Key Insights

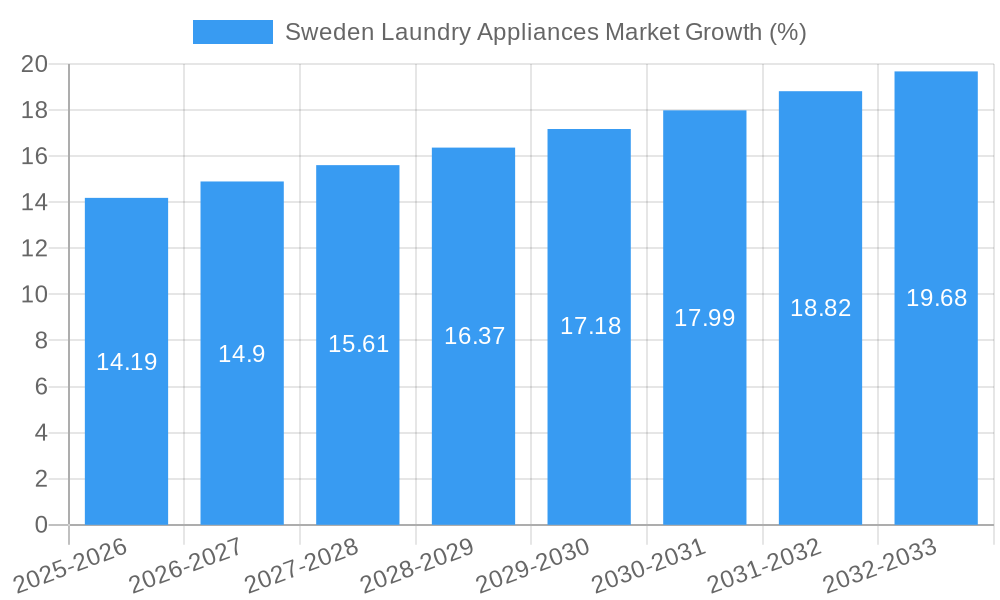

The Swedish laundry appliances market, valued at €325.55 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 4.26% from 2025 to 2033. This growth is driven by several factors. Increasing disposable incomes in Sweden are fueling demand for premium and technologically advanced laundry appliances. A rising preference for convenience and time-saving solutions is boosting the adoption of automatic washing machines and dryers, particularly among younger demographics and busy households. Furthermore, the growing awareness of eco-friendly laundry practices is driving demand for energy-efficient models with features like water-saving technology and improved energy ratings. The market segmentation reveals a strong preference for freestanding appliances over built-in options, with washing machines and dryers dominating the product segment. While automatic appliances are the majority, the semi-automatic/manual segment retains a presence, catering to specific consumer preferences or budgetary constraints. Multi-brand stores remain the primary distribution channel, although online sales are showing significant growth, driven by the convenience and price comparison features of e-commerce platforms. Key players like LG, SMEG, Siemens, Miele, Electrolux, and Samsung are vying for market share, offering diversified product lines and technological innovations to cater to evolving consumer needs.

The market's growth is, however, subject to certain restraints. Fluctuations in raw material prices and potential economic downturns can influence consumer spending on durable goods such as laundry appliances. Additionally, the saturation level in the market for washing machines and dryers, coupled with the increasing price point for premium models, could present challenges for market expansion. Nevertheless, the integration of smart home technology and the emergence of innovative features like AI-powered laundry solutions are expected to drive future growth and enhance market dynamism. The continued penetration of online sales and the potential for subscription models for appliance maintenance and repair services are also expected to create new opportunities within the Swedish laundry appliances market. This makes the Swedish market an attractive landscape for both established and emerging players seeking to capitalize on consumer demand for innovative, convenient, and environmentally conscious laundry solutions.

Sweden Laundry Appliances Market Market Composition & Trends

The Sweden Laundry Appliances Market is characterized by a dynamic interplay of innovation, regulation, and market consolidation. The market concentration is moderate, with key players like LG, Electrolux, and Bosch holding significant shares. In 2025, the market share distribution is as follows: LG (15%), Electrolux (12%), Bosch (10%), with the remaining share distributed among other competitors. Innovation catalysts include the integration of smart technology and energy efficiency, driven by consumer demand for sustainable solutions. The regulatory landscape is supportive, with initiatives like the EU's Ecodesign Directive pushing for more eco-friendly appliances.

Substitute products, such as professional laundry services, pose a minor threat due to their higher costs. End-user profiles are diverse, ranging from individual households to commercial establishments, with a growing trend towards home-based solutions. M&A activities have been significant, with Bosch's acquisition of a 12% stake in Husqvarna AB for approximately xx Million in January 2023, and Whirlpool's strategic move to reduce its European exposure by partnering with Arcelik, valued at xx Million. These activities underscore a trend towards consolidation and international expansion.

- Market Concentration: Moderate, with top three players holding 37% of the market.

- Innovation Catalysts: Smart technology, energy efficiency.

- Regulatory Landscape: Supportive, driven by EU Ecodesign Directive.

- Substitute Products: Professional laundry services.

- End-User Profiles: Households, commercial establishments.

- M&A Activities: Bosch's acquisition of Husqvarna shares, Whirlpool's partnership with Arcelik.

Sweden Laundry Appliances Market Industry Evolution

The Sweden Laundry Appliances Market experienced substantial growth between 2019 and 2024, achieving a 3.5% CAGR. This positive trajectory is projected to continue from 2025 to 2033, with a forecasted CAGR of 4.2%. This robust expansion is fueled by several key factors: the escalating demand for smart home appliances (demonstrated by a 20% surge in penetration rates between 2020 and 2025), a growing preference for energy-efficient models driven by both consumer awareness and stringent environmental regulations (resulting in a 15% reduction in energy consumption per unit since 2019), and a significant shift towards built-in appliances, which now command a 40% market share, up from 30% in 2019. This reflects a broader trend towards space optimization and integrated home design in the Swedish market.

Technological advancements have played a crucial role, with the incorporation of AI and IoT features significantly enhancing user experience and operational efficiency. Furthermore, the expansion of online sales channels has been remarkable, experiencing a 30% annual growth rate since 2020. This reflects the convenience and increased product selection that online platforms offer to Swedish consumers. The market also shows a strong trend towards product customization and personalization, catering to the specific preferences of the Swedish consumer base.

Leading Regions, Countries, or Segments in Sweden Laundry Appliances Market

Within the Swedish Laundry Appliances Market, the "Built-in Appliances" segment reigns supreme, driven by the increasing popularity of space-saving, integrated home designs. This segment benefits from a 5% annual growth in new home constructions prioritizing efficient space utilization.

- Key Drivers for Built-in Appliances:

- Increased investment in smart home technology.

- Government incentives for energy-efficient appliances.

- Growing preference for minimalist and integrated home designs.

Washing Machines hold the leading position in the product segment, capturing a 55% market share in 2025. This strong performance stems from the essential nature of washing machines in both residential and commercial settings.

- Key Drivers for Washing Machines:

- High demand for energy-efficient models.

- Integration of smart features like remote control and diagnostics.

- Essential appliance for both residential and commercial use.

Automatic appliances dominate the technology segment with a 70% market share, reflecting consumer preference for convenience and efficiency.

- Key Drivers for Automatic Appliances:

- Continuous improvements in automation and AI.

- Strong consumer preference for hands-free operation.

Multi-Brand Stores are the primary distribution channel, controlling 45% of sales. Their success is attributed to their broad product selection and competitive pricing.

- Key Drivers for Multi-Brand Stores:

- Extensive presence across urban and rural areas.

- Established reputation for quality and service.

- One-stop shopping experience offering convenience and choice.

The dominance of these segments reflects a confluence of consumer preferences, technological advancements, and effective market strategies employed by key players. The strong performance of built-in appliances, for example, reflects a broader cultural shift towards streamlined living spaces. Similarly, the popularity of automatic appliances highlights a desire for time-saving solutions. The continued success of multi-brand stores emphasizes the importance of a comprehensive retail experience in the Swedish market.

Sweden Laundry Appliances Market Product Innovations

Product innovations in the Sweden Laundry Appliances Market include the introduction of smart washing machines with AI-driven wash cycles that optimize water and energy use based on fabric type and soil level. These innovations offer unique selling propositions such as remote control capabilities and predictive maintenance alerts, enhancing user convenience and machine longevity. Technological advancements like steam cleaning and allergen removal features are also becoming standard, catering to health-conscious consumers.

Propelling Factors for Sweden Laundry Appliances Market Growth

The growth of the Sweden Laundry Appliances Market is propelled by a combination of technological innovation, economic factors, and regulatory influences. The integration of AI and IoT enhances user experience and operational efficiency. Rising disposable incomes empower consumers to invest in premium and smart appliances. Finally, regulatory pressure, such as the EU's focus on energy efficiency, drives manufacturers to develop more sustainable and innovative products, further fueling market growth. The increasing emphasis on sustainability among Swedish consumers also plays a significant role.

Obstacles in the Sweden Laundry Appliances Market Market

The Sweden Laundry Appliances Market faces several barriers, including stringent regulatory standards that increase production costs. Supply chain disruptions, particularly post-COVID, have led to delays and increased prices. Competitive pressures from both domestic and international players result in price wars, affecting profit margins and market stability.

Future Opportunities in Sweden Laundry Appliances Market

Emerging opportunities in the Sweden Laundry Appliances Market include the growing demand for smart home integration, which opens new markets for connected appliances. Technological advancements in energy storage and renewable energy sources present opportunities for eco-friendly laundry solutions. Additionally, shifting consumer trends towards sustainability and customization offer avenues for product differentiation and market expansion.

Major Players in the Sweden Laundry Appliances Market Ecosystem

Key Developments in Sweden Laundry Appliances Market Industry

- January 2023: Bosch agreed to acquire shares in the long-established Swedish company Husqvarna AB. The acquisition increases its shareholding to roughly 12 percent of the company's total share capital, enhancing its market position and product portfolio.

- January 2023: U.S. home appliances maker Whirlpool is folding its European business into a new company controlled by Turkish rival Arcelik, reducing its exposure to the market. The new firm will include Arcelik's European units, such as major domestic, small domestic, and consumer electronics. Whirlpool will own 25%, and Arcelik will own 75%, impacting market dynamics and competition.

Strategic Sweden Laundry Appliances Market Market Forecast

The Sweden Laundry Appliances Market is set for continued expansion, driven by the ongoing adoption of smart and energy-efficient appliances. Future growth opportunities will be significantly shaped by the integration of AI and IoT, further enhancing user experience and operational efficiency. Moreover, the increasing consumer focus on sustainability and the demand for customized products will present key avenues for product differentiation and broader market penetration. The market shows strong potential for continued growth given these factors.

Sweden Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Freestanding

- 1.2. Built in

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Smoothing Irons

- 2.4. Other Products

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic/Manual

- 3.3. Other Technologies

-

4. Distribution Channel

- 4.1. Multi-Brand Stores

- 4.2. Exclusive Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Sweden Laundry Appliances Market Segmentation By Geography

- 1. Sweden

Sweden Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income is Driving the Market; Urbanization and Busy Lifestyles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Saturation in the Market and Price Sensitivity are Restraining the Market; Lack of Awareness about Development in Laundry Appliances

- 3.4. Market Trends

- 3.4.1. E-Commerce Growth is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Laundry Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Freestanding

- 5.1.2. Built in

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Smoothing Irons

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic/Manual

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-Brand Stores

- 5.4.2. Exclusive Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SMEG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Miele

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cylinda

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Whirlpool

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fulgor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Husqvarna

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Samsung

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Sweden Laundry Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Laundry Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Laundry Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Laundry Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Sweden Laundry Appliances Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Sweden Laundry Appliances Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Sweden Laundry Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Sweden Laundry Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: Sweden Laundry Appliances Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: Sweden Laundry Appliances Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 9: Sweden Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Sweden Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 11: Sweden Laundry Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Sweden Laundry Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Sweden Laundry Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Sweden Laundry Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Sweden Laundry Appliances Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Sweden Laundry Appliances Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 17: Sweden Laundry Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Sweden Laundry Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 19: Sweden Laundry Appliances Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Sweden Laundry Appliances Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 21: Sweden Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Sweden Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 23: Sweden Laundry Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Sweden Laundry Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Laundry Appliances Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Sweden Laundry Appliances Market?

Key companies in the market include LG, SMEG, Siemens, Miele, Electrolux, Haier, Cylinda, AEG, Whirlpool, Fulgor, Bosch, Husqvarna, Samsung.

3. What are the main segments of the Sweden Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 325.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income is Driving the Market; Urbanization and Busy Lifestyles is Driving the Market.

6. What are the notable trends driving market growth?

E-Commerce Growth is Driving the Market.

7. Are there any restraints impacting market growth?

Saturation in the Market and Price Sensitivity are Restraining the Market; Lack of Awareness about Development in Laundry Appliances.

8. Can you provide examples of recent developments in the market?

January 2023: Bosch agreed to acquire shares in the long-established Swedish company Husqvarna AB. The acquisition increases its shareholding to roughly 12 percent of the company's total share capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the Sweden Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence