Key Insights

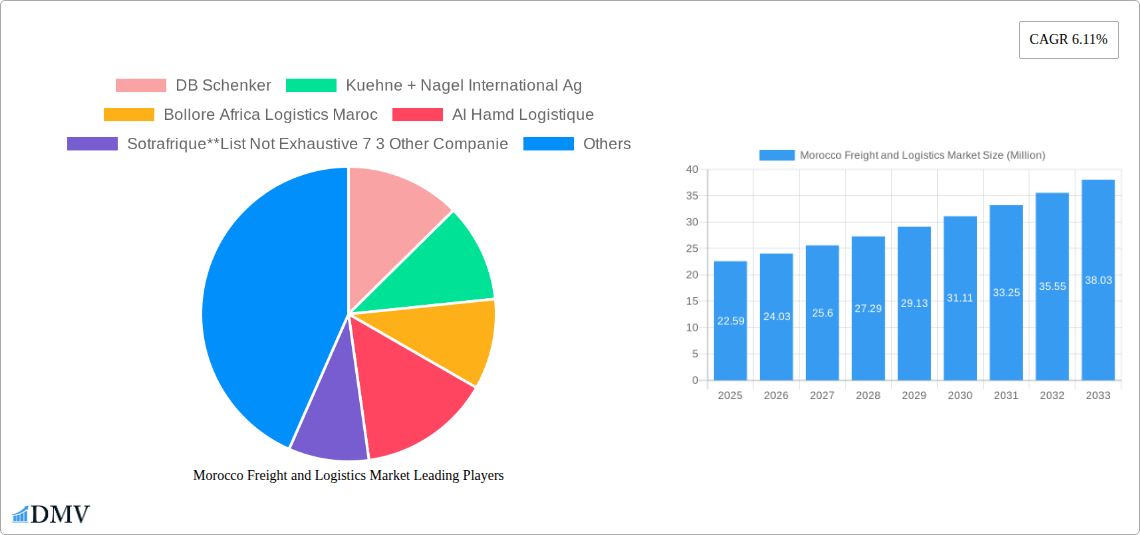

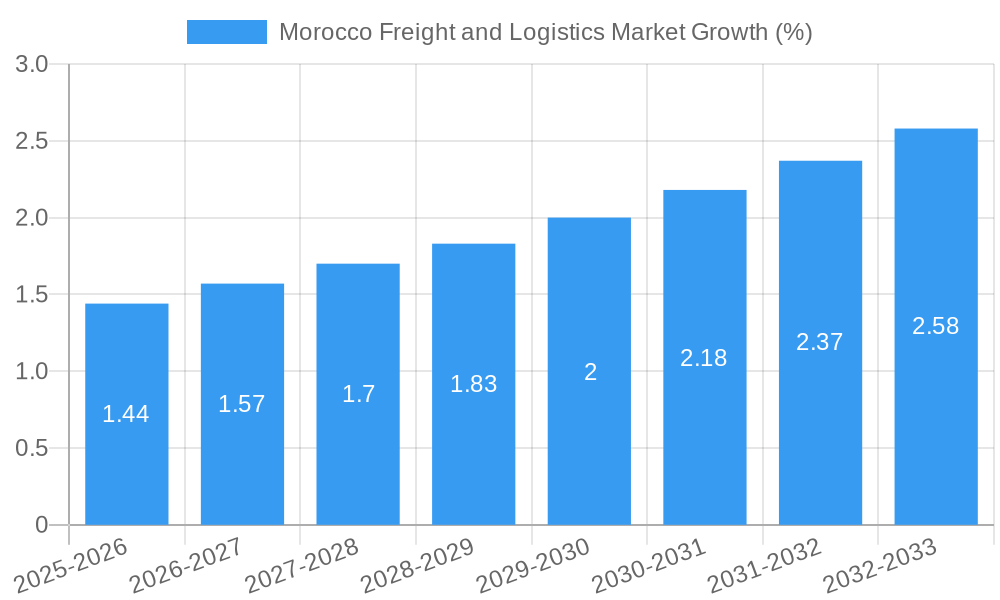

The Moroccan freight and logistics market, valued at $22.59 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.11% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning manufacturing and automotive sectors are significantly increasing demand for efficient transportation and warehousing solutions. Furthermore, growth in e-commerce and the expanding retail landscape are boosting the need for reliable delivery networks. Infrastructure development initiatives by the Moroccan government, aiming to improve port capabilities and road networks, further contribute to this positive trajectory. While challenges such as fluctuating fuel prices and potential workforce limitations exist, the overall market outlook remains optimistic. The market is segmented by function (freight transport, freight forwarding, warehousing, value-added services, and other services) and end-user (manufacturing & automotive, oil & gas, mining & quarrying, construction, distributive trade, healthcare & pharmaceutical, and others). Key players, including DB Schenker, Kuehne + Nagel, Bolloré Africa Logistics Maroc, and UPS, are strategically positioned to capitalize on these market opportunities, competing primarily on service quality, pricing, and network reach. The ongoing diversification of the Moroccan economy and increasing foreign direct investment are expected to sustain market momentum in the coming years.

The competitive landscape is characterized by a mix of international logistics giants and local players. International companies bring advanced technology and global network expertise, while local firms often benefit from strong regional knowledge and established relationships. The increasing adoption of technology, such as digital freight platforms and warehouse management systems, is enhancing efficiency and transparency within the supply chain. This trend towards digitalization is expected to accelerate in the coming years, creating opportunities for technology providers and logistics companies that embrace innovative solutions. Focus on sustainability initiatives, including the use of alternative fuels and environmentally friendly warehousing practices, is also gaining traction, reflecting a broader global trend towards responsible logistics operations.

Morocco Freight and Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Morocco freight and logistics market, offering a detailed examination of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is expected to reach xx Million by 2033.

Morocco Freight and Logistics Market Market Composition & Trends

This section delves into the competitive landscape of the Moroccan freight and logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with key players like DB Schenker, Kuehne + Nagel International AG, and Bolloré Africa Logistics Maroc holding significant market share. However, the presence of numerous smaller players and the continuous entry of new entrants contribute to a competitive dynamic.

- Market Share Distribution: DB Schenker holds an estimated xx% market share, followed by Kuehne + Nagel International AG at xx% and Bolloré Africa Logistics Maroc at xx%. The remaining share is distributed among numerous smaller players, including Al Hamd Logistique, Sotrafrique, and 7-3 other companies.

- Innovation Catalysts: Technological advancements such as the adoption of digital logistics platforms, automation in warehousing, and the growth of e-commerce are driving significant innovation within the market.

- Regulatory Landscape: The Moroccan government's focus on infrastructure development and trade facilitation is creating a favorable regulatory environment. However, ongoing regulatory changes require continuous monitoring and adaptation by market players.

- Substitute Products: The emergence of alternative transportation modes and the increasing adoption of collaborative logistics platforms pose some level of substitutional pressure on traditional players.

- M&A Activities: The past five years have witnessed several M&A transactions in the Moroccan freight and logistics sector, with total deal values estimated at xx Million. These activities have primarily focused on expanding market reach, enhancing service offerings, and integrating technological capabilities.

Morocco Freight and Logistics Market Industry Evolution

This section analyzes the evolutionary path of the Moroccan freight and logistics market, charting its growth trajectories, technological transformations, and shifting consumer demands. The market has experienced steady growth over the past five years, driven by increasing industrial output, the rise of e-commerce, and the government's efforts to improve infrastructure. This growth is expected to continue, albeit at a moderated pace, through the forecast period due to anticipated economic factors and potential global disruptions. The market's evolution has been shaped by several key factors:

- Technological Advancements: The adoption of advanced technologies like blockchain, IoT, and AI is gradually transforming operational efficiency and supply chain visibility.

- Shifting Consumer Demands: Consumers are increasingly demanding faster delivery times, enhanced tracking capabilities, and greater supply chain transparency.

- Growth Rates: The market experienced an average annual growth rate (AAGR) of xx% between 2019 and 2024. The forecast period (2025-2033) projects a AAGR of xx%.

- Adoption Metrics: The penetration of digital logistics platforms is increasing at an estimated AAGR of xx%, indicating a growing acceptance of advanced technologies.

Leading Regions, Countries, or Segments in Morocco Freight and Logistics Market

This section identifies the dominant regions, countries, or segments within the Moroccan freight and logistics market. While Morocco is a single country, regional variations in economic activity and infrastructure development influence segment performance.

By Function:

- Freight Forwarding: This segment dominates the market, driven by the country's significant import/export activity and reliance on international trade. Key drivers include increasing trade volumes and the expanding manufacturing sector.

- Warehousing: The warehousing segment is witnessing substantial growth, fuelled by e-commerce expansion and the need for efficient inventory management.

- Freight Transport: Road freight transport is the most prominent mode, though rail freight is expanding with ongoing infrastructure developments.

By End-User:

- Manufacturing and Automotive: This sector is the largest end-user, due to Morocco's growing automotive industry and manufacturing exports. Investment in automotive manufacturing plants significantly influences this segment's growth.

- Distributive Trade (Wholesale and Retail): The rise of e-commerce has spurred rapid growth in logistics services for wholesale and retail businesses. Growth is driven by the increasing consumer base and the penetration of online shopping.

Morocco Freight and Logistics Market Product Innovations

Recent innovations include the implementation of real-time tracking systems, the adoption of automated guided vehicles (AGVs) in warehousing, and the development of specialized logistics solutions for temperature-sensitive goods, particularly within the healthcare sector. These innovations enhance efficiency, improve delivery times, and reduce operational costs. The integration of advanced analytics and machine learning provides better predictive capabilities for supply chain optimization.

Propelling Factors for Morocco Freight and Logistics Market Growth

Several factors contribute to the market's growth. Firstly, substantial investments in infrastructure development, including port expansion and road network improvements, facilitate efficient goods movement. Secondly, the expanding manufacturing sector, particularly the automotive industry, fuels demand for logistics services. Thirdly, the rise of e-commerce continues to drive demand for faster and more reliable delivery options. Lastly, the government's supportive policies aimed at promoting trade and investment further stimulate market growth.

Obstacles in the Morocco Freight and Logistics Market Market

Challenges include infrastructure limitations in certain regions, the fluctuating price of fuel, and occasional supply chain disruptions due to geopolitical events. Competition from established international players and a shortage of skilled labor can also pose obstacles. Regulatory complexities and customs procedures can also delay transportation and increase costs. These factors can impact overall market efficiency and potentially lead to unpredictable cost fluctuations.

Future Opportunities in Morocco Freight and Logistics Market

Future opportunities lie in expanding cold chain logistics, leveraging technology for greater supply chain transparency, and tapping into the growing e-commerce sector. The development of specialized logistics solutions for specific industries, such as pharmaceuticals and perishables, presents further opportunities. Furthermore, exploring sustainable logistics solutions, such as the increased use of electric vehicles, offers both economic and environmental advantages.

Major Players in the Morocco Freight and Logistics Market Ecosystem

- DB Schenker

- Kuehne + Nagel International AG

- Bolloré Africa Logistics Maroc

- Al Hamd Logistique

- Sotrafrique

- UPS

- CEVA Logistics

- CMA CGM

- SJL Maghreb

- IPSEN Logistics

- Timar

- Logicold

- SMTR CARRE

Key Developments in Morocco Freight and Logistics Market Industry

- 2022 Q4: Bolloré Logistics launched a new temperature-controlled warehouse facility near Casablanca.

- 2023 Q1: Several key players invested in upgrading their technological infrastructure, enhancing tracking and management capabilities.

- 2023 Q3: Government initiatives aimed at streamlining customs procedures were implemented.

Strategic Morocco Freight and Logistics Market Market Forecast

The Moroccan freight and logistics market is poised for continued growth, driven by ongoing infrastructure improvements, a dynamic manufacturing sector, and the burgeoning e-commerce landscape. While challenges remain, the market's potential for expansion is substantial, particularly in specialized logistics sectors and the adoption of advanced technologies. The forecast suggests a steady increase in market value, fueled by a combination of economic growth and technological innovation.

Morocco Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Services

-

1.1. Freight Transport

-

2. End-user

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Construction

- 2.4. Distributive Trade (Wholesale and Retail)

- 2.5. Healthcare and Pharmaceutical

- 2.6. Other En

Morocco Freight and Logistics Market Segmentation By Geography

- 1. Morocco

Morocco Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Growth Driving The Market; Government Aiding The Logistics Sector

- 3.3. Market Restrains

- 3.3.1. Rise in Fuel Price and Energy Price

- 3.4. Market Trends

- 3.4.1. Increasing Infrastructure Investments In The Country Are Anticipated To Drive The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Freight and Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Construction

- 5.2.4. Distributive Trade (Wholesale and Retail)

- 5.2.5. Healthcare and Pharmaceutical

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuehne + Nagel International Ag

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bollore Africa Logistics Maroc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Hamd Logistique

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sotrafrique**List Not Exhaustive 7 3 Other Companie

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UPS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CMA CGM

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SJL Maghreb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IPSEN Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Timar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Logicold

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SMTR CARRE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Morocco Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco Freight and Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Morocco Freight and Logistics Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Morocco Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Morocco Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Morocco Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: Morocco Freight and Logistics Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 8: Morocco Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Freight and Logistics Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the Morocco Freight and Logistics Market?

Key companies in the market include DB Schenker, Kuehne + Nagel International Ag, Bollore Africa Logistics Maroc, Al Hamd Logistique, Sotrafrique**List Not Exhaustive 7 3 Other Companie, UPS, CEVA Logistics, CMA CGM, SJL Maghreb, IPSEN Logistics, Timar, Logicold, SMTR CARRE.

3. What are the main segments of the Morocco Freight and Logistics Market?

The market segments include Function, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.59 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Growth Driving The Market; Government Aiding The Logistics Sector.

6. What are the notable trends driving market growth?

Increasing Infrastructure Investments In The Country Are Anticipated To Drive The Market.

7. Are there any restraints impacting market growth?

Rise in Fuel Price and Energy Price.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Morocco Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence