Key Insights

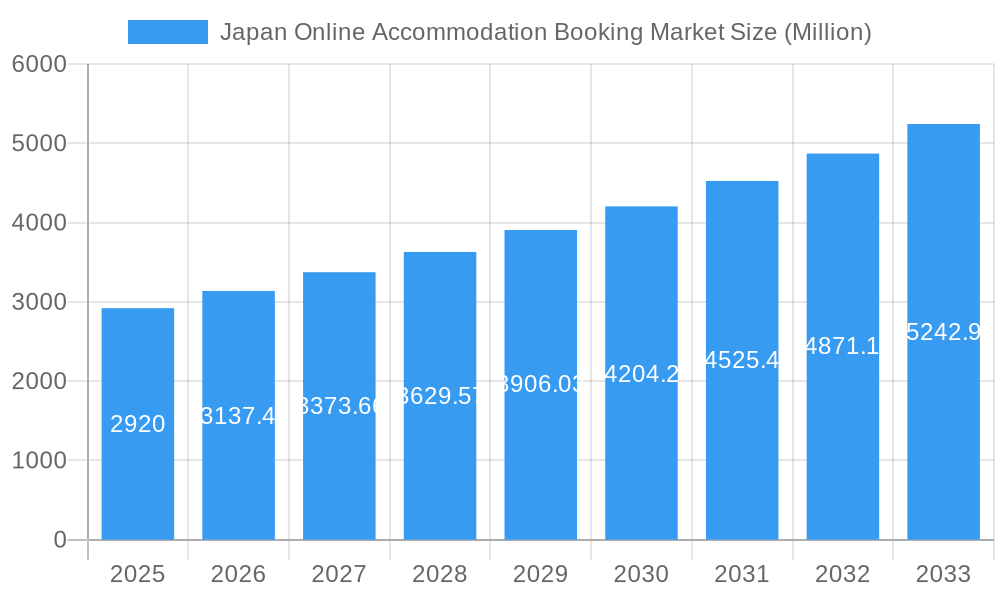

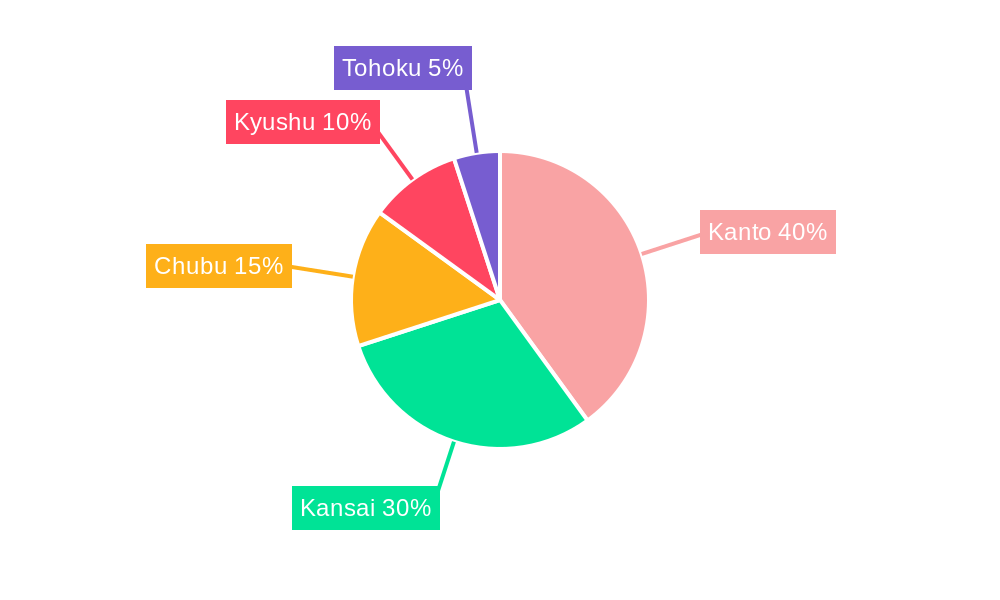

The Japan online accommodation booking market is experiencing robust growth, projected to reach a market size of $2.92 billion in 2025, expanding at a compound annual growth rate (CAGR) of 7.50% from 2025 to 2033. This expansion is driven by several factors. The increasing penetration of smartphones and internet access among Japanese travelers fuels the preference for online booking convenience. Furthermore, the rising popularity of domestic and international tourism in Japan, coupled with a growing preference for budget-friendly travel options facilitated by online platforms offering competitive pricing and deals, significantly contributes to market growth. The market is segmented by platform (mobile applications and websites) and booking mode (third-party online travel agencies and direct bookings). Mobile applications are witnessing particularly strong growth due to their user-friendly interface and on-the-go accessibility. Major players like Rakuten Travel, Agoda, Booking.com, Expedia, and JTB Group, along with local platforms like Jalan and Japanican, compete fiercely, driving innovation and competitive pricing. Regional variations exist, with Kanto and Kansai regions likely holding the largest market share due to their higher population density and significant tourist attractions. However, growth is expected across all regions, driven by increased tourism infrastructure development and marketing efforts targeting a wider range of travelers.

Japan Online Accommodation Booking Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained growth, fueled by continuous technological advancements, improved online payment security, and the evolving preferences of the digitally savvy traveler. The increasing integration of artificial intelligence (AI) and personalized recommendations within online booking platforms will further enhance the user experience and drive market expansion. While potential restraints such as economic downturns and fluctuations in tourism demand exist, the overall positive outlook for Japan’s tourism sector suggests consistent growth within the online accommodation booking market throughout the forecast period. The market's competitiveness encourages constant innovation, pushing companies to improve their services, pricing, and user experience to maintain their position in this dynamic landscape. This competitive pressure ensures that the customer benefits from a wider selection, better deals, and enhanced online booking services.

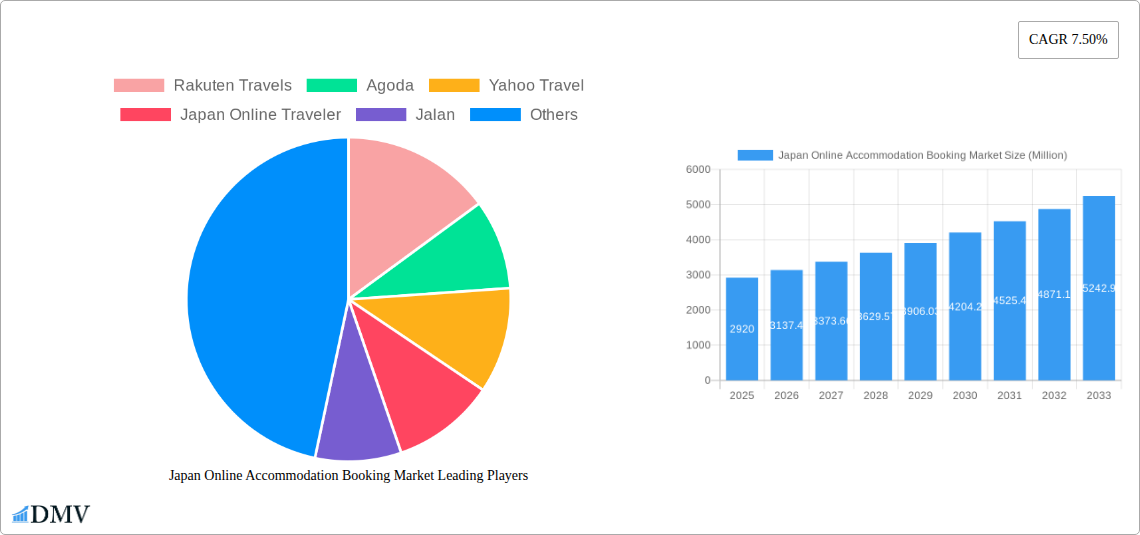

Japan Online Accommodation Booking Market Company Market Share

Japan Online Accommodation Booking Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Japan online accommodation booking market, projecting robust growth from ¥XX Million in 2025 to ¥XX Million by 2033. The study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for stakeholders across the travel and hospitality sectors. Key players like Rakuten Travels, Agoda, Yahoo Travel, Japan Online Traveler, Jalan, Booking.com, Hotels.com, Expedia, JTB Group, JAPANiCAN, and others, are analyzed, revealing market dynamics and future trends.

Japan Online Accommodation Booking Market Composition & Trends

This section dissects the competitive landscape, evaluating market concentration, innovation drivers, regulatory influences, and substitute product impacts. We analyze end-user behavior and the role of mergers and acquisitions (M&A) activity, providing a 360° view of the market's structure.

- Market Concentration: The Japanese online accommodation booking market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Rakuten Travels and Agoda likely hold the largest shares, followed by Yahoo Travel and Jalan. We estimate the top 5 players collectively hold approximately 60% of the market share in 2025.

- Innovation Catalysts: Technological advancements such as AI-powered recommendations, personalized travel planning tools, and seamless mobile booking experiences are driving market growth. The increasing adoption of virtual and augmented reality (VR/AR) for property showcases also fuels innovation.

- Regulatory Landscape: Government regulations concerning data privacy, consumer protection, and taxation significantly influence market operations. Any changes to these regulations could impact the industry’s trajectory.

- Substitute Products: Traditional booking methods (e.g., travel agents, direct hotel bookings) compete with online platforms. However, the convenience and price competitiveness of online booking continue to favor online platforms.

- End-User Profiles: The market caters to a diverse clientele, including domestic and international tourists, business travelers, and leisure seekers. Understanding these distinct user needs is vital for market players.

- M&A Activities: The report analyzes past and potential future M&A activity, providing insights into deal values and their impact on market consolidation. We project approximately ¥XX Million in M&A deal value for the forecast period (2025-2033).

Japan Online Accommodation Booking Market Industry Evolution

This section analyzes the market's growth trajectory, pinpointing key technological advancements and shifts in consumer preferences from 2019 to 2033.

The Japanese online accommodation booking market has experienced significant growth, driven by the rising adoption of online platforms and the increasing penetration of smartphones. The market has shown a Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period (2019-2024), and is expected to maintain a CAGR of XX% during the forecast period (2025-2033). This growth is largely attributable to factors such as increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient and cost-effective online booking options. Technological innovations, including improved user interfaces, personalized recommendations, and the integration of virtual reality (VR) and augmented reality (AR) technologies, have further enhanced the user experience and propelled market growth. The evolving preferences of consumers, including the growing demand for unique and personalized travel experiences, also play a role in shaping the industry’s evolution. The increasing adoption of mobile applications for booking accommodations is also a significant factor, reflecting the growing preference for on-the-go booking capabilities. Furthermore, partnerships and collaborations among online travel agencies (OTAs), hotels, and technology providers are facilitating innovation and market expansion.

Leading Regions, Countries, or Segments in Japan Online Accommodation Booking Market

This section identifies the leading segments and regions within the Japanese online accommodation booking market.

By Platform:

- Mobile Applications: Mobile applications are expected to remain the dominant platform, driven by increased smartphone penetration and the convenience of on-the-go booking. Key drivers include higher investment in mobile app development and optimization for mobile users.

- Websites: While mobile applications are gaining traction, websites still retain a significant market share, particularly among users who prefer a larger screen for browsing and making detailed travel arrangements.

By Mode of Booking:

- Third-Party Online Portals: These portals continue to dominate the market due to their wide selection of properties, competitive pricing, and user-friendly interfaces. Regulatory support for consumer protection on such platforms and higher investment in marketing and promotion help sustain their dominance.

- Direct/Captive Portals: While less dominant than third-party portals, direct booking portals are witnessing growth as hotels increasingly invest in their own online platforms to enhance customer loyalty and reduce reliance on third-party intermediaries. This segment is propelled by investments in direct booking platforms, improved customer service and loyalty programs.

Japan Online Accommodation Booking Market Product Innovations

Recent innovations include AI-powered recommendation engines, personalized travel itineraries, virtual tours of properties, and integrated payment gateways. These enhancements offer users seamless and personalized booking experiences, improving customer satisfaction and driving platform adoption. The integration of loyalty programs and reward systems further enhances user engagement.

Propelling Factors for Japan Online Accommodation Booking Market Growth

The market's growth is propelled by several factors: rising disposable incomes, increasing internet and smartphone penetration, growing tourism, and the convenience offered by online booking platforms. Government initiatives promoting tourism further stimulate the market. Technological advancements in AI and personalized booking tools enhance user experience and drive platform adoption.

Obstacles in the Japan Online Accommodation Booking Market

Challenges include intense competition among numerous players, cybersecurity threats, data privacy concerns, and the fluctuating economic climate. Supply chain disruptions (e.g., those experienced in 2020-2022) temporarily constrained the growth of the tourism sector and negatively impacted the online accommodation booking market. These disruptions led to a temporary decline in the number of bookings and revenue for online accommodation platforms. The quantification of this impact is difficult, but it contributed to a slower growth rate during certain periods.

Future Opportunities in Japan Online Accommodation Booking Market

Future opportunities lie in leveraging emerging technologies such as VR/AR for enhanced property visualization, expanding into niche tourism segments (e.g., eco-tourism, cultural experiences), and catering to the evolving demands of increasingly tech-savvy travelers. Developing personalized travel itineraries and integrated travel planning tools represent key opportunities for expansion and revenue generation.

Major Players in the Japan Online Accommodation Booking Market Ecosystem

- Rakuten Travels

- Agoda

- Yahoo Travel

- Japan Online Traveler

- Jalan

- Booking.com

- Hotels.com

- Expedia

- JTB Group

- JAPANiCAN

Key Developments in Japan Online Accommodation Booking Market Industry

- March 2022: RateGain Technologies partnered with Rakuten Travel Xchange (RTX) to expand Rakuten's global hotel supply, enhancing customer choice and platform competitiveness.

- April 2022: Bear Luxe partnered with Sabre to leverage Sabre's corporate booking tools, driving direct bookings and expanding its reach within the corporate travel market. This increased Sabre's presence in the Japanese market and allowed Bear Luxe to tap into corporate clients.

Strategic Japan Online Accommodation Booking Market Forecast

The Japanese online accommodation booking market is poised for continued expansion, driven by technological innovation, evolving consumer preferences, and government support for the tourism sector. The market's future growth will be influenced by factors such as economic conditions, global travel trends, and the adoption of new technologies. The forecast predicts consistent growth throughout the forecast period, presenting substantial opportunities for established players and new entrants.

Japan Online Accommodation Booking Market Segmentation

-

1. Platform

- 1.1. Mobile application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third party online portals

- 2.2. Direct / captive portals

Japan Online Accommodation Booking Market Segmentation By Geography

- 1. Japan

Japan Online Accommodation Booking Market Regional Market Share

Geographic Coverage of Japan Online Accommodation Booking Market

Japan Online Accommodation Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media and Celebrity Influence; Increasing Disposable Income

- 3.3. Market Restrains

- 3.3.1. Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Advancement in Technology has led to Growth in the Online Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Online Accommodation Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third party online portals

- 5.2.2. Direct / captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Travels

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agoda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yahoo Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Japan Online Traveler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jalan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Booking

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hotels com

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JTB Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JAPANiCAN

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Travels

List of Figures

- Figure 1: Japan Online Accommodation Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Online Accommodation Booking Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Online Accommodation Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Japan Online Accommodation Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Japan Online Accommodation Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Online Accommodation Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: Japan Online Accommodation Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: Japan Online Accommodation Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Online Accommodation Booking Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Japan Online Accommodation Booking Market?

Key companies in the market include Rakuten Travels, Agoda, Yahoo Travel, Japan Online Traveler, Jalan, Booking, Hotels com, Expedia, JTB Group**List Not Exhaustive, JAPANiCAN.

3. What are the main segments of the Japan Online Accommodation Booking Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Social Media and Celebrity Influence; Increasing Disposable Income.

6. What are the notable trends driving market growth?

Advancement in Technology has led to Growth in the Online Accommodation Market.

7. Are there any restraints impacting market growth?

Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2022: Bear Luxe and a B2B membership portal signed a distribution agreement with Sabre to expand Sabre’s footprint in Japan. Sabre’s corporate booking tools will allow the Japanese company to connect with corporate travel buyers. This partnership will also enable the Bear Luxe platform to drive direct bookings, increase engagement, and trigger conversions through the deep retail focus of the Sabre SynXis Booking Engine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Online Accommodation Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Online Accommodation Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Online Accommodation Booking Market?

To stay informed about further developments, trends, and reports in the Japan Online Accommodation Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence