Key Insights

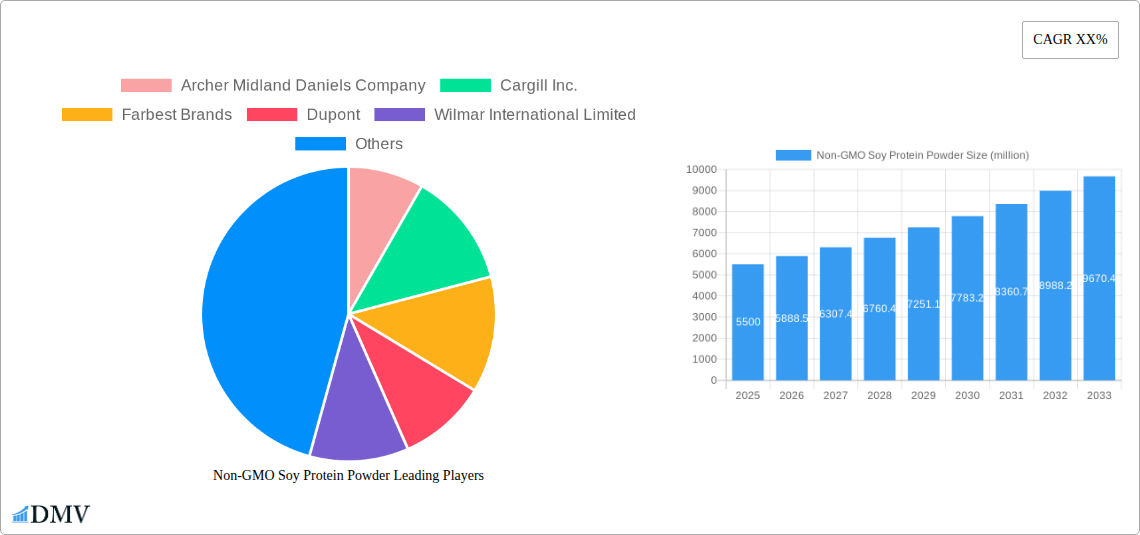

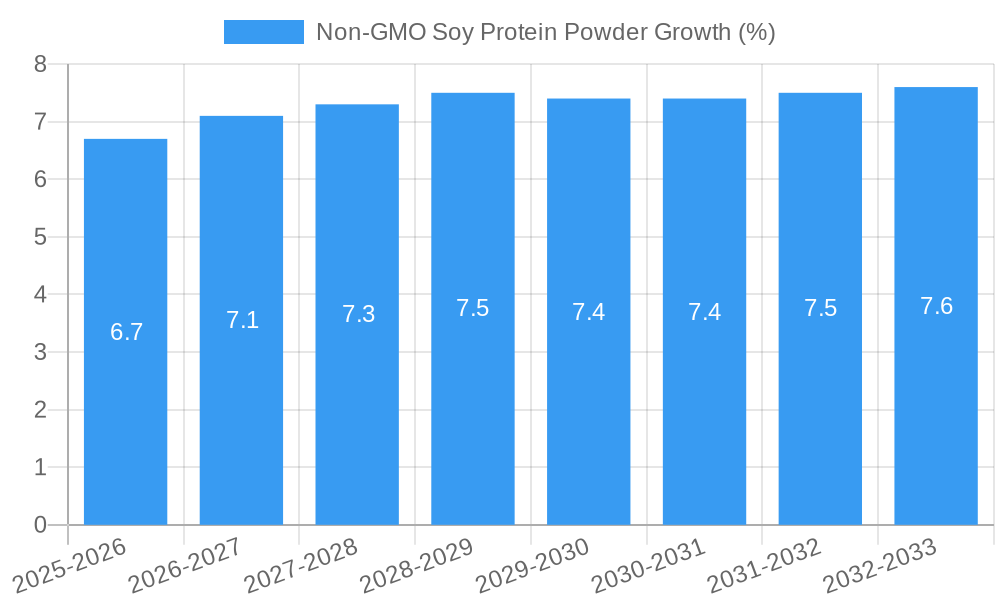

The global Non-GMO Soy Protein Powder market is poised for substantial growth, projected to reach an estimated market size of $5,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% expected to carry it through 2033. This expansion is primarily fueled by the escalating consumer demand for plant-based protein alternatives, driven by increasing health consciousness, ethical considerations surrounding animal agriculture, and a growing prevalence of dietary restrictions and allergies. The market's value unit is in millions, reflecting the significant financial scale of this sector. Key growth drivers include the versatility of non-GMO soy protein powder in various food applications, its perceived health benefits, and the continuous innovation in product development and processing technologies. As consumers become more discerning about ingredient sourcing and ethical production, the "non-GMO" aspect of soy protein powder has become a significant differentiator, commanding premium pricing and attracting a dedicated customer base.

The market segmentation reveals a dynamic landscape. In terms of applications, Bakery and Confectionary, along with Meat Substitutes, are anticipated to be the leading segments, owing to the ingredient's functional properties in texture, binding, and nutritional enhancement. Supplements & Neutraceuticals also represent a significant and growing application, driven by the fitness and wellness trends. The Animal Feed segment, while substantial, may exhibit a more moderate growth trajectory compared to human consumption applications. Regarding types, both Food Grade and Feed Grade are essential, with Food Grade dominating the market value due to its direct application in human food products. Restraints, such as fluctuating raw material prices and potential consumer perceptions related to soy (though largely mitigated by the "non-GMO" label), are present but are being effectively overcome by market participants through strategic sourcing and targeted marketing. Emerging trends like the development of specialized soy protein isolates and concentrates with improved functionality and taste profiles, alongside a greater emphasis on supply chain transparency, are shaping the future of this thriving market. Major players like Archer Midland Daniels Company, Cargill Inc., and Dupont are actively investing in R&D and expanding their production capacities to cater to this surging demand across key regions like North America and Europe, with Asia Pacific showing immense potential for future growth.

Non-GMO Soy Protein Powder Market Composition & Trends

The global Non-GMO Soy Protein Powder market is characterized by a highly fragmented yet dynamic landscape, with key players like Archer Midland Daniels Company, Cargill Inc., Farbest Brands, Dupont, Wilmar International Limited, Kerry Inc., A. Costantino & C. Spa, SHANDONG YUXIN BIO-TECH CO.,LTD., and CROWN SOYA PROTEIN GROUP vying for significant market share. Innovation remains a critical catalyst, driven by the escalating demand for clean label ingredients and plant-based protein solutions. The regulatory environment, particularly concerning non-GMO labeling and soy protein benefits, continues to shape market entry and consumer trust. While direct substitute products exist, such as pea protein and whey protein, the unique nutritional profile of soy protein and its versatility maintain a strong competitive advantage. End-user profiles are diverse, spanning health-conscious consumers seeking soy protein supplements, the rapidly expanding meat substitute industry, the thriving bakery and confectionary sector, and the substantial animal feed market. Mergers and acquisitions are anticipated to play a pivotal role in market consolidation, with estimated M&A deal values projected to reach several hundred million dollars in the coming years, further influencing market concentration and competitive dynamics.

- Market Share Distribution: Key players collectively hold an estimated 60% to 70% of the global market share, with the remaining distributed among smaller regional manufacturers.

- M&A Deal Values: Projected to exceed $500 million over the forecast period, indicating strategic consolidation and expansion efforts.

- Innovation Focus: Emphasis on improving taste profiles, reducing anti-nutritional factors, and developing novel soy protein applications.

Non-GMO Soy Protein Powder Industry Evolution

The Non-GMO Soy Protein Powder industry has witnessed a remarkable evolution, transforming from a niche ingredient to a mainstream powerhouse within the global food and nutrition landscape. Spanning the historical period of 2019–2024, the market has experienced consistent, robust growth, driven by a confluence of factors that continue to shape its trajectory through the study period of 2019–2033. The base year of 2025 serves as a crucial benchmark, with the estimated year also pegged at 2025, providing a stable foundation for the comprehensive forecast period from 2025–2033. Market growth trajectories have been exceptionally positive, with an average annual growth rate of approximately 8% to 10% observed historically and projected to continue. This sustained expansion is largely attributable to the escalating global consumer preference for plant-based diets, fueled by growing awareness of health benefits and environmental sustainability.

Technological advancements have been instrumental in this evolution. Innovations in soy processing have led to improved soy protein isolate and soy protein concentrate production, resulting in enhanced functionality, superior texture, and neutral taste profiles. These advancements have significantly broadened the applicability of non-GMO soy protein powder across diverse sectors. For instance, the development of specialized soy protein ingredients for food processing has enabled seamless integration into a wide array of products, from dairy alternatives to baked goods. Furthermore, advancements in fermentation technologies and enzyme treatments have addressed some of the historical concerns regarding digestibility and anti-nutritional factors, further bolstering consumer acceptance and market penetration. The adoption metrics for non-GMO soy protein powder in various applications have seen exponential increases. In the meat substitutes sector, adoption rates have surged, reflecting the growing demand for plant-based protein alternatives. Similarly, the supplements and nutraceuticals segment has witnessed a substantial rise in the incorporation of soy protein powders for health and wellness. The "Others" category, encompassing various industrial and specialized applications, has also shown consistent growth, underscoring the versatility of this ingredient. The shift in consumer demands towards clean label products and transparent sourcing has further propelled the demand for non-GMO certified soy protein, distinguishing it from conventional soy derivatives. This evolution signifies a profound transformation in how consumers perceive and utilize soy-based proteins, cementing its position as a vital component in a more sustainable and health-conscious global food system.

Leading Regions, Countries, or Segments in Non-GMO Soy Protein Powder

The Non-GMO Soy Protein Powder market's dominance is significantly influenced by a dynamic interplay of regional strengths, country-specific demands, and segment preferences. Analysis of the Application segments reveals a clear hierarchy of importance, with Supplements & Neutraceuticals emerging as a leading driver, closely followed by the rapidly expanding Meat Substitutes sector. The Bakery and Confectionary segment also holds substantial market share, while Animal Feed represents a significant, albeit distinct, application.

Dominant Segments and Their Drivers:

- Supplements & Neutraceuticals: This segment's leadership is underpinned by a global surge in health consciousness and a growing demand for protein supplements for fitness and wellness. The nutritional benefits of soy protein, including its complete amino acid profile and potential cardiovascular advantages, are key attractions. Investment trends in the health and fitness industry, coupled with robust consumer spending on dietary supplements, further solidify its dominant position. Regulatory support for health claims associated with soy protein also plays a crucial role.

- Meat Substitutes: This segment has experienced phenomenal growth, driven by ethical, environmental, and health concerns associated with conventional meat consumption. The development of innovative plant-based meat alternatives has directly translated into increased demand for high-quality non-GMO soy protein. Investment in food technology and the proliferation of vegan and vegetarian lifestyles are major contributing factors. Supportive government policies and initiatives aimed at promoting sustainable food systems also bolster this segment's growth.

- Bakery and Confectionary: Non-GMO soy protein powder is increasingly utilized in this segment to enhance nutritional value, improve texture, and extend shelf life in products like bread, cakes, and energy bars. Consumer demand for fortified food products and healthier snack options drives its incorporation. The versatility of soy protein in various baking applications makes it a cost-effective and functional ingredient.

- Animal Feed: While a distinct market, feed grade non-GMO soy protein is crucial for animal nutrition, particularly in poultry and swine feed. The increasing global demand for meat and animal products, coupled with a focus on animal welfare and growth promotion, necessitates high-quality protein sources. Innovations in animal feed formulations that optimize nutrient absorption and reduce environmental impact also contribute to this segment's stability.

Regional Dominance Factors:

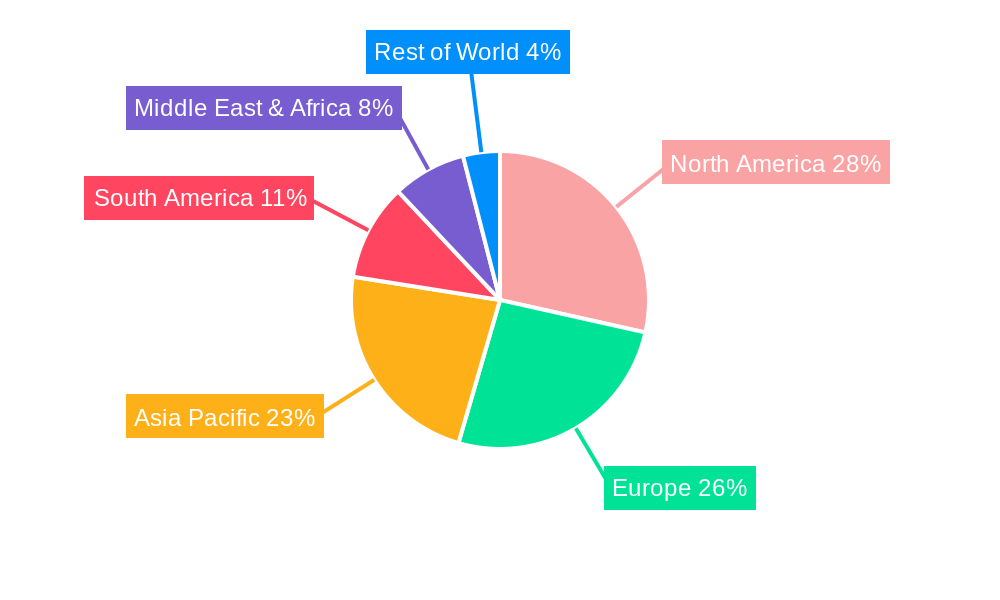

While specific country-level data is proprietary, a broad regional analysis suggests that North America and Europe are leading markets due to higher consumer awareness of health and sustainability, coupled with established regulatory frameworks for non-GMO products. Asia-Pacific, particularly China and India, is a rapidly growing market driven by a burgeoning middle class, increasing disposable incomes, and a growing interest in health and wellness products. Investment trends in these regions are focused on expanding production capacities and developing localized product offerings.

Non-GMO Soy Protein Powder Product Innovations

Product innovations in the Non-GMO Soy Protein Powder market are primarily focused on enhancing functionality and expanding application versatility. Manufacturers are developing specialized soy protein isolates and concentrates with improved solubility, emulsification properties, and heat stability, catering to the demands of the processed food industry. Innovations also include the development of minimally processed soy protein powders that retain more of the natural soy matrix, appealing to the "clean label" trend. Furthermore, research is ongoing to create novel flavor-neutral soy protein variants and to develop hydrolyzed soy proteins for enhanced digestibility and quicker absorption, crucial for the sports nutrition market. These advancements aim to overcome taste and texture challenges, thereby broadening the appeal and application scope of high-quality non-GMO soy protein.

Propelling Factors for Non-GMO Soy Protein Powder Growth

The growth of the Non-GMO Soy Protein Powder market is propelled by a potent combination of technological advancements, robust economic drivers, and supportive regulatory environments. The increasing consumer demand for plant-based protein and healthy food options is a primary economic influence. Technological innovations in processing have led to improved soy protein functionality and taste, making it more attractive for food manufacturers. Furthermore, the growing awareness of the environmental benefits of plant-based agriculture compared to animal agriculture contributes significantly. Regulatory bodies worldwide are increasingly supporting non-GMO labeling, which instills consumer confidence and drives demand for certified non-GMO products.

Obstacles in the Non-GMO Soy Protein Powder Market

Despite its strong growth, the Non-GMO Soy Protein Powder market faces several obstacles. Allergen concerns associated with soy, although manageable with proper labeling and processing, can deter some consumers. The supply chain volatility for non-GMO soybeans, influenced by factors like weather patterns and geopolitical events, can lead to price fluctuations and availability issues. Intense competition from other plant-based protein sources, such as pea and rice protein, also presents a challenge. Regulatory hurdles and varying labeling standards across different regions can complicate market entry and expansion for manufacturers.

Future Opportunities in Non-GMO Soy Protein Powder

The future of the Non-GMO Soy Protein Powder market is brimming with opportunities. The expanding global demand for plant-based diets continues to be a major driver, opening new avenues in emerging economies. Technological advancements in protein extraction and modification offer potential for developing novel ingredients with enhanced nutritional profiles and functionalities. The growing interest in sustainable sourcing and ethical production presents an opportunity for brands that can effectively communicate their commitment to these values. Furthermore, the exploration of new applications beyond traditional food and supplements, such as in the development of biodegradable materials, offers untapped market potential.

Major Players in the Non-GMO Soy Protein Powder Ecosystem

- Archer Midland Daniels Company

- Cargill Inc.

- Farbest Brands

- Dupont

- Wilmar International Limited

- Kerry Inc.

- A. Costantino & C. Spa

- SHANDONG YUXIN BIO-TECH CO.,LTD.

- CROWN SOYA PROTEIN GROUP

Key Developments in Non-GMO Soy Protein Powder Industry

- 2023: Archer Daniels Midland Company announced significant investment in expanding its non-GMO soy processing capabilities to meet growing global demand.

- 2023: Cargill Inc. launched a new line of texturized non-GMO soy protein for the meat substitute market, focusing on improved mouthfeel.

- 2023: Farbest Brands introduced enhanced solubility non-GMO soy protein isolates for use in beverages and nutritional bars.

- 2023: Dupont revealed advancements in enzyme treatment for non-GMO soy protein, aiming to reduce bitterness and improve digestibility.

- 2023: Wilmar International Limited expanded its non-GMO soy supply chain in Southeast Asia to secure raw material availability.

- 2023: Kerry Inc. acquired a company specializing in plant-based protein solutions, including non-GMO soy, to strengthen its portfolio.

- 2024: SHANDONG YUXIN BIO-TECH CO.,LTD. announced the development of a new ultra-filtered non-GMO soy protein concentrate with a neutral taste profile.

- 2024: CROWN SOYA PROTEIN GROUP expanded its production capacity for food-grade non-GMO soy protein to cater to the growing European market.

- 2024: A. Costantino & C. Spa reported a surge in demand for its specialty non-GMO soy protein ingredients for the bakery sector.

Strategic Non-GMO Soy Protein Powder Market Forecast

The strategic forecast for the Non-GMO Soy Protein Powder market is exceptionally positive, driven by sustained consumer demand for plant-based protein alternatives and a growing emphasis on health and sustainability. Anticipated market growth will be fueled by ongoing innovation in product development, leading to enhanced functionality and wider applications across food, beverage, and nutraceutical sectors. Emerging economies represent significant untapped potential. Strategic investments in expanding production capacities, coupled with a focus on transparent and sustainable sourcing practices, will be crucial for market leaders. The market is poised for substantial expansion, with key players expected to leverage these opportunities for considerable growth and market penetration.

Non-GMO Soy Protein Powder Segmentation

-

1. Application

- 1.1. Bakery and Confectionary

- 1.2. Meat Substitutes

- 1.3. Supplements & Neutraceuticals

- 1.4. Animal Feed

- 1.5. Others

-

2. Types

- 2.1. Food Grade

- 2.2. Feed Grade

Non-GMO Soy Protein Powder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Non-GMO Soy Protein Powder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery and Confectionary

- 5.1.2. Meat Substitutes

- 5.1.3. Supplements & Neutraceuticals

- 5.1.4. Animal Feed

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Food Grade

- 5.2.2. Feed Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bakery and Confectionary

- 6.1.2. Meat Substitutes

- 6.1.3. Supplements & Neutraceuticals

- 6.1.4. Animal Feed

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Food Grade

- 6.2.2. Feed Grade

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bakery and Confectionary

- 7.1.2. Meat Substitutes

- 7.1.3. Supplements & Neutraceuticals

- 7.1.4. Animal Feed

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Food Grade

- 7.2.2. Feed Grade

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bakery and Confectionary

- 8.1.2. Meat Substitutes

- 8.1.3. Supplements & Neutraceuticals

- 8.1.4. Animal Feed

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Food Grade

- 8.2.2. Feed Grade

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bakery and Confectionary

- 9.1.2. Meat Substitutes

- 9.1.3. Supplements & Neutraceuticals

- 9.1.4. Animal Feed

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Food Grade

- 9.2.2. Feed Grade

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Non-GMO Soy Protein Powder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bakery and Confectionary

- 10.1.2. Meat Substitutes

- 10.1.3. Supplements & Neutraceuticals

- 10.1.4. Animal Feed

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Food Grade

- 10.2.2. Feed Grade

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Archer Midland Daniels Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Farbest Brands

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dupont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wilmar International Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kerry Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A. Costantino& C. Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SHANDONG YUXIN BIO-TECH CO.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LTD.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CROWN SOYA PROTEIN GROUP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Archer Midland Daniels Company

List of Figures

- Figure 1: Global Non-GMO Soy Protein Powder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Non-GMO Soy Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Non-GMO Soy Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Non-GMO Soy Protein Powder Revenue (million), by Types 2024 & 2032

- Figure 5: North America Non-GMO Soy Protein Powder Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Non-GMO Soy Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Non-GMO Soy Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Non-GMO Soy Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Non-GMO Soy Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Non-GMO Soy Protein Powder Revenue (million), by Types 2024 & 2032

- Figure 11: South America Non-GMO Soy Protein Powder Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Non-GMO Soy Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Non-GMO Soy Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Non-GMO Soy Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Non-GMO Soy Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Non-GMO Soy Protein Powder Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Non-GMO Soy Protein Powder Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Non-GMO Soy Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Non-GMO Soy Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Non-GMO Soy Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Non-GMO Soy Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Non-GMO Soy Protein Powder Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Non-GMO Soy Protein Powder Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Non-GMO Soy Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Non-GMO Soy Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Non-GMO Soy Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Non-GMO Soy Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Non-GMO Soy Protein Powder Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Non-GMO Soy Protein Powder Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Non-GMO Soy Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Non-GMO Soy Protein Powder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Non-GMO Soy Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Non-GMO Soy Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-GMO Soy Protein Powder?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Non-GMO Soy Protein Powder?

Key companies in the market include Archer Midland Daniels Company, Cargill Inc., Farbest Brands, Dupont, Wilmar International Limited, Kerry Inc., A. Costantino& C. Spa, SHANDONG YUXIN BIO-TECH CO., LTD., CROWN SOYA PROTEIN GROUP.

3. What are the main segments of the Non-GMO Soy Protein Powder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-GMO Soy Protein Powder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-GMO Soy Protein Powder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-GMO Soy Protein Powder?

To stay informed about further developments, trends, and reports in the Non-GMO Soy Protein Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence