Key Insights

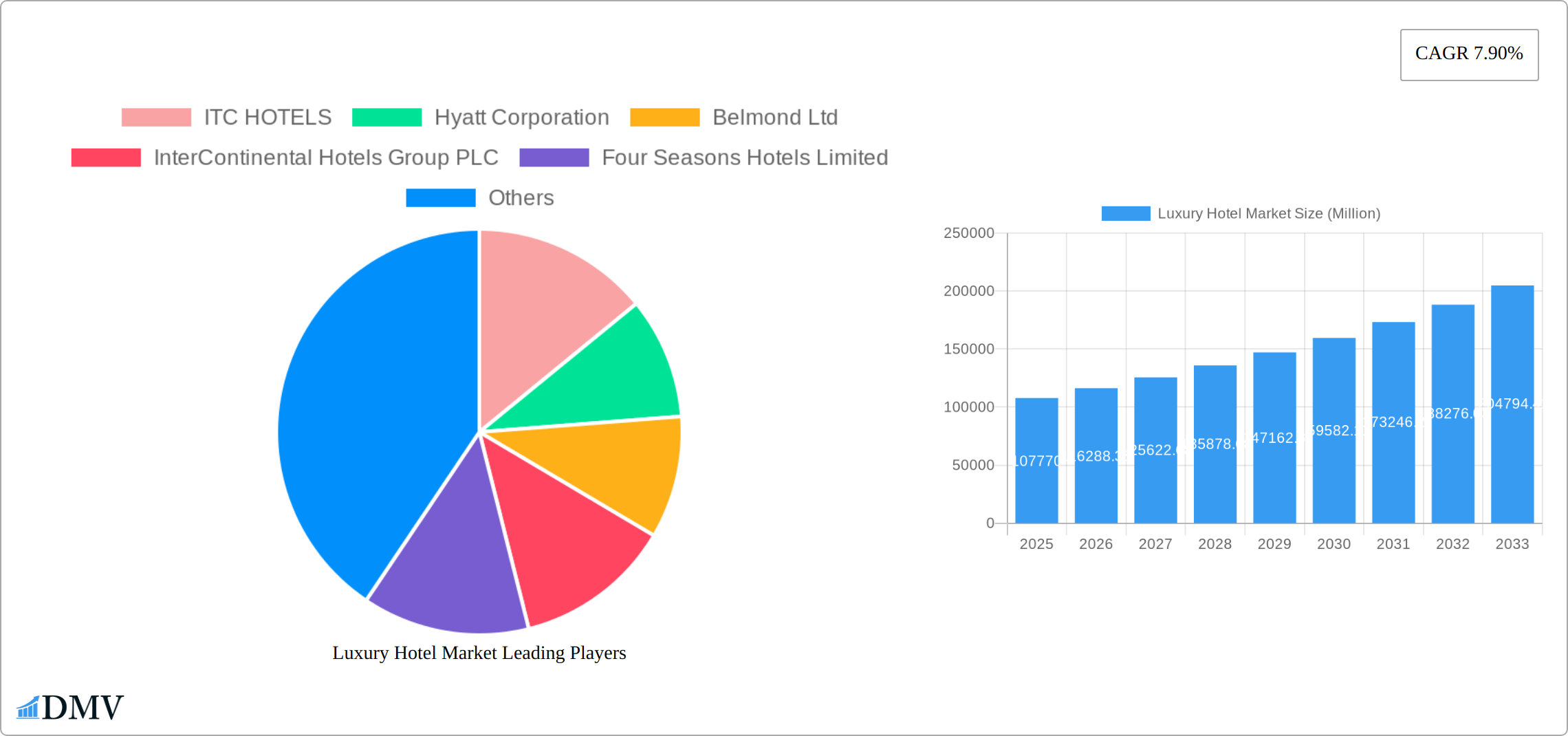

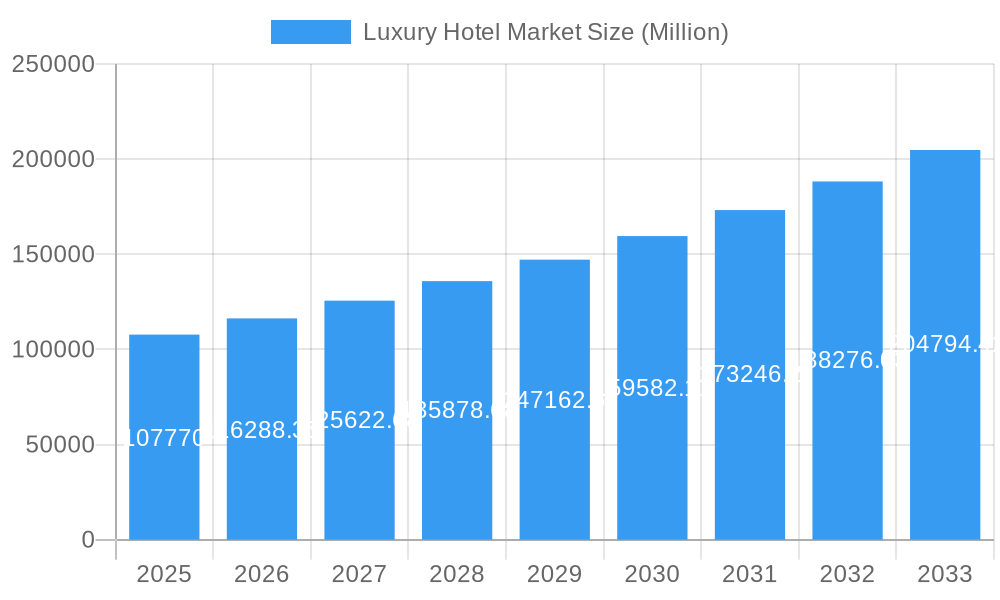

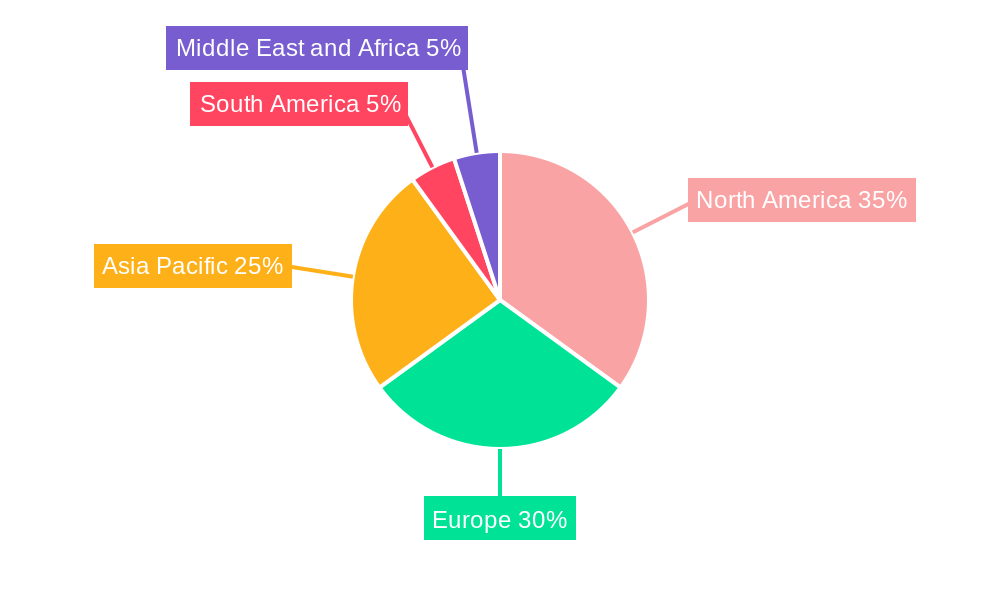

The global luxury hotel market, valued at $107.77 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.90% from 2025 to 2033. This expansion is fueled by several key factors. Rising high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) globally are increasingly seeking exclusive and personalized travel experiences, boosting demand for luxury accommodations. Furthermore, the burgeoning experiential travel trend, where travelers prioritize unique and memorable experiences over mere sightseeing, is significantly impacting the market. Luxury hotels are catering to this trend by offering bespoke services, curated itineraries, and immersive cultural experiences. The segment's growth is also driven by technological advancements, such as sophisticated booking platforms and personalized in-room technology, enhancing guest convenience and satisfaction. Regional variations exist, with North America and Europe currently holding substantial market shares, but the Asia-Pacific region is anticipated to witness significant growth due to the rising disposable incomes and expanding middle class in key markets like China and India.

Luxury Hotel Market Market Size (In Billion)

However, the luxury hotel market faces certain challenges. Economic fluctuations and geopolitical uncertainties can impact travel patterns and spending habits of high-end travelers. Increased competition from boutique hotels and independent luxury properties requires established brands to continually innovate and differentiate their offerings. Sustainability concerns are also playing a larger role; consumers are increasingly seeking environmentally responsible accommodations, pushing luxury hotels to adopt eco-friendly practices to maintain their appeal and brand image. The ongoing focus on personalized service and unique experiences will be crucial for luxury hotel chains to maintain their competitive edge and continue to attract discerning clientele in the coming years. The market segmentation by service type (Business Hotels, Airport Hotels, Suite Hotels, Resorts, Other Service Types) indicates diverse opportunities and strategic focus areas for market players. The mentioned companies, including established players like Marriott International and emerging brands, are actively shaping the competitive landscape through strategic expansions, mergers, and acquisitions, as well as innovative service offerings.

Luxury Hotel Market Company Market Share

Luxury Hotel Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global luxury hotel market, encompassing market size, trends, competitive landscape, and future projections from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study is invaluable for investors, industry stakeholders, and strategic decision-makers seeking to navigate this dynamic sector. The report leverages extensive primary and secondary research to deliver a comprehensive understanding of the luxury hospitality landscape, offering actionable insights for informed business strategies. The global luxury hotel market is projected to reach xx Million by 2033, showcasing substantial growth potential.

Luxury Hotel Market Composition & Trends

This section dissects the intricate composition of the luxury hotel market, examining market concentration, innovation drivers, regulatory frameworks, substitute offerings, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze the market share distribution among key players, including ITC HOTELS, Hyatt Corporation, Belmond Ltd, InterContinental Hotels Group PLC, Four Seasons Hotels Limited, Rosewood Hotels & Resorts, Shangri-La International Hotel Management Ltd, Marriott International Inc, Ritz-Carlton Hotel Company LLC, and Accor SA, to understand market dominance and competitive dynamics. M&A deal values are assessed to determine the influence of consolidation on market structure. The report also delves into the impact of evolving consumer preferences, technological advancements, and regulatory changes on the market's trajectory.

- Market Concentration: The luxury hotel market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report quantifies this concentration using metrics such as the Herfindahl-Hirschman Index (HHI).

- Innovation Catalysts: Technological advancements such as AI-powered personalization, sustainable practices, and innovative guest experiences are driving market innovation.

- Regulatory Landscape: Local and international regulations concerning hospitality operations, environmental standards, and data privacy significantly shape market dynamics. The report analyzes the influence of these regulations across key regions.

- Substitute Products: The emergence of alternative accommodation options, such as high-end vacation rentals, presents a competitive challenge to traditional luxury hotels. The report evaluates the impact of these substitutes on market growth.

- End-User Profiles: The report profiles the typical luxury hotel guest, analyzing their demographics, travel patterns, and spending habits to identify key market segments.

- M&A Activities: The luxury hotel market witnesses significant M&A activity, with deal values exceeding xx Million in recent years. The report analyzes notable mergers and acquisitions, assessing their impact on market consolidation and competitive dynamics. Examples include the Accor/Ennismore merger and the Hamilton Hotel Partners/Pyramid Hotel Group merger.

Luxury Hotel Market Industry Evolution

This section analyzes the evolution of the luxury hotel industry, tracing its growth trajectory from 2019 to 2033. We examine technological advancements like personalized guest services using AI, the rise of sustainable luxury practices, and the increasing adoption of mobile booking platforms. The analysis explores how shifting consumer demands for unique experiences and personalized services are reshaping the industry's offerings. The report includes data points like Compound Annual Growth Rate (CAGR) for different segments and adoption rates of new technologies. We further delve into the impact of macroeconomic factors like economic cycles, global events, and tourism trends on market growth.

Leading Regions, Countries, or Segments in Luxury Hotel Market

This section identifies the key geographic regions and specific market segments driving growth within the luxury hotel sector. A detailed analysis will illuminate the dominant segment among Business Hotels, Airport Hotels, Suite Hotels, Resorts, and other specialized service types. The report will delve into the contributing factors behind this segment's success, including investment trends, governmental policies, and other key market drivers. We will examine the interplay of economic forces, consumer preferences, and infrastructural developments that shape this dynamic landscape.

- Key Drivers for the Dominant Segment:

- Exceptional levels of tourist arrivals and high-value business travel.

- Proactive government support and incentives fostering tourism sector growth.

- Substantial investments in luxury-focused infrastructure and hotel development projects.

- A supportive regulatory environment promoting innovation and sustainable expansion.

- Strategic partnerships and collaborations within the tourism ecosystem.

- In-depth Analysis: The report provides a comprehensive examination of market dynamics. This includes granular analysis of consumer demand, infrastructure development, government policies, and competitive landscapes. Specific regional data on key performance indicators such as occupancy rates, Average Daily Rates (ADR), and Revenue Per Available Room (RevPAR) will be provided, offering a precise picture of market performance and potential.

Luxury Hotel Market Product Innovations

The luxury hotel sector is constantly innovating to provide unparalleled guest experiences. This section details the latest product innovations, outlining their applications and performance metrics. We focus on unique selling propositions, such as personalized in-room technology, bespoke concierge services, and sustainable initiatives, and the technological advancements behind these innovations. These include the integration of AI, virtual reality experiences, and smart room technologies to enhance guest comfort and satisfaction.

Propelling Factors for Luxury Hotel Market Growth

The expansion of the luxury hotel market is fueled by a confluence of factors. Technological advancements, such as AI-powered personalization, mobile booking platforms, and seamless digital guest experiences, are transforming the customer journey. Simultaneously, economic factors, including rising disposable incomes in emerging markets and a global surge in demand for luxury travel experiences, are driving growth. Favorable regulatory environments that support investment and responsible innovation also contribute significantly. The increasing focus on experiential travel and bespoke services further solidifies the sector's growth trajectory.

Obstacles in the Luxury Hotel Market

Despite its potential, the luxury hotel market faces several challenges. Strict regulations related to environmental sustainability, labor laws, and building codes can increase operational costs. Supply chain disruptions, particularly those impacting luxury goods and materials, can impact profitability. Intense competition from established players and emerging alternative accommodations, such as high-end vacation rentals, puts pressure on pricing and occupancy.

Future Opportunities in Luxury Hotel Market

Unprecedented growth opportunities exist in emerging markets across Asia, Africa, and other developing regions. Technological innovations, including immersive virtual reality experiences and hyper-personalized AI-powered services, promise to redefine the very essence of luxury hospitality. A growing emphasis on sustainable practices, wellness tourism, and unique, culturally-immersive experiences will open new avenues for differentiation and innovation. These combined factors suggest substantial potential for expansion and continued growth within the luxury hotel sector.

Major Players in the Luxury Hotel Market Ecosystem

- ITC HOTELS

- Hyatt Corporation

- Belmond Ltd

- InterContinental Hotels Group PLC

- Four Seasons Hotels Limited

- Rosewood Hotels & Resorts

- Shangri-La International Hotel Management Ltd

- Marriott International Inc

- Ritz-Carlton Hotel Company LLC

- Accor SA

Key Developments in Luxury Hotel Market Industry

- November 2020: Accor and Ennismore announced a merger to create a leading lifestyle hospitality operator. This merger significantly impacted market dynamics by creating a larger entity with a broader portfolio of brands.

- February 2020: Hamilton Hotel Partners and Pyramid Hotel Group merged, increasing the combined entity’s asset management portfolio to 141 hotels and 32,000 rooms across eight countries. This consolidation impacted the competitive landscape.

Strategic Luxury Hotel Market Forecast

The luxury hotel market is poised for continued growth, driven by increasing disposable incomes, technological advancements, and a growing preference for luxury travel experiences. The market will see a rise in demand for personalized and sustainable luxury offerings. Emerging markets and innovative technologies will further shape the sector's growth trajectory over the forecast period. Continued consolidation through mergers and acquisitions is also expected.

Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Suite Hotels

- 1.4. Resorts

- 1.5. Other Service Types

Luxury Hotel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Luxury Hotel Market Regional Market Share

Geographic Coverage of Luxury Hotel Market

Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Increasing Digitization of Services and Online Booking on Apps and Websites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Suite Hotels

- 5.1.4. Resorts

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Suite Hotels

- 6.1.4. Resorts

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Suite Hotels

- 7.1.4. Resorts

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Suite Hotels

- 8.1.4. Resorts

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. South America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Suite Hotels

- 9.1.4. Resorts

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Suite Hotels

- 10.1.4. Resorts

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ITC HOTELS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Belmond Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InterContinental Hotels Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Four Seasons Hotels Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rosewood Hotels & Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shangri-La International Hotel Management Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marriott International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ritz-Carlton Hotel Company LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ITC HOTELS

List of Figures

- Figure 1: Global Luxury Hotel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: South America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Middle East and Africa Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 19: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 27: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Market?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the Luxury Hotel Market?

Key companies in the market include ITC HOTELS, Hyatt Corporation, Belmond Ltd, InterContinental Hotels Group PLC, Four Seasons Hotels Limited, Rosewood Hotels & Resorts, Shangri-La International Hotel Management Ltd*List Not Exhaustive, Marriott International Inc, Ritz-Carlton Hotel Company LLC, Accor SA.

3. What are the main segments of the Luxury Hotel Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Digitization of Services and Online Booking on Apps and Websites.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In November 2020, Paris-based hotel company Accor and London-based hospitality firm Ennismore entered exclusive negotiations to form what they are claiming will be the world's leading lifestyle operator in the hospitality sector. Through this all-share merger, a new autonomous asset-light entity will combine the Hoxton, Gleneagles, Delano, SLS, Mondrian, SO/, Hyde, Mama Shelter, 25h, 21c Museum Hotels, Tribe, Jo&Joe, and Working From brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence