Key Insights

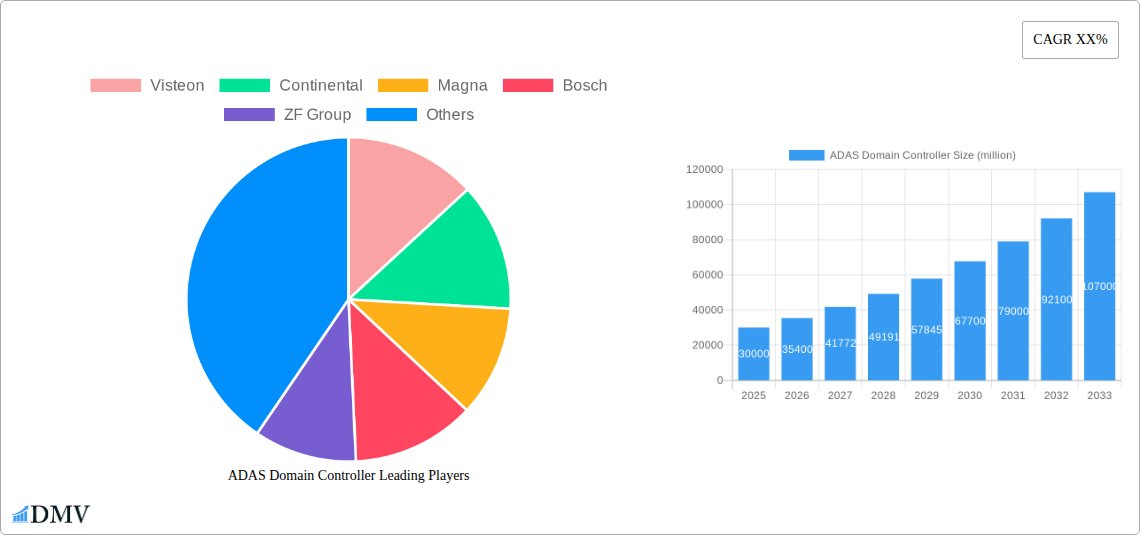

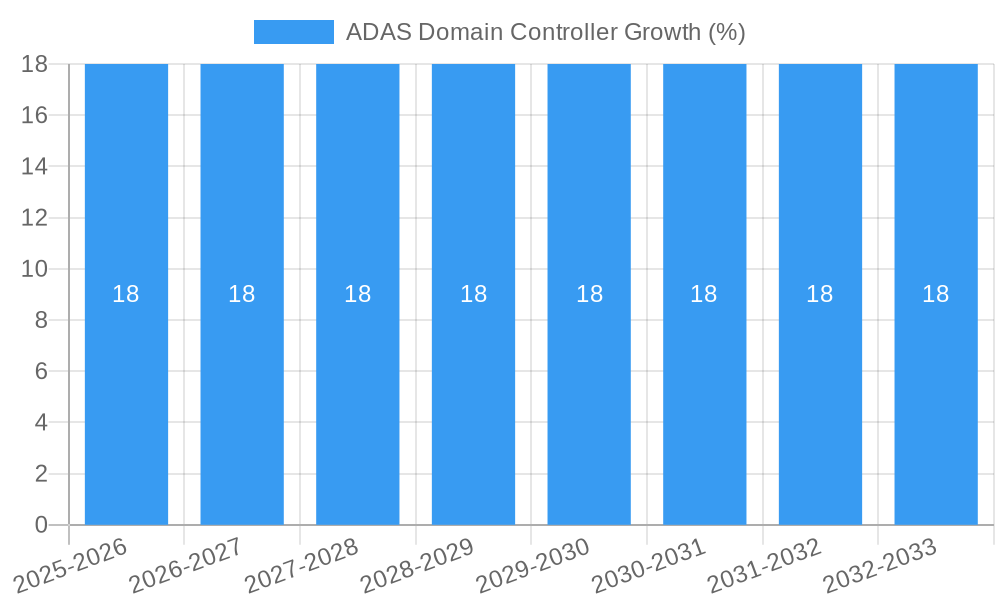

The ADAS (Advanced Driver-Assistance Systems) Domain Controller market is experiencing robust growth, projected to reach an estimated USD 30,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 18% through 2033. This expansion is primarily fueled by the increasing demand for sophisticated safety features in vehicles, driven by evolving consumer expectations and stringent regulatory mandates worldwide. The surge in autonomous driving capabilities, from L2-L3 functionalities to more advanced L4 and L5 systems, necessitates powerful and integrated domain controllers capable of processing vast amounts of sensor data in real-time. Key market drivers include the growing adoption of electric vehicles (EVs), which often come equipped with advanced ADAS features, and the continuous innovation in sensor technologies like LiDAR, radar, and cameras. The push towards smart cities and connected car ecosystems further bolsters the demand for these intelligent computing platforms.

The market is segmented into various applications, with Passenger Vehicles dominating the landscape due to their widespread adoption and the increasing integration of ADAS for enhanced safety and convenience. The Commercial Vehicle segment is also showing significant traction as fleet operators recognize the benefits of ADAS in improving operational efficiency, reducing accidents, and optimizing logistics. Within the types, the Domain Controller above L3 segment is anticipated to witness the highest growth, reflecting the industry's trajectory towards full autonomy. While the market benefits from strong growth drivers, certain restraints exist, including the high cost of development and implementation of these advanced systems, potential cybersecurity vulnerabilities, and the need for robust infrastructure to support widespread autonomous driving. However, ongoing technological advancements, strategic collaborations among key players like Bosch, Continental, and Visteon, and supportive government initiatives are expected to mitigate these challenges, paving the way for continued market expansion.

Absolutely! Here's the SEO-optimized, insightful report description for the ADAS Domain Controller market, incorporating all your requirements.

ADAS Domain Controller Market Composition & Trends

The ADAS Domain Controller market is characterized by a dynamic and evolving landscape, driven by increasing consumer demand for advanced safety features and evolving automotive industry trends. This report delves deep into the intricate market composition, analyzing key influential factors such as market concentration, innovation catalysts, and the ever-shifting regulatory landscapes that govern the Advanced Driver-Assistance Systems (ADAS) domain. We scrutinize the competitive environment, evaluating the influence of substitute products and the evolving profiles of end-users, from passenger vehicles to commercial vehicle segments. Crucially, the report examines strategic Mergers & Acquisitions (M&A) activities, shedding light on deal values that are reshaping the industry's structure.

- Market Share Distribution: The market displays a moderate concentration, with a few key players holding significant market share, particularly in L2-L3 and above L3 domain controllers.

- M&A Deal Values: Historical M&A activities have seen deal values in the hundreds of millions, indicating strategic consolidation and technology acquisition.

- Innovation Catalysts: Rapid advancements in AI, sensor fusion, and high-performance computing are primary innovation drivers.

- Regulatory Landscapes: Stringent safety regulations and government mandates for ADAS adoption are compelling manufacturers to invest heavily.

- Substitute Products: While direct substitutes are limited, integrated cockpit solutions and advanced driver monitoring systems offer partial functional overlap.

- End-User Profiles: Passenger vehicles represent the largest segment, followed by an increasing demand from commercial vehicles for enhanced safety and operational efficiency.

ADAS Domain Controller Industry Evolution

The ADAS Domain Controller industry has witnessed a remarkable evolution, transforming from basic sensor processing units to sophisticated, centralized computing platforms essential for autonomous driving. This evolution is intrinsically linked to the rapid market growth trajectories fueled by advancements in artificial intelligence, machine learning, and high-performance computing. Technological breakthroughs have been pivotal, enabling the integration of an ever-increasing number of sensors – such as cameras, radar, lidar, and ultrasonic sensors – into a single, powerful domain controller. This fusion of data allows for a comprehensive understanding of the vehicle's surroundings, enabling complex decision-making and advanced functionalities. Shifting consumer demands have also played a crucial role. As drivers become more accustomed to semi-autonomous features and prioritize safety and convenience, the demand for integrated ADAS solutions continues to surge. This has propelled the industry’s growth, with market size expanding from approximately $5,000 million in 2019 to an estimated $10,000 million in 2025, projected to reach over $25,000 million by 2033. The adoption metrics for ADAS features, particularly in higher-tier trims and luxury segments, are steadily increasing, demonstrating a clear market preference for these technologies. The development of domain controllers below L2, L2-L3, and above L3 signifies a tiered approach to autonomy, catering to diverse market needs and regulatory phases. This evolution is not just about hardware but also about the sophisticated software architectures and algorithms that orchestrate these complex systems. The industry's ability to adapt to evolving automotive platforms, from traditional internal combustion engine vehicles to electric vehicles and beyond, further underscores its resilience and forward-thinking nature. The increasing complexity of autonomous driving functions necessitates more powerful and integrated domain controllers, driving continuous innovation in processing power, memory, and connectivity.

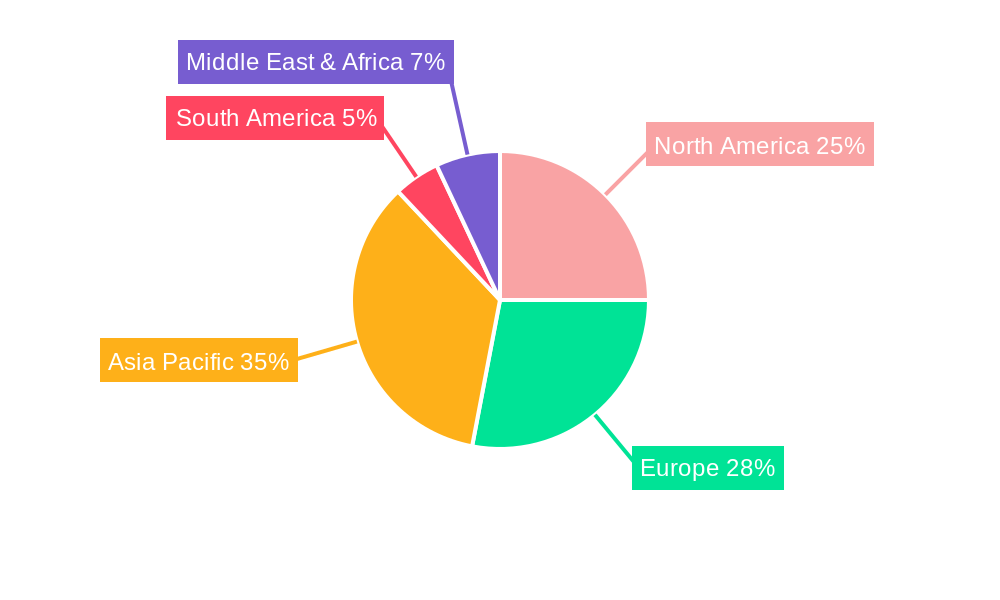

Leading Regions, Countries, or Segments in ADAS Domain Controller

The ADAS Domain Controller market is experiencing significant leadership shifts across various regions and application segments, with Passenger Vehicles consistently emerging as the dominant application, driving innovation and demand for sophisticated domain controllers. Within this broad category, the L2-L3 Domain Controller segment currently holds the largest market share due to the widespread adoption of features like adaptive cruise control, lane keeping assist, and semi-autonomous parking, which fall within these automation levels. However, the Domain Controller above L3 segment is witnessing the most rapid growth, propelled by advancements in autonomous driving technology and the increasing development of Level 4 and Level 5 autonomous vehicles.

- Dominant Application: Passenger Vehicle: This segment accounts for the lion's share of ADAS domain controller sales, driven by consumer demand for enhanced safety, comfort, and convenience features. The sheer volume of passenger vehicle production globally makes it a primary focus for ADAS integration.

- Leading Segment by Type: L2-L3 Domain Controller: This segment currently dominates due to the maturity of technologies like Level 2 and Level 3 autonomous driving systems. Features such as Highway Assist, Traffic Jam Assist, and advanced parking assistance are driving demand.

- Fastest Growing Segment by Type: Domain Controller Above L3: This segment is poised for exponential growth, fueled by investments in autonomous vehicle development, the exploration of robotaxi services, and the anticipation of future regulatory approvals for higher levels of automation.

- Key Drivers in Leading Regions (e.g., North America, Europe, Asia-Pacific):

- North America: High consumer spending power, strong presence of automotive OEMs, and supportive regulatory frameworks for advanced safety features.

- Europe: Stringent safety regulations (e.g., Euro NCAP), a mature automotive market, and a strong focus on sustainability and innovative mobility solutions.

- Asia-Pacific: Rapidly growing automotive market, significant government investments in smart city initiatives and autonomous driving technology, and the presence of major technology hubs.

- Investment Trends: Significant investments are flowing into R&D for higher-level autonomous driving capabilities, leading to increased demand for more powerful and specialized domain controllers.

- Regulatory Support: Favorable government policies and safety standards in key regions are accelerating the adoption of ADAS technologies, thereby boosting the demand for domain controllers.

ADAS Domain Controller Product Innovations

The ADAS Domain Controller market is currently experiencing a wave of groundbreaking product innovations focused on enhanced processing power, AI integration, and modular architectures. Companies are developing domain controllers with advanced AI accelerators, capable of processing vast amounts of sensor data in real-time for complex decision-making crucial for higher levels of autonomy. These innovations aim to reduce the number of Electronic Control Units (ECUs) in a vehicle by consolidating multiple ADAS functions into a single, high-performance domain controller. Features such as real-time object detection, prediction algorithms, and sophisticated sensor fusion capabilities are becoming standard. For instance, new chipsets are offering petaflops of processing power, enabling seamless operation of L4 and L5 autonomous driving systems. The focus is also on cybersecurity and functional safety, with advanced measures integrated into the hardware and software to ensure the reliability and security of ADAS functions, preventing unauthorized access and ensuring predictable behavior even in critical scenarios.

Propelling Factors for ADAS Domain Controller Growth

The growth of the ADAS Domain Controller market is propelled by several interconnected factors. Technological advancements in AI, sensor technology (lidar, radar, cameras), and high-performance computing are making more sophisticated ADAS features feasible and cost-effective. Increasing consumer demand for safety and convenience features in vehicles, coupled with a growing awareness of the benefits of ADAS, is a significant market driver. Furthermore, stringent government regulations and safety mandates worldwide, such as those promoting advanced driver assistance systems for accident prevention, are compelling automotive manufacturers to integrate these technologies, thereby increasing the demand for domain controllers. The global push towards electrification and autonomous driving further accelerates this trend, as domain controllers are fundamental to enabling these advanced vehicle capabilities.

Obstacles in the ADAS Domain Controller Market

Despite its robust growth, the ADAS Domain Controller market faces several obstacles. High development costs associated with sophisticated hardware and software, particularly for advanced autonomous driving functionalities, can be a barrier for some manufacturers. Fragmented regulatory frameworks across different regions, with varying standards and timelines for ADAS deployment, create complexity and uncertainty for global product development. Supply chain disruptions, as highlighted in recent years, can impact the availability and cost of critical components, affecting production schedules. Moreover, cybersecurity threats pose a significant challenge, requiring continuous investment in robust security measures to protect against potential breaches that could compromise vehicle safety. Consumer trust and acceptance of higher levels of automation also remain a factor, requiring extensive testing and public education.

Future Opportunities in ADAS Domain Controller

The ADAS Domain Controller market is ripe with future opportunities. The exponential growth of autonomous driving technologies, particularly L4 and L5 applications in ride-sharing, logistics, and personal mobility, will drive demand for more powerful and specialized domain controllers. The increasing integration of artificial intelligence and machine learning will enable more predictive and proactive ADAS features. Expansion into emerging markets with rapidly growing automotive sectors presents significant untapped potential. Furthermore, the development of edge computing solutions and the increasing adoption of software-defined vehicles will create new avenues for innovation and revenue generation within the domain controller ecosystem, promising enhanced capabilities and personalized driving experiences.

Major Players in the ADAS Domain Controller Ecosystem

- Visteon

- Continental

- Magna

- Bosch

- ZF Group

- Aptiv

- Cookoo

- Imotion

- Reachauto

- Desay SV

- Valeo

- Untouch

- Jingwei Hirain Technologies

- Tianjin Youkong Zhixing Technology

- HingeTech

- Huaruijie

Key Developments in ADAS Domain Controller Industry

- 2024/01: Launch of next-generation domain controllers with enhanced AI processing capabilities for L4 autonomy.

- 2023/11: Major OEM announces strategic partnership for the development of centralized domain controller architecture.

- 2023/08: Significant investment in R&D for secure and redundant domain controller systems.

- 2023/05: Introduction of modular domain controller platforms enabling flexible ADAS feature integration.

- 2023/02: Increased focus on functional safety and cybersecurity certifications for domain controllers.

- 2022/12: Expansion of commercial vehicle ADAS adoption driving demand for ruggedized domain controllers.

- 2022/09: Collaboration on development of unified software stack for diverse domain controller hardware.

- 2022/06: Emergence of new players focusing on specialized ADAS applications.

- 2022/03: Advancements in sensor fusion algorithms for improved perception.

- 2021/11: Increased M&A activities targeting companies with expertise in AI and embedded software.

- 2021/08: Growing demand for domain controllers supporting over-the-air (OTA) updates.

- 2021/05: Development of domain controllers with integrated safety monitors.

- 2020/12: Partnerships formed to address the growing complexity of automotive software.

- 2020/09: Initial deployments of advanced L3 autonomous driving features.

- 2020/06: Increased focus on cost optimization for mass-market ADAS adoption.

- 2019/11: Growing industry consensus towards domain controller consolidation.

Strategic ADAS Domain Controller Market Forecast

- 2024/01: Launch of next-generation domain controllers with enhanced AI processing capabilities for L4 autonomy.

- 2023/11: Major OEM announces strategic partnership for the development of centralized domain controller architecture.

- 2023/08: Significant investment in R&D for secure and redundant domain controller systems.

- 2023/05: Introduction of modular domain controller platforms enabling flexible ADAS feature integration.

- 2023/02: Increased focus on functional safety and cybersecurity certifications for domain controllers.

- 2022/12: Expansion of commercial vehicle ADAS adoption driving demand for ruggedized domain controllers.

- 2022/09: Collaboration on development of unified software stack for diverse domain controller hardware.

- 2022/06: Emergence of new players focusing on specialized ADAS applications.

- 2022/03: Advancements in sensor fusion algorithms for improved perception.

- 2021/11: Increased M&A activities targeting companies with expertise in AI and embedded software.

- 2021/08: Growing demand for domain controllers supporting over-the-air (OTA) updates.

- 2021/05: Development of domain controllers with integrated safety monitors.

- 2020/12: Partnerships formed to address the growing complexity of automotive software.

- 2020/09: Initial deployments of advanced L3 autonomous driving features.

- 2020/06: Increased focus on cost optimization for mass-market ADAS adoption.

- 2019/11: Growing industry consensus towards domain controller consolidation.

Strategic ADAS Domain Controller Market Forecast

The strategic forecast for the ADAS Domain Controller market is exceptionally promising, driven by an intensified focus on autonomous driving and advanced safety functionalities. Future opportunities lie in the rapid expansion of L4 and L5 autonomous vehicle applications, particularly in ride-sharing and logistics, necessitating highly capable and specialized domain controllers. The continuous evolution of artificial intelligence and machine learning algorithms will unlock more sophisticated and predictive ADAS features, enhancing driver safety and convenience. Furthermore, the adoption of software-defined vehicles and the growing importance of over-the-air updates will create recurring revenue streams and demand for adaptable domain controller architectures. Emerging markets present significant growth potential as they increasingly adopt advanced automotive technologies, solidifying the domain controller's role as a cornerstone of future mobility. The market is projected to witness substantial growth, with total market value expected to exceed $40,000 million by 2033.

ADAS Domain Controller Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Domain Controller below L2

- 2.2. L2-L3 Domain Controller

- 2.3. Domain Controller above L3

ADAS Domain Controller Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ADAS Domain Controller REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Domain Controller below L2

- 5.2.2. L2-L3 Domain Controller

- 5.2.3. Domain Controller above L3

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Domain Controller below L2

- 6.2.2. L2-L3 Domain Controller

- 6.2.3. Domain Controller above L3

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Domain Controller below L2

- 7.2.2. L2-L3 Domain Controller

- 7.2.3. Domain Controller above L3

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Domain Controller below L2

- 8.2.2. L2-L3 Domain Controller

- 8.2.3. Domain Controller above L3

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Domain Controller below L2

- 9.2.2. L2-L3 Domain Controller

- 9.2.3. Domain Controller above L3

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific ADAS Domain Controller Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Domain Controller below L2

- 10.2.2. L2-L3 Domain Controller

- 10.2.3. Domain Controller above L3

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Visteon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Magna

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bosch

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZF Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aptiv

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cookoo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Imotion

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Reachauto

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Desay SV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Valeo

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Untouch

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jingwei Hirain Technologies

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tianjin Youkong Zhixing Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HingeTech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Huaruijie

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Visteon

List of Figures

- Figure 1: Global ADAS Domain Controller Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America ADAS Domain Controller Revenue (million), by Application 2024 & 2032

- Figure 3: North America ADAS Domain Controller Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America ADAS Domain Controller Revenue (million), by Types 2024 & 2032

- Figure 5: North America ADAS Domain Controller Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America ADAS Domain Controller Revenue (million), by Country 2024 & 2032

- Figure 7: North America ADAS Domain Controller Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America ADAS Domain Controller Revenue (million), by Application 2024 & 2032

- Figure 9: South America ADAS Domain Controller Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America ADAS Domain Controller Revenue (million), by Types 2024 & 2032

- Figure 11: South America ADAS Domain Controller Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America ADAS Domain Controller Revenue (million), by Country 2024 & 2032

- Figure 13: South America ADAS Domain Controller Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe ADAS Domain Controller Revenue (million), by Application 2024 & 2032

- Figure 15: Europe ADAS Domain Controller Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe ADAS Domain Controller Revenue (million), by Types 2024 & 2032

- Figure 17: Europe ADAS Domain Controller Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe ADAS Domain Controller Revenue (million), by Country 2024 & 2032

- Figure 19: Europe ADAS Domain Controller Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa ADAS Domain Controller Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa ADAS Domain Controller Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa ADAS Domain Controller Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa ADAS Domain Controller Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa ADAS Domain Controller Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa ADAS Domain Controller Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific ADAS Domain Controller Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific ADAS Domain Controller Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific ADAS Domain Controller Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific ADAS Domain Controller Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific ADAS Domain Controller Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific ADAS Domain Controller Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ADAS Domain Controller Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global ADAS Domain Controller Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global ADAS Domain Controller Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global ADAS Domain Controller Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global ADAS Domain Controller Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global ADAS Domain Controller Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global ADAS Domain Controller Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global ADAS Domain Controller Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global ADAS Domain Controller Revenue million Forecast, by Country 2019 & 2032

- Table 41: China ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific ADAS Domain Controller Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ADAS Domain Controller?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the ADAS Domain Controller?

Key companies in the market include Visteon, Continental, Magna, Bosch, ZF Group, Aptiv, Cookoo, Imotion, Reachauto, Desay SV, Valeo, Untouch, Jingwei Hirain Technologies, Tianjin Youkong Zhixing Technology, HingeTech, Huaruijie.

3. What are the main segments of the ADAS Domain Controller?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ADAS Domain Controller," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ADAS Domain Controller report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ADAS Domain Controller?

To stay informed about further developments, trends, and reports in the ADAS Domain Controller, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence