Key Insights

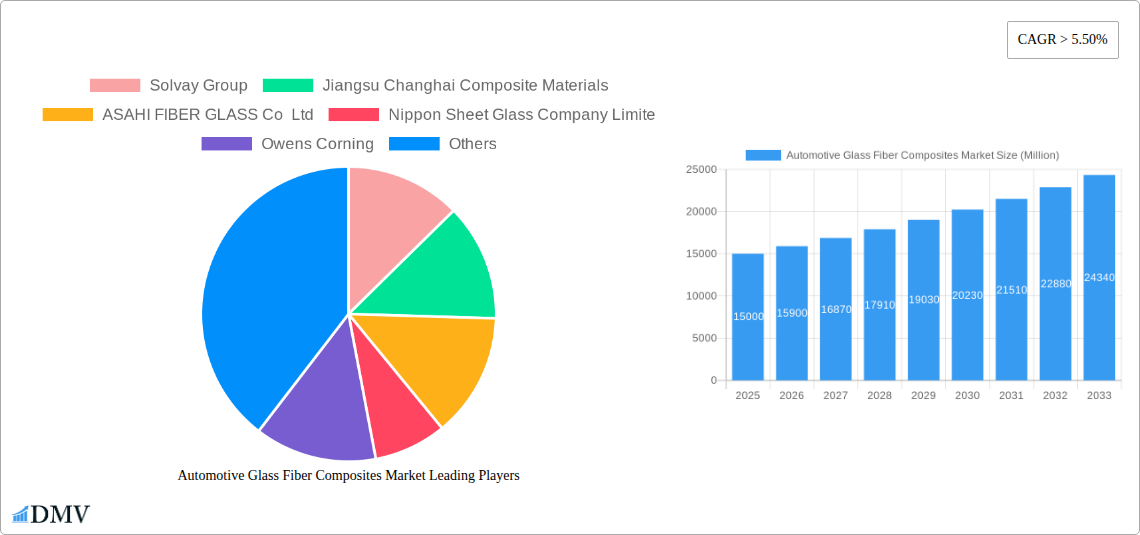

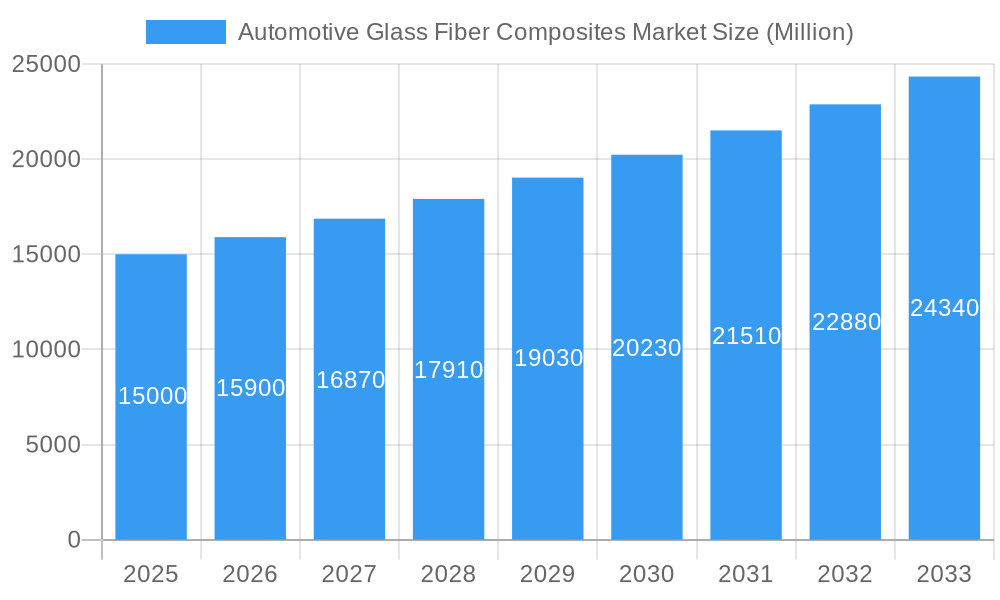

The Automotive Glass Fiber Composites market is experiencing substantial growth, driven by the automotive industry's increasing need for lightweight, high-strength materials. The projected Compound Annual Growth Rate (CAGR) of 14.5% indicates a significant upward trend through 2033. This expansion is propelled by several key factors: the automotive sector's pursuit of enhanced fuel efficiency and reduced emissions necessitates lighter vehicle components, positioning glass fiber composites as a compelling alternative to traditional metals. Advancements in composite manufacturing are improving performance and cost-effectiveness, accelerating market adoption. Furthermore, stringent government regulations promoting fuel efficiency and environmental sustainability serve as significant catalysts. Market segmentation shows Short Fiber Thermoplastics (SFT) currently leading, with Long Fiber Thermoplastics (LFT) and Continuous Fiber Thermoplastics (CFT) exhibiting strong growth potential due to superior mechanical properties. While interiors and exteriors dominate current applications, structural assembly and powertrain components are anticipated to expand significantly as technology matures and confidence in material durability increases. Key industry players, including Solvay Group, Jiangsu Changhai Composite Materials, and Asahi Fiber Glass, are strategically investing in research and development and expanding production capacities to meet escalating demand.

Automotive Glass Fiber Composites Market Market Size (In Billion)

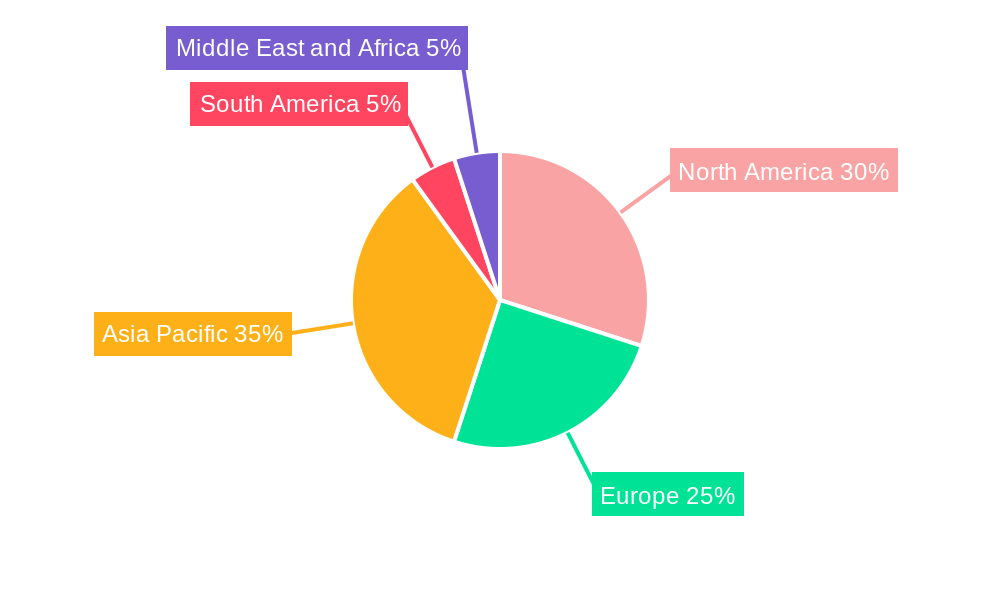

Geographically, the Asia Pacific region, particularly China and India, is expected to be a primary driver of market expansion, supported by burgeoning automotive industries. North America and Europe will retain significant market presence, benefiting from established automotive manufacturing and a focus on technological innovation. However, market challenges include the relatively higher cost of glass fiber composites compared to conventional materials and manufacturing process complexities, which could impact widespread adoption. Nonetheless, ongoing innovation in manufacturing technologies and the long-term advantages of improved fuel efficiency and reduced emissions are expected to overcome these hurdles. The forecast period from 2025 to 2033 promises considerable market expansion, presenting a promising investment landscape for Automotive Glass Fiber Composites, with an estimated market size of 11.1 billion.

Automotive Glass Fiber Composites Market Company Market Share

Automotive Glass Fiber Composites Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Glass Fiber Composites Market, offering a comprehensive overview of market trends, growth drivers, challenges, and future opportunities from 2019 to 2033. The report covers key segments, including Short Fiber Thermoplastic (SFT), Long Fiber Thermoplastic (LFT), Continuous Fiber Thermoplastic (CFT), and other intermediate types, across diverse applications like interiors, exteriors, structural assemblies, powertrain components, and others. Leading players such as Solvay Group, Jiangsu Changhai Composite Materials, ASAHI FIBER GLASS Co Ltd, Nippon Sheet Glass Company Limited, Owens Corning, 3B (Braj Binani Group), Veplas Group, and SAERTEX GmbH & Co KG are profiled, providing valuable insights into their market strategies and contributions. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033, covering the historical period of 2019-2024.

Automotive Glass Fiber Composites Market Market Composition & Trends

The Automotive Glass Fiber Composites market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share distribution amongst the top five players is estimated at approximately xx%. Innovation within the sector is driven by the increasing demand for lightweight, high-strength materials in vehicles, particularly electric vehicles (EVs). Stringent regulatory requirements regarding fuel efficiency and emissions are pushing manufacturers to adopt these composites. Substitute products, such as carbon fiber composites and metal alloys, pose competitive pressures, but glass fiber composites maintain a cost advantage in several applications. End-users predominantly include automotive Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. Mergers and acquisitions (M&A) are frequent, with deal values varying significantly depending on the size and target of the companies. For example, recent M&A activity involved transactions valued between USD xx Million and USD xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Catalysts: Lightweighting demands, stringent emission regulations, and advancements in material science.

- Regulatory Landscape: Fuel efficiency standards and safety regulations heavily influence material selection.

- Substitute Products: Carbon fiber composites and metal alloys pose some competition.

- End-User Profile: Primarily automotive OEMs and Tier-1 suppliers.

- M&A Activity: Frequent, with deal values ranging from USD xx Million to USD xx Million.

Automotive Glass Fiber Composites Market Industry Evolution

The Automotive Glass Fiber Composites market has witnessed significant growth, with a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024). This growth is primarily attributed to the rising adoption of lightweighting strategies within the automotive industry to enhance fuel efficiency and reduce emissions. Technological advancements, such as the development of improved resin systems and manufacturing processes, have further propelled market expansion. The increasing demand for electric vehicles (EVs) is another major driver, as glass fiber composites are well-suited for use in EV chassis and body components. Consumer demand for fuel-efficient and environmentally friendly vehicles has fueled the adoption of lightweight materials. This trend is expected to continue during the forecast period (2025-2033), with an estimated CAGR of xx%, driven by the continued growth of the EV market and ongoing innovations in composite materials. Adoption rates of glass fiber composites in new vehicle models are projected to increase by xx% by 2033.

Leading Regions, Countries, or Segments in Automotive Glass Fiber Composites Market

Dominant Region: North America and Asia are projected to dominate the market with approximately xx% and yy% share, respectively, due to high automotive production volumes and robust government support for EV adoption.

Dominant Segment (Intermediate Type): Short Fiber Thermoplastic (SFT) currently holds the largest market share due to its cost-effectiveness and ease of processing. However, Long Fiber Thermoplastic (LFT) is rapidly gaining traction because of its superior mechanical properties.

Dominant Segment (Application): The interiors segment currently commands a significant portion of market demand. However, structural assembly is anticipated to witness the fastest growth due to the increasing use of composites in lightweight vehicle structures.

Key Drivers:

- North America: High investment in automotive R&D, supportive government regulations, and a large EV market.

- Asia: Strong growth in automotive manufacturing, expanding EV adoption, and cost-effective manufacturing capabilities.

- SFT Segment: Low cost, ease of processing, suitability for various applications.

- LFT Segment: Superior mechanical properties compared to SFT, suitable for demanding applications.

- Structural Assembly Segment: Growing demand for lightweight vehicles and increased use of composites in load-bearing structures.

Automotive Glass Fiber Composites Market Product Innovations

Recent innovations focus on enhancing the performance characteristics of glass fiber composites, such as improved strength-to-weight ratios and durability, using advanced resin systems and fiber architectures. Solvay's introduction of SolvaLite SF200 surfacing film exemplifies this trend, showcasing a lightweight, paintable film for high-end vehicle body panels. The development of new prepreg materials, including Solvay's SolvaLite 714 Prepregs, also enhances manufacturing efficiency and component performance, enabling wider applications in automotive parts. These innovations deliver unique selling propositions, such as improved aesthetics, enhanced durability, and streamlined manufacturing processes, ultimately driving market growth.

Propelling Factors for Automotive Glass Fiber Composites Market Growth

Several key factors drive the market's growth, including stringent fuel efficiency regulations globally. This pushes automotive manufacturers to adopt lightweight materials such as glass fiber composites. The rapid growth in the electric vehicle (EV) market further fuels demand, as these composites are well-suited for various EV structural components. Technological advancements in resin systems and processing techniques enhance the performance and cost-effectiveness of glass fiber composites. Government incentives and supportive policies, including subsidies and tax credits for fuel-efficient and environmentally friendly vehicles, further bolster market growth.

Obstacles in the Automotive Glass Fiber Composites Market

The market faces challenges, including the volatility of raw material prices, particularly for glass fibers and resins. Supply chain disruptions can impact production and lead to delays. Competition from substitute materials, such as carbon fiber composites, and fluctuating demand in the global automotive market present ongoing challenges. The increasing cost of manufacturing, despite improvements, can still make glass fiber composites less competitive compared to other materials in some applications.

Future Opportunities in Automotive Glass Fiber Composites Market

Future opportunities lie in the expansion of electric and autonomous vehicle production, driving greater demand for lightweight, high-performance materials. The development of advanced composite materials with enhanced properties, such as improved impact resistance and thermal management, presents significant growth potential. Exploration of new applications, including components for battery packs and other auxiliary systems in EVs, offers further opportunities. Expanding into emerging markets with growing automotive industries presents substantial growth prospects.

Major Players in the Automotive Glass Fiber Composites Market Ecosystem

- Solvay Group

- Jiangsu Changhai Composite Materials

- ASAHI FIBER GLASS Co Ltd

- Nippon Sheet Glass Company Limited

- Owens Corning

- 3B (Braj Binani Group)

- Veplas Group

- SAERTEX GmbH & Co KG

Key Developments in Automotive Glass Fiber Composites Market Industry

November 2022: Solvay and Orbia's joint venture for battery material production signifies a major investment (USD 850 Million) in the North American market, boosting the supply chain for automotive applications.

October 2022: Solvay's launch of SolvaLite SF200 surfacing film showcases innovation in Class A body panels for high-end vehicles, improving aesthetics and enhancing the overall market offering.

February 2022: Teijin Automotive Technologies' expansion in China highlights the increasing demand for automotive composites, particularly driven by the growing EV sector.

Strategic Automotive Glass Fiber Composites Market Forecast

The Automotive Glass Fiber Composites market is poised for sustained growth, driven by the ongoing lightweighting trend in the automotive industry, expansion of the electric vehicle market, and continuous technological advancements in composite materials. The increasing demand for fuel efficiency and stringent environmental regulations will further support market expansion. New applications in advanced automotive systems, including battery technologies, will drive innovation and create exciting growth opportunities in the coming years. The market is expected to reach a value of USD xx Million by 2033.

Automotive Glass Fiber Composites Market Segmentation

-

1. Intermediate Type

- 1.1. Short Fiber Thermoplastic (SFT)

- 1.2. Long Fiber Thermoplastic (LFT)

- 1.3. Continuous Fiber Thermoplastic (CFT)

- 1.4. Other Intermediate Types

-

2. Application

- 2.1. Interiors

- 2.2. Exteriors

- 2.3. Structural Assembly

- 2.4. Power-train Components

- 2.5. Others

Automotive Glass Fiber Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Glass Fiber Composites Market Regional Market Share

Geographic Coverage of Automotive Glass Fiber Composites Market

Automotive Glass Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Glass Fiber Composites in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 5.1.1. Short Fiber Thermoplastic (SFT)

- 5.1.2. Long Fiber Thermoplastic (LFT)

- 5.1.3. Continuous Fiber Thermoplastic (CFT)

- 5.1.4. Other Intermediate Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Interiors

- 5.2.2. Exteriors

- 5.2.3. Structural Assembly

- 5.2.4. Power-train Components

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 6. North America Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 6.1.1. Short Fiber Thermoplastic (SFT)

- 6.1.2. Long Fiber Thermoplastic (LFT)

- 6.1.3. Continuous Fiber Thermoplastic (CFT)

- 6.1.4. Other Intermediate Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Interiors

- 6.2.2. Exteriors

- 6.2.3. Structural Assembly

- 6.2.4. Power-train Components

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 7. Europe Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 7.1.1. Short Fiber Thermoplastic (SFT)

- 7.1.2. Long Fiber Thermoplastic (LFT)

- 7.1.3. Continuous Fiber Thermoplastic (CFT)

- 7.1.4. Other Intermediate Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Interiors

- 7.2.2. Exteriors

- 7.2.3. Structural Assembly

- 7.2.4. Power-train Components

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 8. Asia Pacific Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 8.1.1. Short Fiber Thermoplastic (SFT)

- 8.1.2. Long Fiber Thermoplastic (LFT)

- 8.1.3. Continuous Fiber Thermoplastic (CFT)

- 8.1.4. Other Intermediate Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Interiors

- 8.2.2. Exteriors

- 8.2.3. Structural Assembly

- 8.2.4. Power-train Components

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 9. South America Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 9.1.1. Short Fiber Thermoplastic (SFT)

- 9.1.2. Long Fiber Thermoplastic (LFT)

- 9.1.3. Continuous Fiber Thermoplastic (CFT)

- 9.1.4. Other Intermediate Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Interiors

- 9.2.2. Exteriors

- 9.2.3. Structural Assembly

- 9.2.4. Power-train Components

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 10. Middle East and Africa Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 10.1.1. Short Fiber Thermoplastic (SFT)

- 10.1.2. Long Fiber Thermoplastic (LFT)

- 10.1.3. Continuous Fiber Thermoplastic (CFT)

- 10.1.4. Other Intermediate Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Interiors

- 10.2.2. Exteriors

- 10.2.3. Structural Assembly

- 10.2.4. Power-train Components

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solvay Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jiangsu Changhai Composite Materials

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASAHI FIBER GLASS Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Sheet Glass Company Limite

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3B (Braj Binani Group)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Veplas Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAERTEX GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Solvay Group

List of Figures

- Figure 1: Global Automotive Glass Fiber Composites Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 3: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 4: North America Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 9: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 10: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 21: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 22: South America Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 2: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 5: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 11: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 18: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 25: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of South America Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 30: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: South Africa Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Glass Fiber Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Automotive Glass Fiber Composites Market?

Key companies in the market include Solvay Group, Jiangsu Changhai Composite Materials, ASAHI FIBER GLASS Co Ltd, Nippon Sheet Glass Company Limite, Owens Corning, 3B (Braj Binani Group), Veplas Group, SAERTEX GmbH & Co KG.

3. What are the main segments of the Automotive Glass Fiber Composites Market?

The market segments include Intermediate Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Increasing Adoption of Glass Fiber Composites in Automobiles.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Solvay and Orbia announced a framework agreement for a joint venture to produce battery materials creating the largest capacity in North America. The total investment is estimated to be around USD 850 million, partially funded by a USD 178 million grant from the US Department of Energy to Solvay to build a facility in Augusta, Georgia. Solvay and Orbia intend to use two production sites in the southeastern United States, one for raw materials and the other for finished goods. Both plants will be fully operational by 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Glass Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Glass Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Glass Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Automotive Glass Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence