Key Insights

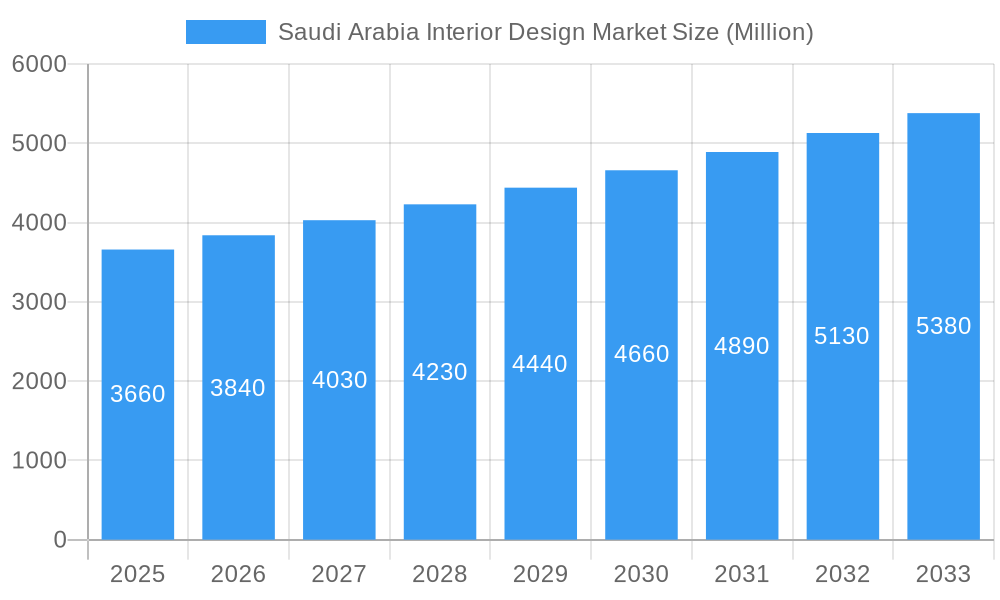

The Saudi Arabian interior design market exhibits robust growth potential, projected to reach a market size of $3.66 billion in 2025, expanding at a compound annual growth rate (CAGR) of 4.81% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant investments in infrastructure and real estate development across the Kingdom, including large-scale projects like NEOM and Qiddiya, are creating immense demand for high-quality interior design services. Secondly, a rising affluent population with a growing preference for sophisticated and aesthetically pleasing living spaces is driving demand for luxury and bespoke interior design solutions. Furthermore, the increasing focus on sustainable and eco-friendly design practices is influencing market trends, with consumers and developers increasingly prioritizing environmentally conscious materials and technologies. The market is segmented by various design styles (modern, traditional, minimalist, etc.), project types (residential, commercial, hospitality), and price points (luxury, mid-range, budget-friendly). Competitive landscape analysis reveals a mix of established local firms like Aljeel Architects and Amsad Architectural Associates, alongside international players like Idegree Design and Esperiri Milano. The market's growth trajectory reflects the Kingdom’s broader economic diversification strategy, showcasing a vibrant and evolving design sector.

Saudi Arabia Interior Design Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion driven by sustained government investment in infrastructure, tourism development, and ongoing urbanization. Emerging trends include the increasing adoption of technology in interior design, such as virtual reality (VR) and augmented reality (AR) for visualization, and the growing emphasis on personalized and customized design solutions tailored to individual client preferences. However, potential restraints include fluctuations in oil prices impacting overall economic activity and the availability of skilled labor, especially specialized designers and craftsmen. Nevertheless, the long-term outlook for the Saudi Arabian interior design market remains positive, driven by a confluence of economic, social, and technological factors shaping the future of the built environment within the Kingdom.

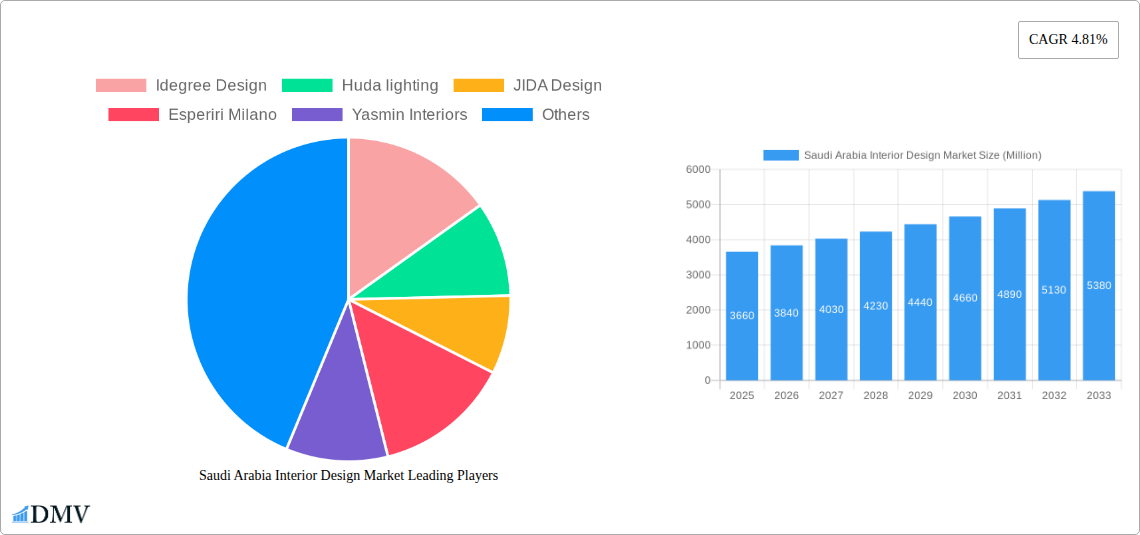

Saudi Arabia Interior Design Market Company Market Share

Saudi Arabia Interior Design Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Saudi Arabia interior design market, offering invaluable intelligence for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, growth drivers, challenges, and future opportunities. The report leverages extensive data and expert analysis to deliver actionable insights for strategic decision-making.

Saudi Arabia Interior Design Market Composition & Trends

The Saudi Arabian interior design market exhibits a moderately concentrated landscape, with key players vying for market share. Innovation is driven by rising disposable incomes, government initiatives promoting Vision 2030, and a burgeoning real estate sector. Regulatory frameworks, while evolving, influence market access and operational efficiency. Substitute products, particularly in budget segments, exert competitive pressure. The end-user profile encompasses residential, commercial, hospitality, and government sectors, with varying design preferences and budgetary considerations. Significant M&A activity, such as the USD 480 Million PIF investment in Depa in March 2022, shapes market consolidation.

- Market Share Distribution (2024 Estimate): Top 5 players hold approximately xx%, with the remaining market share distributed among numerous smaller firms.

- M&A Deal Value (2019-2024): Total deal value exceeding USD xx Million, reflecting significant investor interest.

Saudi Arabia Interior Design Market Industry Evolution

The Saudi Arabian interior design market has experienced robust growth, fueled by several factors. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, driven primarily by substantial investments in infrastructure projects and the Vision 2030 initiative. Technological advancements, including the adoption of Building Information Modeling (BIM) and 3D visualization tools, are enhancing design efficiency and client engagement. Shifting consumer preferences toward sustainable and personalized design solutions are shaping market demand. The increasing adoption of smart home technologies and the growing preference for customized interiors further contribute to market expansion. We project a CAGR of xx% from 2025 to 2033, reflecting continued growth in various market segments.

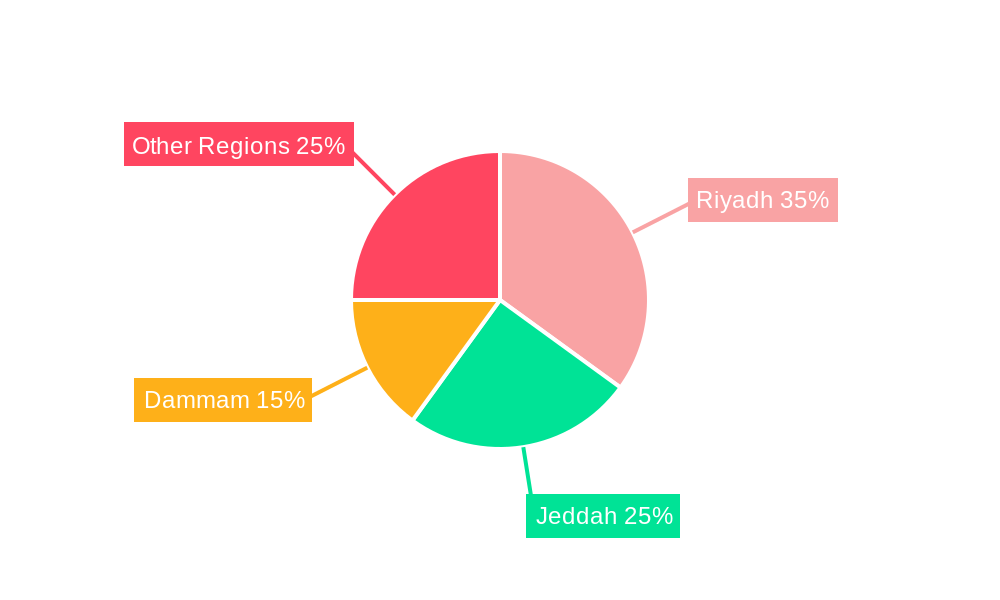

Leading Regions, Countries, or Segments in Saudi Arabia Interior Design Market

Riyadh, Jeddah, and Dammam remain the dominant regions within the Saudi Arabia interior design market, primarily due to higher population density, substantial infrastructure development, and significant investment in both residential and commercial projects.

- Key Drivers for Riyadh's Dominance:

- Highest concentration of high-net-worth individuals fueling luxury interior design projects.

- Extensive ongoing construction of residential, commercial, and hospitality spaces.

- Government support for Vision 2030 initiatives, driving large-scale developments.

- Market Dynamics: The market is witnessing an increasing preference for sustainable and locally-sourced materials, aligning with the nation's environmental sustainability goals. The influx of foreign architectural firms has further intensified competition and introduced diverse design aesthetics. Government regulations related to construction standards and safety also play a major role.

Saudi Arabia Interior Design Market Product Innovations

The Saudi Arabian interior design market showcases ongoing product innovations, from sustainable and eco-friendly materials to technologically advanced furniture and smart home integration. The focus on creating personalized spaces, incorporating augmented reality for design visualization, and the rising popularity of modular furniture are key trends. This innovation directly translates into increased efficiency and customer satisfaction, contributing to the overall market expansion.

Propelling Factors for Saudi Arabia Interior Design Market Growth

Several factors are driving the growth of the Saudi Arabia interior design market. Vision 2030, with its focus on diversification and infrastructure development, is a primary catalyst, creating substantial demand for interior design services. The expanding real estate sector, coupled with rising disposable incomes and a growing middle class, further fuels market expansion. Technological advancements, including BIM and 3D printing, enhance design capabilities and reduce project timelines, while government initiatives supporting local talent and sustainable practices contribute positively.

Obstacles in the Saudi Arabia Interior Design Market

The Saudi Arabia interior design market faces several challenges. Fluctuations in oil prices can impact investment levels, while supply chain disruptions can delay projects and increase costs. Intense competition, both from domestic and international firms, requires firms to differentiate their services and maintain cost-competitiveness. Navigating regulatory compliance and obtaining necessary permits can also present hurdles for businesses.

Future Opportunities in Saudi Arabia Interior Design Market

Future opportunities for the Saudi Arabia interior design market are abundant. The growing emphasis on sustainable design, smart home technologies, and personalized spaces creates a significant demand for innovative solutions. The expansion into new regions and untapped market segments, such as healthcare and educational facilities, offer promising growth avenues. The increasing adoption of digital design tools and the use of virtual and augmented reality for client engagement further present exciting opportunities for businesses to thrive.

Major Players in the Saudi Arabia Interior Design Market Ecosystem

- Idegree Design

- Huda lighting

- JIDA Design

- Esperiri Milano

- Yasmin Interiors

- Aljeel Architects

- Amsad Architectural Associates

- Architectural Scene

- C&P

- Comelite Architecture and Structure

- D&D Est

Key Developments in Saudi Arabia Interior Design Market Industry

- October 2023: Aljazira Capital and Osus Real Estate Co. launched a USD 453.2 Million real estate investment fund focusing on northern Riyadh, boosting demand for interior design services.

- March 2022: Saudi Arabia's PIF acquired a controlling stake in Depa for USD 480 Million, significantly impacting the market landscape.

Strategic Saudi Arabia Interior Design Market Forecast

The Saudi Arabia interior design market is poised for sustained growth, driven by Vision 2030's ambitious development plans, rising affluence, and technological advancements. The continued focus on sustainable and personalized designs, coupled with increased investments in real estate, will significantly contribute to market expansion over the forecast period (2025-2033). This presents significant opportunities for both established and emerging players to capitalize on the growing demand for innovative and high-quality interior design solutions.

Saudi Arabia Interior Design Market Segmentation

-

1. End-Use

- 1.1. Residential

-

1.2. Commercial

- 1.2.1. Hospitality

- 1.2.2. Healthcare

- 1.2.3. Education

- 1.2.4. Offices

- 1.2.5. Others

Saudi Arabia Interior Design Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Interior Design Market Regional Market Share

Geographic Coverage of Saudi Arabia Interior Design Market

Saudi Arabia Interior Design Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of Real Estate in the Country; Increasing Rate of Urbanization

- 3.3. Market Restrains

- 3.3.1. Expansion of Real Estate in the Country; Increasing Rate of Urbanization

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-Use

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.2.1. Hospitality

- 5.1.2.2. Healthcare

- 5.1.2.3. Education

- 5.1.2.4. Offices

- 5.1.2.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End-Use

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Idegree Design

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huda lighting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JIDA Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esperiri Milano

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yasmin Interiors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aljeel Architects

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amsad Architectural Associates

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Architectural Scene

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C&P

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Comelite Architecture and Structure

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 D&D Est**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Idegree Design

List of Figures

- Figure 1: Saudi Arabia Interior Design Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Interior Design Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Interior Design Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 2: Saudi Arabia Interior Design Market Volume Billion Forecast, by End-Use 2020 & 2033

- Table 3: Saudi Arabia Interior Design Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Interior Design Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Interior Design Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 6: Saudi Arabia Interior Design Market Volume Billion Forecast, by End-Use 2020 & 2033

- Table 7: Saudi Arabia Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Interior Design Market?

The projected CAGR is approximately 4.81%.

2. Which companies are prominent players in the Saudi Arabia Interior Design Market?

Key companies in the market include Idegree Design, Huda lighting, JIDA Design, Esperiri Milano, Yasmin Interiors, Aljeel Architects, Amsad Architectural Associates, Architectural Scene, C&P, Comelite Architecture and Structure, D&D Est**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Interior Design Market?

The market segments include End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of Real Estate in the Country; Increasing Rate of Urbanization.

6. What are the notable trends driving market growth?

Increasing Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Expansion of Real Estate in the Country; Increasing Rate of Urbanization.

8. Can you provide examples of recent developments in the market?

October 2023: Saudi Arabia’s Aljazira Capital and Osus Real Estate Co. launched a private closed-end real estate investment fund with a target investment volume of more than USD 453.2 Million focused on developing residential, hotel, office, and commercial properties in northern Riyadh, expanding the business of Interior design market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Interior Design Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Interior Design Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Interior Design Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Interior Design Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence