Key Insights

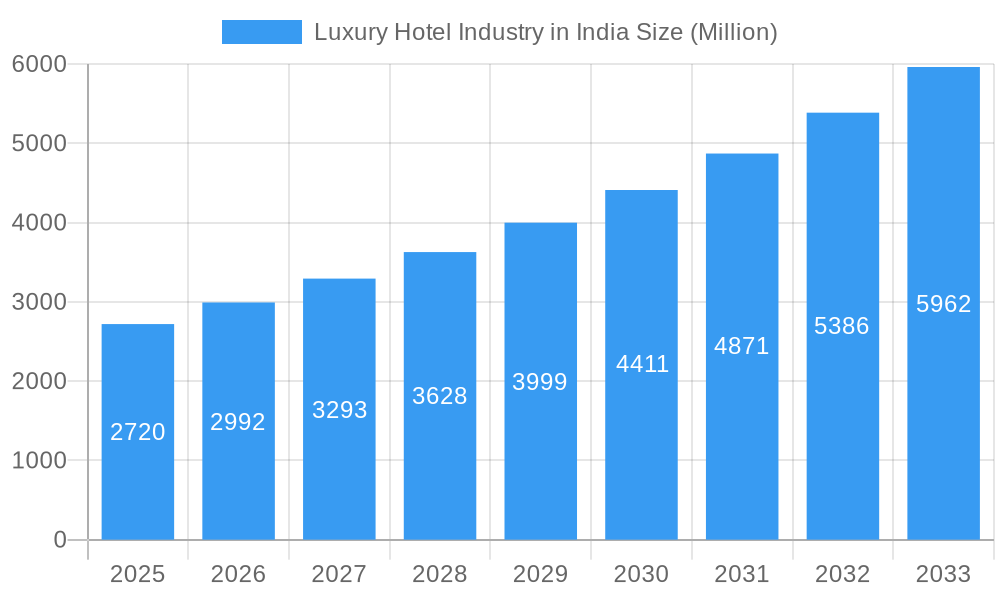

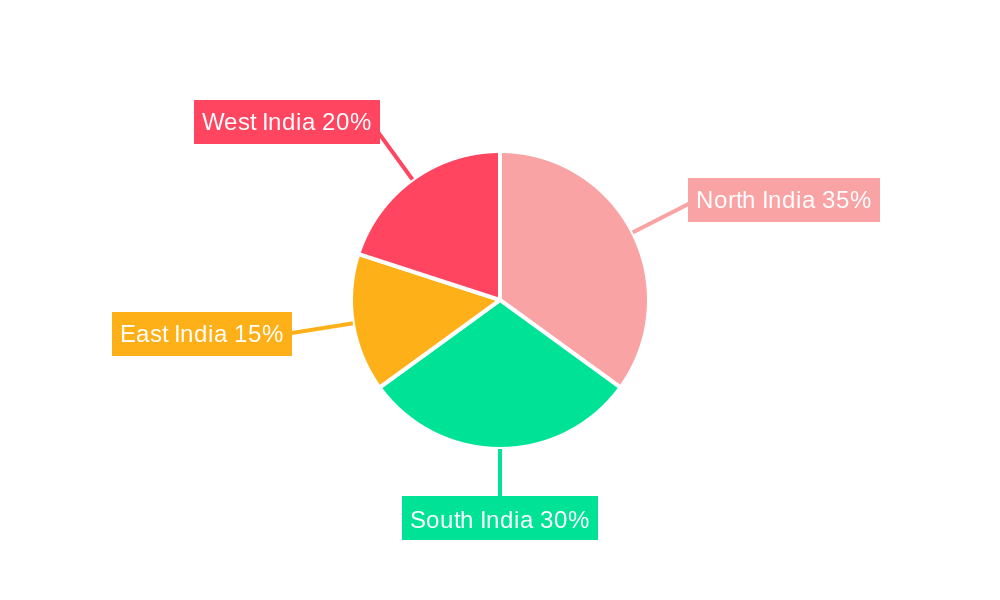

The Indian luxury hotel market, valued at approximately $2.72 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.06% from 2025 to 2033. This expansion is driven by several factors. A burgeoning affluent Indian population with increased disposable income is fueling demand for high-end travel and accommodation. Furthermore, India's growing prominence as a global tourist destination, particularly for experiential luxury travel, is significantly contributing to market growth. The increasing preference for unique and personalized experiences, including wellness retreats, heritage stays, and bespoke services, is reshaping the luxury hotel landscape. Strategic investments by both domestic and international hotel chains in upscale properties, coupled with infrastructural developments in key tourist hubs, are further accelerating market expansion. Competition amongst established players like The Oberoi Hotels, ITC Hotels, and Taj Hotels, alongside the emergence of boutique luxury brands, is driving innovation and enhancing the overall guest experience. The market segmentation reveals strong demand across various property types, including business hotels catering to corporate travelers, resort and spa hotels attracting leisure tourists, and airport hotels catering to the convenience-seeking traveler. Regional variations exist, with North and South India potentially exhibiting higher growth due to existing infrastructure and tourism attractiveness.

Luxury Hotel Industry in India Market Size (In Billion)

While the market presents substantial opportunities, challenges remain. Maintaining consistent service quality and addressing potential fluctuations in tourism due to global economic conditions are key considerations. Ensuring the sustainability of luxury operations while adhering to environmental and social responsibility standards is also becoming increasingly vital for long-term success. The rising cost of labor and operating expenses may pose a challenge to profitability, prompting the need for innovative cost management strategies. Competition from the burgeoning experiential tourism sector that extends beyond traditional hotels also necessitates adaptability and innovation. Future growth will depend on the ability of luxury hotel operators to anticipate and respond to evolving consumer preferences, while continuing to deliver superior service and value to maintain competitiveness in this dynamic market.

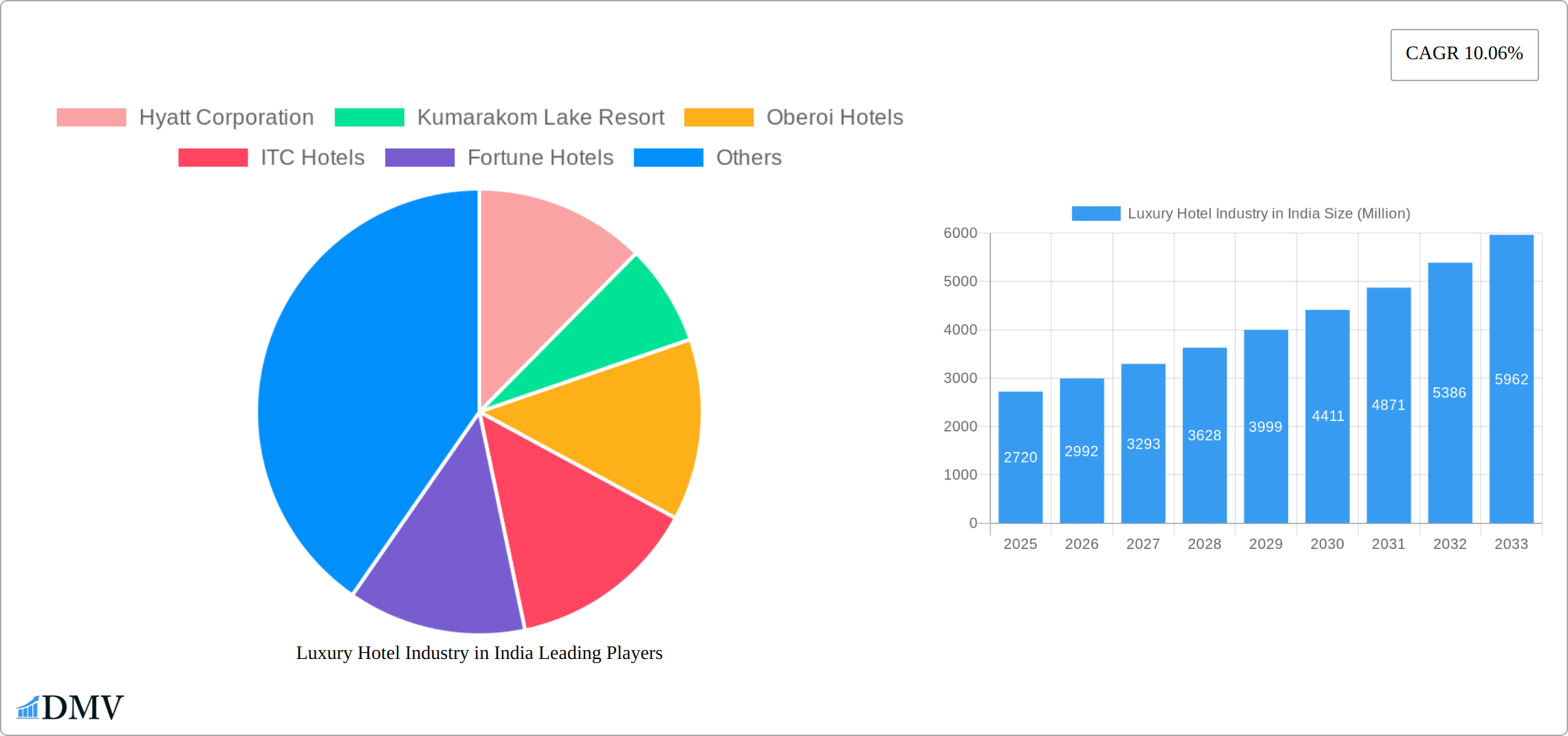

Luxury Hotel Industry in India Company Market Share

Luxury Hotel Industry in India Market Composition & Trends

The luxury hotel industry in India is characterized by a dynamic market composition, driven by a blend of established giants and emerging players. Market concentration is moderate, with key players such as Hyatt Corporation, ITC Hotels, and The Indian Hotels Company Limited holding significant shares. The market share distribution reflects a competitive landscape where ITC Hotels holds approximately 15%, followed by Taj Hotels with 12%, and others sharing the remaining market.

- Innovation Catalysts: Technological advancements in guest experience management and sustainability initiatives are pivotal. The integration of IoT and AI for personalized services is on the rise, enhancing guest satisfaction and operational efficiency.

- Regulatory Landscapes: Government policies promoting tourism and infrastructure development have been conducive. However, stringent environmental regulations necessitate sustainable practices, impacting operational costs.

- Substitute Products: Alternative accommodations like boutique hotels and luxury homestays are gaining traction, offering unique experiences and challenging traditional luxury hotels.

- End-User Profiles: The primary demographic includes business travelers and affluent tourists, with a growing segment of millennials seeking experiential luxury.

- M&A Activities: Recent mergers and acquisitions have been valued at around 500 Million, aimed at expanding portfolios and enhancing market presence. Notable deals include the acquisition of smaller boutique hotels by larger chains.

The market is witnessing a shift towards luxury resorts and spas, driven by the demand for wellness and leisure. This trend is expected to continue, reshaping the market dynamics.

Luxury Hotel Industry in India Industry Evolution

The evolution of the luxury hotel industry in India over the study period from 2019 to 2033 has been marked by significant growth and transformation. The base year of 2025 saw a resurgence in the industry post the global health crisis, with an estimated market size of 5 Billion. The forecast period from 2025 to 2033 anticipates a compound annual growth rate (CAGR) of approximately 7%, propelled by increased domestic and international tourism.

Technological advancements have played a crucial role in this evolution. The adoption of digital solutions, such as mobile check-ins and AI-driven concierge services, has improved guest experiences and operational efficiency. For instance, the implementation of smart room technologies has seen an adoption rate increase by 20% annually since 2021.

Consumer demands have shifted towards personalized and sustainable experiences. Luxury travelers now prioritize eco-friendly accommodations, leading to a surge in green certifications among hotels. This shift is evident in the growth of eco-luxury resorts, which have seen a 15% increase in bookings since 2022.

The industry has also seen a rise in luxury business hotels, catering to the needs of corporate travelers with state-of-the-art facilities and services. The demand for such hotels has grown by 10% per year, driven by India's burgeoning business landscape.

Overall, the luxury hotel industry in India is on a trajectory of sustained growth, fueled by technological innovation, changing consumer preferences, and robust economic development.

Leading Regions, Countries, or Segments in Luxury Hotel Industry in India

India's luxury hotel sector is significantly shaped by the burgeoning Resorts & Spa segment, experiencing a dramatic rise due to the escalating demand for wellness and leisure travel. This segment's dominance stems from several key factors:

- Strategic Investments: Substantial capital injections into luxury resorts, particularly in Kerala and Rajasthan, have fueled remarkable growth. For example, investments exceeding ₹1 billion (approximately $120 million USD) have been poured into Kerala's backwaters over the past five years, demonstrating a significant commitment to luxury hospitality infrastructure.

- Supportive Regulatory Framework: Government initiatives such as the "Incredible India" campaign have created a favorable environment for luxury resort development, streamlining processes and attracting further investment.

- Evolving Consumer Preferences: A noticeable shift towards experiential travel, prioritizing wellness and relaxation, has directly fueled demand for high-end spa resorts. This includes a growing preference for unique, culturally immersive experiences.

A deeper analysis reveals that the Resorts & Spa segment's success lies in its ability to cater to a broad demographic, attracting honeymooners, families seeking relaxation, and discerning solo travelers. This segment's sustainable practices and integration of authentic cultural experiences further enhance its appeal, particularly to eco-conscious travelers.

While Resorts & Spas dominate, other segments like Business Hotels demonstrate robust growth, especially in metropolitan areas such as Mumbai and Delhi. The escalating volume of corporate travel and the need for premium facilities to host international conferences and events have driven this demand.

Airport Hotels exhibit steady, albeit slower, growth, largely influenced by the increase in international flights and the need for convenient luxury accommodations near major hubs. Their Compound Annual Growth Rate (CAGR) over the projected period remains comparatively lower than that of Resorts & Spas, estimated at approximately 5%.

Specialized segments, including Suite Hotels and other niche offerings, cater to the specific requirements of long-stay guests and unique traveler preferences. Although smaller in scale, these segments contribute to the overall diversity and appeal of India's luxury hotel market.

Luxury Hotel Industry in India Product Innovations

Product innovations in the luxury hotel industry in India are centered around enhancing guest experiences and operational efficiency. Notable advancements include the integration of smart room technologies, allowing guests to control room settings via mobile devices. This innovation has improved guest satisfaction by 30% since its introduction. Additionally, the adoption of AI-driven concierge services has personalized guest interactions, offering tailored recommendations for dining and local attractions. These technological advancements, combined with eco-friendly initiatives like solar power integration, underscore the industry's commitment to sustainability and luxury.

Propelling Factors for Luxury Hotel Industry in India Growth

Several key drivers are propelling the expansion of India's luxury hotel industry:

- Technological Integration: The adoption of AI and IoT technologies has significantly enhanced guest experiences and operational efficiency. The widespread implementation of smart room technologies is a prime example of this transformative trend.

- Economic Expansion: Rising disposable incomes and a burgeoning middle class have directly translated into increased demand for luxury travel experiences, fueling the sector's growth.

- Government Initiatives: Continued government support through initiatives like "Incredible India" continues to boost tourism and encourage further investment in luxury accommodations.

These factors collectively contribute to the industry's strong and sustained growth.

Obstacles in the Luxury Hotel Industry in India Market

Despite its potential, the Indian luxury hotel industry confronts several challenges:

- Regulatory Hurdles: Stringent environmental regulations, while crucial, increase operational costs and potentially impact profitability. Careful navigation of these regulations is essential for sustained success.

- Supply Chain Volatility: Fluctuations in global supply chains can disrupt the availability of luxury amenities and services, necessitating robust contingency planning.

- Intensifying Competition: The emergence of alternative accommodations such as boutique hotels and luxury homestays presents a considerable competitive threat, estimated to reduce traditional luxury hotel bookings by approximately 10%. This necessitates innovative strategies to maintain market share.

Addressing these obstacles requires strategic planning, operational innovation, and a keen understanding of evolving market dynamics.

Future Opportunities in Luxury Hotel Industry in India

Emerging opportunities in the luxury hotel industry in India include:

- New Markets: Untapped regions like Northeast India offer potential for luxury resort development.

- Technological Integration: Further adoption of AI and VR for virtual tours and personalized experiences.

- Consumer Trends: Growing interest in eco-luxury and wellness travel, presenting opportunities for specialized offerings.

These opportunities underscore the industry's potential for growth and innovation.

Major Players in the Luxury Hotel Industry in India Ecosystem

- Hyatt Corporation

- Kumarakom Lake Resort

- Oberoi Hotels

- ITC Hotels

- Fortune Hotels

- Rambagh Palace

- The Indian Hotels Company Limited

- Radisson Hotels

- Shangri La Hotels and Resorts

- The Park Hotels

- Marriott International Inc

- The Leela

Key Developments in Luxury Hotel Industry in India Industry

- September 2022: ITC Hotels announced plans to launch over 20 new properties within the next two years, signaling a significant expansion strategy aimed at capturing diverse market segments.

- 2021: The Taj Group implemented a "zero-touch" guest experience, utilizing a touchless interface to enhance guest safety and comfort. This initiative, known as IHCL's Zero-Touch Service Transformation, rolled out digital solutions across its Taj, Vivanta, and other hotel brands.

These developments highlight the industry's commitment to innovation and customer-centricity, shaping the competitive landscape and influencing future growth.

Strategic Luxury Hotel Industry in India Market Forecast

The strategic outlook for India's luxury hotel industry from 2025 to 2033 paints a positive picture, fueled by various growth catalysts. Technological advancements, particularly AI and IoT integration, are poised to further enhance guest experiences and streamline operations. The continuing rise in disposable incomes and the expanding middle class will sustain demand for luxury travel. Government support for tourism and sustainable development will create a favorable environment for sustained growth. Furthermore, untapped regional markets and the integration of eco-luxury and wellness trends present significant opportunities for market expansion. A projected CAGR of approximately 7% reflects the industry's robust growth trajectory and considerable market potential.

Luxury Hotel Industry in India Segmentation

-

1. Product Type

- 1.1. Business Hotel

- 1.2. Suit Hotels

- 1.3. Airport Hotel

- 1.4. Resorts & Spa

- 1.5. Others

Luxury Hotel Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Hotel Industry in India Regional Market Share

Geographic Coverage of Luxury Hotel Industry in India

Luxury Hotel Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Expenses by Domestic Travelers is fueling Luxurious Hotel Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Business Hotel

- 5.1.2. Suit Hotels

- 5.1.3. Airport Hotel

- 5.1.4. Resorts & Spa

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Business Hotel

- 6.1.2. Suit Hotels

- 6.1.3. Airport Hotel

- 6.1.4. Resorts & Spa

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Business Hotel

- 7.1.2. Suit Hotels

- 7.1.3. Airport Hotel

- 7.1.4. Resorts & Spa

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Business Hotel

- 8.1.2. Suit Hotels

- 8.1.3. Airport Hotel

- 8.1.4. Resorts & Spa

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Business Hotel

- 9.1.2. Suit Hotels

- 9.1.3. Airport Hotel

- 9.1.4. Resorts & Spa

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Business Hotel

- 10.1.2. Suit Hotels

- 10.1.3. Airport Hotel

- 10.1.4. Resorts & Spa

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hyatt Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kumarakom Lake Resort

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oberoi Hotels

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITC Hotels

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fortune Hotels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rambagh Palace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Indian Hotels Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Radisson Hotels*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shangri La Hotels and Resorts

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Park Hotels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Marriott International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Leela

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hyatt Corporation

List of Figures

- Figure 1: Global Luxury Hotel Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 7: South America Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: South America Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Middle East & Africa Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Middle East & Africa Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Luxury Hotel Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Industry in India?

The projected CAGR is approximately 10.06%.

2. Which companies are prominent players in the Luxury Hotel Industry in India?

Key companies in the market include Hyatt Corporation, Kumarakom Lake Resort, Oberoi Hotels, ITC Hotels, Fortune Hotels, Rambagh Palace, The Indian Hotels Company Limited, Radisson Hotels*List Not Exhaustive, Shangri La Hotels and Resorts, The Park Hotels, Marriott International Inc, The Leela.

3. What are the main segments of the Luxury Hotel Industry in India?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Expenses by Domestic Travelers is fueling Luxurious Hotel Industry.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2022: ITC Hotel plans to launch more than 20 properties in the next two years. This will help the hotel to grow its market share and to capture various demographic segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Industry in India?

To stay informed about further developments, trends, and reports in the Luxury Hotel Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence