Key Insights

The United Kingdom's online travel market is projected to reach £2 billion by 2025, driven by a CAGR of 10.5% from the base year 2025 to 2033. Key growth factors include widespread digital platform adoption for travel planning and booking, increasing demand for personalized experiences, and continuous innovation from online travel agencies (OTAs). The convenience and competitive pricing of online channels, alongside growing interest in diverse travel segments like vacation packages and unique accommodations, are propelling market performance.

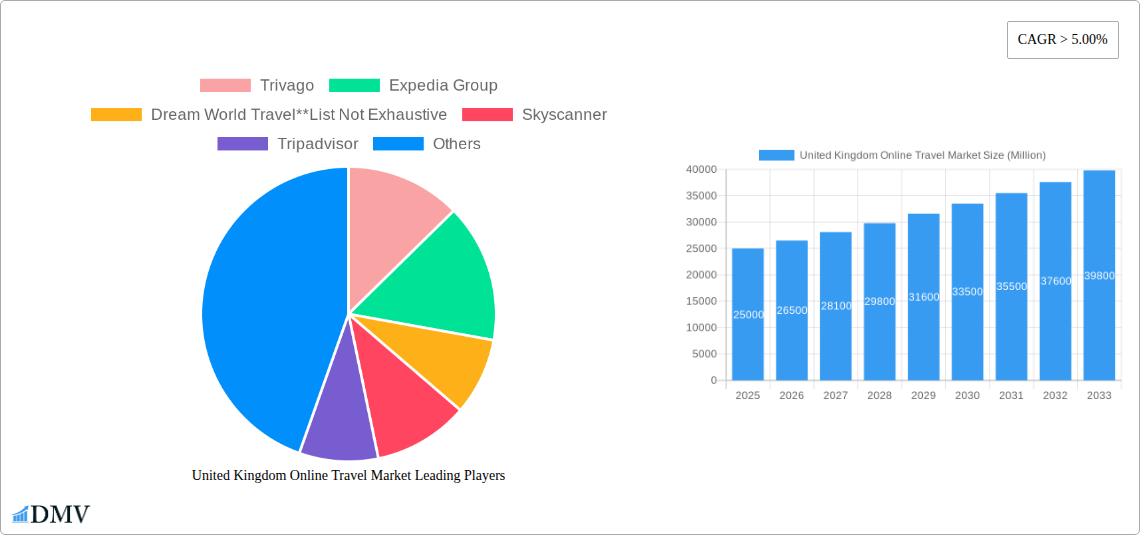

United Kingdom Online Travel Market Market Size (In Billion)

Dominant trends in the UK online travel market include a significant shift towards mobile bookings and the emergence of niche travel services. While OTAs remain leaders, direct bookings with travel suppliers are growing as brands enhance their digital presence. Potential market restraints include intense platform competition, evolving data privacy regulations, and economic uncertainties affecting discretionary travel spending. Nevertheless, the sustained move towards digital-first travel solutions and the inherent resilience of the tourism sector indicate a positive market outlook.

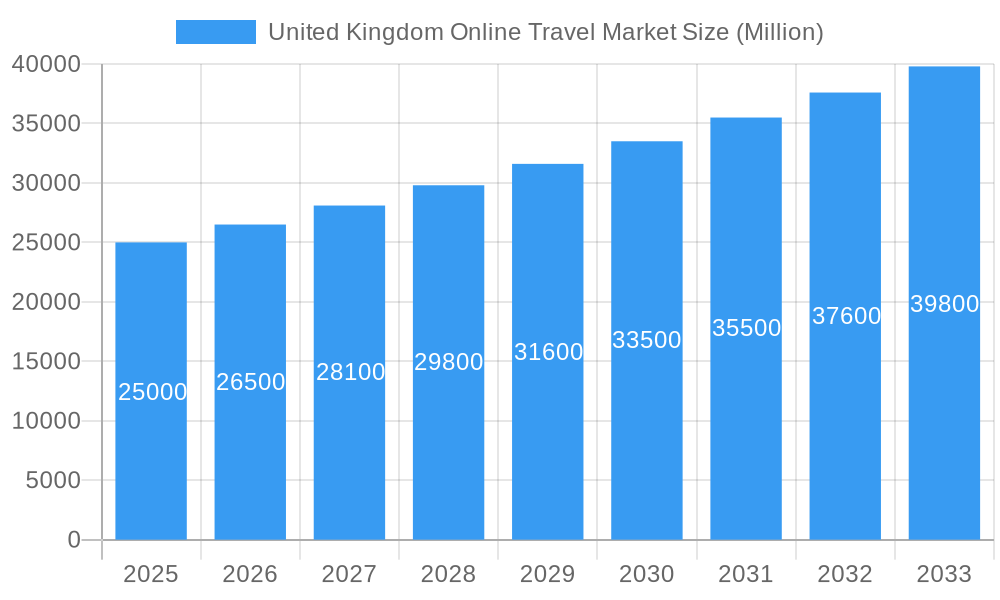

United Kingdom Online Travel Market Company Market Share

United Kingdom Online Travel Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock the intricate dynamics of the UK's digital travel landscape with this definitive report. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Essential for stakeholders, investors, and industry leaders seeking to navigate the competitive online travel agency (OTA) and direct travel supplier ecosystem. Valued in Millions.

United Kingdom Online Travel Market Market Composition & Trends

The United Kingdom online travel market is characterized by a dynamic interplay of established giants and agile disruptors, fostering a moderately concentrated yet fiercely competitive environment. Innovation catalysts are predominantly driven by technological advancements in AI-powered personalization, seamless user experience (UX) design, and the integration of emerging payment solutions. The regulatory landscape, while generally supportive of digital commerce, presents ongoing considerations regarding data privacy (GDPR compliance) and consumer protection. Substitute products, primarily direct bookings via airline or hotel websites, continue to exist but are increasingly challenged by the convenience and comprehensive offerings of OTAs. End-user profiles are diverse, ranging from budget-conscious solo travelers and family vacationers to business travelers seeking efficient booking solutions. Mergers and Acquisitions (M&A) activities, though not extensively detailed in this summary, have historically played a significant role in market consolidation and expansion. The market share distribution showcases a significant presence of major OTAs, with Expedia Group, Booking Holdings (including Booking.com and Hotels.com), and Airbnb holding substantial portions. Skyscanner and Tripadvisor also command considerable influence, particularly in flight and activity bookings, respectively. Niche players like Jet2holidays and lastminute.com cater to specific travel needs, while emerging platforms are continuously seeking to carve out their market segments. M&A deal values are expected to remain substantial, reflecting the ongoing strategic moves to acquire market share, technology, and customer bases.

United Kingdom Online Travel Market Industry Evolution

The United Kingdom online travel market has witnessed a remarkable evolution, driven by persistent technological advancements and a profound shift in consumer behavior. Over the historical period (2019-2024), the market experienced robust growth, amplified by increasing internet penetration and smartphone adoption, facilitating easier access to travel planning and booking services. The COVID-19 pandemic, while presenting unprecedented challenges, paradoxically accelerated the digital transformation within the travel industry. Travelers became more reliant on online platforms for flexible booking options, transparent cancellation policies, and virtual travel experiences. Looking ahead, the forecast period (2025-2033) anticipates continued expansion, albeit with a focus on sustainability, personalized experiences, and integrated travel solutions. The adoption of AI and machine learning is set to revolutionize personalized recommendations, dynamic pricing, and customer service, moving beyond simple search functionalities. Mobile booking is projected to further solidify its dominance, with consumers expecting seamless, on-the-go access to all travel services. Growth rates are expected to average a healthy XX% annually during the forecast period, fueled by a post-pandemic resurgence in travel and an increasing propensity for digital-first booking habits. The integration of travel, accommodation, and local experiences into single, cohesive platforms will become a key differentiator. Companies are investing heavily in data analytics to understand granular customer preferences, leading to hyper-personalized offerings. The shift from transactional bookings to experiential travel planning is a significant trend, with platforms offering curated itineraries and local insights gaining traction. The increasing importance of flexible work arrangements is also influencing travel patterns, leading to a rise in longer stays and "bleisure" (business + leisure) trips, which online travel platforms are increasingly catering to. Furthermore, the growing awareness of environmental impact is driving demand for sustainable travel options, prompting OTAs to highlight eco-friendly accommodations and transportation choices. The industry is also witnessing a trend towards deeper integration of ancillary services, such as travel insurance, car rentals, and activity bookings, directly within the initial booking flow, enhancing convenience and increasing overall transaction value. The competitive landscape is characterized by continuous innovation, with companies investing in new features and partnerships to capture and retain market share.

Leading Regions, Countries, or Segments in United Kingdom Online Travel Market

Within the United Kingdom online travel market, Travel Accommodation stands out as the most dominant segment, driven by the persistent demand for lodging across all traveler demographics. This dominance is underpinned by several key factors.

- Investment Trends: Significant investment flows into the development of user-friendly booking platforms for hotels, apartments, and unique stays, coupled with substantial marketing budgets allocated by major accommodation providers and OTAs.

- Regulatory Support: While not segment-specific, overarching regulations promoting digital commerce and consumer trust indirectly benefit the online accommodation booking sector by fostering a secure and transparent environment for transactions.

- Consumer Demand: The inherent necessity of accommodation for any travel purpose, combined with the convenience of comparing a vast array of options, pricing, and reviews online, makes this segment a cornerstone of the online travel ecosystem.

The Travel Accommodation segment’s dominance is further amplified by the sheer volume of bookings and the average transaction value. Travelers meticulously compare pricing, location, amenities, and guest reviews, leading to extended engagement periods on booking platforms. This sustained interest translates into higher conversion rates and a significant contribution to overall market revenue.

In terms of Booking Type, Online Travel Agencies (OTAs) hold a commanding position. Their ability to aggregate offerings from multiple direct travel suppliers, provide comparative pricing, and offer bundled deals makes them the preferred choice for a majority of consumers. The convenience of a one-stop-shop for flights, accommodation, and often car rentals or holiday packages is a major draw.

- Aggregated Offerings: OTAs consolidate a wide spectrum of travel products, simplifying the search and booking process for consumers.

- Competitive Pricing: The competitive nature of OTAs, vying for customer bookings, often results in attractive pricing and exclusive deals.

- Customer Support & Trust: Established OTAs have built strong reputations for customer service and security, fostering trust among users.

The Platform that witnesses the most significant engagement is Mobile. The proliferation of smartphones and tablets has made mobile devices the primary tool for travel research, booking, and even in-destination management. This trend is further propelled by the development of intuitive mobile applications that offer personalized experiences and push notifications for deals and travel updates.

- Ubiquitous Access: Mobile devices provide constant connectivity, allowing travelers to book and manage trips anytime, anywhere.

- Personalized Experience: Mobile apps are increasingly leveraging AI and user data to offer highly personalized recommendations and booking journeys.

- On-the-Go Convenience: From last-minute bookings to in-destination information, mobile platforms are indispensable for the modern traveler.

While Transportation and Vacation Packages are crucial components, Travel Accommodation consistently leads in terms of overall market value and transaction volume within the United Kingdom. The "Others" segment, encompassing activities, tours, and ancillary services, is also growing but still trails behind the foundational need for lodging. The continuous innovation in mobile technology and the strategic partnerships forged by OTAs further solidify their leadership in facilitating the booking of travel accommodations.

United Kingdom Online Travel Market Product Innovations

The United Kingdom online travel market is experiencing a surge in product innovations aimed at enhancing user experience and personalization. Artificial intelligence (AI) is at the forefront, powering hyper-personalized travel recommendations, dynamic pricing algorithms, and intelligent chatbots for instant customer support. Virtual reality (VR) and augmented reality (AR) are emerging to offer immersive destination previews and hotel tours, allowing potential travelers to “experience” a place before booking. The integration of seamless payment gateways, including cryptocurrency options, and the development of mobile-first booking interfaces with intuitive design are also key advancements. These innovations are designed to streamline the booking process, build customer loyalty, and differentiate offerings in a highly competitive landscape, with a focus on offering unique selling propositions like curated sustainable travel options.

Propelling Factors for United Kingdom Online Travel Market Growth

Several key factors are propelling the United Kingdom online travel market forward. Technological advancements, particularly in AI and mobile technology, are driving greater personalization and convenience. The robust economic recovery post-pandemic, coupled with increased disposable income, fuels a pent-up demand for travel. Furthermore, government initiatives promoting digital transformation and tourism within the UK create a favorable regulatory environment. The growing trend of digital nomads and remote working is also contributing, as individuals have more flexibility to travel and work from different locations, often booking through online platforms.

Obstacles in the United Kingdom Online Travel Market Market

Despite its growth, the United Kingdom online travel market faces several obstacles. Intense competition among numerous online travel agencies and direct suppliers leads to price wars and reduced profit margins. Evolving data privacy regulations (like GDPR) necessitate continuous compliance efforts, adding to operational costs. Supply chain disruptions, particularly in the aviation sector, can lead to flight cancellations and itinerary changes, impacting customer satisfaction and increasing the burden on customer support. Furthermore, the increasing cost of digital marketing and customer acquisition poses a significant challenge for smaller players seeking visibility.

Future Opportunities in United Kingdom Online Travel Market

The future of the United Kingdom online travel market is ripe with opportunities. The burgeoning demand for sustainable and eco-friendly travel presents a significant niche for platforms focusing on responsible tourism. The integration of AI for hyper-personalized travel planning, including bespoke itineraries and curated local experiences, is a key growth area. The expansion into emerging markets within the UK, such as niche adventure tourism or glamping, also offers potential. Furthermore, the development of integrated "super apps" that combine travel booking with other lifestyle services could unlock new revenue streams and customer engagement models.

Major Players in the United Kingdom Online Travel Market Ecosystem

- Trivago

- Expedia Group

- Dream World Travel

- Skyscanner

- Tripadvisor

- Jet2holidays

- Thomas Cook Group

- Airbnb

- lastminute.com

- Booking

- Hotels.com

Key Developments in United Kingdom Online Travel Market Industry

- 2023/05: Skyscanner launches enhanced AI-powered travel planning features, offering personalized itinerary suggestions based on user preferences and budget.

- 2023/11: Expedia Group expands its partnership with a major UK airline to integrate seamless flight and hotel booking options directly within the airline's app.

- 2024/02: Airbnb announces a new initiative to promote sustainable travel options, highlighting eco-friendly accommodations and local carbon offsetting programs.

- 2024/07: Booking.com invests in advanced AI to personalize hotel recommendations, considering factors beyond price and location, such as traveler reviews and past booking behavior.

- 2025/01: Tripadvisor unveils a revamped platform, focusing on user-generated content for activities and tours, with improved search filters for niche experiences.

Strategic United Kingdom Online Travel Market Market Forecast

The United Kingdom online travel market is poised for continued strategic growth, driven by an unwavering focus on technological innovation and evolving consumer demands. The forecast period (2025-2033) will witness a significant uplift in market value, estimated to reach [Predicted Value] Million by 2033. This expansion will be fueled by the increasing adoption of AI for hyper-personalized travel planning, offering bespoke itineraries and unique experiences beyond standard bookings. The rising consciousness around sustainable tourism presents a substantial opportunity, with platforms that champion eco-friendly options set to capture a growing market share. Furthermore, the continued dominance of mobile bookings, coupled with the integration of ancillary services and the potential for new payment solutions, will enhance convenience and drive higher transaction volumes. Strategic partnerships and a focus on delivering exceptional customer journeys will be paramount for sustained success in this dynamic digital travel landscape.

United Kingdom Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Others

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

United Kingdom Online Travel Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Online Travel Market Regional Market Share

Geographic Coverage of United Kingdom Online Travel Market

United Kingdom Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Tourism is Driving the Online Travel Market in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trivago

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expedia Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dream World Travel**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skyscanner

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tripadvisor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet2holidays

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hotels com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trivago

List of Figures

- Figure 1: United Kingdom Online Travel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: United Kingdom Online Travel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: United Kingdom Online Travel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Online Travel Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the United Kingdom Online Travel Market?

Key companies in the market include Trivago, Expedia Group, Dream World Travel**List Not Exhaustive, Skyscanner, Tripadvisor, Jet2holidays, Thomas Cook Group, Airbnb, lastminute com, Booking, Hotels com.

3. What are the main segments of the United Kingdom Online Travel Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Tourism is Driving the Online Travel Market in United Kingdom.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Online Travel Market?

To stay informed about further developments, trends, and reports in the United Kingdom Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence