Key Insights

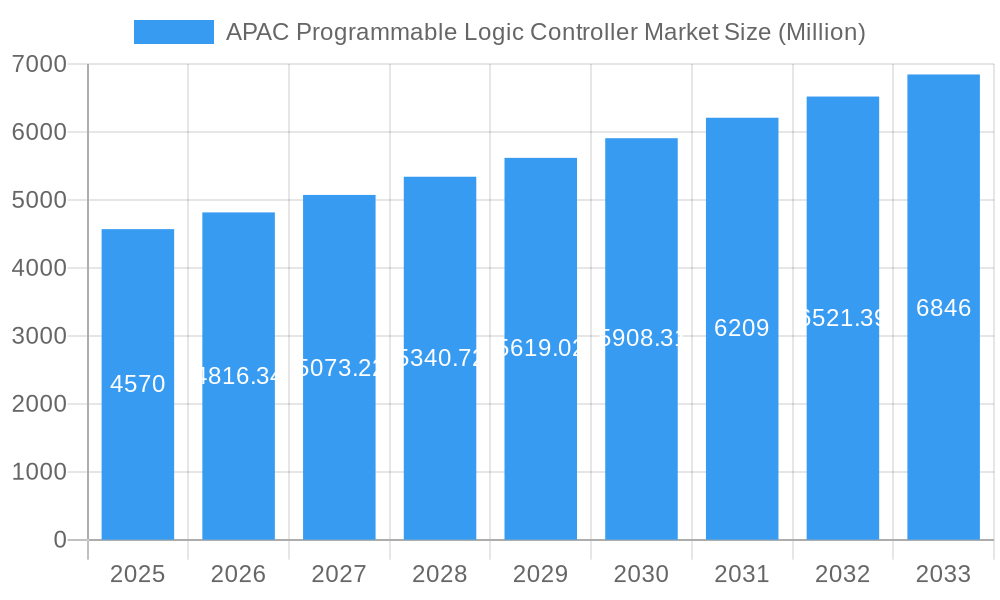

The Asia-Pacific (APAC) Programmable Logic Controller (PLC) market, valued at $4.57 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing automation across various industries, particularly in manufacturing, energy, and infrastructure development within the region, significantly boosts PLC demand. Furthermore, the rising adoption of Industry 4.0 technologies, including smart factories and Industrial Internet of Things (IIoT), necessitates advanced control systems like PLCs for efficient operations and data analysis. Government initiatives promoting industrial automation in countries like China, India, and Japan further stimulate market growth. While supply chain disruptions and potential economic slowdowns could pose challenges, the long-term outlook remains positive due to the sustained growth in industrialization and digital transformation across the APAC region. The market segmentation reveals significant contributions from diverse end-user industries such as food and beverage, automotive, and chemical processing, with hardware and software components comprising a large share of the market value. Leading players like Rockwell Automation, Honeywell, and Siemens continue to invest in research and development, introducing innovative PLC solutions to maintain their competitive edge.

APAC Programmable Logic Controller Market Market Size (In Billion)

The competitive landscape is marked by both established multinational corporations and regional players. The presence of diverse manufacturers ensures a wide range of PLC options catering to varied industrial requirements and budget considerations. The market is expected to see a significant rise in the demand for advanced PLC functionalities, including cloud connectivity, AI integration, and enhanced cybersecurity features. This demand will drive innovation and further propel market growth. The continued expansion of industrial automation across emerging economies within APAC, along with the increasing focus on optimizing operational efficiency and enhancing productivity, will collectively contribute to the sustained growth trajectory of the PLC market. Specific growth rates for individual countries like India, China, and Japan will likely vary based on their unique economic development and industrialization paths, with China and India expected to lead in terms of market size.

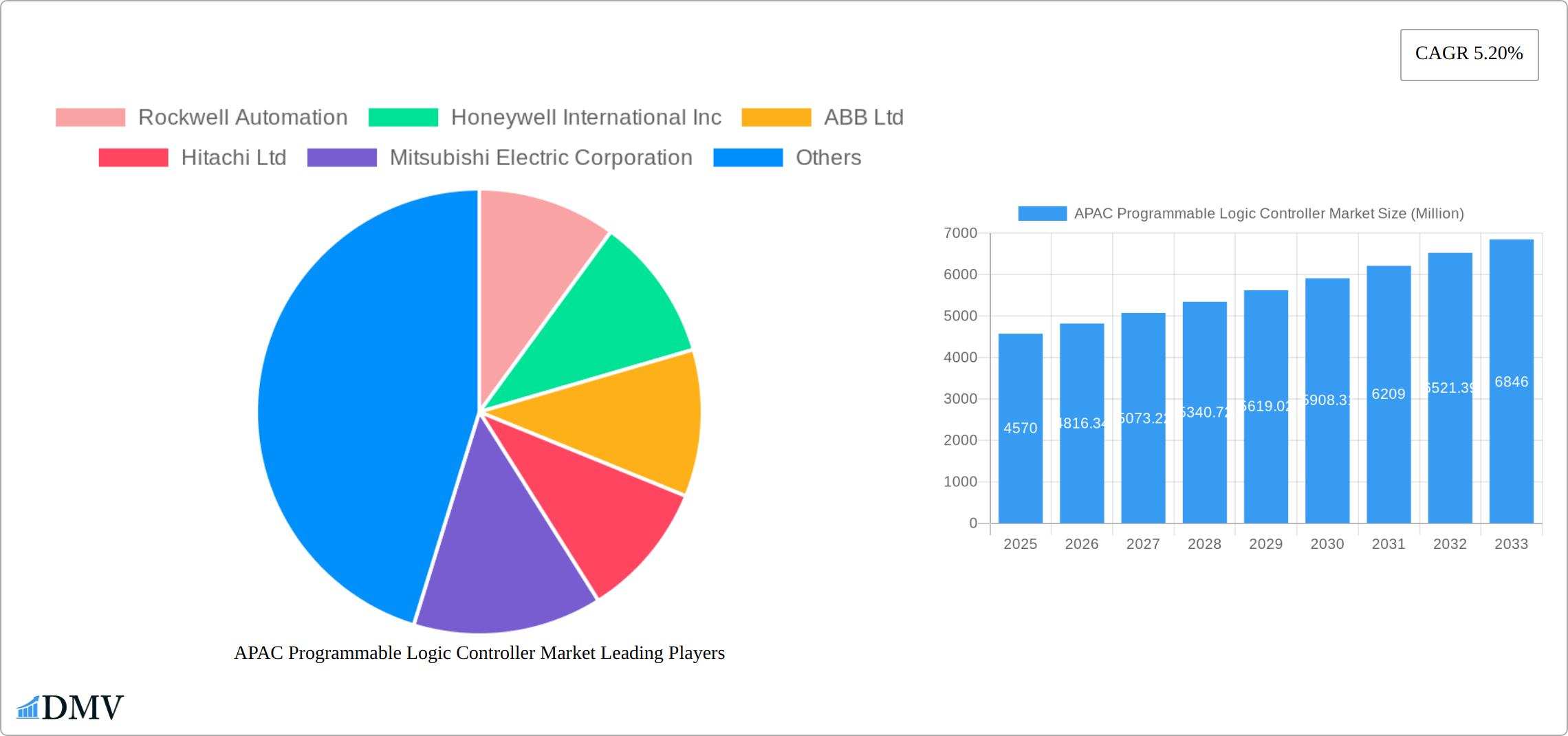

APAC Programmable Logic Controller Market Company Market Share

APAC Programmable Logic Controller Market Market Composition & Trends

The APAC Programmable Logic Controller (PLC) market is characterized by a dynamic interplay of innovation catalysts, regulatory landscapes, and strategic mergers and acquisitions (M&A). The market concentration is moderate, with key players like Rockwell Automation, Siemens AG, and Mitsubishi Electric Corporation holding significant shares. As of 2025, Rockwell Automation is estimated to have a market share of approximately 20%, while Siemens AG and Mitsubishi Electric Corporation follow with 18% and 15% respectively. The innovation catalysts driving the market include the integration of IoT and AI technologies, enhancing the capabilities of PLCs in real-time data processing and automation. Regulatory landscapes are evolving, particularly with the push towards Industry 4.0 standards, which encourage the adoption of advanced automation technologies.

End-user profiles are diverse, with industries such as automotive, food and beverage, and pharmaceuticals showing high adoption rates due to the need for precise control and efficiency. M&A activities have been robust, with deals valued at over $500 Million in 2024 alone, as companies seek to expand their technological portfolios and market reach. Key trends include the shift towards modular and scalable PLC systems, which allow for greater flexibility in industrial applications.

- Market Concentration: Moderate, with key players holding significant shares.

- Innovation Catalysts: IoT and AI integration.

- Regulatory Landscapes: Push towards Industry 4.0 standards.

- Substitute Products: Limited, with PLCs remaining the preferred choice for industrial automation.

- End-user Profiles: High adoption in automotive, food and beverage, and pharmaceuticals.

- M&A Activities: Over $500 Million in deals in 2024.

APAC Programmable Logic Controller Market Industry Evolution

The APAC PLC market has experienced significant growth over the study period of 2019-2033, with the base year set at 2025. The estimated year of 2025 saw a market size of approximately $5 Billion, with a forecasted compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. This growth is propelled by technological advancements such as the integration of IoT and AI into PLC systems, which have enhanced their functionality and application scope. The adoption rate of advanced PLCs in the region has increased by 10% annually since 2019, reflecting a strong demand for automation solutions that offer greater efficiency and reliability.

Consumer demands have shifted towards systems that can provide real-time data analytics and predictive maintenance capabilities, driving the development of more sophisticated PLC technologies. The automotive industry, for instance, has seen a 15% increase in PLC usage over the past five years, driven by the need for precision in manufacturing processes. Similarly, the pharmaceutical sector has adopted PLCs at a rate of 12% per year, as these systems help maintain stringent quality control standards.

The market's evolution is also influenced by the increasing focus on energy efficiency and sustainability, with PLCs playing a crucial role in optimizing industrial processes to reduce energy consumption. The integration of PLCs with renewable energy systems is a growing trend, expected to further drive market growth in the coming years.

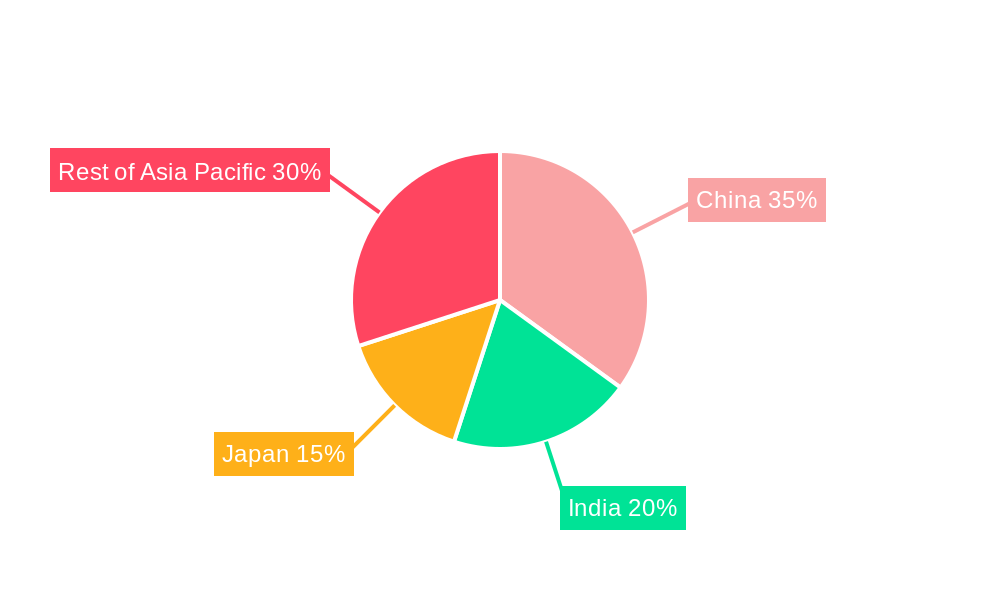

Leading Regions, Countries, or Segments in APAC Programmable Logic Controller Market

The APAC programmable logic controller (PLC) market presents a diverse landscape of regional and segmental dominance. China and Japan stand out as key national players, fueled by robust automotive and broader industrial sectors. The automotive industry remains the leading end-user segment across the region, driven by the need for advanced automation to meet increasing global production demands and efficiency targets. This demand is further amplified by the widespread adoption of smart manufacturing technologies and supportive government regulations promoting Industry 4.0 initiatives. Beyond automotive, significant growth is also seen in sectors like chemicals, energy, and manufacturing in general.

- Key Drivers in the Automotive Industry:

- Investment in advanced automation and smart factories.

- Stringent quality and efficiency requirements from global OEMs.

- Government incentives for automation and technological upgrades.

China's leading market position is solidified by its massive industrial base and proactive government policies like "Made in China 2025," which significantly incentivizes automation across diverse industries. This strategy has spurred widespread PLC adoption, boosting automation in sectors ranging from automotive and chemicals to energy and infrastructure. Japan, with its established automotive and electronics industries, also maintains a strong presence, leveraging its advanced technological capabilities.

- Key Drivers in China:

- Government initiatives (e.g., "Made in China 2025," national infrastructure programs).

- Rapid expansion of industrial production and manufacturing capacity.

- Focus on technological self-reliance and domestic innovation.

Analyzing PLC types, hardware solutions still hold the largest market share, estimated at approximately 60% in 2025, due to their critical role in providing the foundation for complex industrial control systems. However, the software segment is experiencing substantial growth, with a projected CAGR of 8% from 2025 to 2033, driven by increasing demand for enhanced system flexibility, integration with IoT and AI technologies, and improved data analytics capabilities.

- Key Drivers in the Hardware Segment:

- Reliability and robustness in demanding industrial environments.

- High performance and precise control capabilities.

- Key Drivers in the Software Segment:

- Growing need for advanced functionalities and seamless integration.

- Demand for data-driven insights and predictive maintenance capabilities.

- Increased adoption of cloud-based PLC solutions.

The service segment, encompassing maintenance, consulting, and support services, is also exhibiting strong growth, projected at a CAGR of 7% over the forecast period. This reflects the increasing complexity of PLC systems and the need for specialized expertise to ensure optimal performance, system uptime, and long-term operational efficiency.

APAC Programmable Logic Controller Market Product Innovations

Product innovations in the APAC PLC market are centered around enhancing system efficiency and integration capabilities. Recent advancements include the development of PLCs with integrated IoT and AI functionalities, allowing for real-time data processing and predictive maintenance. These innovations have significantly improved the performance metrics of PLCs, with reported uptime increases of up to 20%. Unique selling propositions include modular designs that offer scalability and flexibility, catering to diverse industrial needs. Technological advancements such as the integration of edge computing further enhance the responsiveness and efficiency of PLC systems.

Propelling Factors for APAC Programmable Logic Controller Market Growth

The growth of the APAC PLC market is propelled by several key factors. Technologically, the integration of IoT and AI into PLC systems enhances their capabilities, driving demand. Economically, the region's robust industrial growth, particularly in countries like China and India, increases the need for automation solutions. Regulatory influences include government initiatives such as "Made in China 2025" and "Smart Japan," which promote the adoption of advanced automation technologies. These factors collectively contribute to the market's expansion, with specific examples including the adoption of PLCs in smart factories and renewable energy systems.

Obstacles in the APAC Programmable Logic Controller Market Market

The APAC PLC market faces several obstacles that could hinder its growth. Regulatory challenges, such as varying standards across different countries, can complicate the deployment of PLC systems. Supply chain disruptions, particularly in the wake of global events like pandemics, have led to delays and increased costs, impacting market growth by up to 5%. Competitive pressures from emerging technologies and new market entrants also pose challenges, with some companies reporting a 10% decrease in market share due to intensified competition. These barriers require strategic solutions to ensure sustained market growth.

Future Opportunities in APAC Programmable Logic Controller Market

Emerging opportunities in the APAC PLC market include the expansion into new markets such as renewable energy and smart cities. Technological advancements like edge computing and 5G integration offer new avenues for PLC applications, enhancing their efficiency and scope. Consumer trends towards sustainability and energy efficiency are driving demand for PLCs in green industries. These opportunities, if capitalized on, could significantly boost the market's growth trajectory over the forecast period.

Major Players in the APAC Programmable Logic Controller Market Ecosystem

Key Developments in APAC Programmable Logic Controller Market Industry

- May 2022: Electronics Corporation of India Limited (ECIL) launched advanced PLC and SCADA software for process automation systems. This development has strengthened ECIL's position in the market, particularly in nuclear and space sectors, where their systems have been operational for over four decades.

- August 2021: Bosch Rexroth introduced the IndraControlXM22 PLC with Safety PLC, enhancing the Factory of the Future concept. The integration of this PLC with other systems at ATX West 2021 demonstrated real-time data transparency, boosting market dynamics by showcasing practical applications of Industry 4.0 technologies.

Strategic APAC Programmable Logic Controller Market Market Forecast

The strategic forecast for the APAC PLC market highlights significant growth potential driven by technological advancements and increasing industrial automation demands. Future opportunities lie in the integration of PLCs with emerging technologies like 5G and edge computing, which will enhance system efficiency and responsiveness. The market is expected to reach $8 Billion by 2033, with a CAGR of 6.5% from 2025 to 2033. This growth will be supported by continued investments in smart manufacturing and the expansion into new sectors such as renewable energy and smart cities, offering a robust outlook for stakeholders in the PLC market.

APAC Programmable Logic Controller Market Segmentation

-

1. Product Type

- 1.1. Compact PLCs

- 1.2. Rack-Mounted PLCs

- 1.3. Modular PLCs

-

2. End-use Industry

- 2.1. Automotive

- 2.2. Electronics

- 2.3. Food Processing

- 2.4. Chemical Processing

- 2.5. Pharmaceutical

APAC Programmable Logic Controller Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Rest of Asia Pacific

APAC Programmable Logic Controller Market Regional Market Share

Geographic Coverage of APAC Programmable Logic Controller Market

APAC Programmable Logic Controller Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased deployments of programmable logic controller system in automotive industry.; Technological advancements in manufacturing industry.

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Automotive Industry Driving Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Compact PLCs

- 5.1.2. Rack-Mounted PLCs

- 5.1.3. Modular PLCs

- 5.2. Market Analysis, Insights and Forecast - by End-use Industry

- 5.2.1. Automotive

- 5.2.2. Electronics

- 5.2.3. Food Processing

- 5.2.4. Chemical Processing

- 5.2.5. Pharmaceutical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Compact PLCs

- 6.1.2. Rack-Mounted PLCs

- 6.1.3. Modular PLCs

- 6.2. Market Analysis, Insights and Forecast - by End-use Industry

- 6.2.1. Automotive

- 6.2.2. Electronics

- 6.2.3. Food Processing

- 6.2.4. Chemical Processing

- 6.2.5. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Compact PLCs

- 7.1.2. Rack-Mounted PLCs

- 7.1.3. Modular PLCs

- 7.2. Market Analysis, Insights and Forecast - by End-use Industry

- 7.2.1. Automotive

- 7.2.2. Electronics

- 7.2.3. Food Processing

- 7.2.4. Chemical Processing

- 7.2.5. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Compact PLCs

- 8.1.2. Rack-Mounted PLCs

- 8.1.3. Modular PLCs

- 8.2. Market Analysis, Insights and Forecast - by End-use Industry

- 8.2.1. Automotive

- 8.2.2. Electronics

- 8.2.3. Food Processing

- 8.2.4. Chemical Processing

- 8.2.5. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Compact PLCs

- 9.1.2. Rack-Mounted PLCs

- 9.1.3. Modular PLCs

- 9.2. Market Analysis, Insights and Forecast - by End-use Industry

- 9.2.1. Automotive

- 9.2.2. Electronics

- 9.2.3. Food Processing

- 9.2.4. Chemical Processing

- 9.2.5. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rockwell Automation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ABB Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Emerson Electric Co (GE)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Omron Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Toshiba International Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Rockwell Automation

List of Figures

- Figure 1: APAC Programmable Logic Controller Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Programmable Logic Controller Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 3: APAC Programmable Logic Controller Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 6: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 9: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 12: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 15: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Programmable Logic Controller Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the APAC Programmable Logic Controller Market?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Emerson Electric Co (GE), Schneider Electric SE, Omron Corporation, Robert Bosch GmbH, Toshiba International Corporation, Panasonic Corporation.

3. What are the main segments of the APAC Programmable Logic Controller Market?

The market segments include Product Type, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased deployments of programmable logic controller system in automotive industry.; Technological advancements in manufacturing industry..

6. What are the notable trends driving market growth?

Automotive Industry Driving Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

May 2022 - The advanced Programmable Logic Controller (PLC) and Supervisory Control and Data Acquisition (SCADA) software for process automation systems has been launched by Electronics Corporation of India Limited (ECIL) Hyderabad, a public sector unit under the Department of Atomic Energy. PLC and SCADA are widely utilized in industrial control applications, and ECIL was a player in their development. PLC and SCADA systems supplied by ECIL have been effectively operating at nuclear plants and ISRO centers for the past four decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Programmable Logic Controller Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Programmable Logic Controller Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Programmable Logic Controller Market?

To stay informed about further developments, trends, and reports in the APAC Programmable Logic Controller Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence