Key Insights

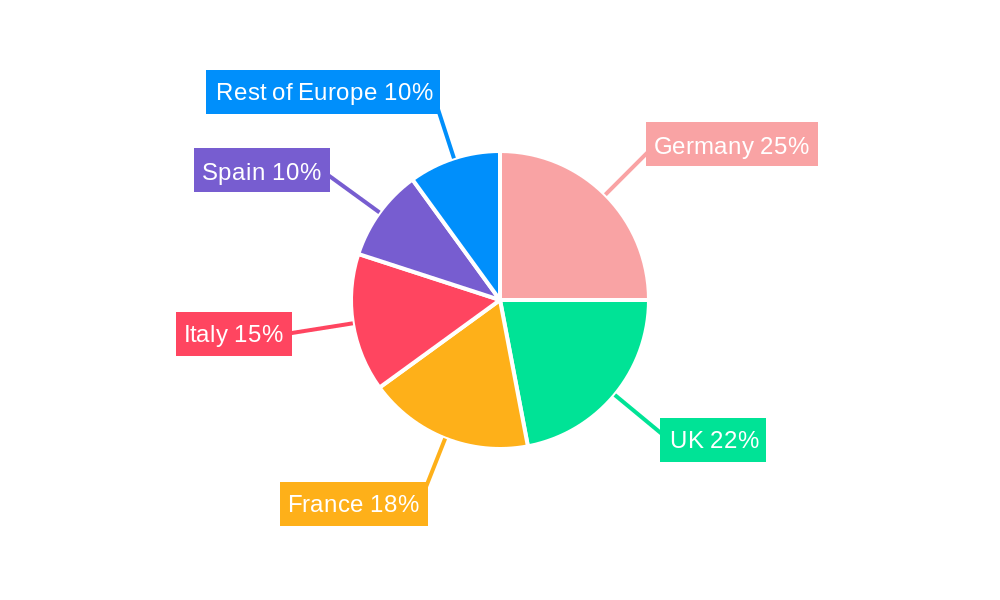

The European travel accommodation market, valued at $7.32 billion in 2025, is projected to grow at a CAGR of 15.29% through 2033. This robust expansion is driven by increasing disposable incomes, a rising preference for experiential and unique accommodations, and the convenience offered by online travel agencies (OTAs) and mobile booking platforms. Growing traveler demand for sustainable and eco-friendly options is also influencing market trends. The market offers a diverse range of options, from budget hostels to luxury resorts and vacation rentals, catering to varied traveler needs. Key national markets include Germany, the UK, France, and Italy, with significant contributions from Spain and the Netherlands.

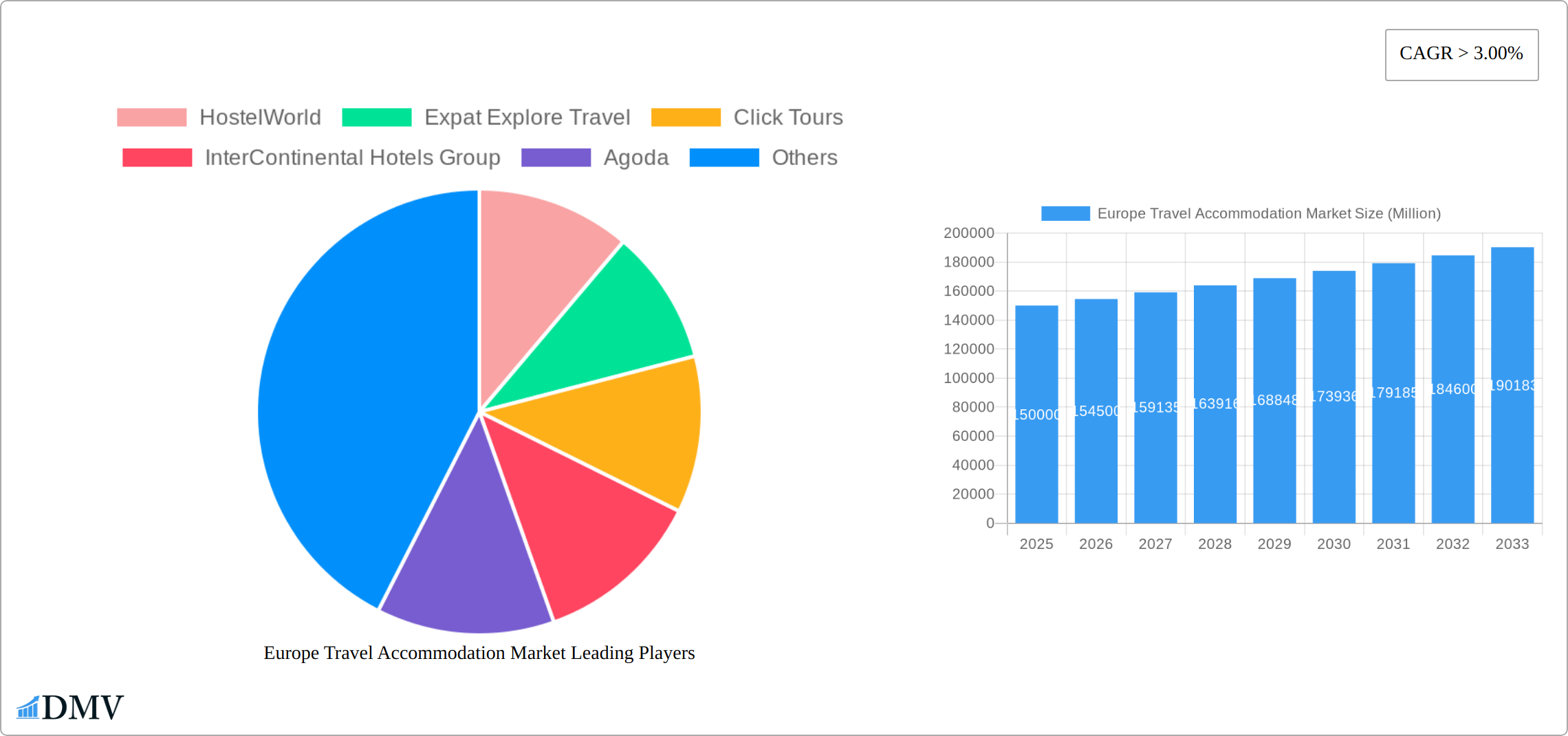

Europe Travel Accommodation Market Market Size (In Billion)

Despite growth, the market faces challenges including economic uncertainties, currency fluctuations, and seasonal tourism variations. Intense competition necessitates continuous innovation, strategic partnerships, and a focus on customer experience. The preference for online booking via OTAs and mobile apps underscores the critical need for a strong digital presence. The increasing demand for sustainable travel and unique experiences will continue to shape accommodation providers' strategies.

Europe Travel Accommodation Market Company Market Share

Europe Travel Accommodation Market: Analysis & Forecast (2025-2033)

This comprehensive report analyzes the current landscape and future trajectory of the Europe travel accommodation market from 2025 to 2033, with 2025 serving as the base year. The study provides granular insights through segmentation by booking mode, country, accommodation type, and platform. The market size in 2025 is estimated at $7.32 billion.

Europe Travel Accommodation Market Composition & Trends

This section delves into the competitive landscape of the European travel accommodation market, examining market concentration, innovation drivers, regulatory frameworks, substitute offerings, end-user behavior, and merger & acquisition (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller niche players, resulting in a moderately concentrated market. Online Travel Agencies (OTAs) like Booking.com and Expedia hold significant market share, while independent hotels and vacation rentals represent a substantial portion of the market.

- Market Share Distribution (2025): Booking.com (xx%), Expedia Group (xx%), Airbnb (xx%), Hotel chains (xx%), Independent Hotels (xx%), Others (xx%).

- Innovation Catalysts: Technological advancements in booking platforms, personalized travel experiences, and sustainable tourism practices are driving market innovation.

- Regulatory Landscape: Regulations related to data privacy, consumer protection, and taxation significantly impact market operations.

- Substitute Products: Alternative accommodation options like homestays and camping pose competitive challenges.

- End-User Profiles: The market caters to a diverse range of travelers, including leisure, business, and group tourists.

- M&A Activities (2019-2024): The historical period witnessed xx M&A deals with a total estimated value of xx Million, primarily focused on consolidation within the OTA and hotel sectors.

Europe Travel Accommodation Market Industry Evolution

The European travel accommodation market has undergone a dramatic transformation since 2019, shaped by technological advancements, evolving traveler preferences, and significant macroeconomic shifts. The period from 2019 to 2024 witnessed fluctuating growth, significantly impacted by unforeseen circumstances such as the COVID-19 pandemic. However, a robust recovery followed, fueled by pent-up demand and adaptable business strategies. Technological innovations, including mobile booking apps, AI-driven personalized recommendations, and immersive virtual reality tours, have significantly enhanced the customer experience, boosting convenience and satisfaction. The increasing emphasis on sustainable and experiential travel is reshaping the market landscape, with travelers actively seeking eco-friendly accommodations and authentic cultural immersions. Economic factors, such as disposable income levels and fluctuations in the Euro exchange rate, have also played a crucial role in market dynamics. Looking ahead to the forecast period (2025-2033), the market is projected to continue its growth trajectory, albeit at a more moderate pace, driven by the resurgence of international tourism and the ongoing adoption of innovative technologies. The Compound Annual Growth Rate (CAGR) for this forecast period is estimated at xx%.

Leading Regions, Countries, or Segments in Europe Travel Accommodation Market

The European travel accommodation market is geographically diverse, with several regions and countries exhibiting significant market dominance. The UK, Germany, France, and Italy are leading markets, driven by robust tourism sectors and strong domestic demand. Online Travel Agencies (OTAs) dominate the booking mode, leveraging their wide reach and user-friendly platforms. Hotels & Resorts remain the most popular accommodation type, although vacation rentals are witnessing significant growth.

Key Drivers:

- United Kingdom: Strong tourism infrastructure, high disposable incomes.

- Germany: Large domestic market, extensive hotel network.

- France: Popular tourist destination, diverse accommodation offerings.

- Italy: Rich cultural heritage, attractive for leisure travelers.

- Spain: Coastal tourism, strong appeal for international visitors.

- Third Party Online Portals/OTAs: Wide reach, convenience, competitive pricing.

- Hotels & Resorts: Established infrastructure, diverse offerings, reliable service.

Dominance Factors: Strong tourism infrastructure, high disposable incomes, established hotel networks, and the accessibility of online booking platforms have all contributed to the dominance of specific regions, countries, and segments within the market.

Europe Travel Accommodation Market Product Innovations

Recent innovations in the travel accommodation sector include AI-powered personalized recommendations, virtual reality tours for pre-trip planning, and the integration of smart home technologies into hotel rooms. These features enhance customer experience, providing greater convenience and personalization. Sustainable practices, such as the use of eco-friendly materials and energy-efficient technologies, are increasingly integrated into accommodation offerings, appealing to environmentally conscious travelers.

Propelling Factors for Europe Travel Accommodation Market Growth

Several key factors are driving the expansion of the European travel accommodation market. These include a rise in disposable incomes across many European nations, a corresponding increase in international tourist arrivals, and continuous technological advancements that streamline travel planning and booking processes. The growing popularity of experiential travel and sustainable tourism, emphasizing unique local experiences and environmentally responsible practices, is significantly boosting demand. Furthermore, government initiatives aimed at promoting tourism, including infrastructure development and marketing campaigns, are contributing to the market's overall growth.

Obstacles in the Europe Travel Accommodation Market Market

The European travel accommodation market faces challenges such as economic uncertainty, fluctuations in currency exchange rates, and potential disruptions to the travel industry from unforeseen events (e.g., pandemics). Increased competition, especially from alternative accommodation providers like vacation rentals, also impacts the market. Stringent regulations related to data privacy and environmental sustainability can add complexity for businesses. Supply chain disruptions can lead to increased operational costs.

Future Opportunities in Europe Travel Accommodation Market

Future opportunities lie in expanding into niche markets, such as sustainable tourism and luxury travel segments. Technological advancements, such as AI-powered personalized travel planning tools, present significant potential for growth. The rise of remote work and digital nomadism creates opportunities for extended-stay accommodation offerings. The development of innovative business models that leverage technology and adapt to changing consumer preferences will be crucial.

Major Players in the Europe Travel Accommodation Market Ecosystem

- HostelWorld - Budget-friendly accommodation leader

- Expat Explore Travel - Group tour specialist

- Click Tours - Online travel agency

- InterContinental Hotels Group (IHG) - Global hotel chain with diverse brands

- Agoda - Primarily focused on Asian markets but with significant European presence

- Booking.com - Dominant online travel agency (OTA)

- HRS - Corporate travel and hotel booking specialist

- Trafalgar - Guided vacation tours

- Travel Talk - Tour operator

- Topdeck - Adventure travel

- eDreams - Online travel agency

- G-Adventures - Adventure travel and small group tours

- Hotelbeds Group SL - Wholesale hotel bed bank

- Vrbo - Vacation rental platform

Key Developments in Europe Travel Accommodation Market Industry

- August 2023: IHG Hotels & Resorts partnered with RB Leipzig, enhancing brand visibility.

- May 2023: Hotelbeds witnessed increased demand for luxury travel, expanding partnerships accordingly.

Strategic Europe Travel Accommodation Market Forecast

The future of the European travel accommodation market looks promising, driven by continuous technological innovation, the growing preference for experiential travel, and the increasing popularity of sustainable tourism practices. The market is expected to experience steady growth over the forecast period, presenting significant opportunities for businesses to capitalize on emerging trends and cater to evolving consumer demands. The focus on personalization, sustainability, and technological integration will be crucial for success in this dynamic market.

Europe Travel Accommodation Market Segmentation

-

1. Type

- 1.1. Hotels & Resorts

- 1.2. Package Holidays

- 1.3. Vacation Rentals

- 1.4. Others

-

2. Platform

- 2.1. Mobile Application

- 2.2. Website

-

3. Mode Of Booking

- 3.1. Third Pa

- 3.2. Direct / Captive portals

Europe Travel Accommodation Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Travel Accommodation Market Regional Market Share

Geographic Coverage of Europe Travel Accommodation Market

Europe Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Luxury Hotels are booming the market

- 3.3. Market Restrains

- 3.3.1. Data Security

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration is Augmenting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hotels & Resorts

- 5.1.2. Package Holidays

- 5.1.3. Vacation Rentals

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Mobile Application

- 5.2.2. Website

- 5.3. Market Analysis, Insights and Forecast - by Mode Of Booking

- 5.3.1. Third Pa

- 5.3.2. Direct / Captive portals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HostelWorld

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expat Explore Travel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Click Tours

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InterContinental Hotels Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Booking com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HRS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trafalgar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Travel Talk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Topdeck**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 eDreams

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 G- Adventures

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hotelbeds Group SL

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Vrbo

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 HostelWorld

List of Figures

- Figure 1: Europe Travel Accommodation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Travel Accommodation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Europe Travel Accommodation Market Revenue billion Forecast, by Mode Of Booking 2020 & 2033

- Table 4: Europe Travel Accommodation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Travel Accommodation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Europe Travel Accommodation Market Revenue billion Forecast, by Mode Of Booking 2020 & 2033

- Table 8: Europe Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Travel Accommodation Market?

The projected CAGR is approximately 15.29%.

2. Which companies are prominent players in the Europe Travel Accommodation Market?

Key companies in the market include HostelWorld, Expat Explore Travel, Click Tours, InterContinental Hotels Group, Agoda, Booking com, HRS, Trafalgar, Travel Talk, Topdeck**List Not Exhaustive, eDreams, G- Adventures, Hotelbeds Group SL, Vrbo.

3. What are the main segments of the Europe Travel Accommodation Market?

The market segments include Type, Platform, Mode Of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Luxury Hotels are booming the market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration is Augmenting the Market.

7. Are there any restraints impacting market growth?

Data Security.

8. Can you provide examples of recent developments in the market?

In August 2023, IHG Hotels & Resorts continued to grow its roster of partnerships across the globe and announced a new partnership with leading German football club, RB Leipzig, to become the Official Partner for the club during the 2023 - 2024 season.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the Europe Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence