Key Insights

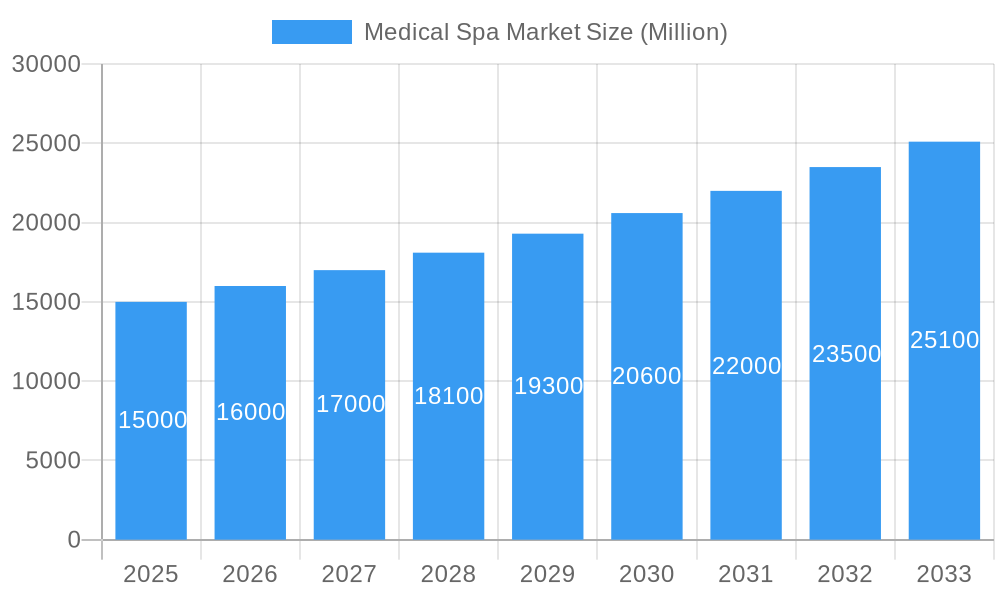

The global medical spa market is projected for substantial expansion, anticipating a Compound Annual Growth Rate (CAGR) of 14.4% from 2025, with an estimated market size of $18.61 billion by 2025. This growth trajectory is propelled by rising disposable incomes, particularly in emerging economies, driving demand for aesthetic services. Advancements in minimally invasive procedures, such as laser treatments and body contouring, enhance efficacy and safety, attracting a wider clientele. Growing awareness of self-care and anti-aging concerns further fuels market demand. The market is segmented by service type, including facial treatments, body sculpting, laser hair removal, and tattoo removal, and by end-user demographics, with both male and female segments exhibiting growth. While the female demographic currently leads, the male segment is experiencing significant acceleration due to evolving societal perceptions and increased male engagement in aesthetic care. The competitive landscape is dynamic, featuring established hospitality brands and numerous independent medical spas.

Medical Spa Market Market Size (In Billion)

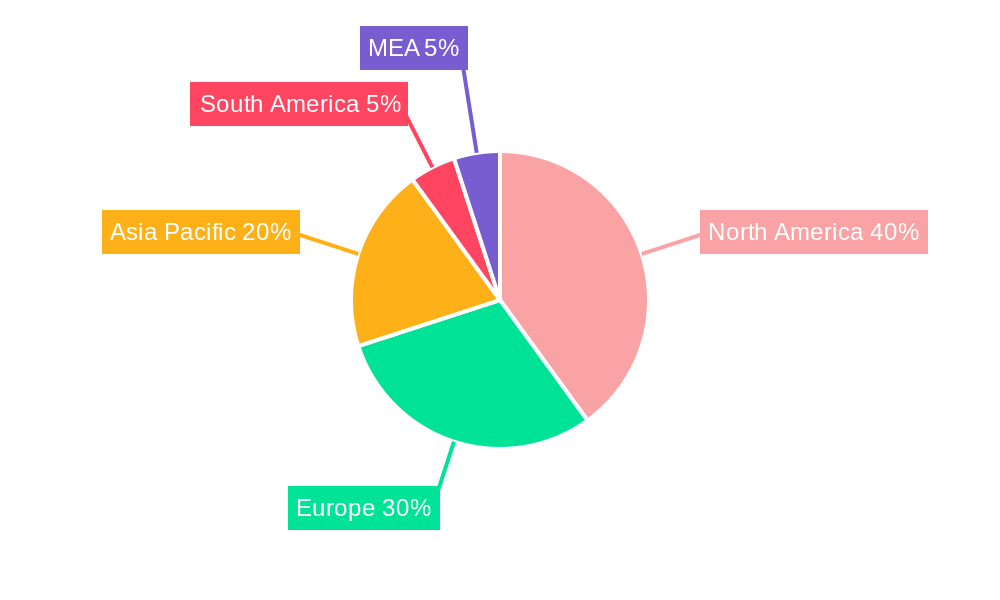

Geographically, North America and Europe demonstrate strong market performance, attributed to high per capita incomes and developed medical tourism sectors. The Asia Pacific region is emerging as a key growth area, fueled by a burgeoning middle class and increased adoption of cosmetic procedures. Future market expansion hinges on sustained economic development in key regions, continuous technological innovation in treatment modalities, and persistent consumer interest in non-invasive cosmetic procedures.

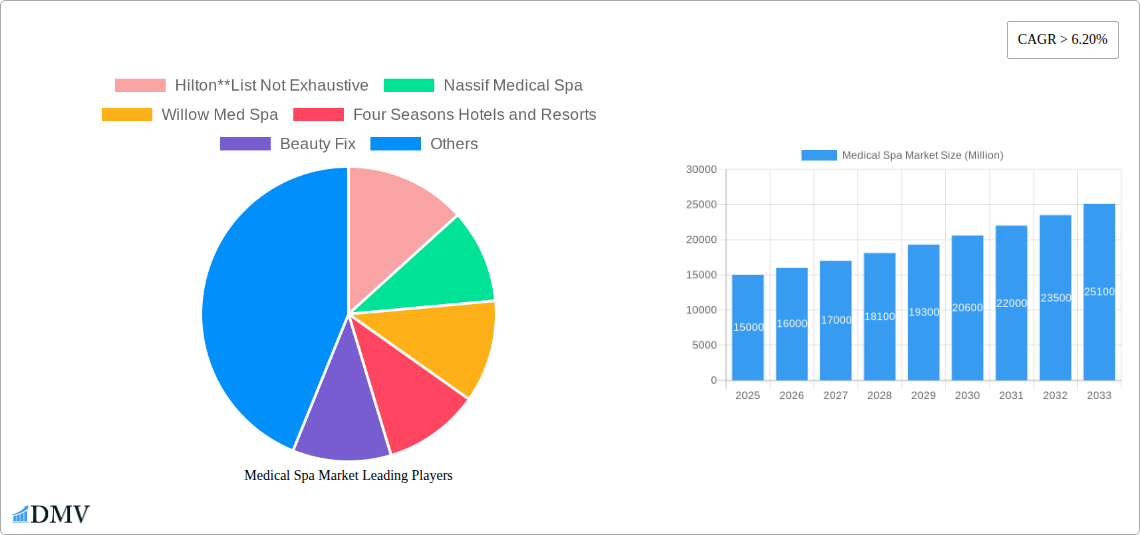

Medical Spa Market Company Market Share

Medical Spa Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Medical Spa Market, projecting robust growth from 2025 to 2033. It examines market dynamics, key players, technological advancements, and emerging opportunities across various segments, empowering stakeholders to make informed strategic decisions. The report covers the period 2019-2024 (Historical Period), using 2025 as the Base Year and projecting to 2033 (Forecast Period). The Estimated Year for key metrics is 2025.

Medical Spa Market Composition & Trends

This section delves into the intricate landscape of the medical spa market, examining market concentration, innovation drivers, regulatory hurdles, substitute products, end-user demographics, and mergers & acquisitions (M&A) activity. The analysis incorporates data from 2019-2024, providing a robust foundation for understanding current market realities and projecting future trends.

The market is characterized by a moderately fragmented landscape, with a few large players and numerous smaller, specialized clinics. Market share distribution among the top 10 players is estimated at xx%, with the remaining share distributed across a wide array of smaller businesses. Innovation is driven by advancements in laser technology, injectables, and non-invasive body contouring procedures. Regulatory landscapes vary significantly across regions, impacting market entry and operational standards. Substitute products include at-home beauty devices and traditional skincare routines, though the medical spa sector benefits from its ability to offer advanced and specialized treatments. End-user profiles reveal a growing demand from both male and female demographics across all age groups, although specific service preferences can vary.

M&A activity has been moderate in recent years, with deal values averaging around xx Million per transaction in the period 2022-2024. Key drivers of M&A are synergies in service offerings, geographic expansion, and access to advanced technologies.

- Market Concentration: Moderately fragmented with xx% held by top 10 players in 2025.

- Innovation Drivers: Laser technology, injectables, non-invasive body contouring.

- Regulatory Landscape: Varies significantly by region, influencing operational standards.

- Substitute Products: At-home devices, traditional skincare.

- End-User Demographics: Growing demand from both males and females across diverse age groups.

- M&A Activity: Moderate activity; average deal value xx Million (2022-2024).

Medical Spa Market Industry Evolution

This section provides a comprehensive analysis of the medical spa market's growth trajectory, technological progress, and evolving consumer preferences from 2019 to 2033. The analysis will highlight key trends and shifts, offering insights into the market's future direction.

From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including rising disposable incomes, increased consumer awareness of aesthetic procedures, and technological advancements that have made treatments safer and more effective. The adoption rate of minimally invasive procedures, such as Botox and fillers, has increased significantly, exceeding xx% of the target demographic in many developed markets. Consumer demand is shifting towards personalized and holistic wellness experiences, encompassing fitness, nutrition, and mental health in addition to cosmetic treatments. Technological advancements, such as AI-powered skin analysis tools and advanced laser systems, are driving treatment efficacy and customization. We project a CAGR of xx% from 2025 to 2033, fueled by continued technological innovation, expanding service offerings, and broadening market reach.

Leading Regions, Countries, or Segments in Medical Spa Market

This section identifies leading regions, countries, and segments within the medical spa market, examining their growth drivers and dominant factors. The analysis encompasses both services (Facial Treatment, Body Shaping and Contouring, Laser Hair Removal, Tattoo Removal, Scars & Striae, Other Services) and end-users (Male, Female).

Dominant Region: North America is projected to hold the largest market share in 2025, driven by high disposable incomes and a strong preference for aesthetic treatments.

Dominant Segment (By Service): Facial treatments (including Botox, fillers, and chemical peels) constitute the largest segment, benefiting from high demand and relatively lower cost of entry compared to other procedures.

Dominant Segment (By End-User): The female demographic comprises the dominant consumer base, though the male segment is experiencing accelerated growth, driven by increasing acceptance of aesthetic procedures among men.

Key Drivers:

- North America: High disposable income, strong aesthetic treatment preference.

- Facial Treatments: High demand, relative affordability, wide range of treatments.

- Female Demographic: Established market, high consumer interest, preference for aesthetic enhancements.

The dominance of these segments reflects a confluence of factors, including higher consumer disposable income, greater awareness of available treatments, and technological advancements that are making those treatments safer and more effective. In-depth analysis further explores the nuances of these factors.

Medical Spa Market Product Innovations

Recent innovations in the medical spa industry include advancements in laser technology, offering greater precision and reduced downtime for procedures like hair removal and skin rejuvenation. Non-invasive body contouring techniques, such as radiofrequency and ultrasound treatments, are gaining popularity due to their effectiveness and minimal invasiveness. The incorporation of AI-powered diagnostic tools allows for more personalized treatment plans, boosting both customer satisfaction and treatment outcomes. Unique selling propositions increasingly emphasize customized treatments tailored to individual skin types and concerns, and the integration of holistic wellness approaches into the overall spa experience.

Propelling Factors for Medical Spa Market Growth

Several factors are driving growth in the medical spa market. Technological advancements, including minimally invasive procedures and sophisticated equipment, are enhancing treatment effectiveness and safety. The rise in disposable incomes, particularly in emerging economies, is fueling increased consumer spending on aesthetic treatments. Favorable regulatory environments in some regions are further stimulating market expansion. Finally, the growing awareness of aesthetic procedures, fueled by social media and celebrity endorsements, is driving increased demand.

Obstacles in the Medical Spa Market Market

Challenges in the medical spa market include stringent regulatory requirements in certain regions, increasing the cost and complexity of market entry. Supply chain disruptions, particularly concerning specialized equipment and consumables, can impact service availability and pricing. Intense competition, both from established medical spas and emerging players, exerts downward pressure on profit margins. The high cost of advanced treatments can limit access for price-sensitive consumers, despite ongoing innovation to deliver cost-effective options.

Future Opportunities in Medical Spa Market

Future opportunities lie in expanding into emerging markets with growing disposable incomes and interest in aesthetic treatments. The development of innovative, non-invasive technologies promises to enhance treatment efficacy and reduce recovery times. Moreover, a focus on personalized and holistic wellness experiences, integrating aesthetic treatments with broader wellness offerings (fitness, nutrition, mental health), will further enhance customer appeal and market expansion.

Major Players in the Medical Spa Market Ecosystem

- Hilton

- List Not Exhaustive

- Nassif Medical Spa

- Willow Med Spa

- Four Seasons Hotels and Resorts

- Beauty Fix

- Qazi Cosmetic Clinic

- Canyon Ranch

- Cocoon Medical Spa

- The Biomed Spa

- Clinique La Prairie

Key Developments in Medical Spa Market Industry

- January 2023: Four Seasons Hotel New York Downtown launched "Next Health and Wellness Services," expanding its medical spa offerings. This signifies a growing trend towards integrated wellness services.

- February 2023: Hilton opened a new resort and spa facility in Egypt (Hilton Marsa Wazar Red Sea Resort & Spa), expanding its footprint in the luxury spa market and signaling growth potential in emerging markets.

Strategic Medical Spa Market Forecast

The medical spa market is poised for sustained growth over the forecast period (2025-2033), driven by technological innovation, expanding service offerings, and increasing consumer awareness. The integration of holistic wellness and personalized treatment approaches will be key differentiators, while expansion into new markets will further fuel market expansion. The growing male segment represents a significant future market opportunity. We project strong market expansion, driven by the trends and opportunities outlined in this report.

Medical Spa Market Segmentation

-

1. Services

- 1.1. Facial Treatment

- 1.2. Body Shaping and Contouring

- 1.3. Laser Hair Removal

- 1.4. Tattoo Removal

- 1.5. Scars & Striae

- 1.6. Other Services

-

2. End User

- 2.1. Male

- 2.2. Female

Medical Spa Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Medical Spa Market Regional Market Share

Geographic Coverage of Medical Spa Market

Medical Spa Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media and Celebrity Influence; Increasing Disposable Income

- 3.3. Market Restrains

- 3.3.1. Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Non-Invasive Cosmetic Procedures

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Facial Treatment

- 5.1.2. Body Shaping and Contouring

- 5.1.3. Laser Hair Removal

- 5.1.4. Tattoo Removal

- 5.1.5. Scars & Striae

- 5.1.6. Other Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Facial Treatment

- 6.1.2. Body Shaping and Contouring

- 6.1.3. Laser Hair Removal

- 6.1.4. Tattoo Removal

- 6.1.5. Scars & Striae

- 6.1.6. Other Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Male

- 6.2.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Facial Treatment

- 7.1.2. Body Shaping and Contouring

- 7.1.3. Laser Hair Removal

- 7.1.4. Tattoo Removal

- 7.1.5. Scars & Striae

- 7.1.6. Other Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Male

- 7.2.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Facial Treatment

- 8.1.2. Body Shaping and Contouring

- 8.1.3. Laser Hair Removal

- 8.1.4. Tattoo Removal

- 8.1.5. Scars & Striae

- 8.1.6. Other Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Male

- 8.2.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Facial Treatment

- 9.1.2. Body Shaping and Contouring

- 9.1.3. Laser Hair Removal

- 9.1.4. Tattoo Removal

- 9.1.5. Scars & Striae

- 9.1.6. Other Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Male

- 9.2.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Medical Spa Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Facial Treatment

- 10.1.2. Body Shaping and Contouring

- 10.1.3. Laser Hair Removal

- 10.1.4. Tattoo Removal

- 10.1.5. Scars & Striae

- 10.1.6. Other Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Male

- 10.2.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hilton**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nassif Medical Spa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Willow Med Spa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Four Seasons Hotels and Resorts

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Beauty Fix

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qazi Cosmetic Clinic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canyon Ranch

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cocoon Medical Spa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Biomed Spa

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Clinique La Prairie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hilton**List Not Exhaustive

List of Figures

- Figure 1: Global Medical Spa Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Medical Spa Market Revenue (billion), by Services 2025 & 2033

- Figure 3: North America Medical Spa Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Medical Spa Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Medical Spa Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Medical Spa Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Medical Spa Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Medical Spa Market Revenue (billion), by Services 2025 & 2033

- Figure 9: Europe Medical Spa Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: Europe Medical Spa Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Medical Spa Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Medical Spa Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Medical Spa Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Medical Spa Market Revenue (billion), by Services 2025 & 2033

- Figure 15: Asia Pacific Medical Spa Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Asia Pacific Medical Spa Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Medical Spa Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Medical Spa Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Spa Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Medical Spa Market Revenue (billion), by Services 2025 & 2033

- Figure 21: Latin America Medical Spa Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Latin America Medical Spa Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Medical Spa Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Medical Spa Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Medical Spa Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Medical Spa Market Revenue (billion), by Services 2025 & 2033

- Figure 27: Middle East and Africa Medical Spa Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East and Africa Medical Spa Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East and Africa Medical Spa Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Medical Spa Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Medical Spa Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Medical Spa Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Medical Spa Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 8: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Medical Spa Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 11: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Medical Spa Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 14: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Medical Spa Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Medical Spa Market Revenue billion Forecast, by Services 2020 & 2033

- Table 17: Global Medical Spa Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Medical Spa Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Spa Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the Medical Spa Market?

Key companies in the market include Hilton**List Not Exhaustive, Nassif Medical Spa, Willow Med Spa, Four Seasons Hotels and Resorts, Beauty Fix, Qazi Cosmetic Clinic, Canyon Ranch, Cocoon Medical Spa, The Biomed Spa, Clinique La Prairie.

3. What are the main segments of the Medical Spa Market?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Social Media and Celebrity Influence; Increasing Disposable Income.

6. What are the notable trends driving market growth?

Increasing Demand for Non-Invasive Cosmetic Procedures.

7. Are there any restraints impacting market growth?

Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market.

8. Can you provide examples of recent developments in the market?

Feb 2023: Hilton opened a new resort and spa facility in Egypt called Hilton Marsa Wazar Red Sea Resort & Spa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Spa Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Spa Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Spa Market?

To stay informed about further developments, trends, and reports in the Medical Spa Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence