Key Insights

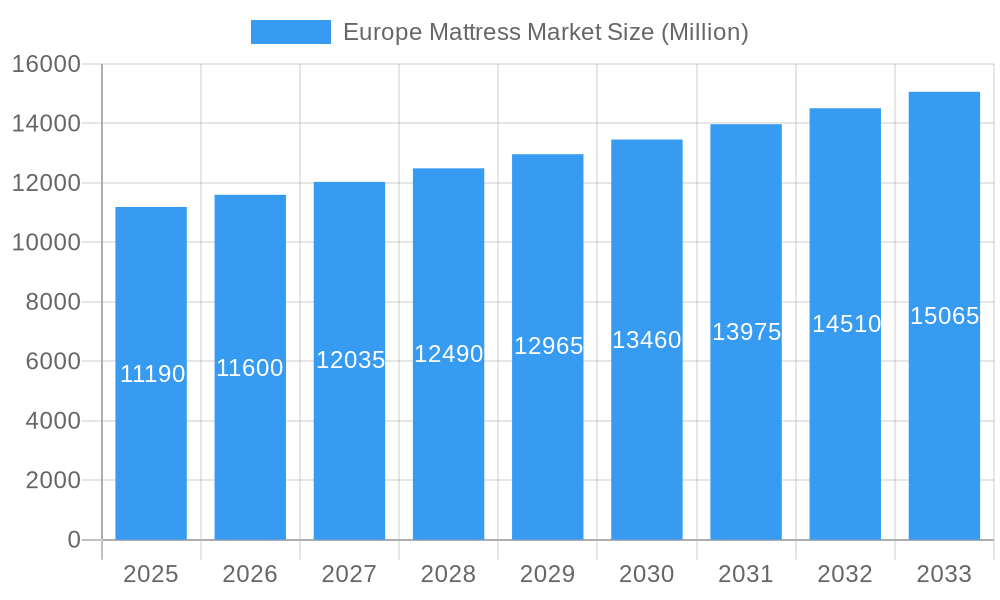

The European mattress market, valued at €11.19 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, rising disposable incomes across major European economies like Germany, France, and the UK are leading to increased consumer spending on premium comfort and sleep solutions. Secondly, a growing awareness of the importance of sleep health and its impact on overall well-being is boosting demand for high-quality mattresses. This trend is particularly pronounced amongst younger demographics, who are increasingly prioritizing their sleep quality. Furthermore, the proliferation of online retail channels has significantly enhanced accessibility and convenience, widening the market reach for both established and emerging mattress brands. The market segmentation reveals a diversified landscape, with Innerspring, Memory Foam, and Latex mattresses capturing significant shares, catering to different preferences and budgets. The residential sector remains the primary end-user, although the commercial segment, including hotels and hospitality, is also contributing to growth.

Europe Mattress Market Market Size (In Billion)

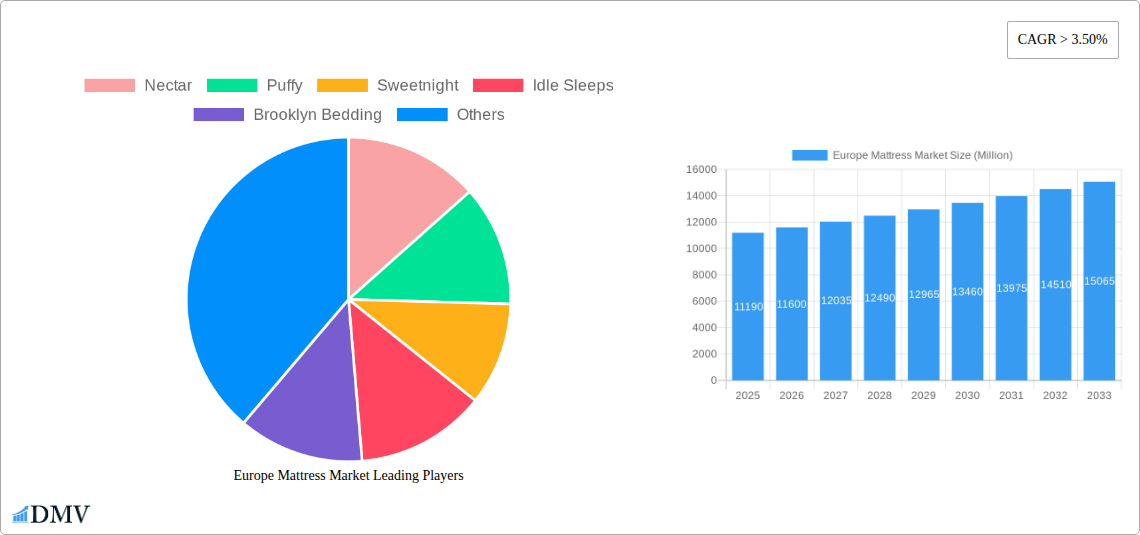

The competitive landscape is characterized by a mix of established international brands and agile local players. Key players like Nectar, Puffy, and Emma are leveraging innovative marketing strategies and product development to maintain market share. The market's expansion isn't uniform across all regions; Germany, France, and the UK are expected to remain the largest markets within Europe due to their larger populations and higher spending power. However, other countries like the Netherlands and Sweden show promising growth potential, reflecting increasing demand for better sleep solutions in these regions. While certain economic factors might pose minor restraints to market growth, the long-term outlook remains positive due to the underlying consumer trends and the continued innovation within the mattress industry. The increasing focus on sustainable and eco-friendly materials is also shaping the market, with latex and other sustainable options gaining traction among environmentally conscious consumers.

Europe Mattress Market Company Market Share

Europe Mattress Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe mattress market, encompassing market size, segmentation, leading players, and future growth projections. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for stakeholders seeking to understand the dynamics of this evolving market and capitalize on emerging opportunities.

Europe Mattress Market Composition & Trends

The European mattress market is characterized by a dynamic interplay of established players and emerging brands, resulting in a moderately concentrated market. Market share distribution shows a few dominant players holding approximately xx% of the market, with the remainder distributed among numerous smaller companies. Innovation is a key driver, with ongoing advancements in materials (e.g., adaptive foam, smart mattresses) and designs responding to consumer preferences for enhanced comfort, health benefits, and technological integration. Regulatory landscapes vary across European countries, impacting material standards and labeling requirements. Substitute products, such as air mattresses and waterbeds, occupy a niche segment, while the primary competition comes from within the mattress sector itself. End-user profiles reveal a significant emphasis on residential applications, although the commercial sector, including hotels and healthcare facilities, represents a notable and growing segment. Mergers and acquisitions (M&A) activity has been significant, with deal values totaling approximately xx Million in the past five years. Noteworthy examples include the restructuring of Hilding Anders International AB in June 2023, involving a USD 21.9 Million equity infusion.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Catalysts: Advancements in materials (adaptive foam, smart technology), design improvements.

- Regulatory Landscape: Variable across European countries, influencing material standards and labeling.

- Substitute Products: Limited impact from air mattresses and waterbeds.

- End-User Profiles: Primarily residential, with growing commercial applications.

- M&A Activity: Significant activity over the past five years, totaling xx Million USD in deal values.

Europe Mattress Market Industry Evolution

The Europe mattress market has experienced consistent growth over the past five years, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is driven by several key factors, including rising disposable incomes, increasing awareness of sleep hygiene, and a growing preference for higher-quality mattresses. Technological advancements, such as the introduction of smart mattresses with sleep-tracking capabilities and customizable firmness settings, have significantly influenced consumer choices. Changing consumer demands show a trend toward personalized comfort, sustainable materials, and better sleep support for improved health and wellness. The adoption of online sales channels has accelerated, transforming distribution and marketing strategies. Furthermore, the market is witnessing a shift towards specialized mattresses catering to specific needs, such as those designed for back pain relief, as seen with the launch of Saatva RX mattress in October 2023. This trend is projected to continue, shaping future market growth trajectories. The forecast period (2025-2033) anticipates a CAGR of xx%, indicating a continued expansion of the market.

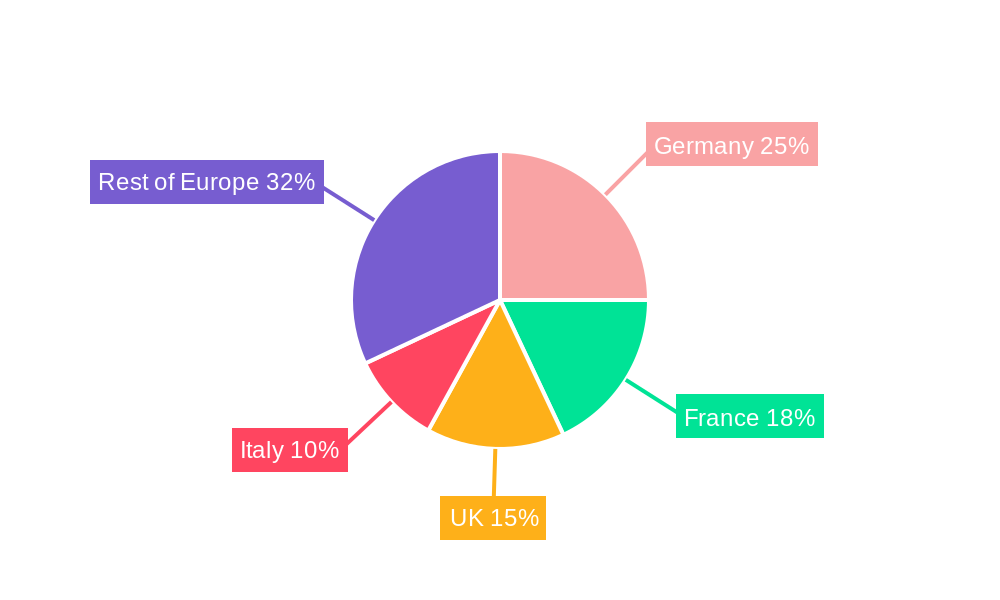

Leading Regions, Countries, or Segments in Europe Mattress Market

The leading segments and regions within the European mattress market demonstrate distinct characteristics influencing their dominance.

By Type:

- Memory Foam: Holds the largest market share due to its popularity for comfort and pressure relief. Growth is driven by ongoing material innovations and increased affordability.

- Innerspring: Remains a significant segment, particularly in the budget-conscious market. Innovations focus on enhanced coil systems and improved durability.

- Latex: A premium segment attracting environmentally conscious consumers. Market growth is driven by its natural properties and durability, though pricing remains a barrier.

- Others: This category includes adjustable beds and air mattresses, holding a smaller market share but experiencing niche growth.

By End-User:

- Residential: Dominates the market, fueled by increasing household incomes and awareness of sleep quality's impact on health.

- Commercial: Demonstrates steady growth, particularly in the hospitality sector. This segment is driven by the need for durable and comfortable mattresses in hotels and other commercial accommodations.

By Distribution Channel:

- Online: Experiencing rapid growth due to convenience, wider selection, and competitive pricing strategies.

- Offline: Remains important, particularly for consumers valuing hands-on experience and immediate purchase.

Dominance Factors:

- Germany and the UK: These countries have the largest market size due to their significant populations, higher disposable incomes, and robust retail infrastructure. Growth is further aided by favorable regulatory environments.

- Investment Trends: Increased private equity investment and venture capital funding fuels innovation and expansion.

- Regulatory Support: Government initiatives promoting healthy sleep and ergonomic standards indirectly bolster market expansion.

Europe Mattress Market Product Innovations

Recent innovations in the European mattress market are largely driven by enhanced comfort, health benefits, and technological integrations. Smart mattresses with sleep-tracking features and customizable firmness settings are gaining popularity. Materials science advancements have led to the development of more durable, breathable, and hypoallergenic foams. The emergence of mattresses designed to address specific medical needs (such as the Saatva RX mattress) demonstrates the market's increasing focus on health-oriented solutions. These developments are reflected in higher customer satisfaction and increased premium pricing.

Propelling Factors for Europe Mattress Market Growth

Several factors propel the growth of the European mattress market. Technological advancements lead to innovative products and improved features, driving demand. Economic growth increases disposable income, allowing consumers to invest in higher-quality mattresses. Favorable regulatory environments support the market's expansion, encouraging innovation and healthy competition. Furthermore, increased awareness of sleep's importance for overall health and wellbeing drives consumer demand for premium sleep solutions.

Obstacles in the Europe Mattress Market

Challenges facing the Europe mattress market include fluctuating raw material prices, potentially leading to increased production costs. Supply chain disruptions and logistical complexities can impact timely delivery and market penetration. Intense competition among established players and emerging brands creates pressure on pricing and profitability. Furthermore, varying regulatory standards across different European countries complicate market entry and expansion strategies.

Future Opportunities in Europe Mattress Market

Future opportunities reside in the growing demand for personalized sleep solutions, sustainable materials, and technologically advanced mattresses. Expansion into underserved markets within Europe presents significant potential. The development of innovative materials with improved comfort, durability, and health benefits will drive further growth. Targeting specific consumer segments with tailored marketing and product offerings will unlock further market potential.

Major Players in the Europe Mattress Market Ecosystem

- Nectar

- Puffy

- Sweetnight

- Idle Sleeps

- Brooklyn Bedding

- Emma

- Nolah

- Saatva

- Ghostbed

- Awara

- DreamCloud

Key Developments in Europe Mattress Market Industry

- October 2023: Saatva launched the Saatva RX mattress, targeting consumers with back and joint issues. This signifies a growing interest in health-focused mattress solutions.

- June 2023: KKR & Co. transferred ownership of Hilding Anders International AB to creditors after debt restructuring, highlighting the financial challenges in the industry and the potential for consolidation.

Strategic Europe Mattress Market Forecast

The Europe mattress market is poised for continued growth, driven by innovation, changing consumer preferences, and economic expansion. Future opportunities lie in the development and adoption of advanced technologies, personalization of sleep solutions, and a greater focus on sustainable and eco-friendly materials. The increasing awareness of the link between sleep quality and overall health will further stimulate market expansion and provide growth potential for innovative companies.

Europe Mattress Market Segmentation

-

1. Type

- 1.1. Innerspring

- 1.2. Memory Foam

- 1.3. Latex

- 1.4. Others

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Europe Mattress Market Segmentation By Geography

- 1. United Kingdom

- 2. Spain

- 3. Germany

- 4. Italy

- 5. France

- 6. Rest of the Europe

Europe Mattress Market Regional Market Share

Geographic Coverage of Europe Mattress Market

Europe Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market

- 3.4. Market Trends

- 3.4.1. Increasing Trend of Disposable Income in Europe is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring

- 5.1.2. Memory Foam

- 5.1.3. Latex

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Spain

- 5.4.3. Germany

- 5.4.4. Italy

- 5.4.5. France

- 5.4.6. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Innerspring

- 6.1.2. Memory Foam

- 6.1.3. Latex

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Spain Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Innerspring

- 7.1.2. Memory Foam

- 7.1.3. Latex

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Innerspring

- 8.1.2. Memory Foam

- 8.1.3. Latex

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Innerspring

- 9.1.2. Memory Foam

- 9.1.3. Latex

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. France Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Innerspring

- 10.1.2. Memory Foam

- 10.1.3. Latex

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of the Europe Europe Mattress Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Innerspring

- 11.1.2. Memory Foam

- 11.1.3. Latex

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online

- 11.3.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Nectar

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Puffy

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sweetnight

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Idle Sleeps

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Brooklyn Bedding

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Emma

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Nolah

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Saatva

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ghostbed

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Awara

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 DreamCloud

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Nectar

List of Figures

- Figure 1: Europe Mattress Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Mattress Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Mattress Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 21: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 36: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 45: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Europe Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Europe Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 51: Europe Mattress Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Europe Mattress Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 53: Europe Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Europe Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mattress Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Europe Mattress Market?

Key companies in the market include Nectar, Puffy, Sweetnight, Idle Sleeps, Brooklyn Bedding, Emma, Nolah, Saatva, Ghostbed, Awara, DreamCloud.

3. What are the main segments of the Europe Mattress Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Trend of Disposable Income in Europe is Driving the Market.

7. Are there any restraints impacting market growth?

Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market.

8. Can you provide examples of recent developments in the market?

In October 2023, The Saatva RX mattress was released as a luxury bed designed for sleepers with chronic back and joint issues such as sciatica and arthritis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mattress Market?

To stay informed about further developments, trends, and reports in the Europe Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence