Key Insights

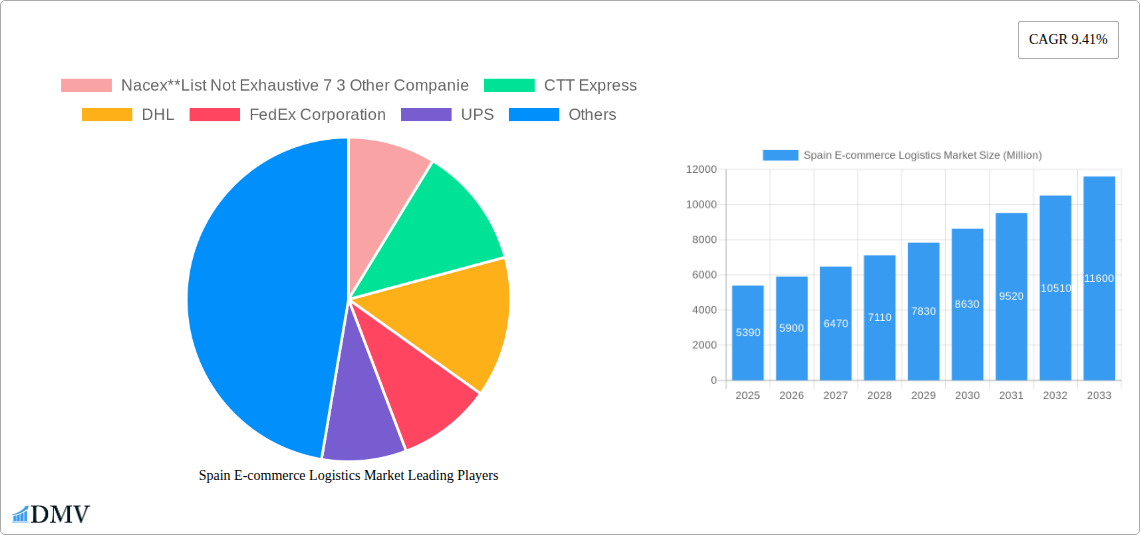

The Spain e-commerce logistics market is experiencing robust growth, projected to reach €5.39 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 9.41% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of online shopping, particularly among younger demographics, is significantly boosting demand for efficient and reliable logistics solutions. Furthermore, the increasing adoption of omnichannel strategies by retailers necessitates sophisticated logistics networks capable of handling diverse fulfillment models, including click-and-collect and same-day delivery. Technological advancements, such as the implementation of advanced warehouse management systems (WMS) and automated sorting facilities, are enhancing operational efficiency and contributing to market growth. The growth of B2C e-commerce, driven by factors such as improved internet penetration and increasing smartphone usage, is a major contributor. While the market is dominated by established players like DHL, FedEx, UPS, and Correos Express, smaller, specialized logistics providers catering to niche segments like fashion and apparel are also experiencing growth. Competition is intensifying, prompting companies to invest in innovative solutions to improve speed, accuracy, and cost-effectiveness. The expansion of cross-border e-commerce presents both opportunities and challenges, requiring logistics providers to adapt to different regulatory environments and customs procedures.

Spain E-commerce Logistics Market Market Size (In Billion)

Growth in the Spanish e-commerce logistics market is expected to continue throughout the forecast period (2025-2033), driven by further penetration of e-commerce, investments in technology and infrastructure, and a growing emphasis on customer experience. While challenges such as fluctuating fuel prices and labor shortages exist, these are expected to be mitigated by ongoing innovation and optimization within the sector. The segmentation by service (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, electronics, furniture, etc.) provides opportunities for specialization and targeted growth strategies. Market players are continuously innovating to meet the rising consumer demands for faster and more convenient delivery options, leading to the adoption of technologies such as drone delivery and autonomous vehicles in the longer term. The robust growth and diversified nature of the market suggest a promising future for e-commerce logistics in Spain.

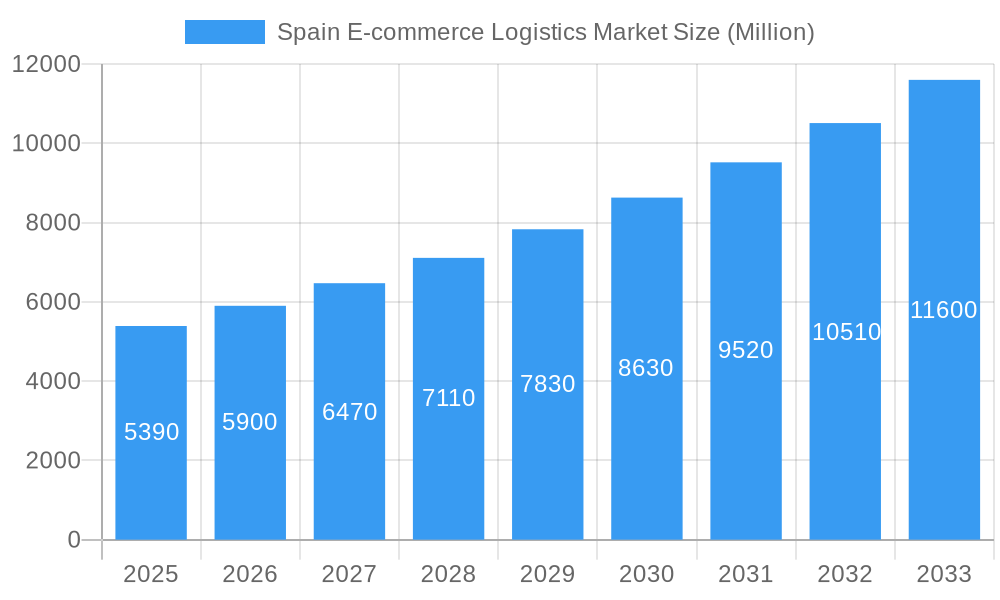

Spain E-commerce Logistics Market Company Market Share

Spain E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Spain e-commerce logistics market, offering a comprehensive overview of its current state and future trajectory. From market size and segmentation to key players and growth drivers, this study equips stakeholders with the knowledge needed to navigate this dynamic sector. With a forecast period extending to 2033, this report is an essential resource for businesses, investors, and policymakers alike. The study period covers 2019-2024 (Historical Period), with 2025 serving as the base and estimated year. The forecast period spans 2025-2033. The total market value in 2025 is estimated at XX Million.

Spain E-commerce Logistics Market Composition & Trends

This section delves into the competitive landscape of the Spanish e-commerce logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We examine the influence of mergers and acquisitions (M&A) activity, quantifying deal values where data is available. The market share distribution amongst key players is meticulously assessed, highlighting the dominance of specific companies. For instance, the top three players—likely including Correos Express, SEUR, and DHL—account for an estimated XX% of the market share in 2025. M&A activity in the period 2019-2024 totaled approximately XX Million, with a focus on enhancing warehousing capabilities and cross-border logistics.

- Market Concentration: High, with a few dominant players.

- Innovation Catalysts: Increased adoption of automation, AI, and sustainable practices.

- Regulatory Landscape: EU regulations impacting data privacy and cross-border trade.

- Substitute Products: Limited, due to the specialized nature of e-commerce logistics.

- End-User Profiles: Predominantly B2C, with growing B2B segment.

- M&A Activity: Focus on expansion and technological integration.

Spain E-commerce Logistics Market Industry Evolution

This section traces the evolution of the Spanish e-commerce logistics market, examining market growth trajectories from 2019 to 2024 and projecting growth rates for the forecast period (2025-2033). Technological advancements, such as the increasing use of autonomous delivery vehicles and sophisticated warehouse management systems (WMS), are analyzed alongside their impact on efficiency and cost reduction. The report considers the influence of shifting consumer preferences, such as the rise of same-day and next-day delivery expectations. The market is predicted to experience a Compound Annual Growth Rate (CAGR) of XX% during 2025-2033, driven by the expanding e-commerce sector and evolving consumer demands. Adoption rates for technologies like AI-powered routing and predictive analytics are expected to increase significantly, boosting operational efficiency.

Leading Regions, Countries, or Segments in Spain E-commerce Logistics Market

This section identifies the dominant regions, countries, and segments within the Spanish e-commerce logistics market. Analysis is conducted across various segmentation categories:

By Service:

- Transportation: Road transportation holds the largest share, driven by its cost-effectiveness and widespread accessibility.

- Warehousing & Inventory Management: Significant growth fueled by the need for efficient inventory control and order fulfillment.

- Value-added Services: Labeling and packaging services are experiencing rapid growth, reflecting the increasing focus on brand presentation and customer experience.

By Business:

- B2C: Dominates the market, driven by the booming online retail sector.

- B2B: Growing steadily, fueled by the increasing adoption of e-procurement solutions.

By Destination:

- Domestic: Largest share, reflecting the concentration of e-commerce activity within Spain.

- International/Cross-border: Growing rapidly, driven by increased cross-border e-commerce and globalization.

By Product:

- Fashion and Apparel: A leading segment due to the high volume of online fashion sales.

- Consumer Electronics and Home Appliances: Significant segment, with high-value items requiring specialized handling.

- Furniture: Growing segment, but challenged by the bulkiness of products and associated logistical complexities.

- Beauty and Personal Care Products: Strong growth driven by the increasing popularity of online beauty retail.

- Other Products: A diverse category, encompassing toys, food products, and other goods.

Key drivers for dominance include strong infrastructure, favorable regulatory environments, and significant investments in logistics infrastructure. The Madrid and Barcelona regions are key hubs for e-commerce activity.

Spain E-commerce Logistics Market Product Innovations

Recent innovations include the introduction of automated sorting systems, drone delivery trials, and the increasing use of data analytics to optimize delivery routes and warehouse operations. These advancements enhance efficiency, reduce costs, and improve delivery speeds. The focus is on enhancing last-mile delivery solutions and implementing sustainable practices. Unique selling propositions emphasize speed, reliability, and cost-effectiveness.

Propelling Factors for Spain E-commerce Logistics Market Growth

The Spanish e-commerce logistics market is propelled by several key factors:

- Technological advancements: Automation, AI, and data analytics are improving efficiency and reducing costs.

- Economic growth: The expanding Spanish economy is driving consumer spending and e-commerce growth.

- Favorable regulatory environment: Government initiatives supporting e-commerce development are creating a conducive environment.

- Rising consumer expectations: Demand for faster and more convenient delivery options is boosting the market.

Obstacles in the Spain E-commerce Logistics Market

Challenges include:

- Infrastructure limitations: Uneven infrastructure in certain regions can hamper efficient logistics.

- Supply chain disruptions: Global events can disrupt supply chains, impacting delivery times and costs.

- Intense competition: The market is highly competitive, with established players and new entrants vying for market share.

- Labor costs and shortages: Finding and retaining skilled logistics personnel can be challenging.

Future Opportunities in Spain E-commerce Logistics Market

Opportunities exist in:

- Expansion into new markets: Reaching underserved regions and tapping into emerging consumer segments.

- Adoption of new technologies: Implementing advanced technologies like blockchain and IoT to enhance transparency and security.

- Sustainable logistics: Meeting growing consumer demand for environmentally friendly delivery solutions.

Major Players in the Spain E-commerce Logistics Market Ecosystem

- Nacex

- CTT Express

- DHL

- FedEx Corporation

- UPS

- Correos Express

- Celeritas

- Citibox

- SEUR

- Amphora Logistics

- 7 3 Other Companies

Key Developments in Spain E-commerce Logistics Market Industry

- 2022 Q4: Correos Express announced a significant investment in automated sorting facilities.

- 2023 Q1: SEUR launched a new sustainable delivery program.

- 2023 Q2: DHL partnered with a local technology firm to improve its last-mile delivery network. (Further key developments will be included in the full report)

Strategic Spain E-commerce Logistics Market Forecast

The Spanish e-commerce logistics market is poised for continued growth, driven by technological advancements, rising consumer expectations, and a supportive regulatory environment. The forecast predicts significant expansion in the coming years, with opportunities across various segments. The focus will be on enhancing efficiency, improving sustainability, and meeting the evolving demands of consumers and businesses.

Spain E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services (Labeling and Packaging )

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics and Home Appliances

- 4.3. Furniture

- 4.4. Beauty and Personal Care Products

- 4.5. Other Products (Toys, Food Products, etc.)

Spain E-commerce Logistics Market Segmentation By Geography

- 1. Spain

Spain E-commerce Logistics Market Regional Market Share

Geographic Coverage of Spain E-commerce Logistics Market

Spain E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of B2C E-commerce; Urbanization and Population Density

- 3.3. Market Restrains

- 3.3.1. Infrastructure Challenges; Last-mile Delivery Complexities

- 3.4. Market Trends

- 3.4.1. The Rise in the Number of Online Shoppers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services (Labeling and Packaging )

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics and Home Appliances

- 5.4.3. Furniture

- 5.4.4. Beauty and Personal Care Products

- 5.4.5. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nacex**List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CTT Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Correos Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Celeritas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Citibox

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SEUR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amphora Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nacex**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Spain E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Spain E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Spain E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Spain E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Spain E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Spain E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Spain E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Spain E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Spain E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Spain E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Spain E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain E-commerce Logistics Market?

The projected CAGR is approximately 9.41%.

2. Which companies are prominent players in the Spain E-commerce Logistics Market?

Key companies in the market include Nacex**List Not Exhaustive 7 3 Other Companie, CTT Express, DHL, FedEx Corporation, UPS, Correos Express, Celeritas, Citibox, SEUR, Amphora Logistics.

3. What are the main segments of the Spain E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of B2C E-commerce; Urbanization and Population Density.

6. What are the notable trends driving market growth?

The Rise in the Number of Online Shoppers.

7. Are there any restraints impacting market growth?

Infrastructure Challenges; Last-mile Delivery Complexities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Spain E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence