Key Insights

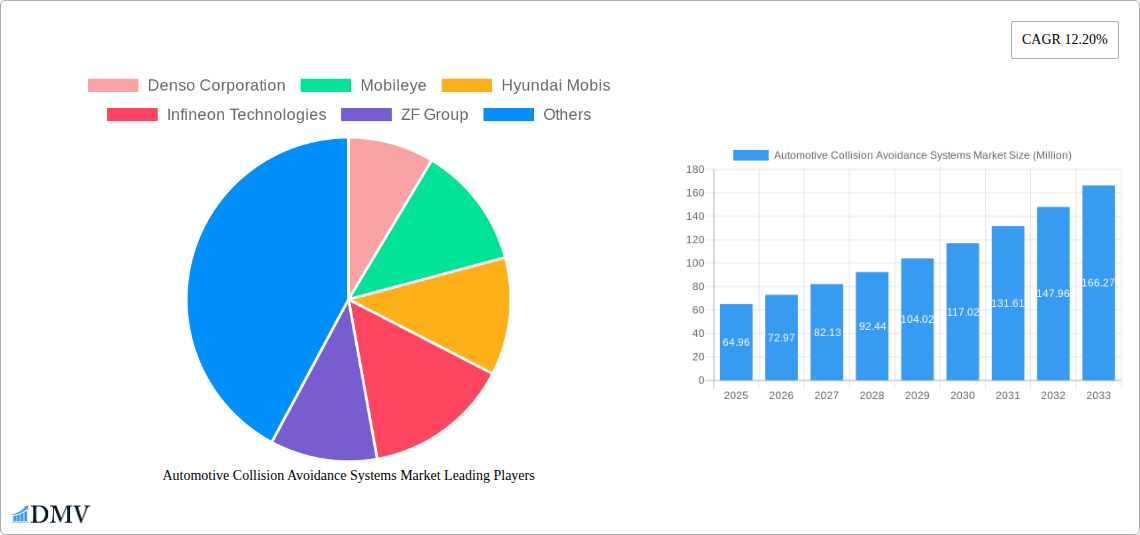

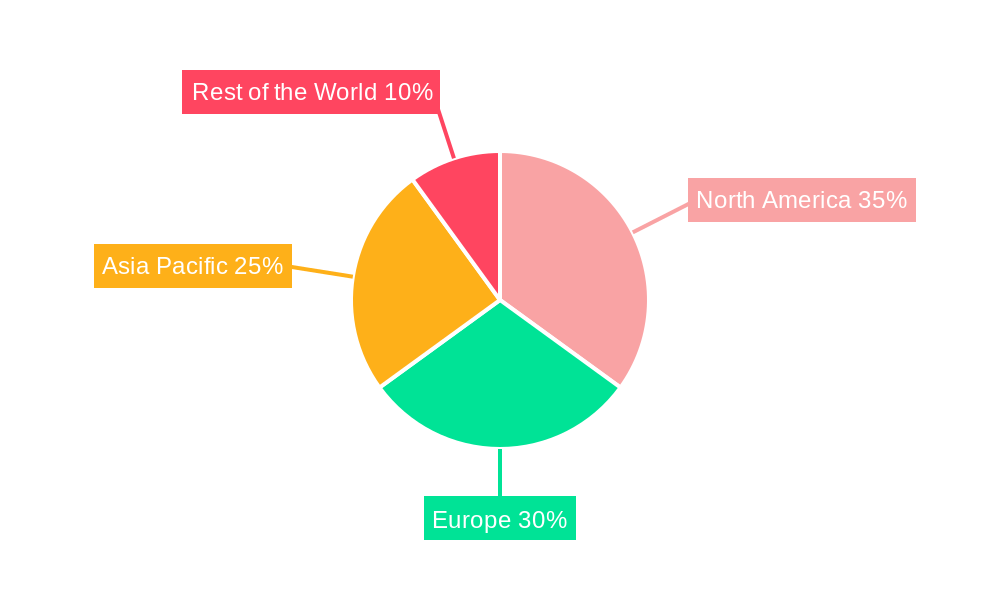

The Automotive Collision Avoidance Systems (ACAS) market is experiencing robust growth, driven by increasing consumer demand for enhanced vehicle safety, stringent government regulations mandating advanced driver-assistance systems (ADAS), and rapid technological advancements in sensor technologies like radar, lidar, and cameras. The market, valued at $64.96 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12.20% from 2025 to 2033, indicating substantial expansion potential. Several factors contribute to this growth. The rising adoption of automated and adaptive systems, providing features like autonomous emergency braking (AEB) and lane departure warnings (LDW), is a key driver. Furthermore, the integration of sophisticated sensor fusion techniques that combine data from multiple sensor types to improve accuracy and reliability are pushing the market forward. The increasing prevalence of connected car technologies further enhances the effectiveness of ACAS by enabling vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, contributing to improved collision avoidance capabilities. Segmentation reveals a significant market share for passenger vehicles, while commercial vehicle applications are experiencing rapid growth fueled by fleet management solutions and safety regulations specific to commercial fleets. Geographically, North America and Europe currently hold significant market shares, but the Asia-Pacific region is poised for rapid expansion due to increasing vehicle production and rising disposable incomes.

Automotive Collision Avoidance Systems Market Market Size (In Million)

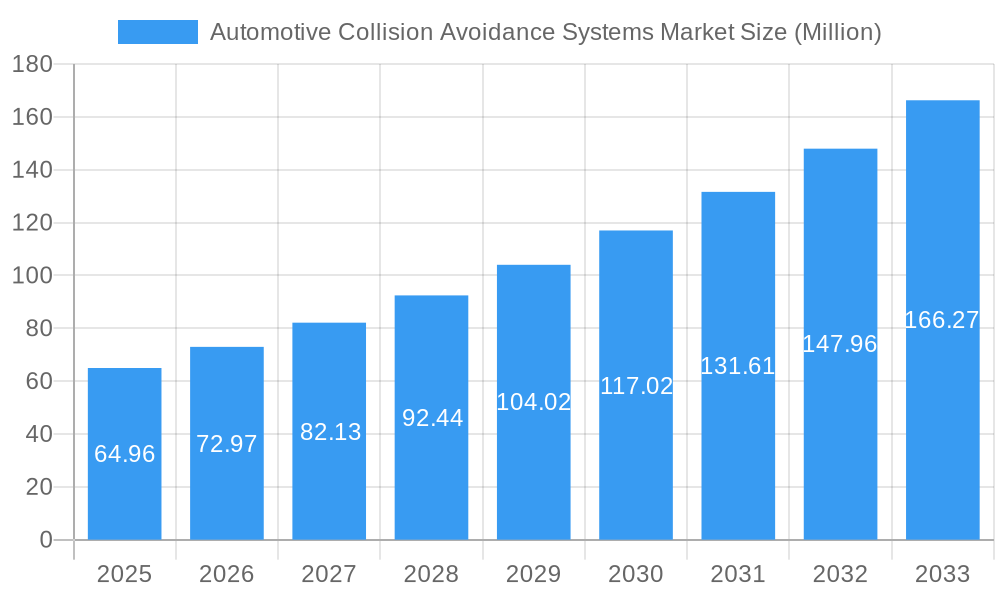

The competitive landscape is characterized by a mix of established automotive Tier-1 suppliers and technology companies. Companies like Denso, Mobileye, and Bosch are major players, leveraging their expertise in automotive electronics and software. The market is expected to witness increased mergers and acquisitions as companies strive to expand their product portfolios and strengthen their market positions. However, challenges such as high initial investment costs for advanced ACAS technologies and concerns regarding data privacy and cybersecurity could potentially restrain market growth to some extent. Despite these challenges, the long-term outlook for the ACAS market remains positive, with continuous innovation and increasing consumer awareness of safety features driving sustained growth over the forecast period. The market is expected to see a diversification of solutions as different technological approaches compete for market dominance.

Automotive Collision Avoidance Systems Market Company Market Share

Automotive Collision Avoidance Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Automotive Collision Avoidance Systems Market, offering a detailed overview of market dynamics, technological advancements, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Automotive Collision Avoidance Systems Market Market Composition & Trends

The Automotive Collision Avoidance Systems market is characterized by a moderately concentrated landscape, with key players such as Denso Corporation, Mobileye, and Bosch holding significant market share. However, the market exhibits considerable dynamism fueled by continuous technological innovations, stringent regulatory mandates promoting safety features, and a growing preference for advanced driver-assistance systems (ADAS). Substitute products, while limited, include traditional driver-focused safety mechanisms, but their effectiveness pales in comparison to the advanced functionalities offered by collision avoidance systems. The end-user profile is primarily automotive manufacturers (OEMs) and Tier-1 suppliers. Furthermore, M&A activity has been significant, with deal values exceeding xx Million in recent years, reflecting the consolidation trend and strategic investments in the sector.

- Market Share Distribution (2024): Top 3 players account for approximately xx% of the market.

- M&A Deal Values (2022-2024): Total value exceeding xx Million.

- Innovation Catalysts: Advancements in sensor technologies (LiDAR, radar, camera), AI and machine learning algorithms.

- Regulatory Landscape: Stringent safety regulations driving adoption in developed and developing markets.

Automotive Collision Avoidance Systems Market Industry Evolution

The Automotive Collision Avoidance Systems market has witnessed exponential growth driven by technological advancements, evolving consumer preferences, and increasingly stringent safety regulations. The historical period (2019-2024) saw a CAGR of xx%, while the forecast period (2025-2033) is expected to show a CAGR of xx%, reaching a market value of xx Million. This growth is fueled by the integration of advanced technologies like AI-powered object recognition, improved sensor fusion, and the increasing affordability of ADAS features. Consumer demand is shifting towards vehicles equipped with comprehensive safety systems, reflecting a heightened awareness of road safety. Adoption rates have risen significantly, with a xx% increase in new vehicle installations observed between 2020 and 2024. The market is witnessing a paradigm shift from basic warning systems to more sophisticated adaptive and automated functionalities, promising enhanced safety and driving experience.

Leading Regions, Countries, or Segments in Automotive Collision Avoidance Systems Market

North America and Europe currently dominate the Automotive Collision Avoidance Systems market, driven by stringent safety regulations, high vehicle ownership rates, and strong consumer demand for advanced safety features. Within the segments, the Adaptive and Automated Function Types are experiencing the fastest growth, while LiDAR technology is gaining traction due to its high accuracy. Passenger vehicles constitute the largest segment, although the commercial vehicle segment is experiencing significant growth due to increasing focus on fleet safety and efficiency.

- Key Drivers (North America): Strong regulatory support, high consumer spending on vehicles with advanced safety features, and robust technological innovation.

- Key Drivers (Europe): Stringent Euro NCAP safety ratings, government incentives for ADAS adoption, and a strong focus on autonomous driving technology.

- Dominant Segment (Function Type): Adaptive systems, owing to their superior capabilities in preventing collisions.

- Dominant Segment (Technology Type): Radar, due to its established market presence and cost-effectiveness.

- Dominant Segment (Vehicle Type): Passenger vehicles, due to high demand for safety features among consumers.

Automotive Collision Avoidance Systems Market Product Innovations

Recent innovations in Automotive Collision Avoidance Systems have focused on improving sensor accuracy, expanding functionalities, and enhancing the overall performance of the systems. This includes the development of more robust sensor fusion algorithms, the integration of AI and machine learning for improved object recognition and decision-making, and the development of cost-effective solutions for wider adoption. Unique selling propositions include features like pedestrian and cyclist detection, lane-keeping assist, and adaptive cruise control, setting these systems apart from conventional safety mechanisms.

Propelling Factors for Automotive Collision Avoidance Systems Market Growth

The Automotive Collision Avoidance Systems market's growth is driven by several converging factors. Technological advancements in sensor technology (LiDAR, radar, camera) constantly improve accuracy and reliability. Stringent government regulations mandating advanced safety features in new vehicles are accelerating adoption. The increasing consumer demand for safety and enhanced driving experience is a key driver. Furthermore, the rising number of vehicles on the road globally contributes significantly to market expansion. Economic factors like disposable income also influence the decision to purchase vehicles with these advanced safety systems.

Obstacles in the Automotive Collision Avoidance Systems Market Market

Despite strong growth potential, the Automotive Collision Avoidance Systems market faces several challenges. High initial costs of implementation can hinder widespread adoption, particularly in developing countries. Supply chain disruptions can impact the production and availability of components. Furthermore, intense competition among established players and new entrants puts pressure on pricing and profit margins. Regulatory inconsistencies across different regions pose a challenge for standardization and global market penetration. These factors, if not effectively addressed, could negatively impact market expansion.

Future Opportunities in Automotive Collision Avoidance Systems Market

The future of the Automotive Collision Avoidance Systems market is promising. Expansion into emerging markets with growing vehicle populations presents significant opportunities. The development of more integrated and sophisticated systems that combine various sensor technologies will offer enhanced performance. Increased focus on autonomous driving functionalities will drive innovation and demand for these systems. Exploring new applications in commercial vehicles, such as autonomous trucking, holds significant potential for future growth.

Major Players in the Automotive Collision Avoidance Systems Market Ecosystem

- Denso Corporation

- Mobileye

- Hyundai Mobis

- Infineon Technologies

- ZF Group

- Siemens AG

- Delphi Automotive

- Fujitsu Laboratories Ltd

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Magna International

- Bendix Commercial Vehicle Systems LLC

- Hella KGaA Hueck & Co

- WABCO Vehicle Control Services

- National Instruments Corp

- Panasonic Corporation

- Toyota

Key Developments in Automotive Collision Avoidance Systems Market Industry

- Sept 2023: Innoviz Technologies announced a distribution agreement with Ask Co. Ltd to sell LiDAR products in Japan, expanding its market reach.

- Aug 2023: Innoviz Technologies and BMW Group collaborated on a new generation LiDAR, showcasing technological advancements.

- Jun 2022: ZF Group inaugurated a new tech center in Hyderabad, India, strengthening its presence in the ADAS sector.

- Apr 2022: Hesai Technology and WeRide partnered to promote autonomous vehicle applications of hybrid solid-state LiDAR, demonstrating industry collaboration.

Strategic Automotive Collision Avoidance Systems Market Market Forecast

The Automotive Collision Avoidance Systems market is poised for continued robust growth, propelled by ongoing technological advancements, increasing regulatory mandates, and rising consumer demand for safer vehicles. The forecast period (2025-2033) anticipates significant market expansion, driven by the adoption of more sophisticated systems and the penetration into new markets. The convergence of AI, sensor technology, and autonomous driving technologies will further fuel this expansion, creating significant opportunities for players in the ecosystem.

Automotive Collision Avoidance Systems Market Segmentation

-

1. Function Type

- 1.1. Adaptive

- 1.2. Automated

- 1.3. Monitoring

- 1.4. Warning

-

2. Technology Type

- 2.1. Radar

- 2.2. Lidar

- 2.3. Camera

- 2.4. Ultrasonic

-

3. Vehicle Type

- 3.1. Passenger Vehicle

- 3.2. Commercial Vehicle

Automotive Collision Avoidance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Norway

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Collision Avoidance Systems Market Regional Market Share

Geographic Coverage of Automotive Collision Avoidance Systems Market

Automotive Collision Avoidance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Autonomous Vehicle Demand To Propel The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Installation Cost May Hamper The Market Growth

- 3.4. Market Trends

- 3.4.1. LiDAR Segment to Grow Significantly During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 5.1.1. Adaptive

- 5.1.2. Automated

- 5.1.3. Monitoring

- 5.1.4. Warning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Radar

- 5.2.2. Lidar

- 5.2.3. Camera

- 5.2.4. Ultrasonic

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Vehicle

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 6. North America Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 6.1.1. Adaptive

- 6.1.2. Automated

- 6.1.3. Monitoring

- 6.1.4. Warning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Radar

- 6.2.2. Lidar

- 6.2.3. Camera

- 6.2.4. Ultrasonic

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Vehicle

- 6.3.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 7. Europe Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 7.1.1. Adaptive

- 7.1.2. Automated

- 7.1.3. Monitoring

- 7.1.4. Warning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Radar

- 7.2.2. Lidar

- 7.2.3. Camera

- 7.2.4. Ultrasonic

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Vehicle

- 7.3.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 8. Asia Pacific Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 8.1.1. Adaptive

- 8.1.2. Automated

- 8.1.3. Monitoring

- 8.1.4. Warning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Radar

- 8.2.2. Lidar

- 8.2.3. Camera

- 8.2.4. Ultrasonic

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Vehicle

- 8.3.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 9. Rest of the World Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 9.1.1. Adaptive

- 9.1.2. Automated

- 9.1.3. Monitoring

- 9.1.4. Warning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Radar

- 9.2.2. Lidar

- 9.2.3. Camera

- 9.2.4. Ultrasonic

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Vehicle

- 9.3.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mobileye

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Mobis

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infineon Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Delphi Automotive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fujitsu Laboratories Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Continental AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Autoliv Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Robert Bosch GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Magna International

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Bendix Commercial Vehicle Systems LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hella KGaA Hueck & Co

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 WABCO Vehicle Control Services

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 National Instruments Corp

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Panasonic Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Toyota

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Collision Avoidance Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 3: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 4: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 11: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 12: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 27: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 28: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 2: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 6: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 13: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 22: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 31: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Collision Avoidance Systems Market?

The projected CAGR is approximately 12.20%.

2. Which companies are prominent players in the Automotive Collision Avoidance Systems Market?

Key companies in the market include Denso Corporation, Mobileye, Hyundai Mobis, Infineon Technologies, ZF Group, Siemens AG, Delphi Automotive, Fujitsu Laboratories Ltd, Continental AG, Autoliv Inc, Robert Bosch GmbH, Magna International, Bendix Commercial Vehicle Systems LLC, Hella KGaA Hueck & Co, WABCO Vehicle Control Services, National Instruments Corp, Panasonic Corporation, Toyota.

3. What are the main segments of the Automotive Collision Avoidance Systems Market?

The market segments include Function Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Autonomous Vehicle Demand To Propel The Market Growth.

6. What are the notable trends driving market growth?

LiDAR Segment to Grow Significantly During The Forecast Period.

7. Are there any restraints impacting market growth?

High Installation Cost May Hamper The Market Growth.

8. Can you provide examples of recent developments in the market?

Aug 2023: Innoviz Technologies and the BMW Group announced a collaboration by starting a B-sample development phase on a new generation of LiDAR. Under the new development agreement, Innoviz will develop B-Samples based on its second-generation InnovizTwo LiDAR sensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Collision Avoidance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Collision Avoidance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Collision Avoidance Systems Market?

To stay informed about further developments, trends, and reports in the Automotive Collision Avoidance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence