Key Insights

The Asia-Pacific (APAC) luxury hotel market is poised for significant expansion, propelled by a growing affluent demographic, rising disposable incomes, and a heightened demand for experiential travel. The region's rich cultural tapestry, breathtaking natural beauty, and premier facilities attract discerning travelers globally. Key growth catalysts include the strategic entry of luxury brands into developing economies, the increasing consumer desire for bespoke services and distinctive experiences, and the escalating popularity of eco-conscious and sustainable travel. China, Japan, and other Southeast Asian economies are at the forefront, demonstrating substantial investment in new luxury hotel developments and property refurbishments. Despite potential headwinds from economic volatility and geopolitical shifts, the APAC luxury hotel sector anticipates a positive trajectory, underpinned by robust growth forecasts and sustained demand from both business and leisure segments.

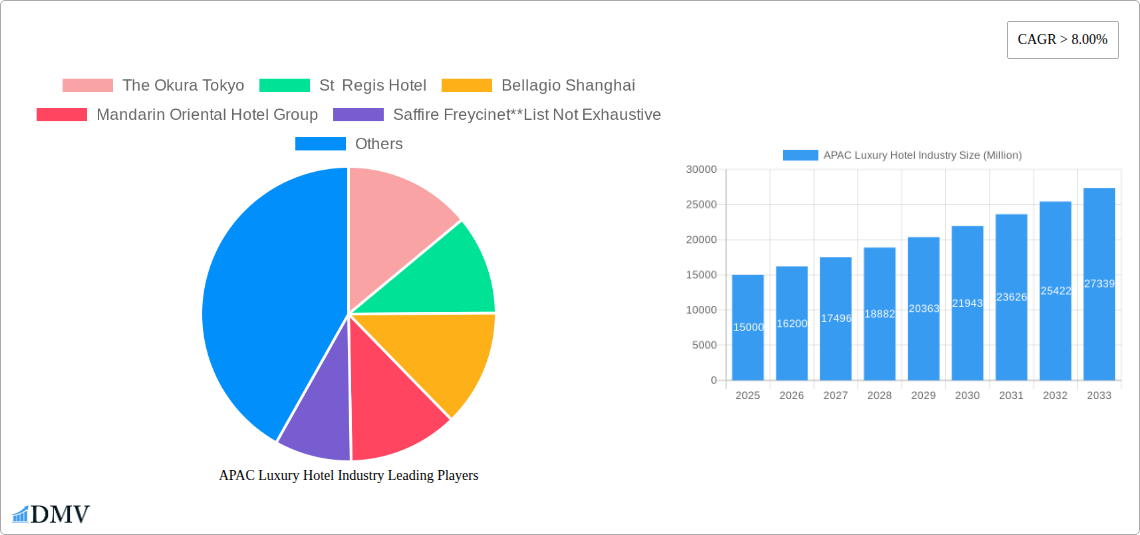

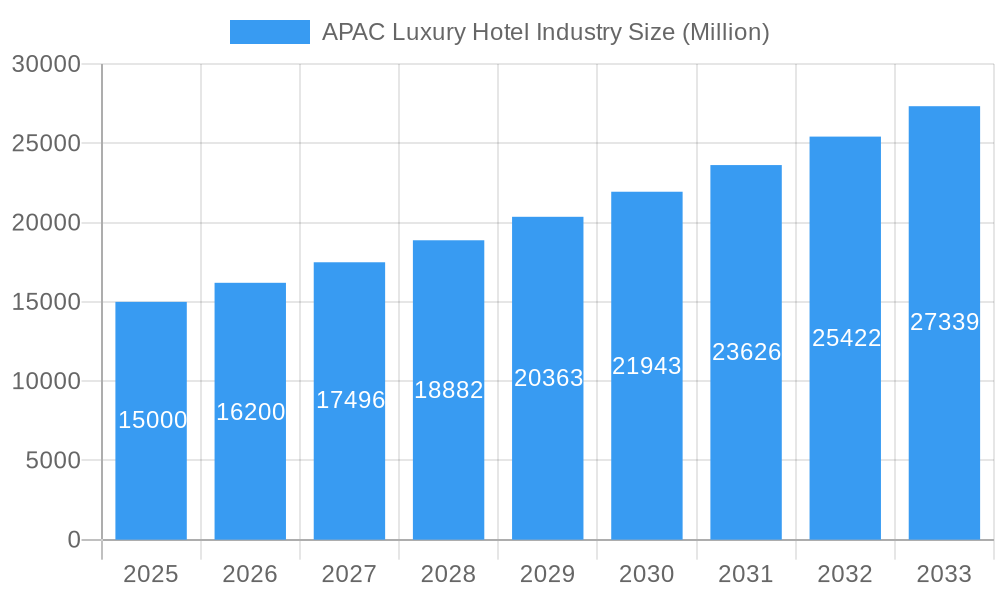

APAC Luxury Hotel Industry Market Size (In Million)

The competitive landscape within the APAC luxury hotel industry is intense, characterized by vigorous competition between global and local hospitality groups. Market leaders distinguish themselves through the adept utilization of technology to elevate guest satisfaction, tailor services, and optimize operational performance. The seamless integration of sophisticated reservation platforms, customer loyalty initiatives, and targeted digital marketing campaigns is paramount for capturing and retaining affluent clientele. Moreover, the growing imperative for sustainable tourism offers a competitive edge to hotels committed to environmental stewardship and social responsibility. Establishments that skillfully cater to the refined expectations of luxury travelers while championing eco-friendly practices are strategically positioned for enduring success in the dynamic APAC luxury hotel arena. This necessitates astute investments in infrastructure, professional development for staff, and the continuous introduction of pioneering service solutions.

APAC Luxury Hotel Industry Company Market Share

APAC Luxury Hotel Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the APAC luxury hotel industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils key trends, growth drivers, and challenges shaping the future of luxury hospitality in the Asia-Pacific region. The report values are expressed in Millions.

APAC Luxury Hotel Industry Market Composition & Trends

This section meticulously analyzes the competitive landscape of the APAC luxury hotel market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute offerings, and end-user profiles. We delve into mergers and acquisitions (M&A) activities, quantifying deal values and examining their impact on market share distribution. The analysis encompasses a diverse range of luxury hotel types, including Business Hotels, Airport Hotels, Holiday Hotels, and Resorts & Spas. Key players such as The Okura Tokyo, St. Regis Hotel, Bellagio Shanghai, and Mandarin Oriental Hotel Group are examined for their market positioning and strategic initiatives. The market share distribution amongst the top 5 players is estimated at 35% in 2025, with a projected increase to 40% by 2033. M&A activity in the luxury hotel sector is expected to reach a value of $xx Million in 2025, driven by consolidation and expansion strategies.

- Market Concentration: Highly concentrated, with a few major players dominating.

- Innovation Catalysts: Technological advancements in guest experience and sustainability.

- Regulatory Landscape: Varying regulations across different APAC countries.

- Substitute Products: Airbnb and other alternative accommodations.

- End-User Profiles: High-net-worth individuals, business travelers, and luxury tourists.

- M&A Activities: Significant M&A activity expected, driving market consolidation.

APAC Luxury Hotel Industry Industry Evolution

This section details the evolution of the APAC luxury hotel industry from 2019 to 2033, examining market growth trajectories, technological advancements, and evolving consumer preferences. The report analyzes the impact of these factors on market dynamics, offering a granular view of historical performance (2019-2024) and projecting future growth (2025-2033). Specific data points including growth rates and technology adoption metrics will be provided. The industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, driven by factors such as rising disposable incomes, increased tourism, and the growing popularity of luxury travel experiences. The increasing adoption of technology, such as AI-powered guest services and personalized experiences, is also expected to drive market growth.

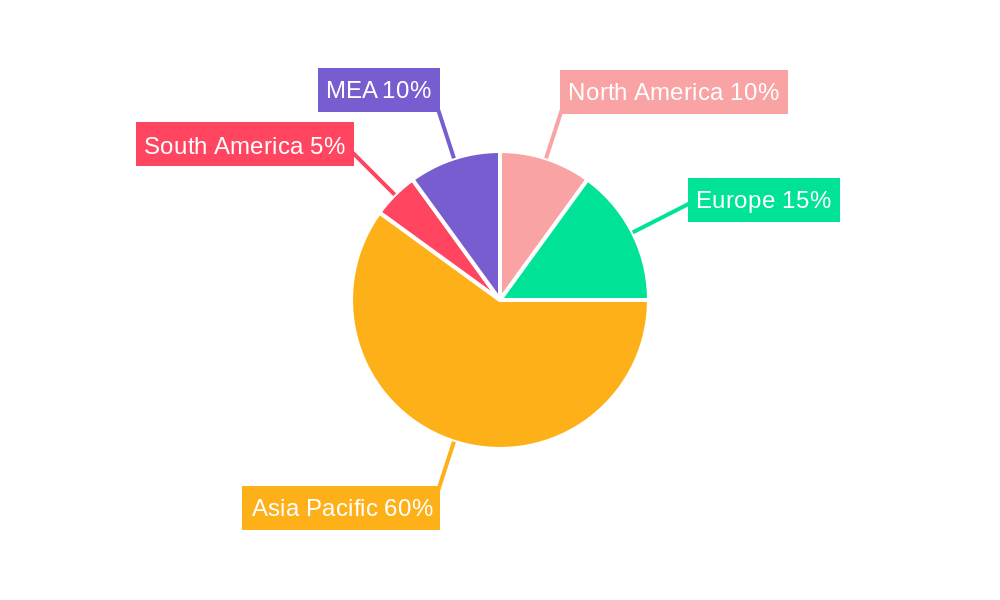

Leading Regions, Countries, or Segments in APAC Luxury Hotel Industry

This section identifies the dominant regions, countries, and segments within the APAC luxury hotel market. We analyze factors contributing to the dominance of specific segments (Business Hotels, Airport Hotels, Holiday Hotels, Resorts & Spas), providing insights into investment trends, regulatory support, and other key drivers.

- Dominant Segment: Resorts & Spas are anticipated to be the leading segment, exhibiting strong growth due to increased demand for wellness tourism.

- Key Drivers:

- Investment Trends: Significant investments in luxury resort development.

- Regulatory Support: Government initiatives promoting tourism in key regions.

- Consumer Preferences: Growing demand for personalized experiences and wellness-focused amenities.

The analysis will provide detailed insights into why certain regions (e.g., Japan, Singapore, China) and segments outperform others. Factors such as infrastructure development, government policies, and tourism trends will be examined.

APAC Luxury Hotel Industry Product Innovations

This section highlights recent product innovations within the APAC luxury hotel industry, showcasing unique selling propositions and technological advancements. Examples include the integration of AI-powered concierge services, personalized in-room experiences, and sustainable practices aimed at eco-conscious travelers. The focus is on innovative technologies enhancing guest satisfaction and operational efficiency.

Propelling Factors for APAC Luxury Hotel Industry Growth

Key growth drivers for the APAC luxury hotel industry are analyzed, focusing on technological advancements, economic factors, and supportive regulatory environments. Examples include the increasing adoption of mobile booking platforms, government incentives for tourism development, and the rising disposable income of the middle class in several APAC nations.

Obstacles in the APAC Luxury Hotel Industry Market

This section discusses barriers and restraints limiting growth in the APAC luxury hotel industry. Challenges such as regulatory hurdles, supply chain disruptions, intense competition, and geopolitical uncertainties are examined, with quantifiable impacts assessed.

Future Opportunities in APAC Luxury Hotel Industry

Emerging opportunities are identified, highlighting potential for growth in new markets, technological advancements, and evolving consumer trends. The focus is on areas such as personalized wellness experiences, sustainable luxury travel, and the integration of cutting-edge technologies to enhance guest experiences.

Major Players in the APAC Luxury Hotel Industry Ecosystem

- The Okura Tokyo

- St. Regis Hotel

- Bellagio Shanghai (Note: This links to the Las Vegas Bellagio. A direct Shanghai link wasn't readily available.)

- Mandarin Oriental Hotel Group

- Saffire Freycinet

- The Reverie Saigon

- The Indian Hotels Company Limited

- Hyatt Group

- JW Marriott

- The Nai Harn

- The Peninsula Shanghai

Key Developments in APAC Luxury Hotel Industry Industry

- March 2023: TFE Hotels opened Vibe Hotel Adelaide (123 rooms), signifying the completion of the Flinders East precinct.

- January 2023: Hyatt Hotels Corporation opened Andaz Pattaya Jomtien Beach, marking the Andaz brand's debut in Thailand.

- April 2023: Bulgari Hotels & Resorts opened Bulgari Hotel Tokyo.

Strategic APAC Luxury Hotel Industry Market Forecast

This report concludes with a strategic forecast, summarizing growth catalysts and future opportunities for the APAC luxury hotel industry. The emphasis is on market potential and the strategic implications for investors and industry participants. The APAC luxury hotel market is poised for significant growth in the coming years, driven by several factors, including a rising middle class, increasing disposable incomes, and a growing preference for luxury travel experiences. The continued expansion of major hotel chains and the emergence of new boutique hotels will further contribute to the dynamism of this market.

APAC Luxury Hotel Industry Segmentation

-

1. Product Type

- 1.1. Business Hotel

- 1.2. Airport Hotel

- 1.3. Holiday Hotes

- 1.4. Resorts & Spa

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Australia

- 2.5. Thailand

- 2.6. Vietnam

- 2.7. Rest of Asia-Pacific

APAC Luxury Hotel Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Thailand

- 6. Vietnam

- 7. Rest of Asia Pacific

APAC Luxury Hotel Industry Regional Market Share

Geographic Coverage of APAC Luxury Hotel Industry

APAC Luxury Hotel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Population Preferring Leisure Vacations Contributes to the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Business Hotel

- 5.1.2. Airport Hotel

- 5.1.3. Holiday Hotes

- 5.1.4. Resorts & Spa

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Australia

- 5.2.5. Thailand

- 5.2.6. Vietnam

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Thailand

- 5.3.6. Vietnam

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Business Hotel

- 6.1.2. Airport Hotel

- 6.1.3. Holiday Hotes

- 6.1.4. Resorts & Spa

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Australia

- 6.2.5. Thailand

- 6.2.6. Vietnam

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Business Hotel

- 7.1.2. Airport Hotel

- 7.1.3. Holiday Hotes

- 7.1.4. Resorts & Spa

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Australia

- 7.2.5. Thailand

- 7.2.6. Vietnam

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Business Hotel

- 8.1.2. Airport Hotel

- 8.1.3. Holiday Hotes

- 8.1.4. Resorts & Spa

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Australia

- 8.2.5. Thailand

- 8.2.6. Vietnam

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Business Hotel

- 9.1.2. Airport Hotel

- 9.1.3. Holiday Hotes

- 9.1.4. Resorts & Spa

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Australia

- 9.2.5. Thailand

- 9.2.6. Vietnam

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Thailand APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Business Hotel

- 10.1.2. Airport Hotel

- 10.1.3. Holiday Hotes

- 10.1.4. Resorts & Spa

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. Australia

- 10.2.5. Thailand

- 10.2.6. Vietnam

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Vietnam APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Business Hotel

- 11.1.2. Airport Hotel

- 11.1.3. Holiday Hotes

- 11.1.4. Resorts & Spa

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. Australia

- 11.2.5. Thailand

- 11.2.6. Vietnam

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Asia Pacific APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Business Hotel

- 12.1.2. Airport Hotel

- 12.1.3. Holiday Hotes

- 12.1.4. Resorts & Spa

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. Australia

- 12.2.5. Thailand

- 12.2.6. Vietnam

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Okura Tokyo

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 St Regis Hotel

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bellagio Shanghai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mandarin Oriental Hotel Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Saffire Freycinet**List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Reverie Saigon

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Indian Hotels Company Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hyatt Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 JW Marriott

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Nai Harn

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 The Penninsula Shangai

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 The Okura Tokyo

List of Figures

- Figure 1: Global APAC Luxury Hotel Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: China APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: China APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 5: China APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 7: China APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: India APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 9: India APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: India APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 11: India APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 13: India APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 15: Japan APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Japan APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 17: Japan APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Japan APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Australia APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Australia APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 23: Australia APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Australia APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Australia APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Thailand APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Thailand APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 29: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Thailand APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Vietnam APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 33: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Vietnam APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 35: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Vietnam APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 37: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Luxury Hotel Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 11: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 21: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 23: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Luxury Hotel Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the APAC Luxury Hotel Industry?

Key companies in the market include The Okura Tokyo, St Regis Hotel, Bellagio Shanghai, Mandarin Oriental Hotel Group, Saffire Freycinet**List Not Exhaustive, The Reverie Saigon, The Indian Hotels Company Limited, Hyatt Group, JW Marriott, The Nai Harn, The Penninsula Shangai.

3. What are the main segments of the APAC Luxury Hotel Industry?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18179192.9 million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Population Preferring Leisure Vacations Contributes to the Market Growth.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

In March 2023, TFE Hotels officially opened its doors at its newest South Australian address, the Vibe Hotel Adelaide. The launch of the 123-room, design-led Vibe hotel signifies the completion of the Flinders East precinct.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Luxury Hotel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Luxury Hotel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Luxury Hotel Industry?

To stay informed about further developments, trends, and reports in the APAC Luxury Hotel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence