Key Insights

The Netherlands DIY home improvement market is experiencing significant expansion, propelled by several key drivers. The aging residential infrastructure necessitates ongoing renovation and repair, directly fueling demand for DIY materials and tools. Furthermore, a growing societal focus on sustainable living and energy efficiency is stimulating investment in home improvement projects centered on insulation, energy-efficient appliances, and renewable energy integration. Increased disposable income among Dutch households, alongside a strong preference for personalized living spaces, further underpins this market's growth.

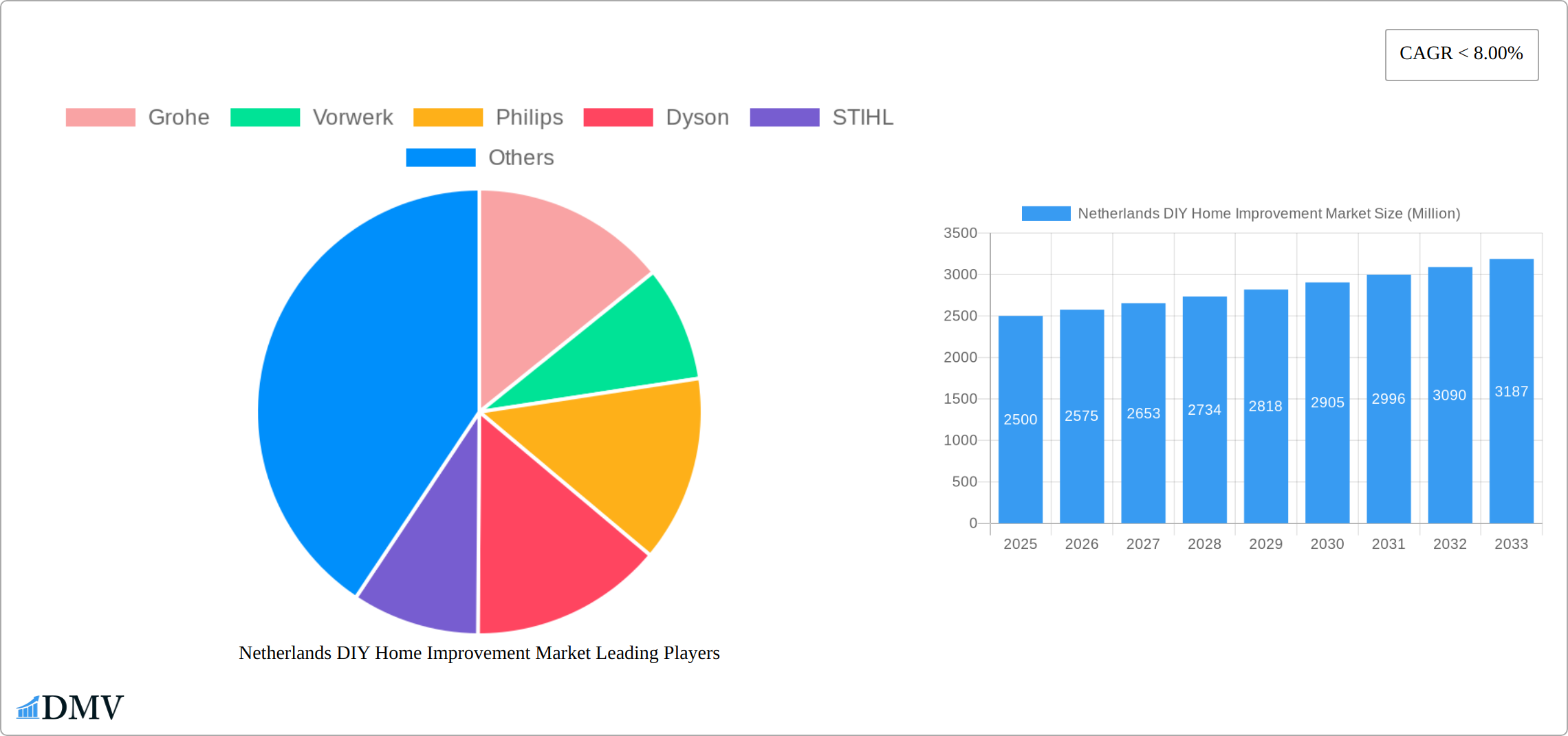

Netherlands DIY Home Improvement Market Market Size (In Billion)

While specific historical data for 2019-2024 is limited, European market trends and the robust Dutch economy suggest consistent growth during this period. For the forecast period (2025-2033), the market is projected to reach a size of 8.79 billion in the base year 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 4.7%. This projection is supported by continued market drivers, including rising consumer confidence and ongoing government incentives for home energy upgrades.

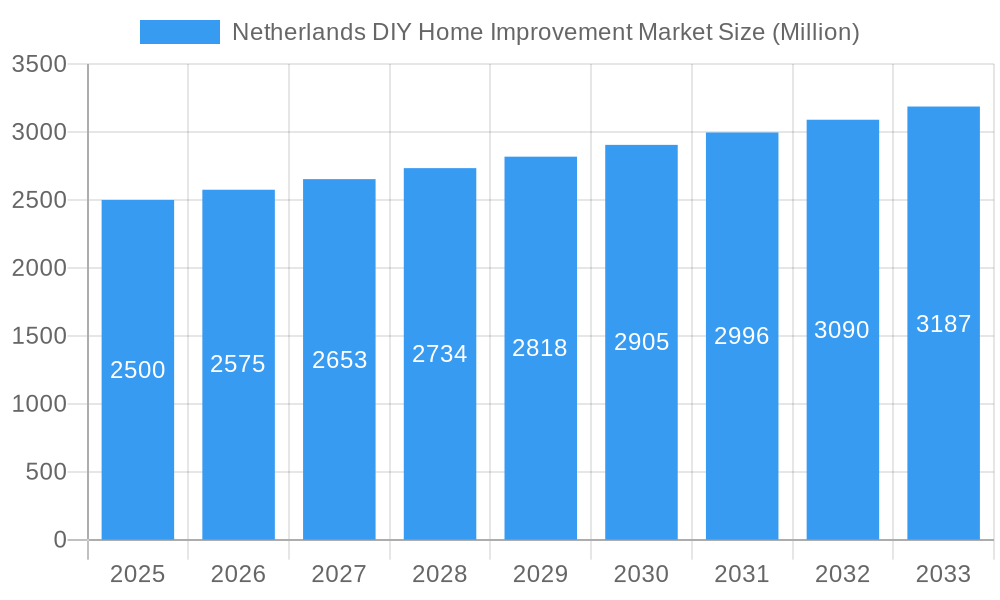

Netherlands DIY Home Improvement Market Company Market Share

The Netherlands DIY home improvement market is segmented across diverse product categories including paints, hardware, tools, building materials, and gardening supplies. Online retail is increasingly prominent, offering convenience and extensive product options. However, traditional brick-and-mortar stores remain vital, particularly for consumers seeking expert advice and immediate product availability. The competitive landscape features both large international retailers and specialized local businesses. Future market expansion will be shaped by economic fluctuations, government housing and sustainability policies, and evolving consumer preferences for smart home technologies and eco-friendly products. The market is expected to exhibit cyclical trends influenced by seasonal demand and broader economic cycles.

Netherlands DIY Home Improvement Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Netherlands DIY home improvement market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The total market size in 2025 is estimated at €XX Billion.

Netherlands DIY Home Improvement Market Market Composition & Trends

This section delves into the intricate composition of the Netherlands DIY home improvement market, examining its competitive landscape, innovation drivers, regulatory environment, and evolving consumer preferences. We analyze market concentration, identifying key players and their respective market shares. The report also explores the influence of substitute products, profiling end-user demographics and analyzing significant mergers and acquisitions (M&A) activities within the sector. M&A deal values are estimated to total €XX Billion during the historical period (2019-2024).

- Market Concentration: The market exhibits a [High/Medium/Low - choose one] level of concentration, with [Percentage]% held by the top 5 players.

- Innovation Catalysts: Growing consumer demand for sustainable and smart home solutions is a major driver of innovation.

- Regulatory Landscape: [Describe key regulations impacting the market, e.g., building codes, environmental regulations].

- Substitute Products: The market faces competition from [List examples of substitute products and their impact].

- End-User Profiles: The market caters to a diverse range of end-users, including homeowners, renters, and professional contractors. [Include a breakdown of end-user segments and their spending habits].

- M&A Activities: Significant M&A activity was observed during 2019-2024, with deals primarily focused on [mention the area of focus like expanding product portfolio or geographic reach].

Netherlands DIY Home Improvement Market Industry Evolution

The Netherlands DIY home improvement market is experiencing dynamic growth, shaped by a confluence of factors impacting its trajectory. From 2019-2024, the market exhibited a [Growth Rate]% CAGR, fueled by [Mention key drivers, e.g., rising disposable incomes, government incentives for energy efficiency, increased homeownership rates]. This expansion is significantly influenced by technological advancements, such as the proliferation of smart home devices and the seamless integration of online retail channels, offering consumers unparalleled convenience and choice. Further analysis reveals a strong correlation between increased consumer confidence and willingness to invest in home improvement projects, particularly those focused on sustainability and enhanced living spaces. The evolving landscape is characterized by a shift towards premium, high-quality products, reflecting a growing preference for durability, performance, and long-term value. A notable aspect is the growing influence of social media and home improvement television programs, inspiring and guiding DIY enthusiasts in their projects.

Leading Regions, Countries, or Segments in Netherlands DIY Home Improvement Market

This section identifies the dominant regions, countries, and product segments within the Netherlands DIY home improvement market. The analysis considers both By Product Type and By Distribution Channel.

By Product Type:

- Kitchen: This segment is experiencing significant growth, driven by increasing demand for modern and functional kitchen designs.

- Bathroom: Similar to kitchens, bathroom renovations represent a significant market segment due to the high value of projects and consumer focus on aesthetics and functionality.

- Tools & Hardware: The robust professional and DIY segments drive significant demand within this segment.

By Distribution Channel:

- DIY Home Improvement Stores: These stores remain the dominant distribution channel, benefiting from their wide product selection and in-store expertise.

- Online: Online sales are growing rapidly, driven by convenience and increased internet penetration.

Key Drivers (Examples):

- Increased disposable income and housing market activity.

- Government initiatives promoting home renovations and energy efficiency.

- Growing popularity of home improvement TV shows and online resources.

Netherlands DIY Home Improvement Market Product Innovations

Innovation is a key driver within the Netherlands DIY home improvement sector. Recent product launches highlight a strong focus on smart home integration, sustainable and eco-friendly materials, and user-friendly designs catering to a broad spectrum of DIY skill levels. Examples include Miele's 2022 introduction of smart home appliances that monitor air quality and health vitals, aligning with the growing demand for healthier living environments. Dyson's high-end humidifiers (2021) exemplify the increasing emphasis on air quality and wellness within the home. Beyond these specific examples, manufacturers are constantly developing tools and materials that are more efficient, durable, and easier to use, making DIY projects more accessible to a wider audience. This includes innovative fastening systems, cordless power tools with improved battery technology, and pre-fabricated components simplifying complex installations.

Propelling Factors for Netherlands DIY Home Improvement Market Growth

Several interconnected factors propel the growth of the Netherlands DIY home improvement market. A significant contributor is the rise in disposable incomes, empowering consumers to invest more readily in enhancing their living spaces. Government policies promoting energy-efficient renovations provide additional impetus, encouraging homeowners to undertake eco-friendly upgrades. Furthermore, the burgeoning smart home technology sector creates new opportunities for market expansion, offering consumers enhanced convenience and control over their homes' functionality. The popularity of home improvement television shows and social media influencers continues to inspire DIY enthusiasts, significantly driving market demand and shaping project trends.

Obstacles in the Netherlands DIY Home Improvement Market Market

The market faces challenges including supply chain disruptions, particularly following the COVID-19 pandemic, leading to increased material costs and project delays. Competition from established players and the entry of new entrants create competitive pressure, requiring constant innovation and adaptation. Furthermore, fluctuating energy prices and changing building regulations impact costs and project feasibility.

Future Opportunities in Netherlands DIY Home Improvement Market

Future opportunities lie in the expanding smart home technology sector, with growing integration of IoT devices and automation systems for improved energy efficiency and convenience. The rising demand for sustainable and eco-friendly materials creates opportunities for companies offering green solutions. Finally, the aging population presents an opportunity for products and services catering to accessibility and age-related modifications.

Key Developments in Netherlands DIY Home Improvement Market Industry

- 2021: Dyson launches two high-end humidifiers focusing on air purification and circulation. This significantly impacted the air quality segment.

- 2022: Miele introduces smart home products monitoring air quality and vital signs, highlighting a growing trend toward health-focused smart home technology.

Strategic Netherlands DIY Home Improvement Market Market Forecast

The Netherlands DIY home improvement market is poised for continued growth, driven by technological innovation, increasing consumer spending, and a favorable regulatory environment. The market is expected to maintain a healthy growth trajectory throughout the forecast period (2025-2033), with significant opportunities in smart home technologies, sustainable materials, and specialized services catering to diverse end-user needs. Further market expansion is anticipated as consumer preferences continue to evolve.

Netherlands DIY Home Improvement Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands DIY Home Improvement Market Segmentation By Geography

- 1. Netherlands

Netherlands DIY Home Improvement Market Regional Market Share

Geographic Coverage of Netherlands DIY Home Improvement Market

Netherlands DIY Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. DIY Purchases made on an online platform and in stores

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands DIY Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vorwerk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dyson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STIHL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Miele

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electrolux

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bissell**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Whirlpool

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Geberit

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Netherlands DIY Home Improvement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands DIY Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands DIY Home Improvement Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Netherlands DIY Home Improvement Market?

Key companies in the market include Grohe, Vorwerk, Philips, Dyson, STIHL, Miele, Electrolux, Bissell**List Not Exhaustive, Whirlpool, Ikea, Geberit.

3. What are the main segments of the Netherlands DIY Home Improvement Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

DIY Purchases made on an online platform and in stores.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

In 2022, Miele Launches new smart home products designed to boost health and efficiency. Such as devices that monitor air quality in the home, but also alert blood pressure or other vitals are off-kilter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands DIY Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands DIY Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands DIY Home Improvement Market?

To stay informed about further developments, trends, and reports in the Netherlands DIY Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence