Key Insights

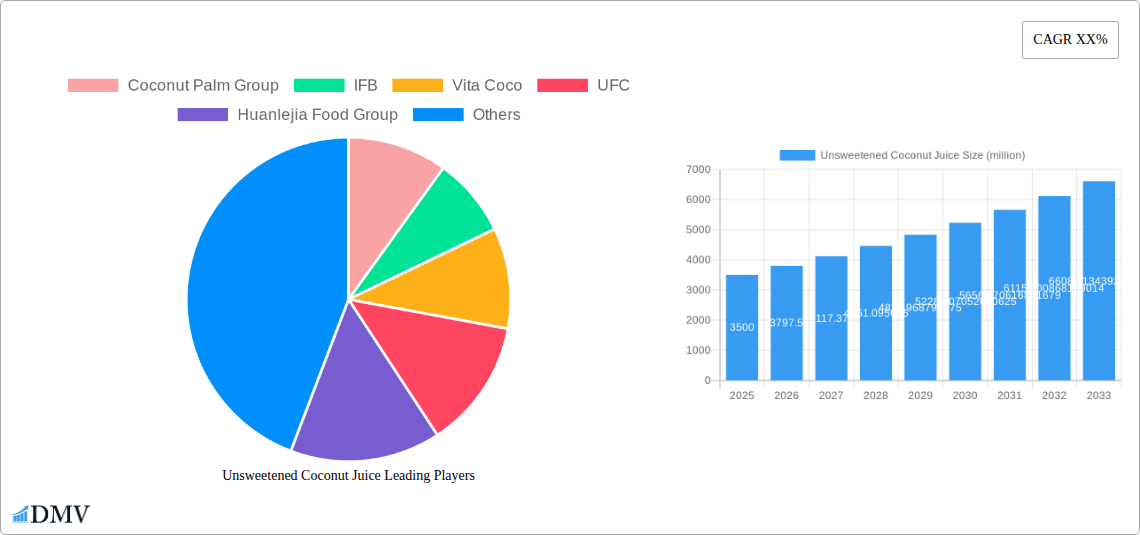

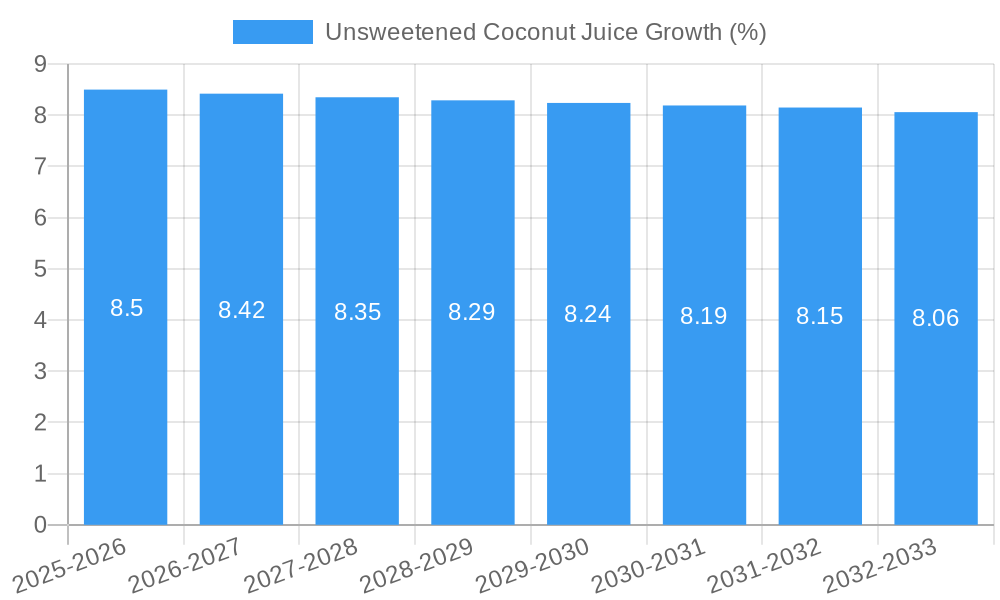

The global Unsweetened Coconut Juice market is experiencing robust expansion, projected to reach approximately USD 3,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This impressive growth is primarily fueled by increasing consumer awareness regarding the health benefits of unsweetened coconut juice, such as its hydrating properties, rich electrolyte content, and natural sweetness, which positions it as a healthy alternative to sugary beverages. The growing trend of wellness and fitness, coupled with the rising demand for natural and plant-based products, are significant drivers propelling market momentum. Furthermore, the versatility of unsweetened coconut juice as an ingredient in culinary applications, smoothies, and as a standalone beverage is broadening its consumer base. Emerging economies, particularly in Asia Pacific, are witnessing a surge in demand owing to a greater disposable income and evolving dietary preferences, with India and China leading the charge in consumption.

Despite the promising growth trajectory, the market faces certain restraints, including the relatively higher price point compared to conventional juices and the limited shelf life of fresh coconut juice, necessitating advancements in preservation and packaging technologies. However, innovations in processing and packaging, such as aseptic packaging and extended shelf-life formulations, are gradually mitigating these challenges. The market is segmented into Online Sales and Offline Sales, with online channels demonstrating a faster growth rate due to enhanced accessibility and convenience. In terms of product types, Coconut Water dominates, followed by Mixed Coconut Juice and Coconut Milk, reflecting consumer preference for the purest form. Key industry players like Vita Coco, Coconut Palm Group, and UFC are actively investing in product innovation, market expansion, and strategic partnerships to capitalize on these evolving market dynamics and secure a significant market share.

Unsweetened Coconut Juice Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Unsweetened Coconut Juice market, offering strategic insights and data-driven forecasts for stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report meticulously dissects market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Uncover critical trends impacting key players such as Coconut Palm Group, IFB, Vita Coco, UFC, Huanlejia Food Group, Kara Coco, Real Coco, SUSA Food, Thai Coconut, and ZICO. This report is essential for navigating the dynamic Unsweetened Coconut Juice landscape, from online and offline sales channels to diverse product types including Coconut Water, Mixed Coconut Juice, and Coconut Milk.

Unsweetened Coconut Juice Market Composition & Trends

The Unsweetened Coconut Juice market exhibits moderate concentration, driven by a mix of established global brands and regional players. Innovation catalysts are primarily focused on sustainability, enhanced nutritional profiles, and novel flavor combinations. Regulatory landscapes are evolving, with increasing scrutiny on labeling transparency and sourcing practices across major consumption hubs. Substitute products, such as other plant-based milks and electrolyte-rich beverages, present a continuous competitive challenge, necessitating clear differentiation for unsweetened coconut juice. End-user profiles are increasingly health-conscious, seeking natural, low-sugar alternatives for hydration and culinary applications. Mergers and Acquisitions (M&A) activities are sporadic but significant, with deal values ranging from approximately 50 million to 500 million for strategic market entries or capacity expansions. The market share distribution sees key players like Vita Coco and UFC holding significant portions, estimated at 15% and 12% respectively in the historical period, with regional players like Thai Coconut and Huanlejia Food Group commanding substantial shares in their respective geographies.

- Market Share Distribution (Estimated):

- Vita Coco: 15%

- UFC: 12%

- Coconut Palm Group: 8%

- Huanlejia Food Group: 10%

- Thai Coconut: 11%

- IFB: 7%

- Kara Coco: 6%

- Real Coco: 5%

- SUSA Food: 4%

- ZICO: 5%

- Others: 17%

- M&A Deal Values (Estimated Range): 50 million - 500 million

- Key Innovation Drivers:

- Sustainable Packaging Solutions

- Functional Ingredient Integration (e.g., probiotics, vitamins)

- Unique Flavor Infusions

- Extended Shelf-Life Technologies

Unsweetened Coconut Juice Industry Evolution

The Unsweetened Coconut Juice industry has witnessed a robust growth trajectory, largely fueled by an escalating global demand for healthier beverage alternatives and a burgeoning awareness of coconut water's natural hydration and electrolyte benefits. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately 8.5%, with significant surges in adoption during post-pandemic recovery phases. Technological advancements have played a pivotal role, particularly in improving processing techniques for enhanced shelf-life and nutrient preservation, alongside innovative extraction methods that ensure a purer, more consistent product. The adoption of ultra-high temperature (UHT) processing and advanced filtration systems has been instrumental in expanding market reach and reducing spoilage rates, contributing to an estimated 90% adoption rate of modern processing technologies among leading manufacturers by 2024.

Shifting consumer demands have been a paramount force, moving away from sugary drinks towards natural, low-calorie, and functional beverages. This trend is further amplified by a growing vegan and plant-based diet movement, which has significantly broadened the appeal of coconut-based products beyond traditional markets. The rise of online sales channels and direct-to-consumer models has also democratized access, allowing smaller brands to gain traction and fostering a more competitive landscape. Furthermore, the wellness trend has positioned unsweetened coconut juice not just as a beverage but as a lifestyle choice, with consumers actively seeking products that align with their health and fitness goals. This has spurred market growth to an estimated 15 billion USD in the base year of 2025, with projections indicating continued expansion at a CAGR of around 7.8% during the forecast period (2025-2033). The market's evolution is marked by a continuous pursuit of product diversification, including the introduction of functionalized variants and convenient packaging formats, catering to an increasingly discerning and health-conscious global consumer base.

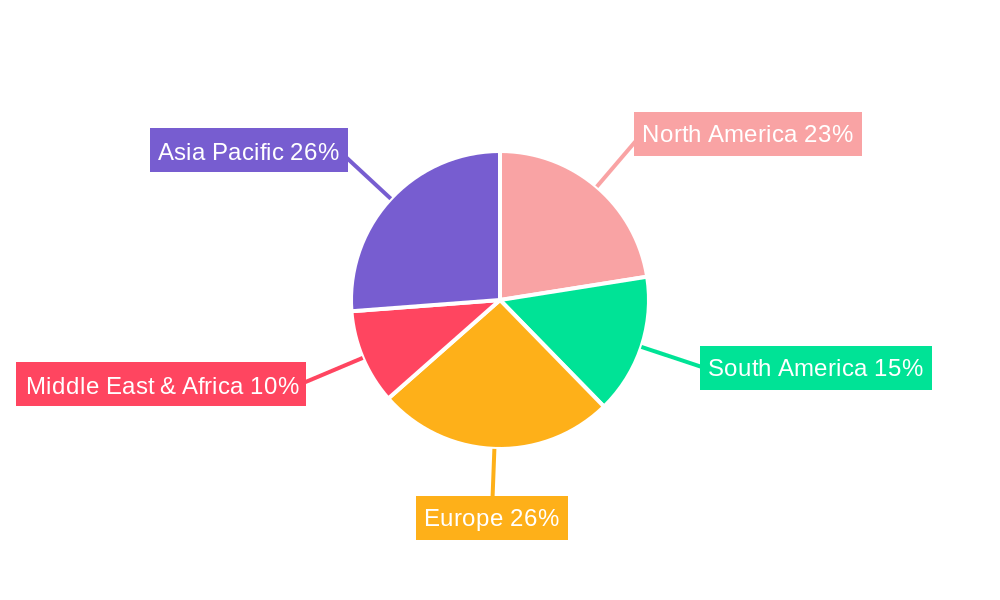

Leading Regions, Countries, or Segments in Unsweetened Coconut Juice

The Unsweetened Coconut Juice market exhibits distinct regional and segmental dominance, with Asia-Pacific emerging as a powerhouse due to its deep-rooted cultural connection with coconut products and a rapidly growing middle class. Within this region, countries like Thailand, Vietnam, and the Philippines are not only major producers but also significant consumers, driving both Offline Sales and increasingly, Online Sales channels. The dominance in Asia-Pacific is underpinned by factors such as abundant raw material availability, lower production costs, and a growing preference for natural beverages over processed options. Investment trends here are robust, with local and international companies pouring capital into expanding production capacities and distribution networks. Regulatory support for the agricultural sector also plays a crucial role in fostering consistent supply chains.

In terms of product segments, Coconut Water undeniably leads the market share. Its natural hydration properties, electrolyte content, and low calorie count make it a preferred choice for health-conscious consumers worldwide. The global market for coconut water is estimated to be worth approximately 10 billion USD in the base year of 2025. Online sales for coconut water have seen exponential growth, contributing an estimated 30% to the total sales volume, driven by the convenience and wider product availability offered by e-commerce platforms. However, offline sales, primarily through supermarkets, convenience stores, and traditional retail outlets, still hold a significant share, estimated at 70%, particularly in emerging economies where online penetration is still developing.

- Dominant Region: Asia-Pacific

- Key Drivers:

- Abundant Raw Material Supply (Coconut Production)

- Growing Middle Class & Disposable Income

- Increasing Health Consciousness

- Strong Traditional Consumption Patterns

- Favorable Government Policies for Agriculture

- Key Drivers:

- Dominant Segment (Application): Offline Sales

- Dominance Factors:

- Established Retail Infrastructure

- Consumer Trust in Traditional Channels

- Impulse Purchases

- Wider Reach in Rural and Semi-Urban Areas

- Dominance Factors:

- Dominant Segment (Type): Coconut Water

- Dominance Factors:

- Perceived Health Benefits (Hydration, Electrolytes)

- Low Calorie & Natural Sweetness

- Versatile Usage (Beverage, Ingredient)

- Strong Brand Marketing & Endorsement

- Dominance Factors:

Unsweetened Coconut Juice Product Innovations

Product innovation in the Unsweetened Coconut Juice market is a crucial differentiator. Companies are focusing on creating value-added variants, such as coconut water infused with natural fruit extracts (e.g., lime, pineapple) for enhanced flavor profiles without added sugars, or fortified options containing added vitamins and minerals. Innovations in packaging are also prominent, with a rise in convenient formats like recyclable pouches, resealable cartons, and smaller, single-serve bottles catering to on-the-go consumption. Performance metrics for these innovations are tracked through consumer adoption rates, repeat purchase behavior, and market share gains within specific product categories. The unique selling proposition often lies in the natural purity, sustainability claims, and the functional health benefits offered by these novel formulations. Technological advancements are enabling cleaner extraction processes that preserve more natural compounds and extend shelf-life without chemical preservatives.

Propelling Factors for Unsweetened Coconut Juice Growth

The growth of the Unsweetened Coconut Juice market is propelled by several converging factors. A primary driver is the escalating global demand for healthy and natural beverages, fueled by increasing consumer awareness regarding the adverse effects of sugar-laden drinks. Technological advancements in processing and packaging are enhancing product quality, shelf-life, and convenience, making unsweetened coconut juice more accessible and appealing. Furthermore, the growing popularity of plant-based diets and veganism has significantly broadened the consumer base for coconut-based products. Supportive government initiatives promoting healthy lifestyles and agricultural development in key coconut-producing regions also contribute to market expansion. The economic factor of rising disposable incomes in developing nations further fuels demand for premium, health-oriented beverages.

Obstacles in the Unsweetened Coconut Juice Market

Despite its growth potential, the Unsweetened Coconut Juice market faces several obstacles. Intense competition from established beverage giants and emerging plant-based alternatives, such as almond and oat milk, poses a significant challenge. Supply chain disruptions, particularly those related to weather patterns affecting coconut harvests and global logistics, can impact availability and pricing. Fluctuations in raw material costs due to these disruptions can also affect profit margins, estimated to cause price volatility of up to 15% in certain periods. Stringent regulatory requirements in some markets regarding labeling, food safety standards, and import regulations can create barriers to entry. Additionally, consumer perception and taste preferences, especially in regions less familiar with coconut juice, can limit widespread adoption.

Future Opportunities in Unsweetened Coconut Juice

The future of the Unsweetened Coconut Juice market is ripe with opportunities. Emerging markets in regions with developing economies present significant untapped potential for growth, driven by increasing health consciousness and disposable incomes. Technological innovations in flavor masking and fortification can lead to new product development, catering to a wider range of palates and nutritional needs. The expansion of online retail channels and direct-to-consumer models offers a direct avenue to reach a global customer base, bypassing traditional distribution hurdles. Furthermore, the growing trend of functional beverages presents an opportunity to develop specialized unsweetened coconut juice products targeting specific health benefits, such as improved digestion or enhanced immunity. Partnerships with fitness and wellness influencers can also amplify brand reach and consumer engagement.

Major Players in the Unsweetened Coconut Juice Ecosystem

- Coconut Palm Group

- IFB

- Vita Coco

- UFC

- Huanlejia Food Group

- Kara Coco

- Real Coco

- SUSA Food

- Thai Coconut

- ZICO

Key Developments in Unsweetened Coconut Juice Industry

- 2023 February: Vita Coco launches a new line of functional coconut waters with added vitamins and adaptogens, expanding their product portfolio.

- 2023 May: Coconut Palm Group announces a significant investment in sustainable coconut farming practices to ensure a stable and ethical supply chain.

- 2023 August: UFC introduces eco-friendly packaging for its coconut water range, aligning with growing consumer demand for sustainable products.

- 2024 January: Real Coco expands its distribution network into new markets in Europe, targeting the growing demand for natural beverages.

- 2024 March: IFB acquires a smaller regional player to strengthen its presence in a key Asian market.

- 2024 June: Thai Coconut reports a record year for sales driven by strong domestic demand and export growth.

- 2024 October: Kara Coco announces a strategic partnership with a major online retailer to enhance its e-commerce presence.

- 2025 January: Huanlejia Food Group unveils innovative new flavors for its mixed coconut juice range, targeting younger consumer demographics.

- 2025 April: ZICO explores advanced water purification technologies to further enhance the purity and quality of its unsweetened coconut juice.

- 2025 July: SUSA Food invests in R&D for plant-based dairy alternatives derived from coconut, potentially diversifying its offerings.

Strategic Unsweetened Coconut Juice Market Forecast

The Unsweetened Coconut Juice market is poised for sustained growth, driven by evolving consumer preferences towards healthier, natural beverage options and the expanding reach of online sales channels. Key growth catalysts include continued innovation in functional beverages, sustainable packaging solutions, and expansion into emerging geographical markets. The market's resilience is further bolstered by its versatility in application, from direct consumption to culinary uses. Strategic investments in R&D and supply chain optimization will be crucial for market leaders to maintain their competitive edge and capitalize on the projected market expansion, which is expected to reach an estimated 25 billion USD by 2033.

Unsweetened Coconut Juice Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Coconut Water

- 2.2. Mixed Coconut Juice

- 2.3. Coconut Milk

Unsweetened Coconut Juice Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Unsweetened Coconut Juice REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Coconut Water

- 5.2.2. Mixed Coconut Juice

- 5.2.3. Coconut Milk

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Coconut Water

- 6.2.2. Mixed Coconut Juice

- 6.2.3. Coconut Milk

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Coconut Water

- 7.2.2. Mixed Coconut Juice

- 7.2.3. Coconut Milk

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Coconut Water

- 8.2.2. Mixed Coconut Juice

- 8.2.3. Coconut Milk

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Coconut Water

- 9.2.2. Mixed Coconut Juice

- 9.2.3. Coconut Milk

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Unsweetened Coconut Juice Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Coconut Water

- 10.2.2. Mixed Coconut Juice

- 10.2.3. Coconut Milk

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Coconut Palm Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IFB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vita Coco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UFC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huanlejia Food Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kara Coco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Real Coco

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SUSA Food

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thai Coconut

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ZICO

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Coconut Palm Group

List of Figures

- Figure 1: Global Unsweetened Coconut Juice Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Unsweetened Coconut Juice Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Unsweetened Coconut Juice Revenue (million), by Application 2024 & 2032

- Figure 4: North America Unsweetened Coconut Juice Volume (K), by Application 2024 & 2032

- Figure 5: North America Unsweetened Coconut Juice Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Unsweetened Coconut Juice Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Unsweetened Coconut Juice Revenue (million), by Types 2024 & 2032

- Figure 8: North America Unsweetened Coconut Juice Volume (K), by Types 2024 & 2032

- Figure 9: North America Unsweetened Coconut Juice Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Unsweetened Coconut Juice Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Unsweetened Coconut Juice Revenue (million), by Country 2024 & 2032

- Figure 12: North America Unsweetened Coconut Juice Volume (K), by Country 2024 & 2032

- Figure 13: North America Unsweetened Coconut Juice Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Unsweetened Coconut Juice Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Unsweetened Coconut Juice Revenue (million), by Application 2024 & 2032

- Figure 16: South America Unsweetened Coconut Juice Volume (K), by Application 2024 & 2032

- Figure 17: South America Unsweetened Coconut Juice Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Unsweetened Coconut Juice Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Unsweetened Coconut Juice Revenue (million), by Types 2024 & 2032

- Figure 20: South America Unsweetened Coconut Juice Volume (K), by Types 2024 & 2032

- Figure 21: South America Unsweetened Coconut Juice Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Unsweetened Coconut Juice Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Unsweetened Coconut Juice Revenue (million), by Country 2024 & 2032

- Figure 24: South America Unsweetened Coconut Juice Volume (K), by Country 2024 & 2032

- Figure 25: South America Unsweetened Coconut Juice Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Unsweetened Coconut Juice Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Unsweetened Coconut Juice Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Unsweetened Coconut Juice Volume (K), by Application 2024 & 2032

- Figure 29: Europe Unsweetened Coconut Juice Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Unsweetened Coconut Juice Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Unsweetened Coconut Juice Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Unsweetened Coconut Juice Volume (K), by Types 2024 & 2032

- Figure 33: Europe Unsweetened Coconut Juice Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Unsweetened Coconut Juice Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Unsweetened Coconut Juice Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Unsweetened Coconut Juice Volume (K), by Country 2024 & 2032

- Figure 37: Europe Unsweetened Coconut Juice Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Unsweetened Coconut Juice Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Unsweetened Coconut Juice Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Unsweetened Coconut Juice Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Unsweetened Coconut Juice Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Unsweetened Coconut Juice Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Unsweetened Coconut Juice Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Unsweetened Coconut Juice Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Unsweetened Coconut Juice Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Unsweetened Coconut Juice Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Unsweetened Coconut Juice Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Unsweetened Coconut Juice Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Unsweetened Coconut Juice Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Unsweetened Coconut Juice Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Unsweetened Coconut Juice Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Unsweetened Coconut Juice Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Unsweetened Coconut Juice Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Unsweetened Coconut Juice Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Unsweetened Coconut Juice Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Unsweetened Coconut Juice Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Unsweetened Coconut Juice Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Unsweetened Coconut Juice Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Unsweetened Coconut Juice Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Unsweetened Coconut Juice Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Unsweetened Coconut Juice Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Unsweetened Coconut Juice Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Unsweetened Coconut Juice Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Unsweetened Coconut Juice Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Unsweetened Coconut Juice Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Unsweetened Coconut Juice Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Unsweetened Coconut Juice Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Unsweetened Coconut Juice Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Unsweetened Coconut Juice Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Unsweetened Coconut Juice Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Unsweetened Coconut Juice Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Unsweetened Coconut Juice Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Unsweetened Coconut Juice Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Unsweetened Coconut Juice Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Unsweetened Coconut Juice Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Unsweetened Coconut Juice Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Unsweetened Coconut Juice Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Unsweetened Coconut Juice Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Unsweetened Coconut Juice Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Unsweetened Coconut Juice Volume K Forecast, by Country 2019 & 2032

- Table 81: China Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Unsweetened Coconut Juice Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Unsweetened Coconut Juice Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unsweetened Coconut Juice?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Unsweetened Coconut Juice?

Key companies in the market include Coconut Palm Group, IFB, Vita Coco, UFC, Huanlejia Food Group, Kara Coco, Real Coco, SUSA Food, Thai Coconut, ZICO.

3. What are the main segments of the Unsweetened Coconut Juice?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unsweetened Coconut Juice," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unsweetened Coconut Juice report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unsweetened Coconut Juice?

To stay informed about further developments, trends, and reports in the Unsweetened Coconut Juice, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence