Key Insights

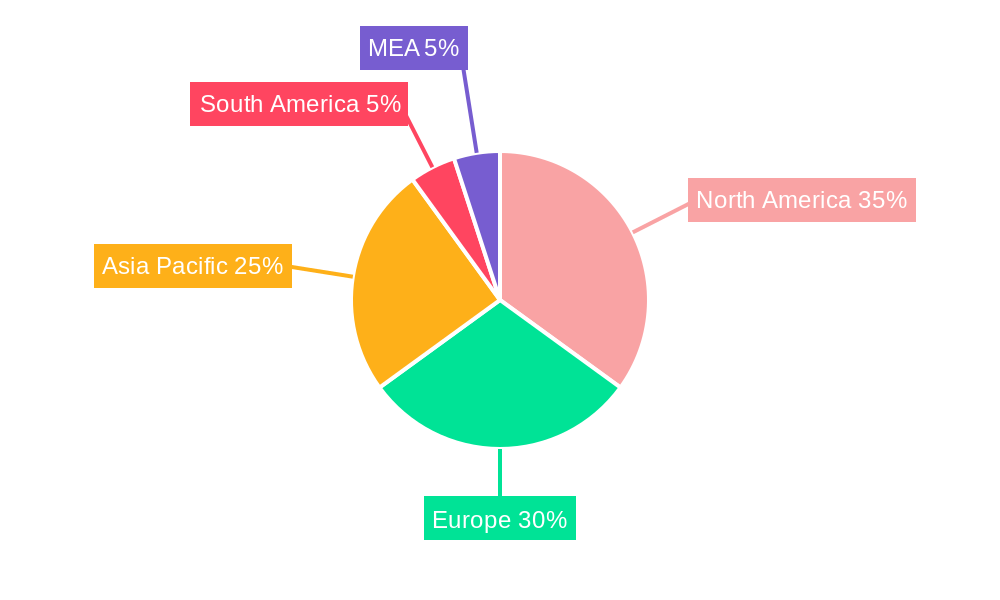

The global non-residential accommodation market, encompassing hotels, motels, resorts, vacation rentals, and other lodging options, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 12% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the burgeoning global tourism sector, encompassing both leisure and business travel, is significantly boosting demand. The rise of online travel agencies (OTAs) and the increasing adoption of technology for booking and managing accommodations are also contributing factors. Furthermore, the diversification of accommodation types, including the growth of vacation rentals and unique lodging experiences, caters to evolving consumer preferences. However, economic fluctuations and potential geopolitical instability represent significant restraints that could impact growth trajectories. Market segmentation reveals strong performance across various end-user groups, with leisure travelers, business travelers, and group travelers all contributing substantially. Distribution channels show a blend of traditional methods like travel management companies (TMCs) and corporate travel agents, alongside the rapid expansion of online channels like OTAs and hotel websites. Geographically, North America and Europe currently dominate the market, but the Asia-Pacific region exhibits significant growth potential, driven by rising disposable incomes and increased tourism in key markets like China and India.

Non-Residential Accommodation Market Market Size (In Billion)

The market's future trajectory is influenced by several significant trends. The increasing adoption of sustainable practices by hotels and the rising popularity of experiential travel are shaping consumer choices. Technological advancements in areas such as AI-powered booking systems and personalized guest experiences are transforming the industry. Competition is expected to intensify amongst established players like Marriott, Hilton, and InterContinental, alongside the emergence of new entrants and innovative business models. Analyzing regional performance is crucial for informed strategic decision-making. While North America and Europe maintain leading positions, the Asia-Pacific region's rapid growth necessitates focused attention and investment. A thorough understanding of market segmentation, considering end-user preferences and distribution channels, is vital for players seeking to maximize market share and adapt to evolving consumer demands within this dynamic sector.

Non-Residential Accommodation Market Company Market Share

Non-Residential Accommodation Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Non-Residential Accommodation Market, encompassing its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study offers invaluable insights for stakeholders seeking to navigate this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Non-Residential Accommodation Market Composition & Trends

This section delves into the intricate composition of the non-residential accommodation market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with key players like Marriott International and Hilton Worldwide Holdings holding significant market share. However, the emergence of boutique hotels and vacation rentals is increasing competition. Innovation is driven by technological advancements such as online booking platforms and personalized guest experiences. Regulatory factors, including zoning laws and building codes, significantly impact market dynamics. Substitute products, such as Airbnb and other short-term rentals, pose a considerable challenge.

- Market Share Distribution (2025): Marriott International (xx%), Hilton Worldwide Holdings (xx%), InterContinental Hotels Group (xx%), Others (xx%). These figures represent estimated market share based on revenue.

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a total deal value of approximately xx Million. Significant deals include Marriott's acquisition of Starwood Hotels.

- End-User Profile: The market caters to diverse end-users, including leisure travelers, business travelers, and group travelers, with varying needs and preferences.

Non-Residential Accommodation Market Industry Evolution

This section meticulously examines the historical and projected evolution of the non-residential accommodation market, encompassing growth trajectories, technological advancements, and shifting consumer demands. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as increased disposable incomes and the rise of experiential travel. Technological advancements such as mobile booking apps and AI-powered customer service have significantly altered the landscape. Consumer demand now emphasizes personalized experiences, sustainable practices, and value for money. The forecast period (2025-2033) anticipates continued growth, fueled by expanding tourism and business travel. However, factors like economic fluctuations and geopolitical events could impact growth rates.

Leading Regions, Countries, or Segments in Non-Residential Accommodation Market

This section identifies the dominant regions, countries, and segments within the non-residential accommodation market. Analysis across end-users, distribution channels, and accommodation types reveals key drivers of market dominance.

By End User:

- Leisure Travelers: Dominant due to the rising trend of leisure travel and exploration of new destinations. Key driver: Increased disposable income and flexible work arrangements.

- Business Travelers: A significant segment driven by global business expansion and corporate travel policies. Key driver: Growing corporate travel budgets.

- Group Travelers: A substantial segment with specific needs for large-scale accommodations. Key driver: Incentives, corporate retreats, and educational group trips.

By Distribution Channel:

- Online Travel Agencies (OTA): Dominant due to convenience, price comparison features, and broad reach. Key driver: Increased internet penetration and mobile usage.

- Hotel Websites: Growing importance as hotels improve their direct booking strategies. Key driver: Focus on loyalty programs and personalized offers.

By Type:

- Hotels: Remains the largest segment due to established infrastructure and diverse offerings. Key driver: Consistent demand across all travel segments.

- Resorts: Strong growth driven by the increasing preference for luxury and experiential travel. Key driver: Rising demand for unique and memorable travel experiences.

Non-Residential Accommodation Market Product Innovations

The non-residential accommodation sector is witnessing significant innovation, with a focus on enhancing guest experiences and operational efficiency. Smart room technology, personalized services powered by AI, and sustainable practices are key trends. Unique selling propositions include bespoke experiences, wellness facilities, and commitment to local communities. Technological advancements such as contactless check-in and mobile key access enhance convenience and efficiency.

Propelling Factors for Non-Residential Accommodation Market Growth

Several factors are driving growth in the non-residential accommodation market. Increased disposable incomes and a growing preference for travel and leisure experiences are primary catalysts. Technological advancements, such as mobile booking apps and AI-powered customer service, significantly impact market expansion. Furthermore, supportive government policies and initiatives focused on promoting tourism and hospitality also contribute to market growth.

Obstacles in the Non-Residential Accommodation Market

The non-residential accommodation market faces several challenges, including increased competition from alternative accommodations, economic downturns impacting travel budgets, and fluctuations in currency exchange rates that influence international travel. Supply chain disruptions and rising operating costs, particularly labor costs, are significant constraints.

Future Opportunities in Non-Residential Accommodation Market

The future of the non-residential accommodation market is bright, with opportunities in emerging markets, expansion into niche segments such as eco-tourism and wellness travel, and leveraging technological advancements such as virtual reality for enhanced guest experiences. Expansion into underserved markets presents significant potential for growth.

Major Players in the Non-Residential Accommodation Market Ecosystem

Key Developments in Non-Residential Accommodation Market Industry

- October 2022: Marriott International announced its acquisition of a city express brand to expand its presence in the affordable midscale segment. This move aims to capture a larger market share by offering budget-friendly options.

- December 2022: Hilton announced the continued expansion of its Waldorf Astoria Hotels & Resorts brand in the Caribbean and Latin America with a new hotel in San Miguel de Allende, Mexico. This expansion demonstrates a strategic focus on luxury travel markets.

Strategic Non-Residential Accommodation Market Forecast

The non-residential accommodation market is poised for continued growth, driven by various factors including increased tourism, technological innovation, and changing consumer preferences. The market's potential for expansion into new segments and geographies remains significant, presenting substantial opportunities for established players and new entrants alike. The focus on personalized experiences, sustainability, and technological integration will shape future market trends.

Non-Residential Accommodation Market Segmentation

-

1. Type

- 1.1. Hotels

- 1.2. Motels

- 1.3. Resorts

- 1.4. Vacation Rentals

- 1.5. Others

-

2. End User

- 2.1. Leisure Travelers

- 2.2. Business Travelers

- 2.3. Group Travelers

-

3. Distribution Channels

- 3.1. Hotel Websites

- 3.2. Online Travel Agencies (OTA)

- 3.3. Travel Management Companies (TMCs)

- 3.4. Corporate Travel Agents

Non-Residential Accommodation Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Non-Residential Accommodation Market Regional Market Share

Geographic Coverage of Non-Residential Accommodation Market

Non-Residential Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Unique and Personalized Travel Experiences; Rising Trend of Online Booking and Mobile Applications

- 3.3. Market Restrains

- 3.3.1. Competition from Other Alternative Accommodation Options Such as Vacation Rentals and Homestays; Seasonal Demand Fluctuations and Dependence on Tourism Industry

- 3.4. Market Trends

- 3.4.1. Technology Driven Services is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hotels

- 5.1.2. Motels

- 5.1.3. Resorts

- 5.1.4. Vacation Rentals

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Leisure Travelers

- 5.2.2. Business Travelers

- 5.2.3. Group Travelers

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.3.1. Hotel Websites

- 5.3.2. Online Travel Agencies (OTA)

- 5.3.3. Travel Management Companies (TMCs)

- 5.3.4. Corporate Travel Agents

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hotels

- 6.1.2. Motels

- 6.1.3. Resorts

- 6.1.4. Vacation Rentals

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Leisure Travelers

- 6.2.2. Business Travelers

- 6.2.3. Group Travelers

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.3.1. Hotel Websites

- 6.3.2. Online Travel Agencies (OTA)

- 6.3.3. Travel Management Companies (TMCs)

- 6.3.4. Corporate Travel Agents

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hotels

- 7.1.2. Motels

- 7.1.3. Resorts

- 7.1.4. Vacation Rentals

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Leisure Travelers

- 7.2.2. Business Travelers

- 7.2.3. Group Travelers

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.3.1. Hotel Websites

- 7.3.2. Online Travel Agencies (OTA)

- 7.3.3. Travel Management Companies (TMCs)

- 7.3.4. Corporate Travel Agents

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hotels

- 8.1.2. Motels

- 8.1.3. Resorts

- 8.1.4. Vacation Rentals

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Leisure Travelers

- 8.2.2. Business Travelers

- 8.2.3. Group Travelers

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.3.1. Hotel Websites

- 8.3.2. Online Travel Agencies (OTA)

- 8.3.3. Travel Management Companies (TMCs)

- 8.3.4. Corporate Travel Agents

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hotels

- 9.1.2. Motels

- 9.1.3. Resorts

- 9.1.4. Vacation Rentals

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Leisure Travelers

- 9.2.2. Business Travelers

- 9.2.3. Group Travelers

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.3.1. Hotel Websites

- 9.3.2. Online Travel Agencies (OTA)

- 9.3.3. Travel Management Companies (TMCs)

- 9.3.4. Corporate Travel Agents

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Non-Residential Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hotels

- 10.1.2. Motels

- 10.1.3. Resorts

- 10.1.4. Vacation Rentals

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Leisure Travelers

- 10.2.2. Business Travelers

- 10.2.3. Group Travelers

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.3.1. Hotel Websites

- 10.3.2. Online Travel Agencies (OTA)

- 10.3.3. Travel Management Companies (TMCs)

- 10.3.4. Corporate Travel Agents

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 InterContinental Hotels Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Hotels Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Marriott International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Four Seasons Hotels and Resorts**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AccorHotels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hilton Worldwide Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MGM Resorts International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Starwood Hotels

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ctrip Com International Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rewe Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 InterContinental Hotels Group

List of Figures

- Figure 1: Global Non-Residential Accommodation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Non-Residential Accommodation Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Non-Residential Accommodation Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Non-Residential Accommodation Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Non-Residential Accommodation Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Non-Residential Accommodation Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 7: North America Non-Residential Accommodation Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 8: North America Non-Residential Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Non-Residential Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Non-Residential Accommodation Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Non-Residential Accommodation Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Non-Residential Accommodation Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Non-Residential Accommodation Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Non-Residential Accommodation Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 15: Europe Non-Residential Accommodation Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 16: Europe Non-Residential Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Non-Residential Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Non-Residential Accommodation Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Non-Residential Accommodation Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Non-Residential Accommodation Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Non-Residential Accommodation Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Non-Residential Accommodation Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 23: Asia Pacific Non-Residential Accommodation Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 24: Asia Pacific Non-Residential Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Non-Residential Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Non-Residential Accommodation Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Non-Residential Accommodation Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Non-Residential Accommodation Market Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Non-Residential Accommodation Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Non-Residential Accommodation Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 31: South America Non-Residential Accommodation Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 32: South America Non-Residential Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Non-Residential Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Non-Residential Accommodation Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East Non-Residential Accommodation Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Non-Residential Accommodation Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East Non-Residential Accommodation Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East Non-Residential Accommodation Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 39: Middle East Non-Residential Accommodation Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 40: Middle East Non-Residential Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Non-Residential Accommodation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 4: Global Non-Residential Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 8: Global Non-Residential Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 12: Global Non-Residential Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 16: Global Non-Residential Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 20: Global Non-Residential Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Non-Residential Accommodation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Non-Residential Accommodation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Non-Residential Accommodation Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 24: Global Non-Residential Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Residential Accommodation Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the Non-Residential Accommodation Market?

Key companies in the market include InterContinental Hotels Group, Hyatt Hotels Corporation, Marriott International, Four Seasons Hotels and Resorts**List Not Exhaustive, AccorHotels, Hilton Worldwide Holdings, MGM Resorts International, Starwood Hotels, Ctrip Com International Ltd, Rewe Group.

3. What are the main segments of the Non-Residential Accommodation Market?

The market segments include Type, End User, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Unique and Personalized Travel Experiences; Rising Trend of Online Booking and Mobile Applications.

6. What are the notable trends driving market growth?

Technology Driven Services is Driving the Market.

7. Are there any restraints impacting market growth?

Competition from Other Alternative Accommodation Options Such as Vacation Rentals and Homestays; Seasonal Demand Fluctuations and Dependence on Tourism Industry.

8. Can you provide examples of recent developments in the market?

December 2022: Hilton Announced Continued Expansion of Waldorf Astoria Hotels & Resorts in the Caribbean and Latin America by signing a new hotel in San Miguel de Allende, Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Residential Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Residential Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Residential Accommodation Market?

To stay informed about further developments, trends, and reports in the Non-Residential Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence