Key Insights

The global travel accommodation market is poised for substantial expansion, projected to reach $961.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.56%. This growth is propelled by rising disposable incomes, escalating global tourism, and the increasing reliance on convenient online booking channels. The market benefits from the growing demand for experiential travel, segmented by booking platforms including mobile applications, websites, and third-party and direct booking portals.

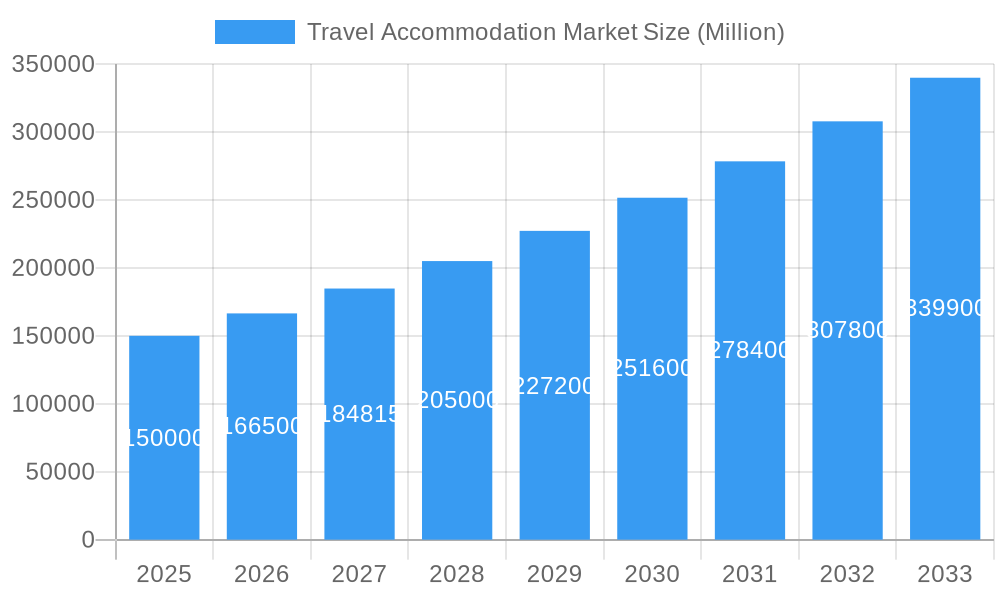

Travel Accommodation Market Market Size (In Billion)

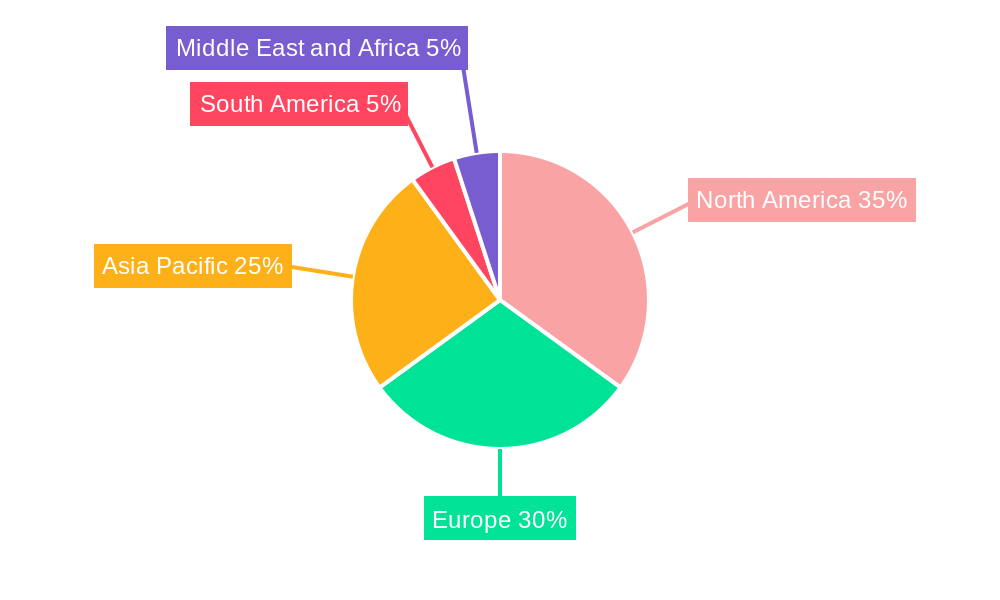

Leading players such as Booking.com, Expedia, and TripAdvisor, alongside disruptive innovators like Airbnb, define the competitive environment. While North America and Europe currently lead in market share, the Asia-Pacific region presents significant growth opportunities driven by its expanding middle class and infrastructural advancements.

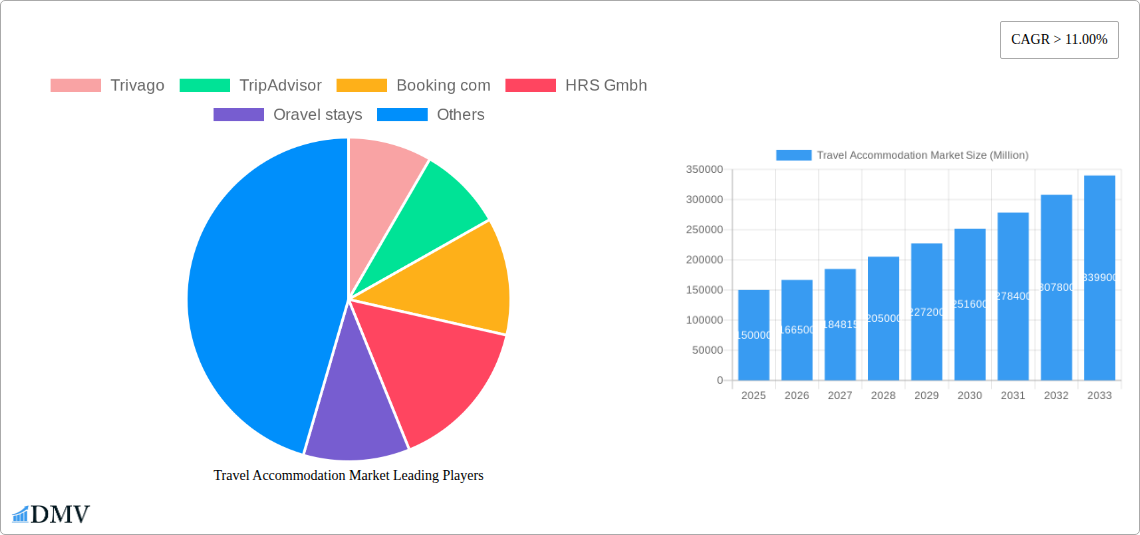

Travel Accommodation Market Company Market Share

Technological innovations, including personalized recommendations, enhanced user interfaces, and the proliferation of unique accommodations like boutique hotels and vacation rentals, are key growth drivers. The widespread adoption of mobile booking further fuels market expansion. Industry players employ strategic collaborations, mergers, acquisitions, and loyalty programs to solidify their market standing.

Despite facing headwinds from economic fluctuations, geopolitical uncertainties, and evolving consumer preferences, the long-term outlook remains optimistic. The intrinsic human desire for travel, coupled with the digital transformation of the tourism industry and the development of sustainable travel practices, will continue to stimulate market growth.

Travel Accommodation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Travel Accommodation Market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). The market is projected to reach xx Million by 2033, exhibiting significant growth driven by technological advancements and evolving consumer preferences. This report is an invaluable resource for stakeholders seeking a deep understanding of market dynamics, key players, and future opportunities.

Travel Accommodation Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory frameworks, substitute offerings, end-user demographics, and merger & acquisition (M&A) activity within the travel accommodation market. The market is characterized by a high level of competition, with key players such as Booking.com, Expedia, and Airbnb vying for market share. The estimated market size in 2025 is xx Million.

- Market Concentration: The market demonstrates a moderately concentrated structure, with a few dominant players controlling a significant share. Booking.com and Expedia hold a combined market share of approximately xx%, while Airbnb contributes approximately xx%. Smaller players, including Trivago, TripAdvisor, and Agoda, occupy the remaining market share.

- Innovation Catalysts: Technological advancements, such as AI-powered recommendation engines and personalized travel planning tools, are driving innovation. The rise of mobile booking platforms further fuels market growth.

- Regulatory Landscape: Varying regulations across different countries impact operational costs and market access for companies. Data privacy concerns and consumer protection laws are increasingly relevant.

- Substitute Products: Alternative accommodation options, such as vacation rentals and homestays, pose a competitive challenge to traditional hotels.

- End-User Profiles: The market caters to a diverse clientele, ranging from leisure travelers to business professionals. Millennials and Gen Z are increasingly adopting online booking platforms and prioritizing unique travel experiences.

- M&A Activities: The travel accommodation sector has witnessed several significant M&A activities in recent years. For example, the acquisition of [Company A] by [Company B] in [Year] valued at xx Million significantly altered the market dynamics. Further analysis reveals a total M&A deal value of approximately xx Million during the study period.

Travel Accommodation Market Industry Evolution

This section delves into the evolution of the travel accommodation market, analyzing growth trajectories, technological advancements, and evolving consumer preferences. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of approximately xx%, driven primarily by the increasing adoption of online booking platforms and the rise of the sharing economy. This upward trend is anticipated to continue throughout the forecast period, with the market expected to experience a CAGR of xx% between 2025 and 2033.

Technological advancements, including the proliferation of mobile applications, have revolutionized the way travelers book and manage accommodations. The increasing sophistication of recommendation systems and the integration of artificial intelligence are improving the user experience and driving customer engagement. Shifting consumer preferences towards personalized experiences and sustainable travel options also shape the industry's trajectory. Data from 2024 indicates xx% of bookings were made via mobile apps, a significant increase compared to xx% in 2019.

Leading Regions, Countries, or Segments in Travel Accommodation Market

This section identifies the leading regions, countries, and segments within the travel accommodation market, focusing on platform usage (mobile application, website) and booking modes (third-party online portals, direct/captive portals).

Dominant Segment Analysis:

- By Platform: Mobile applications dominate the market with xx% of bookings in 2025, driven by increasing smartphone penetration and user convenience. Websites maintain a significant share at xx%, catering to users who prefer detailed information and larger screens.

- By Mode of Booking: Third-party online travel agencies (OTAs) such as Booking.com and Expedia hold a substantial market share (xx%) due to their extensive reach and user-friendly interfaces. Direct booking through captive portals gains traction, reaching xx% in 2025, highlighting hotels’ efforts to enhance their online presence and build customer loyalty.

Key Drivers:

- Investment Trends: Significant venture capital investments in technology and innovation within the OTA segment have significantly expanded reach and capabilities.

- Regulatory Support: Government initiatives promoting tourism and digitalization in certain regions further propel market growth.

Travel Accommodation Market Product Innovations

This section highlights noteworthy product innovations, applications, and performance metrics within the travel accommodation market. The industry has witnessed a surge in innovative offerings, from AI-powered concierge services to personalized travel itineraries crafted using big data. These advancements are improving the user experience, enhancing personalization, and leading to increased customer satisfaction. Notable examples include the implementation of virtual reality tours for property viewing and the introduction of dynamic pricing algorithms that optimize revenue for providers. The adoption rate of these features is rapidly increasing, projected to reach xx% by 2033.

Propelling Factors for Travel Accommodation Market Growth

Several factors fuel the growth of the travel accommodation market. Technological advancements, such as the proliferation of mobile booking apps and AI-driven personalization, significantly enhance user experience. Economic growth in emerging markets boosts travel and tourism, expanding the market base. Favorable government regulations and initiatives promoting tourism further contribute to market expansion. Specifically, the introduction of simplified visa processes in certain regions has spurred a considerable rise in international tourism, boosting demand for accommodation services.

Obstacles in the Travel Accommodation Market

The travel accommodation market faces several challenges. Stringent regulatory requirements related to data privacy and consumer protection impose compliance costs. Supply chain disruptions, such as the impact of global events or unforeseen crises, can restrict the availability of accommodation and affect bookings. Intense competition among established players and new entrants creates pressure on pricing and profitability, impacting the industry’s margins. In 2024, supply chain disruptions led to a xx% decrease in available rooms, impacting overall market revenue.

Future Opportunities in Travel Accommodation Market

Emerging opportunities abound in the travel accommodation sector. The expansion into underserved markets presents significant growth potential. Advancements in sustainable tourism practices, catering to eco-conscious travelers, creates new niches. The integration of blockchain technology for secure and transparent transactions holds promise. Furthermore, the increasing adoption of virtual and augmented reality technologies for immersive travel experiences opens up innovative possibilities.

Major Players in the Travel Accommodation Market Ecosystem

- Trivago

- TripAdvisor

- Booking.com

- HRS Gmbh

- Oravel stays

- AirBnb

- AccorHotels

- Agoda

- Hotels.com

- Expedia

- OUI sncf

Key Developments in Travel Accommodation Market Industry

- 2022-Q4: Booking.com launched a new feature enabling users to filter searches by sustainability criteria.

- 2023-Q1: Expedia Group partnered with a leading AI company to enhance its recommendation engine.

- 2023-Q3: Airbnb expanded its luxury accommodation offerings with the introduction of a new "Luxury Stays" category.

- 2024-Q2: A major merger between two regional hotel chains significantly altered the competitive landscape in the [Region] market.

Strategic Travel Accommodation Market Forecast

The travel accommodation market is poised for continued growth, driven by technological innovations, expanding tourism, and the increasing demand for personalized travel experiences. The market's projected growth trajectory indicates robust opportunities for existing and new players alike. The increasing adoption of sustainable practices and the rise of niche travel segments provide further avenues for expansion and diversification. This positive outlook is underpinned by the persistent growth in global travel and tourism sectors, signifying a promising future for the industry.

Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile application

- 1.2. Website

-

2. Mode of booking

- 2.1. Third party online portals

- 2.2. Direct/captive portals

Travel Accommodation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Travel Accommodation Market Regional Market Share

Geographic Coverage of Travel Accommodation Market

Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Internet Usage Pushing Customers Towards Online Accommodation in France.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of booking

- 5.2.1. Third party online portals

- 5.2.2. Direct/captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Mobile application

- 6.1.2. Website

- 6.2. Market Analysis, Insights and Forecast - by Mode of booking

- 6.2.1. Third party online portals

- 6.2.2. Direct/captive portals

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Mobile application

- 7.1.2. Website

- 7.2. Market Analysis, Insights and Forecast - by Mode of booking

- 7.2.1. Third party online portals

- 7.2.2. Direct/captive portals

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Mobile application

- 8.1.2. Website

- 8.2. Market Analysis, Insights and Forecast - by Mode of booking

- 8.2.1. Third party online portals

- 8.2.2. Direct/captive portals

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Mobile application

- 9.1.2. Website

- 9.2. Market Analysis, Insights and Forecast - by Mode of booking

- 9.2.1. Third party online portals

- 9.2.2. Direct/captive portals

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Mobile application

- 10.1.2. Website

- 10.2. Market Analysis, Insights and Forecast - by Mode of booking

- 10.2.1. Third party online portals

- 10.2.2. Direct/captive portals

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trivago

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TripAdvisor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Booking com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HRS Gmbh

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oravel stays

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AirBnb

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AccorHotels

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agoda**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hotels com

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expedia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OUI sncf

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Trivago

List of Figures

- Figure 1: Global Travel Accommodation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 3: North America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 5: North America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 6: North America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 9: South America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: South America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 11: South America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 12: South America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 15: Europe Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 17: Europe Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 18: Europe Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Middle East & Africa Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 23: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 24: Middle East & Africa Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 27: Asia Pacific Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Asia Pacific Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 29: Asia Pacific Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 30: Asia Pacific Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 2: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 3: Global Travel Accommodation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 5: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 6: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 11: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 12: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 17: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 18: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 29: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 30: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 38: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 39: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Accommodation Market?

The projected CAGR is approximately 9.56%.

2. Which companies are prominent players in the Travel Accommodation Market?

Key companies in the market include Trivago, TripAdvisor, Booking com, HRS Gmbh, Oravel stays, AirBnb, AccorHotels, Agoda**List Not Exhaustive, Hotels com, Expedia, OUI sncf.

3. What are the main segments of the Travel Accommodation Market?

The market segments include Platform, Mode of booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 961.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Usage Pushing Customers Towards Online Accommodation in France..

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence