Key Insights

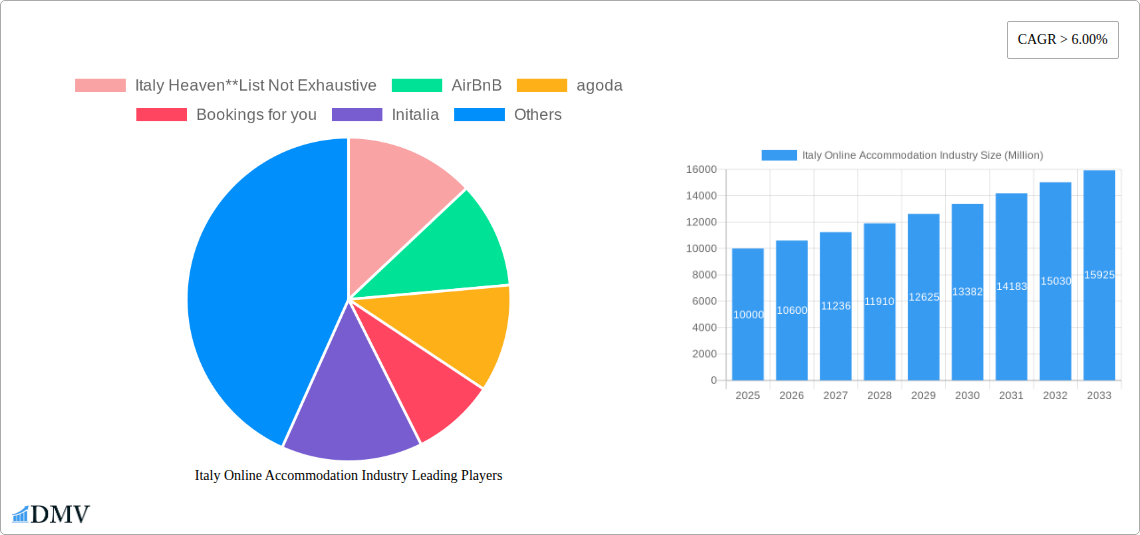

The Italian online accommodation market is poised for significant expansion. Valued at approximately €10.1 billion in the base year 2024, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This upward trend is propelled by several key factors. The increasing prominence of Online Travel Agencies (OTAs) such as Booking.com, Expedia, and Airbnb, alongside widespread smartphone adoption and enhanced internet connectivity, are major growth catalysts. Moreover, a rising consumer preference for convenient and cost-effective booking solutions, coupled with a surge in domestic Italian travel, further fuels market demand. Segment-wise, mobile application bookings are outperforming website reservations, reflecting a clear shift towards mobile-first consumer engagement. Direct bookings via proprietary platforms are also gaining traction as hotels and property owners aim to reduce third-party dependency and strengthen direct customer relationships. However, the market is not without its challenges. Seasonal tourism fluctuations, potential regulatory shifts impacting short-term rentals, and increasing competition from established hospitality providers present hurdles. The competitive arena is characterized by the presence of global leaders and specialized local entities, including Airbnb, Booking.com, Expedia, and Italy-specific platforms, all competing for market share. Sustained future growth hinges on continued investment in technological innovation, optimizing customer experience, and proactively adapting to evolving traveler needs.

Italy Online Accommodation Industry Market Size (In Billion)

The forecast period of 2024-2033 indicates sustained market growth, with the market size anticipated to surpass €18.0 billion by 2033. Key strategic developments will likely include alliances between OTAs and local businesses, the deployment of AI-driven personalized travel recommendations, and the emergence of niche platforms tailored to specific traveler demographics. Addressing sustainability and responsible tourism practices is also becoming paramount for brand reputation and attracting environmentally conscious consumers. Success in this dynamic market will be contingent on competitive pricing, innovative marketing targeting both domestic and international travelers, and the delivery of seamless, secure booking experiences.

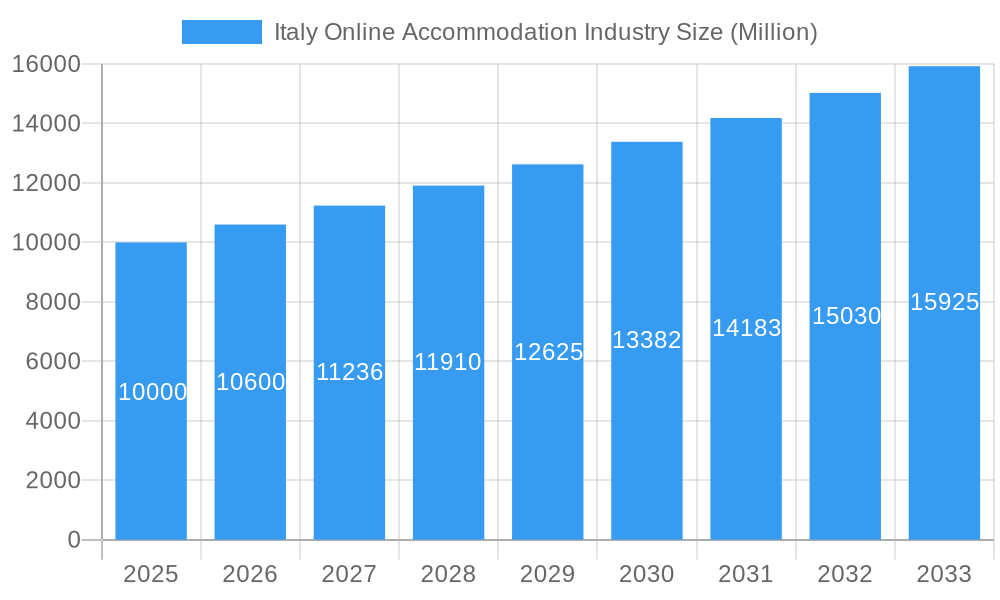

Italy Online Accommodation Industry Company Market Share

Italy Online Accommodation Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Italy online accommodation market, encompassing historical performance (2019-2024), the current state (Base Year: 2025), and a comprehensive forecast (2025-2033). Valued at xx Million in 2025, this burgeoning sector offers significant opportunities for investors and stakeholders alike. This report delves into market composition, leading players, innovative trends, and future growth trajectories.

Italy Online Accommodation Industry Market Composition & Trends

This section analyzes the competitive landscape of the Italian online accommodation market, encompassing market concentration, innovation, regulatory factors, substitute products, user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of established global players and local businesses. Market share is distributed amongst several key players, with Airbnb and Booking Holdings holding significant portions; however, smaller players such as Italy Heaven and Initalia capture niche markets. M&A activity in the period 2019-2024 witnessed xx Million in deal value, largely driven by consolidation among smaller players.

- Market Concentration: Highly fragmented, with global giants like Booking Holdings and Expedia competing alongside numerous local and niche players.

- Innovation Catalysts: Focus on personalized travel experiences, AI-powered recommendations, and sustainable tourism initiatives.

- Regulatory Landscape: Stringent regulations concerning data privacy, consumer protection, and taxation impact market operations.

- Substitute Products: Traditional accommodation options (hotels, guesthouses) continue to compete, although online platforms offer increased convenience and choice.

- End-User Profiles: A diverse range of travelers, from budget backpackers to luxury tourists, utilizing online platforms for bookings.

- M&A Activities: Consolidation through acquisitions has been moderate, with a predicted xx Million in deal value during the forecast period (2025-2033).

Italy Online Accommodation Industry Industry Evolution

The Italian online accommodation market has experienced significant growth from 2019 to 2024, driven by increasing internet penetration, smartphone adoption, and a rising preference for online travel booking. The sector has witnessed a shift towards mobile-first strategies, with mobile applications becoming the primary booking channel for a significant portion of users. This evolution has been further accelerated by technological advancements such as improved search algorithms, personalized recommendations, and virtual reality tours. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a value of xx Million by 2033. Consumer demand is shifting towards unique experiences, eco-friendly options, and flexible booking policies.

Leading Regions, Countries, or Segments in Italy Online Accommodation Industry

The Italian online accommodation market demonstrates strong regional variations. Rome, Milan, and Florence consistently attract the highest number of bookings. Among platform types, Mobile Applications dominate, boosted by ease of use and accessibility. Third-Party Online Portals (e.g., Booking.com, Expedia) capture the largest market share due to brand recognition and extensive inventory.

Key Drivers for Mobile Application Dominance:

- Ease of use and accessibility for travelers on the go.

- Location-based services and personalized recommendations.

- Integration with other travel apps and services.

Key Drivers for Third-Party Online Portals Dominance:

- Extensive network of accommodation options.

- Established brand reputation and consumer trust.

- Robust customer service and support mechanisms.

Italy Online Accommodation Industry Product Innovations

Recent innovations include personalized travel recommendations using AI, virtual reality tours showcasing properties, and seamless integration with ride-sharing and local activity booking platforms. These improvements enhance the user experience and contribute to the growth of the sector. The focus is on creating a more personalized and efficient booking process for travellers.

Propelling Factors for Italy Online Accommodation Industry Growth

Technological advancements, rising disposable incomes, and a growing preference for online travel booking are key drivers for the growth of the industry. Government initiatives promoting tourism also positively contribute. The increasing adoption of mobile booking apps further accelerates growth.

Obstacles in the Italy Online Accommodation Industry Market

The market faces challenges like intense competition, fluctuating currency rates impacting international travel, and occasional supply chain disruptions affecting availability. Regulatory changes and seasonal tourism patterns also pose obstacles.

Future Opportunities in Italy Online Accommodation Industry

Emerging opportunities include expanding into niche markets (e.g., eco-tourism, wellness retreats), incorporating cutting-edge technologies (e.g., blockchain for secure transactions), and leveraging data analytics for more personalized travel planning services.

Major Players in the Italy Online Accommodation Industry Ecosystem

- Italy Heaven

- AirBnB

- agoda

- Bookings for you

- Initalia

- Trip advisor

- Booking Holdings

- Expedia

- Plum guide

- Vrbo

Key Developments in Italy Online Accommodation Industry Industry

- June 01, 2021: Trip.com and TripAdvisor expand their strategic partnership to include TripAdvisor Plus.

- July 20, 2021: TripAdvisor partners with leading hotel technology providers to enhance TripAdvisor Plus participation.

- September 13, 2021: TripAdvisor partners with Audible for enhanced travel audio entertainment.

Strategic Italy Online Accommodation Industry Market Forecast

The Italian online accommodation market is poised for substantial growth over the forecast period. Continued technological innovation, increasing tourist arrivals, and government initiatives supporting the tourism sector are expected to propel the market towards xx Million by 2033. The focus on personalized experiences and sustainable tourism will be key factors driving future expansion.

Italy Online Accommodation Industry Segmentation

-

1. Platform type

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking type

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive portals

Italy Online Accommodation Industry Segmentation By Geography

- 1. Italy

Italy Online Accommodation Industry Regional Market Share

Geographic Coverage of Italy Online Accommodation Industry

Italy Online Accommodation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration has Huge Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Online Accommodation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking type

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Italy Heaven**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AirBnB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bookings for you

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Initalia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trip advisor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Booking Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plum guide

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vrbo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Italy Heaven**List Not Exhaustive

List of Figures

- Figure 1: Italy Online Accommodation Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Online Accommodation Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 2: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 3: Italy Online Accommodation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 5: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 6: Italy Online Accommodation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Online Accommodation Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Italy Online Accommodation Industry?

Key companies in the market include Italy Heaven**List Not Exhaustive, AirBnB, agoda, Bookings for you, Initalia, Trip advisor, Booking Holdings, Expedia, Plum guide, Vrbo.

3. What are the main segments of the Italy Online Accommodation Industry?

The market segments include Platform type, Mode of Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration has Huge Impact on the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

On September 13, 2021. TripAdvisor partnered with Audible for the Ultimate Travel Audio Entertainment, it makes easy for traveller to listen their favourite audio playlists with them during their next trip with just a few taps on their mobile device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Online Accommodation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Online Accommodation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Online Accommodation Industry?

To stay informed about further developments, trends, and reports in the Italy Online Accommodation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence