Key Insights

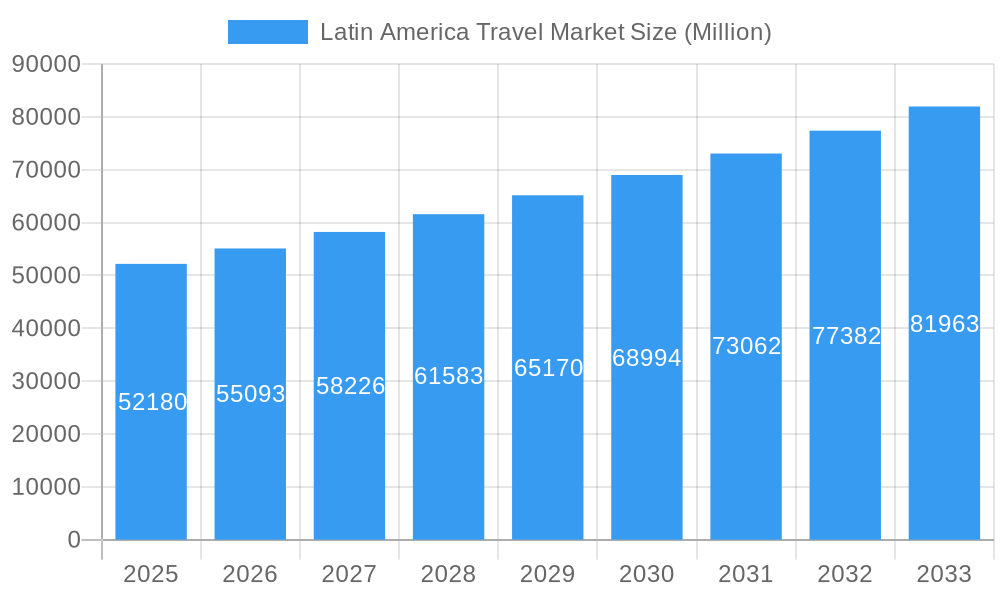

The Latin American travel market, valued at $52.18 billion in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 5.41% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing disposable incomes within the region, coupled with a burgeoning middle class, are significantly boosting domestic tourism. Furthermore, the growing popularity of adventure tourism, particularly eco-tourism and experiences focused on unique cultural offerings, is attracting a substantial influx of international visitors. Strategic government initiatives to improve infrastructure, such as airport expansions and enhanced transportation networks, are also facilitating greater accessibility and stimulating market growth. However, factors such as political instability in certain regions and economic fluctuations can act as restraints on the market's full potential. The market is segmented by country (Brazil, Mexico, Colombia, Chile, Argentina, and the Rest of Latin America), type of tourism (international and domestic), and purpose (adventure, business, conferences, family/friends visits). Brazil, Mexico, and Argentina are expected to dominate the market given their existing tourism infrastructure and popularity as destinations. The rise of online travel agencies and booking platforms is streamlining the travel process, increasing market accessibility and intensifying competition among established players and new entrants.

Latin America Travel Market Market Size (In Billion)

The competitive landscape is characterized by a mix of international hotel chains (Marriott, Hilton), regional players (Tangol SRL, Condor Travel), and smaller boutique hotels and tour operators specializing in niche experiences. The forecast period (2025-2033) anticipates continued growth, driven by ongoing infrastructure development, improved marketing and promotion of the region's diverse offerings, and a strengthening of the tourism ecosystem. While challenges such as seasonality and infrastructure limitations in certain areas persist, the overall trajectory points towards a consistently expanding market, presenting substantial opportunities for businesses across the travel value chain. Effective strategies will leverage digital marketing, personalized experiences, sustainable tourism practices, and focus on specific niche segments to optimize growth within this dynamic market.

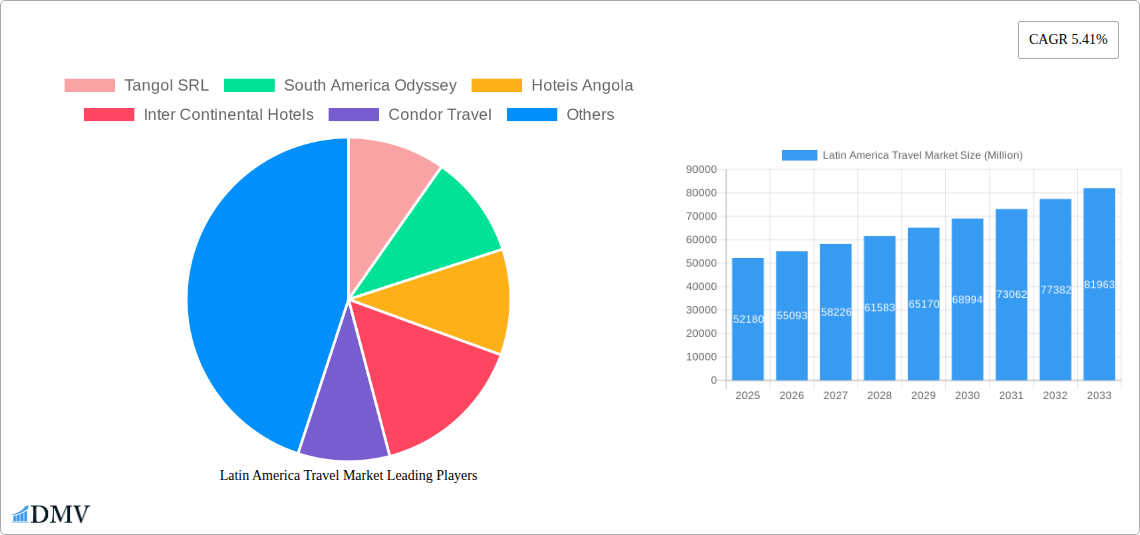

Latin America Travel Market Company Market Share

Latin America Travel Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America travel market, encompassing market size, segmentation, key players, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the dynamic Latin American travel landscape. The report leverages data from the historical period (2019-2024) and provides critical estimations for 2025. Market values are expressed in Millions.

Latin America Travel Market Composition & Trends

This section delves into the competitive dynamics of the Latin America travel market, evaluating market concentration, innovation catalysts, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We analyze the market share distribution amongst key players such as Tangol SRL, South America Odyssey, Hoteis Angola, InterContinental Hotels, Condor Travel, Latin American Escapes Inc, Eco Hotels & Resorts, Marriott International, Hilton Worldwide, and Mobibrasil (list not exhaustive), alongside smaller independent operators and regional players. The report assesses the impact of mergers and acquisitions (M&A) on market consolidation, providing insights into deal values (xx Million) and their influence on market structure. Innovation within the sector is examined, covering technological advancements in booking platforms, sustainable tourism initiatives, and the emergence of niche travel experiences. The regulatory landscape is critically evaluated, considering its impact on market growth and the adoption of new technologies. Finally, we examine substitute products and their potential impact on market share, along with an in-depth analysis of end-user demographics and travel preferences.

- Market Concentration: xx% of market share held by top 5 players (2025 Estimate).

- M&A Activity (2019-2024): xx deals valued at approximately xx Million.

- Innovation Catalysts: Focus on sustainable tourism, personalized experiences, and technological integration.

- Regulatory Landscape: Analysis of key regulations impacting travel and tourism in major Latin American countries.

Latin America Travel Market Industry Evolution

This section analyzes the evolution of the Latin America travel market, exploring market growth trajectories, technological advancements, and shifting consumer demands. We examine the historical growth rates (xx% CAGR 2019-2024) and project future growth (xx% CAGR 2025-2033) based on macroeconomic factors, technological adoption rates (xx% increase in online bookings from 2019 to 2024), and changing consumer preferences (e.g., rise in adventure tourism, increased demand for sustainable travel options). The influence of technological advancements, such as the adoption of mobile booking platforms and the rise of travel influencers, is analyzed in detail. Additionally, the report explores how shifting consumer demands, such as a preference for personalized and authentic experiences, impact market trends.

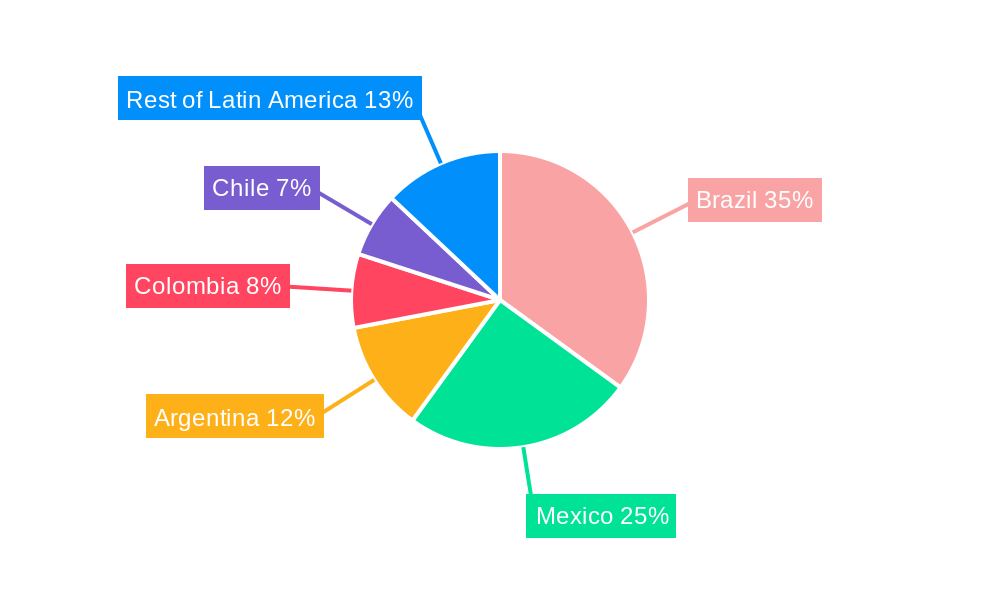

Leading Regions, Countries, or Segments in Latin America Travel Market

This section identifies the dominant regions, countries, and segments within the Latin American travel market, including Brazil, Mexico, Colombia, Chile, Argentina, and the Rest of Latin America. We analyze market performance by travel type (International Tourism, Domestic Tourism) and purpose (Adventure Tourism, Business Travel, Conference or Seminar Travel, Family & Friends Visits).

By Country: Brazil and Mexico are expected to remain dominant due to [explain reasons, e.g., strong domestic markets, significant international tourist arrivals]. Argentina is experiencing growth driven by [explain factors, e.g., successful marketing campaigns, focus on sustainable tourism].

By Type: International tourism contributes a larger share (xx%) than domestic tourism (xx%) in 2025, although domestic travel is projected to see significant growth driven by [explain factors].

By Purpose: Adventure tourism and family/friends visits are key segments, fueled by [factors driving each segment].

Latin America Travel Market Product Innovations

This section highlights recent product innovations in the Latin American travel market. This includes the development of specialized tour packages focusing on sustainable tourism, eco-lodges catering to environmentally conscious travelers, and the use of AI-powered recommendation engines and booking platforms to enhance user experience. The growing adoption of mobile booking apps and virtual reality technologies to showcase destinations are also examined. Unique selling propositions, such as personalized itineraries and immersive cultural experiences, are explored.

Propelling Factors for Latin America Travel Market Growth

Several factors contribute to the growth of the Latin America travel market. These include increasing disposable incomes, improved infrastructure in key tourist destinations, government initiatives promoting tourism, and the expansion of affordable air travel options. Technological advancements, such as user-friendly online booking platforms and improved mobile connectivity, further enhance accessibility and convenience for travelers. The growing popularity of adventure and ecotourism represents a significant growth opportunity.

Obstacles in the Latin America Travel Market

The Latin America travel market faces challenges such as infrastructure limitations in some regions, safety concerns in certain areas, and political instability in some countries. Seasonal variations in tourist arrivals and currency fluctuations also pose risks. Competitive pressures from established international players and emerging regional competitors further impact market dynamics.

Future Opportunities in Latin America Travel Market

Future growth opportunities lie in developing sustainable tourism practices, focusing on niche markets such as luxury travel and medical tourism, and expanding into under-served regions. The adoption of innovative technologies, such as blockchain for secure transactions and AI-powered personalized travel planning, presents exciting possibilities. Further investment in tourism infrastructure and marketing campaigns can unlock significant growth potential.

Major Players in the Latin America Travel Market Ecosystem

- Tangol SRL

- South America Odyssey

- Hoteis Angola

- InterContinental Hotels

- Condor Travel

- Latin American Escapes Inc

- Eco Hotels & Resorts

- Marriott International

- Hilton Worldwide

- Mobibrasil

- Latin American Travel

- Central America Journeys

- Cox & Kings Travel

Key Developments in Latin America Travel Market Industry

- January 2024: Trip.com Group and LATAM Airlines signed a new NDC agreement, enhancing international ticketing.

- January 2023: UNWTO and the Development Bank of Latin America (CAF) partnered to boost tourism investment across Latin America and the Caribbean, creating investment guides for Uruguay, Barbados, Ecuador, El Salvador, and Panama.

Strategic Latin America Travel Market Forecast

The Latin America travel market is poised for substantial growth driven by increasing tourist arrivals, investment in infrastructure, and the adoption of new technologies. The focus on sustainable tourism and niche market segments offers significant opportunities for growth and innovation. The long-term forecast points towards a positive outlook, with sustained growth fueled by these factors.

Latin America Travel Market Segmentation

-

1. Type

- 1.1. International Tourism

- 1.2. Domestic Tourism

-

2. Purpose

- 2.1. Adventure Tourism

- 2.2. Business Travel

- 2.3. Conference or Seminar Travel

- 2.4. Family and Friends Visit

Latin America Travel Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Travel Market Regional Market Share

Geographic Coverage of Latin America Travel Market

Latin America Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Tourism Industry Investment affecting Latin America Travel and Tourism Industry.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. International Tourism

- 5.1.2. Domestic Tourism

- 5.2. Market Analysis, Insights and Forecast - by Purpose

- 5.2.1. Adventure Tourism

- 5.2.2. Business Travel

- 5.2.3. Conference or Seminar Travel

- 5.2.4. Family and Friends Visit

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tangol SRL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 South America Odyssey

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hoteis Angola

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inter Continental Hotels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Condor Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Latin American Escapes Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Hotels & Resorts

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mariott International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hilton Worldwide

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mobibrasil**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Latin American Travel

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Central America Journeys

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cox & Kings Travel

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Tangol SRL

List of Figures

- Figure 1: Latin America Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Travel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America Travel Market Revenue Million Forecast, by Purpose 2020 & 2033

- Table 3: Latin America Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Travel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Latin America Travel Market Revenue Million Forecast, by Purpose 2020 & 2033

- Table 6: Latin America Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Travel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Travel Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Latin America Travel Market?

Key companies in the market include Tangol SRL, South America Odyssey, Hoteis Angola, Inter Continental Hotels, Condor Travel, Latin American Escapes Inc, Eco Hotels & Resorts, Mariott International, Hilton Worldwide, Mobibrasil**List Not Exhaustive, Latin American Travel, Central America Journeys, Cox & Kings Travel.

3. What are the main segments of the Latin America Travel Market?

The market segments include Type, Purpose.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Tourism Industry Investment affecting Latin America Travel and Tourism Industry..

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

In January 2024, Trip.com Group and LATAM Airlines signed a new NDC agreement. Both companies have reached an agreement to give international travellers a contemporary and effective ticketing experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence