Key Insights

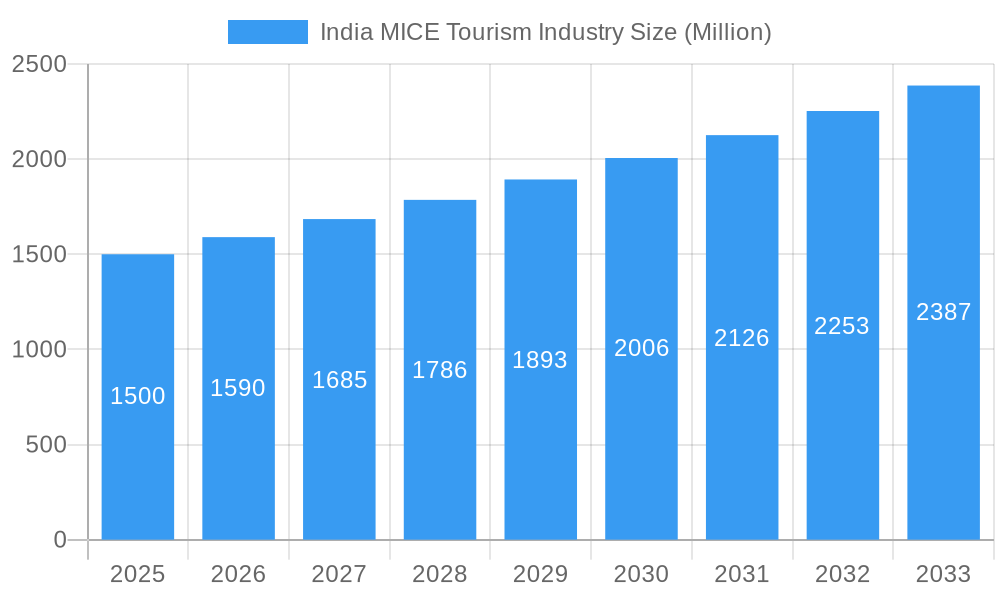

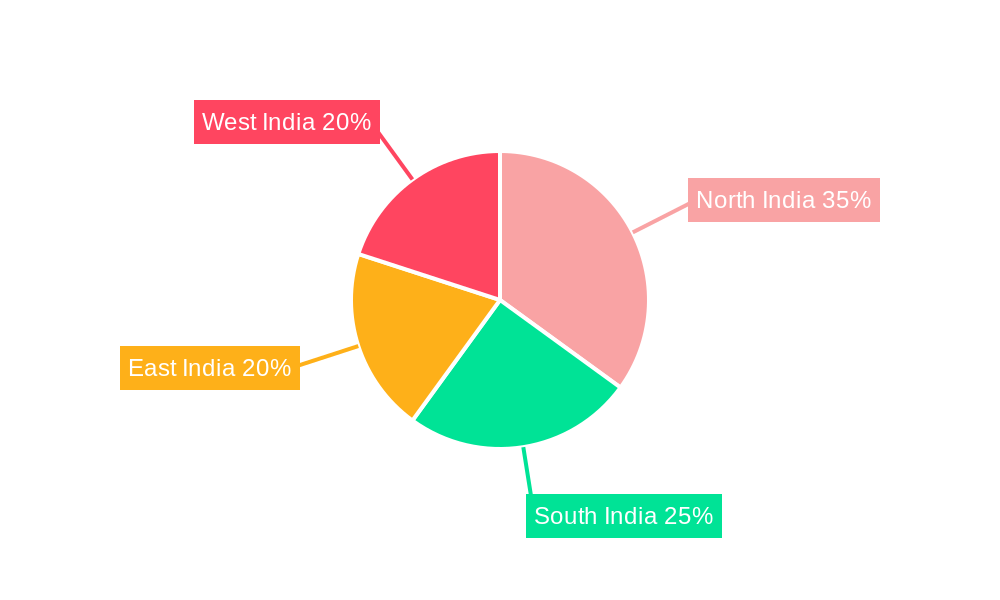

India's MICE (Meetings, Incentives, Conferences, Exhibitions) tourism sector is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 5.2% from 2024 to 2033. This growth trajectory is underpinned by India's rapidly developing economy and its increasing prominence as a global business center, stimulating demand for corporate events and international conferences. Government initiatives focused on enhancing transportation and hospitality infrastructure are also bolstering the nation's capability to host large-scale MICE activities. Additionally, a rising middle class with greater discretionary spending and a growing inclination towards experiential travel are key drivers of market expansion. Conferences and exhibitions are anticipated to be the primary revenue contributors, followed by meetings and incentives, aligning with the varied requirements of businesses and organizations. The market is estimated to reach 110.3 billion by 2033. While specific regional market share data is still developing, North and West India are expected to lead due to established business ecosystems and infrastructure, though all regions are projected to witness substantial growth.

India MICE Tourism Industry Market Size (In Billion)

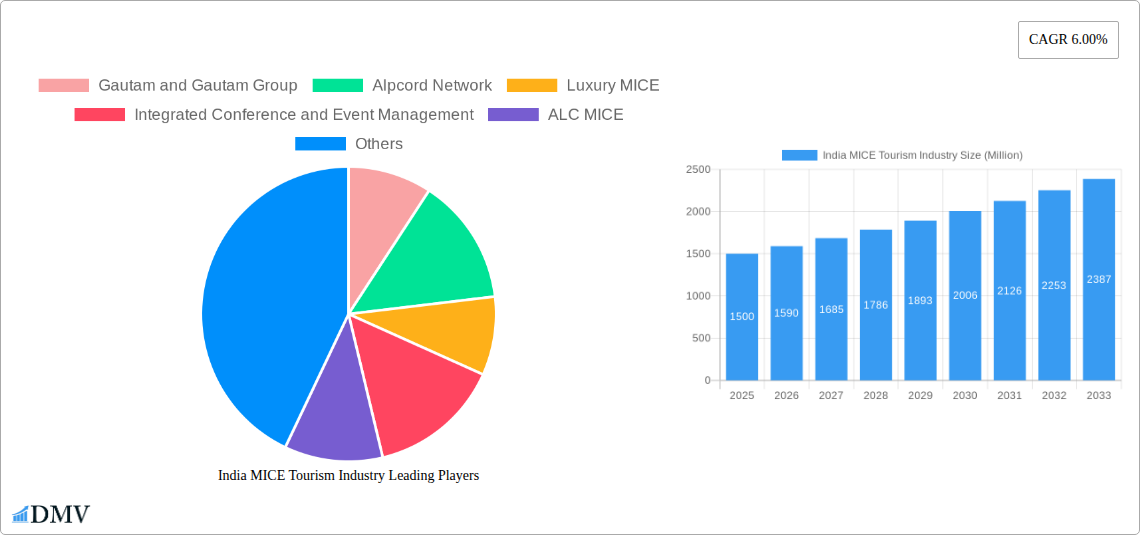

Competitive forces are actively shaping the Indian MICE tourism landscape. Established entities such as Gautam and Gautam Group, Alpcord Network, and Luxury MICE are expected to contend with emerging players. The market features a broad spectrum of service providers, ranging from comprehensive event management firms to niche specialists. Future success for companies in this sector will depend on their ability to adapt to evolving client preferences, integrate technology to elevate event experiences, and deliver innovative solutions in a dynamic marketplace. Persistent challenges include the necessity for uniform infrastructure development across all regions to support industry growth and mitigate potential capacity limitations. Moreover, achieving a competitive pricing strategy while ensuring superior service quality will be paramount for sustained success in this increasingly competitive environment.

India MICE Tourism Industry Company Market Share

India MICE Tourism Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the India MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism industry, offering crucial data and projections for stakeholders from 2019 to 2033. With a focus on market trends, leading players, and future opportunities, this report is an invaluable resource for investors, businesses, and policymakers seeking to navigate this dynamic sector. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033. Base Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024; Study Period: 2019-2033.

India MICE Tourism Industry Market Composition & Trends

This section dissects the competitive landscape of the Indian MICE tourism market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute offerings, end-user profiles, and mergers & acquisitions (M&A) activity. The report estimates that in 2025, the market is fragmented, with the top 5 players holding approximately xx% market share collectively. M&A activity has seen an increase in recent years, with deals valued at an estimated xx Million in 2024.

- Market Concentration: Moderately fragmented, with a few large players and numerous smaller operators.

- Innovation Catalysts: Technological advancements in event management software, virtual and hybrid event platforms, and sustainable tourism practices.

- Regulatory Landscape: Government initiatives promoting tourism and infrastructure development significantly influence market dynamics.

- Substitute Products: Online conferencing and virtual events pose a competitive threat, particularly for smaller-scale meetings.

- End-User Profiles: A diverse range of corporate clients, government agencies, and associations, across various industries.

- M&A Activities: Increasing consolidation through strategic acquisitions, driven by market expansion and technological integration. Deal values are expected to continue their upward trend.

India MICE Tourism Industry Industry Evolution

This section explores the evolution of the Indian MICE tourism industry, tracing market growth trajectories, technological advancements, and shifting consumer preferences. From 2019 to 2024, the market experienced fluctuating growth due to global events. However, it's projected to exhibit robust growth from 2025 onwards. The adoption of digital technologies is transforming event planning and execution, with a growing preference for hybrid and virtual events. The sector is seeing a shift towards sustainable practices and experiential travel.

Leading Regions, Countries, or Segments in India MICE Tourism Industry

This section identifies the dominant segments within the Indian MICE market (Meetings, Incentives, Conferences, Exhibitions). While data varies year to year, the analysis shows that conferences and exhibitions consistently contribute significantly to the overall revenue.

- Key Drivers for Conference Dominance:

- Significant investment in convention centers and infrastructure in major cities.

- Government initiatives to attract international conferences and exhibitions.

- Strong growth in specific sectors like IT, pharmaceuticals, and manufacturing driving corporate event demand.

- Incentive Travel: A rapidly growing sector driven by companies rewarding high-performing employees with customized experiences.

- Meetings: A continuous demand driven by business needs across various sectors.

- Exhibitions: A crucial segment for B2B networking, product launches, and brand building.

India MICE Tourism Industry Product Innovations

The Indian MICE industry is witnessing continuous product innovation, encompassing advanced event management software, virtual reality experiences integrated into conferences, and eco-friendly event planning solutions. These innovations enhance engagement, improve efficiency, and cater to evolving sustainability concerns.

Propelling Factors for India MICE Tourism Industry Growth

Several key factors fuel the growth of India's MICE tourism sector. Government initiatives to improve infrastructure, such as the development of Bangalore and other cities as MICE hubs, play a crucial role. Furthermore, the burgeoning IT sector and the expanding middle class are generating increased demand for business travel and high-quality events.

Obstacles in the India MICE Tourism Industry Market

Despite its potential, the Indian MICE industry faces challenges. These include infrastructural limitations in certain regions, the impact of global economic fluctuations, and fierce competition. Addressing these issues through strategic planning and collaboration is essential for sustainable growth.

Future Opportunities in India MICE Tourism Industry

Future growth is expected from the expansion into niche markets like medical tourism conferences and the leveraging of advanced technology. Further, sustainable and experiential events will continue to gain popularity, driving innovation and attracting a broader range of participants.

Major Players in the India MICE Tourism Industry Ecosystem

- Gautam and Gautam Group

- Alpcord Network

- Luxury MICE

- Integrated Conference and Event Management

- ALC MICE

- ITL World

- India MICE

- Travel XS MICE & More Services

- Dee Catalyst Pvt Ltd

- Plan IT! India

Key Developments in India MICE Tourism Industry Industry

- June 2021: The Ministry of Tourism identified six cities (Agra, Udaipur, Pune, Thiruvananthapuram, Varanasi, and Bhubaneswar) for development as MICE destinations.

- March 2022: The Chief Minister of Karnataka announced the development of Bangalore as a national MICE hub.

Strategic India MICE Tourism Industry Market Forecast

The Indian MICE tourism industry is poised for significant growth, driven by infrastructural improvements, government support, and technological advancements. The forecast indicates a strong upward trajectory, with substantial market expansion across various segments in the coming years.

India MICE Tourism Industry Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentives

- 1.3. Conference

- 1.4. Exhibitions

India MICE Tourism Industry Segmentation By Geography

- 1. India

India MICE Tourism Industry Regional Market Share

Geographic Coverage of India MICE Tourism Industry

India MICE Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Then Number of Meeting and Conventions in India is Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India MICE Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentives

- 5.1.3. Conference

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gautam and Gautam Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alpcord Network

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury MICE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Integrated Conference and Event Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALC MICE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ITL World

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India MICE**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Travel XS MICE & More Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dee Catalyst Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Plan IT! India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gautam and Gautam Group

List of Figures

- Figure 1: India MICE Tourism Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India MICE Tourism Industry Share (%) by Company 2025

List of Tables

- Table 1: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 2: India MICE Tourism Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 4: India MICE Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India MICE Tourism Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the India MICE Tourism Industry?

Key companies in the market include Gautam and Gautam Group, Alpcord Network, Luxury MICE, Integrated Conference and Event Management, ALC MICE, ITL World, India MICE**List Not Exhaustive, Travel XS MICE & More Services, Dee Catalyst Pvt Ltd, Plan IT! India.

3. What are the main segments of the India MICE Tourism Industry?

The market segments include Event.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Then Number of Meeting and Conventions in India is Increasing.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In March 2022, Presenting the budget for 2022/23, the Chief Minister of the State announced the up-gradation of Bangalore into a Meeting, Incentive, Conferences, and Exhibitions (MICE) hub of the country by leveraging the city's advantages as a business capital, IT Capital as well as its developed infrastructure in technology, transport, and air connectivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India MICE Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India MICE Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India MICE Tourism Industry?

To stay informed about further developments, trends, and reports in the India MICE Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence