Key Insights

The global luxury pet bed market is experiencing robust expansion, projected to reach a substantial market size of approximately $1.2 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025-2033. This growth is fueled by the increasing humanization of pets, leading owners to invest in premium products that reflect their lifestyle and provide superior comfort and health benefits for their companions. The market is characterized by a growing demand for beds catering to all pet sizes, with small, medium, and large pet beds each holding significant appeal. Pet owners are increasingly prioritizing orthopedic features, sustainable materials, and aesthetically pleasing designs that complement their home décor. This trend is particularly evident in the home segment, which dominates the application landscape, as owners view their pets as integral family members deserving of the best.

Key market drivers include rising disposable incomes, a growing prevalence of pet ownership across developed and emerging economies, and the significant influence of social media showcasing pampered pets. Companies are responding by innovating with advanced materials like memory foam and hypoallergenic fillings, offering a wide range of styles from bolster beds to elevated designs, and emphasizing therapeutic benefits such as joint support and temperature regulation. While the market is poised for strong growth, restraints such as the high cost of premium materials and a potential saturation in certain segments could pose challenges. However, the persistent trend of pet owners seeking high-quality, durable, and aesthetically superior options ensures continued market dynamism, with a particular focus on brands that can effectively communicate their value proposition and commitment to pet well-being.

Absolutely! Here's your SEO-optimized, insightful report description for the Luxury Pet Bed market, designed to captivate stakeholders and boost search visibility.

Luxury Pet Bed Market Composition & Trends

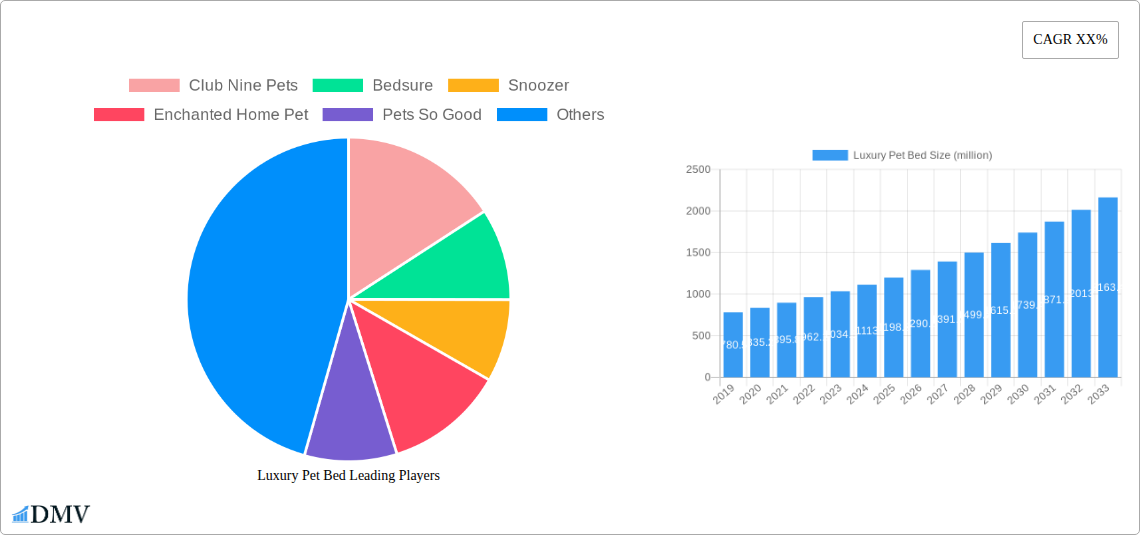

This comprehensive report offers an in-depth analysis of the global luxury pet bed market, examining its intricate composition and prevailing trends. We delve into market concentration, identifying key players and their respective market shares, projected to be around $5,000 million by 2025. Innovation catalysts are meticulously explored, including the rise of orthopedic and eco-friendly materials, driving new product development. The regulatory landscape, while nascent for luxury pet products, is assessed for its potential impact on manufacturing and labeling standards. Substitute products, such as high-end pet furniture and custom-made bedding, are evaluated for their competitive influence. End-user profiles are detailed, segmenting discerning pet owners based on income, lifestyle, and purchasing behavior. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion.

- Market Share Distribution: Analysis of leading companies like Club Nine Pets and Bedsure, with projected individual market shares of approximately 8% and 7% respectively in 2025.

- M&A Deal Values: Historical M&A deal values are estimated to be in the range of $50 million to $200 million, with future consolidation expected to drive larger transactions.

- Innovation Focus: Key innovations include memory foam, cooling gel technology, and antimicrobial fabric treatments, designed to enhance pet comfort and well-being.

- Regulatory Impact: Emerging standards for material safety and pet product durability are influencing manufacturing processes, with potential for new compliance costs estimated at less than 1% of revenue.

- Substitute Threat: High-end pet furniture represents a moderate threat, with an estimated market impact of approximately 10% on luxury pet bed sales in certain premium segments.

Luxury Pet Bed Industry Evolution

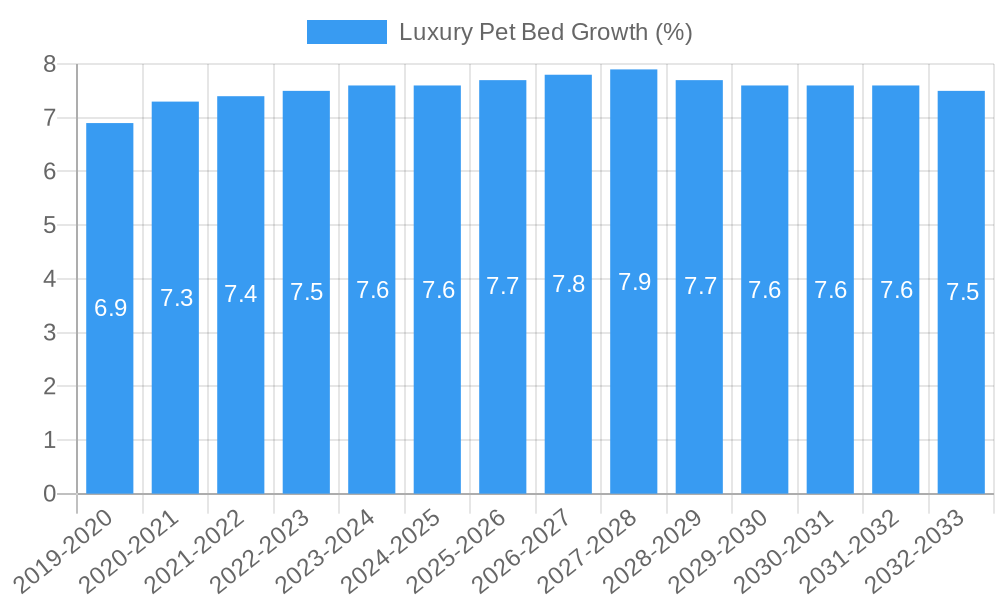

The luxury pet bed industry has witnessed a remarkable evolution, transforming from a niche market to a significant segment within the broader pet care industry. This report meticulously charts this growth trajectory from 2019 to 2033, with a base year of 2025 and a forecast period extending through 2033. The historical period (2019-2024) showcases a steady upward trend, driven by increasing pet humanization and a growing disposable income allocated to pet well-being. Technological advancements have played a pivotal role, with the integration of ergonomic designs, temperature-regulating materials, and enhanced durability becoming standard features in premium offerings. Shifting consumer demands have moved beyond basic comfort to encompass aesthetic appeal, sustainability, and specialized functionalities catering to specific breed needs or health conditions, such as orthopedic support for senior pets or cooling beds for brachycephalic breeds. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period, reaching an estimated market size of over $15,000 million by 2033. Adoption metrics for advanced features like memory foam are expected to exceed 60% among luxury pet bed purchasers by 2028.

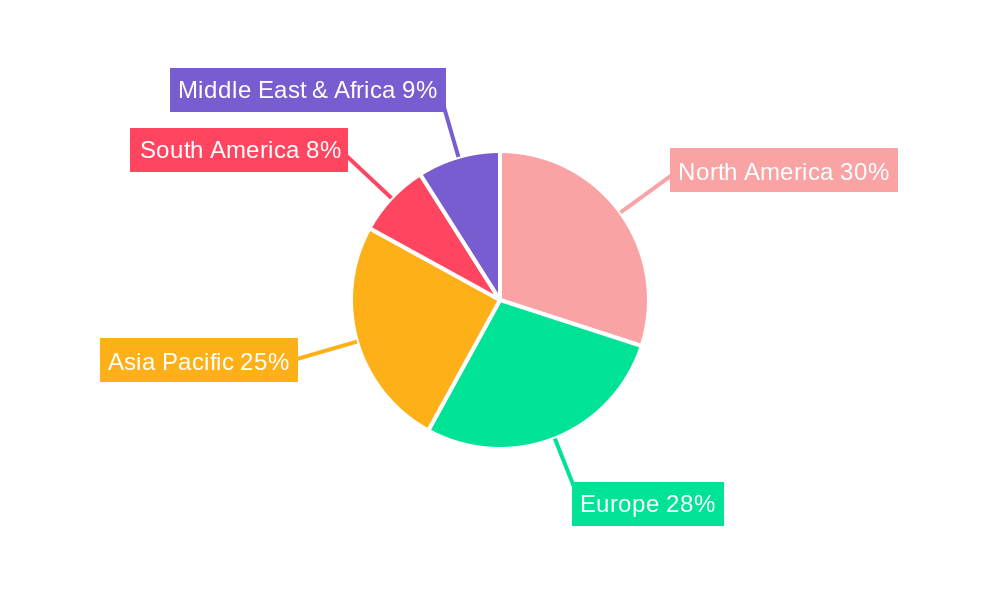

Leading Regions, Countries, or Segments in Luxury Pet Bed

The global luxury pet bed market is characterized by distinct regional dominance and segment preferences. North America, particularly the United States, stands as the leading region, driven by a deeply ingrained pet-loving culture and high per capita spending on pet products. The market size in North America is estimated to be over $7,000 million in 2025. Within this region, the Home application segment commands the largest share, reflecting the increasing importance of pets as integral family members, with an estimated 85% of all luxury pet bed sales occurring in residential settings.

- Dominant Segment (Type): Large Pet Beds represent the most significant segment by volume and value, driven by the popularity of larger dog breeds and a desire for ample sleeping space. This segment is projected to account for approximately 40% of the total luxury pet bed market by 2025, with a market value of roughly $2,000 million. Key drivers include an increasing prevalence of larger dog breeds and a trend towards providing pets with dedicated, comfortable spaces within the home.

- Dominant Segment (Application): The Home application segment is the clear leader, with an estimated market value of over $6,000 million in 2025. This dominance is fueled by the humanization of pets, where owners invest in high-quality products that complement their home décor and provide unparalleled comfort for their furry companions. Increased remote work trends have also contributed, with pets spending more time indoors, necessitating comfortable resting spots.

- Regional Drivers: In North America, high disposable incomes, a strong emotional bond with pets, and a robust e-commerce infrastructure supporting the sale of premium goods are key drivers. Regulatory support for pet welfare, though not directly targeting luxury items, fosters a general environment of quality and safety consciousness.

- Emerging Markets: Europe and Asia-Pacific are showing significant growth potential, with rising pet ownership and increasing disposable incomes fueling demand for premium pet products. Investment trends in these regions are shifting towards specialized pet care, including high-end accessories.

Luxury Pet Bed Product Innovations

Product innovation in the luxury pet bed market is relentlessly focused on enhancing pet comfort, health, and owner convenience. Companies like Club Nine Pets and Serta are at the forefront, introducing orthopedic memory foam beds that significantly alleviate joint pressure for older pets or those with mobility issues, projected to capture 30% of the orthopedic segment by 2028. Cooling gel-infused technology is another key advancement, providing relief for pets in warmer climates or those prone to overheating, with adoption rates expected to reach 25% in specialized product lines by 2027. Advanced antimicrobial and hypoallergenic fabrics from brands like Bedsure and Furhaven are addressing pet allergies and promoting a cleaner sleep environment. Furthermore, waterproof and stain-resistant coatings are becoming standard, offering durability and ease of cleaning, crucial for pet owners. Smart pet beds with integrated heating or cooling elements, controlled via mobile apps, represent a nascent but rapidly growing area of innovation, promising enhanced customization and user experience.

Propelling Factors for Luxury Pet Bed Growth

The luxury pet bed market is propelled by a confluence of powerful factors. Foremost is the escalating trend of pet humanization, where pets are increasingly viewed as family members, justifying significant investment in their well-being and comfort. This is intrinsically linked to rising disposable incomes among pet owners, particularly in developed economies, enabling them to allocate substantial funds towards premium pet products. Technological advancements in material science and ergonomic design are continuously introducing more sophisticated and beneficial features, such as orthopedic support and temperature regulation, driving demand for higher-quality bedding. Furthermore, the robust growth of the e-commerce sector has made these luxury products more accessible globally, facilitating impulse purchases and broader market reach for brands like Orvis and Frontgate.

Obstacles in the Luxury Pet Bed Market

Despite its strong growth trajectory, the luxury pet bed market faces several obstacles. Intense competition from a multitude of established and emerging players, including Best Friends by Sheri and PetFusion, can lead to price wars and pressure on profit margins. The high cost of premium materials and innovative manufacturing processes can result in elevated retail prices, potentially limiting accessibility for a broader consumer base and making it challenging to penetrate price-sensitive segments. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of specialized raw materials. Moreover, evolving consumer preferences and the rapid pace of technological innovation necessitate continuous investment in research and development, posing a financial burden for smaller companies and requiring constant adaptation to stay ahead.

Future Opportunities in Luxury Pet Bed

Emerging opportunities within the luxury pet bed market are abundant and poised for significant expansion. The growing demand for sustainable and eco-friendly pet products presents a substantial avenue, with opportunities for brands utilizing recycled materials or biodegradable components. The expansion into emerging markets in Asia-Pacific and Latin America, where pet ownership is rapidly increasing, offers significant untapped potential. Furthermore, the development of specialized luxury pet beds catering to specific pet needs, such as beds for pets with anxiety, orthopedic requirements, or specific breed-related issues, will continue to drive market segmentation and cater to niche demands. The integration of smart technology, offering features like remote temperature control or activity monitoring, represents a frontier for innovation, attracting tech-savvy pet owners and further differentiating premium offerings.

Major Players in the Luxury Pet Bed Ecosystem

- Club Nine Pets

- Bedsure

- Snoozer

- Enchanted Home Pet

- Pets So Good

- Frontgate

- Orvis

- Paws & Purrs

- Serta

- Furhaven

- Best Friends by Sheri

- PetFusion

- Pet Prestige UK

Key Developments in Luxury Pet Bed Industry

- 2023 Q4: Launch of a new line of orthopedic memory foam pet beds by Serta, featuring enhanced joint support and pressure relief, targeting the aging pet demographic.

- 2024 Q1: Bedsure expands its eco-friendly pet bed range with sustainable materials, responding to increasing consumer demand for environmentally conscious products.

- 2024 Q2: Club Nine Pets acquires a smaller specialized pet furniture manufacturer, aiming to expand its product portfolio and manufacturing capabilities in the luxury segment.

- 2024 Q3: PetFusion introduces smart pet beds with integrated cooling technology and app-based control, marking a significant step into the connected pet product market.

- 2025 Q1: Orvis announces a partnership with a leading veterinary research institute to develop pet beds with scientifically proven therapeutic benefits.

Strategic Luxury Pet Bed Market Forecast

The strategic luxury pet bed market forecast is exceptionally positive, driven by the unwavering humanization of pets and increasing disposable incomes. Future growth will be significantly fueled by innovative product development, particularly in areas of health and wellness, such as advanced orthopedic solutions and temperature-regulating technologies. The expansion of e-commerce platforms will continue to democratize access to these premium products, while emerging markets offer substantial untapped potential for revenue generation. Brands that focus on sustainability, customization, and integrated smart technology are poised to capture a larger market share, capitalizing on evolving consumer preferences and technological advancements to deliver unparalleled comfort and value for beloved animal companions.

Luxury Pet Bed Segmentation

-

1. Type

- 1.1. Small Pet Beds

- 1.2. Medium Pet Beds

- 1.3. Large Pet Beds

-

2. Application

- 2.1. Pet Hospital

- 2.2. Home

- 2.3. Others

Luxury Pet Bed Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Pet Bed REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small Pet Beds

- 5.1.2. Medium Pet Beds

- 5.1.3. Large Pet Beds

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pet Hospital

- 5.2.2. Home

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Small Pet Beds

- 6.1.2. Medium Pet Beds

- 6.1.3. Large Pet Beds

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pet Hospital

- 6.2.2. Home

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Small Pet Beds

- 7.1.2. Medium Pet Beds

- 7.1.3. Large Pet Beds

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pet Hospital

- 7.2.2. Home

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Small Pet Beds

- 8.1.2. Medium Pet Beds

- 8.1.3. Large Pet Beds

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pet Hospital

- 8.2.2. Home

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Small Pet Beds

- 9.1.2. Medium Pet Beds

- 9.1.3. Large Pet Beds

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pet Hospital

- 9.2.2. Home

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Pet Bed Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Small Pet Beds

- 10.1.2. Medium Pet Beds

- 10.1.3. Large Pet Beds

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pet Hospital

- 10.2.2. Home

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Club Nine Pets

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bedsure

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Snoozer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enchanted Home Pet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pets So Good

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Frontgate

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Orvis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Paws & Purrs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Serta

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Furhaven

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Best Friends by Sheri

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PetFusion

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pet Prestige UK

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Club Nine Pets

List of Figures

- Figure 1: Global Luxury Pet Bed Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Luxury Pet Bed Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Luxury Pet Bed Revenue (million), by Type 2024 & 2032

- Figure 4: North America Luxury Pet Bed Volume (K), by Type 2024 & 2032

- Figure 5: North America Luxury Pet Bed Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Luxury Pet Bed Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Luxury Pet Bed Revenue (million), by Application 2024 & 2032

- Figure 8: North America Luxury Pet Bed Volume (K), by Application 2024 & 2032

- Figure 9: North America Luxury Pet Bed Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Luxury Pet Bed Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Luxury Pet Bed Revenue (million), by Country 2024 & 2032

- Figure 12: North America Luxury Pet Bed Volume (K), by Country 2024 & 2032

- Figure 13: North America Luxury Pet Bed Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Luxury Pet Bed Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Luxury Pet Bed Revenue (million), by Type 2024 & 2032

- Figure 16: South America Luxury Pet Bed Volume (K), by Type 2024 & 2032

- Figure 17: South America Luxury Pet Bed Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Luxury Pet Bed Volume Share (%), by Type 2024 & 2032

- Figure 19: South America Luxury Pet Bed Revenue (million), by Application 2024 & 2032

- Figure 20: South America Luxury Pet Bed Volume (K), by Application 2024 & 2032

- Figure 21: South America Luxury Pet Bed Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Luxury Pet Bed Volume Share (%), by Application 2024 & 2032

- Figure 23: South America Luxury Pet Bed Revenue (million), by Country 2024 & 2032

- Figure 24: South America Luxury Pet Bed Volume (K), by Country 2024 & 2032

- Figure 25: South America Luxury Pet Bed Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Luxury Pet Bed Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Luxury Pet Bed Revenue (million), by Type 2024 & 2032

- Figure 28: Europe Luxury Pet Bed Volume (K), by Type 2024 & 2032

- Figure 29: Europe Luxury Pet Bed Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Luxury Pet Bed Volume Share (%), by Type 2024 & 2032

- Figure 31: Europe Luxury Pet Bed Revenue (million), by Application 2024 & 2032

- Figure 32: Europe Luxury Pet Bed Volume (K), by Application 2024 & 2032

- Figure 33: Europe Luxury Pet Bed Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe Luxury Pet Bed Volume Share (%), by Application 2024 & 2032

- Figure 35: Europe Luxury Pet Bed Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Luxury Pet Bed Volume (K), by Country 2024 & 2032

- Figure 37: Europe Luxury Pet Bed Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Luxury Pet Bed Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Luxury Pet Bed Revenue (million), by Type 2024 & 2032

- Figure 40: Middle East & Africa Luxury Pet Bed Volume (K), by Type 2024 & 2032

- Figure 41: Middle East & Africa Luxury Pet Bed Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East & Africa Luxury Pet Bed Volume Share (%), by Type 2024 & 2032

- Figure 43: Middle East & Africa Luxury Pet Bed Revenue (million), by Application 2024 & 2032

- Figure 44: Middle East & Africa Luxury Pet Bed Volume (K), by Application 2024 & 2032

- Figure 45: Middle East & Africa Luxury Pet Bed Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa Luxury Pet Bed Volume Share (%), by Application 2024 & 2032

- Figure 47: Middle East & Africa Luxury Pet Bed Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Luxury Pet Bed Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Luxury Pet Bed Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Luxury Pet Bed Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Luxury Pet Bed Revenue (million), by Type 2024 & 2032

- Figure 52: Asia Pacific Luxury Pet Bed Volume (K), by Type 2024 & 2032

- Figure 53: Asia Pacific Luxury Pet Bed Revenue Share (%), by Type 2024 & 2032

- Figure 54: Asia Pacific Luxury Pet Bed Volume Share (%), by Type 2024 & 2032

- Figure 55: Asia Pacific Luxury Pet Bed Revenue (million), by Application 2024 & 2032

- Figure 56: Asia Pacific Luxury Pet Bed Volume (K), by Application 2024 & 2032

- Figure 57: Asia Pacific Luxury Pet Bed Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Luxury Pet Bed Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Luxury Pet Bed Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Luxury Pet Bed Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Luxury Pet Bed Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Luxury Pet Bed Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Luxury Pet Bed Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Luxury Pet Bed Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 5: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 7: Global Luxury Pet Bed Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Luxury Pet Bed Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 11: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 13: Global Luxury Pet Bed Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Luxury Pet Bed Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 22: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 23: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 24: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 25: Global Luxury Pet Bed Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Luxury Pet Bed Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 34: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 35: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 36: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 37: Global Luxury Pet Bed Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Luxury Pet Bed Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 58: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 59: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 60: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 61: Global Luxury Pet Bed Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Luxury Pet Bed Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Luxury Pet Bed Revenue million Forecast, by Type 2019 & 2032

- Table 76: Global Luxury Pet Bed Volume K Forecast, by Type 2019 & 2032

- Table 77: Global Luxury Pet Bed Revenue million Forecast, by Application 2019 & 2032

- Table 78: Global Luxury Pet Bed Volume K Forecast, by Application 2019 & 2032

- Table 79: Global Luxury Pet Bed Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Luxury Pet Bed Volume K Forecast, by Country 2019 & 2032

- Table 81: China Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Luxury Pet Bed Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Luxury Pet Bed Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Pet Bed?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Luxury Pet Bed?

Key companies in the market include Club Nine Pets, Bedsure, Snoozer, Enchanted Home Pet, Pets So Good, Frontgate, Orvis, Paws & Purrs, Serta, Furhaven, Best Friends by Sheri, PetFusion, Pet Prestige UK.

3. What are the main segments of the Luxury Pet Bed?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Pet Bed," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Pet Bed report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Pet Bed?

To stay informed about further developments, trends, and reports in the Luxury Pet Bed, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence