Key Insights

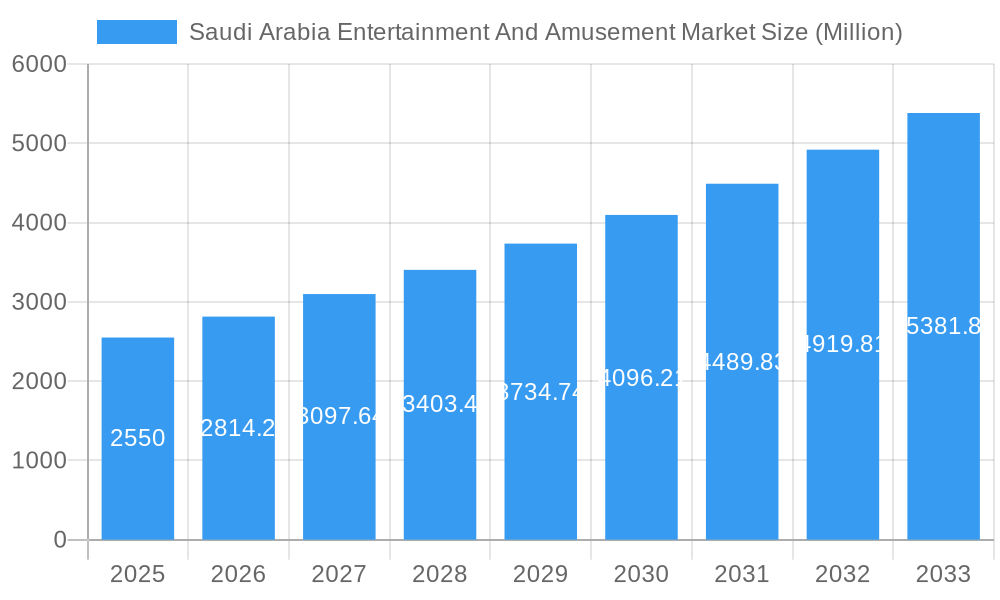

The Saudi Arabian entertainment and amusement market is experiencing robust growth, projected to reach \$2.55 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This expansion is fueled by several key factors. The Vision 2030 initiative, aimed at diversifying the Saudi economy and enhancing the quality of life, is significantly boosting investment in entertainment infrastructure. A burgeoning young population with increasing disposable income is driving demand for diverse entertainment options, from theme parks like Jungle Land and AlShallal to international events featuring Cirque Du Soleil and Broadway Entertainment. Furthermore, the government's efforts to develop world-class tourism infrastructure are creating a more attractive destination for both domestic and international visitors, further fueling market growth. The market segmentation reveals a diversified landscape, with cinemas and theatres, amusement and theme parks, and malls contributing significantly to overall revenue generation. Revenue streams are also diversified across ticket sales, food and beverage offerings, merchandise, and advertising. Geographic distribution shows strong performance across major cities like Riyadh, Jeddah, Makkah, and Dammam, indicating a broad reach across the country. While specific challenges like infrastructure limitations and competition for consumer spending may exist, the overall outlook remains exceptionally positive, suggesting continued strong growth for the foreseeable future.

Saudi Arabia Entertainment And Amusement Market Market Size (In Billion)

The market's growth trajectory is underpinned by strategic government initiatives fostering a vibrant entertainment sector. The diversification of revenue streams and the engagement of prominent international players like AMC, SIX FLAGS, and Disney (through Frozen-themed attractions) indicates a mature and evolving market. Future growth hinges on sustained government support, successful diversification of offerings, and the continued development of world-class infrastructure to accommodate the rising influx of tourists and local consumers seeking leisure and entertainment opportunities. The continued focus on family-friendly entertainment, aligning with societal values and promoting inclusive participation, will further stimulate market expansion in the long term. Specific data on the contribution of each segment, while not explicitly provided, can be reasonably estimated through market research reports and publicly available financial data for comparable markets. This analysis considers publicly available information and general industry trends to provide a realistic and informed perspective on the Saudi Arabian entertainment and amusement market's potential.

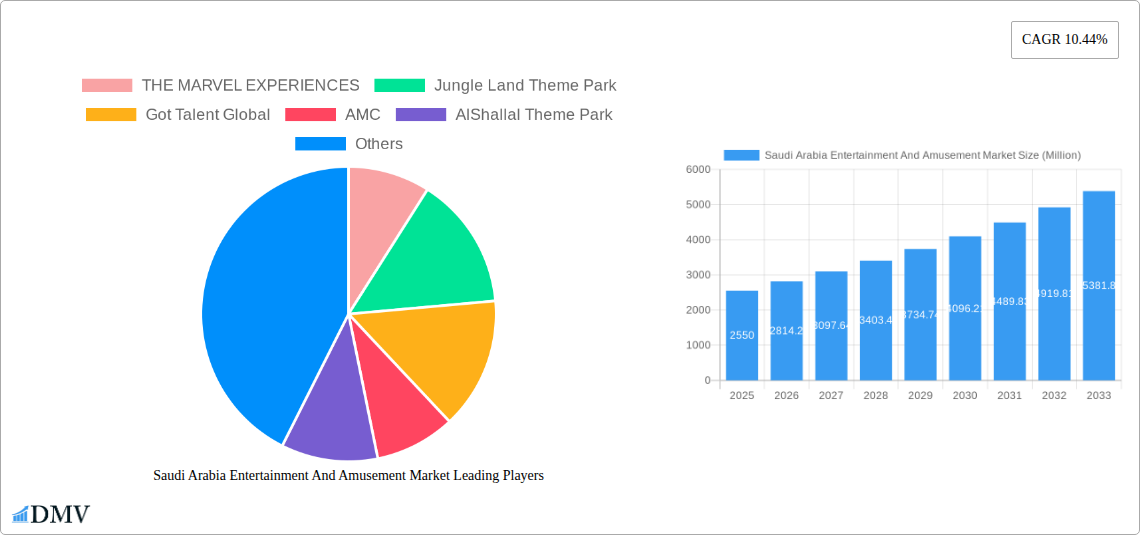

Saudi Arabia Entertainment And Amusement Market Company Market Share

Saudi Arabia Entertainment and Amusement Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Saudi Arabia entertainment and amusement market, projecting significant growth from 2025 to 2033. It delves into market composition, industry evolution, leading segments, and key players, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The report covers the period from 2019-2024 (Historical Period), with 2025 as the base and estimated year, and forecasts extending to 2033.

Saudi Arabia Entertainment and Amusement Market Composition & Trends

This section evaluates the Saudi Arabia entertainment and amusement market's competitive intensity, innovation drivers, regulatory framework, substitute offerings, end-user demographics, and merger and acquisition (M&A) activities. The market is characterized by a moderate level of concentration, with key players such as AMC, SIX FLAGS, and Flash Entertainment vying for market share. However, the rapid expansion fueled by Vision 2030 is fostering new entrants and increasing competition. Innovation is driven by technological advancements in immersive experiences, virtual reality (VR), and augmented reality (AR) technologies. The regulatory environment is generally supportive, with government initiatives aiming to diversify the economy and boost tourism. Substitute products include home entertainment options and online gaming, but the unique live experiences offered by the market remain a strong draw.

- Market Share Distribution (2025): AMC (15%), SIX FLAGS (12%), Flash Entertainment (10%), Others (63%). (These figures are estimates)

- M&A Activity (2019-2024): xx Million in total deal value, with a focus on smaller acquisitions to expand offerings and geographical reach.

The end-user profile is diverse, encompassing families, young adults, and tourists. M&A activity is expected to remain robust, driven by the desire for expansion and consolidation within the sector.

Saudi Arabia Entertainment and Amusement Market Industry Evolution

The Saudi Arabia entertainment and amusement market has witnessed exponential growth, fueled by Vision 2030’s focus on diversification and leisure. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by increased disposable incomes, expanding tourism, and government investments in infrastructure. This trend is projected to continue with a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological advancements, such as interactive attractions and personalized experiences, are reshaping consumer expectations, pushing the industry towards more innovative and immersive offerings. Consumer preferences are also shifting towards unique and experiential entertainment, favoring live events, theme parks, and high-quality cinematic experiences over traditional forms of entertainment. This is reflected in the growing popularity of international brands and the rapid expansion of domestic players.

Leading Regions, Countries, or Segments in Saudi Arabia Entertainment and Amusement Market

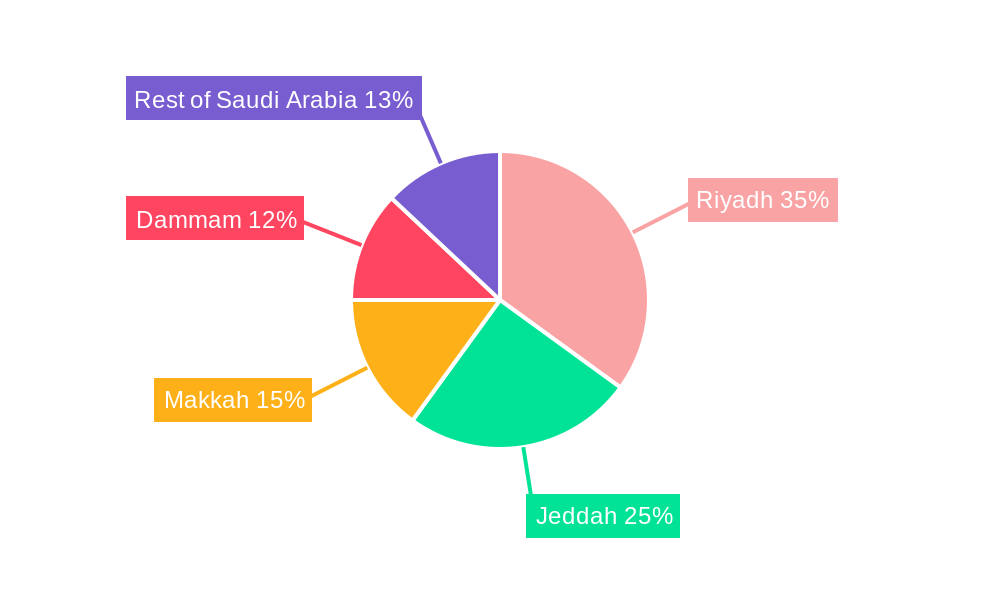

Riyadh remains the dominant region, accounting for approximately xx% of the total market revenue in 2025, owing to its larger population, higher concentration of entertainment venues, and robust infrastructure. Jeddah follows as a significant market, contributing approximately xx%, while Makkah and Dammam hold smaller but growing shares. Among the entertainment types, Amusement and Theme Parks represent the largest segment, accounting for xx% of revenue in 2025. Cinemas and Theatres hold a substantial share, while the Gardens and Zoos segment also demonstrates significant potential for growth.

By City:

- Riyadh: High concentration of entertainment venues, significant population density, strong infrastructure.

- Jeddah: Significant tourist inflow, growing entertainment infrastructure.

- Makkah & Dammam: Smaller markets with growth potential.

By Type of Entertainment Destination:

- Amusement and Theme Parks: High consumer demand, government support for large-scale projects.

- Cinemas and Theatres: Strong box office performance, government initiatives to promote local film production.

By Source of Revenue:

- Tickets: Main revenue source, driven by high attendance rates at events and venues.

- Food & Beverages: Significant revenue contribution due to captive audiences at venues.

Saudi Arabia Entertainment and Amusement Market Product Innovations

Recent innovations include the integration of VR/AR technologies in theme park rides and immersive entertainment experiences, personalized content delivery, and interactive shows. These advancements offer unique selling propositions, enhance customer engagement, and improve the overall entertainment value. The market is also witnessing the introduction of innovative ticketing systems, mobile applications for booking and payments, and enhanced safety and security measures at venues.

Propelling Factors for Saudi Arabia Entertainment and Amusement Market Growth

The Saudi Arabia entertainment and amusement market's growth is propelled by several factors. Vision 2030's emphasis on economic diversification and tourism development creates a favorable environment for investments and expansion. Increased disposable incomes, coupled with a young and growing population, contribute to higher spending on entertainment and leisure activities. Government initiatives to promote local talent and cultural events further support the sector's growth.

Obstacles in the Saudi Arabia Entertainment and Amusement Market

Challenges include potential supply chain disruptions affecting the procurement of equipment and materials. While the regulatory environment is largely supportive, obtaining necessary permits and licenses can sometimes be time-consuming. The market faces increasing competition, with both domestic and international players vying for market share.

Future Opportunities in Saudi Arabia Entertainment and Amusement Market

Emerging opportunities lie in expanding into niche entertainment segments, leveraging advanced technologies such as AI and IoT for enhanced customer experiences, and developing eco-friendly and sustainable entertainment venues. The potential for creating unique Saudi-themed attractions and entertainment concepts holds great promise.

Major Players in the Saudi Arabia Entertainment and Amusement Market Ecosystem

- THE MARVEL EXPERIENCES

- Jungle Land Theme Park

- Got Talent Global

- AMC Theatres

- AlShallal Theme Park

- Cirque Du Soleil

- IMG Artists

- National Geographic

- Broadway Entertainment

- AVEX

- SIX FLAGS

- Disney Frozen

- FELD ENTERTAINMENT

- Loopagoon Water Park

Key Developments in Saudi Arabia Entertainment and Amusement Market Industry

- May 2022: Muvi Cinemas launched Muvi Studios, focusing on Saudi and Egyptian film production. This move stimulates local content creation and strengthens the cinema industry.

- September 2022: Flash Entertainment opened its KSA headquarters in Riyadh, signaling its commitment to the Kingdom's entertainment sector growth and Saudization efforts. This strengthens the industry's local talent base and aligns with Vision 2030 goals.

Strategic Saudi Arabia Entertainment and Amusement Market Forecast

The Saudi Arabia entertainment and amusement market is poised for continued robust growth, driven by Vision 2030 initiatives, increased tourism, and technological advancements. The market's diverse offerings, coupled with the government's strong support, are expected to attract further investments and fuel expansion across all segments. The projected growth trajectory indicates significant opportunities for both established and emerging players in the years to come.

Saudi Arabia Entertainment And Amusement Market Segmentation

-

1. Type of Entertainment Destination

- 1.1. Cinemas and Theatres

- 1.2. Amusement and Theme Parks

- 1.3. Gardens and Zoos

- 1.4. Malls

- 1.5. Gaming Centers

- 1.6. Others

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Food & Beverages

- 2.3. Merchandise

- 2.4. Advertising

- 2.5. Others

-

3. City

- 3.1. Riyadh

- 3.2. Jeddah

- 3.3. Makkah

- 3.4. Dammam

- 3.5. Rest of Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Regional Market Share

Geographic Coverage of Saudi Arabia Entertainment And Amusement Market

Saudi Arabia Entertainment And Amusement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Costs is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Entertainment And Amusement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 5.1.1. Cinemas and Theatres

- 5.1.2. Amusement and Theme Parks

- 5.1.3. Gardens and Zoos

- 5.1.4. Malls

- 5.1.5. Gaming Centers

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Food & Beverages

- 5.2.3. Merchandise

- 5.2.4. Advertising

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Riyadh

- 5.3.2. Jeddah

- 5.3.3. Makkah

- 5.3.4. Dammam

- 5.3.5. Rest of Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THE MARVEL EXPERIENCES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jungle Land Theme Park

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Got Talent Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlShallal Theme Park

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cirque Du Soleil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMG Artists

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National geographic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broadway Entertainment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVEX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIX FLAGS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Disney Frozen

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FELD ENTERTAINMENT

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Loopagoon Water Park**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 THE MARVEL EXPERIENCES

List of Figures

- Figure 1: Saudi Arabia Entertainment And Amusement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Entertainment And Amusement Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 2: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 4: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 6: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 8: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Entertainment And Amusement Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Saudi Arabia Entertainment And Amusement Market?

Key companies in the market include THE MARVEL EXPERIENCES, Jungle Land Theme Park, Got Talent Global, AMC, AlShallal Theme Park, Cirque Du Soleil, IMG Artists, National geographic, Broadway Entertainment, AVEX, SIX FLAGS, Disney Frozen, FELD ENTERTAINMENT, Loopagoon Water Park**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Entertainment And Amusement Market?

The market segments include Type of Entertainment Destination, Source of Revenue, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs is Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Arabia's leading theater operator Muvi Cinemas launched Muvi Studios. The new Studio will focus on developing both Saudi and Egyptian films for the Saudi public, concentrating on films for the big screen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Entertainment And Amusement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Entertainment And Amusement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Entertainment And Amusement Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Entertainment And Amusement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence