2019 to 2024, analyzing historical data and extrapolating trends to forecast growth rates through 2033. The report incorporates detailed analysis of technological advancements, including the introduction of novel organic fertilizer formulations and application techniques, alongside an examination of evolving consumer preferences toward sustainable and environmentally friendly agricultural practices. We analyze the impact of these factors on market dynamics, using specific data points and adoption metrics to support our conclusions. The growth rate from 2019 to 2024 is estimated at xx%, with a projected growth rate of xx% from 2025 to 2033.

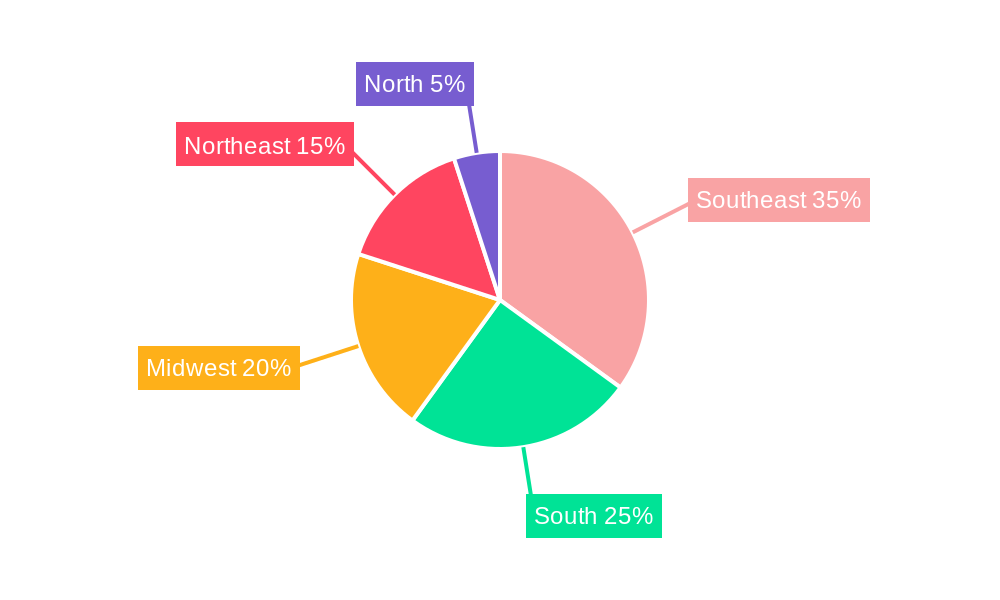

Leading Regions, Countries, or Segments in Brazil Organic Fertilizer Market

This section identifies the dominant segments within the Brazilian organic fertilizer market, focusing on both form (Manure, Meal Based Fertilizers, Oilcakes, Other Organic Fertilizers) and crop type (Cash Crops, Horticultural Crops, Row Crops). We delve into the factors driving the dominance of specific segments, providing a comprehensive analysis of their market share and growth potential.

- Dominant Segment: Identification of the leading segment based on form and crop type.

Key Drivers:

- Investment Trends: Analysis of investment patterns in specific segments.

- Regulatory Support: Assessment of government policies and incentives for specific segments.

In-depth Analysis of Dominance Factors: Detailed explanation of factors contributing to the success of the dominant segment(s). For example, the strong growth of the Manure segment might be attributed to increasing awareness of its benefits and the readily available supply compared to other organic fertilizers. This analysis will be expanded for each dominant segment.

Brazil Organic Fertilizer Market Product Innovations

This section highlights the latest innovations in organic fertilizers, focusing on novel formulations, application technologies, and performance metrics. We showcase unique selling propositions (USPs) of new products, emphasizing their competitive advantages and the technological advancements behind them. This includes examining improved nutrient delivery systems, enhanced soil health benefits, and reduced environmental impact. Expected improvements in fertilizer efficacy could lead to xx% increase in crop yields by 2033.

Propelling Factors for Brazil Organic Fertilizer Market Growth

Several key factors are driving the growth of the Brazil organic fertilizer market. Increasing consumer awareness of the environmental impact of conventional fertilizers and a growing preference for organic produce are significant factors. Government initiatives promoting sustainable agriculture and supportive policies, such as subsidies and tax breaks for organic farming, also play a crucial role. Furthermore, technological advancements in organic fertilizer production and application techniques are boosting efficiency and adoption.

Obstacles in the Brazil Organic Fertilizer Market

The Brazil organic fertilizer market faces certain challenges. Higher production costs compared to conventional fertilizers can hinder wider adoption. Supply chain disruptions, particularly concerning the availability of raw materials, can impact production and pricing. Furthermore, intense competition from established players in the conventional fertilizer market can pose significant hurdles to organic fertilizer market expansion. These factors could negatively impact market growth by approximately xx% annually unless appropriately addressed.

Future Opportunities in Brazil Organic Fertilizer Market

The Brazil organic fertilizer market presents exciting future prospects. The growing demand for organic food products creates a robust market pull, driving increased fertilizer demand. Technological advancements in organic fertilizer production and application are continuously improving efficiency and effectiveness, opening avenues for growth. Additionally, government support for sustainable agriculture and rising consumer awareness of environmental concerns present significant opportunities for market expansion. Expansion into new geographical markets and product diversification will also offer substantial growth potential.

Major Players in the Brazil Organic Fertilizer Market Ecosystem

- Adubasul Fertilizantes

- Coromandel International Ltd [Coromandel International Ltd]

- Plantin

- T Stanes and Company Limite

- Sigma AgriScience LLC

Key Developments in Brazil Organic Fertilizer Market Industry

- May 2021: Coromandel International Ltd launched ‘Godavari BhuBhagya,’ a bio-enriched organic manure, demonstrating a commitment to the organic fertilizer sector and potentially influencing market dynamics through product innovation.

- April 2022: Coromandel International Ltd approved the merger of Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM), expanding their product portfolio to include a broader range of organic fertilizers and potentially increasing market share. This merger's impact will likely be significant, shaping market competition and product availability.

Strategic Brazil Organic Fertilizer Market Forecast

The Brazil organic fertilizer market is poised for substantial growth, driven by increasing consumer preference for organic products, supportive government policies, and ongoing technological advancements. The market's future success hinges on continuous innovation, addressing supply chain vulnerabilities, and effectively competing with conventional fertilizer alternatives. The forecast period (2025-2033) anticipates significant expansion, with various organic fertilizer segments experiencing varying levels of growth. This will be significantly influenced by evolving consumer preferences, technological advancements, and government regulations.

Brazil Organic Fertilizer Market Segmentation

-

1. Form

- 1.1. Manure

- 1.2. Meal Based Fertilizers

- 1.3. Oilcakes

- 1.4. Other Organic Fertilizers

-

2. Crop Type

- 2.1. Cash Crops

- 2.2. Horticultural Crops

- 2.3. Row Crops

-

3. Form

- 3.1. Manure

- 3.2. Meal Based Fertilizers

- 3.3. Oilcakes

- 3.4. Other Organic Fertilizers

-

4. Crop Type

- 4.1. Cash Crops

- 4.2. Horticultural Crops

- 4.3. Row Crops

Brazil Organic Fertilizer Market Segmentation By Geography

- 1. Brazil

Brazil Organic Fertilizer Market Regional Market Share

Geographic Coverage of Brazil Organic Fertilizer Market

Brazil Organic Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Growing Food Demand and Decrease in Arable Land Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Organic Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Manure

- 5.1.2. Meal Based Fertilizers

- 5.1.3. Oilcakes

- 5.1.4. Other Organic Fertilizers

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Cash Crops

- 5.2.2. Horticultural Crops

- 5.2.3. Row Crops

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Manure

- 5.3.2. Meal Based Fertilizers

- 5.3.3. Oilcakes

- 5.3.4. Other Organic Fertilizers

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Cash Crops

- 5.4.2. Horticultural Crops

- 5.4.3. Row Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adubasul Fertilizantes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coromandel International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plantin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 T Stanes and Company Limite

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sigma AgriScience LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Adubasul Fertilizantes

List of Figures

- Figure 1: Brazil Organic Fertilizer Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Organic Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Organic Fertilizer Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Form 2020 & 2033

- Table 3: Brazil Organic Fertilizer Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 4: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 5: Brazil Organic Fertilizer Market Revenue million Forecast, by Form 2020 & 2033

- Table 6: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Form 2020 & 2033

- Table 7: Brazil Organic Fertilizer Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 8: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 9: Brazil Organic Fertilizer Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 11: Brazil Organic Fertilizer Market Revenue million Forecast, by Form 2020 & 2033

- Table 12: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Form 2020 & 2033

- Table 13: Brazil Organic Fertilizer Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 14: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 15: Brazil Organic Fertilizer Market Revenue million Forecast, by Form 2020 & 2033

- Table 16: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Form 2020 & 2033

- Table 17: Brazil Organic Fertilizer Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 18: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 19: Brazil Organic Fertilizer Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Brazil Organic Fertilizer Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Organic Fertilizer Market?

The projected CAGR is approximately 9.63%.

2. Which companies are prominent players in the Brazil Organic Fertilizer Market?

Key companies in the market include Adubasul Fertilizantes, Coromandel International Ltd, Plantin, T Stanes and Company Limite, Sigma AgriScience LLC.

3. What are the main segments of the Brazil Organic Fertilizer Market?

The market segments include Form, Crop Type, Form, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.44 million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Growing Food Demand and Decrease in Arable Land Driving the Market.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2022: Coromandel International Ltd approved the merger of Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly owned subsidiaries), with effect from April 1, 2021. This merger is anticipated to expand the company's product portfolio, including organic fertilizers.May 2021: Coromandel International Ltd launched ‘Godavari BhuBhagya,’ a bio-enriched organic manure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Organic Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Organic Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Organic Fertilizer Market?

To stay informed about further developments, trends, and reports in the Brazil Organic Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence