Key Insights

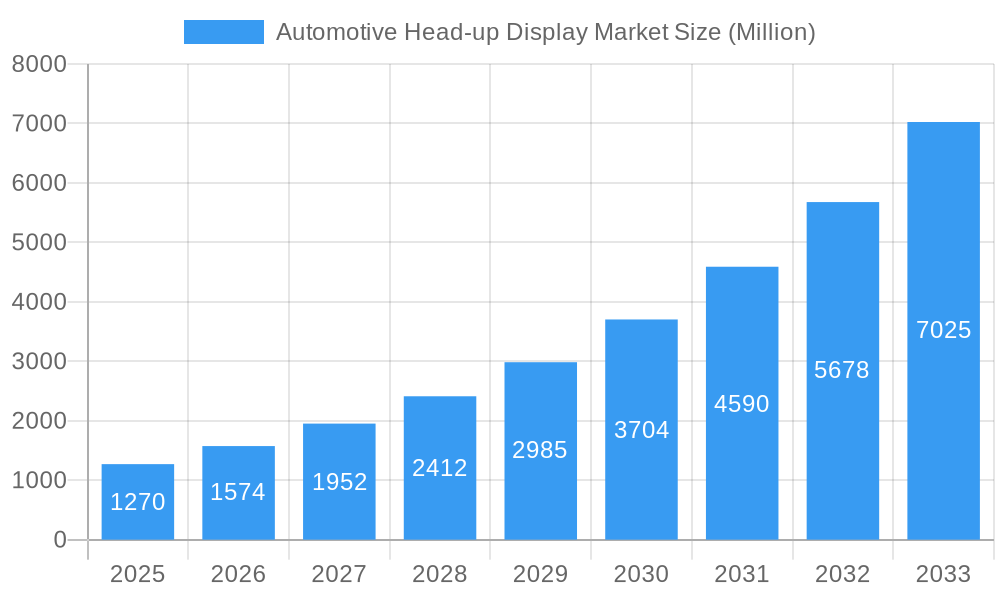

The automotive head-up display (HUD) market is experiencing robust growth, projected to reach a substantial size driven by increasing demand for advanced driver-assistance systems (ADAS) and enhanced safety features. The market's Compound Annual Growth Rate (CAGR) of 24% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. The rising adoption of HUDs in passenger cars, particularly luxury and high-end models, is a major contributor. Furthermore, technological advancements leading to improved display quality, brighter images, and more intuitive user interfaces are driving consumer appeal. The integration of HUDs with other ADAS features, such as lane departure warnings and adaptive cruise control, further enhances their value proposition. Geographically, North America and Europe are currently leading the market, however, rapid economic growth and increasing vehicle production in the Asia-Pacific region are expected to significantly boost market share in the coming years. The market segmentation by HUD type (windshield, combiner) and vehicle type (passenger cars, commercial vehicles) reflects the diverse applications and evolving technological landscape of the industry. Major players such as Visteon, Continental, and Bosch are investing heavily in R&D to improve existing technologies and launch innovative HUD solutions.

Automotive Head-up Display Market Market Size (In Billion)

The projected market size in 2025 of $1.27 billion, extrapolated from a CAGR of 24% over the historical period (2019-2024), suggests substantial continued growth throughout the forecast period (2025-2033). This growth is expected to be driven by increasing consumer preference for enhanced driver comfort and safety features, particularly among younger demographics who are accustomed to technologically advanced in-car experiences. The rising adoption of electric and autonomous vehicles will further propel the HUD market, as these vehicles often incorporate a greater number of advanced driver-assistance systems. While regulatory changes and the overall economic climate could present potential challenges, the long-term prospects for the automotive HUD market remain exceptionally positive. The ongoing development of augmented reality (AR) HUD technologies, offering even more immersive and informative displays, promises to further fuel market expansion in the coming decade.

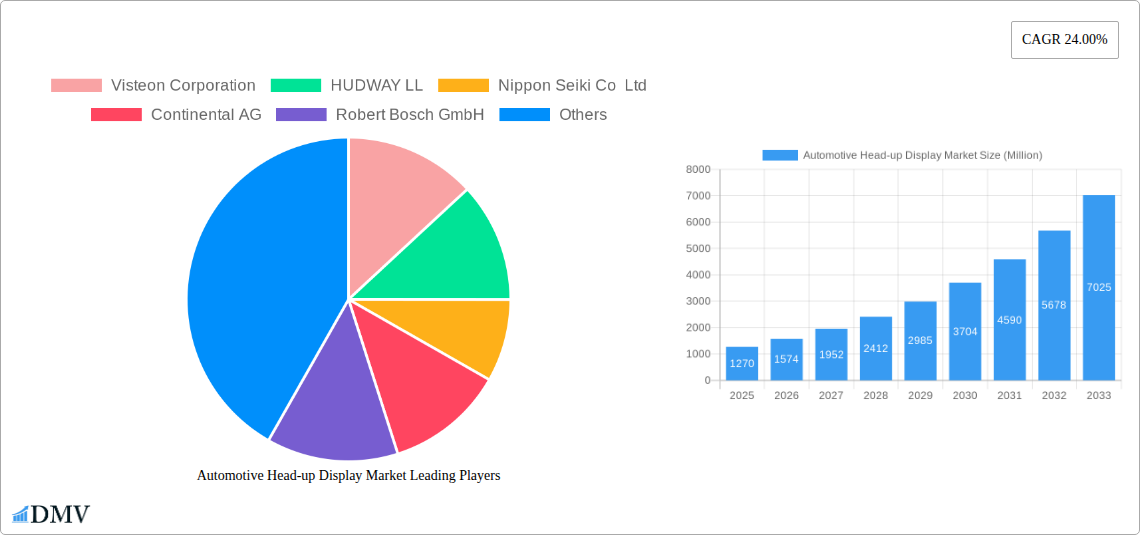

Automotive Head-up Display Market Company Market Share

Automotive Head-up Display (HUD) Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Automotive Head-up Display (HUD) market, projecting robust growth from 2025 to 2033. It delves into market dynamics, technological advancements, and key players shaping this rapidly evolving sector. With a detailed examination of market segmentation (Windshield HUD, Combiner HUD, Passenger Cars, Commercial Vehicles) and regional trends, this report offers invaluable insights for stakeholders seeking to navigate this lucrative market. The report is based on extensive research covering the historical period (2019-2024), the base year (2025) and forecasts until 2033. The total market value is predicted to reach xx Million by 2033.

Automotive Head-up Display Market Composition & Trends

The Automotive Head-up Display market is characterized by a moderately concentrated landscape, with key players like Visteon Corporation, Continental AG, Robert Bosch GmbH, and DENSO Corporation holding significant market share. However, the market is witnessing increased competition from emerging players and technological innovations driving market expansion. The report analyzes market share distribution among these key players and assesses the impact of recent M&A activities, estimating their value at xx Million. Innovation is a crucial catalyst, with advancements in augmented reality (AR) HUD technology and the integration of advanced driver-assistance systems (ADAS) creating significant growth opportunities. Regulatory landscapes, particularly concerning safety standards and emissions regulations, are also significant factors influencing market growth trajectories. Substitute products, such as traditional instrument panels, pose minimal threat, given the increasing consumer preference for enhanced driver convenience and safety features. End-user profiles highlight the strong demand from both passenger car and commercial vehicle segments, with distinct requirements and preferences shaping product development strategies.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Catalysts: AR-HUD technology, ADAS integration, improved display quality.

- Regulatory Landscape: Stringent safety and emission standards influencing product design and adoption.

- Substitute Products: Minimal threat from traditional instrument panels.

- End-User Profiles: Strong demand from both passenger and commercial vehicle segments.

- M&A Activities: Deal value estimated at xx Million in the last 5 years, influencing market consolidation.

Automotive Head-up Display Market Industry Evolution

The Automotive Head-up Display market is experiencing significant growth, driven by technological advancements and rising consumer demand for enhanced safety and convenience features. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). The adoption rate of HUD technology is increasing rapidly, particularly in premium vehicles, although penetration into mass-market vehicles is gradually improving. Technological advancements, such as the development of AR-HUD, are enhancing the user experience and driving higher adoption rates. Shifting consumer preferences towards advanced driver-assistance systems (ADAS) and connected car features are further boosting market growth. The transition towards electric vehicles (EVs) is also presenting significant opportunities, as HUDs are well-suited to the information-rich environment of EVs dashboards. The industry is focusing on developing more compact, energy-efficient, and cost-effective HUD solutions to expand market reach in the budget segment.

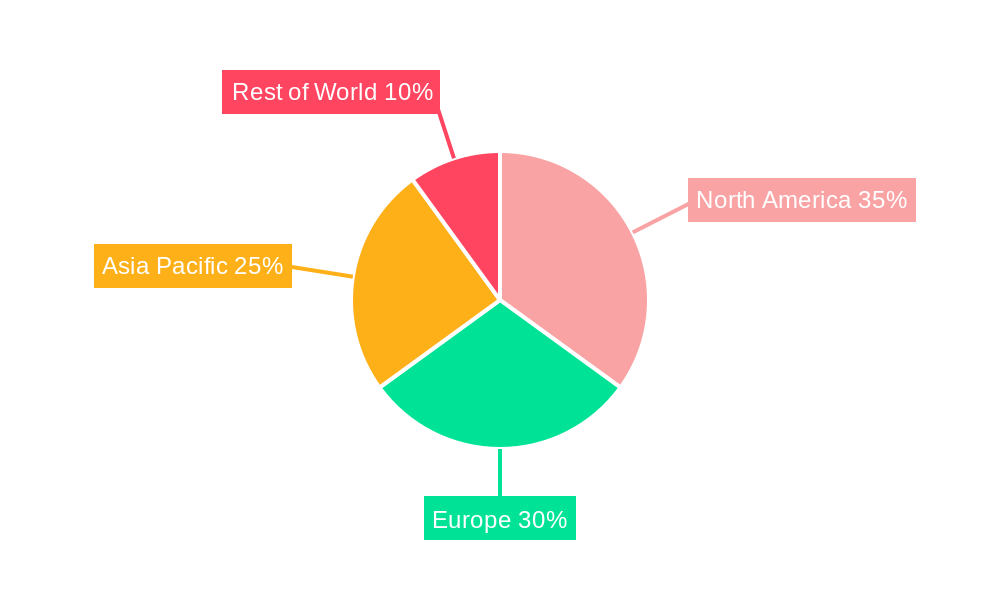

Leading Regions, Countries, or Segments in Automotive Head-up Display Market

The North American market currently dominates the Automotive Head-up Display market, driven by strong consumer demand for advanced safety features and a high vehicle ownership rate. Within HUD types, the Windshield HUD segment holds a larger market share due to its superior visibility and ease of integration. Similarly, the passenger car segment outpaces commercial vehicle adoption, mainly due to higher production volumes and consumer preference.

- Key Drivers for North American Dominance: High vehicle ownership rates, strong consumer demand for safety features, significant investments in automotive technology.

- Windshield HUD Segment Dominance: Superior visibility, easy integration with existing vehicle architectures.

- Passenger Car Segment Dominance: Higher production volumes, increased consumer demand.

- Growth Drivers in Asia-Pacific: Rapid automotive industry growth, increasing disposable income, government support for technological advancements.

Automotive Head-up Display Market Product Innovations

Recent innovations have focused on enhancing the capabilities and user experience of HUD systems. The integration of augmented reality (AR) technology allows for the overlay of virtual information onto the real-world view, providing drivers with contextually relevant information while minimizing distraction. The development of smaller, lighter, and more energy-efficient HUD units is expanding the application possibilities and reducing manufacturing costs. Improved display quality and increased projection brightness ensure clearer and more readable information, even under challenging lighting conditions. Unique selling propositions center around enhanced safety features, improved driver assistance, and personalized user interfaces.

Propelling Factors for Automotive Head-up Display Market Growth

Several factors are driving the growth of the Automotive Head-up Display market. Technological advancements, such as AR-HUD, are significantly enhancing user experience and safety. The increasing demand for ADAS features, coupled with government regulations promoting road safety, are creating a robust market for HUD technology. The cost reduction of HUDs combined with their improved reliability is another compelling factor that accelerates adoption.

Obstacles in the Automotive Head-up Display Market

Despite its potential, the Automotive Head-up Display market faces several challenges. High initial investment costs can be a barrier to entry for smaller manufacturers. Supply chain disruptions and material shortages can affect production and delivery schedules. Intense competition from established players and the emergence of new technologies may create pricing pressures. Finally, differing safety and regulatory standards across different markets may increase compliance costs.

Future Opportunities in Automotive Head-up Display Market

Future opportunities lie in the expansion into emerging markets, particularly in developing countries with a growing automotive sector. The integration of HUD technology with other advanced driver-assistance systems (ADAS) and the continued development of AR-HUD technology promises to further enhance safety and user experience. The development of new HUD designs suited to autonomous vehicles and cost-effective solutions for the mass market also presents opportunities for growth.

Major Players in the Automotive Head-up Display Market Ecosystem

- Visteon Corporation

- HUDWAY LL

- Nippon Seiki Co Ltd

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Yazaki Corporation

- Pioneer Corporation

- Panasonic Corporation

Key Developments in Automotive Head-up Display Market Industry

- July 2022: TomTom's full-stack navigation solution integrated into Opel's new Astra, including HUD functionality.

- July 2022: Foryou Corporation and Huawei collaborate on AR-HUD technology for smart vehicles.

- June 2022: Japan Display strengthens automotive display business, including HUD development.

- May 2022: Panasonic's 11.5-inch WS HUD adopted for Nissan's Ariya EV.

- December 2021: Karma Automotive and WayRay integrate AR-HUD technology in Karma vehicles.

Strategic Automotive Head-up Display Market Forecast

The Automotive Head-up Display market is poised for continued strong growth, driven by technological innovation, rising consumer demand, and supportive government regulations. The increasing integration of HUD systems with ADAS features and the expansion of AR-HUD technology will create significant opportunities for market expansion. The development of cost-effective solutions and expansion into new markets will further fuel growth, making the Automotive Head-up Display market a promising investment opportunity.

Automotive Head-up Display Market Segmentation

-

1. HUD Type

- 1.1. Windshield

- 1.2. Combiner

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive Head-up Display Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Head-up Display Market Regional Market Share

Geographic Coverage of Automotive Head-up Display Market

Automotive Head-up Display Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Safety Features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With The Feature

- 3.4. Market Trends

- 3.4.1. Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by HUD Type

- 5.1.1. Windshield

- 5.1.2. Combiner

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by HUD Type

- 6. North America Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by HUD Type

- 6.1.1. Windshield

- 6.1.2. Combiner

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by HUD Type

- 7. Europe Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by HUD Type

- 7.1.1. Windshield

- 7.1.2. Combiner

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by HUD Type

- 8. Asia Pacific Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by HUD Type

- 8.1.1. Windshield

- 8.1.2. Combiner

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by HUD Type

- 9. Rest of the World Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by HUD Type

- 9.1.1. Windshield

- 9.1.2. Combiner

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by HUD Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Visteon Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HUDWAY LL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nippon Seiki Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continental AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DENSO Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yazaki Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Pioneer Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Panasonic Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Visteon Corporation

List of Figures

- Figure 1: Global Automotive Head-up Display Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 3: North America Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 4: North America Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 9: Europe Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 10: Europe Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 21: Rest of the World Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 22: Rest of the World Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 2: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Head-up Display Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 5: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 11: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 20: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 28: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Head-up Display Market?

The projected CAGR is approximately 24.00%.

2. Which companies are prominent players in the Automotive Head-up Display Market?

Key companies in the market include Visteon Corporation, HUDWAY LL, Nippon Seiki Co Ltd, Continental AG, Robert Bosch GmbH, DENSO Corporation, Yazaki Corporation, Pioneer Corporation, Panasonic Corporation.

3. What are the main segments of the Automotive Head-up Display Market?

The market segments include HUD Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Safety Features in Vehicles.

6. What are the notable trends driving market growth?

Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market.

7. Are there any restraints impacting market growth?

High Costs Associated With The Feature.

8. Can you provide examples of recent developments in the market?

July 2022: Tom Tom announced that Opel's new Astra features a new generation of TomTom's full-stack navigation solution, including over-the-air updates for fresh and accurate maps, highly convenient connected services, and new map-based advanced driver assistance system (ADAS) features for greater safety. TomTom's up-to-date map information and navigation guidance is available across the new Astra's next-generation Pure Panel digital cockpit screens, including the new head-up display. It is also accessible through easy-to-use voice control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Head-up Display Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Head-up Display Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Head-up Display Market?

To stay informed about further developments, trends, and reports in the Automotive Head-up Display Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence